2023-12-11 05:41

DUBAI, Dec 11 (Reuters) - U.N. climate chief Simon Stiell called on countries on Monday to clear "tactical blockages" to reach a deal on tackling climate change at the COP28 summit, saying there had been a narrowing of some gaps. Stiell said a new draft text for a possible agreement would be published shortly. "The world is watching ... there is nowhere to hide," he said. "I urge negotiators to reject incrementalism. Each step back from the highest ambition will cost countless millions of lives." https://www.reuters.com/business/environment/countries-must-clear-tactical-blockages-reach-climate-deal-cop28-2023-12-11/

2023-12-11 05:40

TOKYO, Dec 11 (Reuters) - Japan's weather bureau said on Monday that there was a 90% chance the El Nino phenomenon will continue during the northern hemisphere winter. The bureau also said there was a 50% chance each for El Nino to continue in the spring and for normal weather patterns to return after the winter. El Nino is a warming of ocean surface temperatures in the eastern and central Pacific. https://www.reuters.com/world/asia-pacific/japan-says-90-chance-el-nino-will-continue-during-winter-2023-12-11/

2023-12-11 05:35

A look at the day ahead in European and global markets from Wayne Cole It's set to be a pivotal week as the Federal Reserve leads a quintet of rich-world central bank meetings that will test market optimism for early and rapid-fire rate cuts next year. The U.S. consumer price report for November on Tuesday will also influence the outlook, with analysts forecasting an unchanged headline rate and a 0.3% rise in the core rate. The Fed meets Wednesday ahead of "Super Thursday", when the European Central Bank, the Bank of England, the Swiss National Bank and Norges Bank all meet. Steady outcomes are expected except for Norway, where there might be a hike given the weakness of the crown. There is talk, however,that the SNB might consider intervention to restrain the franc, which hit a nine-year high on the euro last week. The ECB meeting is also shaping up to be an eventful one, given that inflation has slowed enough for even arch-hawk Isabel Schnabel to take a sudden dovish turn. Analysts assume other hawks, led by the Bundesbank, will push back against market pricing for cuts starting in March or April, but it's an open question whether they will be in the majority. As for the Fed, the initial focus will be on the FOMC "dot plots" for rates and whether they will stick to 50 basis points of easing next year or nudge that higher. The last plots also had 125 basis points of cuts for 2025 and another 100 basis points the year after. Attention will then turn to Fed Chair Jerome Powell's media conference where he will have an opportunity, should he choose, to push back against market pricing for early cuts. Markets have already pared pricing for a March easing to 46% following last Friday's upbeat payrolls report, while a May cut is put at a 58% chance and around 100 basis points of easing is implied for all of 2024. Goldman Sachs has brought forward its call for rate cuts to start in the third quarter of next year, rather than the fourth quarter, and has 95 basis points of easing pencilled in for 2024. Chinese blue chips (.CSI300) slid to five-year lows after data showed consumer prices fell 0.5% in November, the sharpest drop since late 2020. The Treasury market faces a test of its own in the shape of $108 billion in new supply of three-year, 10-year and 30-year paper. Yields on 10-year notes are holding at 4.24%, after rising on Friday in the wake of the jobs report, although they still ended flat on the week. Oil prices idled after sliding 3.9% last week to five-month lows amid doubts that all OPEC+ members would stick with supply cuts. Prices did get some support on Friday when Washington announced it would rebuild its strategic oil reserves. The market will also be watching the outcome of the COP28 climate summit, which is working on a first-of-its-kind deal to phase out the world's use of fossil fuels. Oh, and it's not impossible Britain could have a new Prime Minster before the week is out as Rishi Sunak faces a COVID-19 inquiry and a crunch vote in parliament on his plan to revive a policy to send asylum seekers to Rwanda. Key developments that could influence markets on Monday: - Appearances by ECB board member Elizabeth McCaul and Riksbank Deputy Governor Aino Bunge - New York Fed one-year inflation expectations for November https://www.reuters.com/markets/europe/global-markets-view-europe-2023-12-11/

2023-12-11 05:26

BUENOS AIRES, Dec 11 (Reuters) - Argentine voters may have cause to worry about new President Javier Milei's pledge for painful economic shock therapy, but markets are keen, hoping the libertarian will give the economy a "firm kick" when he lays out his plan this week. The outsider economist on Sunday reaffirmed plans for tough spending cuts to address the country's worst economic crisis in two decades and bring down inflation nearing 150%, though he warned the situation would get worse before getting better. "There is no money," he said repeatedly in his maiden speech, pledging to make tough decisions even if that means pain for the country. "The challenge we have ahead is titanic." Analysts said that Milei, who won over voters with a "chainsaw" economic plan to cut state spending and overturn a deep deficit, needed to follow through on this tough talk. His election win has buoyed stocks and bonds in recent weeks. "Milei's calculated echo of 'blood, toil, tears, and sweat' isn't just rhetoric, but a deliberate move to temper expectations and instill urgency ahead of what will be a challenging fiscal path," said Mariano Machado, principal Americas analyst at Verisk Maplecroft. "Beyond fiery speeches, effective governance is the linchpin to stabilization, and the playbook of the new administration remains a puzzle," Machado added. Milei's economy chief Luis Caputo is expected to announce a package of economic measures with investors looking out for a devaluation of the peso, now held by currency controls, public spending cuts and potential privatizations. In his maiden speech, Milei said a fiscal adjustment of 5% of gross domestic product will impact the state but not the private sector, without providing any details. "Milei's focus is on eliminating the fiscal deficit, the Achilles heel of the Argentine economy," said Kezia McKeague, regional director at McLarty Associates in Washington, who advises multinational companies on Argentina. CUTTING BACK Cuts could come from the removal of tariff subsidies, reducing capital expenditures and the reduction of fiscal transfers to provinces, said Fernando Marull, founder of Buenos Aires-based economic consultancy FMyA. Marull said the 5% cut was "achievable," but the governability risk is the main hurdle, as four out of 10 Argentines are poor. "I think he has a six-month window. If he succeeds, Argentina will return to the international arena." Others agreed that time was of the essence for Argentina. "It will be crucial for the new administration to quickly revive confidence," said economist Gustavo Ber, adding that the government needed social and legislative support given the likely economic pain ahead and inflation spiking further. "The macroeconomic picture... is, to say the least, terrifying. Although inflation has already hit its highest in the last 30 years, everything indicates that the worst is yet to come," said consulting firm GMA Capital Research. Milei will need to rebuild depleted central bank reserves analysts estimate to be a net $10 billion in the red, ease a looming recession, bring down 40% poverty and revamp a failing $44 billion program with the International Monetary Fund. His first weeks may set the tone. "To get out of this situation it will be necessary for the new government to act quickly and eliminate capital controls as soon as possible," said Lautaro Moschet, economist at the Freedom and Progress Foundation. Morgan Stanley said in a report said that without a strong economic program, Argentina may need to sharply weaken its exchange rate, currently around 365 per dollar, which could see the price of greenbacks double. "An FX adjustment seems inevitable," the investment bank said in the Dec. 7 note, adding that it could weaken to 700 per dollar. "An economy with no credible economic program may need to compensate with a weaker FX to attract investment." https://www.reuters.com/markets/argentina-markets-want-fiscal-kick-economy-milei-shock-plan-readied-2023-12-11/

2023-12-11 04:48

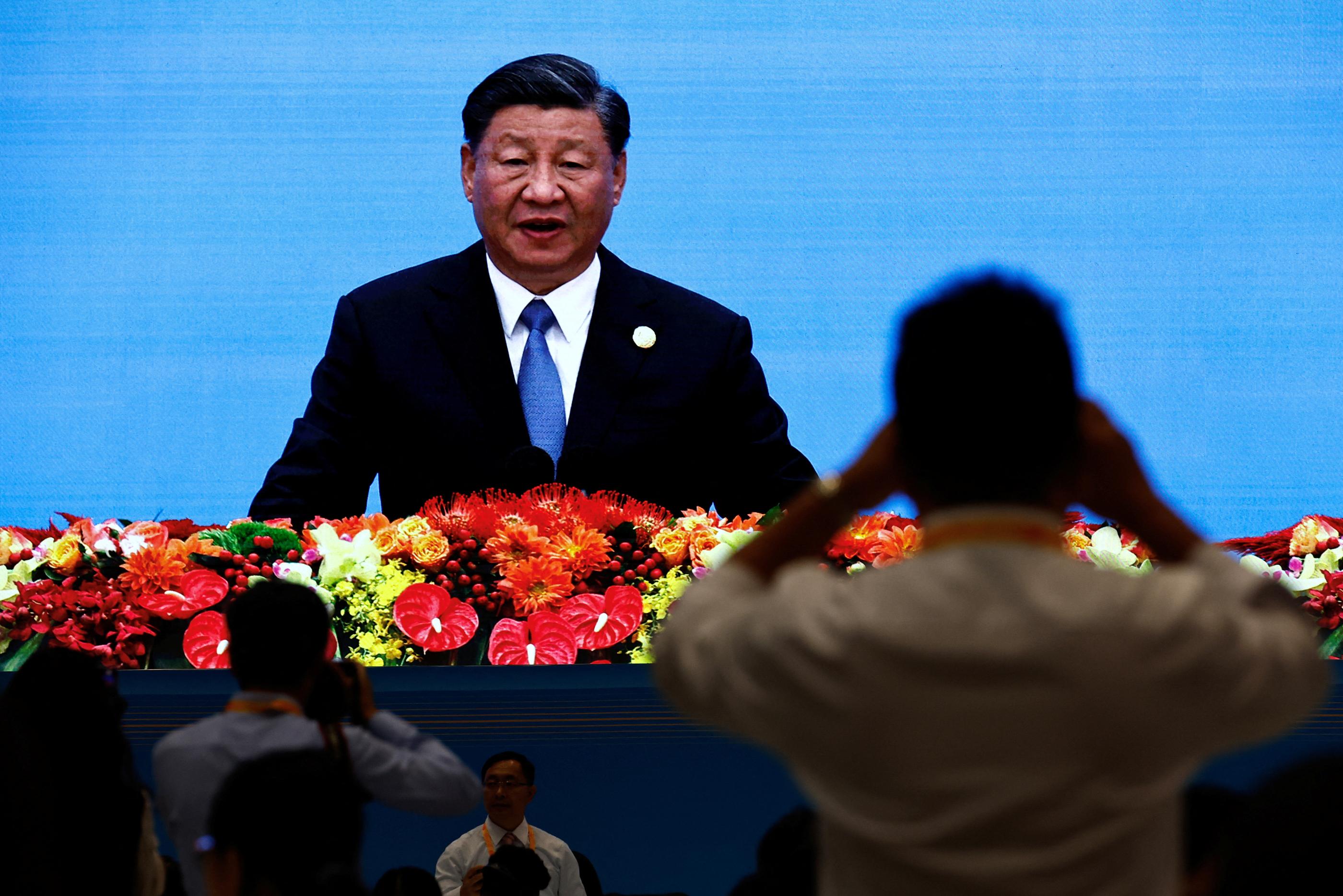

HANOI, Dec 11 (Reuters) - China and Vietnam are set to agree this week on upgraded rail links and other infrastructure, possibly including digital projects, officials said, in moves that would bring Hanoi closer to Beijing as great powers jostle for influence in Vietnam. The announcements are expected during President Xi Jinping's visit to Hanoi from Tuesday, the first in six years to the Southeast Asian neighbour, and shortly after U.S. President Joe Biden travelled to the Vietnamese capital in September to strengthen bilateral ties. China is ready to offer grants to Vietnam to boost the railway between Kunming and the Vietnamese port city of Haiphong, and other transport links from southern China to Hanoi, Vietnamese state paper Tuoi Tre reported, citing the Chinese ambassador to Vietnam Xiong Bo. He said China was ready to provide "non-refundable aid" for these projects, the paper reported late on Sunday, in an offer that, if confirmed, would represent a major concession to a country that is traditionally loath of taking loans. It is however unclear whether grants would come with loans and the share of both. A sizeable offer of grants could also be perceived as a blow to the United States and other Western backers of infrastructure projects in Vietnam, who under a climate plan have offered mostly loans at market values to help Vietnam reduce its coal use. The Kunming-Haiphong rail upgrade plan, which Reuters first reported earlier in December, passes through the region where Vietnam has its biggest rare earths mines, which it has so far been unable to exploit because of a lack of processing technology. Vietnam is estimated to hold the world's second largest deposits of the strategic minerals which are at the moment crucial for electric vehicles and wind turbines. China is by far the world's biggest producer and refiner of rare earths, but is unclear what deal could be reached on that, as Beijing is usually reluctant to share its refining technology and Hanoi largely prevents export of unprocessed rare earths. Vietnam's foreign affairs ministry did not reply on Monday to a request for comment about the possible grants, but Prime Minister Pham Minh Chinh in November supported the upgrade of the Kunming-Haiphong rail. DIGITAL SILK ROAD China's ambassador also mentioned digital interconnections among the priorities to strengthen cooperation between the two countries, which are already enjoying booming economic exchanges. "Both of our countries need to enhance interconnections on land, sea, air and on the internet," Xiong Bo was reported saying. Diplomats, officials and Vietnamese experts said digital interconnections meant including Vietnam in Chinese plans for a Digital Silk Road, Beijing's flagship programme under the wider Belt and Road Initiative focussed on optical fibre cables, data centres and other telecoms infrastructure in friendly countries. Additional submarine cables could be part of the discussion, one diplomat said, as Vietnam has experienced disruptions this year in its undersea digital infrastructure. Vietnam also plans to build a fully-fledged 5G network, an infrastructure in which China's telecom giant Huawei excels. Vietnam's foreign ministry did not comment on Monday but President Vo Van Thuong at the Belt and Road forum in China in October urged to boost cooperation on digital infrastructure. It is however unclear whether Vietnam is only paying lip service to that, as national security concerns tend to prevail on strategic projects, said Le Hong Hiep, a senior fellow at Singapore's Iseas–Yusof Ishak Institute, especially in the South China Sea, where Hanoi and Beijing disagree over borders. https://www.reuters.com/world/asia-pacific/xi-visits-china-offers-rail-grants-vietnam-pushes-digital-silk-road-2023-12-11/

2023-12-11 04:36

LAUNCESTON, Australia, Dec 11 (Reuters) - The prices of differing grades of seaborne thermal coal in Asia are diverging as strong demand for high-quality fuel coal by Japan and South Korea drives a rally, but lacklustre imports by China and India mean lower grades stagnate. Japan and South Korea are the main buyers of thermal coal linked to the Newcastle Index, which assesses coal with an energy content of 6,000 kilocalories per kilogram (kcal/kg) from Australia, the world's second-largest exporter of the power station fuel. The weekly index , as assessed by commodity price reporting agency Argus, rose to $141.59 a metric ton in the seven days to Dec. 8, its third consecutive weekly gain and an increase of 17.5% from its recent low of $120.53 on Nov. 10. The daily assessment by globalCOAL saw the grade reach $149.36 a metric ton on Dec. 8, with the world's leading coal-trading platform reporting physical cargoes trading at a premium to the index, a sign of rising demand. The gains for the high-grade thermal coal come amid rising imports by Japan and South Korea, as utilities appear to prefer coal to liquefied natural gas in meeting additional power demand in the northern winter. Japan, the world's third-biggest coal buyer, is set to import 10.37 million metric tons of seaborne thermal coal in December, showed data compiled by commodity analyst Kpler. This will be the most since March, a strong gain from November's 8.53 million and only slightly below the 11.87 million of December last year. It is also likely that the December 2023 figure will be revised higher as more cargoes are assessed as likely to arrive before the end of the month. Japan's imports from Australia, which will largely be higher-grade coal, are likely to reach 6.87 million metric tons in December, versus 5.5 million in November and the highest since February. South Korea's imports of seaborne thermal coal are forecast to reach 8.59 million metric tons in December, with Kpler data showing this will be the highest since July 2021, and up 13.8% from 7.55 million in December last year. Imports from Australia are forecast to rise to 3.04 million metric tons in December, the most since July 2022 and up from 2.19 million in November and 1.72 million in December last year. SOFT CHINA, INDIA In contrast to the strength in demand from Japan and South Korea, demand for seaborne thermal coal in China and India appears muted. China, the world's biggest coal importer, is forecast to see arrivals of 24.82 million metric tons of seaborne thermal coal in December, down from 29.38 million in November, although arrivals are up from 23.91 million in December 2022. India, the world's second-largest coal buyer, is set to import 14.54 million metric tons of seaborne thermal coal in December, down from 17.42 million in November and 18.87 million in October. China and India favour lower-energy coal from both Indonesia, the world's largest shipper of thermal coal, and from Australia. The price of Indonesian thermal coal with an energy content of 4,200 kcal/kg dropped to $58.40 a metric ton in the week to Dec. 8, and is now 5.3% below its recent high of $61.60 from the week to Oct. 20. Australian coal with an energy content of 5,500 kcal/kg ended at $93.28 a metric ton in the week to Dec. 8, little changed from $93.25 the prior week, but down 11.9% from its recent high of $105.85 in the seven days to Oct. 13. The easing prices for lower-rank thermal coal likely reflects the lower demand for the grades from major buyers China and India. The opinions expressed here are those of the author, a columnist for Reuters. https://www.reuters.com/markets/commodities/thermal-coal-prices-diverge-japan-skorea-buy-more-china-india-less-russell-2023-12-11/