2023-12-20 19:00

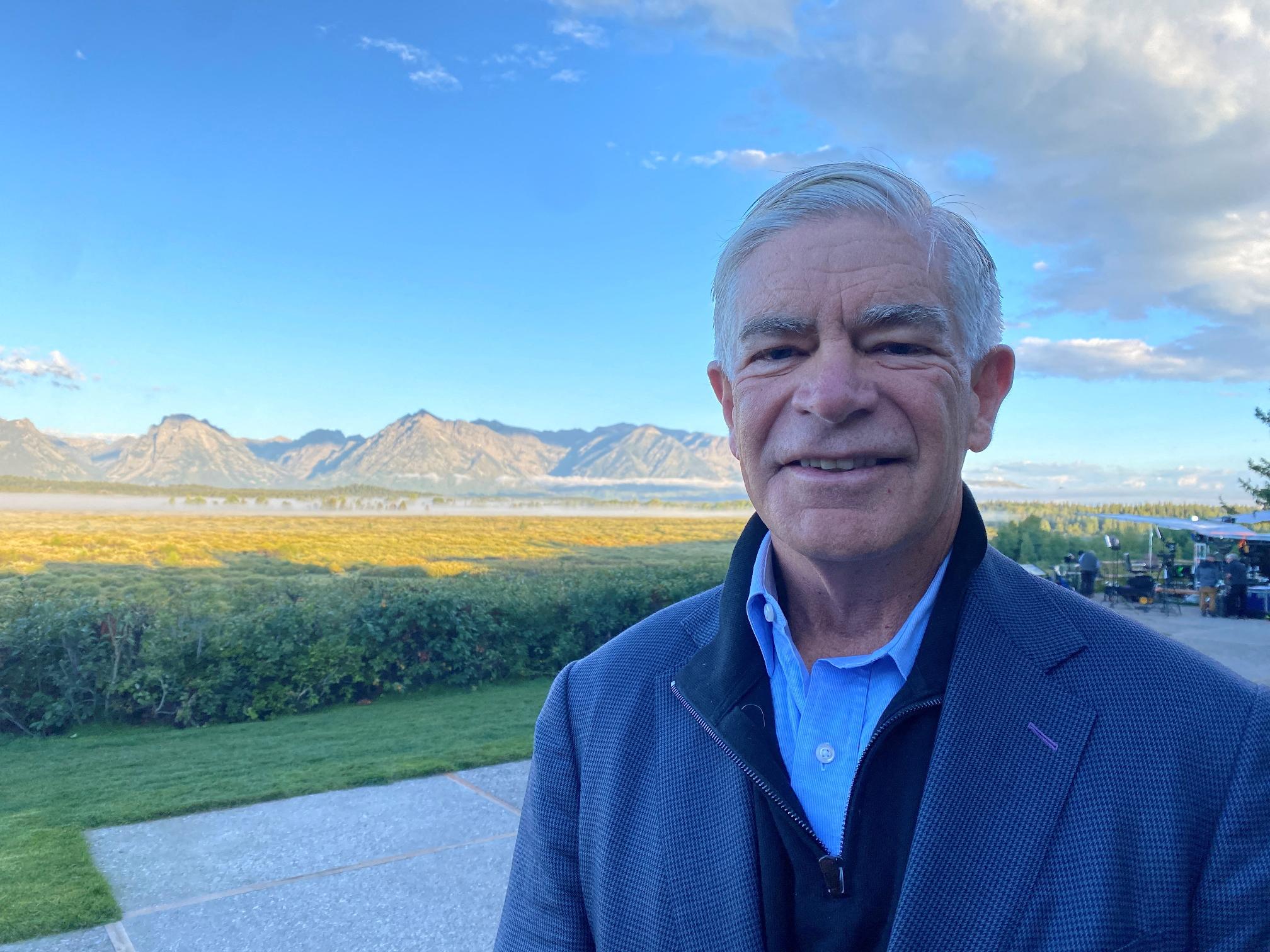

NEW YORK, Dec 20 (Reuters) - Philadelphia Federal Reserve President Patrick Harker on Wednesday said he still opposes any further U.S. central bank interest rate hikes, while signaling openness to lowering short-term borrowing costs, albeit not imminently. "I've been in the camp of, let's hold rates where they are for a while, let's see how this plays out, we don't need to raise rates anymore," Harker said in an appearance on WHYY, a Philadelphia-based radio station. But looking ahead, "it's important that we start to move rates down," he said, adding that "we don't have to do it too fast, we're not going to do it right away, it's going to take some time." Harker's comments were his first since the Fed decided last week to maintain its benchmark overnight interest rate in the 5.25%-5.50% range, while penciling in rate cuts in 2024 amid an expectation that inflation will continue to fall. In recent days, a number of Fed officials have fanned out and cautioned markets to not get too far ahead of themselves regarding the prospect of policy easing amid a still uncertain economic outlook. Harker was a voting member of the central bank's policy-setting Federal Open Market Committee this year, but he won't be again, as he faces mandatory retirement in 2025. Harker was among the leading group of Fed officials who believed the central bank had done enough with its rate increases and needed time to see how those aggressive rises in borrowing costs were playing out in the economy. The central bank has raised its policy rate by 5.25 percentage points since March 2022. In the radio interview, Harker said a "soft landing" for the economy in which a recession is avoided, inflation returns to 2% and the job market is not badly damaged is quite possible. He said he expects unemployment to rise modestly, but added that companies are having better luck finding workers. One reason to lower rates, Harker said, is to help businesses that are struggling with expensive borrowing rates. But he added a note of caution on the outlook. "Let me be clear: The job on inflation is not done, but we are moving in the right direction, things are starting to look better and better." https://www.reuters.com/markets/us/feds-harker-open-lowering-interest-rates-not-imminently-2023-12-20/

2023-12-20 16:35

Dec 20 (Reuters) - The Federal Deposit Insurance Corporation, as the receiver of the failed Signature Bank, said on Wednesday it has sold a 20% equity stake in the entity that holds a $9 billion real estate loan portfolio. The FDIC receiver added it will retain an 80% equity interest in the venture. https://www.reuters.com/markets/us/fdic-run-signature-bridge-bank-sells-20-stake-entity-holding-9-bln-cre-portfolio-2023-12-20/

2023-12-20 15:30

Dec 20 (Reuters) - South Africa's rand advanced against the U.S. dollar in thin trade on Wednesday, with analysts saying the currency was drifting on global market factors in the absence of domestic economic data releases. Stocks on the Johannesburg bourse were little changed. By 1515 GMT, the rand was at 18.2400 to the dollar , about 0.4% stronger than its previous close. The rand has largely tracked dollar moves in recent sessions, when the U.S. currency has been under pressure on bets that the Federal Reserve will soon begin cutting interest rates. "It is offshore developments that are driving the rand much more than local developments at the moment, and so long as the dollar is on the slide, the rand holds the potential to retest the 18.00 handle before the end of the year," ETM Analytics said in a research note. The Johannesburg Stock Exchange's Top-40 index (.JTOPI) ended the day within touching distance of its previous close. The yield on the government's benchmark 2030 bond was 4 basis points lower at 9.69%, indicating a slightly higher price. https://www.reuters.com/markets/currencies/south-african-rand-tracks-dollar-with-no-domestic-data-due-2023-12-20/

2023-12-20 15:18

OSLO, Dec 20 (Reuters) - Sweden has seen several positive developments regarding inflation both at home and abroad since the end of November, and may not need to raise rates again, Riksbank Governor Erik Thedeen said on Wednesday. At its most recent meeting in November, the central bank kept its policy rate on hold at 4.00% after eight rate hikes in a row, but said it was ready to hike again if inflation proved stubborn. However, a bigger than expected drop in inflation in November and a stronger crown point to a brighter inflation outlook, Thedeen said. "We think that we can reach the inflation target without further rate hikes," he told reporters. Forecasts could still be wrong, he said earlier in a speech, striking a note of caution. "It is therefore still important to follow developments to see how they affect the economic outlook and inflation prospects and to adjust monetary policy accordingly." Markets not only see the hiking cycle as over, but expect the Riksbank to start cutting rates sometime in the middle of next year. Thedeen said the Riksbank would return to the outlook for rates at the central bank's next meeting at the end of January. Earlier on Wednesday, leading think tank NIER said it expected inflation to fall rapidly ahead and the Riksbank to start cutting rates in summer next year with the policy rate ending 2024 at around 3.3%. https://www.reuters.com/markets/rates-bonds/sweden-may-not-need-raise-rates-again-riksbank-governor-says-2023-12-20/

2023-12-20 15:01

WASHINGTON, Dec 20 (Reuters) - U.S. existing home sales unexpectedly rose in November, but further gains as mortgage rates retreat from 23-year highs could be limited by a chronic shortage of houses on the market. Existing home sales increased 0.8% last month to a seasonally adjusted annual rate of 3.82 million units, ending five straight monthly decreases, the National Association of Realtors said on Wednesday. Home resales are counted at the closing of a contract. November's sales likely reflected contracts signed in the prior two months, when the average rate on the popular 30-year fixed-rate mortgage jumped to levels last seen in 2000. Economists polled by Reuters had forecast home sales would fall to a rate of 3.77 million units. Sales rose in the densely populated South and the Midwest, which is considered the most affordable region. They fell in the Northeast and West. Home resales, which account for a large portion of U.S. housing sales, dropped 7.3% on a year-on-year basis in November. The rate on the popular 30-year fixed-rate mortgage averaged 6.95% last week, the lowest level since August and down from 7.03% in the prior week, according to data from mortgage finance agency Freddie Mac. It has tumbled from a 23-year high of 7.79% in late October, tracking the decline in U.S. Treasury yields. "A marked turn can be expected as mortgage rates have plunged in recent weeks," said Lawrence Yun, the NAR's chief economist. The Federal Reserve held interest rates steady last week and signaled in new economic projections that the historic tightening of monetary policy engineered over the last two years is at an end and lower borrowing costs are coming in 2024. The government reported on Tuesday that single-family housing starts and permits increased to 1-1/2 year highs in November, which could help to ease the inventory squeeze. There were 1.13 million previously owned homes on the market last month, up 0.9% from a year ago, but well below the nearly 2 million units before the COVID-19 pandemic. At November's sales pace, it would take 3.5 months to exhaust the current inventory of existing homes, up from 3.3 months a year ago. A four-to-seven-month supply is viewed as a healthy balance between supply and demand. With supply still tight, multiple offers remained a feature in some areas, keeping home prices elevated. The median existing home price increased 4.0% from a year earlier to $387,600 in November. Properties typically stayed on the market for 25 days in November, up from 24 days a year ago. Sixty-two percent of homes sold in November were on the market for less than a month. First-time buyers accounted for 31% of sales, compared to 28% a year ago. That share is well below the 40% that economists and realtors say is needed for a robust housing market. All-cash sales accounted for 27% of transactions, up from 26% a year ago. Distressed sales, including foreclosures, represented only 1% of transactions, virtually unchanged from the prior year. https://www.reuters.com/markets/us/us-existing-home-sales-unexpectedly-rise-november-2023-12-20/

2023-12-20 14:47

Dec 19 (Reuters) - (This Dec. 19 story has been corrected to say that the fund replicates writing daily call options rather than using this strategy in paragraphs 3, 5; also corrects a typo in paragraph 4) ProShares expects to launch an exchange-traded fund (ETF) Wednesday that uses the short-dated options commonly referred to as "zero days to expiry" on the Standard & Poor's 500 index. The fund's goal is to offer investors both the additional income that traditional options contracts may sacrifice, as well as upside potential should the stock market extend its rally. The S&P 500 High Income ETF (ISPY.Z) seeks to replicate writing daily call options against the underlying index, generating additional income while giving investors exposure to the index's upside. The new ETF will trade on the CBOE BZX Exchange and have a fee of 0.55%. "It's offering what we believe is a better balance between the opportunities for income and appreciation" as well as the first ETF to employ such a covered call strategy based on short-dated options, said Simeon Hyman, global investment strategist at ProShares. Such covered call strategies are not a new phenomenon. For decades, investors, financial advisors and money managers have written options on securities they hold in order to earn premium income. ETF issuers began building new products around covered call and other options strategies aimed at generating income more than a decade ago. In recent years, as interest rates rose and both stock and bond markets struggled, assets under management have ballooned. The J.P. Morgan Equity Premium ETF , for instance, now has more than $30 billion in assets. The surge of interest in the ultra short-dated options contracts, also known as zero day to expiry or 0DTE options, is starting to shake up the ETF universe. Defiance ETFs LLC rolled out the first ETF to use daily put options, the Defiance Nasdaq-100 Enhanced Option Income ETF (QQQY.O) in September. That fund now has $226 million in assets. In the three months since that launch, however, the Standard & Poor's 500 stock has soared more than 7%. Both the Defiance and J.P. Morgan ETFs, meanwhile, have posted losses. ProShares hopes to deliver more of the stock market's upside than either a monthly-based options expiry strategy or than one based on put options may offer, Hyman said. https://www.reuters.com/markets/us/proshares-launch-sp-500-etf-with-zero-day-call-options-2023-12-19/