2023-12-11 06:38

NEW YORK, Dec 11 (Reuters) - The Japanese yen weakened against the dollar on Monday for a second straight day, giving back most of a rally last week on expectations of less dovish monetary policy, and as investors awaited U.S. inflation data and three major central bank meetings. The Japanese currency surged on Thursday after Bank of Japan (BOJ) Governor Kazuo Ueda, who on the same day met with Prime Minister Fumio Kishida, said the central bank had several options on which interest rates to target once it pulls short-term borrowing costs out of negative territory. Bloomberg, however, reported on Monday that BOJ officials have not yet enough evidence that wage growth is enough to justify ending its ultra-loose monetary policy this month. “This is the right reaction. Ueda’s words last week weren’t actually any sort of concrete statement that they were going to end that negative interest rate,” said Helen Given, FX trader, at Monex USA in Washington. The dollar rose as high as 146.58 yen and was last at 146.14 yen, up 0.85% on the day. The yen has given up almost all of its rally on Thursday, when it reached 141.6 yen against the dollar. The dollar rose 0.13% against a basket of currencies to 104.08. The euro was unchanged on the day at $1.0762, close to Friday's 24-day low of $1.0724. Sterling gained 0.06% to $1.2555, after hitting a 15-day low of $1.2504 on Friday. Traders will watch U.S. consumer price inflation data on Tuesday for clues on the likely path of Federal Reserve policy. It is expected to show that headline inflation was unchanged in November, for an annual increase of 3.1%, down from 3.2% in October. (USCPNY=ECI), (USCPNY=ECI) A New York Fed survey showed that the path U.S. consumers expect inflation to take over the next year softened in November to the lowest level in more than two years, amid retreating projections of higher gasoline and rental costs. The dollar jumped on Friday after jobs growth in November beat economists’ forecasts, pushing back expectations for the first Fed rate cut to May, from March. Central banks will then take the markets’ focus, with Fed officials due to give their updated economic and interest rate projections at the conclusion of the U.S. central bank’s two-day meeting on Wednesday. Fed Chairman Jerome Powell is also likely to reduce expectations of rate cuts being likely in the first half of the year. “His speeches, in particular since the last cycle, have focused on that the remaining risk is going to be to the upside - so he’s still biased towards more tightening rather than this loosening that markets are starting to expect,” said Given. The European Central Bank and the Bank of England will also set rates on Thursday. Meanwhile, China's yuan fell to a three-week low after data showed deflation in the country worsened in November. Data over the weekend showed China's consumer prices fell at the fastest rate in three years in November while factory-gate deflation deepened, indicating increasing deflationary pressure as weak domestic demand casts doubt over the country's economic recovery. The yuan hit a three-week low in both the onshore and offshore markets , with the former last at 7.1750 per dollar. The Australian dollar , often used as a liquid proxy for the yuan, fell 0.17% to $0.6566. The dollar gained 0.39% against the Norwegian krone to 10.95 , after earlier reaching 10.99, the highest since Nov. 14. Analysts are divided over whether Norway's central bank will continue to raise interest rates this week, with a narrow majority predicting an unchanged cost of borrowing, a Reuters poll showed on Monday. In cryptocurrencies, Bitcoin tumbled more than 7% to $40,542. ======================================================== Currency bid prices at 3:00PM (2000 GMT) https://www.reuters.com/markets/currencies/dollar-steady-with-us-inflation-fed-meeting-eyed-yuan-heavy-2023-12-11/

2023-12-11 06:26

MUMBAI, Dec 11 (Reuters) - The Reserve Bank of India likely sold U.S. dollars on Monday to curb losses in the rupee, as the currency opened trading near its lifetime low, four traders told Reuters. The rupee opened at 83.3850 against the U.S. dollar, maintaining the same level as Friday's closing. The currency had previously hit a lifetime low of 83.42 on Nov 10. While most Asian currencies dipped on Monday, traders expect the rupee's losses to be contained. The RBI is likely to "keep protecting," the rupee near these levels, a foreign exchange trader at a private bank said. https://www.reuters.com/markets/currencies/indias-central-bank-likely-sold-us-dollars-limit-rupees-losses-2023-12-11/

2023-12-11 06:05

NEW YORK, Dec 11 (Reuters) - U.S. stocks ended in positive territory and gold slid on Monday, as investors looked ahead to crucial inflation data and the U.S. Federal Reserve's two-day monetary policy meeting. In a busy week for central banks, the yen weakened for a second straight day as expectations faded for the Bank of Japan to shift to a less dovish policy. All three major U.S. stock indexes gained momentum as day progressed, ending the session at their highest close of the year. Gold dropped to a near three-week low as the dollar firmed. "There's a lot we don't know about this week: we don't know what inflation is going to be, we don't we don't know the Fed is going to do and we don't know what retail sales are going to do," said Rob Haworth, senior investment strategy director at U.S. Bank Asset Management Group. "And on the back of all that investors seem to be feeling OK about the market." The U.S. Labor Department's closely watched Consumer Price Index (CPI) report, due on Tuesday, is expected to show inflation still cooling but staying well above the Fed's 2% annual target. The Federal Open Markets Committee's (FOMC) two-day monetary policy meeting will end on Wednesday with its interest rate decision and the release of its summary economic projections. While the Fed is largely expected to let the Fed funds target rate stand at 5.25%-5.50%, market participants will parse the central bank's dot plot and summary economic projections to assess its likely path forward. Interest rate decisions are also expected from the European Central Bank (ECB) on Wednesday and the Bank of England (BoE) on Thursday. "We've had coordinated central bank policies for some time, locking arms as they battle inflation and send rates to high levels," Haworth added. "But they could start to break ranks. Inflation seems to be falling faster and the economy weakening more in Europe than in the U.S." The Dow Jones Industrial Average (.DJI) rose 157.06 points, or 0.43%, to 36,404.93, the S&P 500 (.SPX) gained 18.07 points, or 0.39%, at 4,622.44 and the Nasdaq Composite (.IXIC) dropped 34.64 points, or 0.24%, to 14,432.49. European shares notched modest gains ahead of critical U.S. economic data and interest rate decisions from major central banks. The pan-European STOXX 600 index (.STOXX) rose 0.30% and MSCI's gauge of stocks across the globe (.MIWD00000PUS) gained 0.29%. Emerging market stocks lost 0.15%. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) closed 0.21% lower, while Japan's Nikkei (.N225) rose 1.50%. U.S. Treasury yields were little changed after weak 3- and 10-year note auctions. Benchmark 10-year notes last rose 1/32 in price to yield 4.2409%, from 4.245% late on Friday. The 30-year bond last fell 2/32 in price to yield 4.3285%, from 4.326%. The greenback edged higher against a basket of world currencies ahead of Tuesday's CPI report, while the yen slid on waning expectations for a less dovish monetary policy from Bank of Japan. The dollar index (.DXY) rose 0.07%, with the euro up 0.01% to $1.0762. The yen weakened 0.87% to 146.20 per dollar, while Sterling was last trading at $1.2554, up 0.06% on the day. Oil prices rose slightly as investors balanced concerns over OPEC+ production cuts against worries of softening demand in the coming year. U.S. crude advanced 0.1% to settle at $71.32 per barrel, while Brent ended 0.3% higher at $76.03 per barrel. Gold slid to a near three-week low as focus shifted to Tuesday's CPI report. Spot gold dropped 1.1% to $1,980.91 an ounce. https://www.reuters.com/markets/global-markets-wrapup-1-2023-12-11/

2023-12-11 06:04

AMSTERDAM, Dec 11 (Reuters) - Investors seeking to cash in on a policy pivot from the European Central Bank will watch Thursday's meeting for any hint they should sit tight on bets for swift interest rate cuts next year. Euro zone inflation is tumbling and the economy may be in a shallow recession, so traders don't buy the ECB's mantra that rates will stay high for some time. "The biggest challenge will be to try and navigate around the amount of cuts and the speed of the cuts that's been priced in," said Ed Hutchings, head of rates at Aviva Investors. Here are five key questions for markets. 1/ What can we expect this week? The ECB is likely to say it is pleased that inflation, which exceeded 10% last year, is nearing its 2% target. "They may even clearly tone down the language on the possibility of more hikes. So to the market they'd be saying: this is likely it, this is the peak," said Jens Eisenschmidt, a former ECB economist and now Morgan Stanley's Europe chief economist. But don't expect ECB chief Christine Lagarde to sound dovish beyond that; analysts reckon she will not want to fuel further expectations of policy easing. 2/ Is the inflation fight over? The signs are certainly positive. Euro zone inflation tumbled to 2.4% in November, undershooting expectations for a third straight month, with even the core measure excluding volatile food and energy prices falling sharply to 3.6%. "The inflation picture is much more favourable than the ECB has in its forecasts," said Carmignac chief economist Raphael Gallardo. Inflation is expected to rise again as subsidies shielding consumers from high energy prices expire, however, while wage growth remains elevated. So the ECB will be reluctant to declare victory just yet. 3/ Who's right on rates - traders or the ECB? Traders now see over 130 basis points of ECB rate cuts next year, starting in March. When the ECB last met on Oct. 26, they priced in just 70 bps of cuts commencing in July. Even board member Isabel Schnabel, a renowned hawk, has added fuel to the fire, telling Reuters the ECB can take further hikes off the table and should not guide for steady rates through mid-2024. But wary of inflation risks, the ECB is all but certain to avoid endorsing market pricing, and many economists think March is too early for cuts. "I expect a cautious, conservative, and moderately hawkish counter-reaction to the recent dovish market repricing," said UBS chief European economist Reinhard Cluse. 4/ What's happening to PEPP? Lagarde recently said the ECB will "probably" discuss ending reinvestments under its 1.7 trillion euro Pandemic Emergency Purchase Programme (PEPP) earlier than the current end-2024 deadline, so the topic could come up this week. Italian bonds, the main beneficiary, outperformed in November on rate cut hopes, sharply narrowing the risk premium they pay over Germany. But that has also boosted the case for bringing forward an end to reinvestments, analysts said. Were the ECB to halt the reinvestments in June, Italy would miss out on some 15 billion euros of cash, compared to over 350 billion euros of debt it will sell next year, Pictet Wealth Management's head of macroeconomic research Frederik Ducrozet, estimates. For Ducrozet such a small amount isn't worth risking volatility in markets right now. BNP Paribas nevertheless expects the ECB to start a formal discussion on ending reinvestments. "What the decision may reveal is how much influence the hawks still have," Ducrozet said. 5/ What will new ECB projections show? Analysts largely expect the ECB to lower its growth and inflation projections for next year from September estimates, boosting the case for easing hawkish guidance, and inflation to be around 2% in 2026. With inflation undershooting substantially, the ECB's fresh staff projections, which will include forecasts for 2026 for the first time, are in focus. https://www.reuters.com/markets/europe/time-reckoning-five-questions-ecb-2023-12-11/

2023-12-11 06:00

MUMBAI, Dec 11 (Reuters) - The Indian rupee was little changed on Monday, aided by likely intervention from the Reserve Bank of India (RBI), even as its Asian peers slipped amid an uptick in U.S. Treasury yields. The rupee was at 83.3725 against the U.S. dollar as of 10:20 a.m. IST, barely changed from its close at 83.3850 in the previous session. The RBI likely sold U.S. dollars to cap further depreciation in the rupee, five traders said. The central bank is "not letting (USD/INR) move above 83.40," a foreign exchange trader at a foreign bank said. The rupee has hovered between 83.01 and 83.40 since hitting its record low of 83.42 on Nov. 10. The local unit is likely to see "steady depreciation," but a sharp rise will be tough amid central bank intervention, Dilip Parmar, a foreign exchange research analyst at HDFC Securities said. The dollar index last quoted at 104 while Asian currencies weakened between 0.2% to 0.9%. The 10-year U.S. treasury yield was steady in Asia hours after rising to 4.24% on Friday following stronger-than-expected U.S. labour market data. U.S. job growth accelerated in November and the unemployment rate declined to 3.7% against expectations that it would hold steady at 3.9%, according to a Reuters poll. The data also prompted investors to temper bets on how soon the U.S. Federal Reserve would start easing policy rates. Key central banks like the Fed, the European Central Bank, and the Bank of England will deliver policy decisions this week. India and the United States will also report inflation data. Economists estimate that U.S. core inflation rose to 0.3% month-on-month in November, up from October's 0.2%. India's retail inflation is expected to rise to 5.70% year-on-year in November, up from 4.87% in October, due to higher food prices, a Reuters poll showed. https://www.reuters.com/markets/currencies/rupee-stands-pat-likely-rbi-help-counters-drop-asian-peers-2023-12-11/

2023-12-11 05:44

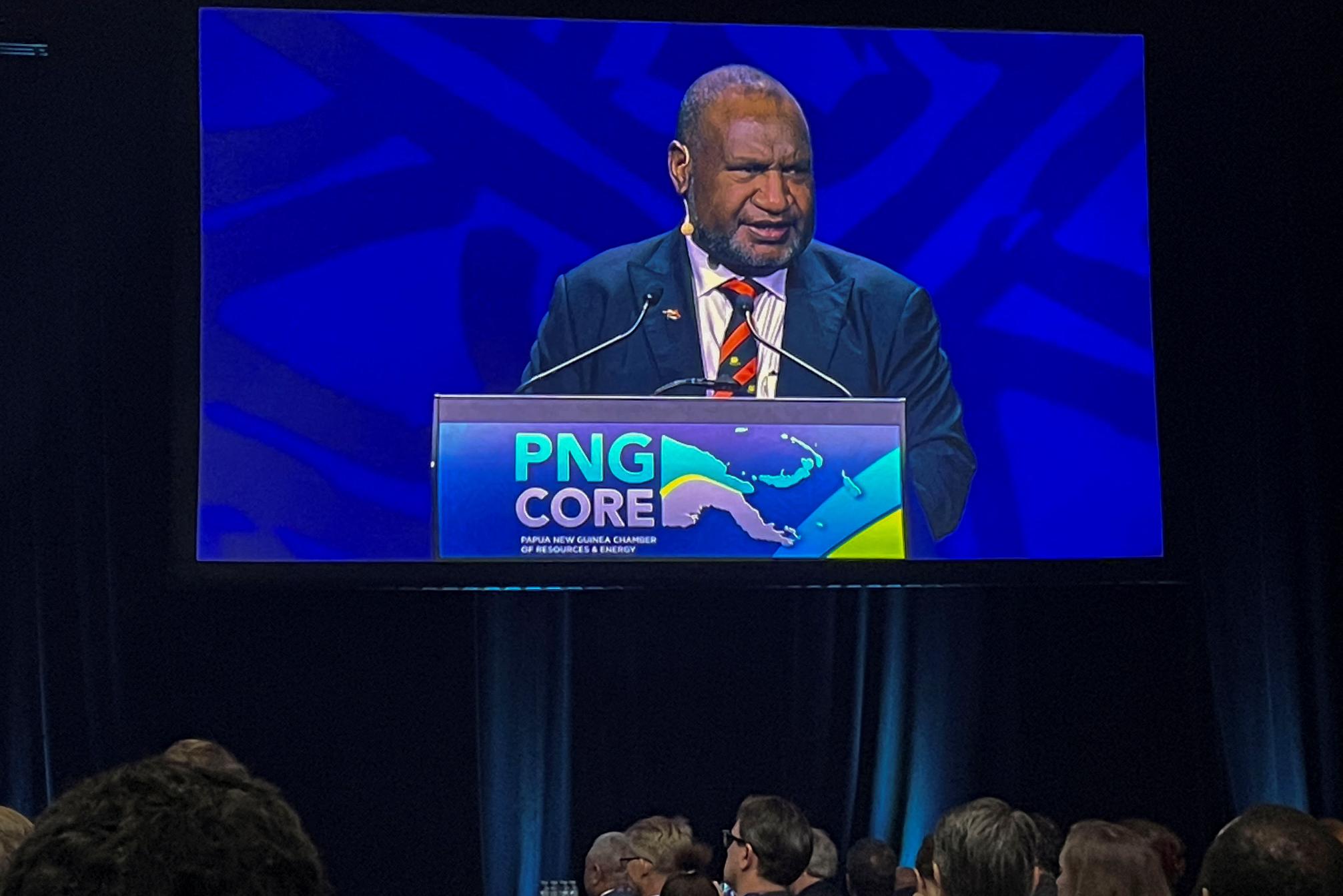

SYDNEY, Dec 11 (Reuters) - Papua New Guinea Prime Minister James Marape said on Monday the Pacific Islands nation, which he sees as a buffer between Asia and the Pacific, had not held talks with China on security after signing a security agreement with neighbour Australia last week. Marape said that Papua New Guinea had been transparent, and that when he visited Beijing this year with his ministers and met China's leaders "there was no conversation on security". "We keep them in the space of the economy, we went with traditional security partners for security," he told a resources investment conference in Sydney. Papua New Guinea signed a defence agreement with the United States in May, and struck a security deal with Australia last week that Marape said was focused on internal security, including boosting police numbers and the judiciary. "These two are complementary. External security with the USA, and internal security with Australia," he said. The resource-rich but largely undeveloped nation north of Australia is seeking to woo foreign investment and trade to boost its economy, amid an increasing jostle for influence in the region between the United States and China, which signed a security pact with neighbouring Solomon Islands last year. PNG is discussing a free trade agreement with China, which already buys half of PNG's produce. Marape said improving security was important for foreign investors. Papua New Guinea's exports are dominated by resources and energy, including liquefied natural gas. Marape said that he did not want to be lectured on climate change, and that nations with the biggest carbon footprints and affluent lifestyles needed to take the lead in curbing emissions. "My country is in the oil and gas business. Lucky for me we have the big forest and ocean to offset," he said. With 70% of Papua New Guinea forested, Marape said it was a "carbon negative" country and offered a green label to energy investors. In a separate speech to the Lowy Institute think tank on Monday, Marape said the greatest challenge facing humanity other than climate change is poverty, and economic investment was "more powerful than just security". "The gap in poverty must be filled - the West cannot be ignorant to this," he said, adding that he believed the next 100 years would be the Asian century. He said PNG's security interests were different from those of smaller Pacific Island nations because of its geographic position, and PNG wanted to "share responsibility with Australia, to assist in keeping our Pacific safe". "PNG stands as a buffer to greater Asia and linking to the Pacific," he said. Marape also said PNG was seeking to forge trade ties with India to ensure it had supplementary markets that would step up, in case "we get problems elsewhere". https://www.reuters.com/world/asia-pacific/papua-new-guinea-pm-marape-says-no-talks-with-china-security-2023-12-10/