2024-01-04 12:34

NEW YORK, Jan 4 (Reuters) - U.S. employers slowed layoffs in December, with the fewest announced job cuts since July, although the total for all of 2023 was the highest since 2020 when the COVID-19 pandemic emerged, a report out Thursday showed. Announced job cuts totalled 34,817 in December, down 24% from 45,510 in November, according to data released by outplacement firm Challenger, Gray & Christmas. Announced layoffs fell 20% from December 2022. For the year, though, announced layoffs roughly doubled from 2022 to more than 720,000. That was the highest since 2020 when over 2 million job cuts were reported, the report said. “Layoffs have begun to level off, and hiring has remained steady as we end 2023," said Andy Challenger, workplace and labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc. "That said, labor costs are high. Employers are still extremely cautious and in cost-cutting mode heading into 2024, so the hiring process will likely slow for many job seekers and cuts will continue in Q1, though at a slower pace,” Challenger said. The technology and retail industries announced the most job cuts in 2023, with employers most frequently citing economic uncertainty and the closure of businesses, units or stores as reasons for layoffs. Employers in the technology industry announced 168,032 job cuts on an annual basis, just shy of the sector's record of 168,395 set in 2001. https://www.reuters.com/markets/us/us-job-cuts-fall-back-december-nearly-double-all-2023-2024-01-04/

2024-01-04 11:48

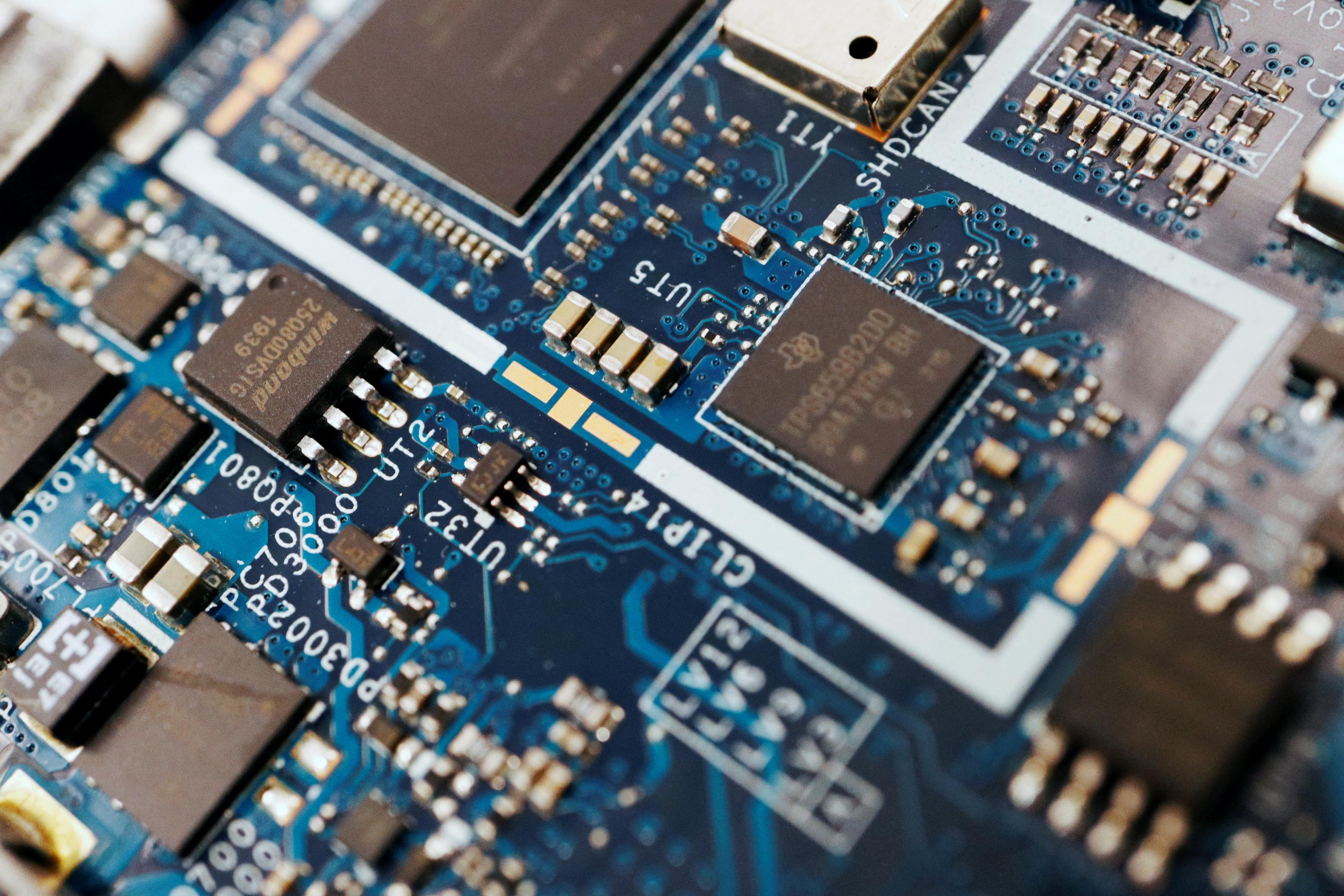

GANDHINAGAR, India, Jan 4 (Reuters) - India's Gujarat state is in talks with chipmakers in Japan, South Korea and the United States for investments in the state, its top minister said on Thursday, in pursuit of India's ambitions of becoming a chipmaker for the world. Semiconductor manufacturing is one of Prime Minister Narendra Modi's key business agendas but initial bids to offer $10 billion in incentives to the chipmaking industry have floundered, with some proposals stalled or cancelled. Gujarat, which is Modi's home state and one of India's major industrial hubs, has recently held investment talks with some chipmakers, and officials have visited Japan to meet some executives from the chips industry there, Chief Minister Bhupendra Patel told Reuters in an interview. "We continue to hold investment talks with semiconductor companies in Japan, South Korea and the U.S.," he said, without disclosing names of the companies citing "non disclosure agreements". India's chipmaking ambitions, first laid out in 2021, have suffered setbacks and the country does not yet have any semiconductor manufacturing plants. Taiwan's Foxconn (2317.TW) backed out of a $19.5 billion chips joint venture with India's Vedanta, saying "the project was not moving fast enough". Foxconn and Vedanta (VDAN.NS) have since decided to go solo, and billionaire Mukesh Ambani's Reliance Industries (RELI.NS) is also exploring opportunities. Gujarat has also held talks with Foxconn over a semiconductor plant, and U.S. memory chip firm Micron Technology Inc (MU.O) is also building a chip assembly and testing facility in the state. Patel's comments come ahead of the biennial Vibrant Gujarat Global Summit next week in which the state expects to secure investments in sectors including renewable energy, electric vehicles and electronics manufacturing. The summit is expected to draw a record number of foreign and domestic investors to the western state in what is seen as Modi's big push to promote investment in the country just months ahead of national elections, in which he will seek a third term. India is increasingly becoming a sought after investment destination, especially as companies look to diversify their supply chain beyond China. Tom Bailey, head of ETF Research at HANetf, said India was at an advantage due to its large size and an increasingly educated population. "The moves are emblematic of the rise of the so-called 'China plus one' supply chain diversification strategies of multinationals," he said. https://www.reuters.com/world/india/indias-gujarat-holding-talks-with-japan-us-firms-modi-eyes-chipmaking-hub-2024-01-04/

2024-01-04 11:47

Jan 4 (Reuters) - U.S. oil producer APA (APA.O) said on Thursday it would buy Permian Basin producer Callon Petroleum (CPE.N) in a $4.5 billion all-stock transaction, including debt, as dealmaking accelerates in the largest U.S. oilfield. Callon's assets will add heft to APA's operations in the Permian Basin, increasing its acreage by 50%. Permian has become a prime target for producers looking to increase their inventory due to its robust infrastructure, high productivity and large undeveloped reserves. The value of U.S. oil and gas mergers and acquisitions in the basin reached a record of more than $100 billion in 2023. Some of the blockbuster deals last year included Exxon Mobil's (XOM.N) $60-billion proposed acquisition of Pioneer Natural Resources (PXD.N) and Chevron's (CVX.N) $53-billion agreement for Hess (HES.N). Shares of Callon, which has a market value of $2.28 billion as of last closing, rose 4.4%, while APA fell 4.22% in premarket trading. Energy firms have been taking advantage of a surge in their stock price for acquisitions, avoiding big cash outlays that would jeopardize buyers' balance sheets. Under the deal, each outstanding share of Callon will be exchanged for 1.0425 shares of APA, representing an implied value to each Callon share of $38.31 per share, the companies said. The implied share value represents a nearly 14% premium to Callon's last close. Callon entered the Permian Basin in 2009 with the acquisition of about 8,800 net acres for $16 million. The deal is expected to close during the second quarter of 2024, with existing APA shareholders owning about 81% of the combined company and existing Callon shareholders owning nearly 19%. After the deal's closing, APA's worldwide pro forma production mix would be about 64% U.S. and 36% international. https://www.reuters.com/markets/deals/apa-corp-acquire-callon-petroleum-45-bln-deal-2024-01-04/

2024-01-04 11:45

PARIS, Jan 4 (Reuters) - France's TotalEnergies has hired former prime minister of Benin Lionel Zinsou to assess land purchases in Uganda and Tanzania as part of the Tilenga oil and East African Crude Oil Pipeline (EACOP) projects. Activist groups, led by Friends of the Earth France, are suing TotalEnergies over the projects, accusing it of failing to protect local people and the environment. TotalEnergies rejects the allegations. TotalEnergies said on Thursday that as the land acquisition process draws to a close, Zinsou will evaluate the procedures used, the conditions for consultation, the compensation and relocation of people affected, and grievance handling. Zinsou's consulting firm will also assess actions taken by TotalEnergies EP Uganda and EACOP to improve living conditions for those affected. It will submit a report by April 2024. TotalEnergies said the Tilenga and EACOP projects include a land acquisition programme covering 6,400 hectares (15,815 acres), carried out on behalf of the Ugandan and Tanzanian governments. The programme concerns 19,140 households and communities owning or using plots of land, and includes the relocation of 775 primary residences. To date, 98% of the households concerned have signed compensation agreements, 97% have received compensation, and 98% of households to be relocated have taken possession of their new homes, TotalEnergies said. NGO Human Rights Watch said that its research shows the land acquisition process for the EACOP pipeline has been a disaster. "Tens of thousands of people have lost land that provided food for their families and an income to send their children to school and they have received too little compensation from TotalEnergies," HRW's Myrto Tilianaki said. She added that Ugandan activists calling out these sorts of problems have been subject to arrests, threats and harassment. The Tilenga project in Uganda is being carried out by TotalEnergies (56.67%, operator), CNOOC (28.33%) and UNOC (15%). Ugandan oil will be transported to the port of Tanga, Tanzania through EACOP, whose shareholders are TotalEnergies (62%), UNOC (15%), TPDC (15%) and CNOOC (8%). Zinsou, prime minister of Benin in 2015-2016, is founder of consulting firm SouthBridge, with which TotalEnergies has collaborated in the past. https://www.reuters.com/business/energy/totalenergies-hires-former-benin-pm-assess-eafrica-land-purchases-2024-01-04/

2024-01-04 11:45

GANDHINAGAR, India, Jan 4 (Reuters) - India's Gujarat state is in talks with semiconductor companies in Japan, South Korea and the U.S. for investment in the state, Gujarat Chief Minister Bhupendra Patel told Reuters on Thursday. Gujarat, which is Prime Minister Narendra Modi's home state, is holding its biennial Vibrant Gujarat Global Summit next week and has signed initial investment agreements worth $86 billion with 58 companies ahead of the event. https://www.reuters.com/world/india/indias-gujarat-talks-with-chipmakers-japan-us-south-korea-2024-01-04/

2024-01-04 11:36

Jan 4 (Reuters) - Ukraine's export value fell 18.7% in 2023 compared with 2022, totalling $35.8 billion, the lowest figure recorded in a decade, the country's Economy Minister Yulia Svyrydenko said on Thursday. Maritime export saw an increase of 30.7% in December compared with November, she said on the LinkedIn platform. "In total, for the year 2023, we have almost 1 million tons more maritime exports," Svyrydenko added. Road exports were affected by a blockade of border crossings by protesting Polish truckers, resulting in an 18.3% decline in December compared with November, when the protests started. However, year-on-year the reduction was only 0.7%, Svyrydenko added. In total, Ukraine exported 99.8 million tons of goods in 2023, 112,000 tons more than in 2022, she added. https://www.reuters.com/markets/europe/ukraines-total-export-value-fell-187-2023-lowest-decade-economy-minister-2024-01-04/