2023-11-28 11:25

HAVANA, Nov 28 (Reuters) - On a small farm outside Havana, a Cuban family-run business produces gluten-free flour from banana, coconut and yucca, preferring locally-sourced ingredients to pricey imports as Cubans seek innovative solutions to a growing food crisis. Cuba purchases most of the food it consumes from abroad, but revenues have plunged following the coronavirus pandemic, hampered by stiff U.S. sanctions and floundering tourism, once a mainstay of the Caribbean island economy. That has led some, such as 38-year old entrepreneur Gabriel Perez, to look for alternatives. "There is a crisis, that is undeniable," said Perez, who recently sold a home and business to settle on farmland in the rural outskirts of Havana. "But in Cuba it stems in part from a lack of culture around eating the foods that we have at hand." He points to Cubans' preference for rice, pork and beans, all locally available but many of which require machinery and agricultural inputs to grow at scale. His business, Bacoretto, dries and mills yucca, rice, banana and coconut into organic flour preferred by gluten-intolerant consumers, who have only recently been able to find food products tailored to their dietary needs in Cuba. Byproducts of their processes are used to make coconut oil, coconut-fiber rope, vinegar and fermented products and sweets, Perez told Reuters. Bacoretto is small and specialized, and its products available primarily in Havana. It produces 6 to 8 kilograms (13.2 to 17.6 pounds) of flour a week, Perez said, in small batches, in addition to byproducts, with a staff of eight people. Perez said the business, which took advantage of a 2021 decision to lift a ban on private companies in place on the island since shortly after Fidel Castro's 1959 revolution, has struggled to find the financing it needs in cash-strapped Cuba. Thousands of small businesses have taken root in Cuba since 2021, but many face persistent problems with financing, infrastructure, supply and workforce in the communist-run country which for decades shunned private enterprise. "To be profitable," Perez said, "technological capacity needs to be increased and better machinery is needed." https://www.reuters.com/markets/cuban-family-business-produces-flour-coconut-yucca-shortages-fester-2023-11-28/

2023-11-28 11:19

Futures: Dow, S&P flat, Nasdaq down 0.10% Nov 28 (Reuters) - U.S. stock index futures were largely muted on Tuesday, as investors awaited comments from a host of Federal Reserve officials for clues on the monetary policy path, while Zscaler shares declined following the company's quarterly update. Wall Street ended lower on Monday with investors taking a post-Thanksgiving pause, though all three major indexes remained on course for monthly gains, snapping three straight months of losses, on growing rate cut optimism. The rebound in equities in November has brought the S&P 500 (.SPX) within a very close range of its 2023 intra-day high. Multiple policy voting members are scheduled to speak during the day, including Board Governors Christopher Waller and Michelle Bowman. Market participants will closely monitor for any cues on the interest rate path, as focus shifts to the likely timing of a rate cut. Money markets have almost fully priced in a pause in rate-hikes at the December meeting, with expectations of at least a 25-basis point rate cut in May 2024 standing at nearly 51%, according to the CME Group's FedWatch Tool. At 5:32 a.m. ET, Dow e-minis were up 14 points, or 0.04%, S&P 500 e-minis were down 1.75 points, or 0.04%, and Nasdaq 100 e-minis were down 16.25 points, or 0.1%. "Subdued sentiment is hanging around with investors keeping their powder dry ahead of a key inflation report in the United States, while the impact of elevated interest rates on economies is still being assessed," said Susannah Streeter, head of money and markets at Hargreaves Lansdown. Personal consumption expenditure data - the Fed's preferred inflation gauge - and the "Beige Book", a snapshot of the U.S. economy, are due later this week, which will help investors to assess the economic condition. On the economic data front, the Conference Board's consumer confidence survey is due for release at 10:00 a.m ET, which is expected to show consumer confidence eased in November. Shares of Zscaler (ZS.O) fell 6.5% before the bell as the cloud security firm's higher operating expenses in the first quarter overshadowed its strong forecast and profit beat. Boeing added 1.7% after RBC Capital Markets upgraded the aerospace company to "outperform" from "sector perform" and set a street-high price target. Affirm Holdings (AFRM.O) gained 2.8%, following its 12% jump in the previous session on Cyber Monday spending boost, and as Jefferies upgraded the payments platform to "hold." https://www.reuters.com/markets/us/futures-subdued-ahead-comments-fed-officials-zscaler-falls-2023-11-28/

2023-11-28 11:08

A look at the day ahead in U.S. and global markets from Mike Dolan Subdued world markets were relieved at the ease with which Monday's sale of U.S. Treasuries was absorbed, but firmer oil prices ahead of the week's postponed OPEC+ meeting cut across any further decline in yields for now. Benchmark Treasury yields fell back more than 10 basis points to 4.37% after a total of $109 billion of 2 and 5-year notes hit the Street on Monday without much disruption. Another weak U.S. housing readout, with sub-forecast new home sales last month, perhaps flattered the post-auction moves. Either way, it helped calm any jitters about another heavy diary of debt sales - with some $39 billion of 7-year notes up for grabs later on Tuesday. November consumer confidence data will also be released as investors assess the mood on the High Street and online from "Black Friday" and "Cyber Monday" retail activity. Preliminary estimates from Adobe Digital Insights indicated that spending online on Monday was on track to reach a record $12.4 billion as bargain hunters turned out in force. The estimate, which does not account for inflation, predicts an increase of more than 9% from the $11.3 billion that shoppers spent during Cyber Monday last year. That's likely a mixed blessing for Federal Reserve watchers - the continued buoyancy of consumption but with increasing price discrimination. With investors confident the Fed will cut rates through the second half of 2024 at least, top Fed policymakers are on the stump again Tuesday. Fed futures priced about 85bps of rate cuts through next year, starting in June, though many major banks expect even more. Oil prices have been a critical factor in the inflation battle of the past two years and although they retreated some 20% from highs of two months ago, traders are now watching closely for signs of further output cuts at OPEC+'s postponed meeting on Thursday - despite murmurs of rifts in the bloc. Israeli forces and Hamas fighters appeared to be abiding by a truce for a fifth morning on Tuesday, after a four-day ceasefire was extended at the last minute for at least two days to let more hostages go free. Encouraged by the retreat in debt yields, softening economic data and cooling geopolitical tensions, the dollar index (.DXY) fell back to its lowest since August and is now down 3.8% this month. Stock indexes were pretty directionless, however. A modest loss in the S&P500 (.SPX) on Monday added little new impetus and futures were flat ahead of Tuesday's bell. It was a mixed picture in Asia and Europe too, with Hong Kong's Hang Seng (.HSI) underperforming with a loss of almost 1%. There was fresh buzz about new equity sales though. Fashion company Shein has confidentially filed to go public in the United States, according to Reuters sources, in what is likely to be one of the most valuable China-founded companies to list in New York. Elsewhere, St. Louis Fed researchers estimated the Federal Reserve will need nearly four more years to cover a historic operating loss and start sending profits again to the U.S. Treasury again. Key developments that should provide more direction to U.S. markets later on Tuesday: * U.S. Nov consumer confidence, Richmond Fed Nov business survey, Dallas Fed Nov service sector survey, Sept house prices * U.S. Treasury sells 7-year notes, 12-month bills * Federal Reserve Board Governor Christopher Waller, Fed Board Governor Michelle Bowman, Fed Vice Chair for Supervision Michael Barr, Chicago Fed President Austan Goolsbee all speak; European Central Bank chief Christine Lagarde and ECB chief economist Philip Lane both speak; Bank of England Deputy Governor Dave Ramsden and BoE policymaker Jonathan Haskel both speak * U.S. corporate earnings: Workday, Hewlett Packard, NetApp, Crowdstrike, Splunk, Alvotech, Pinduoduo, Uxin, Canaan, Elbit, Citi Trends, Fluence Energy, Nano-X Imaging, Safe-T, Leslie's https://www.reuters.com/markets/us/global-markets-view-usa-2023-11-28/

2023-11-28 11:06

Nov 28 (Reuters) - Despite growing excitement that spot bitcoin exchange-traded funds (ETFs) will soon win regulatory approval, some cryptocurrency ETF pioneers plan to sit out what is expected to be a fierce industry battle for market share. Demand for a bitcoin ETF, which would allow retail and institutional investors to easily bet on the price of the world's biggest cryptocurrency, is expected to draw in as much as $3 billion from investors in the first few days of trading and pull in billions more thereafter. Yet some established names in the blockchain and cryptocurrency space - including ProShares, Amplify Investments and Roundhill - are so far steering clear of launching a bitcoin ETF. They worry that the field is too crowded, the regulatory and marketing costs too high, and that demand will not be strong enough to compensate for that. Though they remain a small minority in a race where both big and small players are diving in, their skepticism suggests the hype over a spot bitcoin ETF may be misplaced and that the products could prove unprofitable for some issuers rushing into the space. "This could be the most successful ETF launch in history, but it's still going to be intensely competitive, requiring a lot of investment up front," said Dave Mazza, chief strategy officer at Roundhill Investments, which hopes to launch cryptocurrency ETFs but has no plans for a spot bitcoin ETF. "You have to weigh the odds that you'll end up as one of the winners or an also-ran." The SEC has long rejected spot bitcoin ETF applications on the grounds they do meet its investor protection requirements. Industry hopes that position would shift surged in June when BlackRock (BLK.N), which has an almost unbroken record of SEC ETF approvals, filed for a spot bitcoin ETF. Then in August, a court ruled that the SEC wrongly rejected Grayscale Investments' application to convert its Bitcoin Trust (GBTC.PK) into a spot bitcoin ETF and must review Grayscale's filing. SEC chair Gary Gensler said last month the agency's commissioners will consider as many as 10 bitcoin ETF filings, but could not provide guidance on timing. Even so, ProShares CEO Michael Sapir said he is not convinced the SEC will approve a filing soon. The company's ProShares Bitcoin Strategy ETF , based on bitcoin futures, was one of the most heavily-traded new ETFs when it first launched in 2021, pulling in $1 billion in its first few days. ProShares also has a suite of other cryptocurrency ETFs tied to futures, offering options to clients without the need for a spot ETF, said Sapir. UPFRONT COSTS When it does approve a bitcoin ETF, executives expect the SEC to approve several at once, so no one has a first-mover advantage. That would drive up marketing expenses, one of the biggest costs of an ETF debut. Combined with legal, SEC filing, and listing costs, the bill for launching even a simple ETF rings in at about $100,000, according to lawyers. That can climb to millions of dollars if the product is complex and takes a long time to secure SEC approval. "Having the resources and expertise to file for something that doesn't exist yet in the U.S.," is costly, said Roxanna Islam, associate director of research at VettaFi, a data firm. The only prospective issuer to disclose proposed investor fees so far is Ark Investment, which last week announced its spot bitcoin ETF would charge a fee of 0.8%. "This seems to be strategically priced to attract assets" rather than to cover upfront costs, said Aisha Hunt, a fund lawyer at Kelley Hunt LLC. To be sure, issuers hoping to launch spot bitcoin ETFs have a more bullish outlook than those sticking to the sidelines. Some of the largest ETF providers, like BlackRock and Invesco, can cross-subsidize costs, and have the marketing scale to reach millions of potential customers. But it's unclear to some ETF providers outside of the top two dozen or so, like Amplify, that they would be able to grab sufficient market share to make the economics work. "It will be a game-changer in terms of demand and crypto's evolution into an asset class, but that doesn't mean we'd be able to benefit directly," said Christian Magoon, founder and CEO of Amplify ETFs, whose Amplify Transformational Data Sharing ETF invests in bitcoin miners and other crypto firms. Both Amplify and Roundhill said they will focus instead on other cryptocurrency ETF opportunities. Roundhill last month filed an SEC application to issue an ETF that seeks to generate income and bitcoin exposure through bitcoin-linked options. Mazza said he is optimistic the product could debut as early as January. Magoon hopes the buzz surrounding a spot bitcoin ETF will draw more assets to Amplify's BLOK ETF. That $472 million fund has holdings in crypto companies like Coinbase (COIN.O), as well as CME Group (CME.O), the exchange where crypto futures trade. Even Tom Staudt, chief operating officer of Ark Investments, whose spot bitcoin ETF filing is due for an SEC decision in January, said the excitement has caused some people to lose sight of the bigger picture. "It will solve some real problems for investors. But it won't solve all problems," Staudt said, noting that is why Ark recently launched five ETFs offering various cryptocurrency investing approaches. "The future is about more than just spot bitcoin," he added. https://www.reuters.com/technology/spot-bitcoin-etf-race-some-pioneers-stick-sidelines-2023-11-28/

2023-11-28 10:54

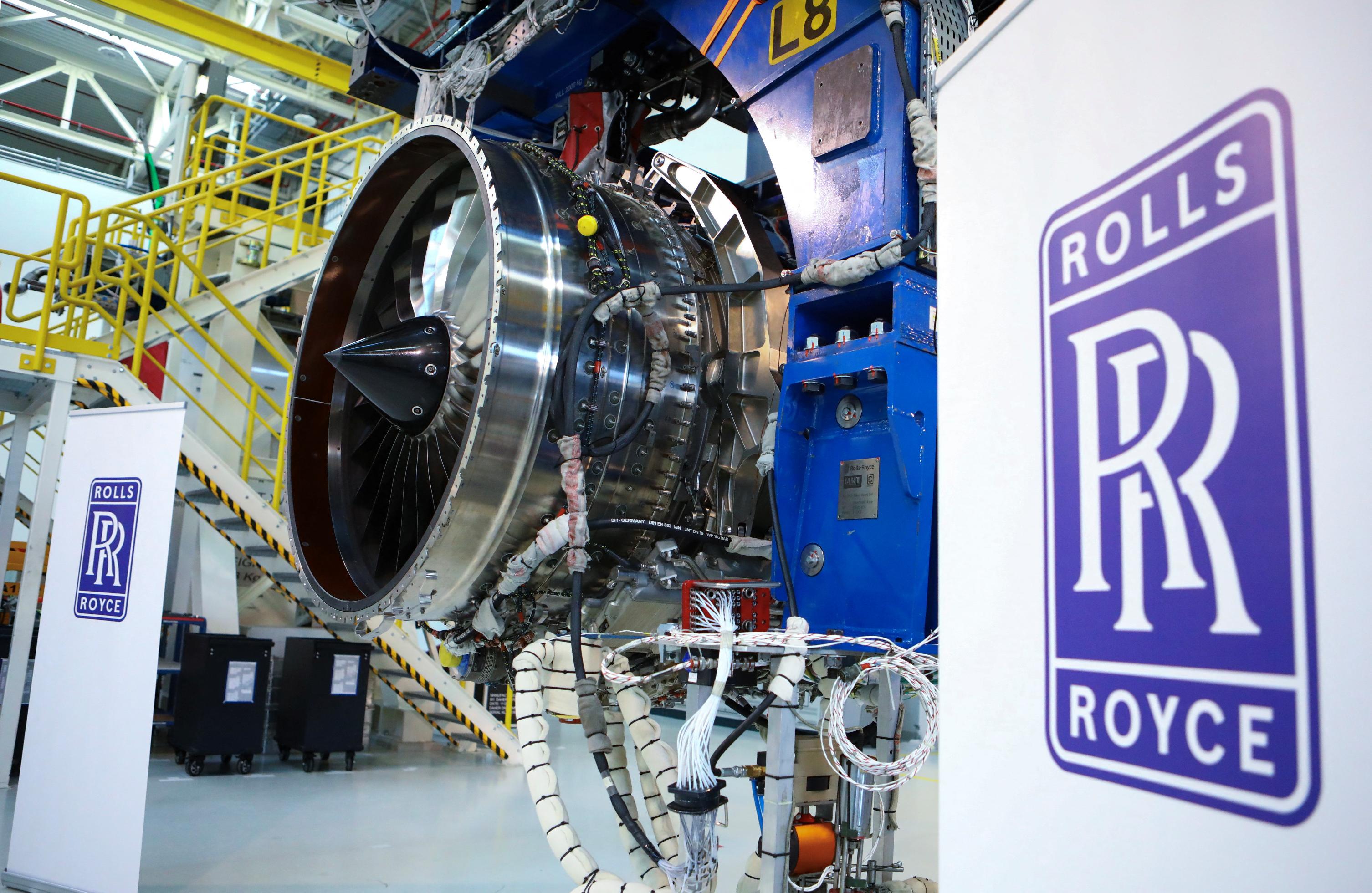

Aims for aerospace margin of 15-17% Expects medium-term annual operating profit of 2.8 bln stg Shares rise 6.5% LONDON, Nov 28 (Reuters) - Rolls-Royce (RR.L) aims to quadruple profit in the next five years by boosting the performance of its jet engines and bearing down on costs in boss Tufan Erginbilgic's masterplan for Britain's most prestigious engineering company. Setting out a strategy that has been almost a year in the making, the chief executive said on Tuesday he would deliver up to 2.8 billion pounds ($3.5 billion) in annual operating profit by 2027, four times 2022's outcome and double its guidance for up to 1.4 billion pounds this year. That would be driven by surge in profit margins at its civil aerospace business to 15-17% from 2.5% last year. Erginbilgic, a former BP executive who took over in January, said he would tackle Rolls-Royce's inefficiencies by focusing on the widebody plane sector, where it is Airbus's exclusive supplier, business aviation, defence and power systems. Its electrical-powered aircraft business will be sold in a drive to raise up to 1.5 billion pounds from selling non-core assets, he said, while the company could re-enter the single aisle jet market through a partnership, leveraging its next-generation UltraFan technology. The biggest driver of profit will be a step change in margins in an engine business that powers nearly half of long-haul aircraft, including all Airbus (AIR.PA) A330neo and A350 models and some Boeing (BA.N) 787 planes. The new target would bring Rolls closer to rivals such as General Electric (GE.N), its major competitor in widebodies. Erginbilgic said it would be achieved by extending the "time on wing" of its engines between maintenance, reducing the costs of manufacturing and repairs, a new pricing strategy and tackling previous low-margin contracts. Shares in Rolls-Royce, which have soared 161% in the year to date, gained 6.5% in early deals. "We are setting compelling and achievable financial targets for the mid-term which will take Rolls-Royce significantly beyond any previous financial performance," Erginbilgic said. Agency Partners analyst Nick Cunningham said the targets implied Rolls-Royce was willing to shed revenues in exchange for better profitability. "If so, that is a deeper culture change from Rolls-Royce’s traditional market share optimisation approach of past decades," he said. Asked if he was willing to sacrifice market share, Tufan said the company had a 55% share of widebody deliveries last year and he expected that level to continue this year, with growth over the next five to 10 years. "We will capture market share every year, but in a profitable way," he said. Rolls said it would sell non-core assets from across the group and create partnerships if that would create extra value. Its finances were hit by problems with its Trent 1000 engine and by the pandemic, which grounded long-haul aircraft and wiped out Rolls-Royce's revenue tied to engine flying hours. Recovery under Erginbilgic has been rapid, with a five-fold rise in first-half operating profit reported in August, helped by increasing prices for maintaining its engines and tightly managing its cost base. ($1 = 0.7921 pounds) https://www.reuters.com/business/aerospace-defense/rolls-royce-aims-big-jump-civil-aerospace-profitability-2023-11-28/

2023-11-28 10:52

Nov 28 (Reuters) - Global asset manager Invesco (IVZ.N) expects better returns from Asian credit markets in 2024 compared with the last two years as bets rise that the U.S. Federal Reserve will pause its interest rate hiking cycle. Asian investment-grade corporate bonds "will return in mid-teen percentages," on average, as the Fed holds off on further rate rises, Freddy Wong, head of Asia Pacific at Invesco Fixed Income, told the Reuters Global Markets Forum (GMF). Wong expected Asian credit markets to broadly offer high single-digit to low double-digit returns in 2024. Research from Bank of America showed investors have poured $145 billion into investment-grade corporate bonds globally, year-to-date, while pulling out $9 billion from high-yield bonds. Asian investment-grade credit, with a return of +1.3%, has outperformed other regions this year, BofA data showed, compared to -0.9% in the U.S., -1.9% in EMEA, and -2.3% in Latin America. Asian high-yield may not be an attractive enough bet just yet, Wong said, adding that he did not expect a recession in the U.S. next year. Investors typically look for low-double digit returns in Asia to enter high-yield, Wong said, but that market may not be cheap enough yet "to put money to work". "They can already get 6% to 8% high-yield-like return through investment-grade credit," Wong added. Within Asia, Wong expects a "strong" performance by Indian and Indonesian local currency bonds, and said debt in Australia and South Korea will "behave well" as the two continue to be correlated to U.S. markets. Wong said he was bullish on China fixed income for the next few years, adding, it is "the big trade we should not miss," in the backdrop of being the most under-allocated country by global investors. Fundamentally, China is changing the composition of its growth from being traditional infrastructure-led to high quality, Wong said, adding that allocations to China have to change focus going forward. (Join GMF, a chat room hosted on LSEG Messenger, for live interviews: https://tinyurl.com/yyr3x6pu) https://www.reuters.com/markets/asia/invesco-positive-asian-credit-2024-fed-pause-looms-2023-11-28/