2024-08-05 22:54

Fear of wider Middle East conflict spurs buying Protests lead to output disruptions in Libya Financial markets recover from recent sell-off US gasoline demand likely above 9 million bpd last week -UBS NEW YORK, Aug 6 (Reuters) - Oil prices settled higher on Tuesday, bouncing off multi-month lows hit in the previous session, as investor attention turned to supply tightness and financial markets recovered from their recent slump. Brent crude futures rose by 18 cents, or 0.2% to settle at $76.48 a barrel. U.S. West Texas Intermediate futures gained 26 cents, or 0.4%, to close at $73.20 per barrel. Both benchmarks broke a three-session declining streak. Iran's vow of retaliation against Israel and the U.S. following the killing of two militant leaders has raised concerns that a wider war is brewing in the Middle East, which could have a direct impact on supplies from the region. Lower production at Libya's 300,000 barrel-per-day (bpd) Sharara oilfield is also adding to concerns of supply shortages. Libya's National Oil Corp said on Tuesday it would start to gradually decrease production at the field due to protests. Recent declines in crude oil and fuel inventories at major trading hubs are also supporting oil prices. "Oil fundamentals are still suggesting an undersupplied oil market, with oil inventories still falling," UBS analyst Giovanni Staunovo said. Gasoline demand in the U.S. was likely at over 9 million barrels per day last week, feeding confidence in the economy, Staunovo said. Global oil inventories decreased by around 400,000 bpd in the first half this year, according to U.S. Energy Information Administration (EIA) estimates published on Tuesday. It expects stockpiles to decline by around 800,000 bpd in the second half of the year. The agency lowered its average oil price forecasts for this year and next year, citing recent declines precipitated by economic concerns. It still expects higher prices in coming months. Brent spot prices will range between $85 and $90 per barrel by the end of the year, the EIA said. On Monday, Brent futures slumped to their lowest since early January and WTI futures had touched their lowest since February, as a global stock market rout deepened on growing concerns of a potential recession in the U.S., the world's largest petroleum consumer. Still, Goldman Sachs said its economists see recession risk as limited and believe oil prices will find support in coming weeks from strong demand in the West and India. Sign up here. https://www.reuters.com/markets/commodities/oil-prices-rise-over-1-mounting-concerns-over-middle-east-supply-2024-08-05/

2024-08-05 22:39

FRANKFURT, Aug 6 (Reuters) - Parts of Frankfurt airport suffered a power outage late on Monday but flights at Germany's busiest hub were not affected, an airport spokesperson told Reuters. Parts of the airport's Terminal One have had no electricity from around 2100 GMT, or 2300 local time, because of a technical defect at an external substation nearby that technicians are dealing with, the spokesperson added. All planned take-offs and landings took place before the airport's ban on night flights began from 2300 until 0500 local time. "The backup power supply has been activated. Even if there were any flights now they would not be affected," said the spokesperson. Sign up here. https://www.reuters.com/world/europe/frankfurt-airport-suffers-partial-power-outage-flights-are-not-impacted-2024-08-05/

2024-08-05 22:30

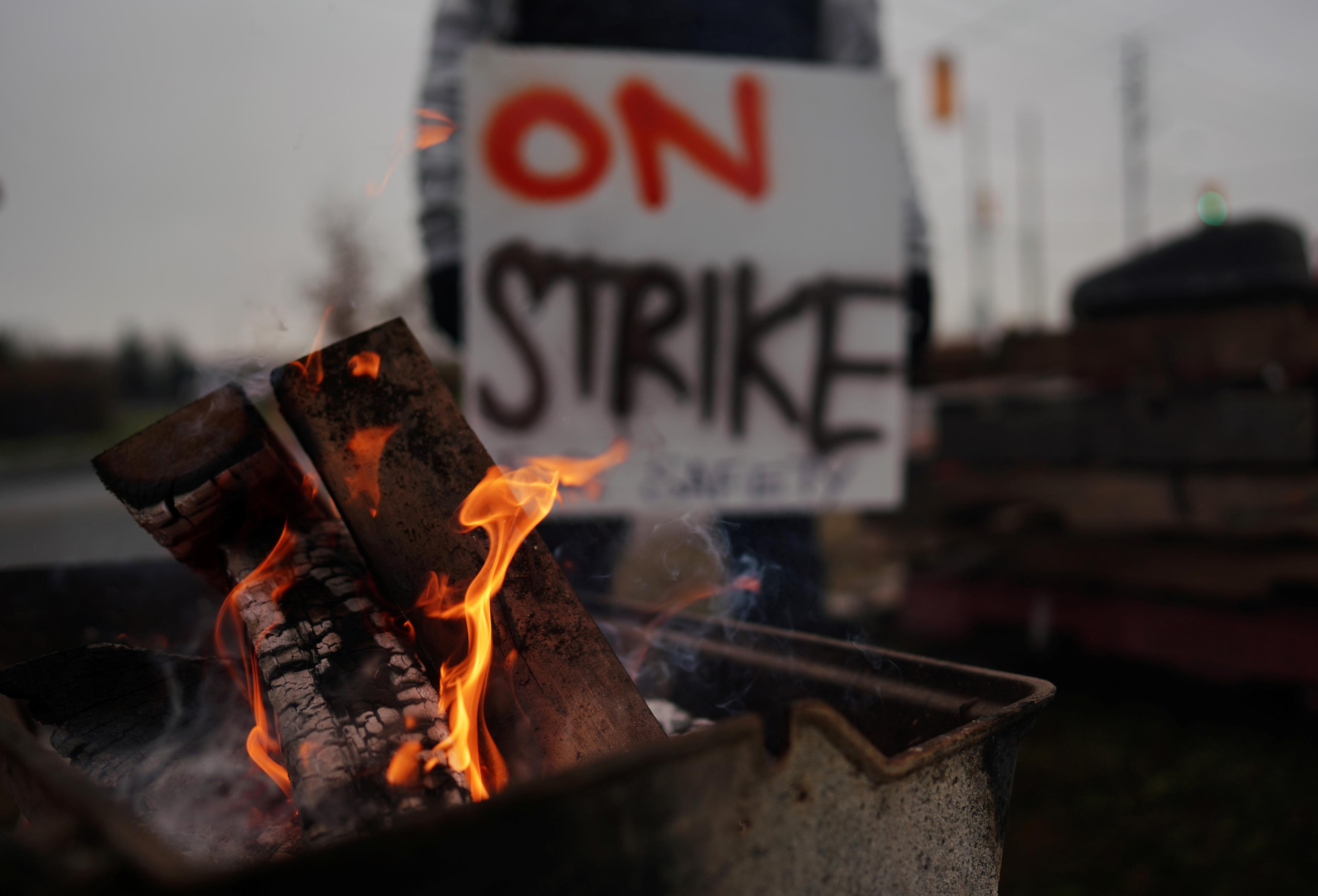

Aug 5 (Reuters) - Teamsters Canada, Canadian National Railway (CNR.TO) , opens new tab and Canadian Pacific Kansas City (CP.TO) , opens new tab have agreed to restart stalled contract negotiations along with federal mediators, Minister of Labor Steven MacKinnon said on Monday. "The meetings were frank, constructive discussions that reflected the gravity of the situation before Canada's railways, workforce and entire economy," MacKinnon said in a statement, posted on X, after a discussion with the leadership of the union and the rail companies. The goal of the meeting was to discuss increasing the pace and frequency of discussions at both companies, which had slowed down after the federal government temporarily suspended workers' right to strike, Teamsters Canada said in a separate statement. All parties would meet again on Wednesday in Montreal and Calgary, the union added. In May, workers represented by the Teamsters union had voted overwhelmingly to strike. "A work stoppage can be avoided, provided both companies are willing to return with fair and equitable proposals," Teamsters Canada said. Canada relies heavily on its extensive railway network, given its expansive geography and significant exports such as grain, potash and coal. Sign up here. https://www.reuters.com/business/autos-transportation/teamsters-canada-rail-companies-agree-restart-contract-talks-minister-says-2024-08-05/

2024-08-05 22:25

Aug 5 (Reuters) - U.S. pipeline operator ONEOK (OKE.N) , opens new tab reported a rise in second-quarter profit on Monday, as it moved more natural gas and liquids from the Rocky Mountain region. The company said its natural gas liquids (NGL) raw feed throughput volumes rose by 12% and natural gas processing volumes increased 10% in the Rocky Mountain region. The gains in volumes helped it offset lower NGL and natural gas prices. U.S. natural gas prices have plunged about 26% this year as mild weather and high storage levels have weakened prices for the commodity. ONEOK's NGL unit adjusted core profit rose 19.1% to $635 million during the reported quarter while natural gas gathering and processing segment core profit rose by 18.5%. NGLs, such as ethane and propane, are used as feedstock by the petrochemicals industry. ONEOK, which has access to about half of entire U.S. refining capacity, said its total refined product volume shipments rose by 8.9% to 1.54 million barrels per day, sequentially. "Looking ahead to the remainder of the year, we expect favorable market fundamentals, strong performance across our operations and additional opportunities ahead," said CEO Pierce Norton II. The Tulsa, Oklahoma-based company reported net income of $780 million, or $1.33 per share, for the three months ended June 30, compared with $468 million, or $1.04 per share, a year earlier. Sign up here. https://www.reuters.com/markets/commodities/oneok-quarterly-profit-rises-strong-rocky-mountain-region-volumes-2024-08-05/

2024-08-05 22:20

Apple falls as Berkshire cuts its stake by half Wall Street "fear gauge" spikes U.S. does not look like it is in recession: Fed's Goolsbee Indexes: Dow down 2.6%, S&P 500 down 3%, Nasdaq down 3.4% NEW YORK, Aug 5 (Reuters) - U.S. stocks ended with steep losses on Monday, leaving the Nasdaq and S&P 500 down at least 3% each as the market extended last week's sell-off amid U.S. recession worries and as Apple shares fell sharply on news that a big investor had cut its stake. All three major indexes registered their biggest three-day percentage declines since June 2022, and the Nasdaq and S&P 500 closed at their lowest levels since early May. The recession fears shook global markets and drove investors out of risky assets following weak economic data last week, including Friday's soft U.S. payrolls report. Investors worry that the economy is losing steam more rapidly than anticipated and that the Federal Reserve erred by keeping interest rates steady at its last policy meeting. Shares of Apple (AAPL.O) , opens new tab fell 4.8% after Berkshire Hathaway (BRKa.N) , opens new tab halved its stake in the iPhone maker. Billionaire investor Warren Buffett also let cash at Berkshire soar to $277 billion. Nvidia (NVDA.O) , opens new tab, Microsoft (MSFT.O) , opens new tab and Alphabet (GOOGL.O) , opens new tab also slid, while the Cboe Volatility index (.VIX) , opens new tab, Wall Street's "fear gauge," had its highest close since Oct. 28, 2020. All 11 of the S&P 500 sectors fell, led by declines in technology (.SPLRCT) , opens new tab. Chicago Fed President Austan Goolsbee downplayed recession fears, but said Fed officials need to be cognizant of changes in the environment to avoid being too restrictive with interest rates. "Today we're seeing a sell-off as an extension of that anxiety that was felt last week," said Neville Javeri, portfolio manager and head of the Empiric LT Equity team at Allspring in Washington. It "started off with the jobs data last week, and it clearly led to the belief that the Fed needs to start being more proactive around where those unemployment numbers are going," he said. The Dow Jones Industrial Average (.DJI) , opens new tab fell 1,033.99 points, or 2.6%, to 38,703.27, the S&P 500 (.SPX) , opens new tab lost 160.23 points, or 3.00%, to 5,186.33 and the Nasdaq Composite (.IXIC) , opens new tab dropped 576.08 points, or 3.43%, to 16,200.08. The S&P 500 was down more than 4% at its lowest level of the session, 5,119.26. Indexes trimmed losses in late morning after data showed U.S. services sector activity in July rebounded from a four-year low amid a rise in orders and employment. The weak jobs report and shrinking manufacturing activity in the world's largest economy added to worries following recent disappointing forecasts from the big U.S. technology companies. The Nasdaq Composite on Friday confirmed it was in correction territory. Traders are now pricing in an 86% chance the Fed will cut rates by 50 basis points at its next scheduled policy meeting in September, and a 14% chance of a 25 basis-point reduction, according to the CME Group's FedWatch Tool. The focus of the sell-off has been the so-called Magnificent Seven group of stocks, which previously had propelled the indexes to record highs this year. Traders also attributed some weakness in stocks to unwinding of sharp positions of carry trades, where investors borrow money from economies with low interest rates such as Japan or Switzerland to fund their bets in high-yielding assets elsewhere. Pringles maker Kellanova (K.N) , opens new tab soared 16.2% after a Reuters report said candy giant Mars was exploring a potential buyout of the company. Volume on U.S. exchanges was 16.50 billion shares, compared with the 12.29 billion average for the full session over the last 20 trading days. Declining issues outnumbered advancing ones on the NYSE by a 9.04-to-1 ratio; on Nasdaq, a 6.44-to-1 ratio favored decliners. The S&P 500 posted 16 new 52-week highs and 26 new lows; the Nasdaq Composite recorded 14 new highs and 508 new lows. Sign up here. https://www.reuters.com/markets/us/us-futures-tumble-recession-fears-grip-investors-2024-08-05/

2024-08-05 21:48

NEW YORK, Aug 5 (Reuters) - Spreads on U.S. interest rate swaps over Treasuries tightened or turned more negative on Monday as long-term investors hedged their exposure in the swaps market to position for lower interest rates in a sign of concern over the sharp sell-off in stocks. In late trading, the spreads were mixed. U.S. swaps measure the cost of exchanging fixed rate cash flows for floating rate ones over a specific time frame. A swap spread is expressed as the basis-point difference between the fixed rate of a swap tied to the Secured Overnight Financing Rate (SOFR) and the Treasury yield of the same maturity . That spread also takes into account the cost of financing a long or short position in Treasuries. In general, a tighter spread means the cost of funding Treasuries is higher compared to swaps. At the height of the meltdown earlier in the session, when stocks sold off sharply and U.S. Treasury yields dropped, swap spreads were tighter across the curve that could have been driven by hedging flows, analysts said. The spread on 10-year U.S. swaps over 10-year Treasuries fell as much as -45.75 basis points (bps) on Monday, from -44.30 bps late on Friday. It settled at -44 bps as Treasury yields sharply came off their lows and for some maturities were even higher. U.S. 20-year swap spreads went as low as -78 bps and were last -76.75 bps, tighter or more negative on the day. "Very often what you'll see is that very large declines in equities lead to receiving needs in swaps, which ... move swap spreads as well," said Gennadiy Goldberg, head of U.S. rates strategy, at TD Securities in New York. Receivers in swaps, or the counterparty receiving a fixed-rate payment, benefit if interest rates fall and lose if interest rates rise. "That's because variable annuity (VA) and fixed index annuity (FIA) accounts will behave more in a fixed income fashion once equities go sharply lower. They could be positioning themselves and hedging more than they usually are, which tends to tighten swap spreads during periods like this." Major U.S. stock indexes fell sharply on Monday, with the Nasdaq down more than 3%, as U.S. recession fears spooked global markets and drove investors out of risky assets. Recession worries followed softer-than-expected economic data last week, including Friday's U.S. payrolls report. U.S. Treasury yields, meanwhile, rebounded from one-year lows as panic eased a little bit after data showed a recovery in U.S. services sector index. Sign up here. https://www.reuters.com/markets/us/us-swap-spreads-tighten-sign-stress-2024-08-05/