2023-12-13 10:31

MOSCOW, Dec 13 (Reuters) - Afghanistan's Taliban government doubled purchases of Russian liquefied petroleum gas (LPG) in the January-November period, according to industry data, as Russia redirects supplies away from Europe amid political fallout from the Ukraine conflict. Russia has not formally recognised the Taliban as legitimate authorities in Afghanistan, but was one of the first countries to make contacts and clinch business deals with the movement following its return to power in 2021. Last year, Afghanistan and Russia signed a deal on supplying gasoline, diesel, gas and wheat after Moscow offered the Taliban administration a discount to average global commodity prices. The move was the first known major international economic deal struck by the Taliban since it returned to power. According to industry data, Russian LPG supplies to Afghanistan by rail in January-November exceeded 176,000 tons, more than double the deliveries seen in the same period in 2022. Half of the volumes were delivered from the Orenburg gas processing plant. Russia's total LPG exports to Central Asia in the first 11 months of the year also doubled, to 390,100 tons. LPG, or propane and butane, is mainly used as fuel for cars, heating and to produce other petrochemicals. Russia's LPG exports, unlike oil, have not been targeted by Western sanctions. However, Russia has redirected its supplies away from Europe, including to Central Asia. Russia's main LPG exporters are Gazprom (GAZP.MM), Rosneft (ROSN.MM), Lukoil (LKOH.MM), Gazprom Neft (SIBN.MM) and Orsk refinery. https://www.reuters.com/business/energy/afghanistan-doubles-russian-fuel-imports-industry-data-shows-2023-12-13/

2023-12-13 10:28

Dec 13 (Reuters) - Argentina will weaken its peso by more than 50% to 800 per dollar, cut energy subsidies and cancel public works tenders as part of an economic shock therapy aimed at fixing the South American country's worst crisis in decades. Below are reactions from some analysts and international agencies to Tuesday's announcement: VERISK MAPLECROFT: "Caputo focused on delivering on the key campaign pledges of ‘taking the chainsaw’ to the public sector and ‘reordering’ the economy to lay the foundations for future growth." "The reordering of economic variables, together with inflationary inertia and accumulated inflation that had been artificially contained through price controls mean that triple digit inflation will continue to hit consumers in 2024." "But by bringing the official FX rate closer in line to the financial, black market, and export-specific rates inherited from the Fernandez administration, Caputo has taken a decisive step towards FX rate convergence, which could be accomplished within the administration’s first six months in office." BANCTRUST & CO: "All in all, we expect bonds to react positively to yesterday’s announcements. The fiscal adjustment is not only sizeable but it also appears to be feasible from a political point of view. The lack of FX unification can hinder disinflation but we think that this will be the second step when seasonally abundant dollar inflows resume with the soybeans harvest from May onwards." J.P. MORGAN: "We believe an evolution of the policy template by second quarter 2024, would be likely required, once international reserves start to be replenished by soybean exports. "First of all, the fact that the fiscal adjustment relies in a relevant manner on a higher tax collection may induce some doubts, particularly due to the temporary nature of some taxes as well as the need for Congress approval. "Second, the still hefty correction lower of real expenditure still needs to be assessed through the prism of social tolerance. A new FX correction may be required to finally migrate into a unified exchange rate system, without capital and financial account restrictions other than macro-prudential." GOLDMAN SACHS: "Our first impression of the announcement is positive. Fiscal profligacy is the root of Argentina’s macroeconomic problems and moving swiftly with the fiscal adjustment is utmost important. "We acknowledge, however, that some of the announced policies remain vague and many lacked quantitative details. The exchange rate, in turn, was highly overvalued and a significantly more competitive exchange rate should allow the central bank to accumulate international reserves that currently stand at critical levels. "Inflation, however, is likely to accelerate in the coming months as the pass-through of the weaker exchange rate is transmitted to consumer prices. For this reason, it will be critical to know what exchange rate policy the central bank will follow going forward to avoid a renewed overvaluation of the currency. "This was clearly absent in today’s policy announcement. Another major absent measure was the treatment of the central bank’s remunerated liabilities. In our view, addressing the central bank’s balance sheet should be another pillar of any macroeconomic adjustment plan." INTERNATIONAL MONETARY FUND: "These bold initial actions aim to significantly improve public finances in a manner that protects the most vulnerable in society and strengthen the foreign exchange regime. Their decisive implementation will help stabilize the economy and set the basis for more sustainable and private-sector led growth. "Following serious policy setbacks over the past few months, this new package provides a good foundation for further discussions to bring the existing Fund-supported program back on track." https://www.reuters.com/markets/argentina-devalues-peso-cuts-spending-economic-shock-therapy-2023-12-13/

2023-12-13 10:16

HOUSTON, Dec 13 (Reuters) - Oil tanker Cururo is taking the long way from Houston to Chile: sailing the length of South America's Atlantic coast, across the Strait of Magellan and heading up the Pacific coast before discharging. The voyage could take 32 days and travel more than 10,000 nautical miles (18,520 km) before it ends next week, compared with about 23 days and less than 5,000 miles for a typical route through the Panama Canal. The odyssey is shipping's new reality due to a severe drought in Panama that is expected to shift trade flows and push up freight costs. The change will mean less U.S. gasoline heading to the West Coast of South America, particularly Chile, said Matt Smith, an analyst at ship tracking service Kpler. Chile will instead likely pull gasoline from Asia, he added. Cururo headed for the Panama Canal last month and, unable to secure a slot for passage, changed its route. Two other refined products vessels, Green Sky and High Loyalty, also have taken longer routes to or from Chile that avoid the Panama Canal. Taking longer routes or opting for bidding in Panama's daily slot auctions has made transportation more expensive for tankers and other vessel types with no priority in the canal. U.S. diesel flows increasingly are heading to Europe as South America buys less due to Panama Canal logjams, Kpler data also showed. About 45% of U.S. diesel exports headed to Europe so far in December, compared with about 21% last month. The redirection of refined product flows will also lead to higher shipping activity measured by tonne-miles and higher freight rates as U.S. tankers that typically go to South America now cross the Atlantic to Europe, or as ships from Asia travel to South America, analysts said. https://www.reuters.com/markets/commodities/fuel-tankers-face-long-slog-panama-canal-drought-reroutes-flows-2023-12-13/

2023-12-13 10:03

LONDON, Dec 13 (Reuters) - Britain's payments regulator on Wednesday provisionally proposed a cap on cross-border interchange fees on retailers and other businesses charged by Mastercard (MA.N) and Visa (V.N) on transactions made between the UK and European single market. The Payment Systems Regulator (PSR) said a cap would protect businesses from overpaying, after it published interim findings of a market review on interchange fees charged since Brexit, when the bloc's longstanding cap ceased to apply in Britain. UK lawmakers had piled pressure on the PSR to consider re-introducing a cap in Britain, and the watchdog said last year it would conduct two market reviews, but that an outcome could take years. The PSR said the review focused on charges set by Mastercard and Visa, as they account for 99% of debit and credit card payments in the UK. The watchdog said both companies had likely raised fees to an "unduly high level", costing UK businesses an extra 150-200 million pounds ($190-250 million) last year due to fee increases, with the charges potentially passed on to consumers. "In short, at this stage, we do not think this market is working well," PSR managing director Chris Hemsley said in a statement. Under the proposals, the PSR would impose an initial time-limited cap of 0.2% on UK-European Economic Area debit transactions and 0.3% on credit transactions. A lasting cap would then be imposed once further analysis is carried out. A spokesperson for Visa said the company strongly disputed the findings of the PSR's interim report and said the proposed remedies were "not justified". "Accepting reliable, secure, and innovative digital payments represents enormous value to UK businesses, especially when selling overseas," the spokesperson said. "These interchange rates apply to less than 2% of UK card payments - European (EEA) cardholders buying online from a UK seller - and reflect the fact that these transactions are more complex and carry far greater risk of fraud." Mastercard said interchange fees reflect value in an extremely competitive market. "We do not agree with the PSR's findings and will continue to educate them on the critical importance of electronic payments to the UK economy," a spokesperson said. The PSR is inviting feedback on the proposals until the end of January, with a final report due in the first quarter of 2024. A government commissioned report last month said Britain needs a "digital alternative" to relying on Visa and Mastercard regardless of what the PSR does, echoing longstanding ambitions in the EU for a "home grown" alternative to the American duo that has yet to emerge. ($1 = 0.7990 pounds) https://www.reuters.com/business/finance/payments-regulator-proposes-cap-mastercard-visa-cross-border-fees-2023-12-13/

2023-12-13 06:53

BEIJING, Dec 13 (Reuters) - China said it found foreign geographic information software could be compromising confidential and sensitive data in key sectors including its military, and warned security departments to conduct in-depth checks to stem any further breaches. The Ministry of State Security said an extensive investigation found overseas geographic information system software was being used to collect data - some involving state secrets - "posing a serious threat to China's national security." The government revealed the threat in an article on its WeChat public account on Monday but did not disclose any information on entities blamed for accessing data or identify specific Chinese firms that were affected or targeted. China said culprits are using software to collect user data without restrictions, deliberately putting in pre-built "backdoors" in software to allow for cyberattacks and data theft. The government said by stealing high-precision geographic information data, three-dimensional geomorphological mapping of specific areas in its transportation, energy, military and other important fields, could be open to threats. China has been taking increasing measures to protect its national security and prevent information leaks that could damage industries and hurt its economy. The government said departments are to carry out investigations of geographic information data security risks, "and rectify and promptly eliminate" any threats. Security agencies are also to establish and improve on a collaborative plan for data security protection to safeguard important national data, it added. As technology evolves, the government said geographic information can be used as a strategic data resource and in production for areas such as agriculture, energy, automated vehicles, and express online shopping and food deliveries. https://www.reuters.com/technology/cybersecurity/china-warns-geographic-info-data-breaches-affecting-transport-military-2023-12-13/

2023-12-13 06:50

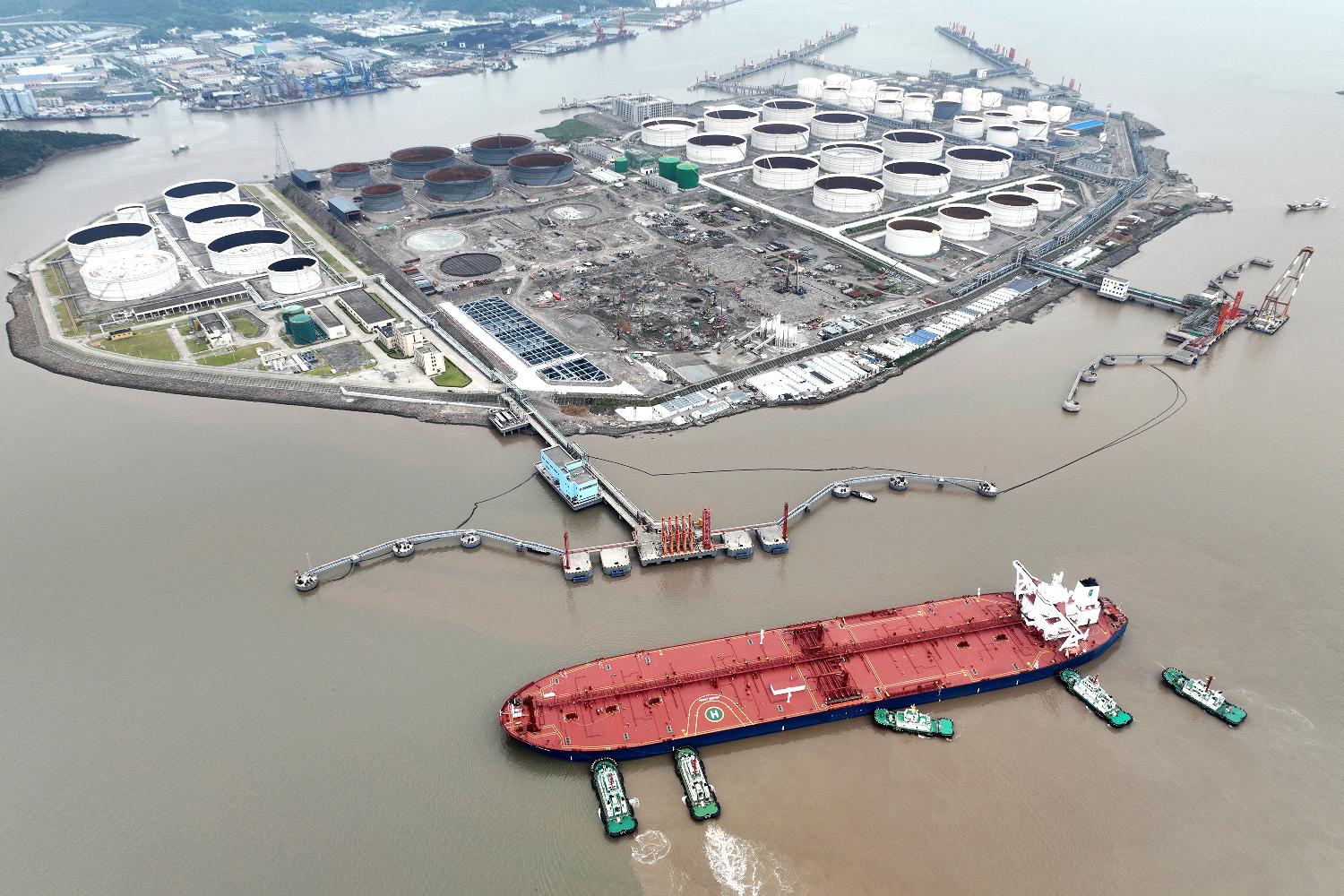

U.S. crude stocks declined 4.3 million barrels last week - EIA Tanker in Red Sea off Yemen fired on by gunmen in a speedboat U.S. Fed holds interest rates steady, signals cuts in 2024 OPEC maintains cautious optimism for 2024 in latest report NEW YORK, Dec 13 (Reuters) - Oil prices edged up about 1% on Wednesday from a five-month low in the prior session on a bigger-than-expected weekly withdrawal from U.S. crude storage and on worries about the security of Middle East oil supplies after a tanker attack in the Red Sea. Traders also noted crude prices held gains after the U.S. Federal Reserve released a statement that it would hold interest rates steady as expected and signaled it would start lowering borrowing costs in 2024. Lower interest rates cut consumer borrowing costs, which can boost economic growth and demand for oil. Brent futures rose $1.02, or 1.4%, to settle at $74.26 a barrel. U.S. West Texas Intermediate (WTI) crude rose 86 cents, or 1.3%, to settle at $69.47. A tanker in the Red Sea off Yemen's coast was fired on by gunmen in a speedboat and targeted with missiles, the latest incident to threaten the shipping lane after Yemeni Houthi forces warned ships not to travel to Israel. The U.S. Energy Information Administration (EIA) said energy firms pulled a bigger than expected 4.3 million barrels of crude from stockpiles during the week ended Dec. 8 as imports fell. EIA/A , "This (EIA) report is definitely more supportive than the (API) report that we saw yesterday," said Phil Flynn, an analyst at Price Futures Group, referring to the "larger than expected drawdown in crude oil supplies" in the EIA report. On Tuesday, both Brent and WTI futures fell to their lowest since June and were in contango, with prices in later months higher than earlier months. Traders say this is bearish because it can encourage marketers to buy oil at current prices and store it to sell later when prices are higher. U.S. INTEREST RATES The U.S. Fed said it held interest rates steady and signaled an end to monetary policy tightening to fight inflation and lower borrowing costs coming in 2024. Elsewhere, nearly 200 nations reached an historic deal at the COP28 conference to begin reducing global consumption of fossil fuels. Saudi Arabia's energy minister said he was in agreement with the COP28 presidency on the final deal, adding it would not affect the kingdom's hydrocarbon exports. In its monthly report, the Organization of the Petroleum Exporting Countries (OPEC) blamed the latest crude price slide on "exaggerated concerns" about oil demand growth. Brent futures have dropped about 10% since OPEC+ announced a new round of production cuts on Nov. 30. OPEC+ includes OPEC and allies like Russia. https://www.reuters.com/markets/commodities/oil-holds-soft-tone-oversupply-concerns-markets-await-fed-2023-12-13/