2023-11-30 11:29

Nov 30 (Reuters) - One of SilverBow Resources Inc's (SBOW.N) largest investors is pushing the U.S. oil and gas producer to revamp its board to address governance concerns and boost its lagging performance, according to a letter reviewed by Reuters on Thursday. Hedge fund Riposte Capital, which currently holds a 6.7% stake in SilverBow, has urged the company to appoint three new directors to its board, months after Reuters reported the investor's attempts to push the shale producer to drop anti-takeover defenses and explore a sale. In its latest letter, Riposte urged the company to appoint new board members at the shareholder meeting due next year, having failed to act on its earlier demands and, instead, pursued a strategy that resulted in a further underperformance against rivals. SilverBow's shares closed at $31.81 on Wednesday, giving the company a market capitalization of about $800 million. Its shares have gained 12.5% this year, outperforming the 5% decline by the S&P Energy index (.SPNY), which is made up of the largest energy companies. New York-based Riposte argues that, when compared with smaller peers, SilverBow has lagged on an earnings multiple basis this year, and may do so again in 2024 based on latest forecasts. Riposte, the fourth-largest shareholder in SilverBow and run by Khaled Beydoun, said the company's deal to acquire assets for $700 million from Chesapeake Energy (CHK.O) had also diluted existing shareholders as it issued new stock to partially fund the deal. The hedge fund's dissent at SilverBow is a rare example of shareholder activism from Riposte, which has only publicly voiced its displeasure at a company whose shares it owns on a couple of occasions in recent years. SilverBow's board is comprised of nine members, most of whom are independent directors. Strategic Value Partners had previously held the right to nominate two directors but one of its nominees dropped off the board on Monday, after the investment firm sold part of its stake. SilverBow operates on around 180,000 net acres in South Texas' Eagle Ford shale basin. The company's deal for Chesapeake's assets, which is due to close by the end of the year, will boost its operations by another 42,000 net acres. https://www.reuters.com/sustainability/boards-policy-regulation/riposte-capital-pushes-board-overhaul-energy-producer-silverbow-2023-11-30/

2023-11-30 11:28

PCE: inflation, consumer spending cooled in October Salesforce jumps on profit forecast raise Ford slumps on labor deal cost estimate Indexes: Dow up 1.47%, S&P up 0.38%, Nasdaq off 0.23% NEW YORK, Nov 30 (Reuters) - The Dow Jones Industrial Average closed at its highest level since January 2022 as investors crossed the finish line of a banner month for stocks and viewed cooling inflation data as a harbinger of easing Federal Reserve monetary policy. The Dow (.DJI) was the clear outperformer, with a solid boost from Salesforce (CRM.N) on the heels of its consensus-beating earnings report. The S&P 500 (.SPX) closed modestly green, while tech and tech-adjacent momentum stocks, led by Nvidia (NVDA.O), pulled the Nasdaq into negative territory. Still, the S&P 500 and the Nasdaq (.IXIC) notched their largest monthly percentage gain since July 2022. November was the Dow's best month for percentage gains since October 2022. "We're putting the cherry on top of a banner month," said Ryan Detrick, chief market strategist at Carson Group in Omaha. "It's a nice reminder for investors how worried everyone was a month ago, and we just finished one of the best months in history for stocks." Among data released Thursday, the Commerce Department's closely watched Personal Consumption Expenditures (PCE) report showed inflation is cooling as expected, along with consumer spending. The data reinforced expectations that the Fed has completed its rate hiking cycle. While New York Fed President John Williams reiterated the central bank's determination to remain data dependent, he would not rule out the possibility of further rate hikes if inflation fails to continue to moderate. "Kicking off much of the strength this month was the realization that inflation is quickly coming back to earth we saw that again today with core PCE data suggesting inflation is no longer a major headwind," Detrick added. Financial markets have priced in a 95.8% likelihood that the central bank will let its key Fed funds target rate stand at 5.25%-5.50% at December's policy meeting. "There's likely no rate hikes any time soon, the next move will likely be a cut, probably in the middle of next year," Detrick said. "The massive drop in (Treasury) yields this month is the bond market's way of saying it thinks the Fed is indeed done raising rates." Powell is scheduled to participate in two separate discussions on Friday, at 11 a.m. ET and 2 p.m. ET. The Dow Jones Industrial Average (.DJI) rose 520.47 points, or 1.47%, to 35,950.89, the S&P 500 (.SPX) gained 17.22 points, or 0.38%, at 4,567.8 and the Nasdaq Composite (.IXIC) dropped 32.27 points, or 0.23%, to 14,226.22. Among the 11 major sectors of the S&P 500, healthcare stocks (.SPXHC) outperformed, while communication services (.SPLRCL) suffered the steepest percentage decline. Dow Transports (.DJT), considered a barometer of economic health, advanced 1.4%. Salesforce jumped 9.4 % following the company's higher-than-expected profit forecast based on solid demand for its cloud services. Ford Motor Co (F.N) slid 3.1 % after the automaker set the cost of a new labor deal at $8.8 billion and cut its full-year forecast. Data cloud company Snowflake (SNOW.N) surged 7.1 % after it forecast fourth-quarter product revenue above Street estimates. Pinterest (PINS.N) and Snap Inc (SNAP.N) gained 2.4 % and 6.5 %, respectively, after Jefferies' upgrade of the social media firms to "buy" from "hold." Advancing issues outnumbered decliners on the NYSE by a 1.62-to-1 ratio; on Nasdaq, a 1.01-to-1 ratio favored decliners. The S&P 500 posted 37 new 52-week highs and two new lows; the Nasdaq Composite recorded 75 new highs and 109 new lows. Volume on U.S. exchanges was 13.22 billion shares, compared with the 10.55 billion average for the full session over the last 20 trading days. https://www.reuters.com/markets/us/wall-st-futures-edge-higher-easing-inflation-hopes-2023-11-30/

2023-11-30 11:25

COP28 president says engaging on fossil fuels 'essential' Countries and oil companies urged to work together Summit delegates hope for early approval of disaster fund deal DUBAI, Nov 30 (Reuters) - The incoming COP28 president, Sultan al-Jaber, opened this year's U.N. climate summit on Thursday by urging countries and fossil fuel companies to work together to meet global climate goals. Governments are preparing for marathon negotiations on whether to agree, for the first time, to phase out the world's use of CO2-emitting coal, oil and gas, the main source of warming emissions. Jaber, who is also the CEO of the United Arab Emirates' national oil company ADNOC, aimed to strike a conciliatory tone following months of criticism over his appointment at the head of COP28. In his opening remarks, Jaber acknowledged that there were "strong views about the idea of including language on fossil fuels and renewables in the negotiated text. ... I ask you to work together." "It is essential that no issue is left off the table. And yes, as I have been saying we must look for ways and ensure the inclusion of the role of fossil fuels." He touted his country's decision to "proactively engage" with fossil fuel companies, and noted that many national oil companies had adopted net-zero targets for 2050. "I am grateful that they have stepped up to join this game-changing journey," Jaber said. "But, I must say, it is not enough, and I know that they can do much more." DISASTER FUND As the U.N. climate conference kicked off, delegates were hoping to clinch an early victory on a disaster fund. The COP28 presidency published a proposal late Wednesday for countries to formally adopt the outlines of a new U.N. fund for poor countries being hit by climate disasters like extreme flooding or persistent drought. An early breakthrough on the damage fund - which poorer nations have demanded for years - could help grease the wheels for other compromises to be made during the two-week summit. Some diplomats said they hoped the draft deal for the fund would be approved quickly, with one delegate describing the possibility of objections at this point as "opening Pandora's box". The deal was crafted over many months of tough negotiations involving wealthy and developing countries. Establishing the fund allows rich countries to begin pledging money for it, and nations including Germany, Denmark and the Netherlands are expected to announce contributions over the next few days, European diplomats told Reuters. The European Union has pledged a "substantial" contribution, but wants countries whose economies have boomed in recent decades, like China and the UAE, to follow suit. "Everyone with the ability to pay should contribute," said EU Climate Commissioner Wopke Hoekstra, who said he wanted to "broaden the donor base beyond the usual suspects, simply because that reflects the reality of 2023." Adnan Amin, CEO of the COP28 summit, told Reuters this month the aim was to secure several hundred million U.S. dollars for the climate disaster fund during the event. He said he was "hopeful" that the UAE would make a contribution. "We cannot rest until this fund is adequately financed and starts to actually alleviate the burden of vulnerable communities," said Samoa's Ambassador to Europe, Pa’olelei Luteru, who is also the chairman of the Association of Small Island States (AOSIS) negotiating bloc. Another major task at the summit will be for countries to assess their progress in meeting global climate goals - chiefly the Paris Agreement goal of limiting global warming to well below 2 degrees Celsius (3.6 degrees Fahrenheit). This process, known as the global stocktake, should yield a high-level plan telling countries what they need to do. https://www.reuters.com/business/environment/cop28-summit-opens-with-hopes-early-deal-climate-damage-fund-2023-11-30/

2023-11-30 11:12

Nov 30 (Reuters) - A German court on Thursday found the government's policy to mitigate climate change to be unlawful on several points, and ordered Berlin to take emergency action. The Berlin-Brandenburg Higher Administrative Court said the government's action on transport and housing fell short under a law setting upper limits for carbon emissions for individual sectors. Under the ruling, Berlin must present emergency programmes to bring its policy on transport and housing back in line with the current Climate Protection Act from 2024 to 2030. The Climate Ministry, headed by Vice Chancellor Robert Habeck of the Greens, has taken note of the ruling and will evaluate the details to see how to proceed, a spokesperson for the ministry told Reuters. The ministry for transport did not immediately comment on the ruling. "We will examine how to proceed once we have the reasons for the judgement. Of course, this will also include examining measures that do justice to the court's judgement," the ministry for housing and construction said in a statement. With its ruling, the regional court upheld complaints from the environmental associations BUND and Deutsche Umwelthilfe (DUH) but left open the possibility to appeal. https://www.reuters.com/world/europe/german-court-finds-govt-climate-policy-unlawful-orders-emergency-action-2023-11-30/

2023-11-30 11:09

A look at the day ahead in U.S. and global markets from Mike Dolan The best month of the year for U.S. stocks and bonds draws to a close on Thursday with investors bulled up by warm feelings about disinflation, even with one wary eye on the latest OPEC+ meet. World stocks captured by MSCI's all-country index (.MIWD00000PUS) are doing even better, with November gains of almost 9% marking their best month in three years. Total returns for the month on global sovereign and corporate bonds were flirting with their best four weeks since the crash of 2008. U.S. Treasury yields alone held near lowest in around two months, with 10-year borrowing rates also heading for their biggest one-month fall since 2008's banking bust - when the Fed floored rates to near zero and first launched its quantitative easing round of bond buying. With signs of turn emerging in Federal Reserve policy guidance and October PCE inflation readings set to encourage that later in the day, rate cut fever was in full flow across the Atlantic too. Money markets now expect the European Central Bank to cut interest rates as soon as April - which would make it the first of the G3 central banks to budge - as November euro zone inflation figures came in much lower than forecast. Headline annual inflation in the bloc fell as low as 2.4% - within arm's length of the ECB's 2% target. 'Core' inflation readings favored were higher at 3.6% - but also well below expectations. Bank of Italy chief and ECB policymaker Fabio Panetta captured the mood on the end of the 20-month rate hike cycle by warning against 'useless damage' to the economy and financial stability from any temptation to overtighten. And while the U.S. dollar (.DXY), had been weakening of late on the back of falling U.S. yields - and futures pricing for as much as two quarter-point Fed rate cuts by June - the prospect of the ECB jumping the gun has dragged the euro back and buoyed the greenback again. Later on Thursday, U.S. PCE inflation for the prior month is pencilled to fall 3.0% from 3.4% - with a core also ebbing to 3.5%. Although slowing again the final quarter of the year, the startling performance of the U.S. economy during Q3 was underlined on Wednesday was an upward revision of GDP growth to more than 5% - while quarterly core rates of PCE inflation excluding food, energy and housing were as low as 1.6%. For a growing number of Fed policymakers, the hiking cycle at least is done and dusted. "Monetary policy is in a good place," Cleveland Fed President Loretta Mester said on Wednesday, echoing comments from previously hawkish Fed governor Christopher Waller the previous day. And the Fed's 'Beige Book' on economic conditions showed activity slowed from early October through mid-November "with four districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity." Concerns about overseas demand also mounted in China. China's manufacturing activity shrank for a second straight month in November and at a quicker pace that surprised economists, suggesting more stimulus will be needed to restore confidence in the spluttering economy. For Thursday alone, stocks were generally higher across the board - with Wall St futures marginally positive too. Oil prices nudged higher awaiting OPEC+'s decision. Key developments that should provide more direction to U.S. markets later on Thursday: * U.S. Oct personal income and consumption and PCE inflation gauge, Dallas Fed Oct PCE cut, U.S. weekly jobless claims, Chicago Nov PMI business survey; Canada Q3 GDP * New York Federal Reserve President John Williams speaks. European Central Bank President Christine Lagarde speaks. Bank of England policymaker Megan Greene speaks * OPEC+ ministerial meeting in Vienna * U.S. corporate earnings: Kroger, Ulta Beauty, Kirkland's, REE Automotive, Duluth, BOS, Academy Sports and Outdoors, 111, Burning Rock Biotech, Domo, Titan Machinery etc * U.S. Treasury auctions 4-week bills https://www.reuters.com/markets/us/global-markets-view-usa-2023-11-30/

2023-11-30 11:07

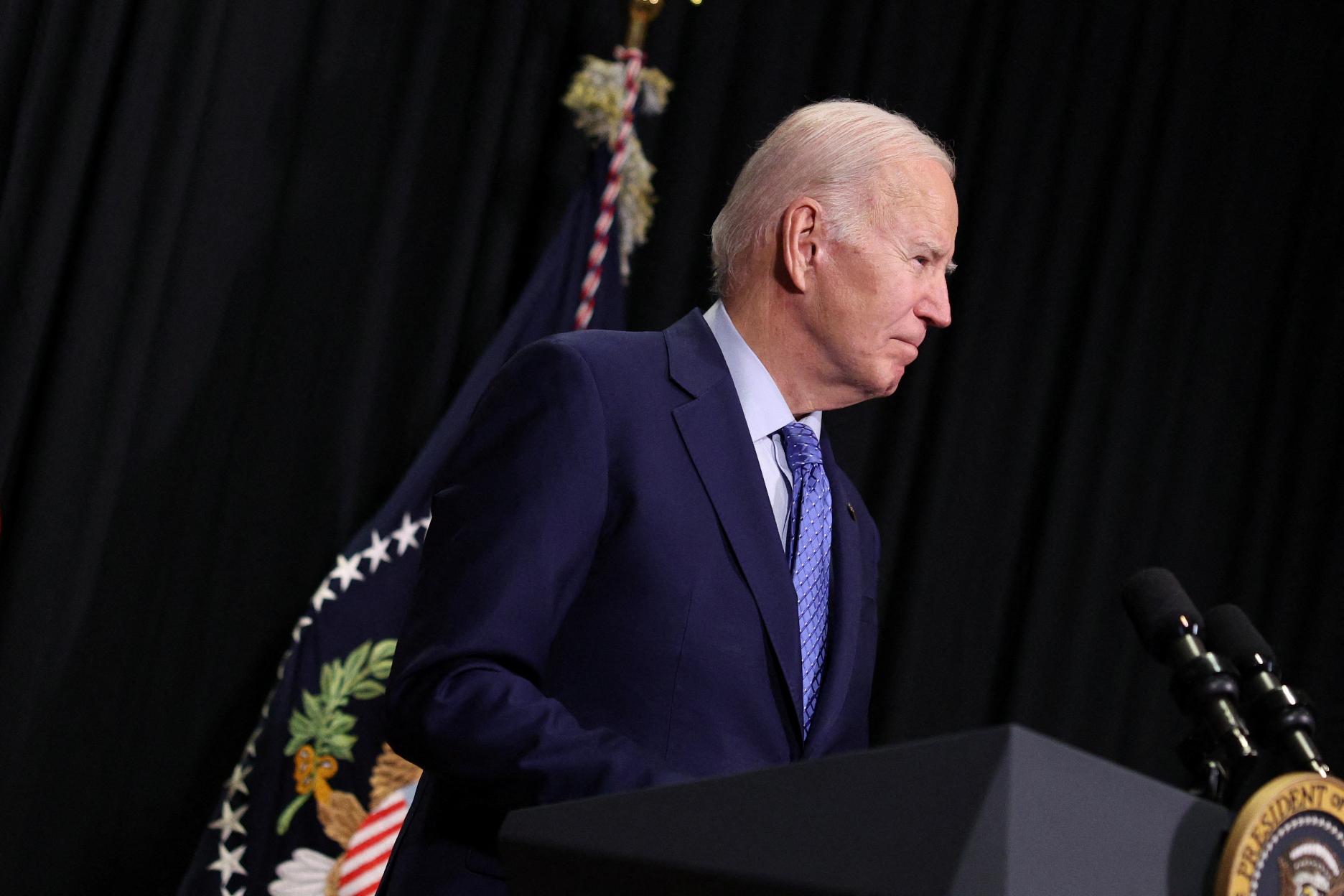

WASHINGTON, Nov 30 (Reuters) - The Democratic Party has no Plan B if President Joe Biden decided for any reason to halt his 2024 re-election campaign, and a sudden need to replace him as its standard-bearer would spark a messy intraparty battle. Despite weak poll numbers and questions, including from some Democrats, about his age, Biden has stuck to his plan to seek a second term after clearing the field of serious Democratic primary challengers when he announced in April that he was running again. Even if more Democratic candidates were to jump in now, the path forward would be unclear as deadlines to get on the primary ballot in critical states such as Nevada, South Carolina and Georgia have already passed. Biden loyalists, citing his record in office, argue that the party does not need a backup plan to defeat probable Republican nominee Donald Trump, who Biden beat in the 2020 election. Among the possible scenarios if the president, 81, did drop out: Democrats could pick another nominee next August at their convention, or even later, in line with party rules. Reuters spoke to multiple current and former officials who, while making clear they want Biden to succeed, acknowledge the party could face upheaval should the oldest president in U.S. history encounter a health issue or step aside for other reasons during the White House contest. Biden's running mate, Vice President Kamala Harris, who has her own popularity problems, would not automatically replace him as the top candidate if he stepped aside; she would benefit from their joint campaign infrastructure if she ran for president in his absence, but other Democrats would likely swoop in to the race as well. "There is no Plan B. If he were ... suddenly not to run, everyone you know would run. The VP scares no one," a senior Democrat told Reuters. If Biden were to drop out while the Democratic primaries were ongoing, other candidates could join the race, depending on state filing requirements. It normally takes months to set up a presidential campaign and raise the money to run, and deadlines to get on the ballot in consequential states including California, Illinois and Michigan are approaching in the coming weeks. Democratic officials are united behind the president, despite some trepidation, they say; otherwise big name competitors already would have entered the race. "Joe Biden will be the Democratic nominee and he will beat whichever MAGA extremist the Republicans put forward,” Biden campaign spokesperson Daniel Wessel said, referring to former President Trump's "Make America Great Again" slogan. Trump, 77, the frontrunner for the Republican nomination, also faces concerns about his age and a litany of charges including mishandling of classified documents and interfering in the 2020 election, which he lost to Biden. He denies wrongdoing. Multiple candidates are challenging Trump in the Republican primary race, giving the party built-in alternatives in the unlikely event that Trump drops out. GOOD OF THE COUNTRY? To the chagrin of the White House, Biden's age has become a defining part of the 2024 campaign. David Axelrod, a top White House adviser during Barack Obama's presidency, said Biden needed to decide whether it was smart to run again, after November polling showed him lagging in key swing states against Trump. "If he continues to run, he will be the nominee of the Democratic Party. What he needs to decide is whether that is wise; whether it's in HIS best interest or the country's?" Axelrod wrote on X, formerly known as Twitter. A physical examination in February found Biden healthy and "fit for duty." Biden has long believed that he is the Democrat most likely to beat Trump, but a Reuters/Ipsos poll on Nov. 7 showed his approval rating at 39%, its lowest since April. Democrats' primary elections start in February and end in June. They hold their convention in Chicago in August. Biden is expected to win his party's nomination after an easy primary process. He has a massive lead in polls over declared Democratic challengers Marianne Williamson, a writer, and U.S. Representative Dean Phillips. If he dropped out after the last primaries in June 2024, delegates would be free to vote for another candidate in Chicago. Any departure before the convention would almost certainly lead to jockeying among a broad group of presidential hopefuls, including Harris and California Governor Gavin Newsom, to convince more than 4,000 Democratic delegates to give them the job. It would augur a return to a time in which convention delegates truly chose, not just rubber-stamped, their nominee. "If he drops out before the convention, we will have an old-fashioned convention where the delegates essentially get to make up their mind (on whom to vote for) regardless of who they were elected to represent," said Elaine Kamarck, an elections expert, senior fellow at the Brookings Institution in Washington and a member of the Democratic National Committee. That could spark intraparty warfare, leaving Democrats to mirror Republicans in a battle in which candidates spend time and money fighting each other. Things get more complicated if for any reason Biden dropped out after the convention. Kamarck, the author of the book "Primary Politics," said the 435 members of the DNC would then meet in a special session to select a nominee. There is some precedent for switching out a nominee. In 1972, then Senator Thomas Eagleton withdrew as Democratic presidential candidate George McGovern's vice presidential running mate after revelations of his treatment for depression forced him out of the race. The DNC had an emergency meeting to fill the vacancy and selected Sargent Shriver to take his place. McGovern lost the election. Newsom has been particularly active as a "surrogate" for Biden by taking high-profile swipes at Republican presidential candidate Ron DeSantis, the governor of Florida. The two men are taking part in a televised debate on Thursday, an unusual move for someone who is not a declared presidential candidate. Newsom's office did not respond to a request for comment. "A bunch of the surrogate activity we see out there - like Newsom all over helping Biden - is partially to remind Democratic voters they are out there as an option," the senior Democrat said. https://www.reuters.com/markets/us/rate-cut-hopes-buoy-us-stocks-ahead-uncertain-2024-2023-11-30/