2023-12-03 15:59

CAIRO, Dec 3 (Reuters) - Maritime security sources on Sunday said that a bulk carrier ship had been hit by at least two drones while sailing in the Red Sea. British maritime security company Ambrey said that another container ship had reportedly suffered damage from a drone attack about 63 miles northwest of the northern Yemeni port of Hodeidah. https://www.reuters.com/world/two-ships-hit-by-drone-attacks-red-sea-2023-12-03/

2023-12-03 14:01

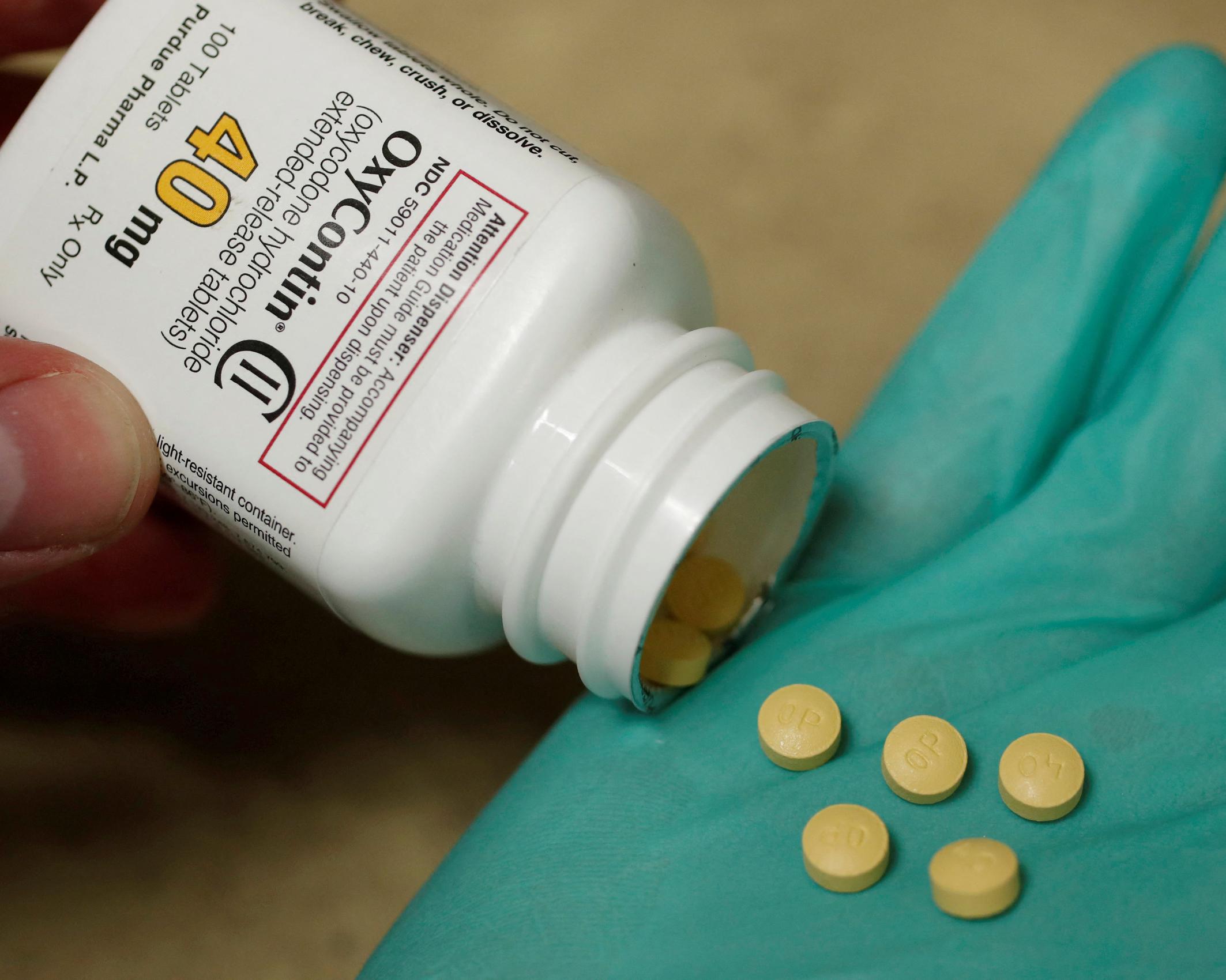

WASHINGTON, Dec 3 (Reuters) - The U.S. Supreme Court is set on Monday to hear arguments over the legality of a roughly $6 billion bankruptcy settlement involving Purdue Pharma, maker of the powerful and highly addictive pain medication OxyContin that played a key role in the country's opioid epidemic. If the justices allow the deal to proceed, it could lead to billions of dollars being poured into addiction-treatment and other relief efforts. The settlement also would shield the Stamford, Connecticut-based pharmaceutical company's wealthy Sackler family owners from lawsuits brought by opioid victims. Here is an explanation of the settlement and its consequences. HOW WOULD THE SETTLEMENT HELP PEOPLE AFFECTED BY OPIOIDS? An opioid epidemic has caused more than a half million U.S. overdose deaths over a period spanning more than two decades. Purdue introduced OxyContin in 1996, and marketed and promoted it aggressively. OxyContin helped kickstart the epidemic, various plaintiffs have argued in thousands of lawsuits against Purdue. The litigation prompted Purdue in 2019 to file for Chapter 11 bankruptcy to address its debts. Purdue reached a bankruptcy settlement with creditors, including various state attorneys general, local governments and the U.S. Justice Department's criminal and civil divisions. Under the deal, Purdue would transform into a nonprofit and dedicate its assets to addressing the harms of opioid addiction in the United States. A U.S. bankruptcy court approved that restructuring plan in 2021. It was revised in 2022 to include more money from the Sacklers after the attorneys general of eight states and the District of Columbia successfully appealed the bankruptcy court approval. The revised deal is supported by all financial stakeholders in the case, including all state attorneys general, but is opposed by the Justice Department's bankruptcy watchdog and some individual opioid plaintiffs. Under the deal, the Sacklers would pay up to $6 billion to a trust that would be used to settle claims filed by states, hospitals, people who had become addicted and others who have sued Purdue. A group comprising more than 60,000 people who have filed personal injury claims stemming from their exposure to Purdue opioid products told the Supreme Court they support the settlement, including legal immunity for members of the Sackler family. WHAT ROLE DID THE SACKLER FAMILY PLAY IN THE OPIOID CRISIS? Lawsuits against Purdue and Sackler family members accuse them of fueling the opioid epidemic through deceptive marketing of its pain medication. The company pleaded guilty to misbranding and fraud charges related to its marketing of OxyContin in 2007 and 2020. The Sacklers' conduct is alleged to have "contributed to the massive overuse of OxyContin and other opioids in this country," according to law professor Joshua Silverstein of the University of Arkansas at Little Rock. Members of the Sackler family have denied wrongdoing but expressed regret that OxyContin "unexpectedly became part of an opioid crisis." They said in May that the bankruptcy settlement would provide "substantial resources for people and communities in need." HOW ARE THE SACKLERS TRYING TO USE BANKRUPTCY AS A SHIELD? Purdue's Sackler family owners under the settlement would receive immunity in exchange for the payment of up to $6 billion to settle thousands of lawsuits, even though they are not bankrupt themselves. They would achieve this through what is called a non-debtor release, also called a third-party release. "The basic idea is that the Sacklers are providing a great deal of money to Purdue Pharma in exchange for having their own liability for opioid harms extinguished without having to declare bankruptcy," Silverstein said. Congress initially granted non-debtor releases in the context of asbestos litigation. Their use has been expanded by companies looking to use such releases as a bargaining chip. President Joe Biden's administration has argued that Purdue's settlement is an abuse of bankruptcy protections meant for debtors in "financial distress," not people like the Sacklers. The administration also has said Sackler family members withdrew $11 billion from Purdue before agreeing to contribute $6 billion to the opioid settlement. WHY IS THE U.S. TRUSTEE OPPOSING THE BANKRUPTCY SETTLEMENT? The U.S. Trustee is an office within the Justice Department that carries out an administrative function, performs a watchdog role and in some instances, like in Purdue Pharma's bankruptcy case, takes policy positions. The watchdog, which is appealing a lower court's ruling approving the settlement, has opposed the use of bankruptcy law to grant sweeping legal protections like those the Sacklers sought. The Trustee told the Supreme Court: "The court of appeals' decision is a roadmap for corporations and wealthy individuals to misuse the bankruptcy system to avoid mass-tort liability." Purdue has accused the U.S. Trustee of managing to "single-handedly delay billions of dollars in value that should be put to use for victim compensation, opioid crisis abatement for communities across the country and overdose rescue medicines." https://www.reuters.com/business/healthcare-pharmaceuticals/how-will-supreme-court-reshape-us-opioid-epidemic-relief-2023-12-03/

2023-12-03 13:59

NEW YORK, Dec 1(Reuters) - As U.S. stocks sit on hefty gains at the close of a rollercoaster year, investors are eyeing factors that could sway equities in the remaining weeks of 2023, including tax loss selling and the so-called Santa Claus rally. The key catalyst for stocks will likely continue to be the expected trajectory of the Federal Reserve's monetary policy. Evidence of cooling economic growth has fueled bets that the U.S. central bank could begin cutting rates as early as the first half of 2024, sparking a rally that has boosted the S&P 500 (.SPX) 19.6% year-to-date and taken the index to a fresh closing high for the year on Friday. At the same time, seasonal trends have been particularly strong this year. In September, historically the weakest month for stocks, the S&P 500 fell nearly 5%. Stocks swung wildly in October, a month noted for its volatility. The S&P 500 gained nearly 9% gain in November, historically a strong month for the index. "We've had a solid year, but history shows that December can sometimes move to its own beat," said Sam Stovall, chief investment strategist at CFRA Research in New York. Investors next week will be watching U.S. employment data, due out on Dec. 8, to see whether economic growth is continuing to level off. Overall, December has been the second-best month for the S&P 500, with the index up an average of 1.54% for the month since 1945, according to CFRA. It is also the month most likely to post a gain, with the index rising 77% of the time, the firm's data showed. Research from LPL Financial showed that the second half of December tends to outshine the first part of the month. The S&P 500 has gained an average of 1.4% in the second half of December in so-called Santa Claus rallies, compared with a 0.1% gain in the first half, according to LPL's analysis of market moves going back to 1950. Stocks that have not performed well, however, may face additional pressure in December from tax loss selling, as investors get rid of losers to lock in write-offs before year-end. If history is any guide, some of those shares may rebound later in the month and into January as investors return to undervalued names, analysts said. Since 1986, stocks that were down 10% or more between January and the end of October have beaten the S&P 500 by an average of 1.9% over the next three months, according to BofA Global Research. PayPal Holdings, CVS Health, and Kraft Heinz Co are among the stocks the bank recommends buying for a tax-related bounce, BofA noted in a late October report. "The market advance has been extraordinarily narrow this year, and there's reason to believe that some sectors and stocks will really take it on the chin until they get some relief in January," said Sameer Samana, senior global market strategist at the Wells Fargo Investment Institute. Despite the market's hefty year-to-date rise, investment portfolios are likely to have plenty of underperforming stocks. Nearly 72% of the S&P 500's gain has been driven by a cluster of megacap stocks such as Apple, Tesla and Nvidia, which have an outsized weighting in the index, data from S&P Dow Jones Indices showed. Many other names have languished: The equal-weighted S&P 500, whose performance is not skewed by big tech and growth stocks, is up around 6% in 2023. Some worry that investor over-exuberance may have already set in after November's big rally, which spurred huge moves in some of the market's more speculative names. Streaming service company Roku soared 75% in November, for instance, while cryptocurrency firm Coinbase Global climbed 62% and Cathie Wood's ARK Innovation Fund was up 31%, its best performance of any month in the last five years. Michael Hartnett, chief investment strategist at BofA Global Research, said in a Friday note that the firm's contrarian Bull & Bear indicator - which assesses factors such as hedge fund positioning, equity flows and bond flows - had moved out of the "buy" zone for the first time since mid-October. "If you caught it, no need to chase it," he wrote of the rally. https://www.reuters.com/markets/us/wall-st-week-ahead-tax-loss-selling-santa-rally-could-sway-us-stocks-after-2023-12-02/

2023-12-03 11:39

AMSTERDAM, Dec 3 (Reuters) - Dozens of flights to and from Amsterdam Schiphol airport were cancelled on Sunday due to snowfall expected to reach the Netherlands in the afternoon. Schiphol's website around midday indicated almost 150 incoming and outgoing flights had been cancelled. Dutch airline KLM, the airport's main user, told Dutch news agency ANP it had scrapped 65 European flights in the afternoon and evening. https://www.reuters.com/world/europe/snow-grounds-dozens-flights-amsterdam-airport-2023-12-03/

2023-12-03 09:47

RIYADH, Dec 3 (Reuters) - Three commercial vessels came under attack in international waters in the southern Red Sea, the U.S. military said Sunday, as Yemen's Houthi group claimed drone and missile attacks on two Israeli vessels in the area. The Carney, an American destroyer, responded to distress calls and provided assistance following missile and drone launches from Houthi-controlled territory, according to U.S. Central Command. Yemen's Houthi movement said its navy had attacked two Israeli ships, Unity Explorer and Number 9, with an armed drone and a naval missile. A spokesperson for the group's military said the two ships were targeted after they rejected warnings, without elaborating. In a broadcast statement, the spokesperson said the attacks were in response to the demands of the Yemeni people and calls from Islamic nations to stand with the Palestinian people. The U.S. military said the Carney shot down three drones as it helped the commercial vessels. It was not clear if the warship was a target. It said the attacks were a threat to international commerce. "We also have every reason to believe that these attacks, while launched by the Houthis in Yemen, are fully enabled by Iran," the statement said. "The United States will consider all appropriate responses in full coordination with its international allies and partners," it added. An Israeli military spokesperson Rear Admiral Daniel Hagari said the two ships had no connection to Israel. "One ship was significantly damaged and it is in distress and apparently is in danger of sinking and another ship was lightly damaged," Hagari told reporters in Tel Aviv. The reported incident follows a series of attacks in Middle Eastern waters since war broke out between Israel and the Palestinian militant group Hamas on Oct. 7. An Israeli-linked cargo ship was seized in November by the Houthis, allies of Iran. The group, which controls most of Yemen's Red Sea coast, had previously fired ballistic missiles and armed drones at Israel and vowed to target more Israeli vessels. MULTIPLE ENGAGEMENTS The Bahamas-flagged bulk carrier Unity Explorer is owned by Unity Explorer Ltd and managed by London-based Dao Shipping Ltd, LSEG data showed. The ship was scheduled to arrive in Singapore on Dec. 15. Number 9, which was headed to Suez port, is a Panama-flagged container ship owned by Number 9 Shipping Ltd and managed by Newcastle-upon-Tyne, UK-based Bernhard Schulte Shipmanagement (BSM), the data showed. BSM said in a statement to Reuters Number 9 is currently sailing and there were no reports of injuries or pollution after the incident. The vessel was hit by a projectile while transiting the Bab al-Mandab Strait, the company said. Unity Explorer's owners and managers could not be reached immediately for comments. According to U.S. Central Command, the Unity Explorer suffered minor damage while the Number 9 also reported damage. British maritime security company Ambrey and sources said earlier that a bulk carrier and a container ship had been hit by at least two drones while sailing in the Red Sea. Ambrey said the container ship had reportedly suffered damage from a drone attack about 63 miles (101 km) northwest of the northern Yemeni port of Hodeidah. Britain's Maritime Trade Operations agency (UKMTO) said it had received reports of a drone attack in the Red Sea's Bab al-Mandab Strait. Last week a U.S. Navy warship responded to a distress call from an Israeli-managed commercial tanker in the Gulf of Aden after it had been seized by armed individuals. https://www.reuters.com/world/britains-maritime-agency-reports-potential-explosion-red-sea-2023-12-03/

2023-12-03 09:34

CAIRO, Dec 3 (Reuters) - Egypt's Suez Canal economic zone and Scatec ASA have signed a memorandum of understanding (MoU) worth $1.1 billion to supply ships with green fuel, a Suez Canal statement said on Sunday. The MoU agreed on the sidelines of the COP28 conference held in Dubai envisages production of 100,000 tonnes of green methanol per year by 2027, the statement said. https://www.reuters.com/sustainability/suez-canal-scatec-sign-11-bln-green-methanol-mou-2023-12-03/