2023-12-05 10:03

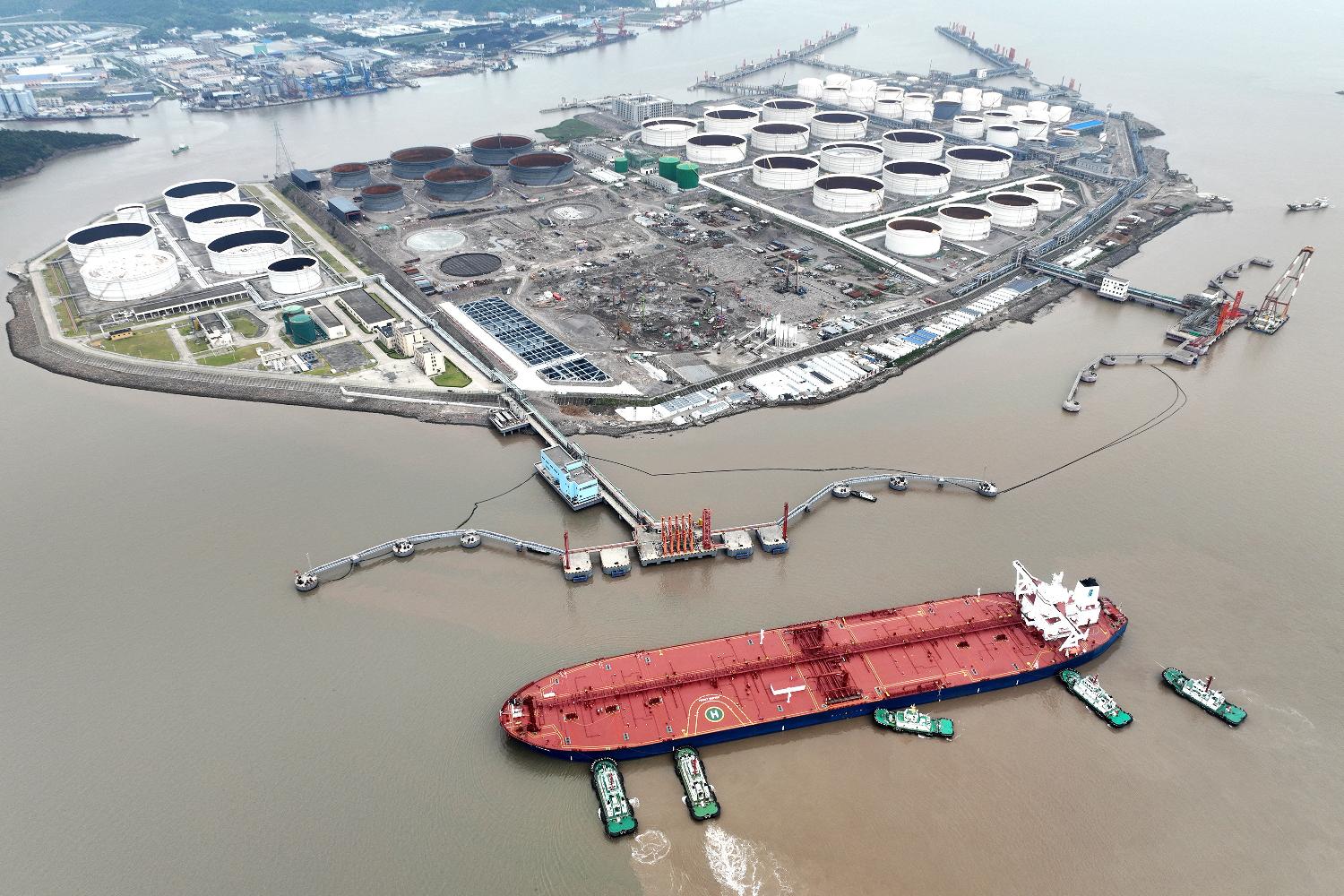

Analysts say OPEC+ cuts unlikely to be significant Russia's Novak says OPEC+ could strengthen oil supply cuts API shows U.S. crude, fuel stockpiles rose last week - sources Moody's cut China outlook to negative, Chinese banks buying yuan Countries considering a formal fossil fuel phase-out at COP28 NEW YORK, Dec 5 (Reuters) - Oil prices fell to a near five-month low on Tuesday on a stronger U.S. dollar and demand concerns, putting the market down for a fourth day in a row on doubts over OPEC+ announced voluntary supply cuts last week. "The OPEC+ deal did little to support prices and given the (four) days of declines that followed it, traders are clearly very unimpressed," said Craig Erlam, senior market analyst UK & EMEA, at data and analytics firm OANDA. Brent crude oil futures fell 83 cents, or 1.1%, to settle at $77.20 a barrel, while U.S. West Texas Intermediate crude (WTI) ended 72 cents, or 1.0%, lower at $72.32. That was the lowest close for both crude benchmarks since July 6. For WTI, it was the first time since May that prices fell for four days in a row. The price declines came despite comments from Russian Deputy Prime Minister Alexander Novak that OPEC+ stands ready to deepen oil production cuts in the first quarter of 2024 to eliminate "speculation and volatility" if existing actions to cut production were not enough. OPEC+ groups the Organization of the Petroleum Exporting Countries and allies such as Russia. On Nov. 30, OPEC+ agreed to voluntary output cuts of about 2.2 million barrels per day (bpd) for the first quarter of 2024. But at least 1.3 million bpd of those cuts were an extension of voluntary curbs Saudi Arabia and Russia already had in place. "The voluntary element of the deal left the markets questioning whether the supply reduction would actually come into effect," said Fiona Cincotta, financial market analyst, at U.S. financial services firm StoneX. The Kremlin said the OPEC+ production cuts will take time to kick in. President Vladimir Putin will visit OPEC members the United Arab Emirates and Saudi Arabia on Wednesday and host Iranian President Ebrahim Raisi in Moscow on Thursday. Russia's oil and gas revenues dropped in November to 961.7 billion roubles ($10.53 billion) from 1.635 trillion roubles in the previous month due to the cyclical nature of profit-based tax payments. Top oil exporter Saudi Arabia lowered the price of its flagship Arab Light crude to Asian customers in January for the first time in seven months, reacting to weakening premiums in the physical market amidst supply overhang concerns. OPEC member Libya's National Oil Corporation, meanwhile, said it was on track to grow oil output to 2 million bpd in the next three to five years. In U.S. supply, U.S. crude oil and fuel inventories rose in the week to Dec. 1, according to market sources citing American Petroleum Institute figures on Tuesday. The data caused oil prices to extend losses post-settlement. Crude stocks rose by 594,000 barrels in the week ended Dec. 1, the sources said on condition of anonymity. Gasoline stockpiles gained by 2.8 million barrels, while distillate inventories rose nearly 1.9 million barrels. U.S. government data on stockpiles is due on Wednesday. DEMAND CONCERNS In China, the world's biggest oil importer, major state-owned banks were busy buying the yuan to prevent it from weakening too much after rating agency Moody's cut China's outlook to negative. Elsewhere, countries at the COP28 climate conference are considering calling for a formal phase-out of fossil fuels as part of the United Nation summit's final deal to tackle global warming. The U.S. dollar (.DXY) rose to a two-week high against a basket of currencies after fresh employment data showed job openings dropped in October to the lowest level since early 2021. The slowing labor market and subsiding inflation have raised optimism that the Federal Reserve is probably done raising interest rates this cycle, with financial markets anticipating a rate cut in mid-2024. A stronger dollar can reduce oil demand by making the fuel more expensive for buyers using other currencies. Lower interest rates, meanwhile, could increase oil demand by making it cheaper for consumers to borrow money to purchase more goods and services. https://www.reuters.com/business/energy/oil-prices-steady-amid-opec-cut-doubts-mid-east-tension-2023-12-05/

2023-12-05 09:27

MOSCOW, Dec 5 (Reuters) - Russia's finance ministry said on Tuesday it would decrease the volume of deferred foreign currency purchases in the coming month by more than 2-1/2 times to a cumulative total of 244.8 billion roubles ($2.68 billion). The purchases are deferred because the central bank in August stopped buying foreign currency until the end of the year to avoid aggravating pressure on the rouble, which tumbled past 100 to the dollar in August and September. The finance ministry said its purchases of foreign currencies and gold for the period from Dec. 7 to Jan. 12 that will be deferred to a later date would amount to 11.7 billion roubles per day. In the previous period, between Nov. 8 and Dec. 6, the ministry had planned to buy foreign currency worth 621.1 billion roubles. Under its budget rule, Russia sells foreign currency from its wealth fund to make up for any shortfall in revenue from oil and gas exports, or makes purchases in the event of a surplus. Last week the central bank said currency interventions on the domestic market would resume in January, but with an adjusted formula that should support the rouble as calculations would include the difference between deferred interventions and the volume of rainy day fund spending on financing the government's budget deficit for 2023. The ministry was selling foreign currency for the first half of 2023 as Western sanctions over Russia's invasion of Ukraine hit energy revenues. Since August, it has purchased FX as commodity prices have risen and energy revenues recovered. The ministry estimated excess oil and gas revenues in December at 362 billion roubles. It said energy revenues in November had declined to 961.7 billion roubles from 1.635 billion roubles in October. ($1 = 91.3625 roubles) https://www.reuters.com/markets/currencies/russia-more-than-halve-deferred-fx-purchases-coming-month-2023-12-05/

2023-12-05 09:25

Graphic: World FX rates in 2020 Graphic: Trade-weighted sterling since Brexit vote (Reuters) - Sterling hovered around its highest levels in almost three months against the euro on Tuesday, as markets raised their bets on rate cuts by the European Central Bank, which widened their divergence with the Bank of England. Higher interest rates attract investors' demand and boost the value of a currency. Money markets fully price in more than 140 bps of ECB rate cuts next year -- from around 135 bps the day before -- with the first move in March, while almost fully discounting a first BoE cut in June 2024. Sterling was flat at 85.80 pence per euro. It retraced earlier this week after hitting its highest since Sept. 11 on Friday -- at 85.60 pence per euro -- as analysts have mixed views about the policy path of the ECB and the BoE. "When it comes to EUR/GBP, the drop appears to be overdone, and we expect a gradual dovish repricing in Bank of England rate expectations to favour a rebound above 0.8600, although that may not happen in the very short term," said Francesco Pesole forex strategist at ING. Dovish commentary from the ECB has now seen investors expecting a deeper easing cycle in the euro zone than in the UK. BofA recently argued that BoE will likely stay on hold for most of 2024, and markets finally see signs that the message that rates might have to stay high for an extended period is finally being heard. The British public's expectations for inflation over the medium to long term, which the Bank of England closely watches, rose in October, supporting a higher-for-longer view. Andrzej Szczepaniak, economist at Nomura, said the market pricing for ECB near-term rate cuts appears too aggressive in response to inflation expectations. He forecasts the next moves to be rate cuts in September 2024 for the ECB and August for the BoE as ongoing weakness in the surveys continued to suggest mild recessions in the euro area and the UK. "We see 125 bps of cuts in both cases, taking rates down to 2.75% for the ECB and 4% for the Bank of England over similar time frames – by early 2025. Deeper recessions could bring that timing forward," he said. The pound was down 0.1% against the U.S. dollar, which regained some ground on Tuesday and hovered near a one-week high ahead of key economic indicators later this week. "We still think that a convergence towards the key 1.2500 and even the 100 and 200-day MA at 1.2470 are more likely than a further rally given room for a dollar rebound, although US data means risks are quite binary," ING's Pesole said. https://www.reuters.com/world/uk/sterling-close-3-month-high-versus-euro-markets-bet-ecb-rate-cuts-2023-12-05/

2023-12-05 06:49

Dec 5 (Reuters) - The U.S. dollar was higher against a basket of currencies on Tuesday, paring losses from a recent selloff in spite of data showing that U.S. job openings dropped in October to the lowest level since early 2021. Job openings, a measure of labor demand, fell 617,000 to 8.733 million on the last day of October, the Labor Department said in its monthly Job Openings and Labor Turnover Survey, or JOLTS report, on Tuesday, coming in below estimates. The slowing labor market and subsiding inflation have raised optimism that the U.S. Federal Reserve is probably done raising interest rates this cycle, with financial markets even anticipating a rate cut in mid-2024. "It just reinforces the narrative that we've been on, which is, Fed hiking is probably done. We're shifting more into, when are they going to be easing? I think expectations are still all over the place in terms of that question," said Brad Bechtel, global head of FX at Jefferies in New York. The dollar index was last up 0.41% at 104.03, its highest in a week. Analysts said the dollar's nudge up was in part due to a reversal of the heavy selloff in recent weeks that stripped 3% off the dollar index in November alone, its steepest monthly decline in a year. Elsewhere, the yuan held steady in the face of a downgrade to the outlook for China's credit rating from Moody's, as major state-owned banks stepped in to stem any slide by selling dollars. Bitcoin hit a fresh yearly high on Tuesday, above $43,000 - its highest since April 2022. CUTS PRICED IN Traders have priced in at least 125 basis points worth of rate cuts from the Federal Reserve next year, with a good chance of 50 bps by June, according to CME's FedWatch tool. "The Fed is trying to convince the markets that it could still raise rates," said Joseph Trevisani, senior analyst at FXStreet.com. "I think the markets think everything's done, but the fact that the Fed is willing to go on about this is giving everybody pause." Investors believe the ECB could deliver its first rate cut by next March. Inflation across the euro zone has fallen more quickly than most anticipated, as evidenced by last Thursday's consumer price data. The euro was last down 0.5% to $1.0782. The yuan held steady after Moody's decision to cut China's credit outlook to "negative" on Tuesday, thanks in part to state-owned banks that were seen swapping yuan for U.S. dollars in the onshore swap market and selling those dollars in the spot market, two sources with knowledge of the matter said. Sterling was $1.258, down 0.4%, while the yen was steady, leaving the dollar at 147.26. The Australian dollar fell 1.03% to $0.6545, well below Monday's four-month high, after the Reserve Bank of Australia (RBA) kept rates at a 12-year high of 4.35% on Tuesday. In cryptocurrencies, bitcoin was up 4.31% at $43,794, its highest since April 2022. The world's largest cryptocurrency has gained 150% this year, fuelled in part by optimism that a U.S. regulator will soon approve exchange-traded spot bitcoin funds (ETFs). https://www.reuters.com/markets/currencies/dollar-stems-decline-after-heavy-november-selloff-2023-12-05/

2023-12-05 06:36

Gold hit record high of $2,135.40/oz on Monday Focus shifts to US non-farm payroll on Friday Palladium down 4% at five-year low Dec 5 (Reuters) - Gold slipped on Tuesday after grazing an all-time high in the previous session as the dollar regained footing and investors refrained from making big bets ahead of key U.S. jobs data that could offer more clarity on the U.S. interest rate path. Spot gold was down 0.5% at $2,020.29 per ounce by 3:10 p.m. ET (2010 GMT). Bullion had climbed to a record high of $2,135.40 on Monday, before dropping more than $100 in a single day to close over 2% lower. U.S. gold futures settled down 0.3% at $2,036.30. The momentum that propelled gold to a record high on Monday may fizzle in the short term due to uncertainty over the timing of U.S. monetary easing, but wider geopolitical risks should give a boost towards fresh peaks, analysts said. Gold bulls are exhausted and hitting a pause after the rally, said Jim Wyckoff, senior analyst at Kitco Metals, adding that "the $2,000 level is probably going to be the near-term floor under the gold market." The dollar rose 0.2% to hover near a two-week high, making gold more expensive for other currency holders. Traders are now pricing in a 66% chance of a rate cut in March, according to the CME FedWatch tool. Lower interest rates tend to support non-interest-bearing bullion. "We only expect the (gold) price to rise lastingly to $2,100 per troy ounce in the second half of 2024, when the Fed begins lowering its interest rates," Commerzbank said in a note. Data showed U.S. job openings fell to a more than two-and-a-half year low in October, signalling that higher interest rates were dampening demand for workers. Investors are on the watch for Friday's U.S. non-farm payrolls report for November. Spot silver lost 1.4% to $24.16 per ounce, while platinum eased 1.8% to $899.80. Palladium slipped 4.1% to a more than five-year low of $936.24 per ounce. https://www.reuters.com/markets/commodities/gold-ticks-up-weaker-us-dollar-bond-yields-2023-12-05/

2023-12-05 06:35

NEW YORK, Dec 5 (Reuters) - A gauge of global stocks declined for a second straight session and U.S. Treasury yields fell on Tuesday, as investors attempted to assess the policy path of major central banks and the trajectory of slowing economic growth. Softening economic data and recent comments from Federal Reserve officials, including Chair Jerome Powell, have heightened expectations that the U.S. central bank has ended its interest rate hiking cycle and will begin to cut rates as soon as March. In addition, expectations have grown that the European Central Bank (ECB) could cut rates in the first quarter of 2024. Expectations for a U.S. rate cut of at least 25 basis points (bps) in March are about 64%, according to CME's FedWatch Tool, up from about 35% a week ago. Markets are pricing in a 74% chance of a cut by the ECB in March, according to LSEG data. On Wall Street, the Dow Jones Industrial Average (.DJI) closed down 79.72 points, or 0.22%, to 36,124.72, the S&P 500 (.SPX) lost 2.59 points, or 0.06 %, to 4,567.19 and the Nasdaq Composite (.IXIC) gained 44.42 points, or 0.31 %, to 14,229.91. The Fed's next policy meeting is on Dec. 12-13. Investors got their first look at what will be a string of data on the labor market this week in the form of the Job Openings and Labor Turnover Survey, or JOLTS report, and will culminate in the government's payrolls report on Friday, which will heavily influence market views on the Fed's policy steps. U.S. job openings dropped in October to the lowest level since early 2021, indicating that the labor market was easing as higher interest rates cool demand in the economy. "As interest rates rise and as demand slows, companies are pulling back on job openings, which is essentially what the Fed wants," said Sam Stovall, chief investment strategist at CFRA Research in New York. "The Fed probably is done raising rates, and the only question outstanding is when they start to cut," Stovall said. Other data indicated the U.S. services sector picked up steam in November as business activity increased, although new orders were flat and a gauge of input inflation slipped. U.S. Treasury yields fell, with the benchmark 10-year Treasury note touching its lowest level since Sept. 1 at 4.163% and was last down 11 basis points to 4.174%. The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, declined 8 basis points to 4.581% on the day. European shares closed higher, and Germany's DAX (.GDAXI) climbed 0.8% to close at a fresh record, buoyed by strong gains in Allianz (ALVG.DE) and Daimler Truck Holding (DTGGe.DE), with the STOXX 600 (.STOXX) index up 0.4%. MSCI's gauge of stocks across the globe (.MIWD00000PUS) lost 0.23%, the first back-to-back declines for the index in five weeks. ECB board member Isabel Schnabel, seen as the most influential voice in the conservative camp of policymakers, told Reuters the ECB can take further interest rate hikes off the table given a "remarkable" fall in inflation and policymakers should not guide for rates to remain steady through mid-2024. The dollar index rose 0.32% at 103.95, while the euro was down 0.38% to $1.0795. In commodities, U.S. crude settled 0.99% lower at $72.32 a barrel while Brent crude settled at $77.20, down 1.06% in choppy trading, the lowest since July, as the stronger U.S. dollar and demand concerns offset supply worries after Russia said OPEC+ was ready to deepen output cuts in the first quarter of next year. https://www.reuters.com/markets/global-markets-wrapup-1-2023-12-05/