2023-12-28 14:27

MOSCOW, Dec 28 (Reuters) - After President Vladimir Putin sent troops into Ukraine in 2022, the United States and its allies prohibited transactions with Russia's central bank and finance ministry, blocking around $300 billion of sovereign Russian assets in the West. The United States has proposed that working groups from the Group of Seven (G7) major industrialized nations explore ways to seize that money, according to the Financial Times. What are these assets, where are they and what could Russia do if the assets were confiscated? CENTRAL BANK RESERVES Like other central banks, the Russian central bank placed some of its gold and foreign exchange reserves in liquid assets such as major currencies, gold and government bonds. About half of those reserves were held in the West. The central bank has confirmed that about $300 billion worth of assets have been frozen in the West. Total Russian foreign currency and gold reserves totalled $612 billion at the time Putin has accused the West of unleashing an economic war against Russia and has called the freezing of the reserves theft. Central Bank Governor Elvira Nabiullina was criticised by nationalists for allowing such a large chunk of the bank's reserves to be frozen. WHAT WAS FROZEN? The Russian central bank has not given a detailed breakdown of what was frozen but a rough outline can be gained from documents detailing Russian holdings at the beginning of 2022. At that time, Russia's central bank held around $207 billion in euro assets, $67 billion in U.S. dollar assets and $37 billion in British pound assets. It also had holdings comprising $36 billion of Japanese yen, $19 billion in Canadian dollars, $6 billion in Australian dollars and $1.8 billion in Singapore dollars. Its Swiss franc holdings were about $1 billion. Russia's central bank said these assets were mainly invested in foreign securities, bank deposits and nostro correspondent accounts. The banks biggest bond holdings were in the sovereign bonds of China, Germany, France, Britain, Austria and Canada. Russia's gold reserves were held in Russia. Investments in yuan are held in China. HOW WERE THE ASSETS HELD? Russia's central bank did not hide behind complex chains of nominal holders so identifying the assets will not be difficult. Most of the assets - including those of private Russian citizens - have been frozen at depositaries. CONFISCATION? Russian officials have repeatedly warned that the state confiscation of assets goes against all the principles of free markets. "Let's see what they decide," one senior Russian official told Reuters on condition of anonymity. "The protection of private property is a sacred cow that has been feeding them for many centuries." Some Russian officials have suggested that if Russian assets are confiscated then foreign investors' assets stuck in special so-called type "C" accounts in Russia could face the same fate. Some foreign assets were effectively locked in the C accounts. It is not clear exactly how much money is in these accounts but Russian officials have said it is comparable to the $300 billion of Russian reserves frozen. Finance Minister Anton Siluanov said last week that there were significant funds on the C accounts. Kremlin spokesman Dmitry Peskov told reporters last week that Russia would challenge any confiscation in the courts. "If something is confiscated from us, we will look at what we will confiscate," Peskov said. "We will do this immediately." https://www.reuters.com/world/europe/what-where-are-russias-300-billion-reserves-frozen-west-2023-12-28/

2023-12-28 14:27

Dec 28 (Reuters) - Cathie Wood's ARK Invest bought 4.3 million shares of ProShares Bitcoin Strategy ETF, which is popularly known as 'BITO' and tracks the price of futures tied to the world's largest cryptocurrency, a trading note showed on Thursday. Based on the fund's closing price on Wednesday, ARK's stake is worth roughly $92 million, according to Reuters' calculations. After a brutal 2022, the crypto market is on a rebound, with Bitcoin climbing more than 150% so far this year. Big asset managers, including BlackRock (BLK.N), are waiting for regulatory approvals from the U.S. Securities and Exchange Commission (SEC) to launch a string of derivative-based products such as ETFs tracking the spot price of Bitcoin. ARK, in partnership with 21Shares, has also refiled paperwork with the SEC seeking approval for a spot bitcoin ETF ARK 21Shares Bitcoin ETF after the regulator said its initial prospectus did not meet the requirements to prevent fraud and market manipulation. Separately, ARK Invest sold shares of Coinbase Global (COIN.O) worth roughly $27.6 million, based on the crypto exchange's last closing price. Shares in Coinbase have rallied more than 400% so far this year. Earlier this week, software firm MicroStrategy (MSTR.O) also disclosed it had bought bitcoin worth about $615.7 million in cash. https://www.reuters.com/technology/cathie-woods-ark-invests-bitcoin-futures-etf-sells-coinbase-shares-2023-12-28/

2023-12-28 13:49

Rate decision due at 1400 GMT on Monday Inflation rate eased to 3.3% in Nov, still above target Economists see start to cuts in Feb if no Jan reduction Central bank to issue updated macro estimates on Monday JERUSALEM, Dec 28 (Reuters) - The Bank of Israel could cut short-term interest rates next week for the first time in nearly four years as inflation slows and the economy weakens, but analysts give equal weight to a fifth straight hold due to uncertainty over Israel's war with Hamas. Of the 14 economists polled by Reuters, seven projected the Bank of Israel would lower its benchmark rate (ILINR=ECI) by a quarter-point to 4.5% when it announces its decision on Monday at 4 p.m. (1400 GMT). Another seven forecast no move, but economists agree the key rate will likely decline to 3.5%-4% in the coming year, starting in February. "It's a difficult call this time," Bank Hapoalim economist Victor Bahar said. The central bank had raised the rate 10 times in a row from 0.1% in April 2022 before pausing in July. It last lowered rates in April 2020. Despite weakening growth and consumer prices, the Bank of Israel has been reluctant to begin lowering short-term interest rates, citing a main focus on stabilising markets and reducing uncertainty. The inflation rate fell to 3.3% in November and is set to reach around 3% in 2023 - the top of the government's 1%-3% target range. Israel's war with Palestinian Islamist group Hamas that began on Oct. 7 is expected to lead to a large economic contraction in the fourth quarter and hamper growth into 2024. "I see all the reasons why interest rates should be cut. Inflation is falling, inflation expectations are falling, economy is down, credit is falling and the real estate market is frozen," Alex Zabezhinsky, chief economist at the Meitav Dash brokerage, said. Economists expecting no change believe there is too much economic uncertainty surrounding the war to start cutting in January, such as whether the conflict will spread to Hezbollah in Lebanon on the northern border as well as supply concerns. Also at issue is whether Israeli policymakers would want to pre-empt the U.S. Federal Reserve. At the subsequent decision in February, there will be two more inflation readings along with more clarity on the war's impact. Minutes of the Nov. 27 policy meeting's discussions showed policymakers were concerned over an expected sharp rise in state spending to help finance the war and compensation to those impacted by the Oct. 7 attacks. Lawmakers have already added some 30 billion shekels ($8.3 billion) in spending to the 2023 budget and Finance Ministry officials seek to add another 50 billion shekels in 2024 that will push the budget deficit to around 6% of gross domestic product from a prior 2.25% target. "Indicators from November and December actually show an improvement in consumption, the government deficit is climbing and the CPI has many measurement problems at the moment because of the war," said Harel Insurance and Finance economist Ofer Klein. "It's more reasonable to wait." The central bank will also issue updated macro estimates on Monday, while at 4.15 p.m. Bank of Israel Governor Amir Yaron will hold a news conference. ($1 = 3.6212 shekels) https://www.reuters.com/world/middle-east/start-israel-rate-cuts-possible-next-week-analysts-split-2023-12-28/

2023-12-28 12:46

ISTANBUL, Dec 28 (Reuters) - Turkey's larger-than-expected minimum wage hike, which impacts some 7 million workers, is expected to push already elevated inflation even higher in the coming months, economists and sector officials said. Labour Minister Vedat Isikhan said on Wednesday the monthly minimum wage will be 17,002 lira ($578) in 2024, a 49% increase from the level determined in July and a 100% hike from January. Economists said the wage hike was set to cause a medium-term deterioration in the outlook for inflation, which was already expected to hit around 70%-75% in the first half of 2024. "A two step increase in the minimum wage would have been better both for employees and employers and would not cause a sudden spike in inflation. Prices will increase by at least 25%-30%. This will be reflected in retail prices," said Berke Icten, the head of Turkey's Shoes Manufacturers Association. The minimum wage is usually revised once a year but due to high inflation and a depreciating currency, the government raised it every six months in the last two years. Sector officials said the support provided to employers to ease the cost impact of the minimum wage hike on production was less than expected and would strain businesses. The central bank said in the minutes of last week's monetary policy committee meeting that monthly inflation would rise in January, particularly due to the increase in minimum wage, but it is expected to slow in February and beyond. The central bank has raised its policy rate by 3,400 basis points since June and said it is committed to reining in inflation, which stood at 62% in November. An economist who spoke on condition of anonymity said the large minimum wage hike caused the market to question the government's commitment to the disinflation programme. "A 40% to 50% increase in the minimum wage was expected, but the increase was at the upper limit. It is not possible to give a clear figure, but we are talking about a level that may have a significant impact on inflation," the economist said. "This increase will distort the medium-term outlook for inflation. Since inflation will hit 70% in H1, if there is no other increase in the middle of the year, wages will be decreasing in real terms." According to the median of a Reuters poll, inflation is seen falling to around 43% by the end of next year, declining slowly despite the tight monetary policy. ($1 = 29.4430 liras) https://www.reuters.com/world/middle-east/turkeys-minimum-wage-hike-seen-fuelling-prices-hitting-inflation-outlook-2023-12-28/

2023-12-28 11:15

World FX rates in 2020 Trade-weighted sterling since Brexit vote LONDON, Dec 28 (Reuters) - Sterling touched a fresh five-month high against a broadly softer dollar on Thursday, putting the currency on track to end the month with gains of more than 1.3%. At 1019 GMT sterling was unchanged at $1.28, after earlier hitting $1.2825, its highest level since Aug. 1. The dollar is dipping as traders increase bets that the U.S. Federal Reserve will slash interest rates in 2024 amid moderating inflation. Inflation is also slowing in the UK, with data earlier in December showing a surprise drop in British CPI for November. "The Bank of England is showing more wariness than the Fed about the trajectory for inflation, so any sign that interest rates might stay higher for longer, in the UK, aren't read well for the housing market," said Susannah Streeter, head of money and markets at Hargreaves Lansdown. Data on Dec. 20 showed UK house prices fell in October by the most since 2011. The figures came after the BoE held rates at its final policy meeting for 2023 on Dec 14. Market players are now betting on around 150 basis points of interest rate cuts by the BoE during 2024 , though they place a 94% chance that there will be no change at the next meeting on Feb. 1. Elsewhere, traders are looking ahead to 2024 after Wednesday's announcement that UK finance minister Jeremy Hunt will present the spring budget on March 6, in what is likely to be the government's last major chance to prepare the ground for an election that must be held by January 2025. https://www.reuters.com/markets/currencies/sterling-hits-fresh-five-month-high-against-softer-dollar-2023-12-28/

2023-12-28 11:07

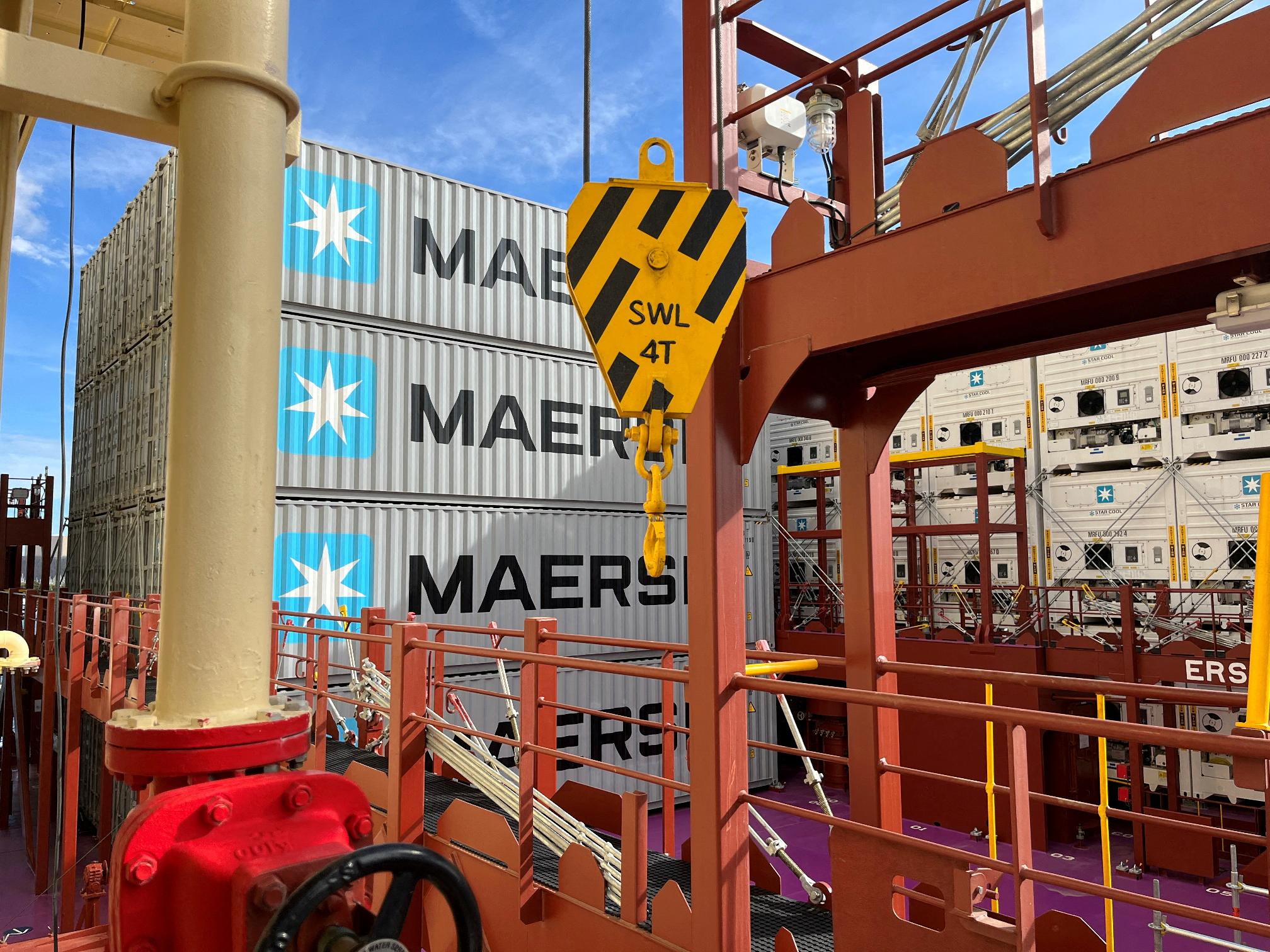

COPENHAGEN, Dec 28 (Reuters) - Denmark's Maersk (MAERSKb.CO) will sail almost all container vessels travelling between Asia and Europe through the Suez Canal from now on while diverting only a handful around Africa, a Reuters breakdown of the group's schedule showed on Thursday. Major shipping companies, including container giants Maersk and Hapag-Lloyd (HLAG.DE), stopped using Red Sea routes and the Suez Canal earlier this month after Yemen's Houthi militant group began targeting vessels, disrupting global trade. Instead, they rerouted ships around Africa via the Cape of Good Hope to avoid attacks, charging customers extra fees and adding days or weeks to the time it takes to transport goods from Asia to Europe and to the east coast of North America. But Maersk on Dec. 24 said it was preparing a return to the Red Sea, citing the deployment of a U.S.-led military operation to protect vessels, and on Wednesday released schedules showing ships were headed for Suez in the coming weeks. A detailed breakdown showed that while Maersk had diverted 26 of its own ships around the Cape of Good Hope in the last 10 days or so, only five more were scheduled to start the same journey. By contrast, more than 50 Maersk vessels are set to go via Suez in coming weeks, the company's schedule showed. But Maersk said alliance partner Mediterranean Shipping Company (MSC) continued to divert all MSC vessels via the Cape of Good Hope for the time being, regardless of date or point of departure and the direction they were sailing in. MSC did not immediately respond to a request for comment. Hapag Lloyd on Wednesday said it still considered the situation too dangerous to pass through the Suez Canal, adding that it planned to review the situation on Friday, The Suez Canal is used by roughly one-third of global container ship cargo, and re-directing ships around the southern tip of Africa is expected to cost up to $1 million extra in fuel for every round trip between Asia and Northern Europe. Among a handful of other third-party vessels in Maersk's alliance that were set to sail in the coming weeks, two would be diverted around Africa while the rest would travel via Suez, the schedule showed. All schedules remain subject to change based on specific contingency plans that may be formed over the coming days, Maersk has said. The company did not immediately respond to a request for comment. https://www.reuters.com/world/middle-east/maersk-send-almost-all-ships-via-suez-schedule-shows-2023-12-28/