2023-12-07 22:35

CHISINAU, Dec 7 (Reuters) - The head of Moldova's national gas company proposed on Thursday that it take over the transport of Russian giant Gazprom's (GAZP.MM) supplies through Ukraine if Kyiv decides against renewing a transit contract that runs out next year. Vadim Ceban said Moldova would prefer to have the contract renewed, but his company, Moldovagaz, was in any event ready to assume control of gas transit through Ukraine to Moldova and beyond to other European countries. Gazprom controls a 50% plus one share in Moldovagaz, while Moldova's government owns 35.6% and 13% is held by the country's pro-Russian separatist enclave Transdniestria. "The optimal situation for Moldova would be for Ukraine to renew the contract on Russian gas transit," Ceban told Vocea Bassarabiei television. "If that doesn't happen, Moldovagaz can carry out transport of Gazprom gas through Ukrainian territory." Ukraine's energy minister said in August that Kyiv had no intention of joining in talks to renew the contract. Russia has said it would consider extending the contract Moldova, which has seen relations with Russia deteriorate sharply since Russia's invasion of Ukraine, receives no Russian gas and secures supplies from other European sources. It has received help in financing purchases from the European Bank for Reconstruction and Development. Pro-European Moldovan President Maia Sandu has denounced Russia's war in Ukraine and accused Moscow of trying to oust her in a coup. But the Transdniestria enclave relies on Gazprom's supplies and has accumulated debts of about $10 billion that Gazprom has not sought to collect. Ceban said that if Moldovagaz assumed control of transit through Ukraine, Transdniestria would have to pay for the transit of gas it receives, currently 5.7 million cubic metres per day. https://www.reuters.com/business/energy/moldovan-natgas-chief-offers-take-over-ukraine-transit-russian-gas-2023-12-07/

2023-12-07 22:33

Dec 7 (Reuters) - The U.S Federal Permitting Improvement Steering Council on Thursday approved the construction of a $1.5 billion offshore wind farm off the coast of Rhode Island. The project, Revolution Wind, is run by Danish company Orsted (ORSTED.CO) and U.S.-based Eversource (ES.N), and would bring a total of 704 megawatts (MW) clean energy to Connecticut and Rhode Island. Another offshore project by the two wind energy developers, the South Fork wind farm off the coast of New York, delivered its first power to the state's power grid on Wednesday. Offshore wind development has been a priority for the Biden administration. Yet soaring costs from rising inflation, high interest rates, and delays in supply chains cast doubts on plans to bring 30 gigawatts (GW) of offshore wind power online by 2030. Many developers canceled or opted to renegotiate power purchase contracts as previously agreed prices were too low to justify investments. In March, the Rhode Island utility rejected Orsted's proposal to build Revolution Wind's second stage, 884-MW Revolution Wind 2, saying it would be too costly for consumers. https://www.reuters.com/world/us/us-gives-final-nod-rhode-islands-15-billion-offshore-wind-farm-2023-12-07/

2023-12-07 22:15

SAO PAULO, Dec 7 (Reuters) - Brazil's largest-ever power transmission auction by expected investment volume may see little competition, experts and executives said, as the need for billions of dollars in investments and tech expertise may dissuade potential bidders. In the last five years, Brazil's transmission lines auctions have had on average at least six bidders for each allotment, according to national energy regulator Aneel, but the trend could change if the current outlook is confirmed. Brazil is expected to sell three power transmission projects at next week's auction, scheduled for Dec. 15, totaling 4,470 kilometers (2,778 miles) across more than five states. Planned investments currently sit at 21.7 billion reais ($4.42 billion), the largest amount ever demanded in a similar auction in Brazil. Chinese company State Grid (STGRD.UL) and Brazil's largest power utility Eletrobras are considered the top candidates to take the auction's darling, an 18 billion real line requiring expertise on high-voltage direct current (HVDC), a system both have experience operating. While Eletrobras has already publicly showed it intends to bid, State Grid told Reuters that while the company is "always alert to business opportunities in power transmission," it does not comment on specific moves related to auctions. Given the capex needed, potential bidders include alliances between fund managers and utilities, a partnership model seen in recent transmission auctions in Brazil, said Jose Roberto Oliva Junior, partner at law firm Pinheiro Neto Advogados. Local power transmission companies, such as Isa Cteep (TRPL4.SA), which was a big winner in the year's first auction, and Taesa (TAEE11.SA) have already said they will not bid. Ana Calil and Leonardo Miranda, partners within law firm TozziniFreire Advogados' infrastructure and energy area, also said they are not expecting new players, like real estate firms, which sometimes enter the contest, to bid in next week's auction. ($1 = 4.9107 reais) https://www.reuters.com/world/americas/brazils-priciest-power-transmission-auction-expects-few-bidders-2023-12-07/

2023-12-07 22:02

Dec 8 (Reuters) - A look at the day ahead in Asian markets. Signals from Federal Reserve and European Central Bank officials have been behind the eye-popping moves in world bond markets recently, but on Thursday investors were reminded of the punch the Bank of Japan can pack. If the pointers from Fed and ECB officials have been towards the lower interest rate environment coming into view, the BOJ is headed in the completely opposite direction. The dramatic moves in Japanese markets on Thursday will likely continue to reverberate around Asia on Friday, and it is perhaps fitting that the region's economic calendar is dominated by key Japanese indicators. The latest household consumption, bank lending and current account data are on tap, as well as revised third quarter GDP. The other main event in Asia on Friday is the Reserve Bank of India's interest rate decision. If the RBI meets investors' expectations - the key repo rate left unchanged at 6.50% for a fifth consecutive meeting, and signals it will be held there well into next year - there are unlikely to be any market fireworks. There were plenty of fireworks in Japanese markets on Thursday, sparked by comments from BOJ Governor Kazuo Ueda about the exit from decades of ultra-low interest rate policy - the yen and bond yields soared, and stocks slumped. These moves bear repeating, as they are a measure of how historic the BOJ's shift is and how sensitive markets are to it. The yen's 2.7% surge against the dollar - it had gained as much as 4% earlier in the day - was its biggest in a year. There have been only seven better days for the yen in the last decade. The five-year Japanese Government Bond yield recorded its biggest rise since the pandemic of almost 10 basis points - it has registered bigger daily spikes on only four occasions in the last 20 years. Long-dated JGB yields spiked sharply higher too after a dismal auction of 30-year paper - the bid-to-cover ratio was the lowest since 2015 at 2.62, and the tail - the difference between the lowest bid and the average bid - was the longest on record. The timing and scale of Japan's inflation-fighting rate hikes is critical. Japan is the world's largest creditor nation, so the potential repatriation flows are huge; while the yen is near its lowest, and the Nikkei stock market is near its highest, in more than 30 years. According to Reuters polls, figures on Friday are expected to show Japanese household spending fell in October, and the economy was slightly weaker in the third quarter than thought. Here are key developments that could provide more direction to markets on Friday: - Japan GDP (Q3, final) - Japan household spending (October) - India interest rate decision https://www.reuters.com/markets/asia/global-markets-view-asia-pix-2023-12-07/

2023-12-07 20:50

WASHINGTON, Dec 7 (Reuters) - The U.S. Securities and Exchange Commission (SEC) is next week expected to vote to adopt a major rule forcing more trading of U.S. Treasuries through clearing houses, in a long-anticipated move aimed at boosting the resilience of the market. According to a notice, the agency will vote Wednesday on the rule. It's part of a broader push by regulators to fix structural problems that have increased volatility and created liquidity crunches in the $25 trillion Treasuries market. Most notably, Treasury market liquidity all but evaporated in March 2020 as COVID-19 pandemic fears gripped investors, prompting the Federal Reserve to prop up the market, although other crunches in recent years have also fueled regulators' concerns. Other regulations in recent years, particularly capital hikes, have seen banks pull back as intermediaries from the Treasury market, causing some of the issues that regulators are trying to fix. Reuters reported in late October that the SEC was expected to soon finalize the clearing rule, which was first proposed in September 2022. A central clearer acts as the buyer to every seller, and seller to every buyer, guaranteeing the transaction in case one party defaults. Advocates for central clearing say it makes markets safer. The proposal applied to cash Treasury and repurchase agreements traded by broker dealers and hedge funds. It's partly aimed at reining in debt-fueled bets by hedge funds, Reuters also reported. But market participants say they are in the dark about how the rule will address some key issues. "This will be an important moment for the structure of the Treasury market going forward. There are some key uncertainties about the final rule," said Nathaniel Wuerffel, head of market structure at BNY Mellon and former head of domestic markets for the New York Federal Reserve. Those include how trades between affiliated entities will be treated, cash market transactions by hedge funds and leveraged accounts, and the implementation timeline, he said. https://www.reuters.com/markets/us/us-sec-set-vote-major-treasury-market-clearing-rule-next-week-2023-12-07/

2023-12-07 20:45

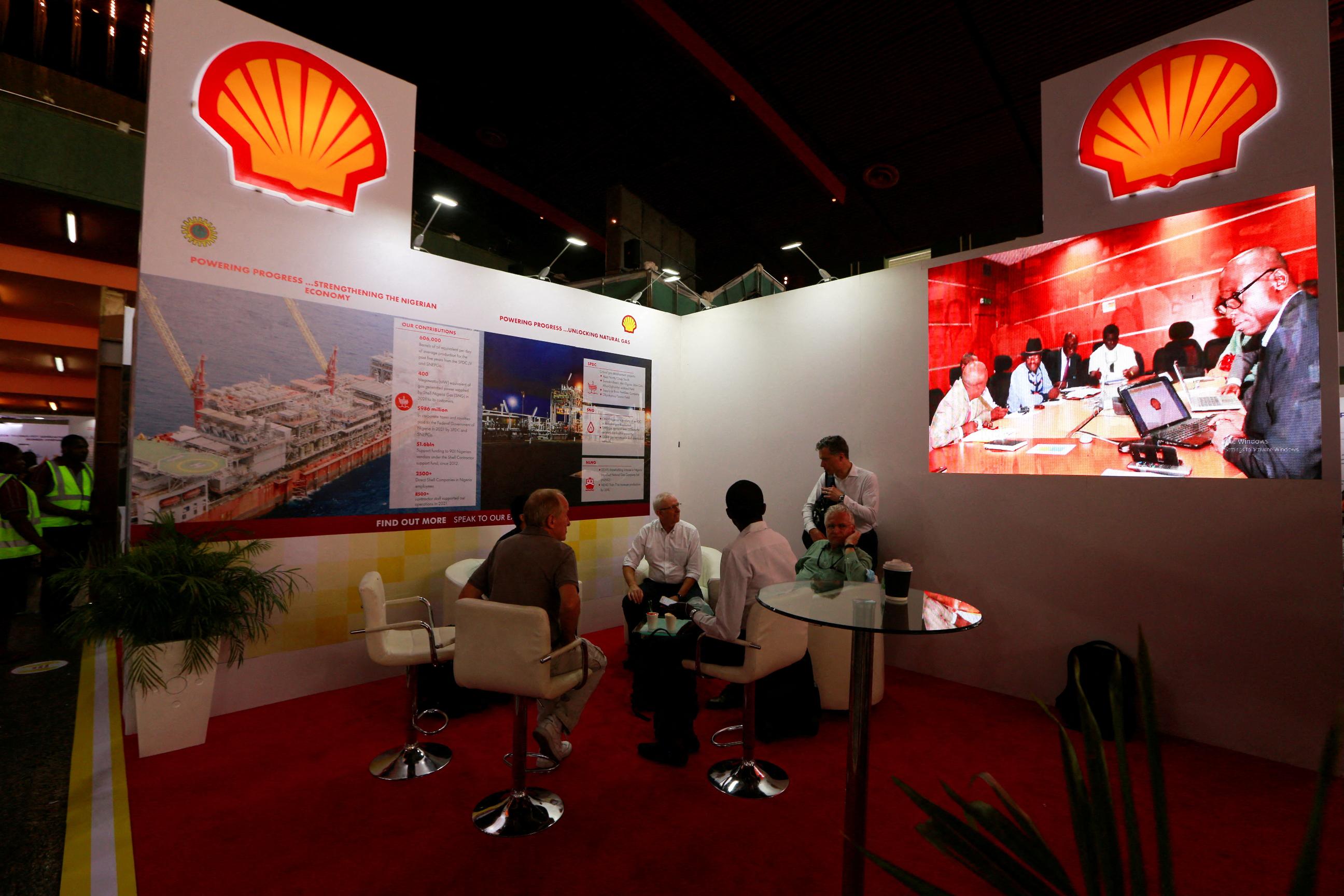

ABUJA, Dec 7 (Reuters) - Shell Plc (SHEL.L) sees a $5 billion offshore oil investment opportunity in Nigeria and pledged to spend a further $1 billion in five to 10 years to boost natural gas output for domestic supplies and exports, a presidential spokesperson said on Thursday, citing Shell's director of upstream operations. Nigerian President Bola Tinubu held talks with Shell's Zoe Yujnovich in a move to attract capital to Africa's top energy producer, presidential spokesperson Ajuri Ngelale said in a statement. Yujnovich was cited as saying Shell has "an imminent $5 billion investment opportunity" in the offshore Bonga North oil project. "I am really keen to make that investment as soon as possible. We want to continue and build a pipeline of new investments in Nigeria," Yujnovich said. A Shell spokesperson did not immediately respond to calls seeking comments. Nigeria's oil output has been in decline for years, hobbled by large-scale theft and sabotage. It has picked up in recent months, helped by offshore production that is less prone to attacks. Tinubu pledged to resolve "all investment-related issues" slowing the flow of capital into Nigeria's energy industry. "There is no bottleneck that is too difficult for us to remove in our determined march toward making Nigeria the African haven for large scale investments," Tinubu was quoted as saying. https://www.reuters.com/business/energy/shell-sees-6-billion-oil-gas-investments-nigeria-presidency-says-2023-12-07/