2023-12-15 11:02

Dec 15 (Reuters) - A look at the day ahead in U.S. and global markets by Amanda Cooper It's fair to say that markets have been holding on for the Federal Reserve to finally cave and agree with the extremely benign outlook that has been priced in for some time now. And this week, it finally happened. Chair Jerome Powell not only did not push back against the 150 basis points of rate cuts priced in by markets for 2024, he went so far as to say the time to discuss lower rates was "coming into view". Cue a rally across practically everything. The Dow Jones scored a second straight record-high close last night, gold has vaulted back above $2,000 an ounce and bitcoin posted a third daily rise. Stocks are pricing for a Goldilocks-themed 2024 - one where growth slows, but not so badly as to tip the economy into recession - while bonds have embraced the prospect of the scale of rate cuts that usually bring with them a sharper slowdown. Both cannot be right and 150 basis points of cuts look ambitious, given the labour market is robust, consumer spending is holding up nicely and financial conditions are already at their loosest since July, according to an index compiled by Goldman Sachs. For now, no one is too bothered about the details. There is also the issue of the huge amount of cash simply parked on the sidelines in money market funds. Data from the Investment Company Institute this week shows a total of nearly $6 trillion parked in money market funds. Some of that at least will, at some point, be looking for a home, one preferably with some yield attached. BlackRock data that stretches back to 1995 shows cash has returned an average of 4.5% in the year following the last rate hike of a cycle by the Fed, while U.S. equities have jumped 24.3% and investment grade debt by 13.6%. The S&P 500 is up about 23% this year, although much of that gain has been in the tech megacap stocks. The equal-weighted S&P, by contrast, is up just 11%, marking its worst annual performance relative to the benchmark since 1998, when it underperformed to the tune of 16 percentage points. The mood music today is cheerful. Futures are pointing to an upbeat start on Wall Street later. The S&P is rattling to its seventh straight week of gains, while the Dow's upward path could well have souvenir collectors busily hunting down "40,000" hats. The path there could prove volatile. Key developments that should provide more direction to U.S. markets later on Friday: * NY Fed manufacturing index December 0830 ET * Industrial production November 0915 ET * S&P Global flash PMIs December 0945 ET https://www.reuters.com/markets/us/global-markets-view-usa-graphics-2023-12-15/

2023-12-15 11:00

LONDON, Dec 15 (Reuters) - Few central bank watchers think the electoral cycle will change the course of monetary policy - but it could complicate the precise timing of interest rate moves next year. Now that markets seem convinced rate cuts are coming in 2024 in the U.S. and Britain, many are pondering just how elections in both countries may affect the sequencing - rather than the direction per se. The Federal Reserve lit the rate-cut fuse on Wednesday as 11 of its 19 policymakers pencilled in 75 basis points or more of rate cuts next year - despite cloaking the public message with words of vigilance about above-target inflation and not declaring victory just yet. The Bank of England, still dogged by inflation well over a percentage point above the U.S. equivalent, was far more reluctant to sound the rate-cut klaxon - preferring to push back against overzealous market expectations for now. But markets still expect both the Fed and European Central Bank to deliver up to 150 basis points and 110 basis points of cuts, respectively, through a year that contains a U.S. presidential election in November and - according to UK bookmakers at least - a likely UK election in the fourth quarter or possibly even as soon as the second quarter. Jealously guarding their operational independence from the political process and insisting on hard-nosed analysis that follows strict mandates, both the Fed and BoE repeatedly deny any influence whatsoever from polling dates. Maybe so. But it's that very sensitivity to accusations of bias either way toward incumbent governments that may, at the margin at least, affect the timing of possible changes in credit policy just ahead of a public vote where the state of the economy, savings returns and borrowing may be influential issues. A boost to the "feel-good" economic factor just before an election, for example, could be open to accusations of bias that challenge central banks' objectivity - even if they claim to be solely data-driven. And vice versa. Any wider urgency behind interest rate changes may trump all that of course. And what's more, most of the impact of rate changes take time, with several months of a lag - and in many instances markets deliver effective easing or tightening well in advance of expected moves anyway. But when rates are merely being recalibrated, as they are now, the timing of the voting could be cause for hesitation in the weeks and months leading to an election - if only for optics of impartiality. 'POLITICAL CONSEQUENCES' A look at the Fed's long history of independence shows little clear pattern, however. Policy rates were held steady for six to 12 months before the 2020, 2016, 2012 and 2000 U.S. presidential elections - only to be cut sharply after the 2000 poll and raised sharply after the 2016 vote. In 2020, the depth of the coronavirus pandemic dominated policy despite the tightness of the race, but the near-zero rates before the election were kept in place for two years after Democratic President Joe Biden's victory anyway. Likewise in 2012, when post-financial crisis rates were on the floor both before and after. Sharp cuts just after the 2000 election owed more to the looming business investment and dot.com bubble burst. Rate hikes after 2016 were rooted in long-flagged "normalisation" amid planned post-election fiscal boosts. In all other cases over the past 45 years, the prevailing rate policy trend before the poll continued on regardless. Next year's U.S. presidential election looks set to be as tight as the last one - with Fed forecasts painting a picture of a "soft landing" for the economy in which inflation subsides without a recession or big rise in unemployment. But Fed futures are currently almost fully priced for a cut at all four policy meetings between March and July, with even odds of another at the September gathering - just over six weeks before the Nov. 5 election. If the Fed wanted to stall for six months ahead of the election, it could still deliver its median forecast of 75 basis points of easing by moving at the March 19-20 and April 30-May 1 meetings and holding off on a third cut until the Nov. 6-7 meeting. But if it were eventually to see the need to agree with current market expectations, then it would have to do that in 50-basis-point clips. For the BoE, the independence optics may be sharper despite its public dismissal of such influence - not least as the central bank has only been operationally free for the past 26 years and recently faced questions over a political review of its mandate. Uncertainty about the timing of UK elections makes that harder to parse, however, especially as the current government only has to give six weeks notice of a national poll. And yet that fact alone may bail the BoE out of any protracted hiatus - even if it has, perhaps coincidentally, never changed rates in the two months before an election since gaining its independence in 1997. Right now, even in the face of Thursday's push-back, markets see the first BoE quarter-percentage-point cut coming as soon as May, a second one by August, a third by September and another by the end of 2024. A near two-month gap between the September and November meetings could well give it some cover. In the end, elections won't change the bigger monetary policy picture for long. That said, many observers still insist interest rate levers matter a lot the other way around - even if not necessarily right in the lead-up to polls. More broadly, Yale University economist Ray Fair reckons his models suggest Fed success in getting inflation back to the central bank's 2% target next year while keeping the economy growing could be a major boost to Democrats' electoral hopes. "This is not to say that the Fed is political. The Fed's main goal at the moment is to get inflation down to 2%, not to help one political party," he wrote earlier this year. "But the political consequences of its actions are huge." The opinions expressed here are those of the author, a columnist for Reuters https://www.reuters.com/markets/us/elections-may-tweak-sequencing-2024-rate-cuts-mike-dolan-2023-12-15/

2023-12-15 10:52

NEW DELHI, Dec 15 (Reuters) - India's merchandise trade deficit narrowed sharply to $20.58 billion in November from the previous month's record levels as imports of gold, petroleum and electronic goods moderated, government data showed on Friday. The trade deficit in November was lower than the $23.60 billion expectation of economists polled by Reuters. India's merchandise exports in November stood at $33.9 billion, while imports were $54.48 billion, government data showed. In the previous month, merchandise exports were $33.57 billion, while imports stood at $65.03 billion. Gold imports nearly halved on month to $3.45 billion in November, an analysis of government data by Reuters showed. Gold imports for October were at $7.2 billion. Imports of petroleum products were 22% lower in November than the previous month at nearly $13.71 billion. Electronic goods imports registered a near 17% decline in the latest print at $6.49 billion, analysis showed. Services exports in November were $28.68 billion, while imports were $13.4 billion. In October, services exports were $28.70 billion and imports were $14.32 billion. The sharp widening in India's merchandise trade deficit in October to a record level, fuelled by a broad-based rise in imports due to festive demand, was expected to be an outlier. India's months-long festival demand peaks during Diwali, the festival of lights, which was celebrated on Nov.12. Merchandise exports for the period April-November totalled $278.80 billion, while imports for the same period reached $445.15 billion, the data showed. https://www.reuters.com/world/india/indias-nov-merchandise-trade-deficit-2058-bln-2023-12-15/

2023-12-15 10:50

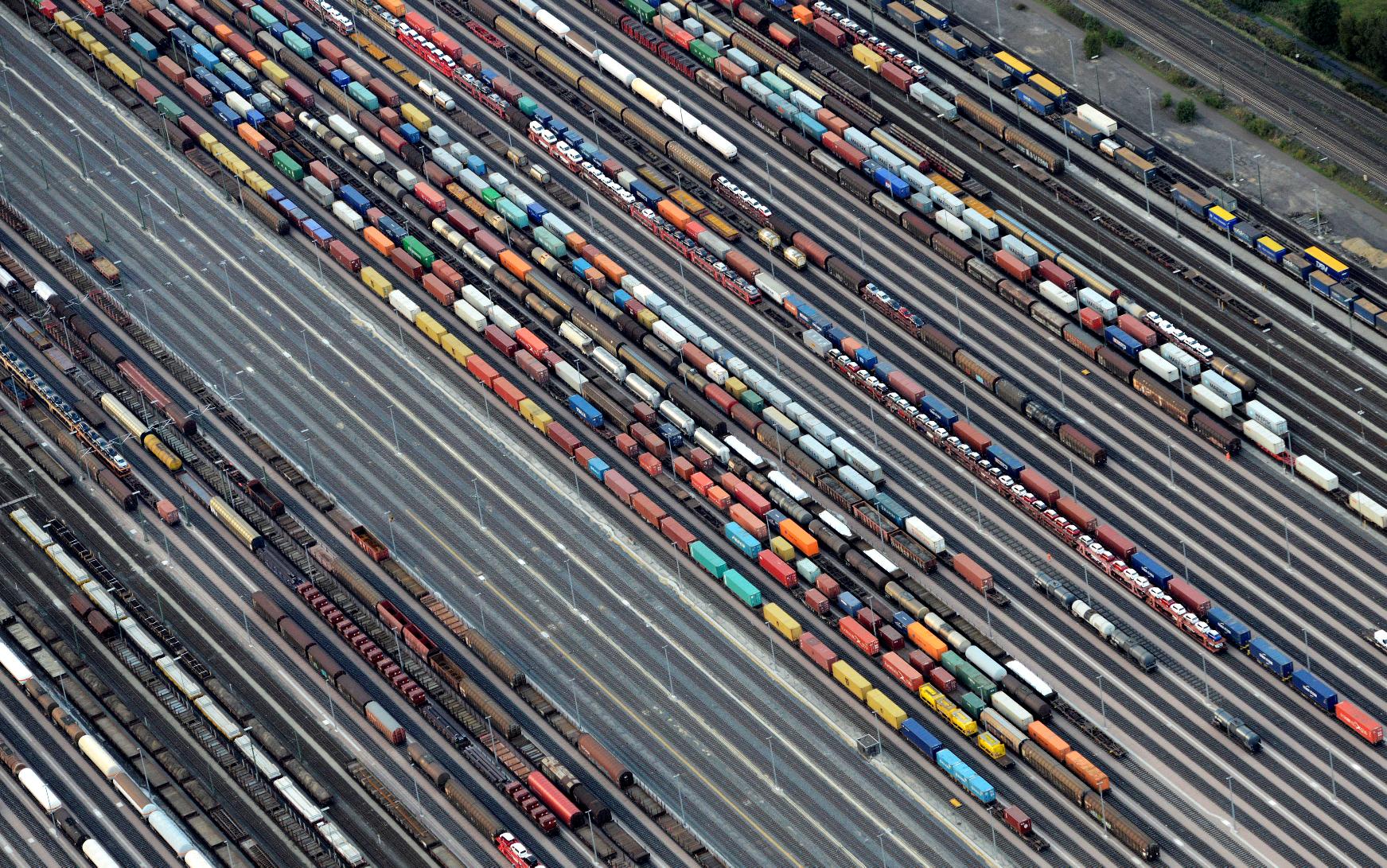

DUBAI/LONDON, Dec 15 (Reuters) - Attacks from Houthi-controlled Yemen struck two Liberian-flagged ships in the Bab al-Mandab Strait on Friday, the U.S. military said, underlining the threat to vessels in shipping lanes being targeted by the Iran-aligned group. Danish shipping company A.P. Moller-Maersk (MAERSKb.CO) said it would pause all container shipments through the Red Sea until further notice. German container line Hapag Lloyd said it was considering a similar move. A drone struck one of the Liberian-flagged vessels, the Al Jasrah, causing a fire which was eventually extinguished, U.S. Central Command said. Two ballistic missiles were fired by Houthi forces in the second attack, one of which struck the Liberian flagged MSC Palatium III, causing a fire, it added. A U.S. warship, the Mason, responded to the request from the Palatium III. Earlier in the day, Central Command said, the MSC Alanya was travelling north in the southern Red Sea and Houthi forces threatened to attack it and told it to turn around and go south. U.S. forces were not in the area but kept communicating with the vessel and it continued north, the statement added. "No injuries have been reported by any of the three ships attacked, but this latest round of attacks is yet another demonstration of the great risk to international shipping caused by these Houthi actions," the Central Command said. The Houthis said in a statement that they had fired missiles at two ships - the MSC Alanya and MSC Palatium III. Their statement made no mention of Al Jasrah. An MSC spokesperson said there had been no attack on the Alanya. Asked about the Houthi claim of an attack on the Palatium III, the spokesperson provided no further comment. The Houthis said both vessels had been heading to Israel. The group has said it wants to support Palestinians as Israeli forces wage war against Iran-aligned Hamas militants in the Gaza Strip. However, Alanya and Palatium III both listed Jeddah in Saudi Arabia as their destination, according to data from ship tracking and maritime analytics provider MarineTraffic. "We will continue to prevent all ships heading to Israeli ports until the food and medicine our people need in the Gaza Strip is brought in," the Houthi statement said. "We assure all ships heading to all ports of the world apart from Israeli ports that they will suffer no harm and they must keep their identification device on," it said. HOUTHIS FIRINGS DRONES, MISSILES TOWARD ISRAEL Part of the Iran-aligned "Axis of Resistance", the Houthis have been attacking vessels in Red Sea shipping lanes and firing drones and missiles at Israel. The Houthis, who rule much of Yemen, have said they would continue their attacks until Israel stops its offensive in the Gaza Strip. A spokesperson for Hapag-Lloyd, the company that owns Al Jasrah, said it was attacked while sailing near the Yemeni coast. "Hapag-Lloyd will take additional measures to secure the safety of our crews," the spokesperson said, declining further comment. British maritime security firm Ambrey said the Liberia-flagged container ship MSC Alanya was ordered to alter course towards Yemen by people aboard a small craft believed to be Houthis, forcing it take evasive measures. Ambrey said the MSC Alanya was warned by the Houthis not to proceed northbound, and quoted them addressing the crew: "Captain you are not allowed to proceed to the Red Sea. Alter your course to the south side, now". Ambrey said the Liberia-flagged, Swiss-owned container ship MSC Palatium III was targeted while sailing northbound some 23 miles southwest of the Mokha, receiving the same warning as the Alanya. Late on Thursday, the Houthis claimed to have carried out a military operation against a Maersk container vessel, directly hitting it with a drone. The Danish shipping company denied the claim and said the vessel was not hit. But the company said on Friday it would pause all container shipments through the Red Sea until further notice and send them on a detour around Africa. "Following the near-miss incident involving Maersk Gibraltar yesterday and yet another attack on a container vessel today, we have instructed all Maersk vessels in the area bound to pass through the Bab al-Mandab Strait to pause their journey until further notice," the company said in a statement. Maersk on Thursday said its vessel Maersk Gibraltar was targeted by a missile while travelling from Salalah, Oman, to Jeddah, Saudi Arabia and that the crew and vessel were reported safe. The U.S. Special Envoy for Yemen, Tim Lenderking, said on Thursday that Washington wanted the "broadest possible" maritime coalition to protect ships and signal to the Houthis that attacks would not be tolerated. Iran warned that the proposed multinational naval force would face "extraordinary problems" and nobody "can make a move in a region where we have predominance". https://www.reuters.com/world/middle-east/uk-maritime-agency-probing-reports-further-incident-near-bab-al-mandab-strait-2023-12-15/

2023-12-15 10:09

BRUSSELS, Dec 15 (Reuters) - The euro zone turned from trade deficit to surplus in October, non-adjusted data showed on Friday, as imports of energy in particular declined in value from a year earlier. The European Union statistics office Eurostat said the seasonally unadjusted trade balance of the 20 countries sharing the euro was an 11.1 billion euro ($12.2 billion) surplus compared with a 28.7 billion euro deficit a year earlier. Adjusted for seasonal swings, the October trade surplus was 10.9 billion euros, up from 8.7 billion euros in September. For the European Union as a whole, the trade surplus in manufacturing goods rose to 313.5 billion euros in Jan-Oct 2023, roughly double the level of a year earlier, with machinery, including vehicles, the main contributor. The EU's trade deficit with Russia fell sharply to 11.0 billion euros from 134.4 billion euros in the same period compared with last year as the 27-nation bloc sharply reduced its purchases of oil and gas and benefited from lower energy prices. The EU's trade deficit with China also narrowed in Jan-Oct, while its trade surplus with the United States widened. The bloc's surplus with Britain also expanded. For Eurostat release, click on: https://ec.europa.eu/eurostat/web/main/news/euro-indicators ($1 = 0.9122 euros) https://www.reuters.com/markets/europe/euro-zone-trade-surplus-october-imports-decline-2023-12-15/

2023-12-15 10:01

Dec 15 (Reuters) - World markets head into year-end on a "buy everything" high, with the Federal Reserve signalling it will switch to rate cuts in 2024, propelling stocks and gold higher. Meanwhile, the Bank of Japan could finally hint at an end to its ultra-loose monetary policy. The road into 2024 for investors could be bumpy. Here's your week ahead in markets from Lewis Krauskopf in New York, Kevin Buckland in Tokyo, Naomi Rovnick, Marc Jones and Amanda Cooper in London. 1/ROLE REVERSAL Speculation is rife the Bank of Japan (BOJ) may soon exit negative interest rates, again making it a global outlier as the focus at the Fed and others turns to when to cut rates. A change likely won't come as soon as the policy decision on Tuesday, but the BOJ meets again in January, and next week could be used to prepare the way for tightening. That expected pivot, plus the Fed's dovish tilt, has pushed the yen back to the stronger side of 141 per dollar for the first time since July. A political scandal over suspected kickbacks could ironically provide a tailwind to ending easing, as Prime Minister Fumio Kishida clears his cabinet of pro-stimulus elements. A reversal of politically unpopular yen weakness may help his sagging approval ratings, but the speed of yen strength could also be damaging. The Nikkei has lagged most other major stock indices this month (.N225). 2\INFLATION WANING? Investors hope a key U.S. inflation gauge will show easing consumer price pressures, after the Fed signalled its campaign of interest rate hikes is ending and cuts may arrive next year. The Dec. 22 release of November's personal consumption expenditures (PCE) price index, which the Fed tracks, will be one of the last key pieces of data this year. Fed Chair Jerome Powell has said the historic tightening of monetary policy is likely over and discussion of rate cuts is coming "into view". Data on consumer confidence, as investors seek to gauge how much higher interest rates may be weighing on spending, is also due out. Whether the Fed has been able to engineer a soft landing for the U.S. economy is a key market theme as the calendar flips to 2024. 3/ GOLD STAR Gold is heading for its first annual increase since 2020, fuelled by a weaker dollar and by the view that interest rates and inflation are going one way and fast in 2024. Gold, which bears no interest, tends to perform better in an environment of falling real rates, those adjusted for inflation. Real U.S. 10-year yields have been rising non-stop since early 2022, but only turned positive in June, knocking gold back from a near-record. They are now at their highest in eight years, but this has been no barrier to gold vaulting above $2,000 an ounce. And yet the price is still some 20% below its inflation-adjusted all-time high above $2,500 in 1980. Investors are banking on a flurry of rate cuts next year, while political and economic uncertainty are on the rise - potentially heralding a sweet spot for gold investors. 4/ INFLATION NATION UK inflation is running at more than double the Bank of England's (BoE) 2% target. Latest data on Dec. 20 may confirm UK price pressures remain elevated compared to other major economies. The pound hit a three-month high against the euro this month after euro zone inflation dropped sharply , fuelling speculation the BoE will take longer to cut rates than the European Central Bank. But high rates could also tip the UK economy, which the BoE expects to flat-line in 2024, into recession, meaning sterling strength is not a one-way bet. The pound's fate rests on whether the BoE keeps reacting to current inflation trends, or takes the longer-term view that economic weakness will dampen wages and prices. 5/DOWN THE NILE Egyptian President Abdel Fattah al-Sisi's third straight election win should be officially confirmed on Monday. With little in the way of opposition, the former general has cruised this one, but faces a daunting list of challenges. War in Gaza is raging next door and Egypt is grappling with an economic crisis fuelled by near-record inflation and past borrowing sprees that mean its debt interest payments alone now eat up almost half the government's revenues. Economists say that is unsustainable. At least $42.26 billion is due in 2024, including $4.89 billion to the International Monetary Fund. The first move after the election looks set to be another big currency devaluation. Egypt's pound has already halved against the dollar since March 2022. A dollar now fetches about 49 Egyptian pounds on the black market versus an official rate of 31 pounds. FX forwards markets say the same. https://www.reuters.com/business/take-five/global-markets-themes-graphic-2023-12-15/