2023-12-20 21:50

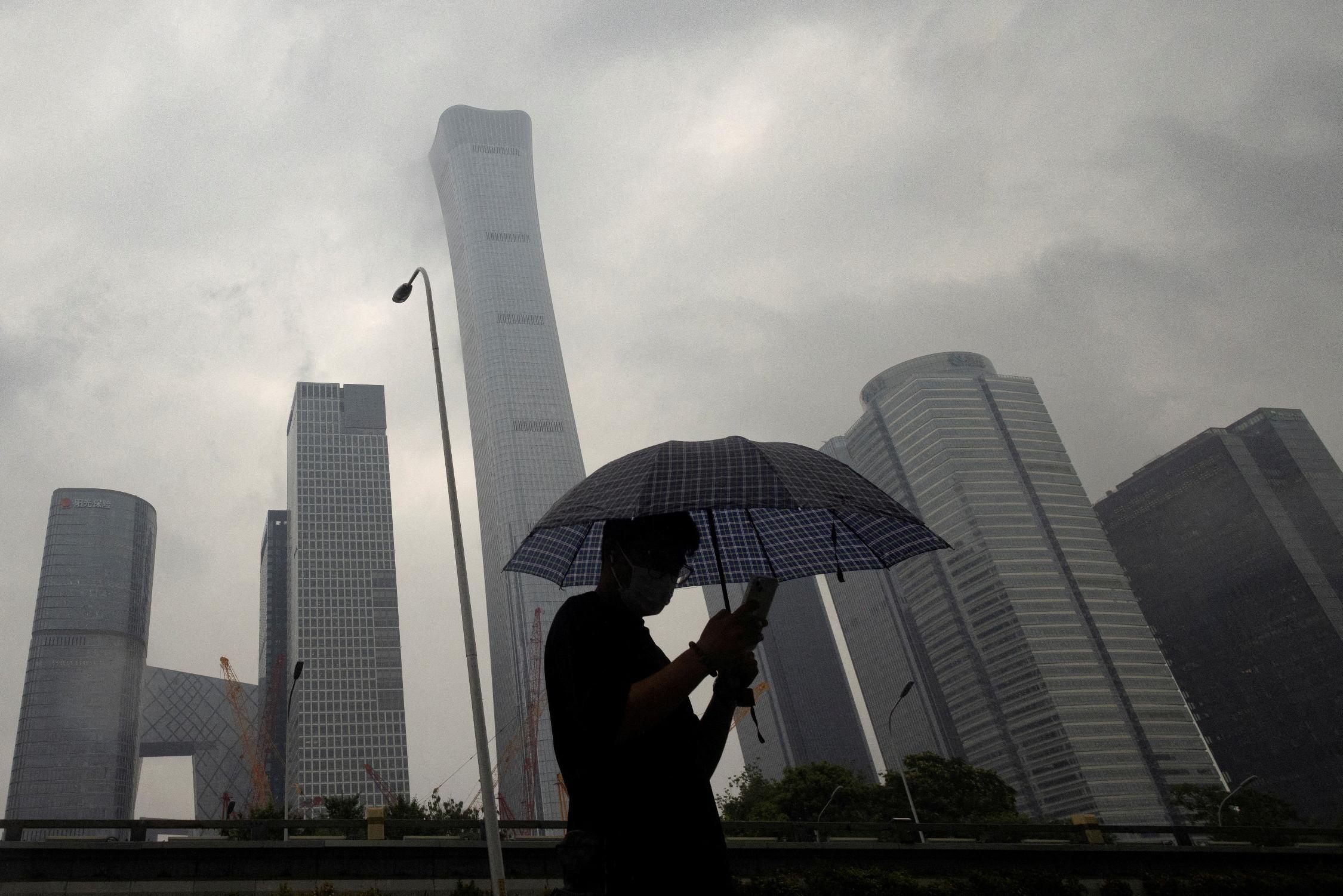

Dec 21 (Reuters) - A look at the day ahead in Asian markets. Investors in Asia go into Thursday's trading session on the defensive, after a late slide on Wall Street took the shine off figures that earlier showed global inflationary pressures cooling further. The regional economic and policy highlights on Thursday are the Indonesian central bank's latest policy decision, consumer price inflation and trade figures from Hong Kong, and producer price inflation data from South Korea. A far steeper decline in UK inflation last month than anticipated hammered gilt yields on Wednesday and strengthened the growing view that major central banks have substantial room to cut interest rates next year. With figures also showing a jump in U.S. consumer confidence to a five-month high, the 'Goldilocks' and 'soft landing' juiced the global risk rally until the last hour of trading on Wall Street triggered a sharp reversal. World stocks, which were up 10 days in a row and on course for their longest winning streak in nearly three years, slumped 0.7% and chalked up their biggest decline in two months. The three main U.S. indexes, at or near record highs this week, also registered their biggest daily losses since October. If that negativity spills over into Asia into Thursday, the long-standing underperformance of emerging market and Asian markets - and Chinese markets, in particular - is likely to continue. The Shanghai blue chip CSI 300 index fell more than 1% on Wednesday. It is on course for a sixth straight weekly loss, which would be its worst weekly run in 12 years, and a record fifth consecutive monthly loss. The big picture remains challenging - deflation is taking hold, the huge property sector is imploding and the growth outlook is questionable at best. It's a different story in Hong Kong, at least as far as inflation is concerned. Consumer price inflation has been rising lately, and reached a year-high of 2.7% in October while the month-on-month rate rose to a two-year high of 1.0%. Economists in a Reuters poll expect figures on Thursday to show that annual inflation held steady at 2.7% in November. Bank Indonesia, meanwhile, is expected to keep its benchmark seven-day reverse repo rate steady at 6.00% for a second month - inflation has been within its 2% to 4% target range for six months and the rupiah has gained nearly 2% since a surprise rate hike in October, easing pressure on imported prices. Economists polled expect the first rate cut to be in the third quarter of 2024. But with inflation well-behaved, the rupiah ticking up, and the Fed forecast to start cutting U.S. rates pretty soon, BI may move well before that. Here are key developments that could provide more direction to markets on Thursday: - Indonesia central bank policy decision - Hong Kong consumer price inflation (November) - South Korea producer price inflation (November) https://www.reuters.com/markets/asia/global-markets-view-asia-pix-2023-12-20/

2023-12-20 20:58

BRUSSELS, Dec 20 (Reuters) - European Union finance ministers agreed changes to the EU's fiscal rules to offer countries tailor-made debt reduction paths and incentives to invest. Here's why the rules matter. 1. The EU has a common currency - the euro - and the European Central Bank takes responsibility for a common monetary policy, but the bloc has no common fiscal policy. The fiscal rules, which limit government borrowing, are to ensure governments observe a common set of fiscal principles to prevent any irresponsible borrowing by one creating problems for all. An example of what can happen when the rules are ignored, is the Greek debt crisis of 2010. It resulted from years of excess Greek borrowing that was hidden by falsified statistics, and almost caused the euro zone to collapse. 2. Because the rules help to coordinate national fiscal policies, they provide a counter-balance to the ECB's monetary policy. If used correctly, the can help the ECB to achieve its inflation goal and so protect the purchasing power of EU citizens. 3. By setting limits on government deficit and on public debt, the rules aim to ensure that EU economies are stable in the long-term and avoid financial or economic crises. 4. The rules give investors confidence in euro zone assets, and the degree of predictability they give to governments' fiscal policy decisions has a favourable impact on the prices at which EU governments borrow. https://www.reuters.com/markets/europe/why-eu-fiscal-rules-matter-2023-12-20/

2023-12-20 20:53

Dec 20 (Reuters) - The U.S. Supreme Court on Wednesday said it would hear a bid to block the Environmental Protection Agency from enforcing a federal regulation aimed at reducing ozone emissions that may worsen air pollution in neighboring states. Acting on requests by the states of Ohio, Indiana and West Virginia, as well as pipeline operators, power producers and U.S. Steel Corp (X.N), to avoid complying with the federal "Good Neighbor" plan restricting ozone pollution from upwind states, the court said it would hear arguments in the dispute in February. In a major ruling last year, the conservative-majority Supreme Court imposed limits on the EPA's authority to issue sweeping regulations to reduce carbon emissions from coal- and gas-fired power plants under the landmark Clean Air Act anti-pollution law. At issue in the current dispute is an EPA rule, finalized in June by President Joe Biden's administration, regulating ozone, a key component of smog, in a group of states whose own plans the agency determined did not satisfy the "Good Neighbor" provision of the Clean Air Act requiring efforts to account for pollution that could drift into states downwind. The agency said the inadequate plans in 23 states required a federal program to reduce emissions from large industrial polluters in those states. A flurry of litigation in lower courts already has paused enforcement of the rule in 12 states. The case before the justices involves litigation brought by three states - Ohio, Indiana and West Virginia - pipeline operators including Kinder Morgan (KMI.N), U.S. Steel, and regional electricity generators and energy trade associations. They challenged the rule in the U.S. Court of Appeals for the District of Columbia Circuit, arguing that the EPA violated a federal law aimed at ensuring agency actions are reasonable. Some of the industry requests were specific: Kinder Morgan asked the justices to block the regulation as it applies to natural gas pipeline engines, while U.S. Steel sought to prevent its enforcement against iron and steel mill reheating furnaces and boilers. When the D.C. Circuit in September and October refused to block the rule pending its review, the challengers asked the Supreme Court to intervene. The EPA's plan will force them to bear unreasonable costs and will destabilize the states' power grids, the states said in a written brief. The Justice Department, defending the EPA, told the Supreme Court that blocking the rule for these challengers would "seriously harm downwind states that suffer from their upwind neighbors' emissions" and expose their residents to public-health risks. https://www.reuters.com/world/us/us-supreme-court-hear-challenge-epas-good-neighbor-air-pollution-plan-2023-12-20/

2023-12-20 20:34

Dec 20 (Reuters) - Shares of FedEx (FDX.N) sank 12% on Wednesday following dismal results and an outlook that prompted a slew of price-target cuts from Wall Street analysts and contributed to a late-day broad market selloff. FedEx is seen as a bellwether for worldwide economic trade. Investors on Wednesday said specific problems at the global delivery giant disappointed Wall Street, particularly its Express delivery business. The overall market initially shook off the news, but fell late in the day to push the S&P 500 down. "The Fed's tightening regime was always going to have a lagging factor and we've seen plenty of companies tightening their belts over the past year in order to be leaner and meaner heading into any downturn," said Danni Hewson, head of financial analysis at AJ Bell. Quarterly operating income for the air-based Express unit fell 60%, hit by volatile macroeconomic conditions, muted retailer restocking and reduced demand from its largest customer, the U.S. Postal Service (USPS). The U.S. Post Office has been diverting more packages from higher-margin air services to ground services. The drop in Express earnings surprised analysts, who had anticipated cost-cutting initiatives announced earlier in the year would offset some of the decline in business from USPS. "FedEx's quarterly results are a step back," Deutsche Bank analyst Amit Malhotra said. The stock lost $33.75 a share at $246.25, while shares of rival UPS (UPS.N) fell 2.9%. The broader S&P 500 (.SPX) index lost 1.5% after a steady run that left it just shy of an all-time record built on falling interest rates. In September 2022, a FedEx warning sparked a selloff in equities that lasted several weeks, but the market has been more optimistic of late. The U.S. Federal Reserve and other world central banks have hiked rates sharply over the past year-plus to combat inflation, but some, including the Fed, have recently pivoted, and are now suggesting rate cuts will be in the offing before long. CEO Raj Subramaniam noted industrial production around the world continues to be weak, saying that was reflected in the company's Express Freight numbers, and even in domestic Express figures. "While it may be easy to blame this on the cycle/macro, we disagree," wrote analysts at Morgan Stanley. The brokerage noted FedEx and UPS are still struggling with "post pandemic normalization of volume and pricing trends". FedEx's drop on Wednesday was poised to shed roughly $8 billion from its market value. At least five brokerages cut their price targets. BoFA Global Research cut its target by $21 to $313, the heftiest on Wednesday. The stock has a median price target of $296.50, according to LSEG data. FedEx said on Wednesday it was negotiating a renewal of the post office contract to try improving profitability from that business. TD Cowen analyst Helane Becker expects FedEx to walk away from the USPS business next year, when the contract expires. Shares of FedEx trade about 14 times forward profit estimates, below rival UPS's 16.7 multiple. https://www.reuters.com/markets/us/fedex-dives-after-quarterly-profit-miss-annual-revenue-forecast-cut-2023-12-20/

2023-12-20 20:23

Ortiz expected to become CEO following the bank's AGM in March Outgoing CEO Dancausa will become non-executive chair Dancausa to replace Pedro Guerrero MADRID, Dec 20 (Reuters) - The board of Spain's Bankinter (BKT.MC) on Wednesday said it would propose Gloria Ortiz as the bank's new chief executive officer, replacing Maria Dolores Dancausa, to oversee a more diversified revenue strategy. Dancausa, who will cease holding executive powers, is to replace Pedro Guerrero as non-executive chair, the country's fifth-biggest lender by market value said. Guerrero announced his intention to step down for personal reasons. The changes will take effect from March 21, 2024, if approved by shareholders on that day during an annual general meeting. The reshuffle comes as Spanish banks are still benefiting from higher interest rates that have prompted many lenders, including Bankinter, to lift their net interest income outlooks for 2023. But with the positive effect of the repricing of mortgage loan portfolios - tied to variable rates - expected to finish at some point after mid-2024, some banks are now counting on other sources of income, such as private banking, and higher-yielding areas such as consumer lending. Ortiz joined Bankinter in 2001 as financial controller. She since served as head of investor relations, chief financial officer, head of digital banking, technology and operations and - since 2021 - head of commercial banking. Dancausa has been CEO of Bankinter since October 2010. She was responsible for integrating Bankinter's private banking in Luxembourg, acquiring Barclay's retail, wealth and insurance management businesses, and part of the corporate unit Portugal in 2022. The lender also acquired the banking operations of Evo Banco and its Irish consumer credit subsidiary Avantcard in 2019. On Wednesday, Bankinter said it had started the mandatory process for the European Central Bank to assess the suitability of the candidates. Supervisors of euro area banks favour separating the roles of chair and CEO. https://www.reuters.com/business/finance/spains-bankinter-appoint-gloria-ortiz-new-ceo-2023-12-20/

2023-12-20 20:14

Canadian dollar strengthens 0.1% against the greenback Touches its strongest since Aug. 2 at 1.3312 Price of U.S. oil settles 0.4% higher 10-year yield hits its lowest since May 17 TORONTO, Dec 20 (Reuters) - The Canadian dollar steadied near a four-and-a-half-month high against its U.S. counterpart on Wednesday as long-term borrowing costs declined and investors weighed prospects of a recovery in the domestic housing market. The loonie was trading nearly unchanged at 1.3330 to the greenback, or 75.02 U.S. cents, after touching its strongest intraday level since Aug. 2 at 1.3312. "The Canadian dollar certainly has some momentum right now," said Adam Button, chief currency analyst at ForexLive. "The main risk for the Canadian dollar for the last year has been housing and with immigration surging and interest rates destined to come down, the possibility of a disorderly housing market is beginning to look remote." Minutes from the Bank of Canada's latest meeting showed that policymakers spent considerable time discussing the chances that shelter prices could remain elevated and make it harder to return to the bank's overall 2% inflation target. Data on Tuesday showed that Canada's population grew 1.1% in the third quarter, the highest rate since 1957. Recent gains for the loonie have come as investors bet that central banks would cut interest rates next year, improving the outlook for the global economy. "Optimism is in the air and the Canadian dollar is benefiting. You can see it throughout markets," Button said. Canadian government bond yields fell across the curve, tracking moves in U.S. Treasuries. The 10-year was down 6 basis points at 3.082%, after earlier touching its lowest since May 17 at 3.06%. The price of oil, one of Canada's major exports, settled 0.4% higher at $74.22 a barrel as investors worried about global trade disruption and tensions in the Middle East. https://www.reuters.com/markets/currencies/c-holds-near-4-12-month-high-housing-optimism-builds-2023-12-20/