2023-12-05 22:54

Dec 5 (Reuters) - The U.S. Federal Trade Commission has sent shale oil producer Pioneer Natural Resources (PXD.N) and Exxon Mobil (XOM.N) a second request for more information on their $60 billion takeover deal, Pioneer said on Tuesday. The companies are working with the FTC and continue to expect that the deal will be completed in the first half of 2024, Pioneer said in a regulatory filing. U.S. Senate Majority Leader Charles Schumer and 22 other Democratic senators wrote to the FTC in November saying multibillion-dollar acquisitions by major oil and gas companies Exxon and Chevron (CVX.N) could lead to higher prices for consumers. Schumer reiterated his interest on Tuesday, saying that the Exxon deal "has all the hallmarks of harmful, anticompetitive effects." "If this merger were to go through it would most certainly raise gas prices for families across the country," he said, adding that the agency should sue to stop the deal "if they find any antitrust laws are being violated." Exxon announced the deal to buy Pioneer in October. Also in October, Chevron (CVX.N) agreed to acquire Hess (HES.N) for $53 billion. Antitrust experts said in October that despite the size of the proposed transaction, the FTC would struggle to stop it because it is a merger of producers rather than refiners or retail outlets. https://www.reuters.com/markets/deals/exxon-pioneer-get-second-ftc-request-information-pending-takeover-2023-12-05/

2023-12-05 22:45

HOUSTON, Dec 4 (Reuters) - Shell's (SHEL.L) ownership in Trinidad and Tobago's Atlantic LNG facility will shrink, while BP (BP.L) and Trinidad's state-owned National Gas Co [RIC:RIC:NGCTT.UL] will increase their stakes in a restructuring agreement to be signed this week, according to three people familiar with the matter. The new agreement would mark the end of five years of talks and pave the way for the largest liquefied natural gas (LNG) export facility in Latin America to return to full production. The first of four liquefaction trains has been idled since 2020 due to reduced gas supplies from Trinidad's offshore fields. Trinidad and Tobago moved to restructure Atlantic LNG after determining it was not getting enough revenue from the facility. The restructuring agreement will also keep a pricing scheme that was revamped in 2020 to generate more revenue for the government, Prime Minister Keith Rowley said late last month. Energy Minister Stuart Young last week told parliament the country was benefiting from the new formula that had earned an additional $2.5 billion since its implementation. Atlantic LNG operates four trains, which can produce up to 15 million tonnes per annum (MTPA) of the gas that is super chilled into a liquid for transport by tanker. But last year it made just 8.2 MTPA due to train 1 being idled. Under the present structure, Shell and BP respectively own 54% and 40% of trains 2, 3 and 4, while NGC has 11.1% of train 4, but no stake in Trains 2 and 3. The agreement simplifies the project's structure into ownership across all four trains, which effectively reduces Shell's stake to 45%, and raises BP's stake to 45% while NGC gets a 10% share, the sources said. The Chinese Investment Co, which had owned about 10% of train 1, will no longer hold shares in Atlantic LNG, the sources said. Atlantic LNG is a significant contributor to Shell and BP's LNG portfolios. Last year, Shell's share of the facility's output was 4.4 million tonnes, or 15% of its global production. BP's take was 3.4 million tonnes, or 18% of its global output, according to the companies' annual reports and figures from Trinidad and Tobago's energy ministry. Shell and BP said on Tuesday the agreement cleared the way for additional upstream investments including in Shell's 2.7 trillion cubic feet (TCF) Manatee gas field and a couple of 1 TCF discoveries by BP off Trinidad's East coast. "For BP, the new structure sets a strong foundation for future investment in T&T’s energy industry, including the deepwater," said David Campbell, president of BP's Trinidad operations. A Shell spokesperson said the commercial restructuring of Atlantic LNG did not only involve changes in equity but also in gas prices and capacity rights. "While we are unable to discuss the commercial terms of the new structure, we believe that the overall structure is fair and equitable for all parties, including Shell," the spokesperson said. The new shareholding structure reflects the amount of gas each party will bring to Atlantic, the sources said. BP has been the largest gas producer on the island, averaging last year, 1.2 billion cubic feet per day, according to energy ministry data. Shell is expected to ramp up production in coming years with an additional 700 million cubic feet per day (mcfd) from its Manatee offshore discovery, expected by 2028, and a potential 250 mcfd in 2026 from Venezuela under a proposed agreement to operate the offshore Dragon gas field. NGC is in discussions with Woodside Energy Group (WDS.AX) to bring gas from its 3.5 trillion cubic feet deepwater discovery, the people said. If gas can be brought from Dragon, Woodside's Calypso field and Manatee, then train 1 could be restarted, the people said. In June, sources told Reuters that it would be restarted by the first quarter of 2027 after the restructuring. However that would depend on gas from Dragon, Manatee and Calypso, with Dragon now expected in 2026, Manatee in 2028 and no date determined for Calypso, the sources said. As part of the restructuring, the parties already agreed in 2020 to calculate Trinidad and Tobago's LNG prices from a mix of global oil benchmark Brent crude futures and three natural gas benchmarks - the Dutch Title Transfer Facility (TTF) in Europe , the Japan Korea Marker (JKM) in Asia and the Henry Hub in the U.S. Prior to 2020, it had been based only on the Henry Hub price, said Rowley. https://www.reuters.com/business/energy/trinidads-atlantic-lng-restructuring-shrink-shells-stake-boost-bps-sources-2023-12-04/

2023-12-05 21:55

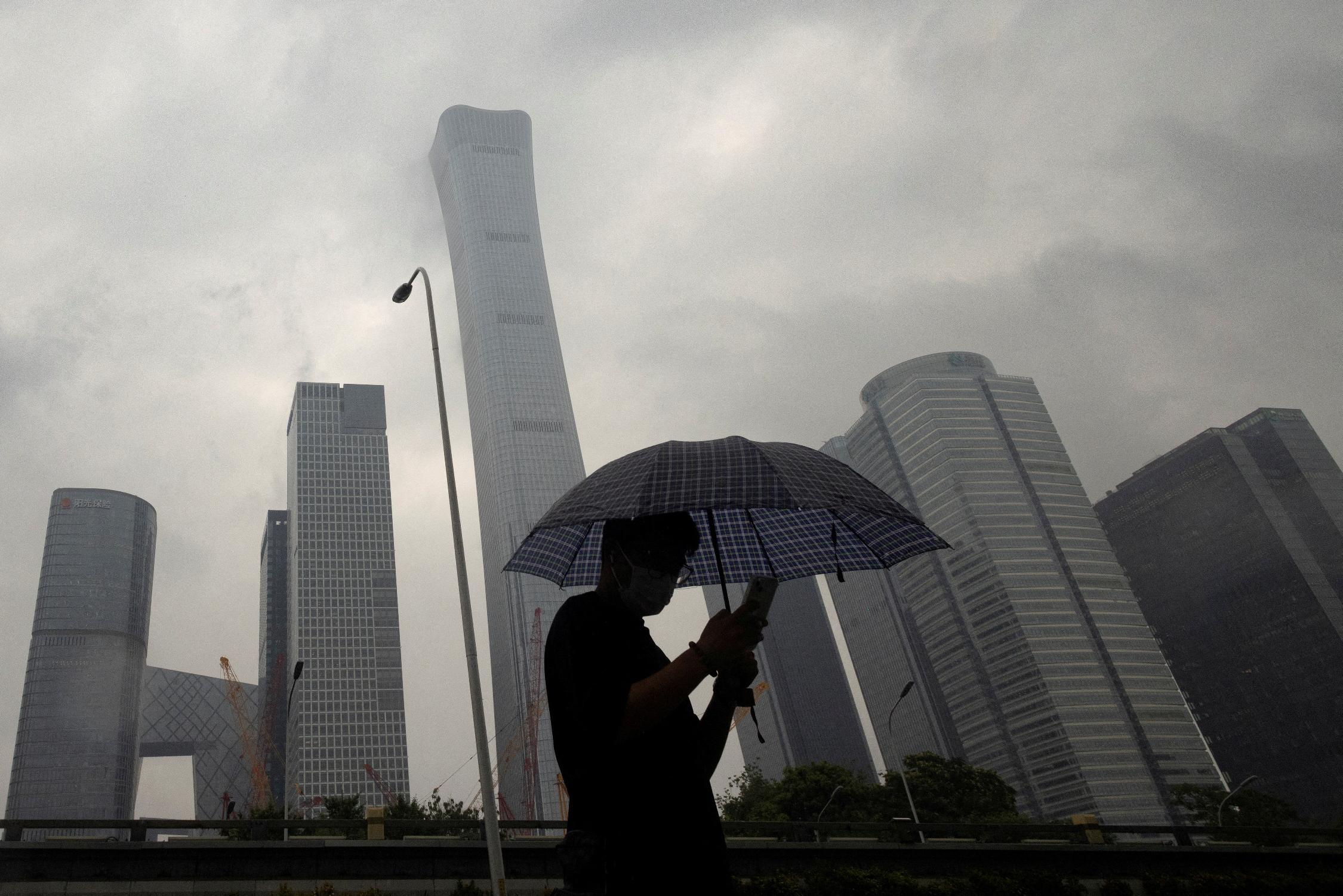

Dec 6 (Reuters) - A look at the day ahead in Asian markets. China's credit downgrade warning from ratings agency Moody's on Tuesday may have come as a surprise to some and a shock to few, but has fired up the debate for everyone around the darkening growth and market outlook for Asia's economic powerhouse. The market fallout was immediate - blue chip stocks in Shanghai and Hong Kong's benchmark Hang Seng index slumped nearly 2%, and while the onshore yuan held up reasonably well the offshore yuan fell sharply too. The CSI300 equity index slumped to its lowest since February 2019, and Chinese markets will likely be fragile again on Wednesday. The main event on the Asian and Pacific calendar is the release of Australian third quarter GDP figures, a day after the Reserve Bank of Australia left interest rates on hold at a 12-year high of 4.35% until at least February. The Aussie dollar was one of the biggest losers on global currency markets on Tuesday, falling 1% for its biggest daily loss since Oct. 12, as traders viewed the RBA's statement as less hawkish than expected and less hawkish than the previous one. The Reuters poll consensus forecast is annual GDP growth slowed in the July-September period to 1.8% from 2.1%. This would be the slowest rate of growth since the first quarter of 2021, and fit with a dovish view on the RBA and Aussie dollar. Investors will also be looking out for the latest inflation data from Taiwan and Japan's latest 'tankan' surveys of manufacturing and non-manufacturing activity in the country. The annual rate of inflation in Taiwan is expected to have slowed in November to 2.8% from a 15-month high of 3.05% in October. Figures on Monday showed that inflation in South Korea and Japan's capital Tokyo last month was cooler than expected. Asian markets open on Wednesday against a backdrop of rapidly declining global bonds yields, the latest trigger being an exclusive Reuters interview with influential European Central Bank policymaker Isabel Schnabel. Falling rates and bond yields may not be enough to brighten sentiment in Asia though, after Moody's lowered the 'outlook' on China's A1 debt rating to "negative". According to Moody's, the amount of money Beijing likely needs to provide to support debt-laden local governments and state firms poses "broad downside risks to China's fiscal, economic and institutional strength." Rival ratings agency S&P Global warned that growth could slow to below 3% next year if the country's property crisis deepens further. Growth that low in China is in many ways difficult to fathom. But if it is indeed on the looming horizon, it helps explain why foreign investors in China are pulling money out, and why those not already in China are reluctant to put their cash in. Here are key developments that could provide more direction to markets on Wednesday: - Australia GDP (Q3) - Japan tankan surveys (December) - Taiwan inflation (November) https://www.reuters.com/markets/asia/global-markets-view-asia-pix-2023-12-05/

2023-12-05 21:21

Dec 5 (Reuters) - Elon Musk's artificial intelligence startup xAI has filed with the U.S. securities regulator to raise up to $1 billion in an equity offering, according to a filing on Tuesday. The company has raised $134.7 million in equity financing from a total offering amount of $1 billion, the filing with the Securities and Exchange Commission showed. Fundraising for AI remains a bright spot for startups this year, following OpenAI's launch of popular chatbot ChatGPT last year and raising of $10 billion from its strategic backer Microsoft Corp (MSFT.O). Regulators, however, are concerned about the potential use of the technology to spread misinformation. Musk has been vocal about his plans to build safer AI. In a Twitter Spaces event earlier in the year he said that rather than explicitly programming morality into its AI, xAI will seek to create a "maximally curious" AI. The billionaire, who has criticized Big Tech's AI efforts as ridden with censorship, in July launched xAI, calling it a "maximum truth-seeking AI" to rival Google's (GOOGL.O) Bard and Microsoft's Bing AI. In 2015, Musk co-founded OpenAI, the company behind ChatGPT, which has created a frenzy for generative AI technology around the world, but stepped down from the board in 2018. XAI last month launched "Grok" a chatbot rivaling OpenAI's ChatGPT. The artificial intelligence startup will be integrated into his social media platform X and also be available as a standalone app, Musk said in a post in November. The team behind xAI, which launched in July this year, comes from Google's DeepMind, the Windows parent, and other top AI research firms. https://www.reuters.com/technology/elon-musks-xai-files-raise-up-1-bln-equity-offering-2023-12-05/

2023-12-05 21:16

LONDON, Dec 5 (Reuters) - The crew of the Galaxy Leader commercial ship seized by Yemen's Iran-backed Houthis last month have been allowed "modest contact" with their families while various countries push for their release, the vessel's owner said this week. The Bahamas flagged car carrier was taken to the port of Hodeidah in the Houthi controlled north of Yemen after being boarded at sea on Nov. 19 by commandos with the group. The vessel's crew is made up of nationals from Bulgaria, Ukraine, the Philippines, Mexico and Romania, Galaxy Maritime said. The vessel is chartered by Japan's Nippon Yusen. "The safety and welfare of the crew members remains the priority of both owners and managers and the modest contact that has been allowed with crew members and their families suggests that the seafarers are being treated as well as can be expected in the circumstances," Isle of Man registered owner Galaxy Maritime Ltd, said in a statement on Monday. "The 25 crew members being held have no connection whatsoever with the current situation in the region," the owner said. "Nothing can be achieved by their further detention." The United States has blamed the Houthis for a series of attacks in Middle Eastern waters since war broke out between Israel and the Palestinian militant group Hamas on Oct. 7. Three vessels were attacked in the Red Sea area on Sunday. At an assembly session on Monday of the UN shipping agency's highest governing body, the United States, the Bahamas and Japan called for the unconditional release of the Galaxy Leader and its crew. Japan's delegation told the International Maritime Organization assembly that it "strongly condemns those acts which threaten the safety and freedom of navigation in that area". The Bahamas said the various attacks including the Galaxy Leader were a "violation of all of the norms relating to innocent passage of ships". "Here we have non-state actors so who do you hold responsible?" the Bahamas said, referring to the Houthis. https://www.reuters.com/world/middle-east/crew-seized-galaxy-leader-allowed-modest-contact-with-families-shipowner-2023-12-05/

2023-12-05 21:15

Dec 5 (Reuters) - Ratings agency Moody's slapped a downgrade warning on China's credit rating on Tuesday, saying costs to bail out local governments and state firms and control its property crisis would weigh on the world's No. 2 economy. Moody's lowered the 'outlook' on China's A1 debt rating to "negative" from "stable" less than a month after it had done the same to the United States' last remaining triple-A grade from a credit rating agency. Historically, about one-third of issuers have been downgraded within 18 months of the assignment of a negative rating outlook. Beijing likely needs to provide more support for debt-laden local governments and state firms which pose "broad downside risks to China's fiscal, economic and institutional strength," it added. Moody's also cited "increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector." China's Finance Ministry called the decision disappointing, saying the economy would rebound and that the property crisis and local government debt worries were controllable. "Moody's concerns about China's economic growth prospects, fiscal sustainability and other aspects are unnecessary," the ministry said. Blue-chip stocks slumped nearly 2% to near five-year lows on growth worries, with some traders also citing speculation about Moody's statement before its release. China's major state-owned banks, which had been supporting the yuan currency all day, stepped selling of U.S. dollars on the news, one source with knowledge of the matter said. The cost of insuring China's sovereign debt against a default rose to its highest since mid-November, while the U.S.-listed shares of heavyweight Chinese firms Alibaba and JD.com dropped 1% and 2%, respectively. "For now the markets are more concerned with the property crisis and weak growth, rather than the immediate sovereign debt risk," said Ken Cheung, chief Asian FX strategist at Mizuho Bank in Hong Kong. NEGATIVE FEELINGS It was the first change by Moody's to its China rating since downgrading it by one notch to A1 in 2017 when debt levels were rising. While Moody's affirmedthe A1 rating on Tuesday, noting that the economy still had a high shock-absorption capacity, it estimated China's economic growth would slow to 4.0% in 2024 and 2025, and average 3.8% from 2026 to 2030. Moody's main peer, S&P Global, said later in a long-scheduled global outlook call that its big concern was that "spillovers" from any worsening in the property crisis could push China's gross domestic product growth "below 3%" next year. China's government advisers are expected to call for more stimulus at the annual agenda-setting 'Central Economic Work Conference' due to be held in the next week or two. Analysts say China's A1 rating is high enough in 'investment-grade' territory that a downgrade is unlikely to trigger forced selling by global funds. S&P and Fitch, the other major global rating agency, both rate China A+, the equivalent of Moody's A1, and have stable outlooks. STRUGGLING FOR TRACTION Most analysts believe China's growth is on track to hit the government's target of around 5% this year, but that compares with a COVID-weakened 2022 and activity is highly uneven. The economy has struggled to mount a strong post-pandemic recovery as the deepening housing crisis, local government debt concerns, slowing global growth and geopolitical tensions have curbed momentum. A flurry of policy support measures have proven only modestly beneficial, raising pressure on authorities to roll out more stimulus. "We spent the better part of three years watching China have this sort of off-and-on reopening from the pandemic, and this was the year they finally sort of officially reopened," said Art Hogan, chief market strategist at B Riley Wealth in New York. "But the pace at which the economy has recovered from that has been disappointing." Analysts widely agree that China's growth is slowing after the breakneck expansion of the past few decades. Many believe Beijing needs to transform its economic model from an over-reliance on debt-fuelled investment to one driven more by consumer demand. Last week, China's central bank head Pan Gongsheng pledged to keep monetary policy accommodative to support the economy, but also urged structural reforms to reduce reliance on infrastructure and property for growth. DEEPER IN DEBT In October, China unveiled a plan to issue 1 trillion yuan ($139.84 billion) in sovereign bonds by year-end to help kick-start activity, raising the 2023 budget deficit target to 3.8% of GDP from the original 3%. After years of over-investment, plummeting returns from land sales, and soaring costs to battle COVID, rating firms have been warning about the contingent liability risks of debt-laden Chinese municipalities. Local government debt reached 92 trillion yuan ($12.6 trillion), or 76% of China's economic output in 2022, up from 62.2% in 2019, according to the latest data from the International Monetary Fund (IMF). Capital outflows from China have also intensified, reaching $75 billion in September, in the biggest monthly exodus since 2016, Goldman Sachs data showed. ($1 = 7.1430 Chinese yuan renminbi) https://www.reuters.com/world/china/moodys-cuts-chinas-credit-outlook-negative-2023-12-05/