2023-11-29 06:49

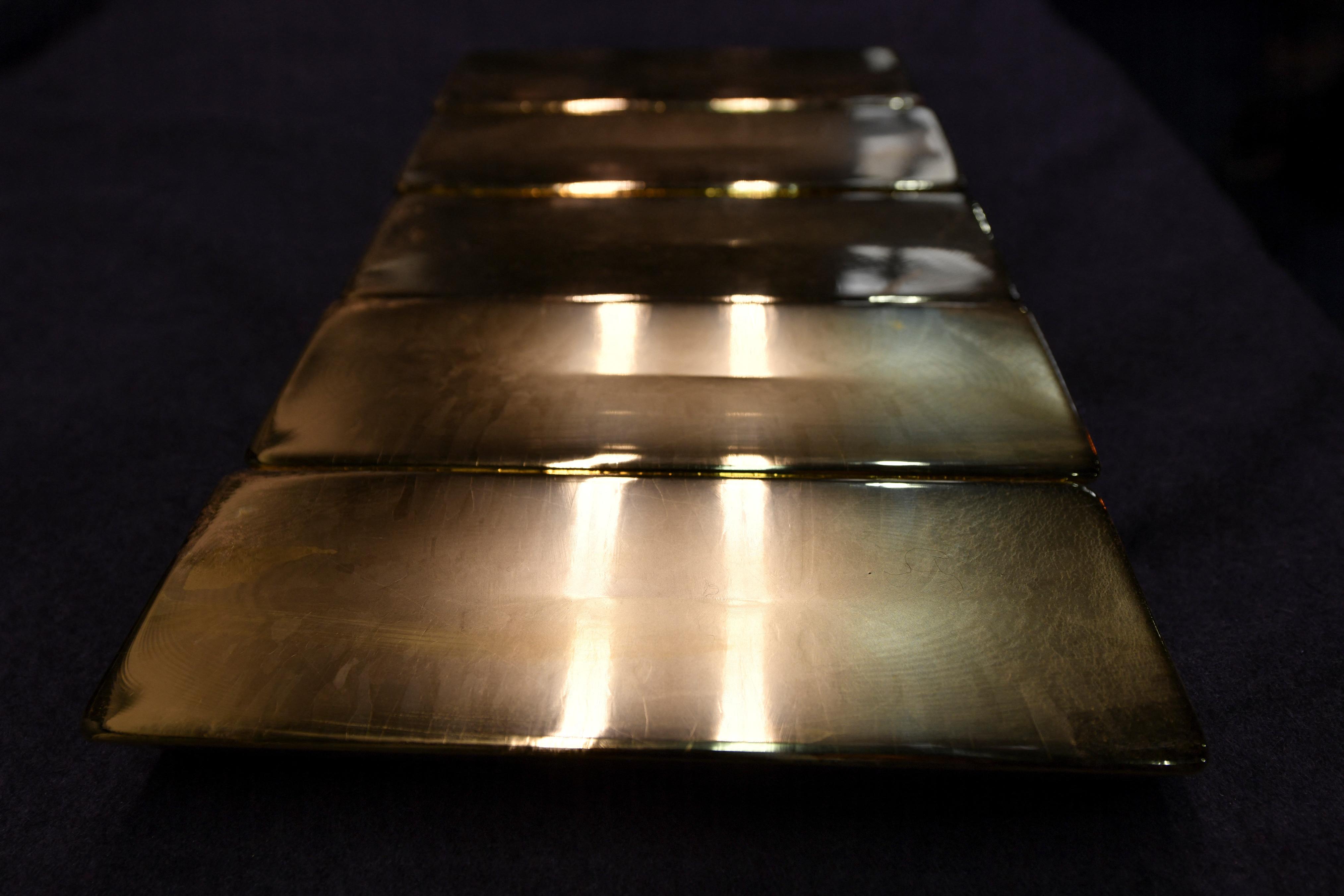

Fed Governor Christopher Waller flags possible rate cut in months ahead Markets see slowdown in inflation on PCE print- analyst Traders raise bets on rate cut by May 2024 to 70%, from 50% earlier Nov 29 (Reuters) - Gold prices touched a nearly seven-month high on Wednesday, propelled by a decline in the U.S. dollar and bond yields as investors grew confident that the Federal Reserve would likely cut interest rates by the first half of next year. Spot gold rose 0.2% to $2,044.69 per ounce by 0632 GMT, after hitting its highest since May 5. U.S. gold futures for December delivery rose 0.3% to $2,045.30 per ounce. "Gold is driven by an increasing market expectation of a Fed pivot from a hawkish tilt to a dovish tilt in the first half of next year - earlier than it did before," said Kelvin Wong, senior market analyst for Asia Pacific at OANDA. "The key point to look for is the PCE (personal consumption expenditures) data and markets are expecting another slowdown in U.S. inflationary pressure." Fed Governor Christopher Waller on Tuesday flagged a possible rate cut in the months ahead. Traders are now pricing in a more than 70% chance of rates easing in May, compared with a 50% chance on Tuesday, CME's FedWatch Tool shows. Lower rates reduce the opportunity cost of holding non-interest-bearing bullion. Investors' attention is now on the revised U.S. third-quarter GDP figures due at 1330 GMT and key PCE data - Fed's preferred inflation gauge - on Thursday. Making gold less expensive for other currency holders, the dollar index (.DXY) hit a more than three-month low against its rivals, and was poised to mark its worst monthly performance in a year. Yields on 10-year Treasury notes fell to an over two-month low of 4.2629%. Spot gold may extend gains into a range of $2,059-$2,069 per ounce, Reuters technical analyst Wang Tao said. Spot silver fell 0.2% to $24.96 per ounce and platinum slipped 0.3% to $936.78. Palladium rose 0.2% to $1,056.62 per ounce. https://www.reuters.com/markets/commodities/gold-hits-near-7-month-peak-dollar-yields-weaken-fed-rate-cut-bets-2023-11-29/

2023-11-29 06:43

JAKARTA, Nov 29 (Reuters) - The Indonesian Coal Mining Association (ICMA) expects the country's 2023 coal output to surpass the official target of 695 million metric tons, a group official said on Wednesday. "As of today, output has reached 690 million tons, so it is estimated that by the end of the year production will exceed the target," said ICMA executive director Hendra Sinadia. Average monthly coal output in September and October stood at 61 million tons, Hendra said. However, the monthly output could drop as the rainy season has started in Indonesia, he said, without providing an estimate of the decline. Indonesia's coal output so far this year stands at 689.37 million tons, while exports are at 350.05 million tons, according to mining ministry data. Coal output for 2022 was 687 million tons and exports amounted to 494 million tons. The world's biggest thermal coal exporter earlier this year set its exports target at 457.3 million tons. https://www.reuters.com/markets/commodities/coal-miners-group-expects-indonesias-2023-coal-output-surpass-target-2023-11-29/

2023-11-29 06:35

Brent, WTI futures rise more than $1 per barrel OPEC+ talks focusing on additional output cuts EIA reports surprise build in crude, distillate stocks Black Sea storm disrupts up to 2 million bpd of oil exports BENGALURU, Nov 29 (Reuters) - Oil prices rose more than $1 a barrel on Wednesday as investors focused their attention on expectations of fresh supply cuts from OPEC+ and looked past a jump in U.S. crude, gasoline and distillate stockpiles. Brent crude futures advanced by $1.42, or 1.7%, to settle at $83.10 a barrel, while U.S. West Texas Intermediate (WTI) crude futures gained $1.45, or 1.9%, to settle at $77.86 a barrel. Oil markets have found support from hopes of some form of a price-supportive resolution from the OPEC+ group, Kpler analyst Matt Smith said. Members of OPEC+, which includes the Organization of Petroleum Exporting Countries and its allies such as Russia, are due to hold a policy meeting on Thursday. Talks ahead of the meeting were focusing on additional cuts, although details were yet to be agreed, sources close to the group told Reuters. Another media report earlier said that the cut could be of as much as 1 million barrels a day. "All eyes are on the Nov. 30 OPEC meeting, and the fine details will matter," CFRA analyst Stewart Glickman said. The Energy Information Administration reported a surprise build in U.S. crude oil and distillate fuel stocks last week, indicating weak demand. Gasoline stocks also rose by more than expected, the data showed. However, the impact of those builds was neutralised by large draws in other refined products, like residual fuel oil, UBS analyst Giovanni Staunovo said. A severe storm in the Black Sea region has disrupted up to 2 million bpd of oil exports from Kazakhstan and Russia, according to state officials and port agent data, raising the prospect of short-term supply tightness. Kazakhstan's largest oilfields are cutting combined daily oil output by 56% from Nov. 27, the Kazakh energy ministry said. https://www.reuters.com/business/energy/oil-prices-rise-after-storm-disrupts-kazakh-russian-exports-2023-11-29/

2023-11-29 06:31

BENGALURU, Nov 29 (Reuters) - Shares of Indian Renewable Energy Development Agency (IREDA) (INAR.NS) surged 80% in their trading debut on Wednesday as investors bet on government-led projects, valuing the state-owned firm at 155.22 billion rupees ($1.86 billion). Shares of IREDA, which were listed at 50 rupees, climbed to a high of 57.75 rupees, well above their initial public offer (IPO) price of 32 rupees. It was also the most heavily-traded stock, with over 458 million shares traded by 11:58 a.m. IST. "The listing was above the market expectations...IREDA's strong financial performance and focus on the burgeoning renewable energy sector make it attractive," said Shivani Nyati, Head of Wealth, Swastika Investmart. The domestic renewable energy sector is poised for significant growth in the coming years, propelled by government-led initiatives and increasing environmental concerns, Nyati added. However, the company is valued much lower than its peers REC (RECM.NS) and Power Finance Corp (PWFC.NS), which are currently valued at $10.89 billion and $12.96 billion, respectively. Last week, the IPO of IREDA - a non-banking financial company that focuses on renewable energy projects - received strong interest, and was oversubscribed 38.8 times. India has seen a record 196 IPOs so far this year, during which the stock market scaled all-time highs as the country's economic growth prospects and a vast consumer base made it an attractive investment destination. However, companies going public have had mixed responses, with some tepid debuts being attributed to market conditions, valuation concerns, or worries about competition. These companies have raised about $5.97 billion, a 22.6% decline from the same period last year, according to data from LSEG. IREDA's profit jumped 41.2% to 5.79 billion rupees in the half year ended Sept. 30, while its interest income climbed 49.1%. The domestic equity market will see a multiple debuts this week, including Tata Motors (TAMO.NS) -owned Tata Technologies (TATE.NS), which will on Thursday mark the first listing from the Tata Group in nearly two decades. ($1 = 83.3090 Indian rupees) https://www.reuters.com/markets/deals/indian-state-run-ireda-up-563-pre-open-debut-trade-2023-11-29/

2023-11-29 06:25

NEW YORK/LONDON, Nov 29 (Reuters) - Treasury yields fell on Wednesday while the dollar gained and MSCI's global stock index barely rose as U.S. Federal Reserve officials provided mixed messages on monetary policy while third-quarter data provided encouraging signs for the economy. In U.S. equities, the S&P 500 edged lower and Nasdaq dipped while the Dow rose slightly as investors waited for a key inflation reading due out early on Thursday. Commerce Department data however, provided some optimism earlier on Wednesday, with U.S. gross domestic product rising at a 5.2% annualized rate in the third quarter, revised up from the previously reported 4.9% and marking the fastest expansion since the fourth quarter of 2021. The GDP report also confirmed inflation was trending lower, with slight downward revisions to measures watched by the Fed for monetary policy, suggesting a so-called Goldilocks scenario to Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions. "The improving data is earning the possibility of some recalibration of policy next year. That's what the market is pricing in. If the data continues on this path it will earn modest rate cuts next year. That's helping to ignite risk appetites," said Melson. While the Federal Reserve officials on Wednesday sent mixed messages, investors still focused on comments made on Tuesday by Fed Governor Christopher Waller, an influential and previously hawkish voice at the U.S. central bank. Waller had said rate cuts could begin in months if inflation keeps easing. On Wednesday the Fed's Bank of Atlanta President Raphael Bostic said he expects U.S. growth to slow and inflation to continue to ease on the back of tight monetary policy. In contrast, Richmond Federal Reserve Bank President Thomas Barkin said on Wednesday he is "skeptical" that inflation is on its way down to 2%, and wants the option of another rate hike in case inflation gains steam. The Dow Jones Industrial Average (.DJI) rose 13.44 points, or 0.04%, to 35,430.42, the S&P 500 (.SPX) lost 4.31 points, or 0.09%, at 4,550.58 and the Nasdaq Composite (.IXIC) dropped 23.27 points, or 0.16%, to 14,258.49. MSCI's gauge of stocks across the globe (.MIWD00000PUS) gained 0.010%. U.S. Treasury yields fell with the benchmark 10-year note on track for a third straight session of declines as the latest economic growth reading failed to upend market expectations that a Fed rate cut could be on the horizon. Benchmark 10-year notes were down 7.3 basis points at 4.263%, from 4.336% late on Tuesday. The 30-year bond was last down 7.8 basis points to yield 4.4463%, from 4.524%. The 2-year note was last was down 9.9 basis points to yield 4.6372%, from 4.736%. The dollar index, which measures the greenback against other major currencies, climbed from its lowest level in more than three months as investors consolidated positions after four days of losses, with support from the U.S. economic data. The dollar index rose 0.205%, with the euro down 0.16% to $1.0972. The Japanese yen strengthened 0.15% versus the greenback at 147.24 per dollar, while Sterling was last trading at $1.2696, up 0.02% on the day. "Given how sharply the dollar has sold off the last few weeks, it's only natural that we could be seeing a bit of profit taking," said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi US in Boston. Oil prices rose more than $1 as investors looked past a jump in U.S. crude, gasoline and distillate stock piles and focused on an upcoming meeting of OPEC+, the Organization of the Petroleum Exporting Countries and allies such as Russia. Talks ahead of the meeting were focusing on additional cuts, although details have yet to be agreed, sources close to the group told Reuters. U.S. crude settled up 1.9% at $77.86 per barrel and Brent finished at $83.10, up 1.74% on the day. Elsewhere, spot gold shot earlier in the day to a roughly seven-month high of $2,051 an ounce and was last up 0.2% to $2,044.16 an ounce. U.S. gold futures gained 0.28% to $2,045.70 an ounce. https://www.reuters.com/markets/global-markets-wrapup-1-2023-11-29/

2023-11-29 06:24

Nov 29 (Reuters) - Ahead of this year's COP28 climate summit in Dubai, U.N. agencies have released several reports offering updates on global progress in limiting climate change. Here are some of the most important findings: GLOBAL GREENHOUSE GASES ARE STILL RISING Global greenhouse gas emissions rose by 1.2% from 2021 to 2022, reaching 57.4 gigatonnes of carbon dioxide equivalent for the year, according to the U.N. Emissions Gap Report. If countries don't quickly plan for steep cuts, global temperatures will rise nearly 3 degrees Celsius (5.4 degrees Fahrenheit) above preindustrial levels in this century, it said — far beyond the 1.5C (2.7F) threshold that scientists say would begin to trigger catastrophic effects. The report, released on Nov. 20, looks at how countries' planned climate action compares with what is needed to meet global climate goals. It found those pledges put the world on track for a temperature rise of 2.5C-2.9C (4.5F-5.2F). Even in the most optimistic emissions scenario, it found there is just a 14% chance of holding warming to 1.5C — adding to a growing body of scientific evidence suggesting the central goal of the 2015 Paris Agreement is out of reach. COUNTRIES ARE LAGGING WITH EMISSIONS-CUTTING TARGETS Planet-warming greenhouse gas emissions are expected to fall only 2% below 2019 levels by 2030, a far cry from the roughly 43% reduction the U.N. Intergovernmental Panel on Climate Change says is needed to have a hope of limiting warming to 1.5C. Like the Emissions Gap Report, the NDC Synthesis Report analyzes countries' pledges, known as Nationally Determined Contributions (NDCs), to determine where governments are in their ambition to wean themselves off fossil fuels. Instead of expected warming under various climate models, however, it assesses emissions trends. The report looked at nearly 200 submissions, including 20 new or updated NDCs received as of September 2023. National plans saw only a marginal improvement over last year's ambitions, with emissions then projected to rise 11% compared to 2010 levels. THE WORLD'S FOSSIL FUEL PLANS THREATEN CLIMATE GOALS Global fossil fuel production is set to be more than double the level needed to limit warming to 1.5C, according to the Production Gap Report published by the U.N. Environment Programme (UNEP). The report analyzes the difference between planned fossil fuel production and the amount deemed consistent with meeting global climate goals. It found that the top 20 fossil fuel-producing countries altogether are planning to produce 110% more fossil fuels in 2030 than would be consistent with limiting warming to 1.5C, and 69% more than is consistent with 2C (3.6F). None of these 20 countries, which include China, Norway, Qatar, the UAE and the U.S., has committed to reducing coal, oil and gas production in line with limiting warming to 1.5C, it said. WEALTHY COUNTRIES ARE OFFERING LESS HELP FOR ADAPTATION Rich countries' promises to help poorer ones adapt to climate change have slowed, with a shortfall now 50% larger than UNEP had previously estimated, the agency reported in November. UNEP researchers found in this year's Adaptation Gap Report that adaptation efforts globally cost about $387 billion per year in 2021, while the funds available for these efforts totaled just $21 billion. That created an estimated shortfall of roughly $366 billion. In 2009, developed countries pledged to provide $100 billion per year in climate finance to developing nations. While the pledge was supposed to strike a balance between adaptation and mitigation, that balance was never defined. Mitigation projects, or efforts to rein in climate-warming emissions, were favored because they were more likely to provide financial return on investments, the report said. https://www.reuters.com/business/environment/ahead-cop28-research-shows-world-far-behind-climate-fight-2023-11-29/