2024-01-04 02:58

MUMBAI, Jan 4 (Reuters) - The Indian rupee will likely open little changed on Thursday, eyeing a further recovery on the U.S. dollar, more losses for equities and flows. Non-deliverable forwards indicate the rupee will open nearly unchanged from 83.2750 in the previous session. "2024 has began on a very different note for the dollar and for risk," a forex trader at a bank said. The dollar was "mounting a decent recovery" and should keep USD/INR buyers "interested", he said. The portfolio inflows "will definitely not keep up the pace of December", making "surprising" dips on USD/INR "difficult", he added. The dollar index reached a more-than-two-week high in the New York session, helped by the weak risk appetite. U.S. equities retreated Wednesday to extend their losing run. The S&P 500 Index has dropped 1.8% over three days. The 10-year U.S. bond yield topped 4% before retreating. Following the December rally, both U.S. bonds and equities have struggled. The move has come on the back on mild pullback in expectations around the Federal Reserve rate cuts. Markets are pricing in a 29% chance that the Fed will hold the policy range of 5.25% to 5.5% at its March policy meeting, up from under 10% a week back, according to CME's FedWatch Tool. Plus, investors are now pricing in total of less than 150 basis points of rate cuts this year. FED MINUTES The minutes of the December Fed meeting noted the progress on inflation and reinforced expectations the Fed policy rate had likely peaked. Further, the minutes reflected on the risk of keeping the funds rate too high for too long, a point that Fed Chair Jerome Powell made at the December press conference. Comments in the minutes on inflation progress to date and risks to growth from keeping rates too high were dovish, Goldman Sachs said in note. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.38; onshore one-month forward premium at 8.50 paise ** Dollar index up at 102.50 ** Brent crude futures up 0.2% at $78.4 per barrel ** Ten-year U.S. note yield at 3.93% ** As per NSDL data, foreign investors bought a net $191.4 mln worth of Indian shares on Jan. 2 ** NSDL data shows foreign investors bought a net $114 mln worth of Indian bonds on Jan. 2 https://www.reuters.com/markets/currencies/rupee-weighs-dollars-decent-recovery-poor-risk-flows-2024-01-04/

2024-01-04 02:36

BEIJING, Jan 4 (Reuters) - Extremely heavy fog in several Chinese provinces on Thursday led to dangerously low visibility, closing highways, delaying flights out of Shanghai and prompting weather forecasters to release a string of warnings and advisories. Dense fog affected Shandong, Hubei, Hunan, Jiangxi and Fujian provinces with visibility below 200 m (656 ft) while some parts of southern Jiangsu and southern Anhui had visibility below 50 m, China's National Meteorological Centre said. The Central Meteorological Observatory issued yellow and orange warnings for heavy fog up to 7:45 a.m. (2345 GMT). Haze is expected in many areas going into Friday, Chinese weather forecasters predicted. Some areas of Anhui issued red warnings for heavy fog - the most serious advisory - and many highways were temporarily closed, according to state media broadcaster CCTV news. In Nanjing, capital of China's eastern Jiangsu province, several areas were hit by extreme fog causing snarls in public transportation to varying degrees, CCTV reported. China has a three-tier colour-coded warning system for thick fog, with red being the most serious, followed by orange and yellow. The fog also caused dozens of scheduled flights out of Shanghai Pudong International Airport to be delayed or diverted over the last three hours, according to FlightView.com's flight tracking app. A Reuters witness flying to Harbin from Shanghai reported that her plane was delayed for hours. "We just returned to the gate, so it looks like forever," said the frustrated traveller, revealing a photo of a wall of dense grey mist outside a plane window that was covered with rain drops. https://www.reuters.com/world/china/chinese-provinces-warn-thick-fog-dozens-shanghai-flights-delayed-2024-01-04/

2024-01-04 01:00

LONDON, Jan 3 (Reuters) - Portfolio investors boosted their petroleum positions in the final two weeks of last year, as some short positions in crude were squared up, but short-covering did little to reverse the downward trend in prices. Hedge funds and other money managers purchased the equivalent of 68 million barrels in the six most important futures and options contracts over the seven days ending on Dec. 26. Total purchases over the last two weeks of the year were 175 million barrels, partially reversing sales of 473 million over the previous 12 weeks. Purchases were concentrated in crude (+155 million barrels) rather than fuels (+19 million) as managers unwound previous bearish bets. Prior to the year-end buying, the net position across all three crude contracts had been reduced to a record low of 128 million barrels on Dec. 12. Afterwards, the net position had increased to 284 million barrels, but that was still in only the 11th percentile for all weeks since 2013. Chartbook: Oil and gas positions In the premier NYMEX WTI contract, short positions betting on a fall in prices were trimmed to 88 million barrels from 128 million two weeks earlier. Some of the reduction in short positions was probably motivated by profit-taking after prices had dropped sharply since the end of September. Many institutional money managers will have wanted to realise mark-to-market paper profits before closing their accounts for the year. Others will have been unwilling to carry large positions over year-end, when markets are shut for multiple days, liquidity is poor and volatility can be high. The period also saw a cross-market improvement in sentiment as traders anticipated the U.S. central bank would cut interest rates in response to signs of slowing inflation. Notwithstanding the short covering, crude positions ended the year on a bearish note, far below the 535 million barrels (60th percentile) reached in the middle of September. Inflation-adjusted front-month Brent futures averaged just $77 per barrel in December, scarcely above the recent low of $76 in June and slightly below the average of $82 since the start of the century. REFINED FUELS In contrast to crude, fund managers are sanguine about the outlook for refined fuels, where prices are underpinned by lower than average inventories in the United States and other major markets. The combined position across U.S. gasoline, U.S. diesel and European gasoil was 98 million barrels (43rd percentile) on December 26, but there were important regional differences. Fund managers were especially bullish about U.S. gasoline where the position was 68 million barrels (75th percentile). Positions in U.S. diesel of 19 million barrels (61st percentile) were also above the long-term average reflecting the positive outlook for the U.S. economy and expectations of rate cuts. But positions in European gasoil were bearish at just 11 million barrels (17th percentile) owing to the continued industrial recession in the region. U.S. NATURAL GAS Similar to crude, the final two weeks of the year saw some squaring up of very bearish positions linked to the price of U.S. gas. Fund managers purchased the equivalent of 344 billion cubic feet (bcf) in the two major futures contracts over the two weeks ending on Dec. 26. But the purchases reversed only a small part of the 1,744 bcf sold since mid-October, according to records published by the U.S. Commodity Futures Trading Commission. All the buying came from covering of previous bearish short positions (+376 bcf) rather than creation of new bullish long ones which were actually reduced (-32 bcf). Even after the year-end book squaring, fund managers were left running a net short position of 654 bcf (15h percentile for all weeks since 2010) down from a net long position of 775 bcf (50th percentile) in mid-October. In the Lower 48 states, the number of population-weighted degree days, a proxy for heating demand and gas consumption, was below the long-term seasonal average every day between Dec. 2 and Dec. 31. By the end of the year, the Lower 48 had experienced 226 heating degree days fewer than average (-14%) since the start of the heating year on July 1. Exceptionally strong El Niño conditions in the Pacific have led to much warmer-than-normal temperatures across the northern tier of states. Working gas inventories were 219 bcf (+7% or +0.81 standard deviations) above the long-term seasonal average on Dec. 22 up from a surplus of just 60 bcf (+2% or +0.23 standard deviations) in early October. As a result, futures prices for gas delivered in January 2024 had fallen to just $2.62 per million British thermal units at the end of December down from $3.89 on Oct. 13. Inflation-adjusted futures prices have fallen to just the 5th percentile or below for all months since the start of the century which will eventually curb production and eliminate the surplus. But unusually warm weather throughout December has postponed the rebalancing and ensured most fund managers remain bearish in the short term. Related columns: - Hedge funds dismiss OPEC⁺ action to support oil prices (December 11, 2023) - Oil investors discounted OPEC⁺ cuts in advance (December 4, 2023) John Kemp is a Reuters market analyst. The views expressed are his own. Follow his commentary on X https://twitter.com/JKempEnergy https://www.reuters.com/markets/commodities/year-end-hedge-fund-short-covering-failed-lift-oil-prices-kemp-2024-01-03/

2024-01-04 00:09

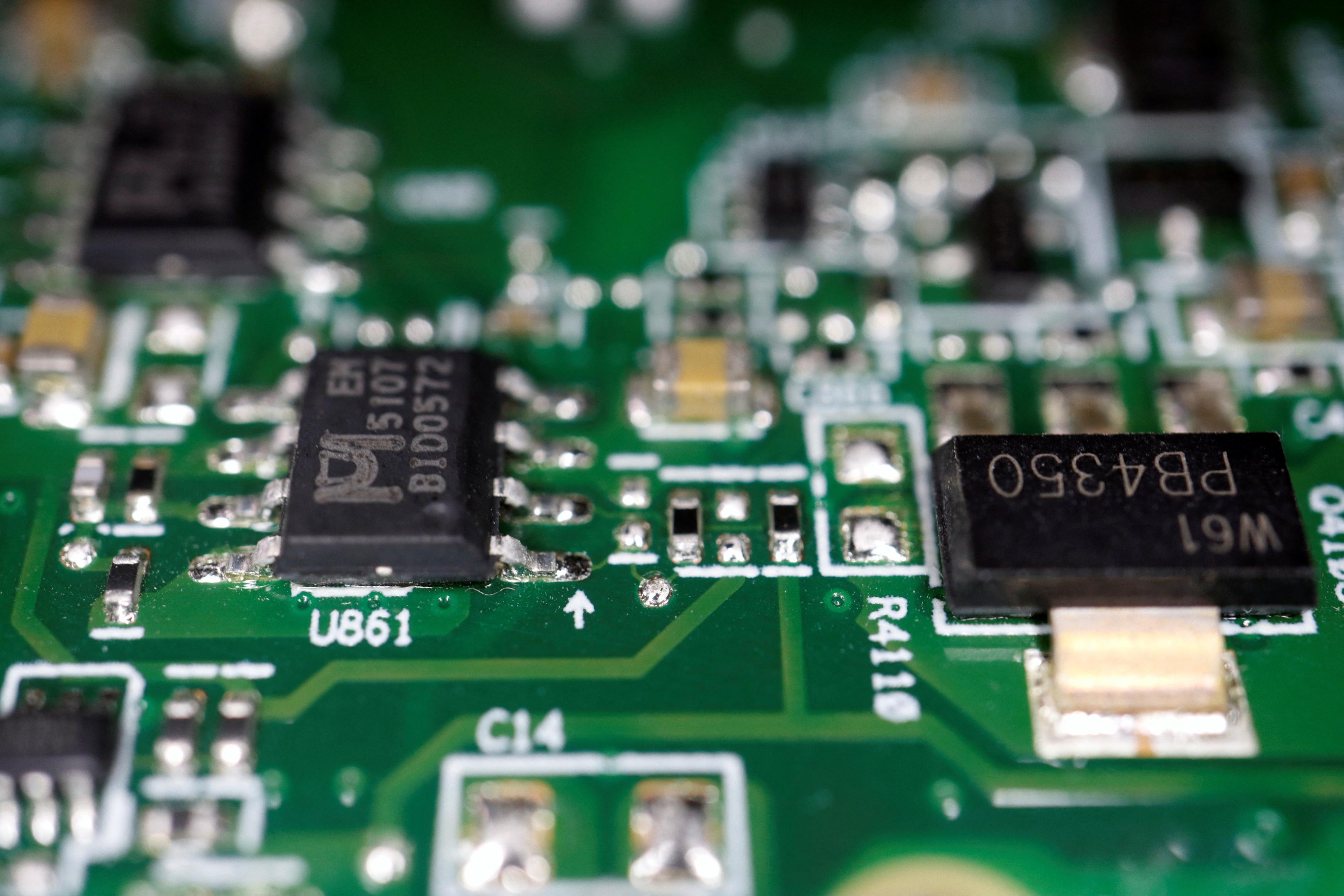

Jan 3 (Reuters) - U.S. chip stocks added to a string of losses on Wednesday, with Wall Street's main semiconductor benchmark tumbling from record highs following its strongest year since 2009, when the sector bounced back after the financial crisis. Drops of over 2% in Advanced Micro Devices (AMD.O), Qualcomm (QCOM.O) and Broadcom (AVGO.O) weighed most on the PHLX semiconductor index (.SOX), which was down 2.1%. The chip index has now declined almost 7% since reaching a record high close on Dec. 27. This week's drop in semiconductor stocks has tracked a broad Wall Street decline as investors await the Federal Reserve's December meeting minutes due later on Wednesday for clues on its interest rate path. Fueled by optimism about artificial intelligence and more recently by expectations the Fed will cut interest rates this year, the PHLX surged 65% in 2023, its strongest performance since 2009. That compares to annual gains of 43% and 24%, respectively, for the Nasdaq (.IXIC) and S&P 500 (.SPX). Chip stocks have also benefited from bets that a downturn in global demand last year that saw memory chip makers cut production has largely bottomed out. Nvidia (NVDA.O), viewed as the top provider of AI-related chips, saw its stock market value more than triple in 2023 to $1.2 trillion, making it Wall Street's fifth most valuable company. It dipped almost 1% on Wednesday. In a client note, BofA Global Research analyst Vivek Arya recommended exposure to cloud computing and cars through stocks including Nvidia, Marvell Technology (MRVL.O), NXP Semiconductors (NXPI.O) and ON Semiconductor(ON.O). Arya also recommended stocks including KLA Corp (KLAC.O) and Arm Holdings (O9Ty.F), for exposure to the increasing complexity of chip designs. In another note, Wells Fargo analyst Joe Quatrochi said he expects a muted recovery for chip equipment sellers in 2024, and pointed to KLA and Applied Materials (AMAT.O) as top picks in that industry. https://www.reuters.com/technology/us-chip-stocks-tumble-after-strongest-year-since-2009-2024-01-03/

2024-01-03 23:47

Jan 3 (Reuters) - The head of the U.N. nuclear power watchdog said on Wednesday his inspectors had been denied access to parts of Ukraine's Russian-occupied Zaporizhzhia nuclear power station and had yet to receive 2024 maintenance plans for the facility. The plant was seized by Russia in the days following Moscow's 2022 invasion of Ukraine. Each side has accused the other of shelling around the station, Europe's largest, though its six reactors now produce no electricity. Rafael Grossi, director general of the International Atomic Energy Agency (IAEA), said inspectors at the plant had for two weeks had no access to the main halls of reactors one, two and six. "This is the first time that IAEA experts have not been granted access to a reactor hall of a unit that was in cold shutdown," Grossi said in a statement on the IAEA website. "This is where the reactor core and spent fuel are located. The team will continue to request this access." Inspectors had also been restricted in their access to turbine halls at the plant which is situated in southeastern Ukraine, he said. Petro Kotin, head of Ukraine's state nuclear power company Energoatom, said Russia might be attempting to hide the true state of affairs at the plant. The country's nuclear security could only be restored with the de-occupation of the plant and territories nearby, he added in a message on the Telegram app. Grossi said the plant's operators had taken action to ensure back-up electricity supplies to the facility for when its main external power line is lost, which he described as a "repeated" occurrence. Losing its main power source has prompted concern as the plant needs power to cool its reactors, even when shut down. Grossi said the IAEA had asked the plant's operators for a maintenance schedule for 2024 "which has not yet been provided". He has visited the plant three times since the invasion - a complicated undertaking crossing the front lines of the 22-month-old conflict. Grossi has repeatedly called for an end to fighting in the vicinity of the facility to avoid a catastrophic accident. In his statement, he said IAEA staff had observed safety standards being upheld at Ukraine's three other working nuclear stations, though missiles and drones had flown close to two of them - Khmelnytskyi in the west and the South Ukraine Nuclear Power Plant. https://www.reuters.com/world/europe/iaea-says-denied-access-parts-russia-controlled-power-station-2024-01-03/

2024-01-03 23:17

Jan 3 (Reuters) - Bitcoin fell 5.07% to $42,689 at 23:03 GMT on Wednesday, losing $2,281 from its previous close. The world's biggest and best-known cryptocurrency is down 7% from the year's high of $45,922 on January 2. Ether , the coin linked to the ethereum blockchain network, dipped 6.54% to $2,202.4 on Wednesday, losing $154.1 from its previous close. https://www.reuters.com/technology/bitcoin-falls-51-42689-2024-01-03/