2023-12-20 20:02

HOUSTON, Dec 20 (Reuters) - Oil and gas activity remained essentially unchanged in the fourth quarter and optimism waned as uncertainty jumped, a survey of oil and gas executives by the Dallas Federal Reserve Bank showed. Some of that uncertainty is centered around lower average oil prices and questions over OPEC's ability to influence oil prices, said the Bank's economist Kunal Patel. "The company outlook for E&P (exploration and production) firms changed more drastically, as the company outlook index for these firms fell sharply from 46.8 to -9.0", the survey showed. Oil production increased in the US Lower 48 but at a slower pace, according to the survey. There is also an expectation of more large mergers and acquisitions. “Executives at larger E&P firms are more likely to report their goal for 2024, their primary goal, is to acquire assets or reduce debt," Patel said in a news conference on Wednesday. The primary goal for smaller E&P firms in 2024 is to grow production, said Patel. In 2024 there was a moderation in input cost increase for service firms, but it higher interest rates remain a concern, the survey showed. “Increases in interest rates are starting to affect activity. We see demand as normal, but oversupply is more of an issue that has downward pressure on the price of oil,” another unnamed executive said. Employment in the energy sector remained unchanged as rig count declined and the industry has become very efficient, said Patel. The Israel-Hamas conflict has led to additional uncertainty, the survey showed. Executives from 143 oil and gas firms were asked this month where they expect WTI crude oil to prices to settle at the end of 2024, with a 28% plurality responding $75-79.99 per barrel. Production from new wells has been greater than expected but is more the result of higher output from specific sites rather than the number of wells, according to Patel. Total U.S. crude production reached a record last week at 13.3 million barrels per day, according to the latest data from the Energy Information Administration on Wednesday. (This story has been corrected to rectify the attribution in the story from Dallas Federal Reserve Bank's Head of Research Chiara Scotti to its economist Kunal Patel, in paragraphs 2, 6, 9 and 12) https://www.reuters.com/business/energy/optimism-wanes-uncertainty-increases-oil-companies-dallas-fed-survey-shows-2023-12-20/

2023-12-20 20:00

President Tshisekedi seeks second term in Congo vote Opposition candidates warn about lack of transparency Provisional presidential results expected Dec. 31 KINSHASA/GOMA, Democratic Republic of Congo, Dec 20 (Reuters) - Democratic Republic of Congo has extended elections into Thursday for those whose polling stations did not open on Wednesday, prompting a group of opposition presidential candidates to call for a rerun of the chaotic vote. At stake is not just the legitimacy of the next administration. Congolese election disputes often spark unrest with potentially far-reaching consequences. Congo is the world's third-largest copper producer, and the top producer of cobalt, a battery component needed for the green transition. The decision by the national election commission (CENI) caps a contentious campaign and an election day beset by delays, opposition allegations of fraud, and violence. Speaking to reporters in the capital Kinshasa after polls were meant to have closed, CENI President Denis Kadima acknowledged many polling stations across the country had opened late and some not at all and said voting would be extended for those whose centres did not open. This "cannot affect the credibility of the process. On the contrary, it is a demonstration that we want to grant the same right to (all) Congolese," he said. The opposition and independent observers had already sounded the alarm about a possible extension, saying it would enable fraud. In a joint statement late on Wednesday, five opposition candidates, including top challengers Martin Fayulu and Denis Mukwege, said the commission had no constitutional or legal right to extend the vote. They demanded "the reorganisation of these failed elections by a differently structured CENI" and at a date agreed by all stakeholders. "It is total chaos," said Fayulu earlier after voting in Kinshasa. The former oil executive was runner-up in the disputed 2018 presidential election. This time, President Felix Tshisekedi is competing against 18 opposition challengers in the hope of a second term running the mineral-rich yet poverty-stricken nation. POLLING STATION CONCERNS Throughout election day, observers flagged delays or failures opening polling stations and other issues, including malfunctioning electronic voting systems and violent attacks. Towards the scheduled end of voting, presidential candidate and Nobel Peace Laureate Mukwege condemned what he called "the proliferation of serious dysfunction and irregularities ... which confirm our fears of evidently planned electoral fraud." We "fear that the results of such a chaotic vote will not reflect the will of the people," he said. The tumult of election day follows a campaign marred by political violence and repeated warnings from the opposition and observers about a lack of transparency. Their concerns include issues with the voter list and illegible ID cards. For months, the electoral commission repeatedly rejected the opposition's allegations of mismanagement and fraud. It insisted it could deliver a free and fair vote as promised across Africa's second-largest country, even as critics flagged irregularities they said would jeopardise the legitimacy of the results. In the eastern cities of Goma and Beni, some polling stations opened hours late and people struggled to find their names on voter lists, according to Reuters witnesses. At one centre in Goma, voting machines' batteries ran out, leaving large crowds of people unable to vote as darkness fell. In Bunia, also in eastern Congo, security forces fired warning shots to disperse protesters after a voting centre was vandalised and kits destroyed, a Reuters reporter said. ELECTORAL TRANSPARENCY About 44 million Congolese registered to take part in the election, which also includes regional ballots. As voting day neared, the electoral commission sought extra helicopters, raising concerns about its ability to open polling stations in areas otherwise unreachable due to bad roads or a lack of security. The observer mission of Congo's powerful Catholic Church known as CENCO, on Wednesday warned such an extension would undermine the integrity of the results. "It is important for the election to take place in one day to avoid fraud," said CENCO Secretary-General Donatien Nshole before the commission announced the extension. Full provisional results were expected by Dec. 31, but it is not clear how the latest developments will affect the schedule. Some vote-counting had started at polling stations where voting was completed, Reuters reporters said. The presidential election is decided in a single round, requiring a simple majority of the vote to win. In Beni, some voters were undeterred by the delays. "Even with night falling, I will wait," said 28-year-old homemaker Rebecca Tommy, standing in line nearly two hours after polls were meant to close. "I am still waiting here to vote because it is my right." https://www.reuters.com/world/africa/congo-holds-presidential-vote-after-fraught-campaign-2023-12-20/

2023-12-20 19:58

Dec 20 (Reuters) - A new proposal by California regulators to further reduce the carbon intensity of transportation fuels will likely balance the market for one of the state's carbon credits, which saw prices fall nearly 65% in recent years due to oversupply, analysts said on Wednesday. The California Air Resource Board (CARB) issued a proposal on Tuesday to tighten requirements for fuelmakers to generate tradable credits after a glut of low carbon fuels like renewable diesel pushed credit prices notably lower. Higher prices for the credits incentivize investment in producing low carbon fuels that help the state meet its climate change targets. California's Low Carbon Fuel Standard (LCFS) credits have fallen from $200 per ton in 2018 to about $71 per ton currently and are still forecast to trade at weaker levels until late 2024 at the earliest, Jason Gabelman, analyst at Cowen Research, said on Wednesday. The LCFS currently requires fuelmakers to buy tradable credits if their products generate more carbon emissions than a baseline set by regulators. Refiners that produce low carbon fuels and gases can generate credits to sell. This drove a boom of renewable diesel and renewable natural gas production in recent years, which has devalued the price of the credits as larger fuel-consuming states like New York failed to adopt similar programs. "These changes should begin tightening up supply and demand of the LCFS program in 2025, which will be supportive for LCFS prices," wrote Matthew Blair, refining analyst at Tudor, Pickering and Holt. Regulators proposed targeting a 30% carbon intensity reduction in transportation fuels from a baseline level, up from 20% currently, a new 90% carbon intensity reduction target by 2045, and interim reduction targets. Among other changes, CARB added a mechanism that will pull forward the standards by one year if the program is in credit surplus for the previous year and the bank of credits exceeds the quarterly surplus by three times. CARB will also require producers of crop-based biofuels to have independent certification that the crops are not contributing to deforestation. The public comment period will run from Jan. 5, 2024, to Feb. 20, 2024, with a hearing on March 21, 2024. https://www.reuters.com/sustainability/climate-energy/california-proposal-cut-fuel-emissions-will-rebalance-credit-market-analysts-2023-12-20/

2023-12-20 19:54

BRUSSELS, Dec 20 (Reuters) - European Union finance ministers agreed on Wednesday changes to the EU's fiscal rules updating them to the post-pandemic realities of high public debt and the need for massive public investment to fight climate change. Below are the main points of the new approach. FOCUS OF THE RULES The rules shift the focus from the annual deficit and debt to net primary expenditure every year - a fiscal indicator which measures those spending components under a government's direct control. On the basis of a debt sustainability analysis, the European Commission and the country concerned agree on a path for net primary expenditure for four years, to cut the debt and deficit to below the EU's limits of 3% and 60% of gross domestic product (GDP) respectively. FOUR AND SEVEN-YEAR PLANS The four years to bring down public debt through control of government spending can be extended to seven years if a government makes certain types of investments and reforms. Reforms and investment in green and digital technologies and approved by the EU to pay out in cash from its post-pandemic recovery fund, if they include "ambitious reforms and investments, in particular with regards to economic growth and fiscal sustainability over the medium term" are enough to automatically extend the time. SPEED OF DEBT REDUCTION To make fiscal consolidation faster for countries that have high debt like Italy, Greece or France, the new rules set a minimum average annual amount of debt reduction. Countries with debt above 90% of GDP must cut it by at least 1% of GDP a year. For countries with debt between 60% of GDP and 90% of GDP, the reduction can be slower at 0.5% of GDP a year. This is much less ambitious than the previous, but unrealistically high requirement that every country should cut debt by 1/20 of the excess above 60% a year. But it is also more stringent than the original plan Commission proposal that any debt cut over four years would be enough. SPEED OF DEFICIT CUTS The upper limit for a budget deficit remains 3% of GDP, but the new rules introduce a "deficit resilience safeguard" - a margin below the 3% ceiling that would be used in planning the spending path, to make sure the government has room for manoeuvre even when something unexpected happens, without breaking the 3% EU limit. This margin is to be 1.5% of GDP. The 1.5% of GDP deficit is now the new overall target for EU countries, replacing the previous concept of a medium-term objective (MTO) that countries were to aim for. For many countries that was a deficit of 0.5% of GDP in structural terms so a move to 1.5% now leaves them additional fiscal space. If a deficit is above 3% of GDP, a government is put under an excessive deficit procedure (EDP)and must cut it by 0.5% of GDP annually. Once the deficit falls below 3% of GDP, the size of the annual improvement will be 0.4% of GDP a year if a country has four years for it, and 0.25% if seven years, until it reaches the deficit of 1.5% of GDP. This is slightly more lenient than the previous rules, which obliged governments to cut structural deficits by a minimum 0.5% of GDP a year until the budget is balanced or in surplus no matter whether the deficit was above or below 3%. The old rules also said a deficit in excess of 3% of GDP should be brought down below the ceiling again the following year, unless there are special circumstances. Now there is no such requirement. To take into account ECB interest rates that are at record highs, until 2027 interest payments will be excluded from calculating the deficit cuts when a country has a deficit above 3% of GDP, leaving more money in national governments' coffers for investment. ENFORCEMENT To enforce the agreed spending path, the Commission will be able to launch disciplinary steps, that could end in fines, against a government that would exceed its spending by a certain amount in a given year, or by a certain amount cumulatively over the four- or seven-year period. The size of the excess spending that would trigger the disciplinary procedure is 0.3% of GDP annually or 0.6% of GDP cumulatively when a country has debt above 60% and is also running a deficit. https://www.reuters.com/markets/europe/main-elements-fiscal-reforms-agreed-by-eu-governments-2023-12-20/

2023-12-20 19:26

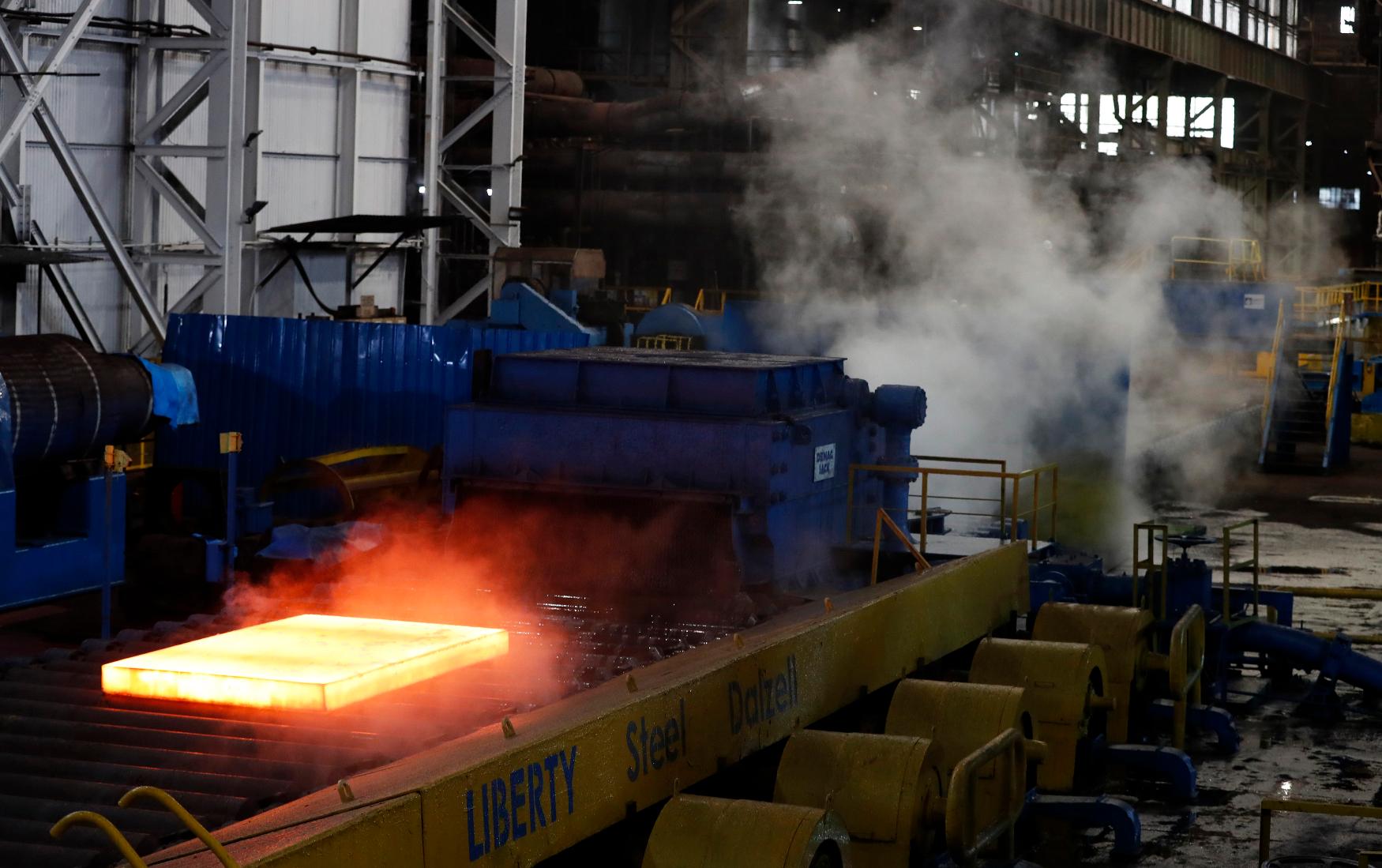

PRAGUE, Dec 20 (Reuters) - The Czech industry minister on Wednesday called on the owners of steel maker Liberty Ostrava to return money lent to related parties to the firm. Liberty, which has an annual capacity of 3.6 million metric tons of steel and employs about 6,000, is on the brink of collapse after its energy supplier declared insolvency over missed payments from the steel maker and prepared to cut off energy supplies. The company, whose parent Liberty Steel is owned by commodities tycoon Sanjeev Gupta, has idled production and shut-off furnaces as it battles a decline in the European steel market. After meeting Liberty Ostrava representatives, Industry and Trade Minister Jozef Sikela said the state would consider various options including an insolvency petition, depending on modifications it requested to a restructuring plan and the owners' willingness to return cash into the company. He said Liberty was owned 7 billion crowns ($313 million) by related firms and the state was owned 1.5 billion crowns by Liberty. "The decisive factor will be a clear commitment from the group, that means a materially significant sum...flowing back into the firm in January and following months," Sikela said a briefing shown live on television. He said Liberty, which won a court order in November protecting it from its energy supplier Tameh, assured him that the production shutdown was reversible and that employees would continue to receive salaries. Liberty Ostrava and its parent Liberty Steel Group did not immediately respond to a request for comment. Tameh was declared insolvent on Tuesday after Liberty, its main customer, missed payments. It expects to finish shutting down supplies to Liberty by Thursday afternoon. A spokesperson for the Czech company earlier said that some employees would continue to work to maintain equipment while others would remain at home. ($1 = 22.3300 Czech crowns) https://www.reuters.com/markets/commodities/czech-minister-calls-liberty-ostrava-steel-owners-return-cash-firm-2023-12-20/

2023-12-20 19:11

WASHINGTON, Dec 20 (Reuters) - U.S. new vehicles set a record high for fuel economy in 2022, with the highest yearly improvement in nine years to an average of 26 miles per gallon (mpg), yet the Detroit Three automakers continued to lag rivals. Vehicles were up 0.6 mpg over 2021 after being unchanged versus 2020, the Environmental Protection Agency said, noting electric vehicles and plug-in hybrid electric vehicles improved the average fuel economy by 1.2 mpg in 2022. Fuel economy is forecast to increase to 26.9 mpg in 2023, the EPA said. EPA Administrator Michael Regan said the report "highlights the historic progress made so far by the industry to reduce climate pollution and other harmful emissions." The report showed Tesla (7203.T) sold additional emissions credits and General Motors (GM.N) and Mercedes-Benz (MBGn.DE) purchased credits in 2022. Automakers use credits to meet requirements. Stellantis had the lowest fuel economy of major automakers, followed by GM and Ford. Horsepower, vehicle weight and size all hit new records in 2022 -- and are projected to hit again hit record levels in 2023. The EPA said EVs, plug-in hybrid and fuel-cell production rose to 7% in 2022 and are projected to hit 12% in 2023. Average range of EVs rose to a new high of 305 miles -- more than four times the 2011 range. The report showed Americans kept moving away from cars and are buying more SUVs. Sedans and wagons fell to just 27% of vehicles sold in 2022, while SUVs rose to 54% The EPA in April, proposed sweeping emissions cuts for new vehicles through 2032, including a 56% reduction in projected fleet average emissions over 2026 requirements that it says would result in 67% of new vehicles by 2032 being electric. Dan Becker, director of the Center for Biological Diversity’s Safe Climate Transport Campaign, said EPA should finalize even tougher rules, while automakers and the United Auto Workers union want the EPA to soften its proposal set to be finalized https://www.reuters.com/business/autos-transportation/us-new-vehicle-fuel-economy-hits-record-high-2022-epa-2023-12-20/