2023-12-18 16:04

Dec 18 (Reuters) - SunPower (SPWR.O) on Monday raised doubts about its ability to stay in business, saying that its breach of a key term in a credit agreement could prompt lenders to recall certain loans, sending its shares tumbling 23%. The company said in a regulatory filing that lenders may demand immediate payment of $65.3 million in debt after it failed to file its third-quarter results on time. SunPower said it was currently in talks with the lenders for a waiver, adding that if it failed to secure one, it would not have sufficient funds for its day-to-day operations. However, Raymond James analyst Pavel Molchanov told Reuters that the company would not have any problem obtaining a waiver since it was essentially a technical issue. Earlier in the month, the company was able to secure a waiver after breaching the terms of a larger credit agreement. SunPower had revealed in October that it would restate its financial statements for last year as well as the first and second quarters due to issues with inventory valuation. https://www.reuters.com/business/energy/sunpower-shares-slide-after-raising-going-concern-doubts-2023-12-18/

2023-12-18 15:36

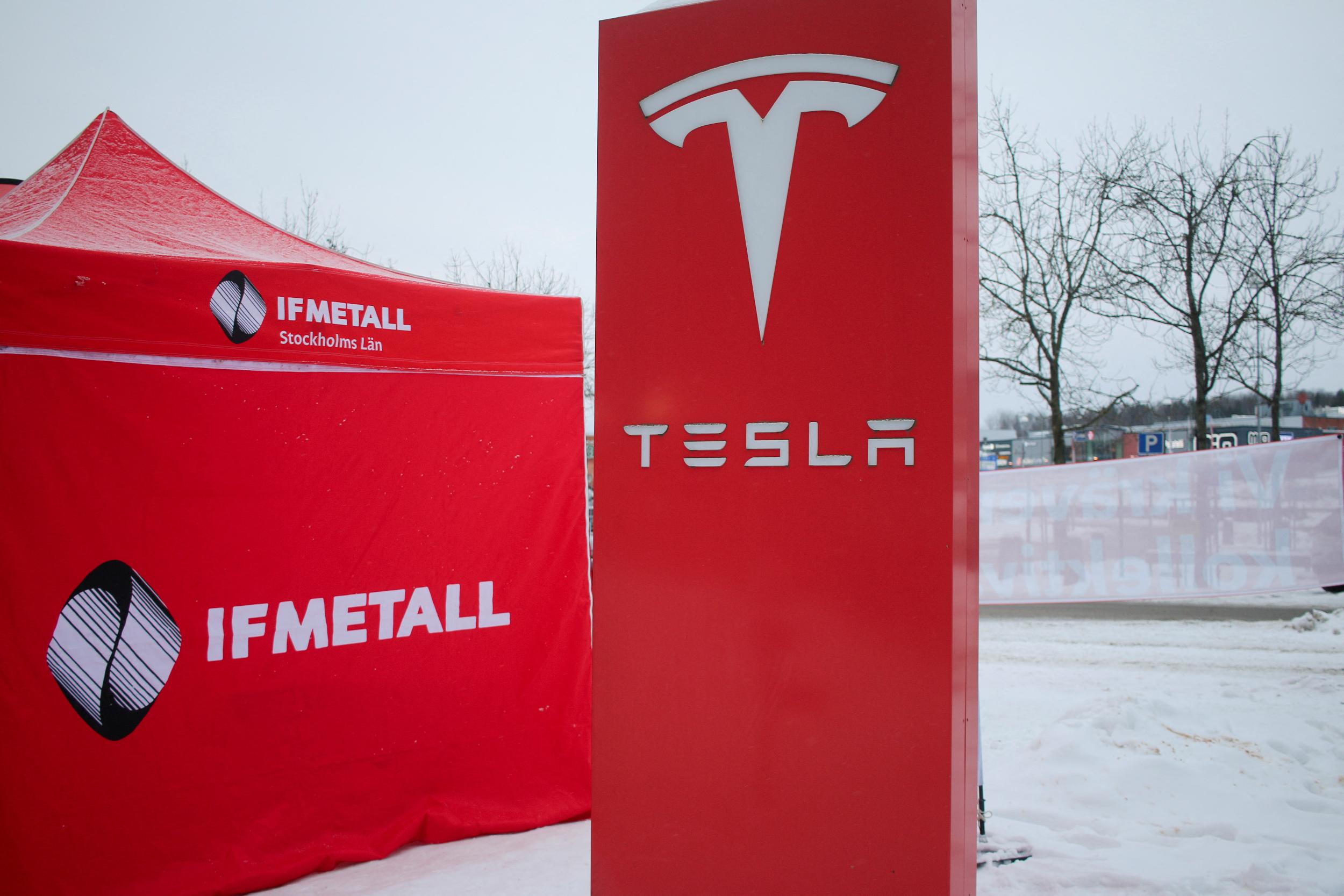

STOCKHOLM, Dec 18 (Reuters) - Most Swedes support an ongoing mechanics strike at Tesla's (TSLA.O) workshops in the Nordic country over the right to collective bargaining, an opinion poll by Novus showed. The U.S. car maker is facing a backlash from unions and pension funds across the Nordic region over its refusal to accept the demand from trade union IF Metall, whose members at Tesla workshops have been on strike since October. "A clear majority - or 58% of Swedes - believe the union is right to take the fight with Tesla," said daily Svenska Dagbladet, which commissioned the poll. "Only 20% of those who answered believe the union's industrial action is wrong." The dispute has sparked sympathy strikes across the Nordics - a key region for Tesla - and prompted some pension funds to sell their shares in the company. Tesla has avoided collective bargaining agreements with its roughly 127,000 workers, and CEO Elon Musk has been vocal about his opposition to unions. A clear majority of Swedes polled by Novus said their confidence in Tesla had faded during the conflict, SvD reported. "The support for the Swedish model is very strong," Novus CEO Torbjorn Sjostrom told the daily. The Swedish labour market model means employers and unions negotiate working conditions and salaries with very little involvement of the government. https://www.reuters.com/business/autos-transportation/swedes-support-tesla-mechanics-strike-poll-shows-2023-12-18/

2023-12-18 15:02

NEW YORK, Dec 18 (Reuters) - U.S. homebuilder confidence rose in December, indicating easing interest rates may be bolstering sales conditions for builders who had struggled to attract prospective buyers amid the highest borrowing costs in two decades in previous months. The National Association of Homebuilders/Wells Fargo Index showed builder confidence increased to 37 in December from 34 the month prior. A Reuters poll showed economists expected a reading of 36. “With mortgage rates down roughly 50 basis points over the past month, builders are reporting an uptick in traffic as some prospective buyers who previously felt priced out of the market are taking a second look,” said NAHB Chairman Alicia Huey. Confidence had fallen in November to the lowest since December 2022. As rates rose, builders have been forced to cut prices since the summer in an effort to boost affordability. The average rate on a 30-year fixed-rate mortgage reached a two-decade high in October at 7.9% before falling to 7.07% last week, according to the Mortgage Bankers Association, amid signals the Federal Reserve’s most aggressive rate-hike cycle since the 1980s is over and it may start cutting rates in 2024. During the surge in rates over the last two years, homeowners who were locked into cheaper rates had a deterrent against selling. Prospective buyers turned to the new construction market during the first-half of this year, with the NAHB’s buyer traffic index reaching a year-high of 40 in July. Amid a final surge in interest rates through October, buyer traffic waned into November and fell to 21 - the lowest reading since December 2022. Prospective buyer traffic picked up to 24 in December. The share of builders slashing prices in December remained unchanged at 36%, tying last month for the highest portion since November 2022. Builders based in the Midwest and South saw the largest boost in sales conditions on a monthly basis, both increasing by 4 points. https://www.reuters.com/markets/us/us-homebuilder-confidence-brightens-interest-rates-ease-nahb-2023-12-18/

2023-12-18 14:47

WASHINGTON, Dec 18 (Reuters) - The U.S. Federal Reserve started 2023 on a grim note, with staffers calling a recession "plausible," and policymakers penciling in growth near stall speed and rising unemployment as the costs of quashing inflation with rapid-fire interest rate increases. But it ends with the Fed registering faster-than-expected progress on inflation that occurred with virtually no rise in the jobless rate and an economy that grew fully five times faster than the 0.5% policymakers anticipated a year ago. Rate cuts are now in the offing. “We were very fortunate,” over the course of the year, Atlanta Fed President Raphael Bostic told Reuters last week. What just happened? Over the year a series of things turned the Fed's way, sometimes unexpectedly and not necessarily due to monetary policy. Just as 2022 was a year of bad forecasts and bad breaks, including war in Europe, the 2023 economy began looking more normal after pandemic-era excesses. It redeemed, to some degree, early Fed thinking that high inflation would ease over time without the central bank squelching growth altogether. Actions taken by the Fed included an emergency lending program for banks that helped ease financial sector tensions at a key point. There were also legitimate surprises like a rise in productivity, and other developments tied to the economy’s underlying performance, like the increase in the labor force. “Institutions have evolved and opportunities have become sufficiently attractive that people have come back in strong. I was not expecting that. That's very positive,” Bostic said. The forecasts still weren't great through an uncertain and volatile period. But this time the surprises were mostly to the good. MONEY FOR NOTHING, CHIPS FOR A FEE Fed Chair Jerome Powell stopped using the word "transitory" to describe inflation long ago, but last week he described, without saying it, why that belief took hold. The pandemic had dumped trillions of dollars of aid into consumers' hands, stoking demand that hit a wall as the global goods supply chain became stilted by that same pandemic. Shortages of basic industrial goods like computer chips kept inventories bare and allowed rising prices to ration what was available. This year saw supply pressures unwind as inventories rebuilt, perhaps to excess. Goods prices began to drag headline inflation lower, as was often the case before the pandemic. Labor supply also surprised to the upside. After concerns early in the pandemic that women's ability to work had been permanently scarred, the number of women in the workforce hit a record high. Rising immigration helped even out what had been a historic mismatch between the number of open jobs and the number of people looking for work. The boost in the labor force and drop in job openings have helped slow wage growth that some top economists worried was on the verge of driving inflation higher. HOUSEHOLDS HOLD THE FORT While the gusher of pandemic aid may have helped push up prices from high demand, the financial buffers built by households and local governments had more staying power than many economists expected. Over 2023, long after pandemic benefit programs had ended, there were still estimates of hundreds of billions of dollars left to spend. That showed up in consumer spending that consistently beat expectations. Though recent data suggests demand has finally begun slowing, the surprising resilience of household spending was a key reason the Fed's initial growth forecasts proved low. A PRODUCTIVITY BONUS All things equal, that unexpectedly strong jump in gross domestic product should be inflationary. The Fed estimates the economy's underlying growth potential is around 1.8% annually, so 2023's estimated 2.6% expansion seems out of kilter. But "potential," at least for now, may have been lifted by a jump in worker productivity. Rising productivity is manna for central bankers, allowing faster growth without inflation because each hour of work yields more goods and services at the same cost. It is also something they are reluctant to predict or rely on. In this instance, however, it helped Powell drop what had been steady references to the "pain" needed to subdue inflation through rising unemployment and instead talk more openly of the relatively pain-free disinflation apparently underway. Today's unemployment rate is 3.7% versus 3.6% when the Fed began raising interest rates. It has been below 4% for 22 months, the longest such run since the 1960s, and roughly what prevailed just before the pandemic, a period Powell heralds frequently. THE BANKING CRISIS THAT WASN'T A final surprise is how contained the spring's round of bank failures proved to be after the rapid collapse of Silicon Valley Bank. Those tremors prompted new caution among Fed policymakers about the speed of further rate increases, and led to warnings of a deep financial fracture as banks took stock of the fact their holdings of government and mortgage securities had lost value due to Fed rate hikes. Certainly there was stress. But it didn't evolve into a broader crisis and stayed in line with what the Fed was trying to do anyway: Tighten credit to cool the economy. Indeed, following what proved to the Fed's last rate increase in July, markets began doing some of the central bank's work for it by driving borrowing costs higher than the Fed anticipated doing with its own rate. Market rates are now falling, some dramatically, as the Fed pivots towards rate cuts. Will the markets go too far? Fed officials are conscious of the time it takes for changes in financial conditions to work into the real economy. Recent weeks have seen increases in loan delinquencies and other signs of household stress, while there was also worry about the amount of corporate debt that needs to be refinanced, and the trouble that could cause companies if rates are unaffordable. The Fed's "soft landing" scenario won't be assured unless the central bank, as Powell noted, doesn't "hang on too long" to its current restrictive policy. "We're aware of the risk," Powell said last week. WILL THE GOOD NEWS CONTINUE? Powell also said he thought some of the forces working in the Fed's favor, particularly supply improvements, have "some ways to run." Inflation for the past half year has only been about 2.5%, with strong arguments for it continuing to fall. In the Fed's most recently released policy documents, officials tucked in a subtle statement about their faith in the economy's return to normal. An index of risk sentiment fell towards a more balanced view, with inflation even seen by a number of officials as more likely to fall faster than to move higher. https://www.reuters.com/markets/us/coal-feds-stocking-last-year-turned-sugar-plums-2023-2023-12-18/

2023-12-18 14:45

Dec 18 (Reuters) - The Federal Reserve is not precommiting to cutting interest rates soon and swiftly, and the jump in market expectations that it will do so is at odds with how the U.S. central bank functions, Chicago Fed President Austan Goolsbee said on Monday. "It's not what you say or what the (Fed) Chair says, it's what do they hear and what do they want to hear?" Goolsbee said in an interview with broadcaster CNBC, in reference to the response of financial markets to Fed Chair Jerome Powell's comments last week that the time frame for when rate cuts will start was beginning to "come into view." "I was confused a bit ... was the market just imputing 'Here's what we want them to be saying.' I thought there seemed to be some confusion about how the FOMC (Federal Open Market Committee) even works. We don't debate specific policies speculatively about the future," he said, talking about the rate-setting committee's method of deliberations. Bets that the Fed will lower its benchmark overnight interest rate at its March meeting by a quarter of a percentage point soared last week after the U.S. central bank left its policy rate unchanged in the 5.25%-5.50% range and officials forecast three-quarters of a percentage point in cuts next year. Earlier on Monday, Cleveland Fed President Loretta Mester, who has a vote on policy in 2024 until she retires in June, also pushed back against financial market expectations of how abruptly the central bank will pivot to rate cuts. That has yet to stop markets from pricing in more cuts than the Fed expects next year, and traders in federal fund futures have maintained their surge in bets for a cut in March. They still see a roughly 75% probability of a cut at that meeting, according to CME Group's FedWatch Tool, while bond yields continue to drift lower. "The next phase is not when to reduce rates, even though that's where the markets are at. It's about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2%," Mester told the Financial Times in an interview. "The markets are a little bit ahead. They jumped to the end part, which is 'We're going to normalize quickly', and I don't see that." "The markets are a little bit ahead," she added. On Friday, two other U.S. central bank officials, the New York Fed's John Williams and Atlanta Fed's Raphael Bostic, who will both have a vote on the rate-setting committee next year, also tried to temper market expectations that cuts to the Fed's policy rate will inevitably begin in March. However, in a separate interview with the Wall Street Journal on Friday, Goolsbee warned that the Fed may soon need to shift its focus to preventing a run-up in unemployment from fighting higher prices as inflation makes progress in returning to the central bank's 2% target, and he did not rule out a cut as early as the March meeting. https://www.reuters.com/markets/us/feds-goolsbee-says-he-has-been-confused-by-market-reaction-2023-12-18/

2023-12-18 11:55

Dec 18 (Reuters) - OCI's (OCI.AS) shares jumped nearly 12% on Monday after the European chemicals maker said it had agreed to sell its stake in Iowa Fertilizer Company to Koch Ag & Energy Solutions for $3.6 billion. The deal is expected to close in 2024, OCI said in a statement, adding that it will use the proceeds to cut its debt significantly. OCI's net debt stood at $2.3 billion at Sept. 30. "A return of capital to shareholders will be considered within the context of OCI's capital returns framework," the company added. The Dutch-listed company's shares were the biggest gainers on the pan-European STOXX index (.STOXX) at 0858 GMT, still up 11% at 22.35 euros. OCI has been selling assets as it seeks to reduce debt, unlock more cash for shareholders and focus on greener chemicals such as lower-carbon ammonia. On Friday it announced the sale of its 50% stake in ammonia and urea producer Fertiglobe to Abu Dhabi National Oil Company for $3.62 billion. "This, in combination with the divestment of its Fertiglobe stake implies OCI will be meaningfully net cash, with significant potential to both return cash to shareholders and fund decarbonisation projects," Jefferies analysts said in a note. ING analysts noted that after the two "transformative" disposal deals, the company nonetheless retains some nitrogen assets in Europe and methanol assets in Europe and the United States, with increasing exposure to the energy transition. Morgan Stanley is acting as financial advisor to OCI on the IFCO deal while Cleary Gottlieb Steen & Hamilton is legal adviser. https://www.reuters.com/business/oci-sell-entire-ifco-stake-koch-36-bln-2023-12-18/