2023-12-07 12:50

Dec 7 (Reuters) - U.S. employers increased their announced job cuts in November, led by the retail and technology sectors, in a further sign that the labor market is beginning to slacken, a report released on Thursday showed. Announced job layoffs by U.S.-based employers totaled 45,510 last month, up 24% from 38,836 in October, global outplacement firm Challenger, Gray & Christmas said in the report. While it was the first time since July the announced cuts were lower than the corresponding month a year ago, the year-to-date tally was the highest since 2020, when the economy was swooning amid the impact of the COVID-19 pandemic. Hiring plans also appeared to have weakened. U.S. employers in November announced plans to hire 15,566 workers, for a year-to-date total of 775,501. It is the lowest year-to-date total for announced hiring since 2015. Likewise, seasonal employers have announced 573,300 hires this year through November, the lowest year-to-date tally since 2013. The Federal Reserve is keenly watching for further indications of labor market cooling as it aims for continued progress in bringing inflation back to its 2% target rate. The central bank's rate-hiking campaign over the past 20 months has already borne fruit in lowering inflation to a 3.0% annual rate by the Fed's preferred measure, less than half its peak in the summer of last year, and the labor market is now steadily slowing too as the surge in borrowing costs dents companies' spending. From January to November, companies have announced plans to cut 686,860 jobs, a 115% increase from the 320,173 cuts announced in the same period in 2022. Job openings fell to a more than 2-1/2-year low of 8.733 million in October, government data showed on Tuesday. There were 1.34 vacancies for every unemployed person, the lowest since August 2021. The much-anticipated monthly jobs report is scheduled for release on Friday. Economists surveyed by Reuters forecast as of Wednesday that total nonfarm payrolls are estimated to have increased by 180,000 in November after rising 150,000 in the prior month. "The job market is loosening, and employers are not as quick to hire. The labor market appears to be stabilizing with a more normal churn, though we expect to continue to see layoffs going into the New Year," said Andrew Challenger, senior vice president at Challenger, Gray & Christmas. Retailers led the announced layoffs in November, with 6,548 job cuts. Technology sector job cuts, while way off the surge seen from last October through May of this year, still came in second, with 5,049 announced. The tech sector stands out in 2023 as the weakest by far, with a net drop of 93,000 payroll jobs, according to the Labor Department, a drop of 3%. https://www.reuters.com/markets/us/us-layoffs-jumped-november-led-by-retail-tech-report-shows-2023-12-07/

2023-12-07 11:26

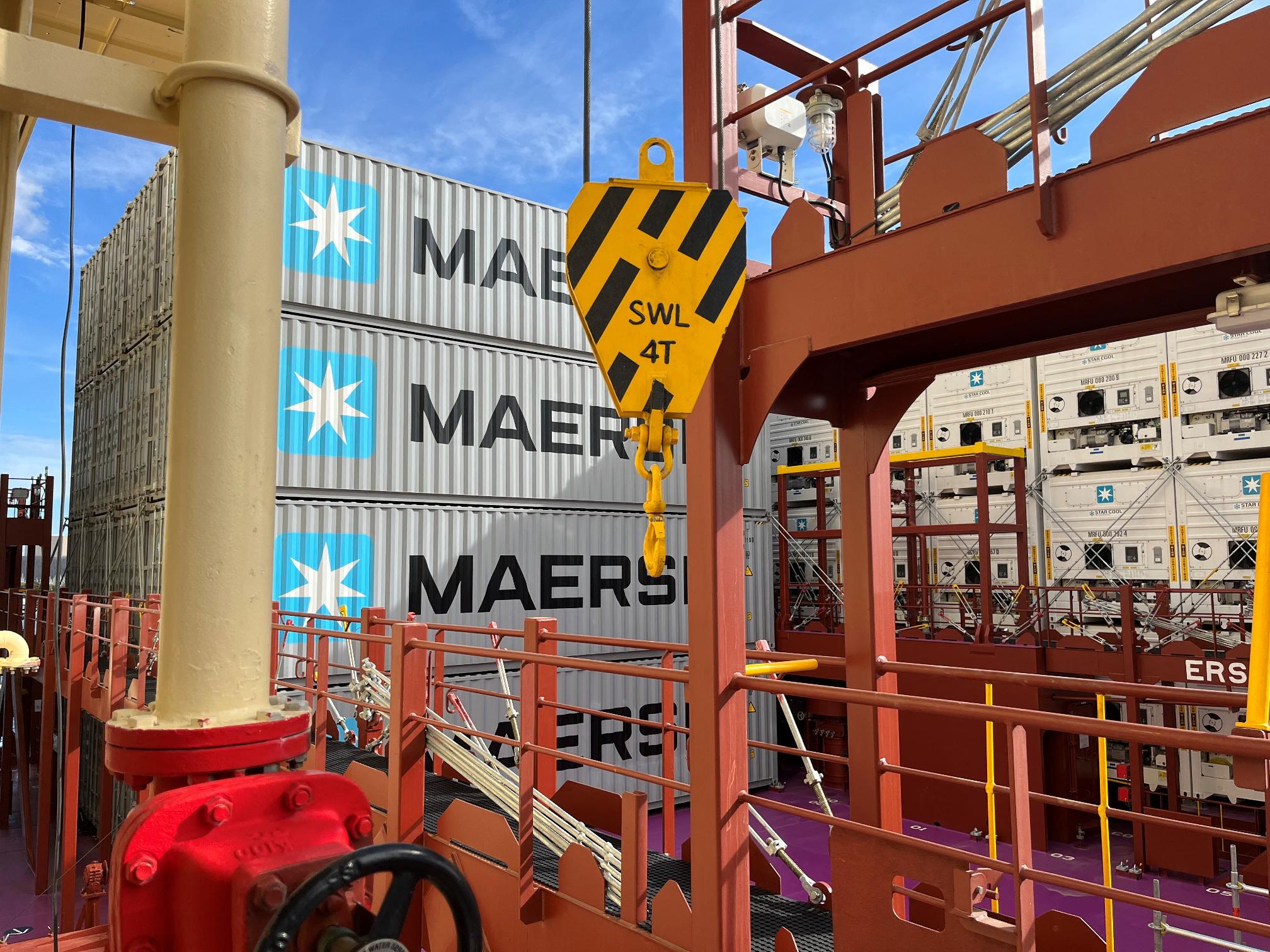

OSLO, Dec 7 (Reuters) - Shipping group A.P. Moller-Maersk (MAERSKb.CO) said on Thursday it will introduce a risk surcharge next year on container shipments to Israel to cover rising insurance premiums due to the security situation. "Moving into 2024, insurance premiums continue to be raised for vessels bound for Israel, which has brought about the need for Maersk to officially implement an Emergency Risk Surcharge (ERS)," the Danish company said in a statement. "The surcharge will be used to accommodate additional insurance costs and ultimately ensure a continued and sustainable service for our customers to Israel," it added. Customers will from Jan. 8 face a $50 surcharge on 20-foot containers while the charge for containers measuring 40 and 45 feet will be $100, Maersk said. https://www.reuters.com/business/maersk-introduces-surcharge-israel-shipments-cover-insurance-2023-12-07/

2023-12-07 11:23

BRUSSELS, Dec 7 (Reuters) - EU antitrust regulators on Thursday fined Lantmannen, the largest ethanol producer in the Nordic region, 47.7 million euros ($51.4 million) for rigging ethanol benchmarks between November 2012 to March 2014. The European Commission raided some companies in 2014 and 2015 that subsequently led to investigations into Lantmannen, Alcogroup and Abengoa in 2015. It said the three companies took part in a cartel focusing on the wholesale price formation mechanism for ethanol in Europe. The EU antitrust enforcer dropped its case against Alcogroup earlier this year because of insufficient grounds to continue its investigation while Abengoa was hit with a 20 million euro fine two years ago. ($1 = 0.9286 euros) https://www.reuters.com/world/europe/eu-regulators-fine-ethanol-producer-lantmannen-51-mln-over-ethanol-benchmarks-2023-12-07/

2023-12-07 11:19

MOSCOW, Dec 7 (Reuters) - Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman have urged all OPEC+ countries to join the group's agreement on output cuts, saying it would serve the interests of the global economy. The appeal was made in a joint statement published on Thursday after the two met a day earlier and also said that Russia and Saudi Arabia had agreed it was important to boost cooperation in oil and gas, including in equipment supplies. Following last week's OPEC+ meeting, Saudi Arabia agreed to extend voluntary oil output cuts of 1 million barrels per day (bpd) into the first quarter, while Russia said it would continue to curb oil exports by 300,000 bpd and additionally reduce its fuel exports by 200,000 bpd in January-March. The total curbs amount to 2.2 million bpd from eight producers, OPEC said in a statement after the meeting last week. But not all OPEC+ members agreed to extend or deepen the voluntary oil cuts and the latest statement from Putin and Mohammed bin Salman appears to be appealing to those countries. "In the field of energy, the two sides commended the close cooperation between them and the successful efforts of the OPEC+ countries in enhancing the stability of global oil markets," the statement said. "They stressed the importance of continuing this cooperation, and the need for all participating countries to join the OPEC+ agreement in a way that serves the interests of producers and consumers and supports the growth of the global economy." OPEC+'s output of some 43 million bpd already reflects cuts of about 5 million bpd aimed at supporting prices and stabilising the market. https://www.reuters.com/markets/commodities/russia-saudi-arabia-urge-all-opec-countries-join-output-deal-2023-12-07/

2023-12-07 11:14

Dec 7 (Reuters) - Discussions between the U.S. securities regulator and asset managers hoping to list bitcoin exchange-traded funds (ETFs) have advanced to key technical details, in a sign the agency may soon approve the products, industry executives said. Thirteen firms including Grayscale Investments, BlackRock (BLK.N), Invesco, and ARK Investments, have pending applications with the Securities and Exchange Commission (SEC) for ETFs that track the price of bitcoin. Proponents argue that a regulated product, like an ETF, tied to the spot price of the cryptocurrency , offers investors the best way to invest in bitcoin. But the agency has long rejected such products, arguing they fail to meet its bar for investor protections. But after a court in August ruled the SEC was wrong to reject Grayscale's application to convert its bitcoin trust into an ETF, the SEC has been engaging with issuers on substantive details, some of which are usually discussed near the end of an ETF application process, according to half a dozen industry executives and SEC public memos. They include custody arrangements; creation and redemption mechanisms; and investor risk disclosures, said the people, who asked not to be identified because the discussions are private. A spot bitcoin ETF would mark a watershed for the industry, allowing previously wary investors access to the world's largest cryptocurrency via the tightly regulated stock market. Demand is expected to be as much as $3 billion on the first few days. The SEC has long worried, however, that bitcoin is vulnerable to manipulation. Previously, discussions focused on that concern and were mostly educational, the people said. The SEC has until Jan. 10 to make a final decision on ARK's filing, which is first in line. The advanced nature of the discussions signals the SEC may approve ARK's application and likely some of the other 12 applications, in the New Year, the people said. The advanced talks help explain a recent rally in bitcoin, the price of which reached a 20-month high this month. ARK CEO Cathie Wood told Yahoo Finance last month that the nature of the SEC discussions had changed and the odds of several applications being approved had gone up. "My guess is that we'll have several ETFs approved at once, which will give investors the best opportunity to compare them," said Bryan Armour, ETF analyst at Morningstar. Memos made public by the SEC show that executives from BlackRock, Grayscale, Invesco and 21 Shares, which is working with ARK, have met with SEC staff since September, together with their lawyers and executives from the exchanges where they hope to list the ETF. Other managers also told Reuters they met with SEC staff in that time. The BlackRock meeting memo includes a detailed description of the asset manager's revised redemptions mechanism. BlackRock did not return requests for comment. Invesco declined to comment. "Grayscale continues to engage constructively with the SEC," a spokesperson said. While past meetings have mostly been with staff from the SEC's trading and markets and corporate finance divisions, some recent meetings have been with staff in Chair Gary Gensler's office, according to the memos and sources. The pace of SEC information requests has also accelerated from every few months to every week or so, the people said. As discussions have advanced, issuers have had to update their filings to reflect the new details, one person said. This week, for example, BlackRock amended its filing to provide more insight into measures it plans to take to protect investors. CRYPTO SKEPTIC To be sure, the SEC has not said publicly - or indicated to people interviewed by Reuters - whether it will approve the products. There also remain sticking points, chiefly whether issuers will create a cash or an "in-kind" settlement mechanism, the people said. An SEC spokesperson said the agency would not comment on individual filings. Gensler, a crypto skeptic who has accused the industry of flouting SEC rules, said in October the agency's commissioners will potentially consider the ETF filings, but he did not indicate when. The SEC began engaging meaningfully with issuers soon after a federal appeals court ruled that the agency failed to justify why it rejected Grayscale's ETF application. The SEC did not appeal and must now review Grayscale's filing. Some sources believe the wording of the Grayscale ruling limits the grounds on which the SEC could again reject the filings. And many issuers feel they have addressed the SEC's market manipulation concerns with a surveillance arrangement between the listing exchanges and Coinbase (COIN.O), the largest U.S. cryptocurrency exchange. If the SEC wants to buy more time, it could ask ARK to withdraw its application and refile, but market participants said that could be legally risky in light of the Grayscale decision. "I don't think much will stop it from moving forward," said Roxanna Islam, head of sector and industry research at data firm VettaFi. https://www.reuters.com/technology/us-bitcoin-etf-issuer-talks-with-sec-have-advanced-key-details-sources-2023-12-07/

2023-12-07 11:07

CHICAGO, Dec 7 (Reuters) - U.S. farmers are likely to plant more soybeans in 2024 as rising demand for soy-based biofuels should boost profits, and many plan to cut back on corn acreage with futures prices for that grain hovering around three-year lows. A larger U.S. soybean crop would help meet booming demand for renewable diesel fuel and animal feed at a time when drought is slashing soybean production in Brazil, the world's top supplier. Another top supplier, Argentina, lacks soybeans after a severe drought last year. Meanwhile, U.S. corn supplies are ample after a record-large crop in 2023. By Sept. 1, before the 2024 crop is harvested, U.S. corn stockpiles are projected to top 2.1 billion bushels, a five-year high. Along with normal crop rotation to keep soils healthy, farmers look at profitability of each crop. They factor in seed costs which are high this year for both corn and soybeans, along with inputs such as pesticides and fertilizer. Corn needs more fertilizer than soybeans. Chris Gibbs, a farmer in western Ohio, expects to cut back on corn in 2024, seeking better profits in soybeans. "My gut is I'm going to plant a little less corn just because of cost," Gibbs said. "Cash corn is now at cost of production, and soybeans, we are still making a profit." Gibbs' plan lines up with early forecasts from the U.S. Department of Agriculture and at least one private firm showing expanded U.S. soybean acreage in 2024 and a reduction in corn acres. On Nov. 7, the USDA projected growers would plant 87 million acres to soybeans in 2024, up 3.4 million acres from 2023. Corn plantings would fall to 91 million acres, down 3.9 million acres, USDA said. S&P Global released similar projections last month, pegging U.S. corn plantings at 91.350 million acres and soybean plantings at 87.150 million acres, according to an S&P document seen by Reuters. U.S. farmers are already making crop decisions, months before planting begins in April and May. Seed and fertilizer retailers frequently offer discounts to producers who book before winter. Corn and soy crop insurance policies must be purchased by mid-March. Labor costs can be a factor. Corn produces three times as much grain per acre as soybeans, which can tie up equipment and crews during harvest, along with grain storage space. Markets play a key role in decisions about crop acreage in the months leading up to planting. Corn futures on the Chicago Board of Trade are near the lowest since late 2020. Benchmark CBOT soybeans bounced after nearing a two-year low and are currently 12% higher than they were in late 2020. "We didn't make money on corn (in 2023)," said Phil Volk, a North Dakota farmer. "If we can hold that $13 (in soybeans), it seems like a high price... that a person can make money with." TIGHT SCENARIO FOR SOYBEANS One supply-demand gauge for grains involves measuring the stocks left at the end of the marketing year as a percentage of total use. For corn, this stocks-to-use ratio is expected to reach 14.9% by Sept. 1, 2024, a five-year high. The USDA projected that a year later, corn ending stocks would rise to 18% of total use, the most in 20 years. The scenario is much tighter for soybeans. At 245 million bushels, the USDA's forecast for how much soy is left over before the next harvest represents just 5.9% of total use, a three-year low, with a modest projected increase to 6.5% in 2024/25. "The soybean market is saying we need to be more aggressive and make sure that we re-purchase some of those acres," said Frayne Olson, an economist with North Dakota State University. Soy acres have expanded sharply in recent years in North Dakota, traditionally a wheat-growing state. Two new soy crushing facilities in North Dakota look poised to create long-term demand for the oilseed, part of a nationwide wave of expansion in soy processing to supply vegetable oil to renewable diesel makers. Export demand will be a wild card for the corn and soybean markets in the coming months, potentially affecting planting decisions. The USDA has projected a drop in U.S. soybean exports in the current marketing year after a bumper crop in Brazil dominated sales to China, the world's biggest soy buyer. The USDA expects U.S. soy exports to recover next year, depending largely on the size of the current soy crop in Brazil, where adverse weather has slowed planting. Export demand for U.S. soybeans picked up in October and November as China made a series of U.S. soy purchases that coincided with mounting worries about Brazilian crop prospects. "We are facing more (soy export) competition, but there is a bigger market to be had," said Iowa State University agricultural economist Chad Hart. https://www.reuters.com/markets/commodities/us-farmers-plan-big-2024-soy-crops-gut-says-less-corn-2023-12-07/