2023-12-06 17:40

LONDON, Dec 6 (Reuters) - Slowing trend growth in China means there are better investment opportunities in emerging markets outside the world's number two economy, senior executives at BlackRock Investment Institute (BII) said on Wednesday. Alex Brazier, deputy head of the BII - the research and analysis arm of the world's largest asset manager - said during its outlook 2024 briefing that the loss of momentum in China's economic growth had prompted more pessimistic view. "5% this year in the context of a reopening of the economy, is not particularly strong," Brazier said during the briefing. "But more importantly for us is the trend growth outlook beyond that," said Brazier. Demographic change and slowing productivity growth had doused trend growth from once 10% to the current 5%, and it was to stand at roughly 3% by the end of the decade. BlackRock Global Chief Investment Strategist Wei Li said there had been some reaction in response to the support measures that have been coming through, but that "really needs to be contextualised in the slowing longer-term growth trend as well as the real estate sector overhang". China's government advisers are expected to call for more stimulus at the annual agenda-setting 'Central Economic Work Conference' due to be held in the next week or two. "In risk adjusted terms, investing in China has become less attractive, which is why we downgraded it earlier in the year. There are better options outside China," said Wei Li. https://www.reuters.com/markets/asia/slowing-china-trend-growth-means-better-opportunities-elsewhere-blackrock-2023-12-06/

2023-12-06 17:23

LONDON, Dec 6 (Reuters) - Ex Millennium trader and founder of hedge fund Kintbury Capital, Chris Dale, says he is short British telecommunications company BT (BT.L). Dale told attendees at the Sohn conference in London that the debt levels of the company were rising and its decision to reinstate dividends would cost the company. Dale entered short positions on Oct. 27 and on Nov. 30, according to the FCA register. “We are confident that we can support our progressive dividend and that we will see a material uplift in our cash flow once our peak full fibre build is completed in December 2026,” a statement from BT said in response to the report. https://www.reuters.com/markets/europe/hedge-fund-kintbury-takes-short-position-bt-2023-12-06/

2023-12-06 17:12

U.S. brands include Newport, Camel, Pall Mall Full-year revenue likely to be at lower end of 3-5% range Wants 50% of its revenues from non-combustibles by 2035 BAT shares at lowest price since 2010 Shares in Philip Morris, Altria also fall LONDON, Dec 6 (Reuters) - British American Tobacco (BATS.L) said it would take a hit of around $31.5 billion as it writes down the value of some U.S. cigarette brands, acknowledging on Wednesday that its traditional market has no long-term future. BAT shares fell as much as 10.2% in London to their lowest since September 2010. U.S.-listed tobacco stocks were also impacted. Shares in Altria (MO.N) were down 3.4% while Philip Morris (PM.N) shares were down 2.1%. BAT's move comes as ever-stricter regulation and growing awareness of health risks squeeze tobacco companies' traditional business, driving declines in cigarette volumes in some markets. The writedown marks the first time a major global tobacco firm has written off the value of its traditional cigarettes business in a major market like the United States and emphasised the need for the industry to focus on alternatives. The maker of Lucky Strike and Dunhill cigarettes pointed to economic challenges in the United States, where some inflation-weary consumers are downgrading to cheaper brands, and the rise of illicit disposable vapes. BAT said these factors combined with the broader move away from smoking meant it would adjust the way some of its U.S. brands are treated on its balance sheet, shifting their value to a finite lifetime of 30 years. This would result in a non-cash adjusting impairment charge of around 25 billion pounds ($31.50 billion), BAT said. Its Newport, Camel, Pall Mall and Natural American Spirit brands were affected, a spokesperson added. Chief Executive Tadeu Marroco described the move as "accounting catching up with reality." While he did not believe cigarettes would disappear in 30 years, he said it was no longer possible to justify an indefinite value for those brands equating to around $80 billion on BAT's balance sheet. Anti-tobacco lobby groups welcomed the decline in cigarette sales in the United States but said the industry was continuing to spends billions of dollars marketing the products. "No one should profit from death and disease," Erika Sward, National Assistant Vice President of Advocacy for the American Lung Association said in a statement. BAT added that it would start amortising the remaining value of its U.S. combustibles brands in 2024, making it the first of the major cigarette players to acknowledge that its tobacco brands' value had an expiry date. Like rivals, BAT has been investing heavily in smoking alternatives like vapes. On Wednesday, it added a new ambition to generate 50% of its revenues from non-combustibles by 2035 and said it now expects its business from such "new categories" to break even in 2023, a year ahead of its current projection. James Edwardes Jones, analyst at RBC Capital Markets, welcomed the ambition given the U.S. charge and a "grim" outlook for BAT. "Goodness, that's a big number," he said of the charge, adding that it exemplifies the "perils of the industry" and sends less confident signals about the outlook for cigarettes. BAT said full-year revenue growth would likely be at the lower end of its 3-5% range. It also expected low single-digit growth in revenue and adjusted profit from operations in 2024. ($1 = 0.7938 pounds) (This story has been corrected to show that BAT expects 50% of revenue from non-combustibles by 2035, not 2025, in paragraph 14 and bullet point) https://www.reuters.com/business/retail-consumer/bat-takes-315-bln-charge-us-cigarette-brands-2023-12-06/

2023-12-06 15:16

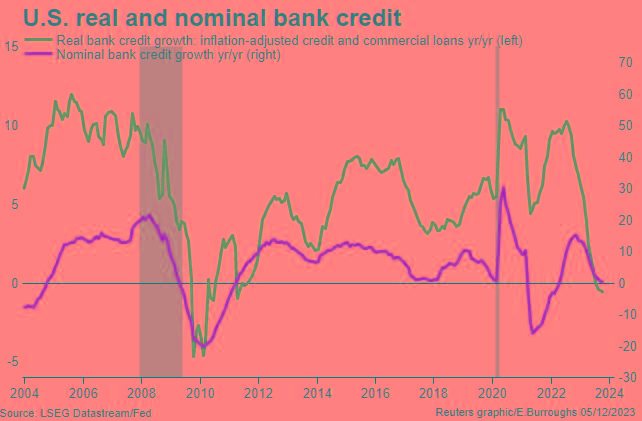

ORLANDO, Florida, Dec 6 (Reuters) - The Federal Reserve could comfortably lop a percentage point off its policy rate next year without changing its mantra of 'higher for longer' - what seems a contradiction is easily resolved. Given the Fed's best estimate of a 'neutral' policy rate that neither stimulates nor slows growth or inflation is 2.5%, anything above that is essentially still bearing down on the economy. Policy remains 'restrictive,' in central bank parlance. The Fed's official fed funds rate now is the mid-point of the 5.25-5.50% range, and rates futures market pricing has it being lowered to around 4.00% by the end of next year. While markets are already nervy that expecting cuts of that magnitude may be jumping the gun given a persistent 'higher for longer' mantra and lack of recession, it would still leave the policy rate some 150 basis points above neutral. At 4.0%, rates would still be far higher than they were before the tightening cycle began in March 2022 and around a full point higher than what markets assumed the end-2024 rate would be just a year ago. A fed funds rate of 4% would still be higher than the peak of the last cycle, considerably higher than where it has been for most of the last 20 years and, in real terms, still the highest in several years. And of course, as inflation ebbs further from here without any policy rate cut, the real fed funds rate is rising. And if prevailing core PCE inflation rates of 3.5% were to fall to target, then the Fed could comfortably cut 150 bps without ever reducing the real policy rate - again, 'higher for longer' applies. "That is probably the base case now in terms of likelihood," says Alex Etra, senior macro strategist at Exante Data and a former New York Fed analyst. "'Higher for longer' is always a function of your base of comparison - it is possible the Fed could still cut interest rates and still have higher rates than previously experienced or higher than had previously been anticipated," he adds. HIGHLY RESTRICTIVE A trend has emerged over the last 30 years or so - the Fed is keeping its policy rate at the cycle peak for longer than it used to. If the first rate cut comes in May, as futures market pricing indicates, the 10-month gap since the last hike will be the second longest since at least the 1950s. That could fairly be seen as keeping rates 'higher for longer,' in nominal and basic timeline terms. But the 'higher for longer' line that Fed officials drove for much this year is evaporating from market thinking. Fed Governor Christopher Waller's hints on Nov. 28 that rates could be cut sooner than previously anticipated were significant. Fed Chair Jerome Powell had the perfect opportunity to push back against that view in prepared remarks and a question and answer session on Dec. 1, but chose not to. Bond yields have slumped, implied interest rates have cratered, and the dollar has softened up. Financial conditions have loosened considerably, at least as far as market-based indicators go. The Chicago Fed U.S. financial conditions index (FCI) is its lowest since February last year, and Goldman Sachs's FCI is the lowest in four months. These indexes are compiled of financial market inputs like money market rates, equity prices, credit spreads, the dollar exchange rate, and long- and short-dated yields. But if financial conditions for Wall Street have loosened over the past year, financial conditions for Main Street have tightened. A range of 'Main Street' indicators like the Fed's Senior Loan Officer Opinion Survey show that the Fed's 525 bps of rate hikes since March last year are biting - bank lending standards are tightening, loan growth is turning negative, and delinquencies and bankruptcies are increasing. Ultimately though, the most important financial conditions indicator is the Fed's policy rate, and whether it is accommodative, neutral, or restrictive for the economy at large. The Federal Open Market Committee next week updates its Summary of Economic Projections, including the median estimate for the longer-run policy rate which has been 2.5% for almost five years, save for a brief dip to 2.4% in early 2022. Assuming annual inflation returns to the Fed's 2% target, this implies a real neutral interest rate - the nebulous, holy grail of central bankers known as 'r-star' - of 0.5%. New York Fed President John Williams said last week that some models suggest monetary policy right now is the most restrictive in a quarter century. "I expect it will be appropriate to maintain a restrictive stance for quite some time ... to bring inflation back to our 2% longer-run goal on a sustained basis," he said last week. Room to cut rates, and stay 'higher for longer.' (The opinions expressed here are those of the author, a columnist for Reuters.) https://www.reuters.com/markets/us/fed-can-slash-rates-still-be-higher-longer-2023-12-06/

2023-12-06 15:15

WASHINGTON/NEW YORK, Dec 6 (Reuters) - U.S. bank supervisors are increasing scrutiny of lenders' risk management practices and taking disciplinary action as they try to fix problems that could lead to more bank failures, banking industry sources said. The changes follow the collapse of Silicon Valley Bank, Signature Bank and First Republic Bank earlier this year after depositor runs sparked, in part, by worries that high interest rates would hurt bank balance sheets. After official reviews found frontline examiners failed to act quickly upon spotting problems, they are taking a tougher, more proactive approach. Interviews with a dozen industry executives, lawyers and regulatory officials show examiners are executing surprise reviews of a key confidential supervisory bank health rating and in some cases have issued downgrades. They are increasingly warning big banks they will be placed under an order restricting a range of activities if they don't fix lapses; and are pressing top executives to take personal accountability for addressing the banks' problems. While regulators including the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) have pledged to get tough on supervision, the process is confidential and officials have not released details. The activity, which Reuters is reporting for the first time, sheds light on how the agencies are making good on that promise, and suggests they continue to have concerns about some lenders' health amid high interest rates and a slowing economy. Supervisors are targeting small, mid-size and larger banks, the people said. Reuters could not ascertain exactly how many banks overall were targeted, but eight of the sources said they each had knowledge of multiple cases or banks affected. "This is not unlike some of the more enhanced monitoring we saw during the Great Recession, where there was concern over all the banks' financial health," said John Geiringer, a Partner and banking attorney at Barack Ferrazzano Kirschbaum & Nagelberg LLP. The FDIC and other regulators wrote in recent months to regional and community banks in a number of states notifying them they had launched surprise reviews of their "CAMELS" rating, five of the people said. The confidential rating measures bank safety and soundness on metrics including capital adequacy, asset quality, management competence and liquidity. Examiners typically review small banks' ratings every 12 to 18 months via an analysis of financial and loan data banks report quarterly, onsite exams, and discussions with executives. Anne Balcer, a senior executive vice president at the Independent Community Bankers of America (ICBA), said members of the Washington trade group in different regions had received letters around October notifying them of the off-cycle reviews. In some cases, banks were advised components of their CAMELS rating had been downgraded. The reviews were based on regulators' analysis of the quarterly data, she and three other people with knowledge of several other cases said. The implications "are pretty far reaching," said Balcer. CAMELS ratings contribute to banks' deposit insurance premiums and affect their audits. Downgraded lenders can be barred from doing deals, and could be denied emergency Fed liquidity. Reasons regulators cited for downgrades included insufficient capital, management issues, and in many cases, exposure to commercial real estate, a sector struggling amid high rates and lingering office vacancies, the people said. The ICBA, which represent banks with up to $50 billion in assets, declined to name the banks concerned. "Off-cycle downgrades are a touchy thing," said Michael Tierney, CEO of the Community Bankers of Michigan, who said he had been briefed on some off-cycle reviews. "What I've been told by regulators is that this will be used sparingly, they will only downgrade CAMEL components, not the overall CAMELs rating." In those conversations, officials said they are looking much harder at liquidity and interest rate risk management. "They've been very clear...those are their top priorities," said Tierney. 'PAINFUL' A spokesperson for the FDIC said the agency has long used off-site monitoring to supplement and guide examinations, and has developed tools using quarterly data reports to do so. "Off-site monitoring programs can provide an early indication that an institution's risk profile may be changing," he said. "CAMELS ratings, including those that are changed on an interim basis are confidential, but as a general matter, ratings trends tend to deteriorate as macroeconomic conditions worsen," he continued, citing inflation and high rates as key headwinds. Two small banks have failed since First Republic, and the FDIC recently added another to its list of problem banks. Many lenders are holding onto piles of cash as insurance against a slowing economy, Reuters has reported. Spokespeople for the Fed and Office of the Comptroller of the Currency, another federal regulator, declined to comment. Bigger banks are monitored continuously but they are still feeling increased pressure, said five other sources that work with multiple big lenders. Their supervisors are more frequently warning top management that failing to fix problems could result in a confidential "4(m)" sanction, the people said. Supervisors typically impose a 4(m) for weak capital, poor management, or following a CAMELS downgrade. Banks under a 4(m) must get regulatory approval to engage in some new business, such as securities underwriting, or to make nonbank investments. Exiting a 4(m) can take years. It can involve hiring new people and reorganizing businesses. "It's really painful," said one source who asked not to be identified discussing confidential supervisory issues. Supervisors are also pressing big bank bosses to take more personal accountability for problems, in some cases seeking briefings with C-suite executives or board members to secure assurances that they are personally on top of the problems, two of the people said. They said this had raised concerns for some senior executives worried about personal liability. "As risks increase, supervisors are going to react appropriately," said Karen Lawson, executive vice president for policy and supervision at the Conference of State Bank Supervisors, the national organization representing state regulators, which supervise 79% of U.S. banks alongside federal agencies. State regulators are discussing ways to be more responsive, including by moving independently to quickly address problems without waiting for a consensus with federal regulators, she said. "Certainly, we all learned things earlier this year." https://www.reuters.com/markets/us/us-regulators-clamp-down-bid-prevent-more-bank-failures-2023-12-06/

2023-12-06 15:13

JOHANNESBURG, Dec 6 (Reuters) - The South African rand firmed on Wednesday after subdued U.S. labour data boosted bets that the Federal Reserve was done hiking interest rates and might start easing its monetary policy early next year. At 1500 GMT, the rand traded at 18.8425 against the dollar , around 0.7% stronger than its previous close. The dollar was little changed against a basket of global currencies. Jobs figures out of the U.S. were below market estimates on Tuesday, "raising the prospect of a Fed rate cut in March next year," said Andre Cilliers, currency strategist at TreasuryONE. Like other risk-sensitive currencies, the rand often takes cues from global drivers like U.S. monetary policy in the absence of local data points. The rand breached 19.00 on Tuesday after South Africa's third-quarter gross domestic product data showed a slightly bigger than expected contraction. "The local currency will remain susceptible to any stronger moves in the Dollar and will likely trade on the back foot in the short term," Cilliers added. Investor focus will turn towards monthly reserves data and third-quarter current account figures due to be published by the South African Reserve Bank on Thursday. On the Johannesburg Stock Exchange, the blue-chip Top-40 index (.JTOPI) closed over 0.2% higher. South Africa's benchmark 2030 government bond was stronger, the yield down 3 basis points at 9.980%. https://www.reuters.com/markets/currencies/south-african-rand-gains-bets-fed-rate-cut-after-muted-us-jobs-data-2023-12-06/