2024-01-04 17:41

Jan 4 (Reuters) - Walgreens Boots Alliance (WBA.O) on Thursday nearly halved its dividend payout as it attempts to conserve cash amid low consumer spending and intense competition, sending the U.S. pharmacy chain's shares down 11%. The stock was the second-biggest drag on the blue chip Dow Jones Index (.DJI), and the decline was set to wipe off more than $2 billion in Walgreens' market capitalization. Walgreens has been grappling with waning demand for COVID vaccines and testing, and decreased spending on personal care and beauty products by inflation-weary consumers. It announced a $1 billion cost cut program in October and is aiming to win back some market share lost to rivals like CVS Health (CVS.N). On Thursday, Walgreens said the hit from lower consumer spending was worse than previously expected, and forecast a low-single digit decline in same-store sales at its U.S. retail business compared to its previous forecast of flat sales. "We have hard work ahead of us in our journey to simplify and strengthen Walgreens," said CEO Tim Wentworth, who was brought on board recently. The 48% dividend cut to 25 cents per share could help "shore up" Walgreens' balance sheet and save about $800 million on an annual basis, Evercore analyst Elizabeth Anderson said. Walgreens had long-term debt of $7.59 billion as of Nov. 20, 2023. "It's still a tough year for them," said Jeff Jonas, portfolio manager at Gabelli Funds. "Earnings are going to be down for the current year that ends in August. Hopefully, this is the bottom." The company, however, beat profit estimates for its first full quarter under Wentworth, helped by cost cut measures and higher drug prices. It reported a loss of $67 million, or 8 cents for the quarter. On an adjusted basis, earned 66 cents per share, compared with estimates of 61 cents per share. https://www.reuters.com/business/retail-consumer/walgreens-beats-q1-profit-estimates-core-business-strength-cuts-dividend-2024-01-04/

2024-01-04 16:52

Weekly jobless claims fall 18,000 to 202,000 Continuing claims drop 31,000 to 1.855 million Private payrolls increase by 164,000 in December WASHINGTON, Jan 4 (Reuters) - The number of Americans filing new claims for jobless benefits dropped to a two-month low last week, pointing to underlying labor market strength even as demand for workers is easing. With the report from the Labor Department on Thursday also showing the number of people on unemployment rolls remained elevated towards the end of December, financial markets continued to anticipate that the Federal Reserve would start cutting interest rates in March. The government reported on Wednesday that job openings fell to a near three-year low in November. Labor market resilience is expected to again shield the economy from recession this year. "The labor market is not too hot and not too cold at the moment," said Christopher Rupkey, chief economist at FWDBONDS in New York. "The total number of Americans on the jobless rolls receiving benefits remains elevated relative to prior year levels, but at the moment there is not enough unemployment to say the economy is on the downward slope to recession." Initial claims for state unemployment benefits dropped 18,000 to a seasonally adjusted 202,000 for the week ended Dec. 30, the lowest level since mid-October. Economists polled by Reuters had forecast 216,000 claims for the latest week. Claims data tend to be volatile around this time of year because of holidays. They have largely bounced around in the lower end of their 194,000-265,000 range for 2023. Unadjusted claims fell 6,820 to 268,020 last week. Claims plunged by an estimated 7,572 in California and tumbled 6,080 in Texas. That helped to more than offset notable increases in Pennsylvania, New Jersey, Michigan, Massachusetts and Connecticut. The labor market is steadily cooling following 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022. The unemployment rate, however, has remained below 4% as companies hoard workers following difficulties finding labor in the aftermath of the COVID-19 pandemic. "The labor market is nowhere near a tipping point lower. That's excellent news for consumption and the economy at large," said Jamie Cox, managing partner at Harris Financial Group in Richmond, Virginia. "Recession calls get trampled by a strong, employed consumer and that's currently where things stand." Stocks on Wall Street were trading higher. The dollar fell against a basket of currencies. U.S. Treasury yields rose. LAYOFFS LOW IN DECEMBER Low layoffs were underscored by a separate report from global outplacement firm Challenger, Gray & Christmas on Thursday that showed job cuts announced by U.S.-based employers dropped 24% to 34,817 in December. Planned layoffs, however, jumped 98% to 721,677 in 2023, the highest annual count since 2020. That largely reflected cuts earlier in the year, with most of them in the technology, retail, healthcare and media sectors. Excluding the pandemic, it was the highest tally since 2009. Financial markets are betting the Fed will begin cutting interest rates as early as March. Minutes of the U.S. central bank's Dec. 12–13 policy meeting published on Wednesday showed officials viewed the labor market as remaining tight, but also continuing to "come into better balance." They also showed that "several participants noted the risk that, if labor demand were to weaken substantially further, the labor market could transition quickly from a gradual easing to a more abrupt downshift in conditions." The U.S. central bank held its policy rate steady in the current 5.25%-5.50% range at last month's meeting and policymakers signaled in new economic projections that the historic monetary policy tightening engineered over the last two years is at an end and lower borrowing costs are coming in 2024. The number of people receiving benefits after an initial week of aid, a proxy for hiring, decreased 31,000 to 1.855 million during the week ending Dec. 23, the claims report showed. The so-called continuing claims have mostly increased since mid-September, a trend blamed largely on difficulties adjusting the data for seasonal fluctuations after an unprecedented surge in filings early in the pandemic. Economists expect the distortion will be smoothed out when the government revises the data this year. The claims data have no bearing on the Labor Department's employment report for December, which is scheduled to be released on Friday, as they fall outside the survey period. Nonfarm payrolls likely increased by 170,000 jobs in December, according to a Reuters survey of economists, after rising by 199,000 jobs in November. The unemployment rate is forecast to rise to 3.8% from 3.7% in November. Another report on Thursday showed private payrolls increased by 164,000 jobs in December, the biggest gain in four months, after a rise of 101,000 in November. The ADP National Employment Report, however, has been unreliable in predicting the private payrolls count in the Labor Department's monthly employment report. It showed wage growth continuing to slow, with salaries for workers staying at their current jobs rising 5.4% year-on-year in December after increasing 5.6% in November. "The labor market is becoming less tight but not collapsing," said Nancy Vanden Houten, lead U.S. economist at Oxford Economics in New York. https://www.reuters.com/markets/us/us-weekly-jobless-claims-fall-more-than-expected-2024-01-04/

2024-01-04 14:42

TORONTO, Jan 4 (Reuters) - Activity in Canada's service sector deteriorated for a seventh consecutive month in December as elevated borrowing costs weighed on the housing market, S&P Global Canada services PMI data showed on Thursday. The headline business activity index edged up to 44.6 in December from a near three-and-a-half-year low of 44.5 in November. However, it remained well below the 50 threshold which separates expansion from contraction in the sector. The index has been below 50 since June. "The impact of tight monetary policy on Canada's service sector economy was plain to see in December," Paul Smith, economics director at S&P Global Market Intelligence, said in a statement. "Panellists widely reported that ongoing weakness in demand and activity was in part being driven by high interest rates, with weakness notably seen in real estate markets." The Bank of Canada has raised interest rates to a 22-year high of 5% to tame inflation. The latest Canadian housing data shows sales down 43% in November from their peak in the first quarter of 2021. The PMI's measure of new business fell to a three-year low of 45.3 from 45.5 in November, while new export business also showed a deeper contraction. Signs of cooling inflation pressures were a bright spot in the data. The prices charged index dipped to 52.9 from 53.7 in November, posting its lowest level since August 2021, while the input prices index was at 58.7, down from 60.0. The S&P Global Canada Composite PMI Output Index, which captures manufacturing as well as service sector activity, posted its lowest level in December since June 2020, dipping to 44.7 from 44.8 in November. On Tuesday, data showed that Canada's manufacturing PMI fell to 45.4 in December, marking the steepest pace of contraction for the factory sector since the early months of the COVID-19 pandemic. https://www.reuters.com/markets/canadian-service-economy-shrinks-seventh-straight-month-2024-01-04/

2024-01-04 13:32

WASHINGTON, Jan 4 (Reuters) - U.S. private employers hired more workers than expected in December, pointing to persistent strength in the labor market that should continue to sustain the economy. Private payrolls increased by 164,000 jobs last month, the ADP National Employment Report showed on Thursday, the largest monthly increase since August. Data for November was revised slightly lower to show 101,000 jobs added instead of 103,000 as previously reported. Economists polled by Reuters had forecast private payrolls rising 115,000. The ADP report, jointly developed with the Stanford Digital Economy Lab, was published ahead of the release on Friday of the Labor Department's more comprehensive and closely watched employment report for December. The ADP report has been a poor gauge for predicting the private payrolls count in the employment report. The labor market is steadily slowing in the aftermath of 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022. The government reported on Wednesday that job openings dropped to nearly a three-year low in November. There were 1.40 vacancies for every unemployed person. According to a Reuters survey of economists, the Labor Department's Bureau of Labor Statistics is expected to report that private payrolls increased by 130,000 jobs in December. Total nonfarm payrolls are estimated to have increased by 170,000 jobs after rising 199,000 in the prior month. https://www.reuters.com/markets/us/us-private-payrolls-increase-december-adp-2024-01-04/

2024-01-04 13:08

NAIROBI, Jan 4 (Reuters) - Nigeria's naira and the Kenyan and Ugandan shillings are expected to weaken in the next week to Thursday, while Ghana's cedi and Zambia's kwacha could be steady, traders said. KENYA Kenya's shilling is seen falling on increased demand for dollars from sectors including manufacturing. Commercial banks quoted the shilling at 157.00/158.00 per U.S. dollar, compared with last Thursday's close of 156.50/157.50. "It (dollar demand) is just across industry; manufacturing and so on. It (the shilling) continues to weaken," one trader said. Traders said the central bank had agreed with banks late last month to allow bid-ask spreads of up to 1 shilling, up from a 20-cent spread previously. UGANDA Uganda's shilling is expected to weaken, undermined by dollar demand from the energy sector and general goods importers. Commercial banks quoted the shilling at 3,800/3,810 to the dollar, compared with last Thursday's closing rate of 3,775/3,785. "Fuel importers are exerting significant (dollar) demand, I would anticipate that will be a key dynamic in the coming days," one trader said. He said the shilling was likely to trade in the 3,800-3,840 range in the next week. NIGERIA Nigeria's naira is likely to drop on the official market to trade close to levels on the unofficial market owing to dollar shortages and as businesses resume activity after the Christmas break. The naira was quoted at 899 to the dollar on the official market on Thursday, versus the parallel market rate of 1,230 naira . "Unless there is renewed confidence or (forex) buyers start resisting, I don't see anything stopping the naira from trading lower," one trader said. GHANA Ghana's cedi is expected to be broadly stable as trading activity is yet to pick up on the interbank market. LSEG data showed the cedi at 11.9000 to the dollar on Thursday, the same as at last Thursday's close. "The cedi has been largely stable against the dollar to start the year, with the market quiet as many participants have not yet returned from their holiday breaks," said Sedem Dornoo, a senior trader at Absa Bank Ghana. "We expect this narrative to persist." ZAMBIA Zambia's kwacha will probably be steady, propped by up central bank interventions after a sustained slide. On Thursday the kwacha was trading at 25.75 per dollar, weaker than 25.20 per dollar on Dec. 21. Zambia's central bank sold $74 million in Wednesday's trading session to buttress the local currency, Access Bank said. https://www.reuters.com/markets/currencies/africa-fx-nigerian-kenyan-ugandan-currencies-seen-falling-2024-01-04/

2024-01-04 12:39

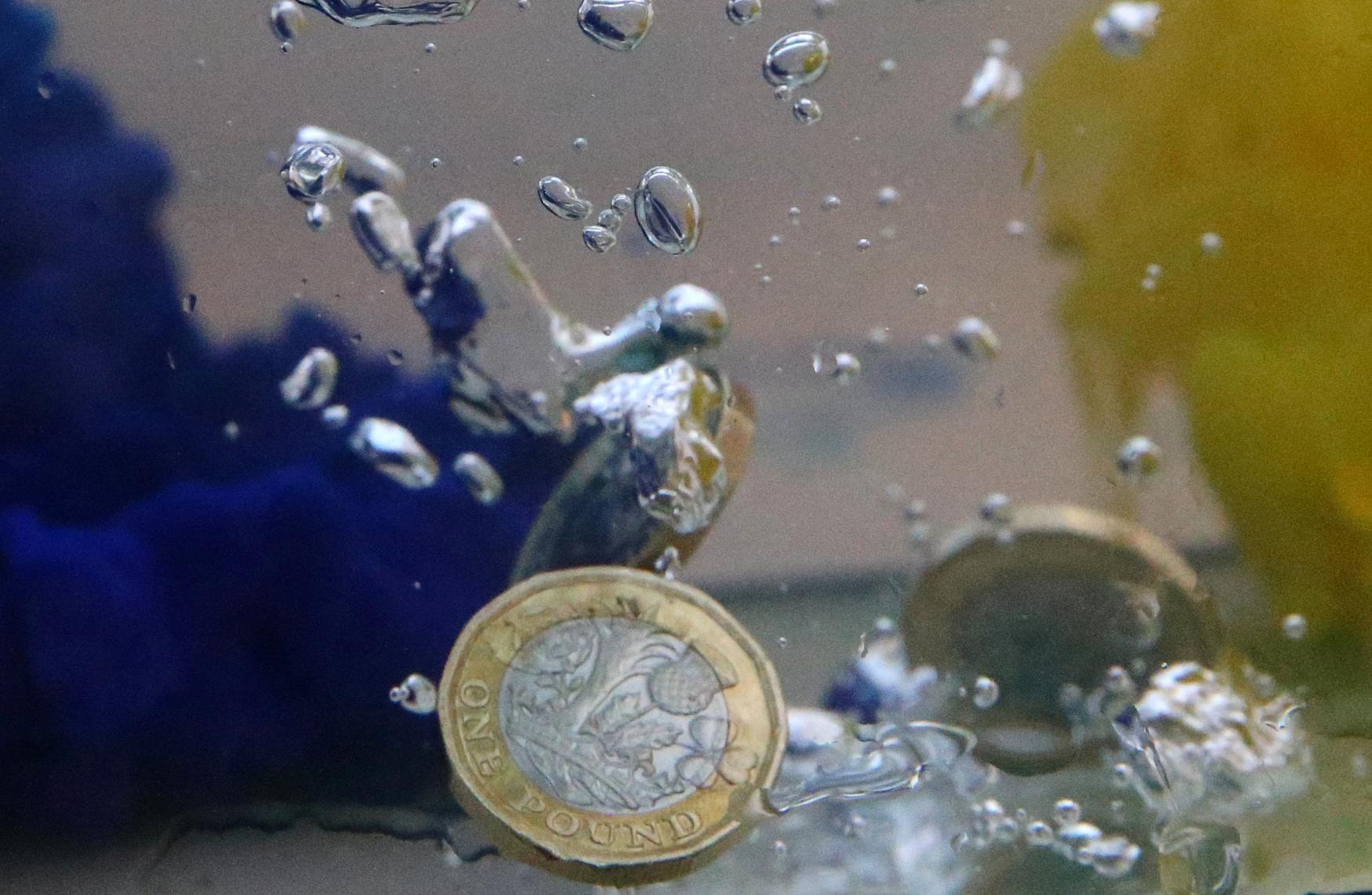

LONDON, Jan 4 (Reuters) - Sterling surged on Thursday after data showed British borrowers increased demand for loans, while a separate business survey showed a more resilient than feared economic picture. Bank of England (BoE) data showed on Thursday net borrowing by British consumers was the highest in nearly seven years in November and lenders approved the most mortgages since June, in a sign households were mostly coping with high interest rates. A separate survey, the final S&P Global/CIPS UK Services Purchasing Managers' Index (PMI), showed Britain's services firms grew more strongly in December than initially thought and optimism hit a seven-month high. The composite PMI, which combines the services survey with a weak reading of the manufacturing sector published on Tuesday, reached its highest since May in December, rising to 52.1 from 50.7 in November. Jeremy Stretch, head of G10 FX Strategy at CIBC Capital Markets, said sterling found some comfort as "early BoE rate cut expectations (are) continuing to be pared." The large increase in monthly consumer credit, combined with an upgrade to final services PMI "provides a more constructive UK macro backdrop," he said. Sterling was last up 0.23% against the dollar at $1.2690 It rose as much as 0.5% to $1.2728 after the data release, having fallen 0.87% on Tuesday to a three-week low, in its biggest one-day drop since mid-October. Traders expect around 140 basis points of rate cuts in 2024, according to money market pricing, not far off the roughly 150 expected from the Fed and the European Central Bank, but they are split on the timing of the first BoE cut. British business leaders have called on the BoE to start cutting interest rates in early 2024. Prime Minister Rishi Sunak, who is expected to call an election later this year, promised to get the economy growing more strongly but official data published last month suggested it could already be in a mild recession. The opposition Labour Party, which is far ahead of Sunak's Conservatives in opinion polls, has accused him of overseeing a slump in the country's growth. The central bank raised interest rates to a 15-year high of 5.25% in August and has said it expects to keep them elevated for "an extended period of time" to ensure that the risks posed by the surge in inflation in 2022 are snuffed out. Inflation in the UK fell more than expected in November to 3.9%, from 4.6% in October. https://www.reuters.com/markets/currencies/sterling-surges-better-than-expected-pmi-consumer-credit-2024-01-04/