2023-11-27 23:29

WINNIPEG, Manitoba, Nov 27 (Reuters) - The premier of Canada's oil and gas producing province Alberta said on Monday her government will consider creating a publicly-owned electricity company, in a bid to evade federal requirements to develop a net-zero power grid by 2035. The move is Alberta's latest attempt to undermine the climate action plans of Liberal Prime Minister Justin Trudeau, which Premier Danielle Smith and other conservative politicians say are unrealistic. Smith's United Conservative Party (UCP) government introduced a resolution in the Alberta legislature to study forming a province-run power corporation run under its Sovereignty Act, a previously unused law enacted last year to give Alberta a legislative framework to defy federal laws it deems unconstitutional. The resolution, once passed by the UCP majority government, would also order provincial authorities not to cooperate in implementing the Canadian federal government's planned clean electricity regulations. Such regulations would be costly and could lead to power shortages, Smith said. "It's simply too massive a risk for Albertans," Smith told reporters. "If we do not act we will end up with instability in our grid (and) we will either not be able to grow as a province or end up with brownouts and blackouts." Smith said her government hoped Ottawa would back down, adding the fight may end up in court. Federal Environment Minister Steven Guilbeault said Ottawa would continue moving ahead with its clean electricity regulations and there was no legal basis for Alberta's actions. "That's what I find unacceptable with the position that Premier Smith has taken because it's bad for Albertans, it's bad for workers in Alberta, it's bad for the economy of Alberta," Guilbeault told reporters in Ottawa. Canadian provincial laws are not allowed to frustrate the progress of federal laws, meaning Alberta's plan is unconstitutional, said Martin Olszynski, an associate professor at the University of Calgary. "This is just a bunch of political theatre," Olszynski said. The resolution would instruct the Alberta government to study forming a corporation to produce electricity if private-sector generators determine it is too risky to operate such facilities because of the Canadian government's regulations. The Alberta government company would be "generator of last resort," Smith said, meaning it would produce power only when supplies from private-sector companies are insufficient. The province currently generates most of its power from the private sector, unlike most others. That power corporation would not recognize federal regulations as valid. It would build or buy power plants that run on natural gas that might otherwise not be able to operate past 2035 due to the regulations. Canada already produces most of its power from renewable sources such as hydro and nuclear. Alberta, however, generates nearly half of Canada's emissions from electricity generation due to its reliance on natural gas. Power generators such as TransAlta TA.TO and Capital Power (CPX.TO) have not committed to Trudeau's 2035 goal but some say they may reach net-zero ahead of Alberta's own 2050 target. The federal government's electricity regulations are in draft form and scheduled to come into force on Jan. 1, 2025 after further consultation. https://www.reuters.com/world/americas/alberta-study-forming-its-own-power-company-fight-with-pm-trudeau-2023-11-27/

2023-11-27 23:06

European Investment Bank poll of 30,000 people globally 60% of EU citizens back paying compensation U.S. support at 63%, China at 74%, Japan at 72% SINGAPORE, Nov 27 (Reuters) - Citizens in Europe, the United States, China and Japan believe their countries should compensate poorer nations to help address the impact of climate change, a European Investment Bank poll of more than 30,000 people shared with Reuters showed. The fifth annual climate survey conducted by the bank revealed a broad global consensus to fund the fight against climate change, even if it means higher taxes and the elimination of fossil fuel subsidies. But concerns about the economic impact of climate action still prevailed across the world, with most respondents saying the transition to a low-carbon economy would only be successful if it also addresses inequalities, the survey revealed. "The latest EIB Climate Survey underlines people's profound awareness of climate change and their commitment to tackle it head on," said EIB Vice-President Ambroise Fayolle. "They recognise that a successful transition to a climate-neutral world goes hand in hand with addressing social and economic inequalities at home and globally," Fayolle said. Climate finance for adaptation and loss and damage will be a key issue at COP28 talks set to begin in Dubai this week, and more than 60% of respondents in the European Union and the United States agreed their countries needed to provide funds, said the EIB, the lending arm of the European Union. Though China still regards itself as a developing country, and believes that industrialised nations should provide the bulk of climate financing, nearly three quarters of Chinese respondents said China - the world's top carbon polluter - should also make contributions. Respondents from around the world ranked climate change as one of the world's three biggest challenges, along with the rising cost of living and income equality. The survey also revealed strong global support for the elimination of subsidies and tax breaks for fossil fuels, which is expected to be another major topic of contention at COP28. In India and China, two of the biggest providers of fossil fuel subsidies, more than 90% of those polled agreed they should be eliminated, with around three quarters of respondents in the United States, Europe and Japan also supporting such a move. https://www.reuters.com/business/environment/citizens-richer-countries-back-climate-help-vulnerable-eib-poll-2023-11-27/

2023-11-27 23:03

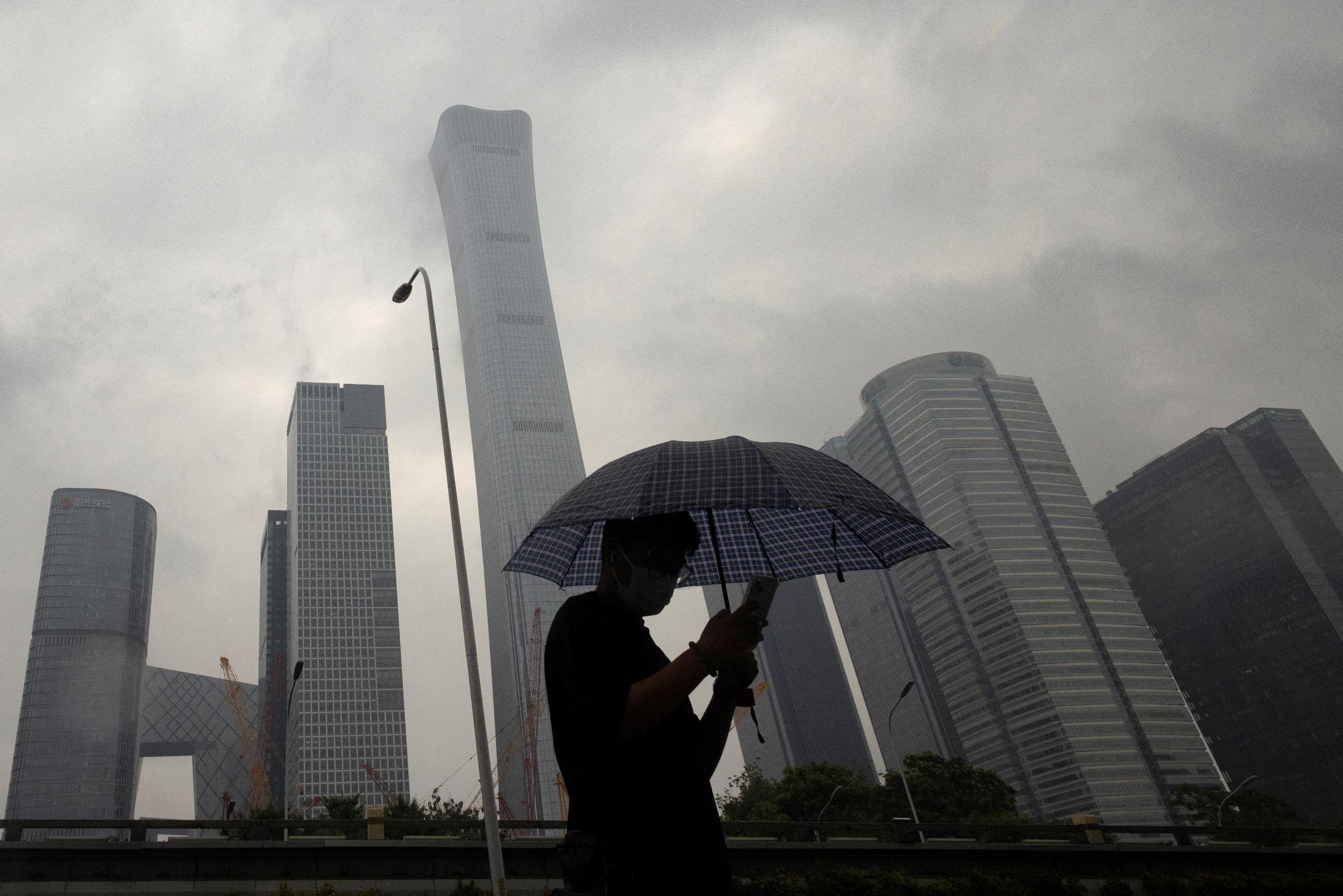

China records first quarterly foreign direct investment deficit Execs worry about China slowdown, geopolitics, regulations Trend could weigh on yuan, chip away at growth potential-analyst China-focused buyout fundraising has ground to a halt-data BEIJING/HONG KONG, Nov 28 (Reuters) - U.S. furniture company head Jordan England thinks his firm's Chinese suppliers are among the best in the game, but geopolitics and a slowing economy have pushed him to source more products from Southeast Asia, Eastern Europe and Mexico. "I'm looking to move away from it (China)," said England, CEO and co-founder of Florida-based Industry West. "It was always 'China plus one,'" he said, referring to the diversification strategy many businesses began implementing after Washington imposed trade tariffs on Beijing in 2018 to ensure they were not wholly dependent on Chinese suppliers. Now "it's like 'plus-10' and then China," he added, with the latter down to providing half of Industry West's products and being trimmed more. Foreign investors have been sour on China for most of this year, but data released over the past month has provided clear evidence of the negative impact de-risking strategies are having on the world's second-largest economy. Activity surveys showed manufacturing unexpectedly contracted in October, while exports accelerated their decline. China recorded its first-ever quarterly deficit in foreign direct investment in July-September, suggesting capital outflow pressure. Nicholas Lardy, senior researcher at the Peterson Institute for International Economics, said in a note the new data imply that foreign firms are not only declining to reinvest earnings, but are selling existing investments and repatriating funds. This trend could further weaken the yuan and clip China's economic growth potential, he added. "In recent years, the scale, proportion and growth rate of foreign investment absorbed by China have all remained at a relatively high level," He Yadong, a Chinese commerce ministry spokesperson, said in response to a question from Reuters. LONG-TERM PROSPECTS Businesses have longstanding worries about geopolitics, tightening regulations and a more favourable playing field for state-owned companies. But for the first time in the four decades since China opened up to foreign investments, executives are now also concerned about long-term growth prospects. A survey released last week by The Conference Board, a think tank, showed more than two-thirds of the CEOs who responded said China's demand has not returned to pre-COVID levels, with 40% expecting a decrease in capital investments in the country over the next six months and a similar proportion expecting to cut jobs. China is outwardly confident about growth despite a global economic slowdown, with policy advisers favouring a target of about a 5% expansion of gross domestic product in 2024 and the country aiming to double the economy's size by 2035. But England said he is concerned about how his Chinese suppliers that also produce for the domestic market will cope with the country's severe property market downturn. "I'm worried about these factories going from 500 workers to 200, to 100," he said. OPEN FOR BUSINESS? Premier Li Qiang's overtures declaring China open for business to foreign investors after the pandemic have been greeted with scepticism in some Western boardrooms in light of a broader anti-espionage law, raids on consultancies and due diligence firms and exit bans, trade bodies say. Li is expected to make a similar call on Tuesday at the country's inaugural China International Supply Chain Expo, which it is expected to use to tout its supply chain advantages. "Foreign business executives here are eager to continue in China," AmCham President Michael Hart said. "But boards back in the U.S. are wary." European firms have raised fair competition concerns about state-directed lending to Chinese manufacturers, while Noah Fraser, managing director of the Canada China Business Council, said "bad blood" remains over the detention of two Canadians from 2018 to 2021. In private equity, while Asia-focused funds have allocated capital to China, data from Preqin shows that as of Nov. 24, no China-focused buyout fund had been raised in 2023 in any currency, compared with $210 million in 2022 and $13.2 billion in 2019, before the pandemic. Primavera Capital founder Fred Hu cites mounting macroeconomic uncertainty, a "murky capital market outlook," and lingering concerns over past regulatory crackdowns on high-growth industries such as technology and education. "Tech firms and other private enterprises must be able to tap public markets for financing and liquidity, so the current market conditions in China do considerable harm to the real economy," said Hu, adding China-focused private equity firms were diverting capital to Southeast Asia, Australia and Europe. Despite the challenges, foreign investment flows are not unidirectional. Many firms, especially in the retail sector, still target China's giant market. McDonald's (MCD.N) said last week it had struck a deal to boost its stake in its China business. An executive at a European hotel chain, who spoke on condition of anonymity due to the topic's sensitivity, said his firm was happy to reinvest profits in China for now. "We know what's going on politically and yes, economically," he said, adding the latest data "was nothing to be proud of." "It's slow, but only warrants taking a 'wait and see approach.'" https://www.reuters.com/business/wests-de-risking-starts-bite-chinas-prospects-2023-11-27/

2023-11-27 22:52

Shein yet to determine IPO size, valued at over $60 bln in May IPO comes amid challenging markets and U.S. scrutiny Fast-fashion retailers still behind Amazon on sales Nov 27 (Reuters) - Fashion company Shein has confidentially filed to go public in the United States, according to two sources familiar with the matter, in what is likely to be one of the most valuable China-founded companies to list in New York. Goldman Sachs, JPMorgan Chase and Morgan Stanley have been hired as lead underwriters on the initial public offering (IPO), and Singapore-based Shein could launch its new share sale some time in 2024, the sources said. Shein has not determined the size of the deal or the valuation at IPO, the sources said. Bloomberg reported earlier this month it targeted up to $90 billion in the float. Shein and the banks declined to comment. The company founded in mainland China in 2012 was valued at more than $60 billion in a May fundraising, down by a third from a funding round last year. The most valuable China-founded enterprise to go public in the United States so far is ride-hailing giant Didi Global's (92Sy.MU) debut in 2021 at $68 billion valuation. The fast-fashion giant's move to go public in the U.S. comes as the market for initial public offerings is struggling to rebound after a string of lacklustre stock market debuts. In recent months there were four major IPOs, and three of them disappointed investors. Shares of German sandal-maker Birkenstock (BIRK.N), grocery delivery app Instacart (CART.O) and chip designer Arm Holdings dropped below their IPO prices in the days that followed debuts, though Arm's shares are now trading above that price. "It doesn't strike me as the most opportune time for Shein to come public, but if they need capital the markets are open ... and investor sentiment has been more positive than it was a few weeks ago," said Jason Benowitz, senior portfolio manager at CI Roosevelt. "When investors can review the financials, I would expect to see pretty strong growth historically ... the key question will be if they can kind of maintain the pace or to continue to gain market share going forward," he said. U.S. IPOs have raised about $23.64 billion so far this year, compared with $21.3 billion during the same period last year. In 2021, the comparable number was $300 billion when the IPO market was close to its peak. SUPPLY CHAINS Shein had started low-profile roadshows for the float in the U.S., said one of the sources, who declined to be identified due to confidentiality restraints. It is not immediately clear if the company has filed with China Securities Regulatory Commission (CSRC) for the U.S. IPO. Chinese companies need to receive clearance from the regulator before going ahead with their offshore offerings. CSRC did not immediately respond to a request for comment. "As it is a significant and highly disruptive player in the retail space, Shein will attract a lot of investor interest," said GlobalData managing director Neil Saunders. Reuters in July reported that Shein - which attempted to list in the U.S. in 2020 but shelved that plan - has been working with at least three investment banks about a potential IPO. In August, Republican attorneys general from 16 U.S. states asked the Securities and Exchange Commission to audit Shein's supply chain for the alleged use of forced labor ahead of its potential IPO. 'GOOD TIME TO LIST' Known for its $10 tops and $5 biker shorts, Shein ships the majority of its products directly from China to shoppers by air in individually addressed packages. The direct shipping strategy helped the firm avoid unsold inventory piling up in warehouses and avoid import tax in the United States, one of its biggest markets, as it allows the e-tailer to take advantage of the "de minimis" provision that exempts cheap products from tariffs. Some critics say the provision allows companies to evade higher tariffs on Chinese goods. Fast fashion retailers have been gaining popularity in the United States, with Shein taking away market share from the likes of Gap (GPS.N) as shoppers look for fresher styles. In August, Shein partnered with SPARC Group, a joint venture between Forever 21 owner Authentic Brands (AUTH.N) and mall operator Simon Property (SPG.N), in an attempt to expand their market reach. Shein along with Temu.com, however, have not been able to turn shopper visits into sales and are far behind market leader Amazon.com (AMZN.O) on that score. Sumeet Singh, an analyst at Aequitas Research who publishes on SmartKarma, said big companies like Shein were tapping capital markets due to peaking interest rates and ahead of possible changes in U.S. regulations for small retailers. "It's probably as good as it gets for them right now," he said. Shein's confidential U.S. IPO filing was first reported by China's Shanghai Securities Journal last week. The Wall Street Journal earlier on Monday confirmed the report citing sources. https://www.reuters.com/markets/deals/chinese-fast-fashion-shein-files-us-ipo-wsj-2023-11-27/

2023-11-27 22:50

Nov 27 (Reuters) - Delfin Midstream Inc said on Monday it had entered into a long-term liquefied natural gas (LNG) supply agreement with global commodity trader Gunvor. Delfin said in a news release its LNG plant in Louisiana will supply between 500,000 to 1 million tonnes of LNG per annum to Gunvor on a free-on-board basis at Delfin Deepwater Port for at least 15 years. Delfin has been developing the Delfin LNG Deepwater Port project supporting up to four floating LNG vessels with a combined export capacity of about 13.3 million tons per annum (MTPA), the release said. The company secured commercial agreements for LNG sales, liquefaction services and is in the final phase towards final investment decisions (FID) on its first three floating LNG vessels, the release added. Last month, U.S. energy regulators extended the amount of time Delfin had to put the onshore part of its proposed Gulf of Mexico floating export project off Louisiana into service until September 2027. In August, natural gas developer Tellurian Inc (TELL.A) revealed in a securities filing that trader Gunvor Singapore Pte Ltd terminated its contract to take cargoes. https://www.reuters.com/business/energy/delfin-signs-15-year-lng-supply-agreement-with-gunvor-2023-11-27/

2023-11-27 22:38

KYIV, Nov 27 (Reuters) - A winter storm lashed central and southern Ukraine, killing at least five people in Ukraine and three in neighbouring Moldova, with snow and high winds knocking out power to hundreds of towns and villages and shutting highways At least 19 people were injured in Ukraine and a further 10 in Moldova. Forecasters said more bad weather was on the way, with snow and rain forecast throughout Ukraine on Tuesday. The extreme weather struck as tens of thousands of troops man front-line positions in the 21-month-old war with Russia amid fears Moscow could attack the power grid with air strikes this winter. Ukrainian President Volodymyr Zelenskiy, speaking in his nightly video address, said five people had died in southern Odesa region and suggested there might be others elsewhere. Emergency services said the power remained out in 882 localities. Traffic was halted on 10 highways and more than 1,500 trucks were stranded. Schools were closed in both southern Ukraine and in Moldova. High winds left drifting snow up to two metres (six feet) deep in some places, Interior Minister Ihor Klymenko said. Ukrainian authorities shared images of damaged power grid facilities, toppled trees and rescuers helping people to climb out of drifts and towing cars away from snow-covered roads. Central Kyiv and southern Odesa and Mykolaiv regions were the hardest hit by the power cuts, with 40,000 homes initially affected in Kyiv region, authorities said. By 6:30 p.m, more than 15,000 homes in the region were still without electricity. In Moldova, two people were found frozen to death in a car in the east of the country and another outside the capital. Ukraine's border service said that two border crossings in Odesa region to Moldova reopened after a temporary suspension on Sunday, but traffic conditions remained difficult. On Sunday, the mayor of the Black Sea port of Odesa urged residents to stay at home, and authorities warned that water supplies were being interrupted by power cuts that stopped pumps from working. Eight people suffered hypothermia and five were injured by falling trees in Odesa region, the emergency service said. On Monday evening, the boiler facility in Odesa, where a 100-metre (yard) pipe broke and fell on Sunday, resumed operations. "Currently, heating is provided in a test mode for 120,000 customers in Odessa. People's homes should be warm by morning," Oleh Kiper, the regional governor, said on Telegram. https://www.reuters.com/world/europe/winter-storm-causes-power-outages-road-closures-ukraine-2023-11-27/