2023-12-11 23:40

Macy's up as investors mount $5.8 bln buyout bid Cigna surges on report it's ditching Humana deal; share buyback Nike higher after Citigroup says "buy" Indexes up: Dow 0.43%, S&P 500 0.39%, Nasdaq Composite 0.20% NEW YORK, Dec 11 (Reuters) - U.S. stocks registered modest gains on Monday but managed to close at new highs for the year, ahead of major market catalysts this week that include inflation readings and the Federal Reserve's policy announcement, which will strongly influence investor expectations on the path of interest rates. Market watchers increasingly believe the central bank is done with its interest rate hike cycle and could potentially cut rates in the first half of next year. These expectations have helped fuel a rally in equities in recent weeks that sent each of the three major indexes to their highest closing levels of the year. While markets had been pricing in a better than 50 percent chance of a rate cut in March by the Fed last week, data on Friday showed job growth accelerated and the unemployment rate dipped, while a separate report showed consumer inflation expectations had dropped. The data raised hopes the inflation could continue to decelerate without the economy falling into a recession and expectations for a March cut softened. Investors will eye the Consumer Price Index (CPI) data due on Tuesday, which is expected to show headline inflation remaining unchanged in November, followed by the Producer Price Index (PPI) and the last interest rate decision of the year from the Fed on Wednesday. "I don't think there is any reason to react ahead of either of those three events, it's just in wait-and-see mode. The trend is just going to stay higher," said Ken Polcari, managing partner at Kace Capital Advisors in Boca Raton, Florida. "Certainly if the CPI number comes in softer, if it's weaker than what the expectation is that will be quite bullish because it will just speak to the slowing inflation, Goldilocks kind of landing story." The Dow Jones Industrial Average (.DJI) rose 157.06 points, or 0.43%, to 36,404.93, the S&P 500 (.SPX) gained 18.07 points, or 0.39 %, to 4,622.44 and the Nasdaq Composite (.IXIC) gained 28.51 points, or 0.20 %, to 14,432.49. Markets have almost fully priced in the central bank keeping rates steady at Wednesday's announcement, but questions remain as to the timing of the first rate cut, with expectations of a March cut of at least 25 basis points (bps) around 43% and a nearly 75% chance for May, according to CME's FedWatch Tool. Later in the week, the European Central Bank (ECB) and the Bank of England (BOE), are also due to make policy announcements. Semiconductors climbed 3.4% with the PHLX semiconductor index (.SOX) closing at its highest level since Jan. 5, 2022, led by an 8.99% surge in Broadcom (AVGO.O), after Citigroup resumed coverage on the chipmaker with a "buy" rating. Cigna (CI.N) jumped 16.68% after the health insurer ended its attempt to negotiate the acquisition of rival Humana (HUM.N), according to sources, and announced a $10 billion share buyback plan. Humana shares slipped 1.04%. Nike (NKE.N) gained 2.33% to help buoy the Dow after brokerage Citigroup upgraded its stock to "buy" from "neutral". Among other movers, Macy's (M.N) shot up 19.44% after an investor group consisting of Arkhouse Management and Brigade Capital made a $5.8 billion offer to take the department store chain private, according to a source. Advancing issues outnumbered decliners by a 1.2-to-1 ratio on the NYSE while declining issues outnumbered advancers by a 1.2-to-1 ratio on the Nasdaq. The S&P 500 posted 54 new 52-week highs and no new lows while the Nasdaq recorded 197 new highs and 143 new lows. Volume on U.S. exchanges was 11.32 billion shares, compared with the 10.89 billion average for the full session over the last 20 trading days. https://www.reuters.com/markets/us/futures-muted-traders-brace-inflation-data-fed-verdict-2023-12-11/

2023-12-11 23:04

Dec 12 (Reuters) - U.S. private equity firm Bain Capital has agreed to sell Japan Wind Development to Infroneer Holdings (5076.T), a Japanese civil engineering group, for about $1.5 billion, two people with knowledge of the deal said. The sale was made through a competitive bidding process and marks a significant step up in Infroneer's efforts to develop wind power projects, said one of the people. The companies are expected to sign the deal later on Tuesday, according to the sources, who declined to be identified as the information was confidential. Infroneer said in a statement its board would discuss the matter at a meeting on Tuesday. Bain Capital, which led a management buyout of Japan Wind Development in 2015 for 9.7 billion yen ($80 million), declined to comment. Renewable assets have become increasingly attractive as Japan seeks to transition to a zero-emission economy. Mergers and acquisitions involving Japanese companies in the renewable energy sector have climbed more than eight times to $1.8 billion for the year to date from the same period a year earlier, marking the highest level since 2019, LSEG data showed. The number of deals at 28 is a record high. Shares in Infroneer, which has said it is focusing on the renewable energy market as part of its medium-term business strategy, edged down 0.3% in morning trade. It has worked on two wind farms in northern Japan, one of which was sold last year. News of the deal was first reported by the Nikkei business daily. ($1 = 146.1300 yen) https://www.reuters.com/markets/deals/infroneer-buy-japan-wind-development-bain-capital-137-bln-nikkei-2023-12-11/

2023-12-11 22:42

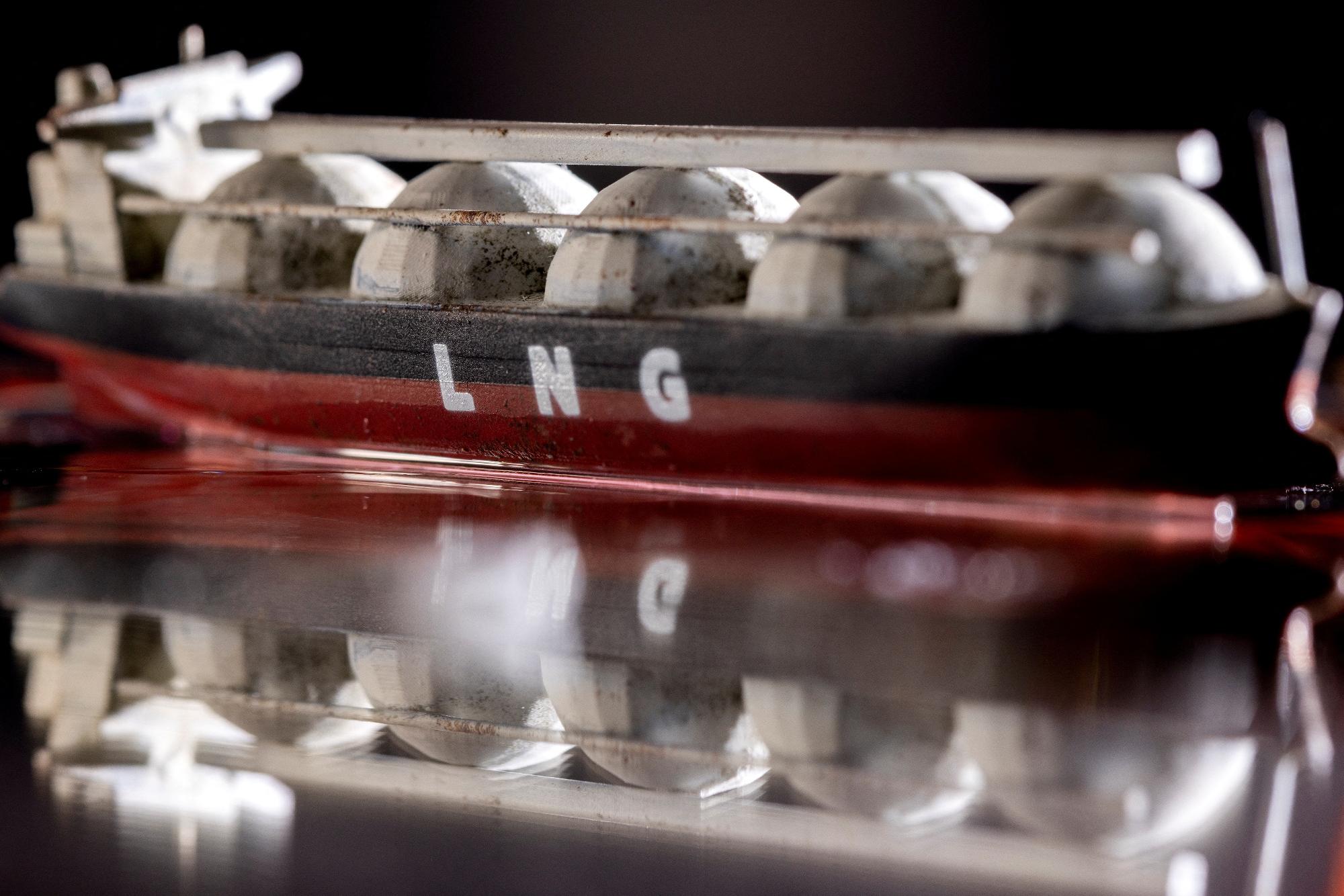

HOUSTON, Dec 11 (Reuters) - BP PLC (BP.L) has challenged U.S. energy regulators' approvals of a Venture Global LNG liquefied natural gas export facility, arguing the Federal Energy Regulatory Commission (FERC) has failed to enforce its regulations, according to a letter filed with FERC on Monday. Venture Global LNG has become a major U.S. exporter of the superchilled gas since it started processing at its Calcasieu Pass, Louisiana, plant early in 2022. It has sold more than 200 cargoes of the gas under its own accounts without supplying BP and other long-term contract customers, who have complained they have lost billions in revenue. "By failing to follow the Commission’s requirements ...(Venture Global Calcasieu Pass) has immunized its self-serving assertion that commercial operations must be deferred from the public scrutiny," BP said in its letter to FERC. FERC oversight of LNG facility operations has not met the commissions transparency requirements, including the public disclosure of key facts and documents necessary to ensure that commission’s rulings are in fact being followed, BP wrote. A FERC spokesperson declined to comment, citing pending matters before the commission. BP's action follows the denial of a request by Spanish energy firm Repsol SA (REP.MC) for the reopening of U.S. authorization of facility. It asked the Department of Energy to revisit the export approval of the 10 million metric tons per year Calcasieu plant in view of startup problems that has prevented Repsol from receiving its contracted LNG cargoes. "The complaint that BP filed with FERC has no merit and is another attempt, after Repsol tried and failed, to use a federal energy regulator to advance its own interests in a commercial dispute,” Venture Global LNG spokesperson Shaylyn Hynes said. Venture Global LNG will be submitting a formal response to the BP letter, she added. In the Repsol request, the DOE denied the request to open the approval, and said disagreements with contract terms and performance were a matter for the commercial parties to resolve. "DOE has no basis to second-guess FERC’s determinations concerning the operational status of the Project," the DOE's November decision said. The latest request comes after BP, Edison SpA, Shell and Repsol filed contract arbitration claims on the lack of LNG cargoes under their contracts. Venture Global LNG has said the claims are without merit and the company's contracts allow it alone to decide when the facility is operating commercially. https://www.reuters.com/business/energy/bp-challenges-us-energy-regulators-oversight-venture-global-lng-plant-2023-12-11/

2023-12-11 22:33

DUBAI, Dec 12 (Reuters) - Negotiations have formally entered high-stress mode. With just hours to go before the COP28 climate summit is scheduled to end, nearly 200 countries remain sharply divided on the toughest issue: what to do about fossil fuels. The COP28 President Sultan Al Jaber had an urgent tone on Monday night when he asked negotiators to find consensus, and quickly: "Let's not rest until we get this done." The latest draft deal, released by the UAE host on Monday, touched off a firestorm of criticism. It listed options nations could take to slash emissions, but "phasing out" oil and gas wasn't among them - an apparent concession to OPEC nations that have lobbied against such language from start. Big powers like the U.S. and the EU that have pushed for a phase out were not pleased, and tiny ones like Samoa and the Marshall Islands were calling it a death sentence. The best guess for what to expect on Tuesday is for a new draft of a potential final deal to drop sometime, perhaps in the morning. Then, if all goes well, it will be adopted. More likely: divisions will remain, and the summit will go into overtime, a pattern that has become routine for COPs. https://www.reuters.com/business/environment/what-watch-cop28-tuesday-2023-12-11/

2023-12-11 22:16

DOHA, Dec 11 (Reuters) - OPEC's top Arab energy ministers arrived in Doha on Monday for the 12th Arab Energy Conference as countries clash at the UN's COP28 climate summit over a possible agreement to phase-out fossil fuels. OPEC Secretary General Haitham Al Ghais in a letter dated Dec. 6 and seen by Reuters urged OPEC members to reject any COP28 deal which targets fossil fuels rather than emissions. Countries in the Organization of the Petroleum Exporting Countries hold about 80% of the world's proven oil reserves, most of which is concentrated among Middle Eastern members. For the majority of those countries, oil revenue is the main source of income, so any message from COP28 aimed at slashing oil and gas demand becomes a question of survival. Ministers from Iraq, Kuwait, Algeria, Libya and non-OPEC member Oman arrived for the energy meeting, as well as Saudi Energy Minister Prince Abdulaziz bin Salman who had been in Dubai for the U.N climate summit. United Arab Emirates Energy Minister Suhail Mohamed Al Mazrouei was absent. The UAE, the second Arab country to host the climate summit after Egypt in 2022 and an OPEC member, has alongside other Gulf energy producers called for what they consider a more realistic energy transition in which fossil fuels retain a role in securing energy supply while industries decarbonise. Sultan Al Jaber, who is chief of UAE state oil giant ADNOC and president of COP28, has maintained that a phase down of fossil fuels is inevitable and essential, but is part of a transition that takes into account the circumstances of each country and region. Saudi Arabia, the de-facto leader of OPEC, and top ally Russia are among several countries insisting that the COP28 conference in Dubai targets emissions, rather than the fossil fuels causing them, according to observers in the negotiations. Qatar, which left OPEC in 2018, but whose position is largely aligned with other oil and gas producing nations, said that it had invested tens of billions of dollars in its liquefied natural gas (LNG) industry, even when many doubted the feasibility of such investments. "Our decision at the time was based on a realistic understanding of market fundamentals and efforts to reduce global carbon emissions," Saad al-Kaabi, the head of Qatar's state-run energy company, told the conference. PHASE OUT At least 80 countries including the U.S., the European Union and many poor, climate-vulnerable nations are demanding that a COP28 deal call clearly for an eventual end to fossil fuel use. "Kuwait works according to a policy based on preserving the sources of petroleum wealth and their optimal exploitation and development," Oil Minister Saad Al Barrak said, adding that oil was a primary source energy for Kuwait and the rest of the world. Kuwait reaffirmed its rejection for the inclusion of any call for phasing out fossil fuels consumption and production in the COP28 draft final climate deal, he later said in remarks to Kuwait's state news agency (KUNA). However, the minister said his country deeply believes in the need to cut greenhouse gas emissions to protect environment. Like Kaabi, Barrak also spoke of the importance of investing in order to increase production capacity for fossil fuel-based energy resources. Deals at U.N. climate summits must be passed by consensus among the nearly 200 countries present. The summits aim to establish a consensus on the world's next steps to address climate change - though it is up to individual countries to ensure it happens through their national policies and investments. COP28 is scheduled to end on Dec. 12, as is the two-day 12th Arab Energy Conference. https://www.reuters.com/business/environment/arab-opec-ministers-gather-doha-cop28-fossil-fuel-talks-continue-2023-12-11/

2023-12-11 21:51

Dec 12 (Reuters) - A look at the day ahead in Asian markets. Inflation data from India and Japan dominate the Asian calendar on Tuesday, with investors expecting contradictory signals - a significant cooling in Japanese wholesale inflation, and the first rise in Indian consumer inflation since July. These indicators come just hours ahead of the latest reading of U.S. CPI inflation, and a few days after figures from Beijing showed that China's slide into deflation accelerated at a surprisingly fast rate in November. China's yuan slid to a three-week low against the dollar on the back of that news, and Japan's yen fell sharply on Monday after a media report citing sources said Bank of Japan officials are in no rush to scrap negative interest rates this month as they have not seen enough evidence of persistent wage growth. Their patience will be justified if the consensus forecast for Tuesday's wholesale inflation report is borne out. Economists expect annual wholesale inflation to slump to 0.1% from 0.8% in October. That would be the lowest since February 2021, and a remarkable reversal from above 10% just over a year ago. Annual consumer price inflation in India, meanwhile, is seen rising to 5.7% in November from 4.87% in October on the back of higher food prices, which would be the first increase since July and further above the central bank's target of 4%. As 2023 draws to a close, disinflationary forces across the Asia & Pacific region are mostly intensifying although, with headline inflation still above target in many countries, central banks are in no hurry to cut interest rates. The Reserve Bank of Australia is one. It delivered a 'hawkish pause' on interest rates earlier this month, and rates traders are only pricing in one quarter percentage point rate cut next year. And not until the fourth quarter too. RBA Governor Michele Bowman speaks on Tuesday morning and investors - and the Aussie dollar - will be keen to see if she maintains that hawkish stance, or if it softens at all. Investor sentiment was pretty neutral on Monday - U.S., Chinese and global stocks edged up but Asian stocks slipped, while bond yields and the dollar index were little changed on the day - but Japanese markets were more eye-catching. The yen lost around 1% against most major currencies, and the Nikkei jumped 1.5%. Japanese markets have been on edge since investors interpreted remarks from BOJ governor Kazuo Ueda last week as paving the way for a more rapid exit from ultra-loose monetary policy. Part of that reversed on Monday. What's in store Tuesday? Elsewhere, U.S. Commerce Secretary Gina Raimondo told Reuters on Monday that the Biden administration is in discussions with Nvidia about sales of some artificial intelligence chips to China but not its most advanced semiconductors. Here are key developments that could provide more direction to markets on Tuesday: - India CPI inflation (November) - Japan wholesale inflation (November) - RBA governor Michele Bullock speaks https://www.reuters.com/markets/asia/global-markets-view-asia-pix-2023-12-11/