2023-12-08 20:46

BUENOS AIRES, Dec 8 (Reuters) - Argentine state oil company YPF (YPFD.BA) has increased fuel prices at the pump by an average of 25%, a company source told Reuters on Friday, as the country battles inflation that could reach over 180% this year. The move comes ahead of the inauguration of President-elect Javier Milei over the weekend, and as other oil companies also pushed up prices at gas stations nationwide by around 20%, according to local TV news. Milei, a far-right libertarian swept a second-round victory last month with 56% vote over ruling party Economy Minister Sergio Massa. On Sunday, he will inherit a country with soaring inflation, dwindling foreign reserves and rising poverty rates. Milei has pledged economic shock therapy, which includes eventually shuttering the central bank, dollarizing the economy and slashing public spending. "At some point it had to blow up. It's a shame but there's no other way and we're paying the consequences," Franco Hit, 43, said as he refilled his tank at a gas station in Buenos Aires. "These things are inevitable. It is not because of the new president," he added. "It's going to be hard, very hard." This week, Milei's incoming Energy Secretary Eduardo Rodriguez told the Surtidores news site that a "free fluctuation (in fuel prices)" was needed, "without indirect (government) control... through YPF." The Argentine government holds 51% of YPF shares. Last month, Milei selected senior energy executive Horacio Mari to lead YPF, one of Argentina's top domestic sellers of refined fuels. The firm also leads development of Vaca Muerta, a key supplier of natural gas and crude oil. https://www.reuters.com/markets/commodities/argentine-oil-company-ypf-ups-fuel-prices-by-average-25-company-source-2023-12-08/

2023-12-08 20:33

Dec 8 (Reuters) - California's ambitious high-speed rail project that aims to move travelers from San Francisco to the Los Angeles basin in under three hours still faces significant funding challenges despite a $3.1 billion federal award. The White House on Friday announced $8.2 billion in federal funding for rail projects across the country, including the California project billed at the first U.S. speed rail project with speeds of 220 miles per hour. California Governor Gavin Newsom, who in October asked President Joe Biden to approve funding, said the award was "a vote of confidence in today’s vision and comes at a critical turning point, providing the project new momentum." The administration also awarded $3 billion for a planned high speed rail line between Las Vegas and Los Angeles. Transportation Secretary Pete Buttigieg told reporters Thursday the California project "is facing a lot of the challenges that come with being the very first at anything" and added winning rail awards faced an "extraordinary level of scrutiny." The costs for the California high-speed rail project, which voters approved $10 billion in 2008, have risen sharply and the authority has not identified key funding needed for the project that has faced numerous delays. The full San Francisco to Los Angeles project was initially estimated to cost around $40 billion but has now jumped to between $88 billion and $128 billion. The rail authority estimated costs for an initial 171-mile segment connecting Merced to Bakersfield rose from $25.7 billion to at least $32 billion and is hoping initial service will begin in 2030. The Obama administration awarded California $3.5 billion in 2010 and the state has dedicated another $4.2 billion to the project. California wants $8 billion in total from the Biden administration for the project after recently winning another $202 million in federal funds for grade separation projects. In 2021, the Biden administration restored funding for the California project after then-President Donald Trump pulled funding for the project, hobbled by delays and rising costs, calling it a "disaster." Many Republicans in Congress want to bar the White House from awarding more funding to the project. https://www.reuters.com/world/us/california-high-speed-rail-faces-challenges-after-us-award-2023-12-08/

2023-12-08 20:33

MOSCOW, Dec 8 (Reuters) - Around a dozen aggrieved retail investors met with the senior management of Russia's SPB Exchange this week, demanding the recovery of their foreign currency assets blocked by U.S. sanctions. Russia's second-largest stock exchange, which specialises in trading foreign shares, last week said Washington's restrictions were blocking more than two thirds of clients' foreign currency funds and the rest would be transferred to them in roubles. "We have lost access in full to our foreign securities that were purchased through SPB Exchange and denominated in U.S. dollars," said Yulia Zykova, an entrepreneur and retail investor. She said investors had come to the exchange to find out where their funds were, whether any transactions had been made and for more clarity. "I bought shares in 2018-2020, when the whole world was friendly," pensioner Lyudmila Roshchupkina told Reuters outside the bourse's Moscow headquarters on a blustery, snowy afternoon. "At that time it was being advertised from all sides to go to the exchange in retirement and earn a pension...and today all my accounts are blocked and I can't withdraw or sell." SPB Exchange said it does not work directly with retail investors, but is in constant contact with brokers through which it gives information to investors. It said it prioritises helping investors and that the bourse is seeking international legal advice. SPB says it is seeking an agreement from the United States on how to return clients' trapped assets. The U.S. Treasury did not respond to an emailed request for comment. The investors asked to be given a means by which to interact with the U.S. Office of Foreign Assets Control (OFAC). "We were refused, the exchange said it would do everything itself," said Zykova. Washington targeted SPB in early November as part of sweeping new measures that also aim to curb Russia's future energy capabilities and sanctions evasion. This forced SPB to halt trading of shares on the exchange and tweak its strategy to focus on settlements in roubles. The exchange has endured a turbulent few weeks. Following sanctions and the trading suspension, it was forced in late November to deny that it had filed for bankruptcy, blaming fraudsters for filings with a Russian court and promising that it would push for a criminal investigation. (This story has been refiled to change the photograph) https://www.reuters.com/markets/europe/aggrieved-russian-retail-investors-demand-spb-exchange-recover-their-assets-2023-12-08/

2023-12-08 20:05

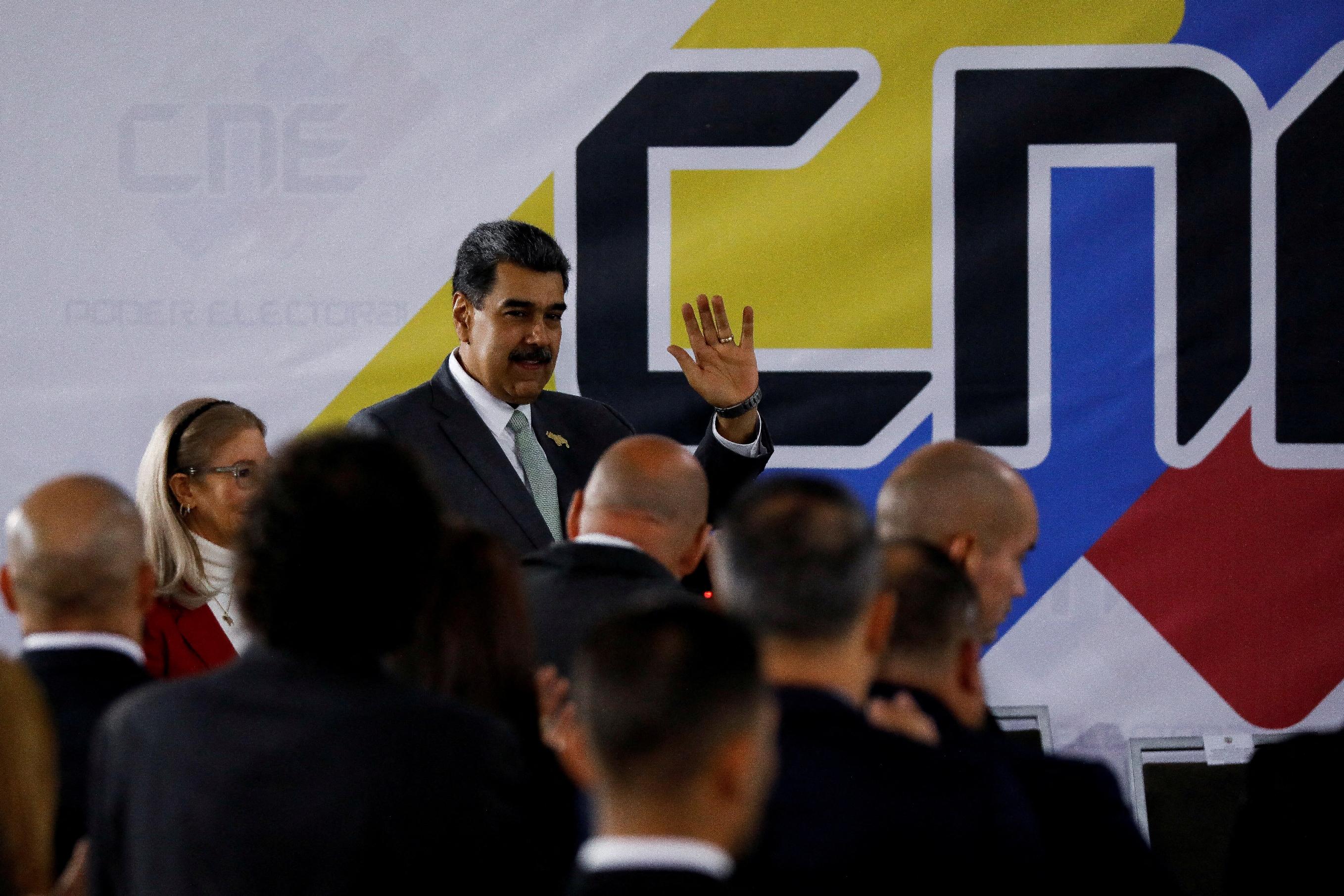

HOUSTON/CARACAS, Dec 8 (Reuters) - Venezuela has begun contacting energy firms involved in an long-idled offshore natural gas project to push them to begin new exploration and operations near its maritime border with Guyana, five people close to the talks said. The request to act on blocks that have not been touched in more than a decade comes amid an escalating territorial dispute with Guyana that has rattled the country and led to an emergency meeting of the United Nations Security Council. Venezuelan President Nicolas Maduro wants state oil company PDVSA, and oil majors' BP (BP.L), Chevron (CVX.N) and Shell (SHEL.L) to revive an offshore project shared with Trinidad and Tobago with some 8 trillion cubic feet (tcf) of gas reserves. Called Plataforma Deltana, the discoveries were never developed amid insufficient capital, an unfinished reservoir sharing effort with Trinidad, and a lack of clear rules for investment. In 2019, both countries authorized Shell to develop Trinidad's portion of the largest reservoir, called Manatee, with a final investment decision expected next year and gas output to start in 2028. Recently, Maduro has backtracked on that decision, telling Trinidad's government in public comments in September that the fields should be jointly developed. His government and PDVSA started tapping companies to weigh their interest. Chevron was the only company that completed exploration in Plataforma Deltana, certifying 7.3 tcf of recoverable gas and declaring two of Venezuela's five blocks commercial in 2010. It never took steps to begin production. Russia's Rosneft (ROSN.MM) in recent years explored another block but did not complete work in the area, while TotalEnergies (TTEF.PA) and Equinor (EQNR.OL) returned one block to Venezuela after a non-commercial discovery. One of the five blocks was never awarded. "They are talking about working at blocks 2 and 4, which are the most advanced ones," one of the sources said. On Trinidad's side, those two blocks extend to Shell's Manatee project and to BP's Manakin shallow water block, both of which are moving to development and production design. BP and Trinidad's government expect to begin negotiations with Venezuela to jointly produce gas at Manakin upon completion of discussions for Manatee, which have already started, according to another person familiar with the matter. Chevron has been in talks with Venezuela about its license, two of the people said. Venezuela also made initial contact with Australia's Melbana Energy (MAY.AX), which operates in Cuba. The discussions could lead to a seismic contract for the less explored blocks, one of the people said. Melbana said in a Dec. 10 statement that it is not in talks with Venezuela's government, and remains focused on its own projects, with "a busy work program underway." Shell declined to comment. Venezuela's oil ministry, Trinidad's energy ministry, PDVSA and Chevron did not reply to requests for comment. BP told Reuters it views the Manakin field as an important part of its future area development plan, even though it had been unable to progress work there. "Since the temporary lifting of sanctions by the U.S. government, BP has been in early talks with the Trinidad and Tobago government assessing the opportunity to recommence development planning," the spokesperson said. TRIPLE INTEREST Plataforma Deltana is the closest energy project that Venezuela has to the waters in dispute with Guyana. Both nations have drawn maritime border lines that cross offshore oil and gas areas in the other's claimed territory. The north portion of the Stabroek block, a massive area in development by Exxon Mobil (XOM.N), CNOOC (0883.HK) and Hess (HES.N) under license from Guyana, extends into Venezuelan waters, according to Maduro's government. One of Plataforma Deltana's blocks extends into Guyana's claimed waters. Venezuela's oil ministry and PDVSA have worked since 2016 to outsource 2D seismic data collection and map areas including the Esequibo and the Isla de Aves territory in the Caribbean, which are in dispute with Guyana and Dominica, respectively, said Antero Alvarado, managing partner of consultancy Gas Energy Latin America. "Venezuela has not completed seismic work in a very long time. The urgency of doing it now comes amid the dispute with Guyana and its renewed interest to export gas to markets like Trinidad," he said. The territorial dispute with Guyana is being discussed at the International Court of Justice (ICJ), which this month ordered Venezuela to refrain from taking any action that would alter the situation with its neighbor. That came after Maduro's government held a vote on a referendum asking Venezuelans whether they accepted the ICJ's jurisdiction on the issue. They did not. Maduro on Dec. 5 said he would authorize oil and mining exploration in the disputed areas with Guyana, but did not elaborate on locations or projects. PDVSA and state industrial conglomerate CVG were asked to create specific divisions for that purpose. Guyana's President Irfaan Ali called Maduro's actions a blatant disregard of ICJ orders and an imminent threat to Guyana's territorial integrity. https://www.reuters.com/business/energy/venezuela-prods-bp-chevron-revive-gas-project-near-trinidad-guyana-2023-12-08/

2023-12-08 19:56

OSLO, Dec 8 (Reuters) - U.S. auto maker Tesla Inc (TSLA.O) should respect fundamental labour rights, including collective bargaining, Norway's $1.5 trillion sovereign wealth fund, the world's biggest stock market investor, told Reuters on Friday. The electric vehicle producer faces a backlash in the Nordic region from unions and some pension funds over its refusal to accept a demand from Swedish mechanics for collective bargaining rights covering wages and other conditions. Norges Bank Investment Management, which operates the Norwegian fund, is Tesla's 7th biggest shareholder with a 0.88% stake worth some $6.8 billion according to LSEG data. "We expect companies in which we invest to respect fundamental human rights, including labour rights," NBIM said in a statement to Reuters when asked about Tesla's conflict with its Swedish workers. "In 2022 we supported a shareholder proposal at Tesla that asked the company to introduce a policy to respect the right to organise," it added. The 2022 proposal, which NBIM said was supported by 32% of those who voted, called on Tesla to adopt a policy of respecting labour rights such as freedom of association and collective bargaining. The company's board recommended a 'no' vote. Tesla, which has revolutionised the electric car market, has managed to avoid collective bargaining agreements with its roughly 127,000 workers, and CEO Elon Musk has been vocal about his opposition to unions. Tesla did not respond to a request for comment on Friday. The company has said its Swedish employees have as good or better terms than those the union is demanding. PensionDanmark, one of Denmark's largest pension funds, said on Thursday it had divested its $69 million holdings in Tesla, while fund manager Paedagogernes Pension said it would follow suit and divest its $35 million stake. NBIM declined to comment on whether its investment in Tesla would be affected by the car maker's position. The Norwegian fund's separate ethics council, which can recommend that NBIM divests from companies that do not meet its expectations, also declined to comment. NBIM said its expectations are built on international standards drawn up by the International Labour Organization (ILO) and global conventions on human rights. In its expectations documents NBIM says that companies it invests in "should engage with workers and their representatives, such as trade unions" in a transparent manner when developing and implementing policies and practices. 'WATCH LIST' Denmark's AkademikerPension said on Friday it would hold on to its $18 million stake in Tesla but added that it kept the car maker on a watch list and expected the parties to find a satisfactory solution to the ongoing conflict. "It seems that it has not dawned on Tesla's management that proper working conditions create more value and fewer risks in companies," AkademikerPension's CEO Jens Munch Holst said. Sweden's AP1 state pension fund, which held a $187 million stake at the end of June, said keeping a dialogue with Tesla was its preferred course of action over selling its shares. Another Swedish fund, AP4, which has a $114 million Tesla stake, said the workers dispute did not constitute a basis for exclusion as a shareholding. The New York State Common Retirement Fund said it has "long been concerned" with Tesla's labor issues. "We have filed multiple shareholder proposals and written letters seeking improvements to Tesla's labor policies and parties," it said in a statement. "Divestment is not a consideration at this time." https://www.reuters.com/business/autos-transportation/tesla-must-respect-collective-bargaining-rights-norways-sovereign-wealth-fund-2023-12-08/

2023-12-08 19:21

Nonfarm payrolls increase 199,000 in November Unemployment rate falls to 3.7% from 3.9% Labor force participation rate rises to 62.8% from 62.7% Average hourly earnings gain 0.4%; up 4.0% year-on-year WASHINGTON, Dec 8 (Reuters) - U.S. job growth accelerated in November while the unemployment rate fell to 3.7%, signs of underlying labor market strength that suggested financial market expectations of an interest rate cut early next year were probably premature. The Labor Department's closely watched employment report on Friday, however, did not change views that the Federal Reserve's rate-hiking cycle was complete as annual wages rose moderately last month. Inflation has been cooling in recent months. The drop in the jobless rate from a nearly two-year high of 3.9% in October alleviated fears that the economy was close to tipping into recession. The U.S. central bank is expected to keep rates unchanged next Wednesday. "This was a relatively healthy report and will help to push back some of the excitement around imminent and aggressive rate cuts," said Richard de Chazal, macro analyst at William Blair in London. Nonfarm payrolls increased by 199,000 jobs last month after rising by an unrevised 150,000 in October, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast 180,000 jobs created. Still, the labor market is cooling. The economy added 35,000 fewer jobs in September than previously estimated. November's employment gains were below the monthly average of 240,000 over the past year. Nonetheless, payroll gains are well above the 100,000 jobs per month needed to keep up with growth in the working age population. Employment was in part boosted by the return of automobile workers and actors after strikes. The healthcare sector led the almost broad increase in payrolls, adding 77,000 jobs, most of which were in ambulatory services as well as at hospitals, nursing and residential care facilities. Government payrolls jumped by 49,000 jobs, boosted by local government hiring. Manufacturing employment increased by 28,000 jobs, with motor vehicles and parts jobs rising 30,000 as members of the United Auto Workers (UAW) union returned to work after striking against Detroit's "Big Three" car makers. Leisure and hospitality payrolls advanced 40,000, driven mostly by hiring at restaurants and bars. Employment in the motion picture and sound recording industries increased by 17,000 jobs, largely as labor disputes were resolved. But retail employment fell by 38,000 jobs amid declines at department stores as well as furniture, home furnishings, electronics and appliance outlets. Some economists attributed the drop to issues adjusting the data for seasonal fluctuations. The transportation and warehousing industry shed 5,000 jobs. Temporary help, a harbinger for future hiring, resumed its downward trend, with 13,600 positions lost. Financial markets lowered their bets of a rate cut in March. Traders saw higher odds of cut in May. Most economists continued to believe that the Fed would start easing monetary policy in the second half of 2024 as inflation subsides. Those hopes were kept alive by the University of Michigan's survey on Friday, which showed consumers' 12-month inflation expectations plunged to 3.1% in December, the lowest reading since March 2021, from 4.5% in November. The Fed has raised its policy rate by 525 basis points, to the current 5.25%-5.50% range, since March 2022. Stocks on Wall Street were trading higher. The dollar rose against a basket of currencies. U.S. Treasury prices fell. NO RECESSION "A fully employed economy means that consumers can keep spending and that dynamic should lead to economic growth and not a contraction, which so many people have been calling for, for so long," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina. Details of the smaller household survey from which the unemployment rate is derived were equally upbeat. Household employment surged by 747,000 jobs last month, more than absorbing the 532,000 new entrants to the labor market. The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one, rose to 62.8% from 62.7% in the prior month. Fewer people were experiencing long bouts of unemployment in November, with the number declining by 132,000 to 1.150 million. The number of people working part-time for economic reasons decreased 295,000 to 3.988 million. The employment-to-population ratio, viewed as a measure of an economy's ability to create employment, increased to 60.5% from 60.2% in the prior month. The rise in labor supply could over time help to tamp down wage inflation. Average hourly earnings increased 0.4% last month after gaining 0.2% in October. That kept the annual increase in wages at 4.0% in November. Still, wages are rising too fast to lower inflation to its 2% target. Americans worked longer hours last month, which bodes well for the economy's growth prospects in the fourth quarter, with gross domestic product estimates currently below a 2% annualized rate. The economy grew at a 5.2% pace in the third quarter. The average workweek rose to 34.4 hours from 34.3 hours in October. Aggregate weekly hours increased 0.3%, more than reversing the prior month's 0.2% drop. "This is a strong indicator that fourth-quarter GDP prospects will improve when November data are incorporated," said Chris Low, chief economist at FHN Financial in New York. https://www.reuters.com/markets/us/us-job-growth-accelerates-november-unemployment-rate-drops-37-2023-12-08/