2024-01-09 19:15

HOUSTON, Jan 9 (Reuters) - U.S. crude production will hit records over the next two years but grow at a slower rate, the U.S. Energy Information Administration (EIA) said on Tuesday, as efficiency gains offset a decline in rig activity. The rise in U.S. output comes as the Organization of the Petroleum Exporting Countries and its allies are cutting their own output in a bid to boost oil prices. U.S. crude production will rise by 290,000 barrels per day (bpd) to a record 13.21 million bpd this year, the EIA said in its Short-Term Energy Outlook (STEO). The EIA forecast OPEC+ production, excluding Angola which left the bloc in January, would fall by 620,000 barrels per day to 36.44 million barrels per day next year. That was down from a five-year average of 40.2 million bpd before the Covid-19 pandemic. A Reuters survey on Friday found that oil output by the members of the Organization of the Petroleum Exporting Countries (OPEC) rose in December as increases in Angola, Iraq and Nigeria offset continuing cuts by Saudi Arabia and others in the wider OPEC+ alliance. Worries of rising supply and weak demand for light crude also pushed Saudi Arabia to cut the February official selling price (OSP) of its flagship Arab Light crude to Asia to the lowest level in 27 months. While U.S production is set to climb to new records in 2024 and 2025 due to well efficiencies, the growth is set to slow from the 1 million bpd growth in 2023 due to lower drilling activity. Prices for global benchmark Brent crude is expected to average $82 per barrel in 2024 and $79 in 2025, close to the 2023 average of $82, EIA said. "Although we expect OPEC+ to restrict production to prevent prices from falling, we still anticipate global production to exceed consumption by mid-2025 and therefore for petroleum inventories to increase," the agency wrote in its report. EIA cautioned that heightened tensions in the Middle East and attacks on ships in the Red Sea could disrupt trade flows and push up prices. Oil prices climbed over 2% on Tuesday as the Middle East crisis and a Libyan supply outage pared the previous day's heavy losses. Brent crude futures were trading around $77.91 a barrel, while U.S. West Texas Intermediate futures were trading at $72.72 a barrel. On the demand side, the agency expects growth in global liquid fuels consumption to be 1.4 million bpd in 2024 and 1.2 million in 2025, lower than the 1.9 million bpd growth in 2023 due to a weaker Chinese economy, increasing vehicle fleet efficiency, and an end to pandemic recovery-related growth in 2023. https://www.reuters.com/markets/commodities/us-crude-production-touch-record-2024-eia-2024-01-09/

2024-01-09 18:52

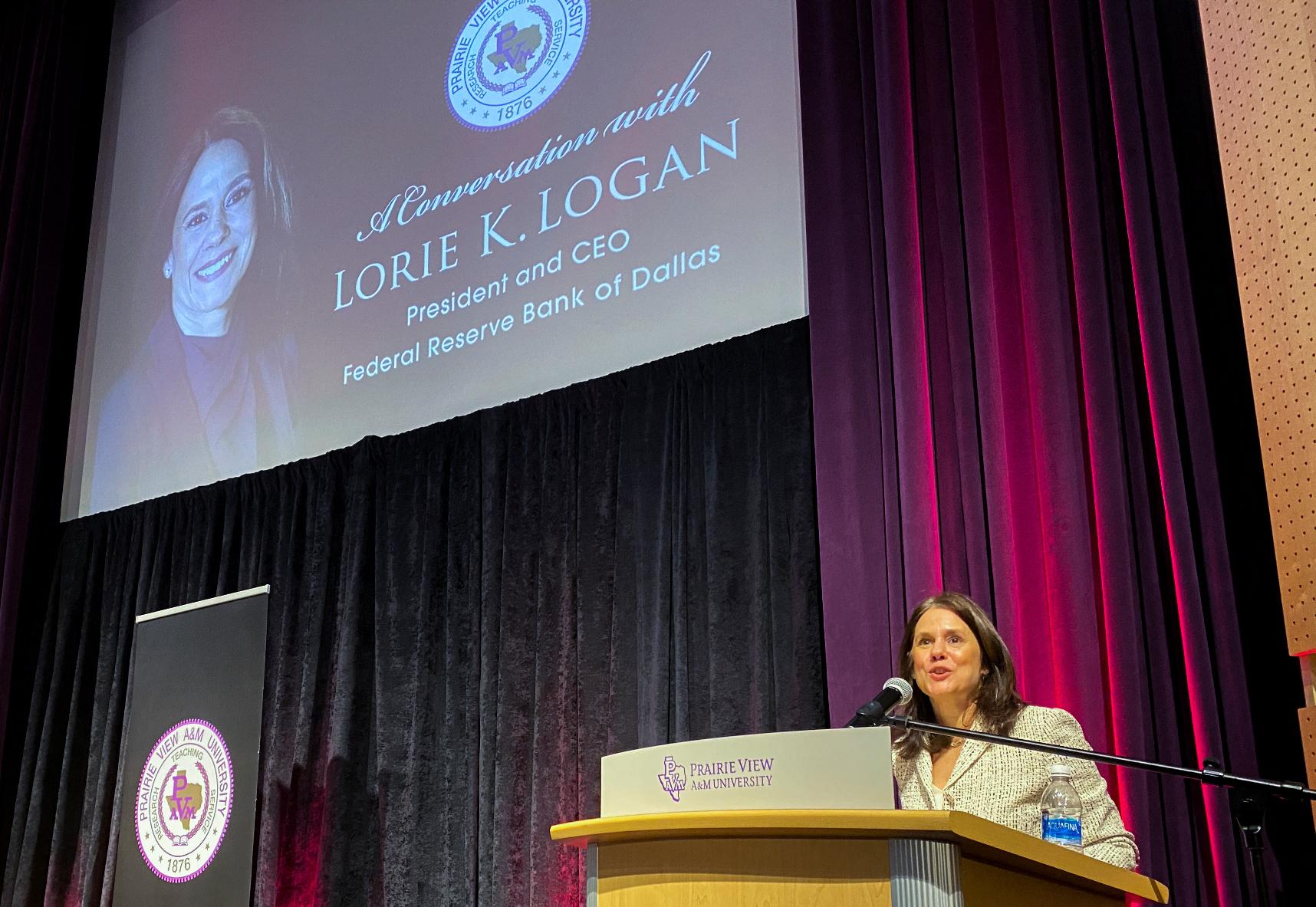

NEW YORK, Jan 9 (Reuters) - Comments over the weekend from a key Federal Reserve official have shed new light on how the central bank might end its ongoing effort to shrink its bond holdings, causing some market participants to revise views on the process’ endgame. Speaking on Saturday, Dallas Fed President Lorie Logan explained how contracting liquidity in money markets may sway the outlook for what’s commonly referred to as quantitative tightening, or QT. Logan’s voice on the issue is notable because before taking over the reins of her bank in 2022, she managed the New York Fed’s massive holdings of cash and securities and implemented the monetary policy decisions of the rate-setting Federal Open Market Committee. QT complements aggressive Fed rate rises aimed at combating high levels of inflation and involves the central bank shedding Treasury and mortgage bonds it bought to provide stimulus and stabilize markets during the early stages of the coronavirus pandemic. The Fed doubled the size of its balance sheet between the spring of 2020 and the summer of 2022, when its holdings topped out at $9 trillion. Since 2022, the Fed has been allowing just under $100 billion per month in Treasury and mortgage bonds to mature and not be replaced, and that’s caused Fed holdings to shrink to $7.7 trillion. The Fed wants bank liquidity at “ample” levels that avoids dislocations in money markets and affords it firm control over short-term rates. But outside of saying the process has a long way to go, Fed officials thus far offered only cursory guidance about how they’ll end QT. The almost certain end of Fed rate rises and the prospect of rate cuts this year have put the outlook for the balance sheet at the forefront of markets' attentions. Markets have been closely watching the rapid rundown in what’s called the Fed’s overnight reverse repo facility, or ON RPP, as a barometer for the liquidity the Fed wants to remove on the way to stopping QT. "In my view, we should slow the pace of runoff as ON RRP balances approach a low level,” Logan said. “Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run" by making it easier for financial firms to adjust their individual liquidity levels, she said. Logan also noted that there are signs liquidity is getting tighter for banks. SAME PLACE, DIFFERENT PACE The process Logan describes echoes the last time the Fed shrunk its holdings, where it slowed the pace of the drawdown before bringing it to a close. Some economists now believe that while the ultimate destination for Fed holdings will be the same, it may take a touch longer to get there. Logan’s comments indicated Fed officials “could start discussing slowing the pace of balance sheet runoff and then slow it a bit earlier,” Goldman Sachs economists said in a note. “But in that case, runoff should last a bit longer and the terminal size of the balance sheet should end up in roughly the same place, so the macroeconomic effects of starting earlier should be very minor.” Analysts at research firm Evercore ISI said “Logan is not signaling an early end to QT” while noting market developments could still cause such a thing. Instead, they viewed her comments as providing a more fleshed-out roadmap for how the Fed will manage an end to QT. “The Fed is paying attention to [the Secured Overnight Financing Rate] and QT evolution will be guided as much or more by price signals as quantity targets,” they wrote, adding “the timeline for agreeing internally, communicating and then executing a slowdown in the QT pace is speeding up a bit,” and it remains likely a tapering of QT will start in summer and the effort will end at the close of the year. Evercore’s view jibes with a survey of Wall Street banks, which projected ahead of the Fed's December policy meeting that QT will end in the fourth quarter with Fed holdings at $6.75 trillion, with bank reserves at $3.125 trillion and the Fed’s reverse repo facility holding $375 billion. That said, Bank of America economists now project Fed officials will announce a tapering of the drawdown at the March FOMC meeting, while holding onto the view QT will end in summer. There remain considerable devils in the details of how the Fed will shift gears, some noted, as the Fed still owns a lot of mortgages amid a desire to get its holdings back to all government bonds, so it’s possible decisions on tapering and halting may focus squarely on Treasury securities. https://www.reuters.com/markets/us/markets-tweak-fed-balance-sheet-views-after-comments-dallas-fed-chief-2024-01-09/

2024-01-09 18:51

Jan 9 (Reuters) - Officials at the U.S. Federal Reserve are carefully considering possible adjustments to key parts of the pending "Basel III endgame" overhaul for bank capital regulations, the central bank's supervision chief said on Tuesday, including operational risk calculations and potential offsets for mortgage servicing. The remarks from Fed Vice Chair for Supervision Michael Barr suggested for the first time that the Fed is mulling significant changes to a policy that has drawn stiff opposition from the banking industry, which says it needlessly risks causing banks to curtail lending. The Fed will also publish the results of a survey on the impact of the pending reforms, Barr said, adding that public comments received so far had been "super helpful" in developing the proposal's approach to matters like operational risk and fee-based income. "We want to make sure that the rule supports a vibrant economy that supports low- and moderate-income communities, that gets the calibration right upon things like mortgages," he said. "So the public comment that we're getting on this is really critical for us getting it right. We take it very, very seriously." Barr also said a lending program created during the 2023 banking crisis, in which three banks with high levels of uninsured deposits succumbed to depositor runs, was an emergency measure, suggesting that it was unlikely to be renewed. "That program was really designed in that emergency situation," he said. "It was designed for that emergency to say, we want to make sure that banks and creditors of banks and depositors [in] banks understand that banks have the liquidity they need." https://www.reuters.com/markets/us/fed-considering-changes-basel-proposal-supervision-chief-2024-01-09/

2024-01-09 18:45

RIYADH, Jan 9 (Reuters) - Saudi Arabia has revised upwards estimates for its untapped mineral resources including phosphate, gold and rare earths to $2.5 trillion, from a 2016 forecast of $1.3 trillion, its mining minister said. Mining is a key part of Riyadh's efforts to build an economy that does not largely rely on oil, involving a shift towards tapping vast reserves of phosphate, gold, copper and bauxite. Its Saudi Arabian Mining Company (1211.SE), known as Ma'aden and established in 1997, already produces some of these minerals. "We believe today that our reserves' potential have now grown by 90%," Mining Minister Bandar Al-Khorayef told Reuters in an interview. "This increase of $1.2 trillion is a combination of more of what we have, like phosphate, and new, like rare earths, and revaluation of (commodities) pricing," he added. A formal announcement will made on Wednesday during the Future Minerals Forum (FMF) mining gathering. Al-Khorayef said that 10% of the increase in estimate comes from the addition of rare earths minerals, important for electric vehicles and high-tech products. Saudi Arabia also plans to award over 30 mining exploration licences to international investors this year, he said. He added that the kingdom will announce a new regulation that allows the mining ministry to offer larger exploration areas of more than 2,000 kilometers for each license. "One of the things we have heard from global players ... is that the size of the areas (awarded) is probably not as big as they want." Riyadh has started awarding licences to international miners in 2022. Al-Khorayef has also said previously that the kingdom plans to move beyond exploration and extraction to processing and manufacturing. "Saudi Arabia could be a good place for processing of different minerals where we see minerals being mined in Africa being processed here." As part of its push to diversify away from fossil fuels, Saudi Arabia has also established investment fund Manara Minerals, a joint venture between Ma'aden and the Public Investment Fund (PIF), to buy assets overseas. Its first major foray abroad was a deal to become a 10% shareholder in Vale's (VALE3.SA) $26 billion copper and nickel unit last July. "Manara's ...management are looking around, finding different assets to buy or to partner with different countries." https://www.reuters.com/world/middle-east/saudi-arabia-ups-mineral-resource-estimates-25-trillion-minister-2024-01-09/

2024-01-09 17:09

NEW YORK, Jan 9 (Reuters) - U.S. small business sentiment rose for the first time in five months in December, a survey published on Tuesday showed, but hiring costs and ongoing concerns around inflation continue to sour business owners' confidence. The National Federation of Independent Business (NFIB) index rose to 91.9 in December from November’s 90.6. It was the first increase since July and matched that month's reading, but it held below its 50-year average of 98 for a 24th-straight month. Conditions have tracked the Federal Reserve’s most aggressive rate hike campaign since the 1980s, launched in 2022, during which small business owners have described tightened credit conditions. A net negative 25% of businesses reported improved profits in December, a 7 point increase from the month prior, with labor costs continuing to weigh on earnings, the report said. Inflation was the top problem for owners, and the share of owners reporting inflation as their main concern rose to a seasonally adjusted 23%. The jump comes after U.S. consumer prices unexpectedly rose 0.1% in November, Bureau of Labor Statistics data showed. On a 12-month basis, prices in November edged up 3.1% driven in part by a resurgence in the prices of cars and trucks, the BLS data said. Uncertainty around future economic conditions has also eroded the business outlook, the NFIB report said. The share of business owners citing labor quality as their greatest concern fell four points to 20%, while labor costs rose slightly as an area of worry. The portion of owners expecting better business conditions on a six-month basis rose 6 points to a net negative 36% in December. https://www.reuters.com/markets/us/us-small-business-sentiment-up-labor-inflation-worries-persist-2024-01-09/

2024-01-09 15:31

NEW YORK, Jan 9 (Reuters) - U.S. bond manager PIMCO said on Tuesday it was too early to declare victory over inflation and that recession risks persist, despite market expectations for a so-called soft landing for the American economy as the Federal Reserve looks to cut interest rates this year. The company said in a note it expects bonds to outperform stocks in 2024 should there be a recession and, given starting high yields, to provide a cushion in case of a re-acceleration in inflation. Still, after a rapid rally in bonds at the end of last year spurred by expectations that the Fed will cut rates as inflation cools down, PIMCO said it was neutral on so-called duration - a measure of a fixed income portfolio's sensitivity to changes in interest rates. "At this point, we don’t see duration extension as a compelling tactical trade," Tiffany Wilding, an economist, and Andrew Balls, chief investment officer for global fixed income at PIMCO, wrote in the note. "We expect to be broadly neutral on duration after the most recent bond-market rally, which has brought global yields back in line with our expected ranges, and amid the shifting balance of inflation and growth risks," they said. Benchmark U.S. Treasury 10-year yields, which move inversely to prices, have declined sharply in recent months, from over 5% in October to about 4% as of Tuesday. Going forward, long-term bonds could be affected again by concerns over widening U.S. fiscal deficits and increased government bond issuance. Such worries contributed to a sell-off of long-term bonds last year, before rate cut expectations injected optimism into the market. "We see potential for further bouts of long-end curve weakness amid anxiety about elevated supply, as occurred in late summer, stemming from the increased bond issuance needed to fund large fiscal deficits," PIMCO said. It said it favors government bond maturities of five to 10 years and is "underweight" the 30-year area. https://www.reuters.com/markets/us/too-early-declare-victory-over-inflation-or-recession-pimco-says-2024-01-09/