2023-11-28 15:34

MOSCOW, Nov 28 (Reuters) - Russia's SPB Exchange, which specialises in trading foreign shares, said on Tuesday it would transfer almost a third of clients' funds held in foreign currency to them in roubles, with U.S. sanctions blocking access to the rest of the funds for now. The U.S. Treasury in early November targeted SPB as part of sweeping new measures that also aim to curb Russia's future energy capabilities and sanctions evasion. This forced SPB to halt trading of shares on the exchange and to tweak its strategy to focus on settlements in roubles. SPB said it had agreed with brokers on a mechanism to distribute a portion of funds now trapped, referring to funds, denominated in U.S. dollars, Hong Kong dollars, China's yuan and the Kazakh tenge, amounting to the equivalent of 5.9 billion roubles ($66.44 million) and representing 31.05% of clients' total FX funds. SPB has distributed the funds to brokers who will independently determine how to pass them on to clients, SPB said. "(Brokers') clients will be able to withdraw these funds only in roubles, as settlements in foreign currencies are currently inaccessible to SPB Exchange," SPB said. From Tuesday, the remaining funds in foreign currencies and securities that the exchange is currently unable to clear or settle would be transferred temporarily to non-trading entities, SPB said. The exchange said its international legal advisors would deliver their opinion by Dec. 4, at which time more information would be provided. Trading of foreign securities on the exchange remains suspended. SPB has endured a turbulent month. Following sanctions and the trading suspension, SPB was forced on Monday to deny that it had filed for bankruptcy, blaming fraudsters for filings with a Russian court and promising that it would push for a criminal investigation. "What we saw yesterday ... is not an abuse of rights, it is almost a crime," Mikhail Mamuta, head of consumer protection at the central bank, said on Tuesday. "I think law enforcement should sort out what happened." SPB's Moscow-listed shares (SPBE.MM), which recovered after slumping over 30% to a record low at one point on Monday, were flat on Tuesday. ($1 = 88.8000 roubles) https://www.reuters.com/markets/europe/russias-spb-exchange-clients-get-third-fx-funds-back-after-us-sanctions-2023-11-28/

2023-11-28 13:47

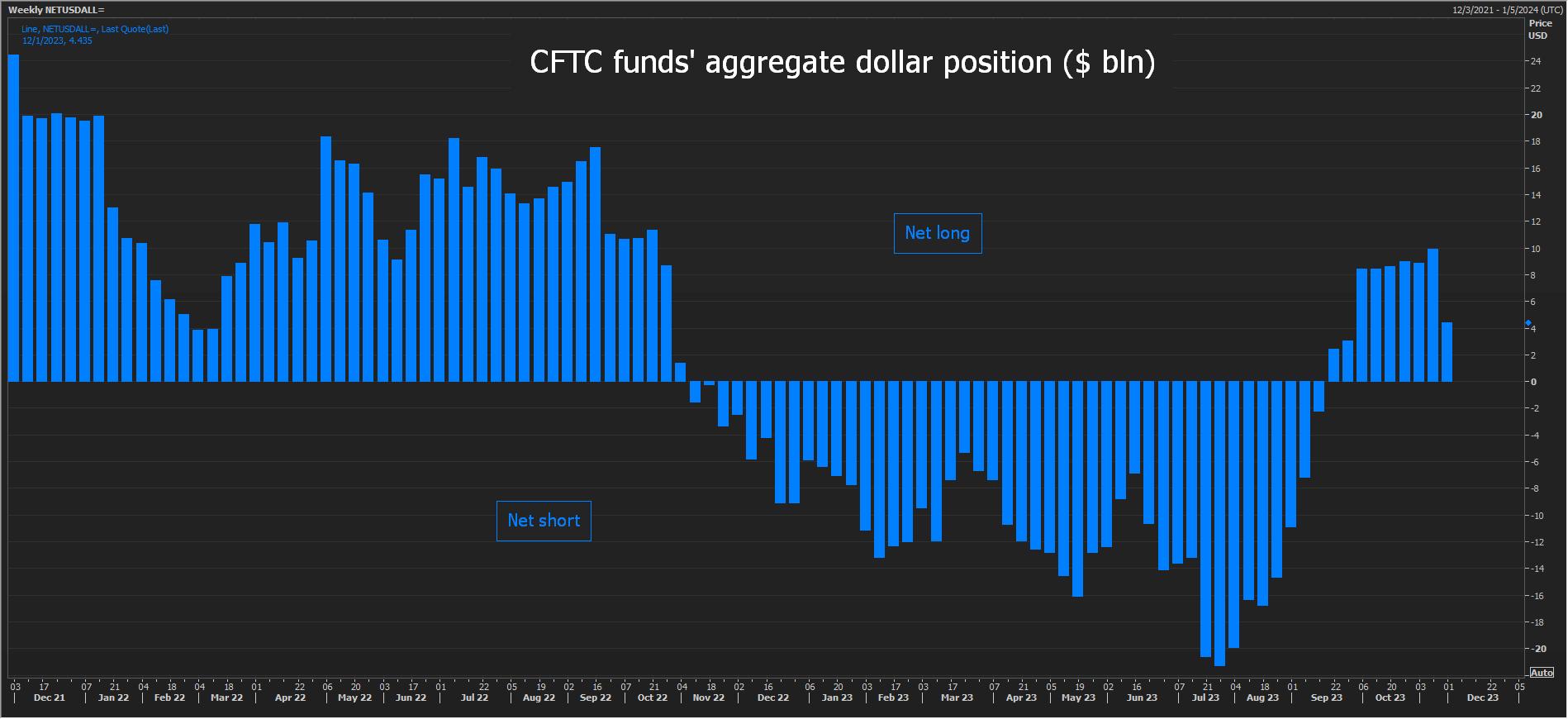

ORLANDO, Florida, Nov 28 (Reuters) - The rise in U.S. rate cut expectations for next year seems to have prompted hedge funds to cool their optimism on the dollar, potentially weakening a key plank of support for the currency in the coming months. The latest Commodity Futures Trading Commission (CFTC) data shows that funds cut their net long dollar position against a range of major and emerging currencies to $4.5 billion in the week ending Nov. 14 from $10 billion the week before. The $5.5 billion week-on-week swing is the biggest since July and second largest this year, and comes as interest rate futures markets had moved to price in up to 100 basis points of Fed rate cuts by the end of next year. That dovishness has been tempered in recent days, but not by much. Traders have consistently underestimated the Fed's resolve to keep rates elevated, but they are sticking to their guns and banking on hefty easing in the second half of next year. If the latest CFTC figures are any indication, this has prompted hedge funds to put the brakes on their dollar-buying spree. Whether that's a temporary pause or a more lasting move will depend on the Fed. "Large USD weakness requires Fed cuts and better ex-US growth, but these conditions are not met yet," JP Morgan's currency strategy team wrote in their 2024 outlook. Funds' $10 billion net long dollar position in the week ending Nov. 7 was the biggest bullish bet on the greenback since October last year and a huge turnaround from the net short position worth more than $20 billion in mid-July. This momentum suggested a base was being formed for another prolonged dollar upswing, and coincided with a 7% rise in the dollar index. But the dollar has slid 3% in November, which would be its worst month in a year. THIS TIME IT'S DIFFERENT? The last decade has shown that CFTC funds' net dollar positions tend to be long-term, directional trades held for at least a year, the longest of which was the net long from May 2013 through June 2017. But this time may be different - funds have only been net long dollars for nine weeks. The long dollar liquidation in the week to Nov. 14 was mostly against the euro and Japanese yen. Funds expanded their net long euro position by $2.9 billion, or nearly 21,000 contracts, the sixth increase in a row and the biggest since July. That position is now worth nearly $18 billion, the most in three months and well up from $11 billion only two weeks ago. Funds cut their net short yen position by $2 billion, or almost 25,000 contracts, essentially reversing the previous week's move which had pushed the overall net short yen position to the biggest in six years. Positioning is still stretched, and if the Bank of Japan signals an end to negative interest rates sooner rather than later, the yen's upside is potentially huge - it is languishing near a 33-year low against the dollar, a 15-year low against the euro, and a 50-year low on a real effective exchange rate basis. "The clear exception to widespread USD strength is JPY, which ends up the broad-based outperformer: We see USD/JPY falling to 142 by mid-2024," Morgan Stanley's FX strategy team wrote in their 2024 outlook. (The opinions expressed here are those of the author, a columnist for Reuters.) https://www.reuters.com/markets/currencies/funds-slash-bullish-dollar-bets-half-mcgeever-2023-11-28/

2023-11-28 13:45

MUMBAI, Nov 28 (Reuters) - Chinese payments group Alipay plans to sell its 3.4% stake in Indian food delivery giant Zomato (ZOMT.NS) for nearly $400 million through block deals on Indian stock exchanges, according to three sources and a Reuters review of the deal's term sheet. Alipay, owned by Ant Group, will offload its entire 3.44% stake in the deal, the term sheet seen by Reuters showed. Bank of America and Morgan Stanley are advisers on the deal, which is likely to be executed later this week on Indian exchanges, said the three sources, who declined to be named as the plan is private. Zomato, Bank of America and Morgan Stanley did not immediately respond to a request for comment. Alipay also did not respond outside regular business hours. Zomato shares have surged more than 90% this year, after falling by more than half in 2022 when tech stocks struggled around the world. Alipay "wants to cash out ... the (market) timing is good," said the first source, referring to the rapid rise in Zomato's shares in recent months. The block deals are set to be executed at 111.28 rupees per share, a 2.2% discount to Zomato's close on Tuesday, the term sheet said. In October, Japan's SoftBank (9984.T) sold a 1.1% stake in Zomato, which is India's biggest food delivery service. Demand for online ordering has rapidly grown in recent years, prompting companies like Zomato to aggressively expand. Alipay's exit from Zomato comes as other Chinese investors have been paring their stakes in Indian companies. In August, China's Antfin sold a 10.3% stake in Indian financial giant Paytm (PAYT.NS). Tech stocks such as Zomato have staged a rebound after a drubbing last year amid a market meltdown, when investors also raised questions about sky-high valuations of some Indian startups that had made their stock market debut in recent years. https://www.reuters.com/technology/chinas-alipay-plans-near-400-mln-stake-sale-indias-zomato-sources-2023-11-28/

2023-11-28 13:22

LONDON, Nov 28 (Reuters) - Bank of England interest-rate setter Jonathan Haskel said the inflationary heat still in Britain's labour market suggested there was no way to cut interest rates from their 15-year high any time soon. "The labour market is still historically tight. At current rates of change it would take at least a year to fall back to average pre-pandemic tightness," Haskel said in a text copy of a speech he was due to make later on Tuesday. "Rates will have to be held higher and longer than many seem to be expecting." Haskel's message echoed that of most members of the BoE's Monetary Policy Committee which this month kept borrowing costs on hold for a second meeting in a row after 14 back-to-back increases but said they were likely to have to stay high. Haskel said people in Britain were finding it harder to get work suited to their skills than before the coronavirus pandemic and the country's long-standing problem of weak productivity growth was also adding to inflation pressures. Earlier on Tuesday, Deputy Governor Dave Ramsden sought to hammer home the BoE's message that "monetary policy is likely to need to be restrictive for an extended period of time." On Monday, Governor Andrew Bailey said it was too soon to think about cutting interest rates as the BoE faced the "hard work" of getting inflation down to its 2% target from the latest reading of 4.6%, higher than in many other economies. https://www.reuters.com/world/uk/boes-haskel-says-labour-market-too-hot-think-rate-cuts-2023-11-28/

2023-11-28 13:04

LONDON, Nov 28 (Reuters) - Amundi, Europe's largest asset manager and among the top 10 in the world, has started dipping its toe back into the Turkish lira having been impressed by the country's turnaround efforts since its mid-year elections. The Paris-based firm, which has $2 trillion worth of assets under management, is yet to go all in given the lira's ongoing grind lower but says it has taken its first step towards it by reversing long-held bets against the currency. Sergei Strigo, Amundi's co-Head of Emerging Markets Fixed Income, said last week's 500 basis-point interest rate hike to 40% in Turkey was "all very positive" and a sign of its seriousness in tackling its inflation problem. "We have started to cover our underweight in Turkish lira a few weeks ago," Strigo told Reuters, referring to the process of taking a more positive view on the currency. "We are not yet ready to increase the allocation but it is definitely on our radar screen." Having seen international appetite for investing in Turkey shredded by the near 85% plunge in the lira's value over the last five years, more positive moves by heavyweight firms like Amundi will be seen as a signal of hope. Following his re-election in May, President Tayyip Erdogan brought in a new-look cabinet and central bank that have sought to ditch years of unorthodox policymaking by embracing aggressive interest rate hikes. They have also begun unwinding the state's heavy-handed financial market regulations to help entice investment and rebuild depleted reserves wiped out over recent years. Amundi, while the first major fund to formally declare its shift, is not alone in testing the waters, according to other foreign investors and bankers. Investment bank JPMorgan has recommended the FX forwards trade in recent weeks and both it and rival Goldman Sachs are aggressively pitching Turkish government bonds with durations of 1-10 years, according to some investors. The scars of Erdogan's unpredictability however - including firing four central bank chiefs in the last four years – means international funds as a group hold less than 1% of lira-denominated government bonds. "It could be one of the most interesting stories for 2024," Strigo said, referring to a potential mass return of investor appetite if the policy shift sticks. For now, the FX forwards that Amundi is using currently price in the lira slumping another 40% to around 40 to the dollar over the next year , , , which Strigo sees as unlikely. Amundi's tentative optimism is balanced by upcoming nationwide local elections in March, when vote-getting fiscal stimulus could distract Erdogan from his newfound policy path. "It is probably the easiest way for now," Strigo said about the use of FX forwards to express that balance. Next year could be the time to start buying local currency debt he added, but "local elections have historically been the event when the fiscal (stance) needs to be loosened up to get the necessary votes." Seeking to boost confidence in the policy shift - and convince sceptics that Erdogan backs it - Central Bank Governor Hafize Gaye Erkan will hold the bank's first investor day meeting in New York on Jan. 11. With the bank having lifted rates to 40% from 8.5% since June, Amundi thinks another hike next month could finish the job. "For sure what is true is that the lira as a currency, considering the carry (interest rates on bonds versus elsewhere in the world), is becoming much more attractive than it use to be." https://www.reuters.com/markets/europe/european-fund-giant-amundi-dips-toe-back-into-turkeys-lira-2023-11-28/

2023-11-28 12:01

PARIS, Nov 28 (Reuters) - Paris metro ticket prices will almost double during the 2024 Olympics, the French capital region's president said on Tuesday, adding that residents with passes would be shielded from the temporary rise and visitors would be charged "a fair price". The mayor of Paris warned last week that public transport services, which are provided by the regional authority, would be insufficient during the events. The Olympics will be held from July 26 to Aug. 11 and the Paralympics from Aug. 28 to Sept 8. "During the Olympics and the Paralympics, the Ile de France region will dramatically increase its transport offer. It is out of question that the residents support that cost," the region's president Valerie Pecresse said on social media. "We're going to create a new pass, the Paris 2024 pass, that will allow visitors to travel through the whole Ile de France region. It will cost 16 euros a day, and up to 70 euros a week. It is the fair price," Pecresse said in a video. She said a single journey metro ticket will cost 4 euros ($4.38) for the period from July 20 to Sept. 8, adding that residents of the region with a usual monthly or yearly pass will not be affected. A monthly pass normally costs 84.10 euros, while single journeys currently costs 2.10 euros. Last week, Paris mayor hit out at Pecresse, saying the French capital would not be ready in terms of transport. Transport minister Clement Beaune backed Pecresse on Tuesday, saying Paris would be 'ready', adding that 'it is important that there are no changes for the Parisians during the Games'. Pecresse said that it was crucial that the Paris region residents be spared. "The prices will go up so that the Olympics are 100% accessible by public transport," she told reporters at a test ride of the future line 15 of the metro on Tuesday. "Public services have a cost and pretending otherwise is a lie. If it's not the visitors who pay, it's going to be the tax payer." ($1 = 0.9135 euros) https://www.reuters.com/sports/paris-metro-ticket-price-double-during-2024-olympics-2023-11-28/