2023-12-20 04:32

MEXICO CITY, Dec 19 (Reuters) - The prolonged closure of two major U.S.-Mexico rail bridges vital to cross-border trade worth billions of dollars will cause "huge losses," top Mexican farm lobby CNA has warned. In a statement late on Tuesday, the CNA said inventories of yellow corn and soymeal, both crucial for Mexico's massive livestock sector, were running low, putting at risk exports of beef and pork. Mexican soymeal supplies range from just 3-8 days, while yellow corn 8-20 days, according to the lobby. "The flow of goods and supply of inputs (are) essential to feeding the livestock sector and industrial uses," it said. Earlier on Tuesday, major rail freight operator Union Pacific Corp (UNP.N) said the two key border bridges connecting El Paso, Texas with Ciudad Juarez, Mexico and Eagle Pass, Texas with Piedras Negras, Mexico account for about 45% of its cross-border shipments. The bridges were closed on Dec. 18 by U.S. border officials amid a surge in crossings by illegal migrants. The railroad operator estimates that the overall economic impact of the closures will be more than $200 million per day. Union Pacific added it was working to prevent congestion at the border, stressing it will be more difficult for cross-border trade to resume the longer the bridge closures remain in effect. On Monday, Mexico's main poultry producers association issued a similar warning. Union Pacific said it is working closely with multiple government agencies to reopen the two border crossings. Earlier this week, Union Pacific flagged that its other locations cannot handle the extra traffic. In September, about 8,000 trailers carrying goods worth $1 billion were stranded on the U.S.-Mexican border after authorities shut down crossings and imposed extra security checks amid a similar rise in migration. https://www.reuters.com/business/autos-transportation/union-pacific-says-closed-rail-bridges-mexico-account-about-half-cross-border-2023-12-19/

2023-12-20 04:04

Dec 20 (Reuters) - China's coal imports last month from top supplier Indonesia rose 16% from October while those from Australia were up nearly 30% as utilities restocked for winter power generation. Indonesian coal shipments, with an energy content mostly of 3,800 kilocalories (kcal) and many of which are under annual supply contracts, reached 18.33 million metric tons last month, data from the General Administration of Customs showed on Wednesday. Total coal imports in November into China, the world's largest coal buyer, expanded 35% from a year earlier to 43.51 million tons thanks to cheaper imports. Indonesian arrivals in November were up from 15.8 million tons in October but down from 20.04 million tons a year earlier. Russian coal arrivals, most of which hold an energy content of 5,500 kcal, dipped further to 7.32 million tons last month to the lowest since February, the data showed, versus 7.64 million tons in October. Chinese utilities have been sitting on ample coal inventories this year thanks to consistently high output weighing on domestic prices, with current coal stocks at key utilities holding above 200 million tons. However, recent mine accidents have lent some support to domestic wholesale prices which were at 950 yuan ($133.19) per ton for 5,500-kcal fuel at north China's coal hub of Qinhuangdao, traders said. Imports from Mongolia, largely of coking coal, reached 7.89 million tons, the customs data showed, the highest since at least 2022 and a sharp increase from 5.01 million tons in October. December imports from the landlocked nation could slow as heavy snow hampered road transport of coal. Australian coal arrivals last month rose to 6.22 million tons, the third-highest monthly amount this year and up 28.5% from October's 4.84 million tons, the data showed. Chinese traders and downstream users have been increasing coal purchases from Australia since Beijing removed a nearly two-year ban on coal trade with the country in January. ($1 = 7.1325 Chinese yuan renminbi) https://www.reuters.com/business/energy/chinas-coal-imports-indonesia-australia-rise-november-2023-12-20/

2023-12-20 03:29

NEW DELHI, Dec 20 (Reuters) - India's steel demand will likely slow in the next financial year beginning March as a mammoth general election will delay government projects and infrastructure spending, analysts and industry executives said. Steady government spending on infrastructure projects propelled India, the world's second-biggest crude steel producer, into one of the fastest-growing markets for the alloy globally, even as world demand slackened. But steel demand is expected to grow at a modest 7%-10% in the 2024-25 fiscal year, slower than a projected 11%-12% growth in the current year to March 2024, the analysts and industry executives said. Prime Minister Narendra Modi's ruling Bharatiya Janata Party will seek a third term in the next general elections due in early 2024. Staggered voting in India's general elections, the world's largest democratic exercise, takes place for weeks. "We expect finished steel consumption in India to increase by 9% in FY25, following a 12% rise in FY24," Fitch Ratings said. But India would still remain the main growth market globally for steel, it said. Finished steel consumption hit a five-year high between April and October as construction activity picked up and the automobile sector showed robust demand. The construction sector grew 13.3% year-on-year in the July-September quarter and posted a 7.9% growth from the previous quarter to June 2023, the highest in five quarters. The construction sector has been the main driver for India's steel market, said Puneet Paliwal, an analyst at London-based CRU Group. "This government capex-led steel demand growth is not expected to sustain in 2024," Paliwal said, adding that this would be particularly true during the first half of next year because of an expected reduction in government spending. India has also seen a steady rise in steel imports, with shipments touching a four-year high during April-October, government data showed. While the steel industry has sought measures to curb imports, the government has said it would monitor the situation. In addition to the rising imports, India's steel mills are struggling with higher raw material costs, and industry officials say slower demand would exacerbate their problems. https://www.reuters.com/world/india/indias-fy25-steel-demand-be-slower-elections-loom-analysts-officials-2023-12-20/

2023-12-20 02:58

MUMBAI, Dec 20 (Reuters) - The Indian rupee is likely to open marginally higher on Wednesday, boosted by the dollar's decline against most currencies on the Federal Reserve's interest rate outlook and positive risk appetite. Non-deliverable forwards indicate the rupee will open at 83.14-83.16 to the U.S. dollar, compared with 83.18 in the previous session. "The excitement of the (USD/INR) drop below 83 has all but faded and I expect a very quiet session," a FX trader at a bank said. "It seems to me that the risk is on the upside (for USD/INR), but only very marginally." The dollar index dropped in the European and U.S. trading sessions on Tuesday, pressured by expectations of sizeable U.S. rate cuts next year. Despite comments from a number of Fed officials that indicated that investors have priced in too dovish an outcome for next year, expectations have barely budged. Fed fund futures indicate investors still expect a total of nearly 150 basis points of rate cuts in 2024 and the odds of a cut as early as March are near 70%. More Fed speakers are lined up to speak on Wednesday and their comments will draw additional interest in wake of what other policymakers have said. The positive risk sentiment was an additional problem for the safe-haven dollar. The S&P 500 Index rose 0.6% overnight, nearing its all-time high. Asian shares advanced. The Bank of Japan on Tuesday disappointed hawkish expectations, helping riskier assets and weighing on the yen. The Japanese currency was down to 144 to the dollar. "The BoJ kept its dovish guidance unchanged ("take additional monetary easing steps without hesitation if needed") which forced markets to abandon speculation of a rate hike in January," ING Bank said in a note. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.22; onshore one-month forward premium at 7.50 paise ** Dollar index at 102.16 ** Brent crude futures down 0.1% at $79.1 per barrel ** Ten-year U.S. note yield at 3.92% ** As per NSDL data, foreign investors bought a net $215.2mln worth of Indian shares on Dec. 18 ** NSDL data shows foreign investors bought a net $259.7mln worth of Indian bonds on Dec. 18 https://www.reuters.com/markets/currencies/rupee-may-inch-up-upbeat-risk-appetite-fed-outlook-undermine-dollar-2023-12-20/

2023-12-20 00:33

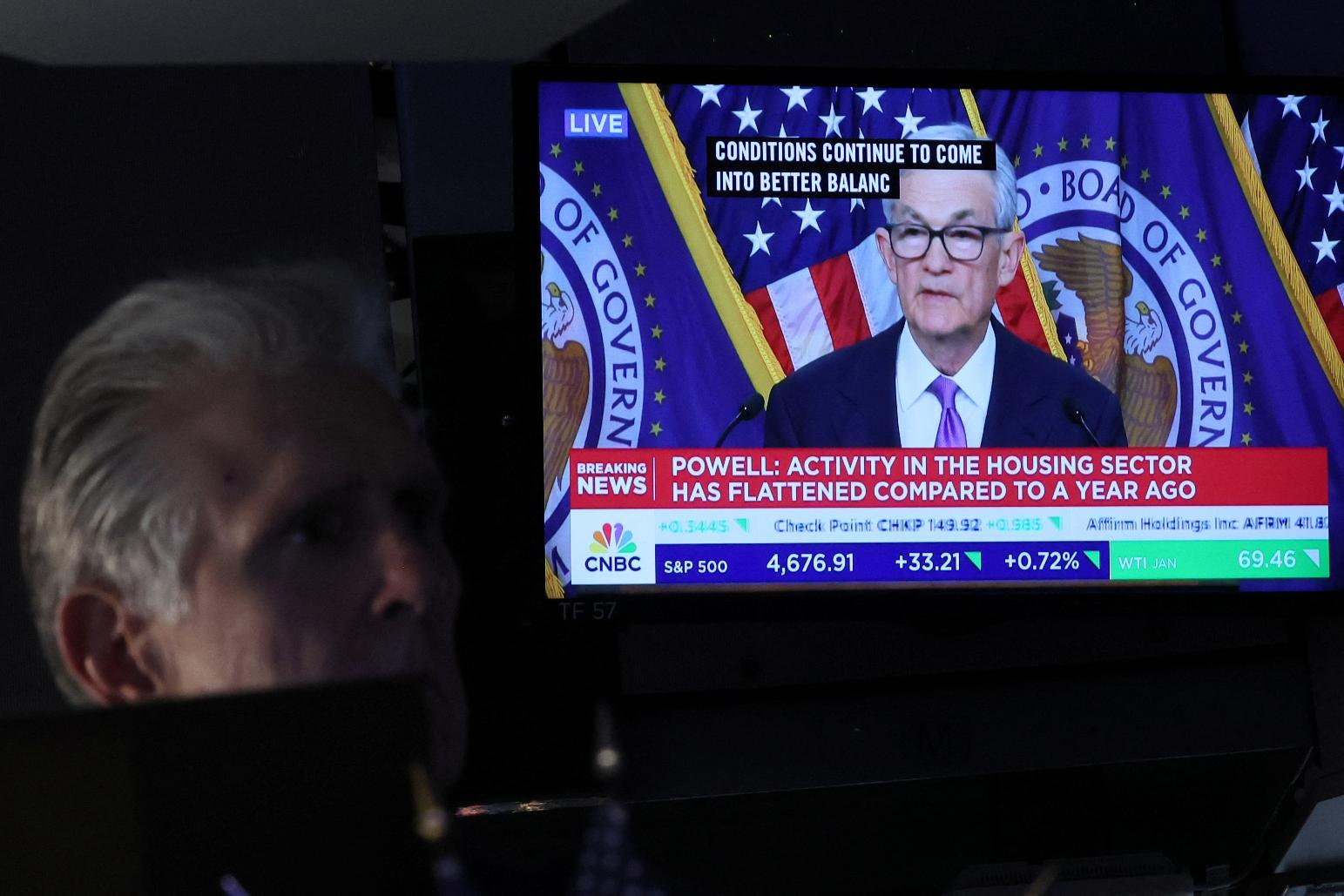

US single-family housing starts surge in November S&P 500 within 1 percent of record closing high Boeing gains on Lufthansa plane order Indexes up: Dow 0.68%, S&P 0.59%, Nasdaq 0.66% NEW YORK, Dec 19 (Reuters) - Wall Street extended its rally on Tuesday, advancing on the day as last week's dovish policy pivot from the Federal Reserve continued to reverberate and investors looked ahead to crucial inflation data. Broad-based gains boosted all three major U.S. stock indexes and nudged the S&P 500 (.SPX) to within 1 percentage point of its all-time closing high reached in January 2022. If the benchmark index closes above that level, that would confirm it has been in a bull market since bottoming in October 2022. The blue-chip Dow (.DJI) nabbed another all-time closing high. Small-caps have had a strong run in December; the Russell 2000 (.RUT) led gainers, rising 1.9%. The index has surged over 11.7% in December so far. "It’s Fed fumes," said Ross Mayfield, investment strategy analyst at Baird in Louisville, Kentucky. "And there's no real catalyst at this point in the calendar year to provide any kind of downside pressure." "Obviously, the levels investors hold dear like bull and bear markets are important psychologically," Mayfield said. "But what’s more important is the breadth is expanding, the momentum is there, and the economy is confirming this move." FedEx (FDX.N) tumbled 8% in extended trade after the package delivery company cut its full-year revenue forecast as it battles United Parcel Service (UPS.N) in what is shaping up to be a weak holiday season. UPS dropped 2.6%. At the conclusion of the central bank's policy meeting last Wednesday, the Federal Open Market Committee signaled that it had reached the end of its tightening cycle and opened the door to rate cuts in the coming year. Atlanta Fed President Raphael Bostic said on Tuesday there was "no urgency" to begin cutting rates, given the strength of the economy and the slow rate at which inflation is cooling down toward the central bank's 2% annual target. Even so, financial markets are pricing in a 67.5% likelihood that the Fed will implement a 25 basis-point rate cut as soon as March, according to CME's FedWatch tool. "The market is probably running ahead of the Fed a little bit and the Fed is right to throw some water on that," Mayfield added. "But the markets aren’t really buying it and the Fed is not doing much to change the narrative." On the economic front, a report from the Commerce Department showed groundbreaking on new single-family homes surged 18% to more than a 1-1/2 year high in November. The S&P 1500 Homebuilding index (.SPCOMHOME) and the Philadelphia SE Housing index (.HGX) advanced 1.6% and 1.2%, respectively. The Commerce Department is expected to release its final take on third-quarter GDP on Thursday, to be followed by its broad-ranging Personal Consumption Expenditures (PCE) report on Friday, which will cover income growth, consumer spending, and crucially, inflation. The Dow Jones Industrial Average (.DJI) rose 251.9 points, or 0.68%, to 37,557.92, the S&P 500 (.SPX) gained 27.81 points, or 0.59%, to 4,768.37 and the Nasdaq Composite (.IXIC) added 98.03 points, or 0.66%, to 15,003.22. All 11 major sectors of the S&P 500 ended the session in positive territory, with energy (.SPNY) and communication services (.SPLRCL) enjoying the largest percentage gains. Boeing (BA.N) rose 1.2% after German airline Lufthansa (LHAG.DE) revealed it ordered 40 737-8 MAX jets from the planemaker. Kenvue climbed 2.2% following a U.S. court ruling in favor of the consumer health company in a lawsuit over the company's drug Tylenol. Amgen (AMGN.O) advanced 1.1% after BMO upgraded the company's shares to "outperform" from "market perform." Advancing issues outnumbered declining ones on the NYSE by a 4.68-to-1 ratio; on Nasdaq, a 2.85-to-1 ratio favored advancers. The S&P 500 posted 48 new 52-week highs and 1 new lows; the Nasdaq Composite recorded 200 new highs and 82 new lows. Volume on U.S. exchanges was 11.61 billion shares, compared with the 11.97 billion average for the full session over the last 20 trading days. https://www.reuters.com/markets/us/futures-inch-up-investors-pin-hopes-fed-rate-cuts-2023-12-19/

2023-12-19 23:54

Dec 19 (Reuters) - Further progress on beating back inflation will be the decisive factor in any Federal Reserve decision next year to reduce interest rates, Chicago Federal Reserve Bank President Austan Goolsbee said on Tuesday. "If inflation continues to come down to target, then the Fed can reconsider how restrictive it wants to be," Goolsbee said in an interview on Fox News. The stock market, which surged after Fed Chair Jerome Powell last week signaled that rate hikes are likely over and rate cuts may be next, "got a little ahead of themselves" with "euphoria" over the thought of Fed interest-rate cuts, Goolsbee said, adding that the U.S. central bank won't be "bullied" by markets. The decision is also "not about politics," he said, responding to the suggestion that the Fed would cut rates to help President Joe Biden's reelection prospects. https://www.reuters.com/markets/us/inflation-not-politics-or-markets-will-determine-feds-next-move-goolsbee-2023-12-19/