2023-12-28 19:18

SUCUNDURI, Brazil, Dec 28 (Reuters) - Deep in the Amazon rainforest, Brazil is fighting destructive wildcat gold mining as it spreads from Indigenous lands into government-protected conservation areas. Federal Police have joined the government's biodiversity conservation agency ICMBio on a series of recent operations to catch illegal gold miners and destroy their camps and equipment. Leftist President Luiz Inacio Lula da Silva's government has already been cracking down on mining on Indigenous reservations. But that has pushed some miners to other forests where there has been little enforcement. This month, armed officers of ICMBio, a government agency named after murdered environmental activist Chico Mendes, swooped down in helicopters on wildcat camps in the upper reaches of the Tapajos, a tributary of the Amazon River. They set fire to barges used to pump and filter ore, destroyed excavators and chainsaws, and seized weapons, radios and scales used by miners to weigh their gold. Lula has vowed to stamp out illegal mining and end deforestation by 2030. That is a sharp reversal of policy from his predecessor Jair Bolsonaro, who was criticized globally for relaxing environmental controls, giving illegal loggers and miners free range in the Amazon. He argued that Brazil had the right to develop its natural resources. On one recent mission, a Reuters photographer followed an ICMBio team into the Urupadi National Forest where agents detained a handful of wildcat miners and destroyed their tents, excavators, dredging equipment and fuel supplies. The miners had cut down swathes of jungle and dug dozens of ponds to dredge for gold that they separated from sand and ore with mercury, a contaminant that poisons fish in the rivers. Through the open door of their incoming helicopter, the ICMBio agents fired automatic weapons at motor boats carrying fleeing miners. They fired again to blow up barrels of diesel fuel and set fire to excavators so they could not be used again. "We destroy their camps and they keep coming back," said mission commander Sidney Serafim. During a three-week operation, the agents found 20 mining sites and 11 clandestine airstrips in the forest, along with kilos of mercury and thousands of liters of diesel. Detained miner Fabio Santos said he had worked prospecting for gold in Munduruku territory further along the Tapajos river, but had moved out due to law enforcement missions and conflict with the Indigenous people. "We thought it would be quieter here. Bolsonaro did not destroy our equipment," he said. "Things are going downhill with the new government," said another miner, Ramon Marques. "God left the gold here for us to enjoy it," he added. The men were set free into the jungle on foot. Only the manager of one of the wildcat mining sites, Manuel de Jesus Silva, was taken into police custody. He ran a store in a wooden shack where he sold canned food and liquor to the miners for grams of gold, and had a snooker table outside for them to play. "I used to make 200 grams a month, but in the last two months I got just 100 grams," Silva complained. https://www.reuters.com/world/americas/brazil-cracks-down-wildcat-miners-amazon-shift-their-operations-2023-12-28/

2023-12-28 18:49

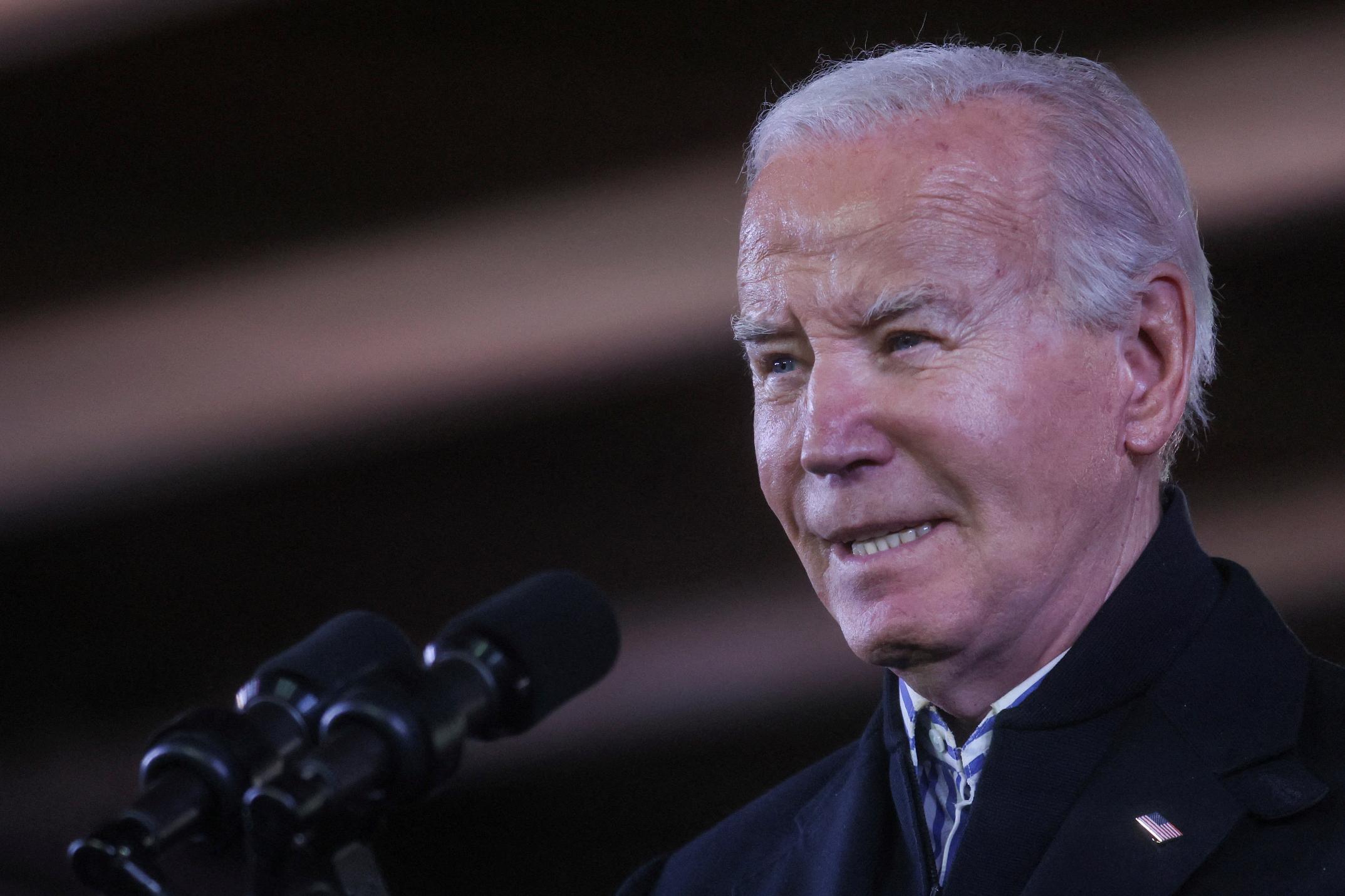

WASHINGTON, Dec 28 (Reuters) - U.S. President Joe Biden on Thursday extended the suspension of tariffs on European Union steel and aluminum for two years to continue negotiations on measures to address overcapacity and low-carbon production. The United States suspended import tariffs of 25% on EU steel and 10% on EU aluminum for two years from January 2022, replacing the tariffs imposed by former President Donald Trump with a tariff rate quota (TRQ) system. EU tariffs, imposed in retaliation, covered a range of U.S. goods from Harley Davidson (HOG.N) motorcycles to bourbon whiskey and power boats. Those have also been shelved until 2025, after elections on both sides of the Atlantic. The United States and the European Union had been seeking agreement measures to address excess metal production capacity in non-market economies, such as China, and to promote greener steel. The discussions were supposed to be resolved by 2023 but had stalled. In a presidential proclamation, Biden said the two sides had made "substantial progress" and were "continuing their discussions." The TRQ allows up to 3.3 million metric tons of EU steel and 384,000 tons of aluminum into the United States tariff-free, reflecting past trade levels, with the tariffs applying for any further amounts. The new exemption applies through December 31, 2025. Biden kept tariffs fixed at the current level for non-EU countries. https://www.reuters.com/world/us/biden-extends-eu-steel-aluminum-tariff-exemption-2-years-2023-12-28/

2023-12-28 18:16

MEXICO CITY, Dec 28 (Reuters) - Mexican authorities have located remains from two of the 10 coal miners trapped and killed at the El Pinabete mine in the state of Coahuila in August 2022, the government said in a statement on Thursday. WHY IT'S IMPORTANT The disaster highlighted the dangers workers face at Mexico's small, unregulated coal mines and drew attention to Mexico's state-owned power utility CFE, which the miner provided coal for. Support for CFE and for Mexico's coal industry has been a pillar of President Andres Manuel Lopez Obrador's energy policies. CONTEXT The miners became confined underground at the Pinabete mine in the northern border state of Coahuila on Aug. 3, 2022, when a tunnel wall collapsed, triggering flooding throughout the mine. Reuters reported last year that the mine had not been visited by labor inspectors. KEY NUMBERS It took authorities 512 days to find the first remains 62 meters below the surface, after rescue authorities extracted 2.3 million cubic meters of rock and soil, the government's statement said. https://www.reuters.com/world/americas/mexico-finds-first-remains-coal-miners-lost-2022-accident-2023-12-28/

2023-12-28 16:10

NEW YORK, Dec 28 (Reuters) - The number of Americans filing initial claims for unemployment benefits rose last week, indicating the labor market continues to cool in the year's fourth quarter. New state unemployment benefit claims rose by 12,000 last week to 218,000, according to the Labor Department. A Reuters poll showed economists expected an increase to 210,000 initial claims for the week ended Dec. 23. The rolls of those receiving benefits after one week of aid rose 14,000 from the week prior, reaching 1.875 million. Continued unemployment claims, a measure for hiring, have increased since mid-September, indicating those already out of work may be having difficulties getting a job. In November's economy, 199,000 new jobs emerged, up from 150,000 in October according to the Labor Department's non-farm payrolls report. The unemployment rate also fell moderately from the month prior, to 3.7% from 3.9%. Amid slower job growth and milder inflation, the Federal Reserve has left its benchmark interest rate unchanged for three consecutive policy meetings, and economists expect its hike campaign to be at an end. The Fed has raised its policy rate by 525 basis points, to the current 5.25%-5.50% range, since March 2022 in a bid to curb inflation. https://www.reuters.com/markets/us/new-us-jobless-claims-rise-again-labor-market-cools-2023-12-28/

2023-12-28 15:43

Dec 28 (Reuters) - Liquefied natural gas firm Tellurian (TELL.A) has agreed to issue about 47.9 million shares of its common stock to High Trail, an institutional investor, to extinguish some of its previous bonds, it said on Thursday. Shares of the company rose 9% to $1.04 in morning trading. The company said $37.9 million out of $250 million of a 2025 bond would be extinguished and it would amend certain terms of its debt agreements, according to a regulatory filing. Tellurian also said upon issue of the shares, the company will be deemed to have satisfied its obligations to make the cash interest payments due in respect of debt on Jan. 1. On Wednesday, a filing showed that another investor Chatterjee Fund Management had increased its stake in Tellurian to 7.3%, from 5.2% previously. Tellurian's Driftwood project has seen many setbacks including the cancellation of LNG supply deals. https://www.reuters.com/markets/commodities/tellurian-issue-shares-institutional-investor-reduce-debt-2023-12-28/

2023-12-28 14:57

NEW YORK, Dec 28 (Reuters) - When Ted Pick takes over as the new CEO of Morgan Stanley (MS.N) next week, the three-decade bank veteran's frank manner and steady hand will help him steer the firm through a dealmaking slump. Pick's cool head in difficult situations is an asset, said Tom Glocer, Morgan Stanley's independent lead director since 2017 and former Reuters CEO. "The great sin that gets people into super trouble at banks is the trader's instinct to hold on (to losing positions)... Ted has that ability to be disciplined" and take action, Glocer said. Over a frenetic weekend in 2021, Pick worked with a team into the night to cut Morgan Stanley's exposure to Archegos Capital Management, said Glocer. The family office's collapse triggered huge losses at global banks. Morgan Stanley lost more than $900 million in the Archegos ordeal, in what was otherwise a bumper year for the firm. Credit Suisse and Nomura took hits of $5.5 billion and $2.9 billion, respectively, while Goldman Sachs and Deutsche Bank exited their positions relatively unscathed. Pick, 55, will be elevated at a time of heightened economic uncertainty and geopolitical tensions. Dealmaking conditions are improving, but activity remains dismal, posing challenges for the banking industry. "He goes from boom to bust easily," said a close friend, referring to Pick's career navigating market cycles. The executive worked alongside Pick for more than 20 years and declined to be identified discussing internal Morgan Stanley business. Pick declined to comment for this story. The executive's success on initial public offerings won him support from private equity investors, which helped when he handled Morgan Stanley's stock buyback program during the global financial crisis. "He got along well with some shareholders and was also smart playing poker with the market when the firm did not have a lot of liquidity," the former executive said. Morgan Stanley was saved in 2008 by a U.S. government bailout and emergency investment from Mitsubishi UFJ. As the tumult spread through the financial system, Pick convinced Roberto Mignone, founder of hedge fund Bridger Capital, to keep his money at the bank as a sign of confidence. The two have been close friends ever since. "Ted never forgot that," Mignone said. "He's an old school Wall Street guy that cares about long-term relationships." Years later, Mignone gifted Pick a replica of the Titanic as a joking reminder of potential disasters. Billionaire and former Blackstone (BX.N) executive Hamilton "Tony" James said the private equity giant chose Morgan Stanley to lead its 2007 IPO mainly because of Pick. The banker later advised Blackstone as its stock dove to $3 after the financial crisis, from a debut of more than $30. "He's a truth teller, I was very impressed by that," said James. "He tells you straight out when something is not going to work." The banker once joined James for fly fishing in the Brazilian Amazon in search of Peacock bass, even though he had never fished, nor met James' dozen other friends on the trip. "He threw himself into it and was the life of the party," James said. While Pick gained prominence for turning Morgan Stanley's equities business into a global leader, he also tackled its challenges. The executive turned around its fixed income division, cutting 25% of employees, and helped raise capital when the bank was on the brink of collapse in 2008. He inherits a company that current CEO James Gorman, 65, built into a wealth management juggernaut since taking the helm in 2010. Australian-born Gorman will become executive chairman for a transitional period after Pick is elevated, and will also join the board of Disney next year. Steady revenue from the wealth unit has fueled a 214% climb for Morgan Stanley's stock under Gorman's leadership, compared with 126% at rival Goldman Sachs (GS.N) and 304% at JPMorgan Chase (JPM.N) in the same period. At $152 billion, Morgan Stanley's market capitalization exceeds Goldman's by $28 billion. Pick "has a broad range of experience, and appreciates the value of wealth management," said Colm Kelleher, the chairman of UBS Group, who preceded Pick as president of Morgan Stanley and left in 2019. The new CEO will present his first quarterly earnings in mid-January and give a strategy update that will be closely scrutinized by investors. His debut as CEO follows a 27% decline in investment banking revenue for the third quarter. LOW PROFILE While Pick holds one of the biggest jobs in finance, he keeps a low profile. He tends to celebrate birthdays privately with his wife and two daughters, ducking plans for larger gatherings, said Mignone. Despite his busy schedule, Pick enjoys attending his daughters' school events and sports matches, his friends said. The incoming CEO is also known to be a foodie who is always willing to try new cuisines. A fan of the New York Rangers ice hockey team, Pick prefers to buy his own tickets and attend games with family instead of entertaining clients. The executive lives in New York's Upper East Side and spends vacations at his house in Martha's Vineyard. In a break with Wall Street tradition, Pick's competitors for the top job -- executives Andy Saperstein and Dan Simkowitz -- will stay on with expanded roles. Both will get $20 million bonuses if they stick around for at least three more years. Gorman, meanwhile, may remain for up to a year to help with the transition. Rob Kindler, the global chair of mergers and acquisitions (M&A) at law firm Paul, Weiss, Rifkind, Wharton & Garrison, welcomed the arrangement. "James is there because employees and stockholders wanted him to be there," said Kindler, who previously ran M&A at Morgan Stanley. "But I really don't think Ted needs any handholding. He is ready." https://www.reuters.com/business/finance/morgan-stanleys-straight-talking-new-ceo-ted-pick-taking-charge-2023-12-28/