2023-11-29 19:29

Nov 29 (Reuters) - Slovak truckers will block the main border crossing with Ukraine from Friday, the country's truckers association UNAS said, joining Polish protests to win restrictions against Ukrainian drivers. Polish truckers have been blocking several crossings with Ukraine since Nov. 6 to demand tougher conditions for Ukrainian peers. Polish and Slovak truckers complain Ukrainian truckers offer cheaper prices for their services and also transport goods within the European Union, rather than just between the bloc and Ukraine. Slovak drivers staged a symbolic protest earlier this month but will begin their blockade at the Vysne Nemecke/Uzhhorod crossing from 3 p.m. (1400 GMT) on Friday. "The purpose of the protest is to join truck carriers from Poland," UNAS said in a statement on its Facebook page on Wednesday. "We cannot leave them alone in the fight." They say their business has been undercut since truckers from Ukraine gained exemptions from seeking permits to cross following Russia's invasion of Ukraine in February 2022. Vysne Nemecke is the only crossing on the Slovakia-Ukraine border open to heavy trucks. UNAS said its blockade would not restrict humanitarian aid, military support or fuel and chilled food deliveries. Polish truckers started protests this month, demanding the EU reintroduce a permit system for Ukrainian truckers entering the bloc and for EU truckers entering Ukraine, with exemptions for humanitarian aid and military supplies. Ukraine says the protest - which has left over a thousand lorries stranded for days in queues that stretch for miles (km) - is damaging its fragile war-time economy by hampering exports and stopping supplies of essentials like motor vehicle gas (LPG) from entering the country. Kyiv also says humanitarian aid has been blocked, which protesters deny. EU Commissioner for Transport Adina Valean said on Wednesday that Ukraine and the EU could not be "taken hostage" by Polish truckers' blockades, calling the situation "unacceptable". https://www.reuters.com/world/europe/slovak-truckers-block-ukraine-crossing-joining-polish-protests-2023-11-29/

2023-11-29 19:09

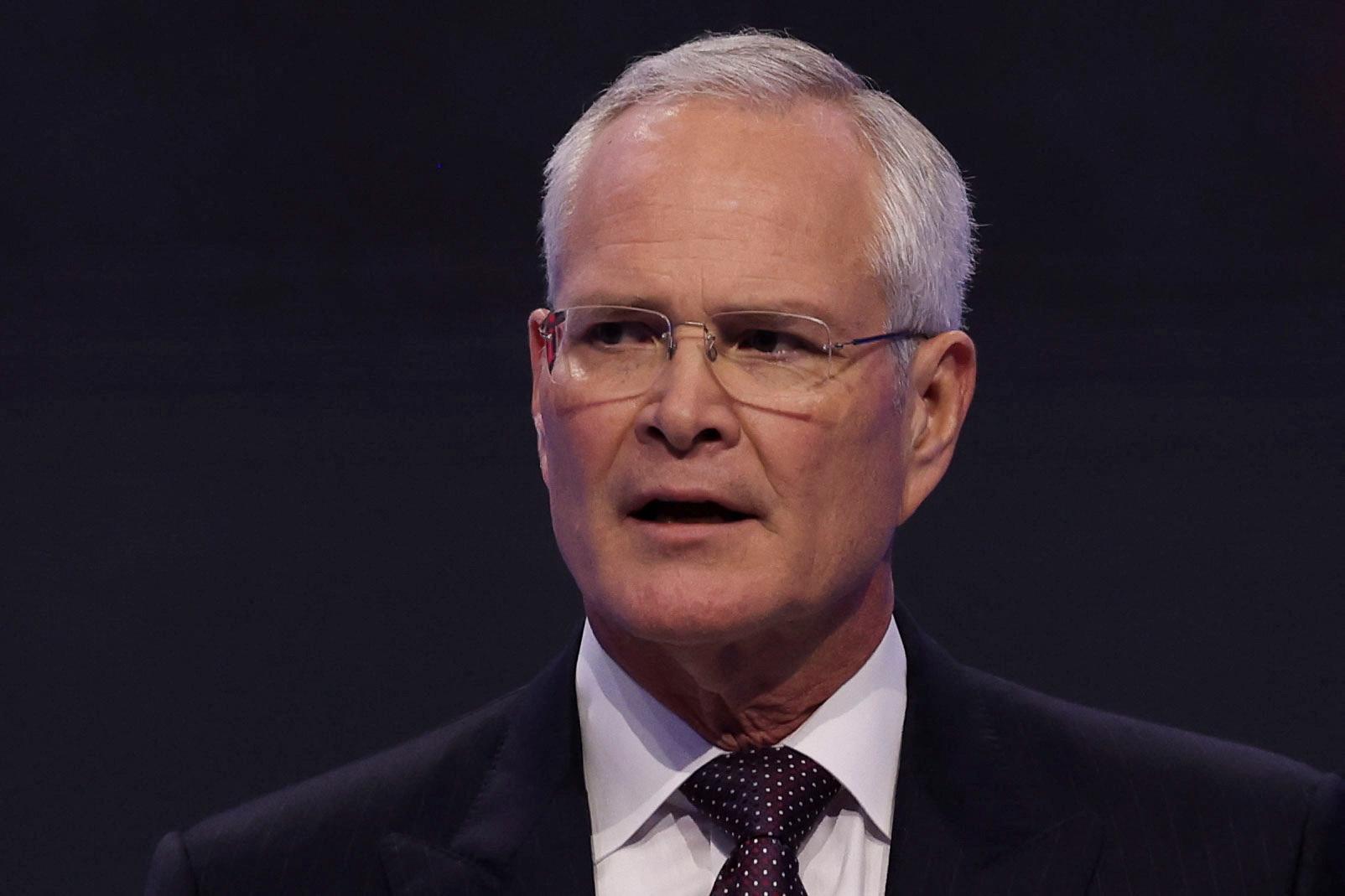

HOUSTON, Nov 29 (Reuters) - Exxon Mobil Corp (XOM.N) Chief Executive Darren Woods is making plans to attend the COP28 climate summit in Dubai next week, two people familiar with the matter said, in what would mark a first for an Exxon CEO, if confirmed. Woods is expected to advocate that reducing carbon emissions should be a priority in addressing climate change, rather than reducing oil production. He has made that something of a mantra in the past couple of years that the world needs affordable energy and that cutting emissions is a more effective solution. "We commit to solving the world’s energy and emissions challenges simultaneously," Darren Woods said at the APEC CEO summit earlier this month. A record number of oil and gas industry representatives are expected to be in attendance at this year's COP, a summit intended to address the catastrophic effects of climate change, which scientists say is largely fueled by fossil fuel industry emissions. Leading the climate talks is Sultan al-Jaber, also chief executive of the UAE’s state-owned Abu Dhabi National Oil Company (ADNOC), whose work with the industry in the run-up to the summit has led to more than 20 oil and gas companies signing up to voluntary climate pledges. Environmentalists have criticized Exxon's plans to increase oil production and failure to address scope 3 emissions, or emissions caused by burning the fuels that Exxon sells. Exxon on Wednesday said it decided to join a United Nations-led initiative to monitor its methane emissions, following in the footsteps of its European rivals taken years ago. Exxon has been catching up with industry emission reduction initiatives since 2021, when it suffered an investor rebellion over the company's lack of climate strategy. The move follows the acquisition in October of U.S. shale producer Pioneer Natural Resources (PXD.N), already a member of the U.N.'s Oil & Gas Methane Partnership (OGMP). Reuters reported in October that Exxon was considering joining the partnership after that deal. Exxon could either join the group or face the reputation risk of removing Pioneer assets from OGMP, the world's largest initiative to monitor methane emissions. The program uses standardized, independently verified methods that are comparable across the industry. Exxon says technology advancements allowed it to join the initiative and that the decision guards no relation with Pioneer's acquisition. "The evolving technical landscape and ongoing collaboration with the United Nations Environment Programme (UNEP) have opened the door for us to meet OGMP 2.0’s expectations," Exxon's Chief Environmental Strategist Matt Kolesar said in a statement. More than 95 companies, including Shell, BP, Total, Conoco and Occidental are part of the U.N. initiative. Chevron is the main absence among large Western oil producers. https://www.reuters.com/business/environment/exxon-ceo-darren-woods-likely-attend-cop28-sources-2023-11-29/

2023-11-29 18:58

DUBAI/LONDON, Nov 29 (Reuters) - OPEC+ talks on 2024 oil policy ahead of a Thursday ministerial meeting were focusing on an additional oil supply cut to support the market, although the details were yet to be agreed, sources close to the group said. Saudi Arabia, Russia and other members of OPEC+ pump around 43 million barrels per day, or over 40% of global supply. They already have supply cuts in place of about 5 million bpd, or about 5% of global demand. Two OPEC+ sources said the group was discussing a deeper collective supply cut in the first quarter of which the exact duration and volume was not yet clear. One of them said OPEC+ may not be able to agree on this and it was possible the meeting could roll over existing policy. The Wall Street Journal reported the new cut could be of as much as 1 million bpd, a figure that the Financial Times had also reported on Nov. 17. On Tuesday, sources had said a further delay to Thursday's meeting of the Organization of the Petroleum Exporting Countries and allies was possible, although as of Wednesday evening the meeting looked set to go ahead as planned. The meeting has already been delayed from Nov. 26. OPEC+ sources said this was because of a disagreement over output quotas for African producers, though sources have since said the group has largely resolved this issue. The talks on African quotas come against a backdrop of the United Arab Emirates being allowed, as per OPEC+'s last agreement in June, to raise output in 2024. Global benchmark Brent crude oil was up 1.3% and near $83 a barrel as of 1836 GMT on Wednesday . Prices have dropped from near $98 in late September, pressured by concerns about weaker economic growth and expectations of a supply surplus in 2024. OPEC+ talks over production quotas have often been difficult in the past, most recently at their June meeting, which extended existing oil output cuts into 2024 and agreed the increase for the UAE because of its efforts to expand production capacity. Saudi Arabia, Russia and other members of OPEC+ have already pledged total oil output cuts of about 5 million bpd in a series of steps that started in late 2022. This includes Saudi Arabia's additional voluntary production cut of 1 million bpd, which is due to expire at the end of December, and a Russian export cut of 300,000 bpd until the end of the year. https://www.reuters.com/markets/commodities/opec-talks-continue-no-meeting-delay-currently-expected-sources-say-2023-11-29/

2023-11-29 18:31

NEW YORK, Nov 29 (Reuters) - Federal Reserve Bank of Atlanta President Raphael Bostic said on Wednesday he expects U.S. growth to slow and inflation to continue to ease on the back of tight monetary policy. "The research, data, survey results, and input from business contacts tell me that tighter monetary policy and tighter financial conditions more broadly are biting harder into economic activity," Bostic wrote in an essay published by his bank. "At the same time, I don’t think we’ve seen the full effects of restrictive policy, another reason I think we’ll see further cooling of economic activity and inflation." Bostic said comments from local business contacts "points to ongoing disinflation and a measured slowing in economic activity." He added there's additional "good news" in that as the economy slows, it is not doing so so rapidly that it signals a recession. https://www.reuters.com/markets/us/feds-bostic-sees-slower-growth-falling-inflation-pressures-2023-11-29/

2023-11-29 18:17

Nov 29 (Reuters) - Health insurers Cigna (CI.N) and Humana (HUM.N) are in talks for a merger, the Wall Street Journal reported on Wednesday, citing people familiar with the matter. The companies are discussing a stock-and-cash deal that could be finalized by the end of the year, according to the report, without providing details on the deal value Humana had a market capitalization of roughly $62.84 billion and Cigna had a market value of $83.71 billion, based on Tuesday's closing prices. Cigna's shares were down 4.4% in noon trading, while Humana's stock was flat. The companies did not immediately respond to Reuters requests for comment. https://www.reuters.com/markets/deals/health-insurers-humana-cigna-talks-merge-wsj-2023-11-29/

2023-11-29 17:37

OTTAWA, Nov 29 (Reuters) - Most financial institutions consulted by the Bank of Canada (BoC) expressed skepticism about the benefits of a potential digital currency, the central bank said on Wednesday. Canada, like most other countries, is exploring a digital version of its currency to avoid leaving digital payments to the private sector as COVID-19 pandemic helped accelerate a decline in the use of cash. As part of that effort, the BoC consulted civil society groups, focus groups, financial institutions, and the general public to gauge support and the viability of a digital Canadian dollar. Feedback received was varied, with civil society and focus groups broadly in support of the idea, while financial institutions and the general public were more reserved, according to a statement from the BoC. "The need for a digital dollar doesn't exist yet, but we're getting ready in case one day parliament and the government of Canada ask us to issue one," the bank said. Most of the 36 financial institutions consulted by the bank felt existing digital payment services served Canadians well and that a digital dollar would not offer any advantages over existing private offerings. Financial institutions were concerned that a digital dollar could replace bank deposits, reducing a source of funding for their operations, the BoC said. The institutions also noted that reducing the physical barrier cash creates could accelerate potential bank runs during a crisis. A few countries have introduced central bank digital currencies (CBDCs). China is trialling a prototype yuan with 200 million users, India is gearing up for a pilot and some 130 countries representing 98% of the global economy are exploring digital cash. Earlier this year, a comprehensive survey of the global investment industry on central bank digital currencies showed both limited support and a lack of understanding of how a digital dollar, euro, yen or pound would work. https://www.reuters.com/markets/currencies/most-canadian-financial-institutions-skeptical-about-potential-digital-c-central-2023-11-29/