2023-12-01 08:01

MUMBAI, Dec 1 (Reuters) - The Indian rupee rose on Friday, boosted by inflows and data that prompted economists to raise their growth forecasts for Asia's third-largest economy. The rupee was at 83.3275 to the U.S. dollar at 10:54 a.m. IST, up from 83.3950 in the previous session. The local currency hit an intraday high of 83.2525, likely on dollar inflows. USD/INR saw "sizeable" selling interest just before the usual open for spot, a FX trader said. "Suspect that is related to an inflow - the daily fix and the cash swap bears that out. After that, it is the usual dip buying (on USD/INR) kicking in." The daily fix was dealt at a discount of 0.25 paisa, indicated dollar selling interest at the reference rate. Banks usually receive orders from their clients to sell dollars at the fix rate, which they can then hedge in the interbank market. Meanwhile, the USD/INR overnight swap rate, Friday over Monday, pushed higher. Banks having a dollar inflow would typically sell dollars in spot and conduct sell/buy swaps if they wanted to adjust the transaction to settle today instead of on a spot basis which is today + two days. That would prompt a rise in the overnight swap rate. The rupee was helped by data that showed that India's economy expanded at a faster clip than what economists had expected, prompting them to upwardly revise growth forecasts. India's central bank "is likely to remain hawkish", Deutsche Bank said, considering the robust GDP print and upside risks to near-term inflation due to food price volatility. https://www.reuters.com/markets/currencies/india-rupee-propped-up-by-inflows-held-back-by-importers-2023-12-01/

2023-12-01 07:12

China's foreign minister visits Hanoi amid plans for Xi's trip Upgraded rail link may be part of Belt Road China is top investor in Vietnam despite maritime tensions HANOI, Dec 1 (Reuters) - China and Vietnam are working on a possible significant upgrade of their underdeveloped rail links to boost a line that crosses Vietnam's rare earths heartland and reaches the country's top port in the north, senior officials and diplomats said. The talks are part of preparations for a possible visit to Hanoi in coming weeks by Chinese President Xi Jinping, officials and diplomats said, which would further confirm Vietnam's increasingly strategic role in global supply chains as major powers including the United States vie to gain influence there. Deeper trade ties and railways connections were expected to be discussed on Friday as China's top diplomat Wang Yi met Vietnamse leaders, diplomats said. Wang Yi and Vietnam's Communist Party leader Nguyen Phu Trong said the two countries would bolster their relations after they met on Friday, according to Vietnam's national radio broadcaster VOV. Vietnamese Prime Minister Pham Minh Chinh called for the upgrade of the railway linking Kunming in southern China to Vietnam's port city of Haiphong in a statement released last month, after China's Commerce Minister Wang Wentao made a rare visit to Vietnam. Chinese officials have stressed the importance of boosting infrastructure connectivity with their southern neighbour. Vietnam has already rail connections to China, but the system is old with limited capacity on the Vietnam side. The two systems are also not interoperable at the moment, meaning trains have to stop at the border where passengers and goods are transferred to domestic services. The upgraded railway would pass through the region where Vietnam has its largest deposits of rare earths, of which China is by far the world's biggest refiner. Vietnam is trying to build its own industry in what is seen as a possible challenge to China's dominance, but what appear as internal fights have cast a shadow over these efforts. Chinese and Vietnamese rare earths industry experts discussed last week stronger cooperation on processing the minerals, according to Vietnamese state media. BELT AND ROAD TRACK? It is unclear how much China would contribute to the upgraded railway track in Vietnam and whether Hanoi would accept sizeable financing from Beijing on this. The line could be seen as part of China's flagship Belt and Road Initiative (BRI) which is supporting infrastructure investment across the world, but is not clear whether it would be labelled as a BRI project, one diplomat said. A strengthened railway link could also boost Vietnam's export to China, mostly of agriculture products, boost Chinese tourism to northern Vietnam and further integrate the two countries' manufacturing industries, which experts already consider as symbiotic, with factories in Vietnam largely assembling components produced in China. China is Vietnam's largest trading partner and so far this year is also the main investor, taking into account investment from Hong Kong, as many Chinese companies move south some of their operations amid trade tensions between Beijing and Washington. Despite the booming economic links, the two communist nations are embroiled in a years-long maritime dispute in the South China Sea and fought a brief war in the late 70s, China's latest. https://www.reuters.com/world/asia-pacific/china-vietnam-consider-rail-link-through-rare-earths-heartland-2023-12-01/

2023-12-01 06:40

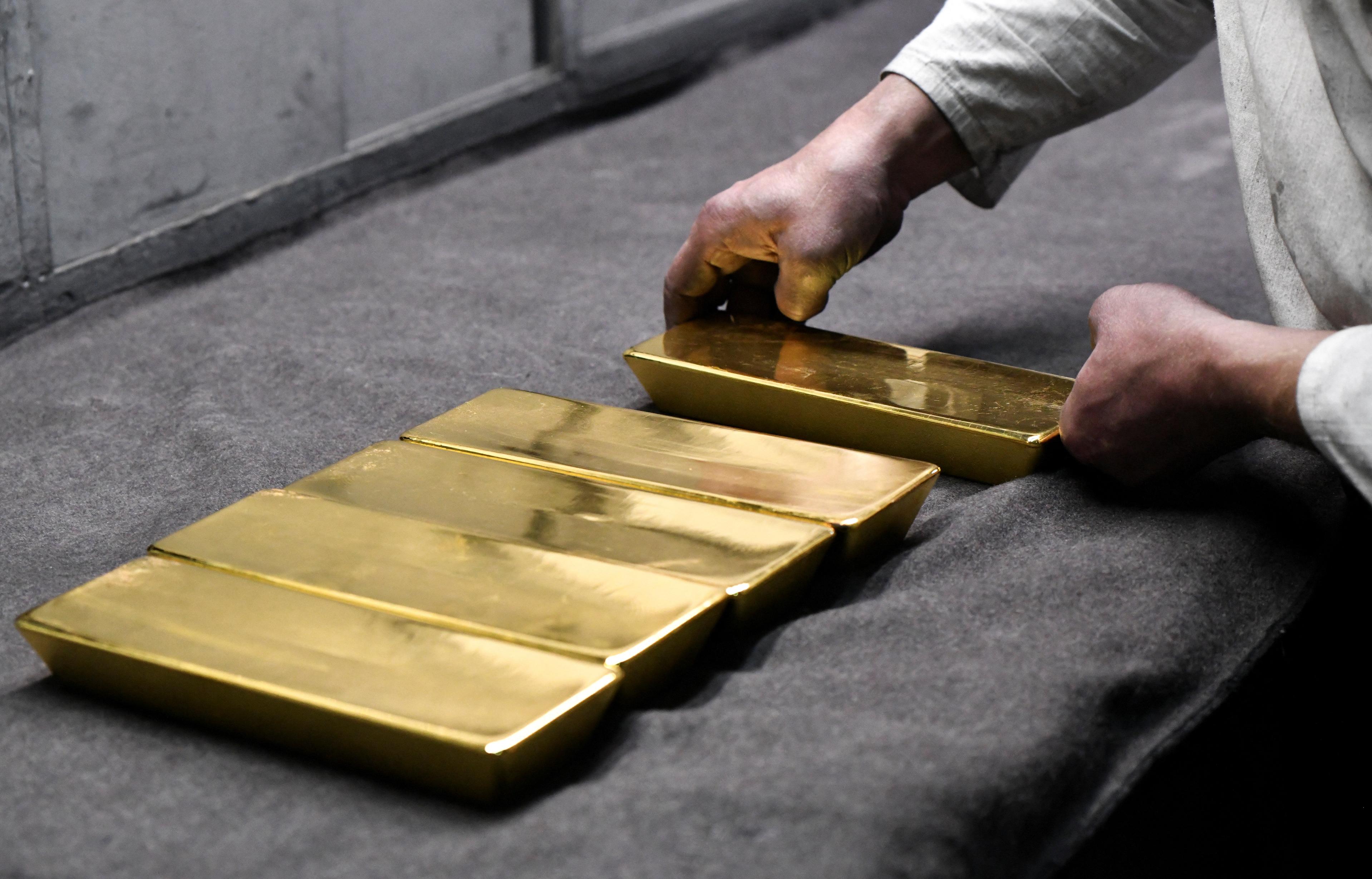

Gold up over 3% so far for the week Fed to move 'carefully' on interest rates Silver hits six-month high Dec 1 (Reuters) - Gold prices rallied to an all-time high on Friday after remarks from Federal Reserve Chair Jerome Powell increased traders' confidence the U.S. central bank had completed its monetary policy tightening and could cut rates starting March. Spot gold climbed 1.6% to $2,069.10 per ounce by 3:30 p.m. ET (2030 GMT). Prices were 3.4% higher so far this week, and earlier rose to $2,075.09 per ounce to beat the previous all-time high of $2,072.49 scaled in 2020. U.S. gold futures also settled 1.6% higher at a record peak of $2,089.7. Powell said "the risks of under- and over-tightening are becoming more balanced," but the Fed is not thinking about lowering rates right now. "Gold bulls are focusing on Powell's comment that rate is well into restrictive territory which plays into the narrative that cuts will come sooner, pointedly ignoring his warning that it was premature to speculate on easing rates," Tai Wong, a New York-based independent metals trader. Markets added to bets of a March start to rate cuts and an interest rate of under 4% by the end of next year. Lower interest rates reduce the opportunity cost of holding zero-yield gold. But, "prices may have entered overbought territory and gold has been known to price in monetary policy expectations prematurely over the past two years," Standard Chartered analyst Suki Cooper said in a note. Boosting bullion's appeal, benchmark 10-year Treasury yields slipped to a 12-week low and the dollar (.DXY) ticked 0.3% lower. "Gold has had a Santa Claus rally and I expect that to continue until the end of this year. It is certainly within the realm of possibility that gold re-tests record highs," said Everett Millman, chief market analyst at Gainesville Coins. Silver gained 0.9% to a more than six-month high at $25.47 per ounce, set for a third consecutive weekly rise. Platinum rose 0.6% to $932.44 and palladium lost 0.3% to $1,004.92. https://www.reuters.com/markets/commodities/gold-set-3rd-weekly-gain-cooler-data-cements-fed-cut-bets-2023-12-01/

2023-12-01 06:33

LUSAKA, Dec 1 (Reuters) - Zambia has selected United Arab Emirates' International Resources Holdings as the new strategic equity partner in Mopani Copper Mines, state-firm ZCCM-IH (ZCCM.LZ) said in a statement late on Thursday. IRH, which is linked to Abu Dhabi's most valuable listed company, International Holdings Company (IHC), will invest funds into Mopani to help with short-term working capital and finance the completion of the mine development to unlock Mopani's long-term potential as well as restructure the copper miner's balance sheet, ZCCM said. The new investor is also expected to "reset" Mopani's existing relationship with Glencore (GLEN.L) , ZCCM said. Zambia has been searching for a new investor for Mopani since it took control of the assets from Glencore in 2021 after agreeing to pay the Swiss commodities giant $1.5 billion in a deal funded by debt. As part of the deal, Glencore retained off take rights for copper from Mopani. The proposed partnership should enable Mopani to increase copper production to at least 200,000 metric tons per annum, ZCCM said. Mopani requires $300 million investment to expand output over the next three years and an additional $150 million to sustain operations, ZCCM said in September. The UAE firm is taking steps to invest in critical metals and develop a new entity that encompasses the entire metals and mining supply chain. "The proposed investment in Mopani is the largest single investment to date by IRH and represents a key step in the development of its strategy to become a major player in the African minerals sector," ZCCM said. The Zambia state firm, which holds a minority stake in Mopani, was being advised by Rothschild & Co on the Mopani sale. Other firms that were bidding for Mopani include South Africa's Sibanye Stillwater (SSWJ.J) and China's Zijin(601899.SS) , Reuters reported Oct. 10, citing a source. https://www.reuters.com/markets/commodities/zambia-selects-uaes-ihc-unit-new-partner-mopani-copper-mines-2023-12-01/

2023-12-01 06:15

Powell says risks of over- or under-tightening now balanced U.S. manufacturing sector remains in contraction territory Post-Powell, U.S. rate futures price in 62% chance of March rate cut NEW YORK, Dec 1 (Reuters) - The dollar fell on Friday, after two days of gains, as Federal Reserve Chair Jerome Powell struck a cautious tone on further interest rate moves, saying that the risk of under- or over-tightening is now more balanced. The market viewed his comments as dovish, with investors pricing in expectations that the Fed is likely done raising rates. Powell said it was clear that U.S. monetary policy was slowing the economy as expected, with a benchmark overnight interest rate "well into restrictive territory." Powell noted, however, that the Fed is prepared to tighten policy further if deemed appropriate. "Powell just gave the thumbs up to the other side of the camp believing that the Fed has acted correctly and can afford to wait-and-see without (hiking), but not necessarily cutting," said Juan Perez, director of trading at Monex USA in Washington. The U.S. dollar index - which tracks the currency against six major counterparts - was last down 0.2% at 103.23 after ending November on Thursday with its weakest monthly performance in a year. It is poised to end lower for a third straight week. Following Powell's remarks, U.S. rate futures on Friday priced in a 64% chance of a rate cut by the March meeting, compared to 43% late on Thursday, according to the CME's FedWatch tool. For the May meeting, U.S. rate cut chances surged to 90%, from about 76% the day before. Powell's remarks came after data showed the U.S. manufacturing sector remained weak in November, affirming his comments that Fed rate hikes have started to slow the economy. The Institute for Supply Management (ISM) said its manufacturing PMI was unchanged at 46.7 last month. It was the 13th consecutive month that the PMI stayed below 50, which indicates contraction in manufacturing. Softer U.S. and euro zone inflation data on Thursday reinforced expectations that central banks in both regions might be done raising interest rates, leading traders to bet on earlier cuts next year. Goldman Sachs on Friday said it expected the European Central Bank to deliver its first rate cut in the second quarter of 2024, compared to a previous forecast of a cut in the third quarter. Mixed economic data across Europe failed to set the tone for the euro, with a survey showing a downturn in euro zone manufacturing activity eased slightly last month but remained deeply in the red. Britain also reported contraction in manufacturing but an improved reading for a third straight month. The euro was last down 0.1% at $1.0874 , cutting losses and benefiting from a sell-off in the dollar following Powell's comments. Sterling rose 0.5% to $1.2699 . Against the yen, the dollar dropped 0.9% to 146.855 yen . The yen was on course for its third straight week of gains, pulling it away from the near 33-year low of 151.92 per dollar touched in the middle of November. Rising expectations of the Bank of Japan abandoning its ultra-easy monetary policy next year along with a drop in U.S. yields have buoyed the Asian currency in the past few weeks. In cryptocurrencies, bitcoin continued to strengthen, rising to an 18-month high of $38,839. It was last up 2.8% at $38,788. ======================================================== Currency bid prices at 3:10PM (2010 GMT) https://www.reuters.com/markets/currencies/dollar-eases-traders-weigh-rate-cut-prospects-2023-12-01/

2023-12-01 06:11

Dec 1 (Reuters) - A stellar rally in equities and bonds suggests market confidence is high for the world economy to reach a soft landing after a run of aggressive interest rate hikes. Yet labour markets are softening, the euro zone faces recession and China's property sector is in crisis. Here's what some closely-watched market indicators say about global recession risks: 1/ AMERICAN EXCEPTIONALISM? The U.S. economy grew 5.2% in the third quarter, defying dire recession warnings. But unemployment is rising, nearing a closely-watched 'Sahm rule' threshold, that has shown historically a recession is underway when the three-month rolling average unemployment rate rises half a point above the low of the prior 12 months. The picture is bleaker elsewhere. China grew faster than expected in the third quarter but manufacturing activity shrank for a second straight month in November. Britain's economy avoided the start of a recession in the third quarter but still failed to grow. The euro zone contracted 0.1% in the third quarter and a business activity downturn remained broad-based in November, suggesting a year-end recession. Economists broadly expect the global economy to slow next year but avoid a recession. "The outlier is really the U.S.," said Guy Miller, chief market strategist at Zurich Insurance Group. "At a global level, growth has and will be disappointing," he added. 2/ EVERYTHING RALLY Inflation slowing quicker than expected has boosted bets on central bank rate cuts next year, fuelling a broad market rally pinned on a 'soft landing' scenario. A global index of government and corporate investment-grade bonds in November delivered the best monthly return on record (.MERGBMI) U.S. 10-year Treasury yields tumbled over 50 basis points in November, the biggest monthly drop in over a decade. World stocks (.MIWO00000PUS) rose around 9%, their best month since November 2020, when markets cheered COVID-19 vaccines hoping for economies to reopen. "We are of the view that risks are to the downside heading into January, and suspect investors are underestimating the risks that persist, most notably slowing economic growth," said Zurich Insurance's Miller. 3/ DOUBLING DOWN Traders have doubled down on 2024 rate cut bets, pricing in at least four 25 basis-point cuts from the U.S. Federal Reserve, the most since August. Expectations are similar for the ECB, which is seen moving first among peers in April. Bets on the first cut have been brought forward swiftly, having been priced for July in late October, highlighting the darkening outlook for the bloc. But these moves may also reflect expectations of rate cuts to prevent an overtightening of lending conditions as inflation falls, not only recession fears, with market prices suggesting interest rates will remain elevated for years to come. "The market is extremely bullish on the economic outlook over the next five years," said Apollo Global Management chief economist Torsten Slok. 4/ (DI)STRESSED Corporate defaults globally this year reached 118 by September, nearly double the 2022 total, according to S&P Global, a worry for policymakers watching the impact of rate hikes that operate with a time lag. Property companies are particularly badly hit, from Sweden's SBB (SBBb.ST), Austria's Signa and China's Country Garden (2007.HK). The Bank of England has urged lenders not to underestimate the risk of loan defaults as higher inflation and rates hit vulnerable borrowers. Business insolvencies in England and Wales rose 18% anually in October. Euro zone lending to businesses has dropped for the first time since 2015. Yet corporate debt markets show little concern, with the cost of insuring exposure to junk bonds in Europe through credit default swaps this week hitting the lowest since April 2022. David Katimbo-Mugwanya, head of fixed income at EdenTree Investment Management, expected defaults to pick up next year. "We've been telling clients, default risks here are quite apparent, but they're not yet reflected in (corporate bond) spreads," he said. 5/ WATCH OIL Oil, which often tracks expectations for global growth, is down around 14% in the past two months -- a period that coincided with worries that an Israel-Hamas war could disrupt supplies and push up prices. Brent crude has dropped to $84, from almost $97 in late September , partly as Chinese and European economies weakened further. If supply shocks resulting from the Israel-Hamas war become severe enough to push Brent crude to $150, a level it has never breached, a "mild and fleeting" global recession could result, Oxford Economics reckons. https://www.reuters.com/markets/us/global-markets-recession-2023-12-01/