2024-08-07 15:43

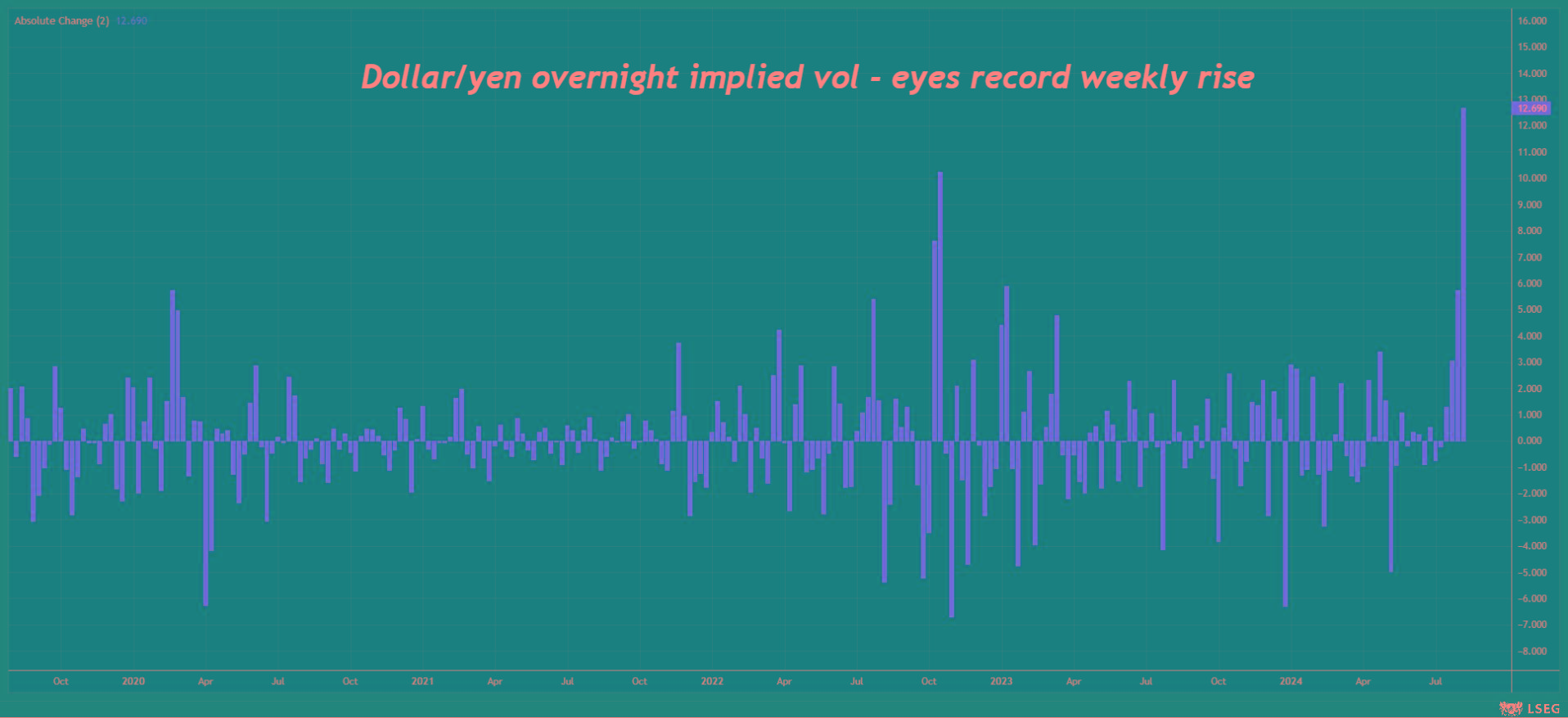

ORLANDO, Florida, Aug 7 (Reuters) - One of the ironies of the burst of volatility that just blindsided financial markets is its inevitability. Trades that are only feasible – and only highly profitable – in a world of low volatility are suddenly exposed when "vol" spikes. While traders can maintain these positions for a long time, they are inherently unstable, and getting the time right consistently is next to impossible. These wagers include FX "carry trades" – considered by many to be central to the gyrations that have recently rocked world markets – and the so-called "basis" trade in U.S. Treasuries, where hedge funds arbitrage the tiny price difference between futures and bonds. Importantly, the leverage needed to juice the profits of many of these arbitrage trades amplifies the risk – and the pain when the inevitable turning point arrives. In theory, none of these opportunities should last long if you believe in the efficiency of the free market, and its self-correcting ability to iron out arbitrage wrinkles once they appear. The reality is rather different, of course. Leveraged, speculative bets exploiting interest rate or price differentials can last for a remarkably long time. Witness the yen carry trade. It lasted for years, aided by a decade of "Abenomics" during which Japan deliberately weakened its currency with ultra-loose monetary policy. There's nothing wrong with this, of course. Financial markets draw in participants of all guises with widely varying agendas, time horizons and risk tolerance profiles. But, as we saw recently, high-risk gambles can sour in the blink of an eye as selling to cover losses and meet margin calls begets more selling. INTEREST RATE DIFFERENTIAL From a theoretical and fundamental perspective, such trades are often counterintuitive. Look at the FX carry trade. In its simplest form, this involves borrowing cheaply in a low-yielding currency and investing in a higher-yielding currency or asset. The trader pockets the interest rate differential and, in theory, the price divergence as the borrowed currency depreciates. But currencies that offer low returns are relatively low-risk assets backed by solid fundamentals like a big current account surplus. Interest rates are low because inflation is low. Currencies offering higher rates of return are fundamentally less appealing. Yields are high to compensate for higher or more volatile inflation, increased credit risk, or greater political instability. In some cases, all of the above. Successful carry trades thus rely on two things: low volatility – or, more precisely, long periods of below-average vol – and timing. The investor needs to exit the trade before the inevitable spike in volatility sparks a wave of short covering that blows up the trade. TIMING IS HARD Getting the timing right on these types of trades is more luck than expertise, but even sophisticated investors often seem to forget this, especially when volatility remains low for a long time. "The nature of the carry trade is very skewed - you make money slowly but lose it very quickly," says Brent Donnelly, president of Spectra Markets. "It seems too good to be true but it's very difficult to risk manage. You're hoping for a benign world with low economic and financial market volatility ... but when volatility spikes you are forced to get out quickly." Investors can be lulled into complacency because dramatic spikes in vol, though inevitable, are rare. According to analysts at HSBC, the dollar's 10% fall against the yen in the past month is in the bottom 0.4th percentile of its history of 20-day changes dating back to 1974. The last time there was a similarly large decline was in October 2008. The two-year Treasury yield's near 50 basis point plunge in only two days is similarly infrequent. This has happened only a few times in the past 40 years, notably on Black Monday, after 9/11, and during the global financial crisis in 2008 and the U.S. regional banking shock last year. The fallout when these trades go bust can be severe. A "Value at Risk" shock of this magnitude, essentially a jump in the maximum loss an investment can sustain over a period of time, can destroy portfolios and bring down funds. In extremis, it can risk sparking global financial instability, as was seen when Long Term Capital Management crashed in 1998. Part of the problem may be how "VaR" models are constructed. Many use basic vol gauges like the S&P 500 "VIX" index as a core input. But such metrics are often artificially depressed by the speculative frenzy that inflates these leveraged trades in the first place. Then they pop. While we don't yet know how the current episode will play out, it's safe to say there will be casualties. Consider that positions in the U.S. Treasury "basis trade" that regulators have warned about are now worth over $1 trillion. Jonathan Ruffer, chairman of the eponymous UK-based fund Ruffer, wrote on July 11 that performance had been sub-par partly because the yen had not rebounded as he hoped. He lamented the difficulty in timing the turn, but he noted that when it goes, it will move "explosively" and appreciate "far, far above reasonable value." The yen turned on July 11. It remains to be seen what will turn next. (The opinions expressed here are those of the author, a columnist for Reuters.) Sign up here. https://www.reuters.com/markets/dont-be-surprised-when-unstable-trades-blow-up-2024-08-07/

2024-08-07 14:45

TORONTO, Aug 7 (Reuters) - Canadian economic activity expanded at a slower pace in July as a measure of inflation fell to a four-month low, Ivey Purchasing Managers Index (PMI) data showed on Wednesday. The seasonally adjusted index fell to 57.6 from 62.5 in June. The Ivey PMI measures the month-to-month variation in economic activity as indicated by a panel of purchasing managers from across Canada. A reading above 50 indicates an increase in activity. The gauge of employment rose to an adjusted 56.1 from 52.9 in June, while the prices index was at 59.2, down from 62.3 and its lowest level since March. The unadjusted PMI fell to 55.3 from 62.4. Sign up here. https://www.reuters.com/markets/canadas-ivey-pmi-shows-activity-expanding-slower-pace-july-2024-08-07/

2024-08-07 12:58

LONDON, Aug 7 (Reuters) - The pound rose on Wednesday after falling to a five-week low the previous day, and climbed sharply against the yen after a Bank of Japan official played down the chances near-term rate hikes. Sterling was last up 0.27% at $1.2726 after falling to $1.2674 on Tuesday, the lowest since the start of July. The pound has fallen from a one-year high above $1.30 in July, pulled down by expectations that the Bank of England would cut rates, which it did in early August, and a selling of currencies deemed riskier investments during the recent turbulence. Sterling fell on Monday and Tuesday even as the dollar dropped following weak economic data, as investors moved out of currencies deemed to be more closely linked to the health of the global economy. The focus in currency markets on Wednesday was on the Japanese yen, which dived after an influential Bank of Japan official said a further rate hike was not under consideration while markets were so volatile. BOJ Deputy Governor Shinichi Uchida's comments helped soothe nerves across global markets, where a rapid rally in the yen had caused investors to unwind other investments and was a key factor in sending stocks tumbling. Sterling was last up 1.88% against the yen at 186.92 yen , although it remained 3% lower for the month after the Japanese currency's powerful rally. "Uchida's dovish remarks following the (Bank of Japan) rate hike on July 31 provided relief to markets, resulting in a rebound in Japanese equities and a depreciation of the yen against the dollar," said Charu Chanana, Saxo's head of FX strategy. The pound was up against the euro , which rallied this week as investors sold the dollar. The euro was last 0.44% lower at 85.78 pence, after hitting a three-month high of 86.2 pence on Monday. Sign up here. https://www.reuters.com/markets/currencies/sterling-rebounds-five-week-low-rallies-against-yen-2024-08-07/

2024-08-07 12:52

French police cite email possibly sent by rail saboteurs US-based digital group Riseup unlikely to comply with subpoena Foreign involvement not ruled out; 2023 Polish rail hack of interest French far-left, anarchist groups notoriously hard to penetrate PARIS, Aug 7 (Reuters) - Police in France investigating the sabotage of high-speed rail lines hours before the Paris Olympics' Opening Ceremony have asked the U.S. FBI for help, two sources with direct knowledge of the French inquiry said. Investigators called in the FBI after media organisations, including Reuters, received an email the police believe may have been sent by the perpetrators. It set out a rambling list of grievances but did not explicitly claim responsibility. The email, signed by "an unexpected delegation", was sent from a riseup.net address, a Seattle-based collective that says it provides "communication and computer resources to allies engaged in struggles against capitalism and other forms of oppression". The saboteurs targeted four high-speed TGV lines heading into Paris with incendiary devices, causing travel chaos hours before a global audience tuned in to follow the parade of Olympic athletes along the River Seine on July 26. There have been no arrests. French officials suspect domestic far-left groups, but have not ruled out foreign involvement. As riseup.net is U.S.-based, French police have asked the FBI to push that organisation to identify the email account-holder, the two sources told Reuters. The FBI declined to comment. Riseup did not respond to an emailed request for comment. The FBI would need to subpoena Riseup to hand over the details, but Riseup would be unlikely to comply. "We will actively fight any attempt to subpoena or otherwise acquire any user information," it says on its website. "We do not share any of our user data with anyone." In a 2020 interview with Belarusian anarchist group Pramen, Riseup said it had never complied with a foreign legal request. "We regularly get legal requests from all around the world. We are not required to respond, and so our policy is to not." However, the FBI has previously served warrants on Riseup. In 2012, FBI agents seized a server used by Riseup as part of a probe into bomb threats. In 2017, Riseup begrudgingly complied with two FBI warrants seeking the identity of accounts involved in extortion. The author of the email railed against France's arms, energy and nuclear sectors, and criticised a TGV network as only benefiting "a few privileged people". They said the impact of the attacks - "spoiling tourists' trips or disrupting holiday departures" - was minimal when compared with the legacy of a transport system that has "always been a means for the colonisation of new territories". FOREIGN FINGERPRINTS? Both sources said French investigators have yet to find firm evidence of foreign involvement. One source said police are looking for a possible link to a 2023 hack of the Polish rail system, which Polish intelligence initially believed was carried out by Russia. In December, a Polish court sentenced 14 citizens of Ukraine, Belarus and Russia for spying for Russia. The operatives were monitoring rail transports of arms for Ukraine via Poland and planning to disrupt them. France has accused Russia of waging a concerted disinformation campaign to sow chaos ahead of the Olympic Games, now in their second week. French police arrested a Russian man in July suspected of planning to destabilise the Olympics. The Russian Foreign Ministry did not respond to a request for comment lodged after the sabotage incident. Police have yet to establish a link to a similar sabotage of France's telecoms network two days after the TGV attacks, the sources said. Although both involved incendiary devices, one source said the explosive materials used were different. One line of enquiry relates to explosive material found on a TGV line near Marseille on May 8 - the same day the Olympic torch arrived in the city. The explosive material was almost identical to that used in the July 26 attacks, the source said. The prosecutor's office in Aix-en-Provence confirmed it was investigating, but declined to comment further. French police are investigating former employees of state-owned rail operator SNCF, as well as third-party contractors, but one of the sources said much of the knowledge needed to undertake the TGV sabotage can easily be found online. French police are also in talks with Italian, German and Spanish counterparts as the attacks may have been coordinated with anarchist groups from abroad, the source added. Far-left and anarchist cells typically oppose the state and capitalism, and are increasingly incorporating environmental concerns into their ideologies, French officials say. They have proven hard to penetrate, the two sources said. Their members often live off-grid and are paranoid of outsiders. They shun mainstream communication channels and practice impeccable digital hygiene. As their attacks are generally non-lethal, they are less of a priority for security services predominantly focused on deadly Islamist militants. Sign up here. https://www.reuters.com/world/europe/france-seeks-fbi-help-probe-high-speed-train-sabotage-hours-before-olympics-2024-08-07/

2024-08-07 12:45

TOKYO, Aug 7 (Reuters) - Japanese utility Electric Power Development (J-Power) (9513.T) , opens new tab has signed a joint study agreement with two Australian carbon capture and storage developers, deepC Store and Azuli, for a strategic partnership, they said on Wednesday. The two Australian companies have been awarded two greenhouse gas assessment permits, or GHG acreages, in the Bonaparte and Browse Basins, some 200-250 km off Australia's Northwest coast. Through the partnership, the three companies aim to commercialize a project to capture carbon dioxide (CO2) emitted in Japan, Australia and the surrounding region and store it in Australia, they said in a statement. J-Power intends to become a joint venture participant in the GHG acreages, which could permanently store up to 1 billion metric tons of CO2. The Japanese utility will also make a cash contribution to the joint study and secure rights to a participating interest in the venture developing the GHG acreages. The three companies aim to develop a full value chain project, receiving liquefied CO2 at locations in Japan, Australia and the surrounding region, and transporting it by ship to floating storage and injection facilities in Australian waters, they said. Australia, one of the world's largest liquefied natural gas exporters, is banking on CCS technology to decarbonise its industries and continue expanding its LNG production to meet demand from top buyers such as Japan and South Korea. Sign up here. https://www.reuters.com/business/energy/japans-j-power-partners-with-australias-carbon-capture-developers-2024-08-07/

2024-08-07 12:33

TOKYO, Aug 7 (Reuters) - The Japanese government is closely monitoring stock and currency markets and cooperating with the central bank and other countries, Japan's top currency diplomat Atsushi Mimura said on Wednesday. "We've been cooperating with other countries, as well as the Bank of Japan and other government agencies," Mimura said when asked about recent financial market routs at an event hosted by the Nikkei Business magazine. He also stressed that there have been no major changes in Japan's economic fundamentals, saying that the Japanese economy is likely to recover modestly. When asked specifically about current foreign exchange rates, Mimura said he doesn't have specific levels in mind. "We're focused on volatility, as excessive volatility raises uncertainties for businesses," he said. "It's desirable for currencies to move in a stable manner reflecting economic fundamentals," he added. The yen has faced high volatility in recent weeks. It fell on Wednesday after an influential Bank of Japan official played down the chances of a near-term rate hike, though it remained far above its 38-year low of 161.96 per dollar hit in early July. Sign up here. https://www.reuters.com/markets/currencies/japans-top-currency-diplomat-says-monitoring-markets-with-sense-urgency-2024-08-07/