2023-11-29 20:18

NEW YORK, Nov 29 (Reuters) - J.P. Morgan equity strategists on Wednesday issued a dour outlook for U.S. stocks for the year ahead, pointing to weak expected earnings growth, expensive valuations and high geopolitical risks. The bank projected a 2024 price target for the benchmark S&P 500 (.SPX) of 4,200, or about 8% below current levels. Absent rapid easing of monetary policy by the Federal Reserve, "we expect a more challenging macro backdrop for stocks next year," J.P. Morgan's Dubravko Lakos-Bujas and his team said in an outlook report on Wednesday. The firm expects S&P 500 earnings growth of 2% to 3% in 2024 -- a rate that's well below the consensus analyst estimate of 11.4% growth next year, according to LSEG data. Consensus earnings-per-share estimates are in sync with assumptions of a "Goldilocks" environment that sees inflation cool without a significant hit to demand and pricing power, the firm said in its report. "In contrast to this robust outlook, we expect lower sequential revenue growth, no margin expansion, and lower buyback executions," the strategists wrote. Current valuations are "rich," J.P. Morgan said, "especially in light of the aging business cycle, restrictive monetary policy, and geopolitical risks." Those risks include two major wars and 40 countries holding national elections including the U.S., which the strategists expect will drive equity volatility to be generally higher in 2024 than in 2023. Further, the strategists said a recession is "a live risk for next year even though investors are not pricing in this uncertainty consistently across geographies, styles, and sectors yet." https://www.reuters.com/markets/us/jpmorgan-strategists-see-challenging-backdrop-us-stocks-2024-2023-11-29/

2023-11-29 20:13

WASHINGTON, Nov 29 (Reuters) - Conservative U.S. Supreme Court justices on Wednesday signaled skepticism toward the legality of certain proceedings conducted in-house by the Securities and Exchange Commission to enforce investor-protection laws - a case that gives them an opportunity to further undercut the power of federal agencies. The court, which has a 6-3 conservative majority, heard arguments in an appeal by President Joe Biden's administration of a lower court's ruling that deemed unconstitutional the SEC's tribunal proceedings before administrative judges installed by the agency that can lead to financial penalties for infractions. The conservative justices focused on a part of the 2022 ruling by the New Orleans-based 5th U.S. Circuit Court of Appeals that found that in-house proceedings violated the U.S. Constitution's Seventh Amendment right to a jury trial. Texas-based hedge fund manager George Jarkesy, who the SEC fined and barred from the industry after determining he had committed securities fraud, challenged the legality of the agency's system. His lawsuit was supported by numerous conservative and business groups, which long have complained about the regulatory reach of the federal "administrative state" in areas such as energy, the environment, climate policy, workplace safety and financial regulation. The conservative justices expressed concern that SEC administrative proceedings are conducted for certain charges, such as fraud, without a jury, when similar cases alleging fraud in federal court would have one. "It does seem to me to be curious that - and unlike most constitutional rights - you have that right until the government decides that they don't want you to have it. That doesn't seem to me the way the Constitution normally works," Chief Justice John Roberts said. "What sense does it make to say the full constitutional protections apply when a private party is suing you, but we're going to discard those core constitutional, historic protections when government comes at you for the same money?" Justice Brett Kavanaugh asked Justice Department lawyer Brian Fletcher, defending the SEC's system. A ruling by the court against the SEC could reduce or delay action against misconduct by brokers, investment advisers and others, and potentially frustrate enforcement at other federal agencies as well. Fletcher warned of "wide repercussions" from such a decision, noting that two dozen agencies impose penalties in administrative proceedings. The SEC in recent years has faced a series of legal attacks even as the Supreme Court's conservatives display skepticism toward expansive federal regulatory power. The court in 2018 faulted the way the SEC selected its in-house judges, and in April made it easier for targets of agency actions to mount challenges in federal court. The court also has curbed the power of other agencies in recent years including the Environmental Protection Agency. SEC critics have said the agency has an unfair advantage litigating cases before its own judges in "administrative proceedings" rather than before a jury in federal court. The SEC, which enforces various U.S. laws that protect investors, pursued 270 new in-house proceedings in the fiscal year that ended on Sept. 30, compared to 231 in federal court. 'NO RESPECT' Liberal Justice Elena Kagan told Jarkesy's lawyer Michael McColloch that Congress gave the SEC more power after the Great Depression of the 1930s and later financial crises to combat investor fraud given that other remedies were inadequate. "Is Congress' judgment that more powers were needed within an administrative agency entitled to no respect?" Kagan asked. Some justices asked questions that suggested a ruling against the SEC could be narrow. Roberts appeared interested in McColloch's view that certain SEC actions could be brought in-house, such as those involving taxes or Social Security benefits, while others would need to go to federal court. The SEC in 2011 began investigating Jarkesy, who founded two hedge funds with his Houston-based investment advisory firm, Patriot28 LLC. The funds had about 120 investors and roughly $24 million in assets under management. An SEC administrative judge found Jarkesy and his firm violated the Securities Act of 1933 and other laws including by misrepresenting the identity of the funds' auditor and value of the holdings. The SEC then ordered them to pay a $300,000 civil penalty and Patriot28 to disgorge nearly $685,000 in ill-gotten gains. The 5th Court threw out the SEC's decision. In addition to its conclusion about the right to a jury trial, the 5th Circuit found that Congress gave the SEC too much power to choose whether to bring cases in-house, and that job protections for its administrative judges make them too difficult to remove, infringing on presidential powers under the Constitution. In another case involving agency powers, the justices in October heard a constitutional challenge by the payday loan industry to the Consumer Financial Protection Bureau's funding structure. Rulings in that case and the SEC one are expected by the end of June. https://www.reuters.com/markets/us/us-supreme-court-weighs-legality-sec-in-house-enforcement-2023-11-29/

2023-11-29 20:02

ORLANDO, Florida, Nov 29 (Reuters) - If cash has been king, the Fed may be plotting regicide. As the Federal Reserve's policy 'pivot' draws into view, investors face a $6 trillion question - where to deploy this record amount of cash if the beefy interest rate returns drawing people there evaporate again? Earning short-term rates not seen for well over a decade, the attraction of 5% cash is considerable and raises a high bar for other assets to perform in such an uncertain economic environment. But once the first Fed cut comes into view, that money will move rapidly out the maturity curve and into riskier assets. Doubly fast if, as is consensus, those cuts arrive without being forced by recession. And the scramble to lock into high long-term coupons could quickly become a stampede. Fed Governor Christopher Waller this week gave the strongest hint yet that the first Fed cut may be closer than many had been anticipating, and rates and bond traders have reacted swiftly. Rates futures markets are now pricing in more than 100 basis points of cuts next year starting in May, and the two-year Treasury yield is its lowest since July - it has slumped 35 basis points this week alone. A recent report by BlackRock, the world's largest asset manager, notes that on average, cash returns 4.5% in the year following the final Fed rate hike, significantly underperforming a wide array of asset classes. This becomes particularly acute once the Fed actually starts cutting rates, as the opportunity cost of owning an asset whose nominal and real returns are dwindling relative to other asset classes is magnified even further. Emerging market debt, U.S. equities and dividend stocks are investments which, on average, provide the juiciest returns of 20% or more in the 12 months after the Fed's last rate hike, the BlackRock report finds. "Clients should be deploying cash into assets that are consistent with their base case scenario for 2024," says Justin Christofel, co-head of Income Investing for BlackRock's Multi-Asset Strategies & Solutions group and one of the authors of the report. "There's a lot of dry powder out there and that can power decent returns," he adds. MAKE CASH TRASH AGAIN? There certainly is a lot of dry powder. The latest figures tracked by ICI, a global funds industry body, show that total money market fund assets stood at a record high $5.76 trillion on Nov. 21. Of that, $2.24 trillion is in retail investor funds and $3.52 trillion is in institutional funds. That has risen substantially since the Fed started its rate-hiking cycle early last year. According to Bank of America, investors have poured $1.2 trillion into money market funds so far this year. Cash has been investors' favorite destination in recent years, and with an annual return tracking 4.5%, it is on course for its best year since 2007. BofA's private clients' cash holdings as a share of their total $3.2 trillion assets under management is currently 12%, close to the average level over the past 20 years of around 13%. If their wider holdings are representative of investor positioning more broadly, a negative correlation between fixed income and equities could soon emerge. BofA private clients' share of equities stands at 60% of total assets, above the longer term average of 56%, and their debt allocations is currently 21.5%, below the average 26%. With market-based borrowing costs heading lower in anticipation of official rates being cut next year, many investors will be strongly tempted to lock in yields of 4.5% across the U.S. Treasuries curve now. Those with a more benign view of the economy will be more risk-friendly. Analysts at Goldman Sachs, BofA and Deutsche Bank, among others, see the S&P 500 hitting new all-time highs of at least 5000 next year, while U.S. high yield debt is still yielding more than 8% nominally. Ultimately, fund managers will have to work that bit harder and be more selective, as the easy money from simply parking clients' investment in cash can no longer be made. "A negative bond-equity correlation paves the way for the only free lunch in finance: diversification," Robeco's investment team says. Bridgewater founder Ray Dalio said as recently as last month that cash still holds "relatively attractive appeal," offering a real return of around 1.5% with no price risk. It might not be long, however, before he veers back towards his bluntly-articulated view from early 2020 that "cash is trash." (The opinions expressed here are those of the author, a columnist for Reuters.) https://www.reuters.com/markets/us/fed-starting-gun-6-trillion-dash-cash-mcgeever-2023-11-29/

2023-11-29 19:58

Nov 29 (Reuters) - U.S. economic activity slowed from early October through the middle of November, while businesses reported inflation largely moderated and it was easier to hire workers, the Federal Reserve said in a report on Wednesday, underscoring waning economic momentum into the tail end of the year. The U.S. central bank released its latest temperature check on the state of the economy a day after Fed Governor Christopher Waller, an influential voice on its policy-setting committee, flagged that current progress on lowering inflation means the possibility of a reduction in the Fed's benchmark overnight lending rate next year is coming into view. "Economic activity slowed since the previous report, with four districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity," the Fed said in its survey, known as the "Beige Book," which polled business contacts across the central bank's 12 districts through Nov. 17. "The economic outlook for the next six to twelve months diminished over the reporting period." The Fed kept its policy rate unchanged in the 5.25%-5.50% range earlier this month for the second consecutive meeting after ramping up borrowing costs by more than 5 percentage points over the past 20 months to quell high inflation. The Fed is seeking to weaken the economy just enough to bring inflation down without causing a recession. The four Fed districts reporting growth were Dallas, Richmond, Atlanta and Chicago. Most districts said growth was down, with the Kansas City Fed reporting consumers increasingly likely to "share a roof and share meals" to manage household budgets, and contacts in the San Francisco Fed district expressing concern over a weaker economic outlook and increased overall uncertainty. PRICE PRESSURES Investors expect Fed policymakers to stand pat again at the Dec. 12-13 policy meeting, given the progress made in returning inflation to the central bank's 2% target rate and the fact that it will take more time for the full impact of the rise in its policy rate to filter through the economy. By the Fed's preferred measure, inflation in September was running at a 3.4% annual rate, down from the 7.1% peak reached in June of last year when pandemic-induced goods and labor supply shortages juiced price pressures. New inflation data is scheduled to be released on Thursday. There were some hints in the survey that firms are finding it harder to raise prices, potentially an important signal for policymakers on the hunt for signs of further cooling in inflation. "Some firms noted that pricing power was reduced by weakening demand and competition," the Cleveland Fed reported. The Dallas Fed noted that price pressures were above average in the service sector, but modest in other sectors, adding that "outlooks worsened ... with numerous contacts citing geopolitical instability and high interest rates as headwinds." The economy grew faster than initially thought in the third quarter, government data showed earlier on Wednesday, but activity appears to have since moderated as higher borrowing costs dampen hiring and spending. A separate gauge of consumer prices was flat in October, retail spending has weakened, and there has been a slow easing in wage growth, although the labor market still remains tight. The mixed picture on the labor market featured in the Fed's latest survey, with demand for labor continuing to ease and "flat to modest" increases in overall employment. Some employers reported feeling comfortable letting go low performers, although "several districts continued to describe labor markets as tight with skilled workers in short supply." Wage growth remained modest to moderate in most Fed districts, the report said, although some wage pressures did persist. https://www.reuters.com/markets/us/us-economy-slowed-recent-weeks-fed-survey-shows-2023-11-29/

2023-11-29 19:56

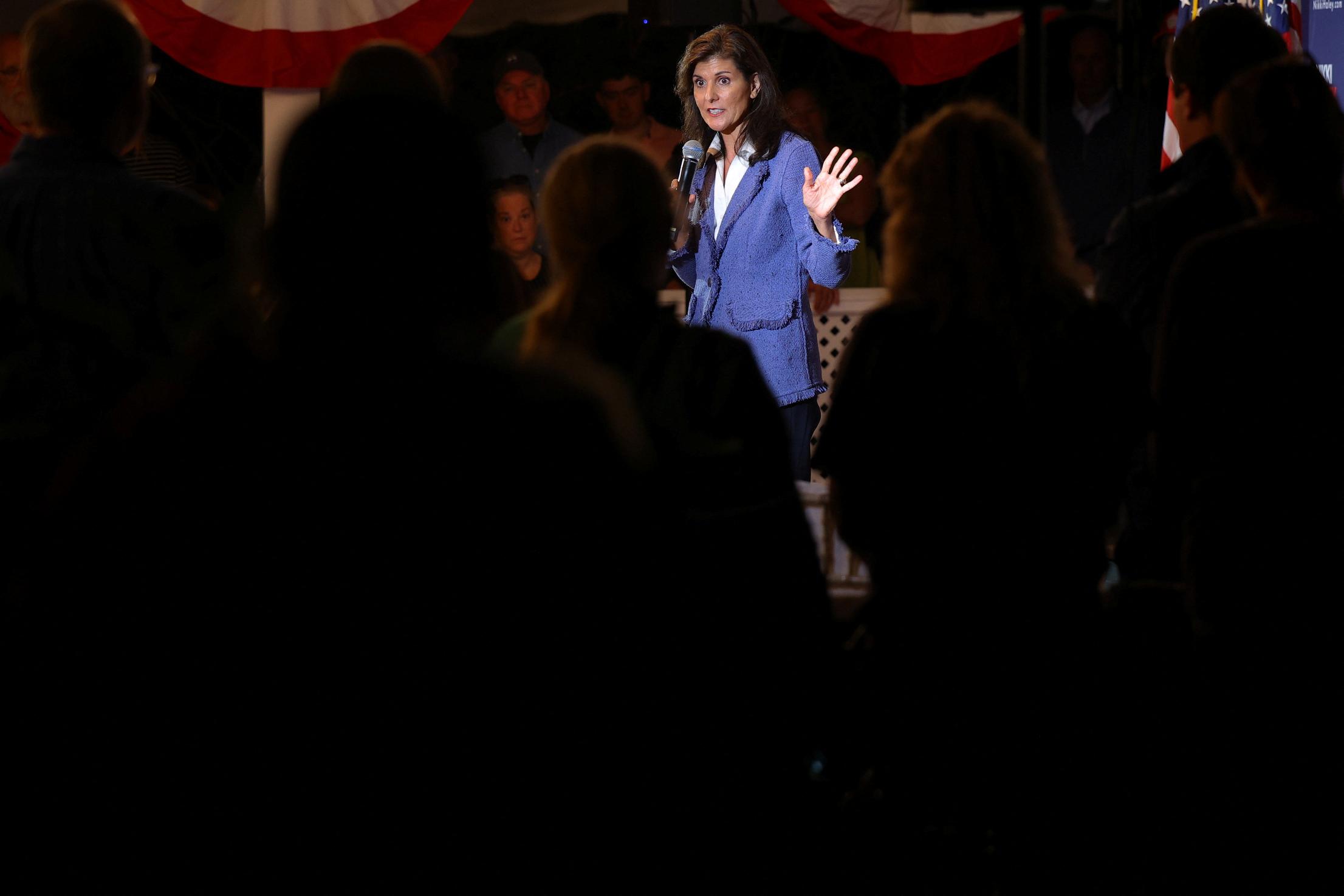

For 2024 US election stories, results and data: WASHINGTON, Nov 29 (Reuters) - Nikki Haley is having a moment: The 2024 Republican presidential candidate is seeing a swell in media coverage, new interest from big-dollar donors and increasing chatter that she is poised to make a real run at Donald Trump. But there is buzz, and there is reality. The reality is that Haley, 51, faces a massive uphill battle to take down the former president and gain the Republican presidential nomination - but the sooner the race can be whittled down to her and Trump, 77, the better her still-remote chances. "I don't think you can look at the numbers right now and see much of a path for anyone other than Trump," said Kyle Kondik, an elections analyst at the University of Virginia Center for Politics. Trump, according to aggregates of national opinion polls, holds about a 50-percentage-point lead over her, with Florida Governor Ron DeSantis also in the mix. Trump also has large leads in early Republican nominating states such as Iowa and New Hampshire. Still, Haley has been gaining ground in some polls on the back of strong performances in debates. The polls show her tied with DeSantis in Iowa and surpassing him in New Hampshire. "There is a narrow path" to victory for Haley, said Republican pollster Whit Ayres. That path involves top-tier finishes in both Iowa and New Hampshire and perhaps a victory in her home state of South Carolina, where she served as governor. That would provide Haley with the things she would need most to have a chance against Trump: momentum, media coverage and money flowing in from anti-Trump donors. From there, it would be a matter of trying to compete in the larger states later in the calendar such as California and Texas, which award large swaths of delegates. "Momentum matters a tremendous amount in these things," Ayres said. "So much of it depends on who does well in early states. That has a dramatic effect on later states." Opinion polls suggest winning South Carolina, her home state, will be a tall order: According to RealClearPolitics, which aggregates poll numbers, Trump has a 30-point edge over the field there with Haley in second place. Trump's edge in Iowa is also about 30 points, where Haley is running third behind DeSantis, and a 27-point edge over Haley in New Hampshire. Trump has gained strength since facing a battery of legal charges surrounding his attempts to overturn Democrat Joe Biden's 2020 election win and pay hush money to a porn star, with voters who were initially reluctant to support him rallying to his side. HEAD-TO-HEAD WITH TRUMP? To have a chance, Haley needs the field to shrink so that ultimately, it becomes a two-person race between her and Trump, which would allow her to try to knit together the anti-Trump factions within the party, while also perhaps stealing some of Trump's voters. In a memo by Haley's team released earlier in November, campaign manager Betsy Ankney pointed to polling that showed Haley strengthening in Iowa and New Hampshire and Desantis weakening. "The field has consolidated and will continue to consolidate in the coming weeks, and as the only candidate with momentum - Nikki is gaining the most from that," said Olivia Perez-Cubas, a Haley spokesperson. So far, Trump's campaign has trained most of their fire on DeSantis. Should Haley's rise continue, she would likely face a full onslaught of attacks from the Trump campaign, pro-Trump social media influencers, and related super PAC spending groups. A Trump spokesperson did not respond to questions about whether the campaign would soon turn its attention to Haley. Political analysts largely agree that Haley's best chance against Trump would be facing him head on, without other rivals, but even that would require a significant and perhaps unprecedented swing in Republican voter opinion. CONTRASTS BETWEEN TRUMP AND HALEY Trump's free-wheeling, anti-immigration platform remains immensely popular with much of the Republican voter base. Haley, by contrast, is more of a traditional Republican establishment candidate who has campaigned as a foreign policy hawk and fiscal conservative. While Haley favors a more interventionist foreign policy than the more isolationist Trump and has taken a more hardline stance on abortions than the former president, it is not clear whether she is drawing more support for her policies or for the fact that she is simply not Trump. Haley, who served as U.N. ambassador under Trump, further cemented herself as the establishment candidate on Tuesday when the influential Koch network endorsed her and pledged to use its vast resources to promote her candidacy. Haley will have another chance to make her case to a national audience next week when the fourth Republican debate will be held in Tuscaloosa, Alabama. https://www.reuters.com/markets/us/nikki-haleys-getting-buzz-faces-tough-math-beat-trump-2023-11-29/

2023-11-29 19:47

WASHINGTON, Nov 29 (Reuters) - The U.S. Treasury Department said on Wednesday it had imposed sanctions on 21 Iranian and foreign nationals and entities for their involvement in financial networks to benefit Iran's defense ministry and other parts of its military. In a statement, the Treasury said those sanctioned helped generate funds for Iran’s Ministry of Defense and Armed Forces Logistics, the Iranian Armed Forces General Staff (AFGS), and the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF). "Iran generates the equivalent of billions of dollars via commodity sales to fund its destabilizing regional activities and support of multiple regional proxy groups, including Hamas and Hizballah," it said, referring to the Islamist Palestinian group and the Lebanese Shi'ite armed force and political party. The Treasury said the Iranian military used "intricate networks of foreign-based front companies and brokers to enable these illicit commercial activities." Washington wants to crack down on Iran's evasion of previous U.S. sanctions and cut off support for Iran-backed Palestinian militant group Hamas following its attack on Israel last month. Those sanctioned include Iran-based companies Sepehr Energy Jahan Nama Pars Company and Pishro Tejarat Sana Company as well as Iranian citizens Majid A’zami, Elyas Niroomand Toomaj and Seyyed Abdoljavad Alavi. Treasury also put sanctions on two Hong Kong-based firms, accusing Puyuan Trade Co Limited of brokering sales of tens of millions of condensate, a form of ultralight crude oil, to HK Sihang Haochen Trading Limited. Also sanctioned were several United Arab Emirates-based firms. These included Unique Performance General Trading LLC, to which Sepehr Energy agreed to sell Iranian light crude for delivery in China, and OPG Global General Trading Co LLC, which offered to sell crude and gasoline on Sepehr Energy's behalf to Gulf customers for onward shipment to Europe, the Treasury said. In addition, the Treasury said it had sanctioned Dubai-based JEP Petrochemical Trading LLC, which paid Dubai-based Future Energy Trading LLC the equivalent of more than $400 million to buy Iranian oil from Sepehr Energy. Three other companies restricted were Dubai-based A Three Energy FZE along with Sharjah-based brokers Tetis Global FZE and Royal Shell Goods Wholesalers LLC, which Sepehr Energy used to enable sales of Iranian commodities to foreign buyers. In addition, the Treasury said imposed sanctions on four companies and three individuals for supporting illicit financial networks on behalf of the IRGC-QF. It named the companies as UAE-based Transmart DMCC and Solise Energy (FZE) and as Singapore-based MSE Overseas PTE Ltd and Sealink Overseas PTE Ltd and the individuals as Zabi Vahap, Adelina Kuliyeva and Mehboob Thachankandy Palikandy. https://www.reuters.com/world/us/us-puts-sanctions-21-people-entities-aiding-iran-2023-11-29/