2024-01-12 10:18

NEW YORK, Jan 12 (Reuters) - A U.S. presidential race that is about to heat up could add a fresh wrinkle to markets in 2024, as investors gauge the potential for post-election changes in fiscal spending, taxation and other policy areas. For months, the Federal Reserve's monetary policy trajectory and the U.S. economy have consumed investors, with expectations for 2024 rate cuts by the central bank fueling an explosive stocks rally in late 2023 and putting the S&P 500 (.SPX) within striking distance of a fresh record high. The importance of those factors for asset prices is unlikely to wane anytime soon. But with the Iowa caucus set to kick off the state-by-state nominating process on Monday, a potentially close race and sharp partisan divisions in the electorate could add unexpected twists to the path for stocks this year. "The election is introducing an extra layer of uncertainty," said Irene Tunkel, chief U.S. equity strategist at BCA Research. This year's election is pointing toward a rematch between President Joe Biden, a Democrat, and former President Donald Trump, who holds a commanding lead over Republican rivals. However, any narrowing of the Republican field following the Iowa caucus "could also make for a more competitive race" for the party's nomination, Goldman Sachs economics analysts said in a Monday note. Trump's lead in the upcoming New Hampshire primary would shrink to around 3% if the field narrowed to him and former South Carolina Governor Nikki Haley, they said. "Uncertainty tends to rise at the start of presidential election years, and that pattern looks particularly likely to hold in 2024," the bank's analysts said. WHAT HISTORY SHOWS A president seeking re-election, as Biden is this year, has in the past been concurrent with above-average performance for U.S. stocks. Since World War II, the S&P 500 has gained all 14 times in the year that a president has sought re-election, regardless of who wins, with an average total return of 15.5%, said CFRA chief investment strategist Sam Stovall. That compared to the index's average annual return of 12.8% in that period. Overall since 1928, the S&P 500 has gained about 7.5% on average in presidential election years, according to RBC Capital Markets. Seasonal patterns in election years, however, suggest the ride is not always smooth. The first three months or so of an election year tend to be choppy for stocks, with the S&P 500 generally flat, said Keith Lerner, co-chief investment officer at Truist Advisory Services, who reviewed data going back to 1950. The three months ahead of Election Day in early November also tend to be volatile, Lerner said. The seasonal pattern of election years "does provide another reason to be on guard for an early year pullback," Lori Calvasina, RBC's head of U.S. equity strategy, said in a note on Monday. This year, tax and spending policies are among those investors will be watching. During his presidency, Trump enacted tax cuts set to expire in 2025, with Republicans expected to try to prevent that from happening. Democrats and Biden, who enacted a wide-ranging law that seeks to promote clean energy and lower prescription drug costs, would be expected to pursue tax hikes on corporations and the wealthy while spending to expand the social safety net, such as childcare investments, according to Oxford Economics. An economic downturn this year would likely increase market focus on the elections, said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management. "If the economy does start to decelerate and we potentially see a recession, then the fiscal response and who becomes the political leaders will become much more important to markets," Miskin said. Certain areas of the stock market could become particularly volatile as the race advances and policy proposals are fleshed out, including any related to healthcare costs, defense spending or energy regulations. In the 2020 election, for example, solar stocks rose as Biden's election prospects improved. Trump's victory in 2016 sparked a so-called reflation trade that boosted a broad range of sectors on expectations of looser fiscal policy. Some investors doubt the election will have a lasting effect on markets. One factor potentially moderating the impact is expectation of a split Congress following the election that limits more radical policy changes. While elections can bring some volatility, "the over-arching theme that matters the most is where are we in the economic cycle," said Jack Janasiewicz, portfolio manager at Natixis Investment Managers Solutions. https://www.reuters.com/markets/us/us-elections-toss-twist-markets-fixated-fed-economy-2024-01-12/

2024-01-12 10:16

LONDON, Jan 12 (Reuters) - Sterling was little changed on Friday, not far off its highest level in five months, after data showed British growth beat expectations in November but remained subdued over the last three months. The pound was last flat at $1.2753, close to the $1.2825 hit at the end of December, which was the highest since August. Sterling has risen around 0.3% this year after climbing more than 5% in 2023. Britain's economy grew 0.3% month-on-month in November, more than the 0.2% expected by economists, after shrinking 0.3% in October. Yet output shrank 0.2% in the three months to the end of November. Sterling was also flat against the euro , with the euro zone's currency trading at 85.95 pence. The euro has slipped 0.8% so far this year against the pound. The pound has benefited in recent months from UK inflation running hotter than the U.S. and Europe. That's caused traders to expect fewer rate cuts from the Bank of England than its two major peers, supporting British bond yields and making sterling look relatively more attractive. Traders currently expect around 125 basis points of interest rate cuts from the BoE next year, according to money market pricing. "We think the pound will continue to appreciate gradually against the dollar, as it becomes apparent the (BoE) won't reduce Bank Rate quite as quickly as markets currently anticipate," Gabriella Dickens, senior UK economist at consultancy Pantheon Macroeconomics, said in a note to clients on Thursday. "The general election, which will probably be held in the autumn, likely won't weigh materially on sterling." The U.S. dollar index , which tracks the currency against six major peers, was up 0.14% at 102.35 on Friday. https://www.reuters.com/markets/currencies/sterling-holds-near-5-month-high-uk-growth-beats-expectations-2024-01-12/

2024-01-12 10:04

Jan 12 (Reuters) - Global political and business leaders meet in the Swiss resort of Davos this week against a complex geopolitical backdrop beset by war, tectonic shifts in monetary policy, climate change and an uncertain election-packed year. The global economy appears to be avoiding recession for now, but a key litmus test looms for China with GDP figures, while U.S. retail sales data will shed light on its 2024 outlook. Here's a look at the week ahead in global markets from Kevin Buckland in Tokyo, Li Gu in Shanghai, Ira Iosebashvili in New York, Karin Strohecker, Stefania Spezzati and Amanda Cooper in London. 1/ GROWING PAINS Just how close China got to realising the official 5%-or-so growth goal for 2023 will become clear on Wednesday, with the release of full-year GDP figures. That it hit the target is not really in question. The challenge is how to do the same this year, if Beijing follows its advisers and keeps the goal unchanged. Unlike last year, there's no 2022 COVID-lockdown slump to flatter the result. A hint of what Beijing has planned has come from a key central bank official, who was reported by state media as saying policy tools would be used to support reasonable credit growth. Chinese government bond yields neared an almost four-year trough and the yuan bounced off a one-month low, after the central bank left its medium-term rate unchanged on Monday, contrary to expectations for a cut. 2/ DAVOS The 54th annual World Economic Forum meeting kicks off in the Swiss ski resort of Davos. Central bankers, financiers and business leaders will discuss a challenging global economic picture, shifting monetary policy and rising debt levels. They will try to seek answers on how to navigate a complex geopolitical framework that includes war in Ukraine and Gaza. U.S. Secretary of State Antony Blinken, French President Emmanuel Macron and key Middle East leaders are due to attend. One key event is the Jan. 17 closed-door Financial Services Governors Meeting, which will bring together 100 chairs and CEOs from banking, markets, insurance and asset management. A separate survey released by the WEF showed extreme weather and misinformation were seen by risk specialists as most likely to trigger a global crisis in the next couple of years. 3/ ELECTION MANIA Taiwanese voters swept the ruling Democratic Progressive Party's (DPP) presidential candidate Lai Ching-te into power on Saturday, strongly rejecting Chinese pressure to spurn him, as China said it would not give up on achieving "reunification". This high-stake geopolitical event marks the start of one of the busiest election years ever: countries making up over 60% of the world's economic output and more than half of its population hold elections this year. The United States, Britain, Russia, South Africa, India and Indonesia are just some of the more than two dozen countries holding national elections. The heavy election calendar has fuelled fears that financial market volatility could soar and fiscal discipline be at risk as growth prospects face and debt hits record highs. 4/ SHOPPING AROUND The health of U.S. consumers will be in the spotlight, through the lens of retail sales data and bank earnings. The Jan. 17 retail sales numbers are expected to give a glimpse into consumer spending and offer evidence of the resilience of the U.S. economy in the face of 525 basis points of rate increases from the Federal Reserve since 2022. Signs that consumers may be pulling back might undermine the expectation of a economic soft landing that helped boost stocks 24% last year. Economists polled by Reuters expect retail sales rose a monthly 0.3% in December, matching November's increase. Investors are also keen to hear what big financial institutions say about consumers and their own operations, with Goldman Sachs and Charles Schwab both reporting. 5/ BRIT-FLATION The next batch of UK consumer price data could be exactly what Bank of England officials and politicians are hoping for: a big enough slide to declare victory on the war on inflation. With headline inflation at 3.9%, the UK doesn't look like such an outlier any more compared with other developed nations -- a welcome development for a government expected to hold a general election later this year. Typically stickier price pressures, such as those in services and workers' wages, are softening, but only marginally. And the near-21% rise in inflation since 2020 still outstrips that of any other G7 economy and is the joint-highest increase in western Europe. The pound has got off to a relatively firm start to the year, supported by a rise in UK government bond yields. A soft read of inflation on Jan. 17 may prove an unwelcome development for sterling bulls. https://www.reuters.com/business/take-five/global-markets-themes-graphic-2024-01-12/

2024-01-12 06:39

MUMBAI, Jan 12 (Reuters) - The Indian rupee was trading higher on Friday, surpassing the 83-level against the U.S. dollar, as traders capitalised on the opening decline to build bullish bets on the local currency. The rupee was at 82.9775 to the dollar at 11:22 a.m. IST, up from 83.0275 in the previous session. The currency had opened at 83.08. "The view has changed. It is now a sell on rally rather than a buy on dips (on USD/INR)," a foreign exchange trader at a bank said. "The opening up move ran into a host of offers and now we are back below 83. Now the question is if we can sustain here, which then will open dollars for a larger move." The rupee on Wednesday and Thursday failed to stay above the 83 level. ASIAN PEERS RANGEBOUND Most Asian currencies were rangebound after bets of aggressive Federal Reserve rate cuts remained intact despite the higher-than-expected U.S. inflation data. Headline U.S. Consumer Price Index (CPI) rose 3.4% from the previous year in December, compared to forecasts of a 3.2% increase. On a monthly basis, CPI rose 0.3% as opposed to expectations of a 0.2% increase. Core CPI rose 3.9% year-on-year, against 3.8% expected. The U.S. yields and the dollar index rose following the data. However, the moves faded as the New York Session progressed. The data did not offer any fresh signals for Fed officials. Policymakers are currently looking to gauge whether inflation is likely to return to 2% target and when to cut policy rates. In December, Fed officials forecast three rate cuts in 2024. Investors have priced in six rate cuts. The real test for investors will come with the US PCE deflator on Jan. 26, DBS Research said in a note. https://www.reuters.com/markets/currencies/rupee-recovers-opening-dip-sustainability-above-83usd-key-2024-01-12/

2024-01-12 06:36

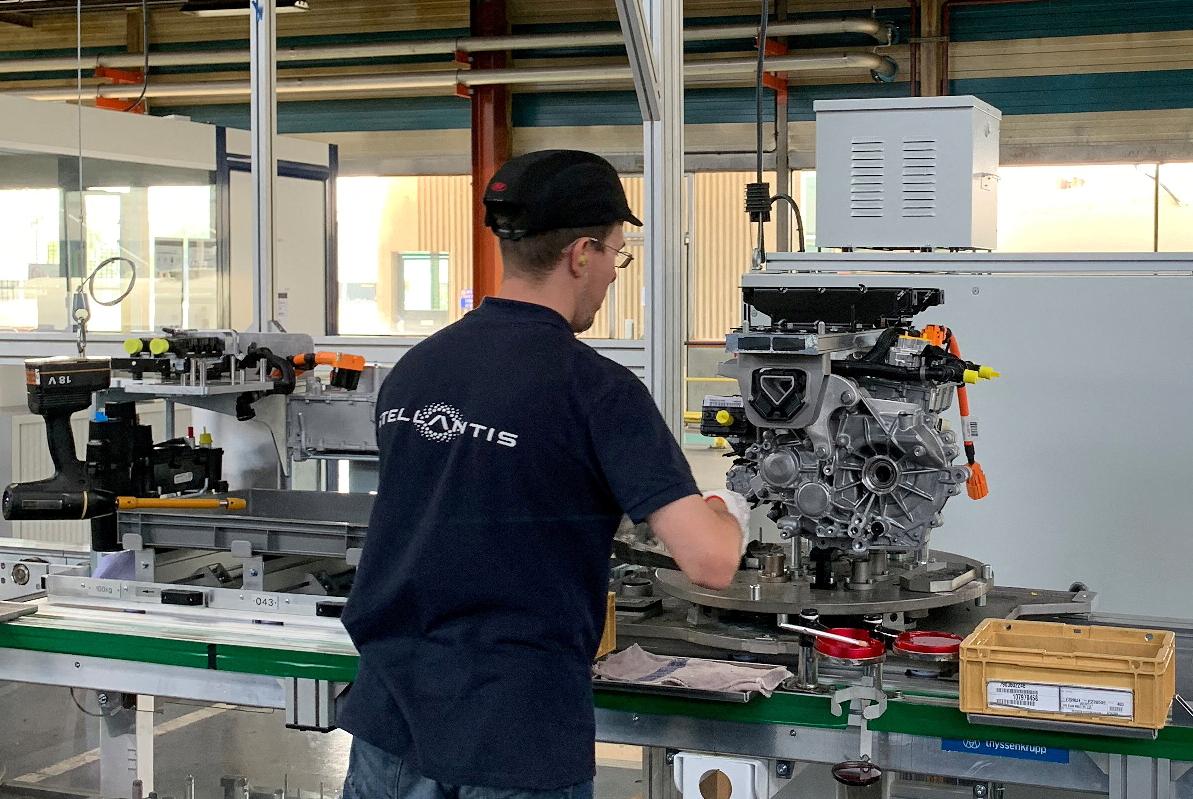

PARIS, Jan 12 (Reuters) - Stellantis (STLAM.MI) announced on Friday that it is investing in French sodium-ion battery startup Tiamat to diversify its portfolio and mass-produce electric vehicles while reducing exposure to scarce resources. The exact amount of the investment, which is part of an initial fundraising of 150 million euros from Tiamat, was not disclosed. The funds will be used in part for the construction of a battery factory in northern France, Tiamat Chief Executive Herve Beuffe told journalists. This site, the fifth so-called gigafactory for the electric vehicle supply chain in the region, should have an initial capacity of 0.7 gigawatt-hours by 2026, which could be increased to 5 GWh by 2029, he added. Born out of France's state institute for scientific research CNRS in 2017, Tiamat claims it can produce competitive batteries without lithium, a metal highly sought after due to the global electrification boom, which it replaces with far more abundant sodium. Its batteries, which are cheaper but also offer less mileage, will be suited to small vehicles. Their reduced reach can be compensated for by faster charging capacity, Tiamat says. "Exploring new options for more sustainable and affordable batteries that use widely available raw materials is a key part of our ambitions of the Dare Forward 2030 strategic plan that will see us reach carbon net zero by 2038," said Ned Curic, Director of Engineering and Technology at Stellantis. https://www.reuters.com/business/autos-transportation/stellantis-invest-french-sodium-ion-battery-maker-ev-output-2024-01-12/

2024-01-12 06:20

U.S. stocks end little changed U.S. Treasury yields ease Data shows U.S. producer price unexpectedly fall in December NEW YORK, Jan 12 (Reuters) - Oil prices gained on Friday as some oil tankers diverted course from the Red Sea after overnight strikes by the U.S. and Britain on Houthi targets in Yemen, while U.S. Treasury yields eased on news that U.S. producer prices unexpectedly fell in December. Wall Street stocks closed nearly flat after moving between modest gains and losses during the session. U.S. earnings season unofficially began, with major U.S. banks reporting lower profit on Friday in a quarter hit by special charges and job cuts and signs some consumer loans are starting to sour. Even as its quarterly profit fell, JPMorgan Chase (JPM.N) reported its best-ever annual profit and forecast higher-than-expected interest income for 2024. Its shares fell 0.7%, and an S&P 500 bank index (.SPXBK) dropped 1.3%. American and British warplanes, ships and submarines launched dozens of air strikes across Yemen overnight in retaliation against Iran-backed Houthi forces for attacks on Red Sea shipping. The move widened a conflict stemming from Israel's war in Gaza. Brent crude futures rose 88 cents, or 1.1%, to settle at $78.29 a barrel. The session high was more than $80, highest this year so far. U.S. West Texas Intermediate crude futures climbed 66 cents, or 0.9%, to settle at $72.68, paring gains after touching a 2024 high of $75.25. The U.S. PPI data raised expectations of an early U.S. interest rate cut from the Federal Reserve. The producer price index for final demand dipped 0.1% last month as the cost of goods declined, while prices for services were unchanged, which bodes well for lower inflation in the months ahead. Data on Thursday showed U.S. consumer prices rose more than expected in December. "Markets are shrugging off yesterday's CPI report since the underlying inflation trend is improving and the Fed can legitimately consider cutting rates this year," Jeffrey Roach, chief economist for LPL Financial in Charlotte, North Carolina, wrote. "The inflation pipeline is clearing and consumer prices will gradually get to the Fed's 2% target." U.S. two-year Treasury yields dropped to their lowest since May at 4.119% in the wake of the PPI data. They were last down 11.8 basis points (bps) at 4.142%. For the week, two-year yields, which reflect rate move expectations, were down 13.1 bps, their worst weekly showing in a month. The benchmark 10-year yield slid to a one-week trough of 3.916% , and was last at 3.955%, down 1.7 bps. The U.S. rate futures market has priced a nearly 80% chance of a rate cut at the Fed's March policy meeting, up from 71% late on Thursday, according to LSEG's rate probability app. The Dow Jones Industrial Average (.DJI) fell 118.04 points, or 0.31%, to 37,592.98. The S&P 500 (.SPX) gained 3.59 points, or 0.08%, at 4,783.83 and the Nasdaq Composite (.IXIC) rose 2.58 points, or 0.02%, to 14,972.76. For the week, the S&P 500 rose 1.84% in its biggest weekly percentage gain since mid-December. The U.S. market will be closed on Monday for the Martin Luther King Jr. holiday. The pan-European STOXX 600 index (.STOXX) rose 0.84% and MSCI's gauge of stocks across the globe (.MIWD00000PUS) gained 0.33%. European Central Bank (ECB) President Christine Lagarde said rates could be cut if the central bank was sure that inflation had fallen to its 2% target. The dollar index pared gains after the PPI data. The dollar index was last up 0.19% at 102.40. Bitcoin last stood at $43,643, down more than 5%, having surged to a two-year high of $49,051 on Thursday after the U.S. Securities and Exchange Commission late on Wednesday approved exchange-traded funds linked to bitcoin. In Taiwan, hundreds of thousands of people attended final pre-election rallies in Taiwan ahead of Saturday's critical presidential and parliamentary polls. https://www.reuters.com/markets/global-markets-wrapup-1-2024-01-12/