2024-08-13 06:25

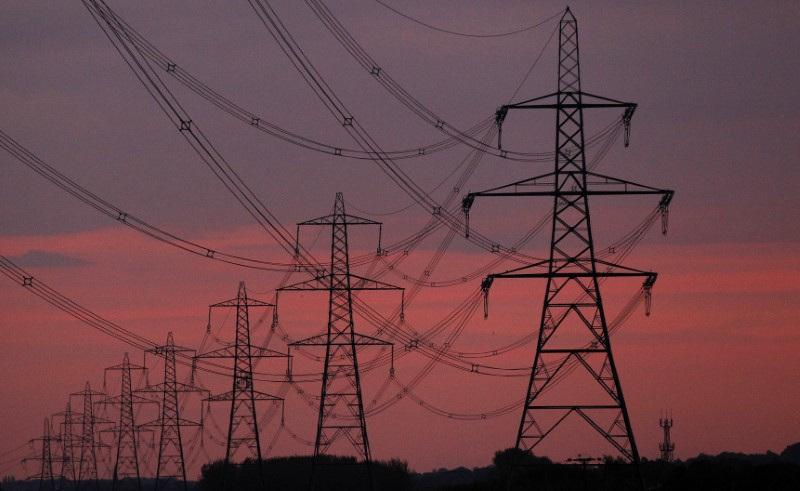

Aug 13 (Reuters) - Britain's energy regulator Ofgem on Tuesday approved the 3.4 billion pound ($4.35 billion) 2 gigawatt electricity 'Superhighway' from Scotland to Yorkshire. The approval for the biggest single investment for the electricity transmission infrastructure in Britain comes as part of the regulator's scheme , opens new tab to get new offshore wind energy to the market and delivery it quickly. Ofgem said the Eastern Green Two project for a subsea 'superhighway' with an underground 436 kilometre cable between Scotland and Yorkshire will be able to power up to 2 million homes across Britain. The construction of the project - a joint venture between National Grid Electricity Transmission and SSEN Transmission - is expected to begin later this year, and the transmission line will be operational in 2029, the regulator said. ($1 = 0.7817 pounds) Sign up here. https://www.reuters.com/business/energy/ofgem-signs-off-435-bln-electricity-superhighway-scotland-yorkshire-2024-08-13/

2024-08-13 06:03

LITTLETON, Colorado, Aug 13 (Reuters) - Slower consumption in China spurred the Organization of the Petroleum Exporting Countries (OPEC) to cut estimates for global oil demand growth this week, highlighting the vital role that the world's second largest economy plays in energy markets. Yet overall electricity generation in China climbed to new highs in the first half of 2024 - indicating robust use by households and factories - and imports of liquefied natural gas (LNG) rose 10% to the highest in three years. The country's ongoing efforts to transition energy systems away from polluting fuels towards cleaner power sources can help reconcile some of the conflicting signals, and account for cuts to refined fuel use and rising electricity demand. But record large thermal coal imports during the first half of 2024 also underscore the enduring challenge facing China's power suppliers, which remain hugely dependent on some fossil fuels even as they cut back consumption of others. Below are some of the key energy and power sector data points that can help provide a gauge of China's appetite for fossil fuels going forward, and the potential impact on world markets. OIL CUTS The main high-level measure of China's oil demand is the country's imports of crude oil, as China imports roughly 75% of its total oil needs and is the world's largest crude purchaser. China's imports in July fell to their lowest since September 2022, as weak processing margins and low fuel demand curbed operations at state-run and independent refineries. The world's largest crude oil buyer brought in 42.34 million metric tons in July, or about 9.97 million barrels per day (bpd), data from the General Administration of Customs showed. That import total was nearly 12% below the prior month and around 3% below the year-before tally, and so dealt a blow to oil market bulls who may have been hoping for sustained growth in China's oil purchases. However, analysts who have been tracking more granular data on China's refinery throughput and domestic production will have already been aware of the weak tone of the country's oil use. Additional detail can also be discerned by the implied direction of the country's oil reserves, which can be estimated by subtracting domestic output and refinery processing levels from total imports over a given time. The recent stretch of softening crude refinery processing data suggest that China's oil inventories have likely been climbing for several weeks, and so in turn will have tempered demand for imports. Going forward, any sustained drawdown in those oil stockpiles could herald a change in China's import appetite, and potentially trigger a sentiment boost in the broader oil market. CARS, COAL & POWER Further undermining oil and fuel demand in China lately has been a steady increase in the share of electric and clean energy vehicles in the national car fleet. For the first time, half of all vehicles sold in China in July were either pure electric or hybrid - marking a major milestone in China's efforts to wean consumers off petroleum products. But while higher sales of EVs and hybrids help to chip away at China's fossil fuel needs, they drive continued growth in the country's electricity demand. China's total electricity demand climbed by 32% between 2018 and 2023, according to energy think tank Ember, to 9,442 terawatt hours and the highest in the world. That growth rate is over 2.5 times the global average, and compares to just 1% growth in electricity demand in the United States over the same period. Coal remains the primary source of electricity, accounting for around 60% of total generation, and total coal-fired generation has scaled new highs for the past 8 years. However, coal's share of the generation mix has declined steadily over the past decade, while generation from clean sources has increased from around 22% in 2013 to over 35% in 2023. Further expansions in clean generation capacity are planned which will cement China's status as by far the world's largest producer of clean power, even as the country also holds the status of the top global coal consumer. Growth in natural-gas fired generation is also expected, driven by both higher local gas production and higher imports of liquefied natural gas (LNG). Through the first half of 2023, LNG imports were 38 million tonnes, according to ship tracking data from Kpler. That total is up 10.1% from the same period in 2023 and is the highest since the opening half of 2021. Seasonal flows data from LSEG show that LNG imports tend to decline after the summer months as demand for cooling systems drops. But gas demand should crank up again ahead of the coldest months of the year, and could help push China's annual LNG import totals to new highs for 2024 as a whole. Coal use and imports tend to follow similar swings, but power firms may opt to reduce coal-fired generation in favour of more gas-fired output if global gas prices remain relatively stable and competitive with imported coal. Sign up here. https://www.reuters.com/business/energy/key-china-energy-indicators-track-rest-2024-maguire-2024-08-13/

2024-08-13 05:59

Europe's STOXX steady, Nikkei rallies after wild week Investors awaiting key U.S. data this week Sentiment remains fragile, yen still in focus NEW YORK/LONDON, Aug 13 (Reuters) - Stocks jumped and bond yields fell on Tuesday after data showed U.S. producer prices increased less than expected in July, reinforcing market expectations that cooling inflation will allow the Federal Reserve to cut interest rates soon. The producer price index for final demand gained 0.1% last month after rising by an unrevised 0.2% in June, the Labor Department's Bureau of Labor Statistics said on Tuesday. Economists polled by Reuters had forecast the PPI gaining 0.2%. "The muted 0.1% month-on-month increase in final demand PPI and unchanged core PPI for July is not quite as good as it looks, but it is nevertheless consistent with the Fed’s preferred core PCE prices measure increasing at a below-2% annualised pace," said Paul Ashworth, the chief economist in North America at Capital Economics. Hopes that rate cuts are in the offing underpinned gains on Wall Street. The S&P 500 (.SPX) , opens new tab jumped 1.7%, the Dow Jones Industrial Average (.DJI) , opens new tab added 1% and the Nasdaq Composite (.IXIC) , opens new tab climbed 2.4%. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab jumped 1.5%. In line with speculation of monetary policy easing, Treasury yields fell. The benchmark 10-year Treasury yield slipped to 3.8484%, while the two-year Treasury yield fell to 3.9398%. Europe's STOXX 600 index (.STOXX) , opens new tab gained 0.5%, while Japan's Nikkei (.N225) , opens new tab jumped more than 3% following a holiday on Monday, a welcome relief after last week's wild swings that began with a massive selloff spurred by a rising yen and fears of a U.S. recession. "While aftershocks might reveal vulnerabilities, we continue to view recent volatility as being an equivalent of a 'heart palpitation' not a 'cardiac arrest,'" Viktor Shvets, head of global desk strategy at Macquarie Capital, said in a note. "We also maintain that the nervousness about a U.S. slowdown is overdone." The yen was firmer against the dollar at 146.77 per dollar, having touched a seven-month high of 141.675 on Monday last week, a far cry from the 38-year lows of 161.96 it was rooted to at the start of July. A Bank of Japan rate rise last month following bouts of intervention from Tokyo earlier in July wrong-footed investors and led them to bail out of popular carry trades, which use the currency of a low-rate market to fund investments with higher returns. The latest weekly data to Aug. 6 showed that leveraged funds - typically hedge funds and various types of money managers - closed their positions in the yen at the quickest rate since March 2011. Given the yen's recent rally, the dollar-yen is now more in sync with its yield differential, according to Karsten Junius, chief economist at Bank J. Safra Sarasin. "Another wave of the yen-funded carry trade unwind will likely push the yen still somewhat higher towards year-end. Yet we do not expect USD-JPY to fall meaningfully below 140," he said. DATA-HEAVY WEEK Data this week could sharpen views on the Federal Reserve's next move. Markets are currently evenly split between a 25 basis-point cut or a 50-bp cut at the next meeting in September. Traders are pricing in 100 bps of cuts this year. Surprisingly soft payrolls data kicked off the market meltdown at the start of last week but strong U.S. data since then has eased slowdown fears. Any hints of soft inflationary pressures could cause financial markets to double down on wagers the Fed will sharply cut rates this year, which would weigh on the dollar, said Kristina Clifton, a senior economist at Commonwealth Bank of Australia. U.S. consumer price index data for July is due on Wednesday and expected to show month-on-month inflation ticked up to 0.2%. Retail sales data is scheduled for Thursday. Euro zone bond yields were little changed. Germany's 10-year yield , the benchmark for the euro zone, fell to 2.188%. It hit its lowest since January at 2.074% last week. The dollar index , which measures the U.S. currency against six others, dipped 0.49% to 102.58. The euro was rose 0.6% to $1.09968, while sterling was up 0.8% at $1.28670. In commodities, Brent crude futures fell 1.9% to $80.78 a barrel, while U.S. West Texas Intermediate crude futures slipped 2% to $78.46 a barrel. Brent had gained more than 3% on Monday, while U.S. crude futures had risen more than 4%. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-08-13/

2024-08-13 05:47

HONG KONG, Aug 13 (Reuters) - Global investors are turning bearish on once-favoured Japanese stocks following last week's turbulence as they reassess economic prospects and the viability of yen-funded trades. Using cheap yen to buy stocks on the Nikkei (.N225) , opens new tab was a hot trade until this month. The Nikkei index had doubled since the start of 2023, and a tumbling yen had boosted returns for investors and companies. That trade is being turned on its head by sudden volatility in the Japanese yen, Bank of Japan (BOJ) rate rises, doubts around Japan Inc.'s earnings and worries the U.S. economy is stalling. The CSOP Nikkei 225 Daily Double Inverse exchange-traded fund (7515.HK) , opens new tab - the only ETF outside Japan that allows bearish bets against the Nikkei index - saw a surge in its trading volume during the week ended Aug. 9. Average daily turnover on the Hong Kong-listed product reached nearly HK$20 million ($2.57 million), a 20-fold increase from previous week's roughly HK$1 million per day and the highest since its launch in May this year. Investors are also exiting direct exposure to Japan. Global hedge funds dumped Japanese equities at the fastest pace in more than five years during the Aug. 2 to Aug. 8 week, Goldman Sachs said, and even some long-term investors have started cutting exposure. The BOJ's quantitative tightening and a strong yen will be headwinds for Japanese stocks, said Ben Bennett, head of investment strategy for Asia at LGIM, a London-based asset management giant. The firm's multi-asset funds had turned underweight Japanese equities before last week, he said, adding they maintained that weighting after the volatile week. Japanese stocks (.N225) , opens new tab had their worst one-day sell-off since 1987 last Monday. Fears of a U.S. recession and a surprise rate hike in Japan triggered a massive unwinding of billions of dollars of a popular yen carry trade that was financing the purchase of risk assets, including Japanese equities. While the actual size of the unwinding remains uncertain, some analysts warn it has room to go, given expectations of yen appreciation and a spike in the CBOE Volatility Index (.VIX) , opens new tab. The yen has surged from around 162 per dollar in mid-July to roughly 142 per dollar last Monday, its strongest level in seven months. "One of the drivers of upside in Japanese equities is going to phase out," said Carlos Casanova, senior economist for Asia at Swiss asset manager UBP, referring to yen carry trades. "Now we need to see an improvement in fundamentals, meaning that you need to see upward revisions in earnings. And that's not going to happen unless we see a recovery in the domestic economy," he said. UBP has recently exited some positions in Japanese equities and now holds a neutral view. Zuhair Khan, Tokyo-based senior portfolio manager at UBP, said it was getting tougher to trade the Japanese market as the U.S. interest rate cut path and the yen had both become harder to predict. Markets, meanwhile, are waiting for data due this week on Japanese second-quarter economic growth and U.S. inflation. "No one wants to act rashly now," said Steven Leung, a Hong Kong-based executive director at UOB-Kay Hian. "Investors need to wait for important figures this week to draw a more informed conclusion about whether the sell-off in Japanese stocks is over." ($1 = 7.7882 Hong Kong dollars) Sign up here. https://www.reuters.com/markets/asia/overseas-investors-turn-bearish-japanese-equities-after-brutal-sell-off-2024-08-13/

2024-08-13 05:04

NEW YORK, Aug 13 (Reuters) - Panic appears to have faded following last week's outbreak of volatility in U.S. stocks, but if history is any guide, markets might remain jittery for months. Wall Street's most closely watched gauge of investor anxiety, the Cboe Volatility Index (.VIX) , opens new tab, has rapidly eased after closing at a four-year high last week and stocks came screaming back following the year's worst tumble. The S&P 500 (.SPX) , opens new tab is up 3% from last week's lows, while the VIX hovers around 20, far below the Aug. 5 close of 38.57. Investors pointed to the rapid dissipation of market anxiety as further evidence that last week's meltdown was fueled by the unwinding of massive leveraged positions, including yen-funded carry trades, rather than longer-term concerns such as global growth. Even so, turbulent episodes in which the VIX shot higher show markets tend to stay frothy for months after a blowup, arguing against the kind of risk-taking that lifted asset prices in the first part of the year. Indeed, a Reuters analysis showed the VIX has taken an average of 170 sessions to return to its long-term median of 17.6 once it has closed above 35, a level associated with high investor anxiety. "Once (the VIX) settles into a range, then people will get a little more passive again," said JJ Kinahan, CEO of IG North America and president of online broker Tastytrade. "But for six months to nine months, it usually shakes people up." This month's U.S. stock market tumult follows a long, placid period in which the S&P 500 rose as much as 19% for the year to a record high in early July. Cracks formed when disappointing earnings from several richly valued technology companies last month sparked a broad-based sell-off and lifted the VIX from its range in the low teens. More serious ructions followed in late July and early August. The Bank of Japan unexpectedly raised interest rates by 25 basis points, squeezing players in a carry trade fueled by traders borrowing cheaply in Japanese yen to buy higher-yielding assets from U.S. tech stocks to bitcoin. Meanwhile, investors rushed to price in the chance of a U.S. slowdown following a spate of alarming economic data. The S&P 500 fell as much as 8.5% from July's records, just missing the 10% threshold commonly considered a correction. The index is still up 12% this year. Mandy Xu, head of derivatives market intelligence at Cboe Global Markets, said the market's rapid drop and quick rebound pointed to a positioning-driven unwinding of risk. "What we saw on Monday (Aug. 5) was really isolated to the equity market and the FX market. We did not see a correspondingly big increase in volatility in the other asset classes, like rate volatility and credit volatility," she said. Investors have ample reason to remain jumpy in the months ahead. Many are waiting for U.S. data, including a consumer price report later this week, to show whether the economy is merely downshifting or heading for a more serious slowdown. Political uncertainty ranging from the US election in November to the prospect of increased Middle East tensions is also keeping investors on their toes. Nicholas Colas, co-founder of DataTrek Research, is watching whether the VIX can remain below its long-term average of 19.5 to determine whether calm is truly returning to markets. "Until it (the VIX) drops below 19.5 (the long run average) for a few days at least we need to respect the market's uncertainty and stay humble about trying to pick bottoms in markets or single stocks," he said. CORRECTION WATCH? The market's close brush with correction territory may be another worry. In the 28 instances in which the S&P 500 got within 1.5% of confirming a correction, the index went on to do so within 20 cases in an average span of 26 trading sessions, data going back to 1929 showed. In the eight cases which it did not confirm a correction, however, the index took an average 61 trading sessions to hit a new high. CPI data due on Aug. 14 and earnings from Walmart and other retailers this week could be crucial in determining investor sentiment, said Mark Hackett, chief of investment research at Nationwide, in a recent note. "It wouldn't be surprising to see potentially overblown reactions to this week's CPI number, retailer earnings and retail sales from investors given the heightened emotional responses in the market recently." Sign up here. https://www.reuters.com/markets/us/fear-fades-us-stocks-history-shows-quick-return-calm-unlikely-2024-08-13/

2024-08-13 04:36

A look at the day ahead in European and global markets from Ankur Banerjee Japanese shares returned from a holiday with a bang on Tuesday, erasing all of last week's losses as a stable yen provided relief to wary investors, with a slew of U.S. data this week set to sharpen market views on the Fed's next move. U.S. producer price data are due later in the day and will likely sway markets before focus switches to consumer price index data for July scheduled for Wednesday. The retail sales report on Thursday rounds up the data dump this week. Investors will parse through the dataset to gauge whether the Federal Reserve will go for a 50 basis point cut or a 25 bps cut in its September meeting. Traders are currently evenly split between the two, the CME FedWatch tool showed. They had at one point last week fully priced in a 50 bps cut during the selloff sparked by fears of a U.S. recession. That has left traders hesitant in placing major bets before the data, although Japan's Nikkei (.N225) , opens new tab grabbed the spotlight in an otherwise lacklustre Asian session as a stable yen calmed investor nerves after last week's sharp swings. The over 2% surge in Japanese shares means they are back at levels last seen on Aug. 2. What market meltdown? The yen, the other epicentre of the steep selloff last week, was slightly weak at 147.435 per dollar, away from the seven-month high of 141.675 it hit on Monday last week. Much of the yen's moves in the past few trading days have been muted, allowing some semblance of calmness to return to the market and leaving investors wondering whether the unwinding of carry trade has concluded for now. Investors will also watch out for comments from Federal Reserve Bank of Atlanta President Raphael Bostic who is due to speak later in the day, while European hours will likely be dominated by UK wage data. Meanwhile, those turning up for Republican presidential candidate Donald Trump's interview with billionaire entrepreneur Elon Musk had to wait a while before the session got going due to a lengthy delay caused by technical problems that kept many users from accessing the live stream. Key developments that could influence markets on Tuesday: UK wage data for June, UK ILO unemployment rate for June, Germany ZEW economic survey and current conditions for August Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-08-13/