2024-02-20 22:36

Feb 20 (Reuters) - Chemicals maker Celanese Corp (CE.N) , opens new tab missed Wall Street estimates for fourth-quarter profit on Tuesday, weighed by lower prices for its products across units. The company forecast adjusted earnings in the range of $1.75 per share to $2.00 per share in the first quarter of 2024, compared with analysts' estimate of $2.53 per share. Celanese added it does not expect "volumes and pricing conditions to materially improve to start 2024", sending its shares down about 7% in extended trading. "Early signs of demand improvement in certain products and end-markets are insufficient to improve the overall sequential backdrop we see early in 2024...," said CEO Lori Ryerkerk. Chemicals companies in the U.S. have been struggling to trim excess inventory due to a slower-than-expected rebound in demand from Europe and China. On an adjusted basis, the Dallas-based firm earned $2.24 per share in the quarter ended Dec. 31, compared with analysts' estimate of $2.31 per share, according to LSEG data. https://www.reuters.com/business/chemicals-maker-celanese-corp-misses-quarterly-profit-estimates-lower-prices-2024-02-20/

2024-02-20 21:53

Feb 20 (Reuters) - Chesapeake Energy (CHK.O) , opens new tab beat Wall Street estimates for fourth-quarter profit on Tuesday as the U.S. natural gas producer tackled weak commodity prices with lower operating expenses. Chesapeake shares fell about 2% in aftermarket trading as the company forecast a 20% drop in spending on baseline production this year. Its fourth-quarter shareholder returns also fell sharply versus earlier quarters. Share buybacks and dividends totaled about $117 million in the final quarter, down from an average of $242.6 million per quarter in the first nine months. The Oklahoma-based company reported fourth-quarter output fell to 3.43 billion cubic feet equivalent (bcfe) per day, from 4.05 bcfe per day the previous year. Its capital spending plan will fund about 2.7 bcfe per day in volumes this year, the company said. Average natural gas prices dipped over 50% in the fourth quarter compared with last year, and have fallen to a three-and-one-half year low this month. "We continue to show the resilience of this organization and assets in the midst of lower commodity prices," said CEO Nick Dell'Osso said in the earnings release. Adjusted profit was $1.31 per share for the three months ended Dec. 31, compared with analysts' average estimate of 73 cents per share, according to LSEG data. The business generated $470 million in operating cash flow in the quarter, down from $1.05 billion in the year ago period. Chesapeake said in January it had agreed to buy rival Southwestern Energy (SWN.N) , opens new tab in an all-stock deal valued at $7.4 billion, making it the largest independent U.S. natural gas producer. https://www.reuters.com/business/energy/chesapeake-energy-reports-fall-quarterly-profit-2024-02-20/

2024-02-20 21:51

GEORGETOWN, Feb 20 (Reuters) - Guyana will delay until 2025 its biggest effort to capitalize on its energy bounty, a $1.9 billion gas-to-power project that was to start this year, using untapped gas to slash electricity costs, a Ministry of Natural Resources consultant said on Tuesday. The rising oil producing nation relies on imported fuels in its shaky electric grid and has promised to use its oil wealth to construct a 140-mile (225 km) pipeline, gas processing facility and up to 300 megawatt (MW) power plant. Winston Brassington, a government consultant involved in the project, said the combined-cycle power plant is delayed and full operation will not be possible until the fourth quarter of 2025. The project suffered work delays, late equipment deliveries and issues on the foundation at the location chosen for the project, he said. The project was an election-year pledge to its about 800,000 residents to reduce their energy costs by 50% this year. Guyana has been seeking a $646 million loan from the Export-Import Bank of the United States to finance the onshore facilities. Exxon Mobil Corp (XOM.N) , opens new tab is currently building the $1 billion pipeline and will be reimbursed by proceeds from the country's offshore production. Guyana will pay Exxon and its partners $55 million over a 20-year period, at a fixed price with no adjustments, totaling $1.1 billion, Brassington said. The gas pipeline is expected to be ready by the end of this year, Exxon Guyana country chief Alistair Routledge said on Tuesday at the Guyana Energy Conference and Exposition. However, the government expects the power plant will start delivering 200 MW by June 30 next year, with project completion and delivery of 300 MW on a combined cycle by the end of 2025, Brassington said. https://www.reuters.com/business/energy/guyanas-19-billion-gas-to-power-project-delayed-2025-2024-02-20/

2024-02-20 21:47

Feb 20 (Reuters) - Palo Alto Networks (PANW.O) , opens new tab forecast third-quarter billings below Wall Street estimates on Tuesday, signaling cautious spending by businesses in an uncertain economy, sending its shares down more than 13% in extended trading. Businesses are navigating in a digital world which is highly susceptible to online threat activity as they ramp up digitizing and migration to cloud, but sluggish spending in an uncertain economy has hit demand for companies such as Palo Alto. Palo Alto forecast third-quarter billings between $2.30 billion and $2.35 billion, compared with analysts' average estimate of $2.62 billion, according to LSEG data. https://www.reuters.com/technology/palo-alto-forecasts-third-quarter-billings-below-estimates-shares-fall-2024-02-20/

2024-02-20 21:47

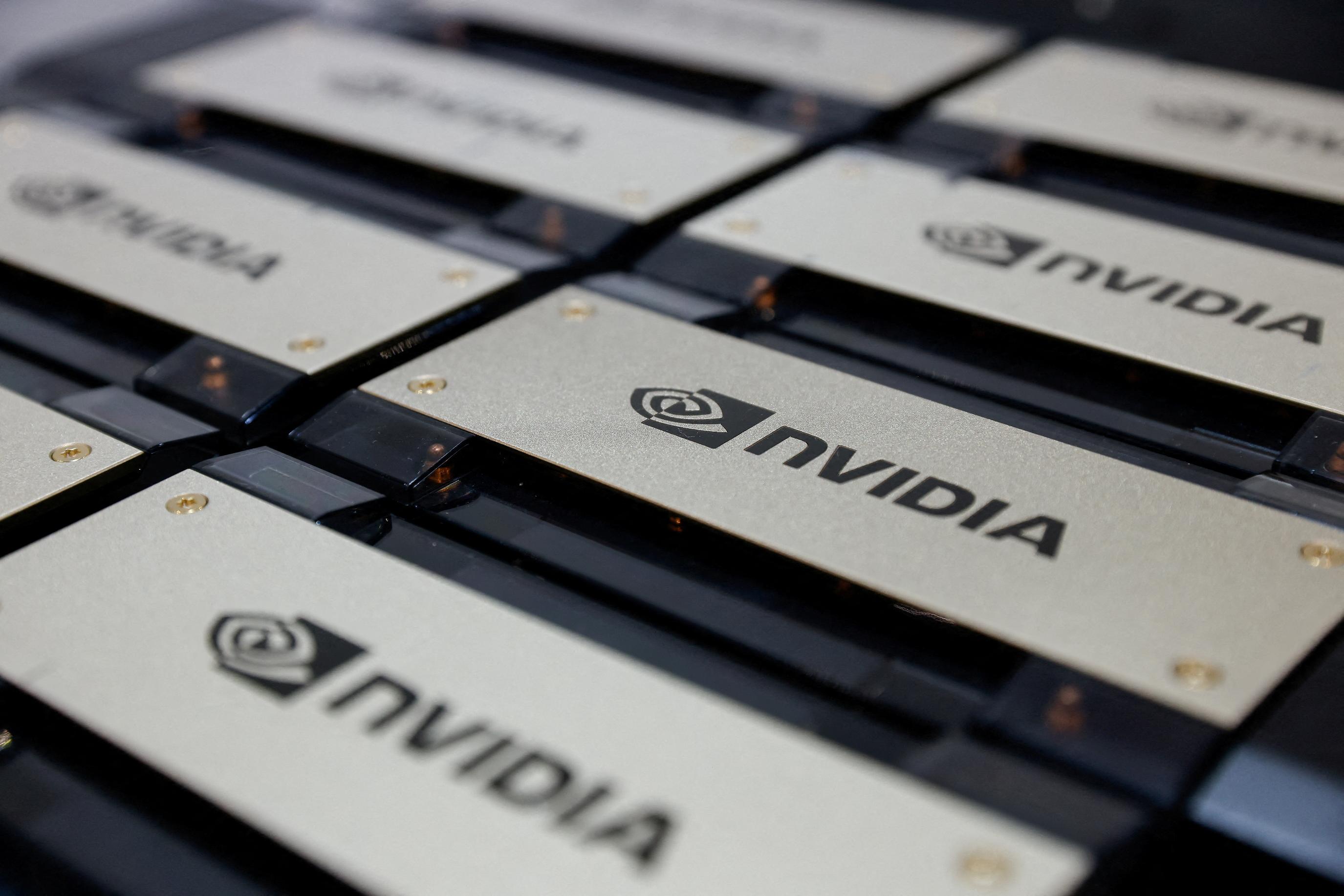

Feb 21 (Reuters) - A look at the day ahead in Asian markets. A fairly heavy sprinkling of Asian economic data and an interest rate decision in Indonesia dominate the regional calendar on Wednesday, as investors digest another uptick in Chinese stocks and brace for Nvidia's fourth quarter earnings report. Stocks and risk appetite in Asia could fall at the open on Wednesday after worries over the U.S. chip designer and artificial intelligence leader's results slammed its shares and pushed the broader U.S. indexes into the red on Tuesday. The 4.4% drop in Nvidia's shares was the biggest fall since October, and the Nasdaq lost 1%. In Asia, stock markets in Hong Kong, China and Taiwan will be particularly sensitive to the results. These three regions accounted for 46% of Nvidia's revenue in the third quarter. Investors will be keen to see whether Nvidia warns again that U.S. curbs on selling its chips to China are hurting its business and longer-term prospects. Nvidia has come up with new products for the Chinese market, but there is a risk that they will also be banned like its first round of China market chips. Nvidia is also grappling with supply shortages at its Taiwan-based chip contractor TSMC, the world's largest contract chipmaker. Hong Kong's Hang Seng has underperformed this year, and is currently down 4.7% year to date. The performance of its tech sector has been even more dismal - it is down 13%. But the tentative recovery in Chinese stocks from recent five-year lows - the CSI 300 index of leading blue chips is now basically flat year-to-date - should lend support. The Shanghai Composite and CSI300 are gunning for a sixth and seventh straight day of gains, respectively, which would be their longest winning streaks since January last year. China's interest rate cut on Tuesday could keep that run going. Elsewhere on the policy front, Indonesia's central bank will keep its key seven-day repo rate unchanged at 6.00% on Wednesday, according to all 30 economists in a Reuters poll. Opinion over the rest of the year is more mixed, but the median forecast is for Bank Indonesia to start cutting rates by 25 basis points in the second quarter, and by the same amount every quarter this year, down to 5.25% by the end of December. Indonesia's inflation rate has stayed within BI's 1.5% to 3.5% target range since July, suggesting cumulative rate hikes of 250 basis points are working. The rupiah is down 1.7% against the dollar this year, but has performed better than many of its peers. Elsewhere in Asia on Wednesday Japan releases its latest trade data and tankan surveys of manufacturing and non-manufacturing activity, South Korea publishes producer price inflation figures, and Australia releases hourly wage growth data for Q4 last year. Here are key developments that could provide more direction to markets on Wednesday: - Indonesia interest rate decision - Japan trade (January) - South Korea produce price inflation (January) https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-02-20/

2024-02-20 21:26

ATHENS, Feb 20 (Reuters) - Thousands of farmers from across Greece descended on Athens' central square on Tuesday, parking tractors in front of parliament in their biggest protest yet over rising costs. Police estimate at least 8,000 farmers with 130 tractors joined the protest on Syntagma square, echoing grievances at similar demonstrations in France, Belgium, the Netherlands, Poland and Italy. "This is our answer to the Greek government," a 53-year-old farmer who gave his name as Grigoris said. "We're not afraid, and we won't retreat." The farmers said they planned to remain in the square overnight. Greek farmers dealing with high energy prices and production costs say they have also been hurt by climate change-driven weather, with unpredictable flooding, extreme heat and wildfires making their work ever more hazardous. They have been staging brief blockades of roads and border crossings for weeks while their unions have been negotiating with Prime Minister Kyriakos Mitsotakis' conservative government for more financial aid and other relief measures. The farmers said they drove to Athens to pile pressure on the government, which has so far offered discounts on power bills and a one-year extension of a tax rebate for agricultural diesel to the end of 2024. They are also demanding more compensation from natural disasters along with tax-free diesel fuel and protection against foreign competition. "We want the government to give us solutions to our problems. We're not just fighting for our own survival, we're fighting for everyone," said farmer Spyros Hatzis. "We're selling cheap, and the consumer is buying at a great cost" As night fell, horns blared and protesters lit flares. A banner on a tractor with a black coffin attached to its front read: "Livestock farming died today." Others held up funeral wreaths to symbolise what they say is a dying sector. "The government called us to a meeting, taunting us, without giving us anything," said Kostas Zarkadoulas, head of the farmers' union of Stylida in central Greece. WAKE UP Earlier on Tuesday, at the last toll booths some 30 km outside the capital, farmers waved Greek flags and cheered each other on as the convoy passed through. "No farmers, no food, no future," a banner read. "The time has come for all of us to finally wake up," said Thanasis Symeonidis, a farmer at the rally. "Our problems will reach their doorstep too." On Monday, the government reiterated that it was willing to discuss a more permanent future tax rebate scheme, but had no fiscal room for further concessions this year. "We have nothing more to give," Mitsotakis said during an interview with Greek Star TV on Monday evening. "I think farmers acknowledge this and know very well that the government has probably exceeded even their expectations, especially on the power bills issue." The farmers vowed to push for more. "We believe something will come of this. Otherwise we'll have to harden our stance," said Vergos Vergou, a protester in Athens. https://www.reuters.com/world/europe/greek-farmers-gear-up-tractor-protest-athens-over-rising-costs-2024-02-20/