2024-07-31 18:55

BOGOTA, July 31 (Reuters) - Colombia's central bank cut its benchmark interest rate by 50 basis points to 10.75% on Wednesday, its sixth cut since December, as the bank's technical team raised its growth outlook for the year. The decision was backed by five of the central bank's seven board members. Two members pushed for a cut of 75 basis points, the central bank said in a statement. The decision was in line with market expectations. All 22 analysts quizzed in a Reuters poll last week said they expected the board to vote to cut the rate to 10.75%, down from 11.25%, taking the benchmark interest rate to its lowest level since 2022. Earlier, the U.S. Federal Reserve voted unanimously to keep its benchmark overnight interest rate in the 5.25%-5.50% range, citing "elevated" inflation, but it signaled that a rate cut in September was possible. The technical team of Colombia's central bank on Wednesday revised its growth outlook for the year to 1.8%, up from 1.4% previously, the bank said in a statement. Colombia's 12-month inflation through the end of June was 7.18%, marginally above the 7.16% rate at the end of May, putting the brakes on a downward trajectory and keeping inflation well above the bank's 3% target. Wednesday's rate decision takes accumulated cuts to a total of 250 basis points since December. The meeting comes just weeks before Colombia publishes its second-quarter growth figure, which will be key in determining what measures are needed to push the economy further, analysts say. Sign up here. https://www.reuters.com/markets/rates-bonds/colombia-central-bank-cuts-benchmark-rate-1075-raises-growth-outlook-2024-07-31/

2024-07-31 18:45

Canadian dollar gains 0.3% against the greenback Touches a one-week high at 1.3788 Flash estimate shows GDP up 2.2% in Q2 2-year yield rebounds from 15-month low TORONTO, July 31 (Reuters) - The Canadian dollar strengthened to a one-week high against its U.S. counterpart on Wednesday as data showed faster-than-expected growth in Canada's economy and the Federal Reserve signaled a possible move to cutting interest rates. The loonie was trading 0.3% higher at 1.3810 per U.S. dollar, or 72.41 U.S. cents, after touching its strongest intraday level since last Wednesday at 1.3788. Canada's gross domestic product grew by 0.2% in May, above estimates for a 0.1% increase, while a preliminary estimate for June showed the economy expanded by 0.1%, taking the quarterly economic growth rate to 2.2%. Last week, the Bank of Canada forecast second-quarter growth of 1.5% as it cut interest rates for a second time since June, lowering its benchmark rate by 25 basis points to 4.50%. "These latest GDP figures should tamp down talk of the Bank being wildly behind the curve, and quiet rumblings about the BoC potentially looking at a 50 bp (basis point) cut," Doug Porter, chief economist at BMO Capital Markets, said in a note. "Canada's economy is still walking that fine line of struggling to keep upright, but just staying out of serious trouble, consistent with continued, measured interest rate cuts." The U.S. dollar (.DXY) , opens new tab lost ground against a basket of major currencies as the Bank of Japan raised rates, boosting the yen, and the Fed held rates steady but opened the door to reducing borrowing costs as soon as its next meeting in September. The price of oil, one of Canada's major exports, rebounded from seven-week lows, settling 4.3% higher at $77.91 a barrel, as tensions increased in the Middle East. Canadian government bond yields were mixed across a flatter curve. The 2-year was up 1.9 basis points at 3.520%, after earlier touching its lowest level since April 2023 at 3.469%. Sign up here. https://www.reuters.com/markets/currencies/c-gains-gdp-data-quells-50-basis-point-rate-cut-chatter-2024-07-31/

2024-07-31 18:40

LONDON/SINGAPORE, July 31 (Reuters) - The Bank of Japan's move to raise interest rates to their highest in 15 years has jolted the yen to its strongest against the dollar since March and left it poised for further gains, as investors reassess carry trades, once the year's favoured play. The shift will come as a relief to Japan's Ministry of Finance which spent 5.53 trillion yen ($37 billion) in the foreign exchange market to prop up their currency this month, Wednesday data showed, their second batch of intervention of the year. Wednesday's rate hike was the largest since 2007 and came just months after the BOJ ended eight years of negative interest rates. Governor Kazuo Ueda, furthermore, did not rule out another hike this year and stressed the bank's readiness to keep raising borrowing costs to levels deemed neutral to the economy. The dollar dropped 1.7% against the Japanese currency to 150.2 yen after the BOJ's move and is now over 10 yen lower than its early July level of 161.9. That July level was the Japanese currency's weakest since 1986. The yen came under heavy pressure as benign market conditions and a wide gap between borrowing costs in Japan and those elsewhere meant it was a popular choice as a funding currency for carry trades. These see investors borrow in a currency where interest rates are low - the yen has been popular - and then swap them for another currency in which they can invest in higher yielding assets. They had been very popular with investors earlier in the year as global rate cuts that had been expected early in 2024 got pushed back, and currency prices were stable - sudden swings in price can wipe out gains from yield differentials. But with the BOJ raising rates at a time when cuts by central banks around the world finally gather pace, investors are changing tack. "It's the rate of change (of interest rate differentials) that matters. And so if the BOJ are stepping up the pace of rate hikes relative to market pricing, and if the Fed is also becoming in play here, then the pressure on the carry trade increases," said James Malcolm, head of FX strategy at UBS. The Federal Reserve held interest rates steady on Wednesday but opened the door to reducing borrowing costs as soon as its next meeting in September as inflation continues coming into line with the U.S. central bank's 2% target. "Hedge funds are likely reassessing their strategies in light of these developments," said Tareck Horchani, head of prime brokerage dealing at Maybank Securities in Singapore. "This shift could diminish the attractiveness of short yen positions, as the narrowing rate differential between the BOJ and other central banks, particularly the Fed which is expected to cut in September and December, makes the yen less appealing for carry trades." PACE AND VOLATILITY While it is difficult to gauge the exact amount of global positions in yen-funded carry trades, and hence the impact their unwinding could have on the currency, a lot of speculative positions are based on pure currency swaps between the yen and higher yielding currencies. There are hundreds of billions of dollars worth of yen-funded short-term investments too. Yen-funded carry trades in U.S. Treasuries, for example, yield nearly 6% - a mighty incentive for market participants that has so far been hard for Japan to counter. The BOJ's 15 basis points rate rise will only marginally erode the 'carry' on such trades. But what could upend the trades and force liquidation is volatility. "The carry trade works when volatility is low, but if that volatility goes up, people will unwind positions," said Yusuke Miyairi FX strategist at Nomura. That is rising, and dollar/yen overnight implied volatility jumped to 27% on Wednesday, its highest level this year. It is not just Wednesday's BOJ move that has jolted the yen, as the MOF's intervention earlier in July stopped the currency's slide. Remarks from Republican presidential candidate Donald Trump criticising Japan for the yen's weakness, and the changing Fed expectations were in the mix. Those factors have already seen carry trades get unwound, with knock on effects on currencies from Mexico to Switzerland. CFTC data shows speculators' bearish bets against the yen are 40% below April's near-seven year high, though at a still elevated $8.61 billion. And there is still scope for the yen's moves to get more dramatic. "You can't discount the notion that we might have a single day move of five or seven or even like the historic extremes of 10 (yen) in a single day," said UBS' Malcolm. "In 1998, we had two consecutive days of 10 (yen) moves in dollar/yen. That's what carry trade unwinds look like. That's what we've seen in the past and that's what the setup still looks like today." Sign up here. https://www.reuters.com/markets/currencies/boj-shift-gives-yen-shake-causes-reassessment-popular-fx-trade-2024-07-31/

2024-07-31 18:08

STIP, North Macedonia, July 31 (Reuters) - Firefighters in North Macedonia fought a dozen wildfires fanned by heavy winds for a third day on Wednesday, and hot temperatures and dry weather also fueled smaller blazes across Greece and the Balkans, officials said. One fire was spreading in the municipality of Negrevo near the Bulgarian border and another around Kumanovo near Serbia, said Goran Stojanovski at North Macedonia's centre for crisis management. "Because of the high temperatures, the vegetation is dry and the soil is very hot, which is making our work more difficult," he said. North Macedonia's southerly neighbour Greece has long struggled with wildfires caused by rising temperatures and sporadic rainfall that scientists link to climate change. A series of blazes also started further north across the Balkans this week following weeks of heat and little rain. On the western side of mainland Europe, firefighters in Spain are also battling wildfires amid extreme heat. Roads, fields and houses were covered with smoke near the central town of Stip, 100 kilometres (62 miles) east of North Macedonia's capital Skopje, a Reuters witness said. The extent of the damage nationwide is unclear. Fires earlier in the week burned dozens of homes and killed one elderly man. Stojanovski said that out of 66 active fires on Tuesday, 12 were not yet under control on Wednesday. A helicopter came from Serbia to help while Germany and Czech Republic have offered to provide aircraft. In neighbouring Albania, the coastal tourist town of Shengjin was evacuated on Tuesday as fires encroached, forcing some tourists to leave hastily in cars and buses. Fires were still burning there on Wednesday but appeared to be under control, a Reuters witness said. In Croatia, firefighters contained a blaze near the coastal town of Tucepi, a local official told N1 TV. At a mountainous stretch of the Greece-Bulgaria border, firefighters relied on air support to douse the flames of a fire that has been burning low-lying vegetation since July 18. Ground forces cannot reach the area because of land mines from past conflicts, said Greek fire service spokesman Vassilis Vathrakogiannis. Firefighters and local authorities have used diggers to build fire break zones around villages, he said. Sign up here. https://www.reuters.com/business/environment/n-macedonia-fights-dozen-wildfires-after-weeks-hot-weather-2024-07-31/

2024-07-31 14:37

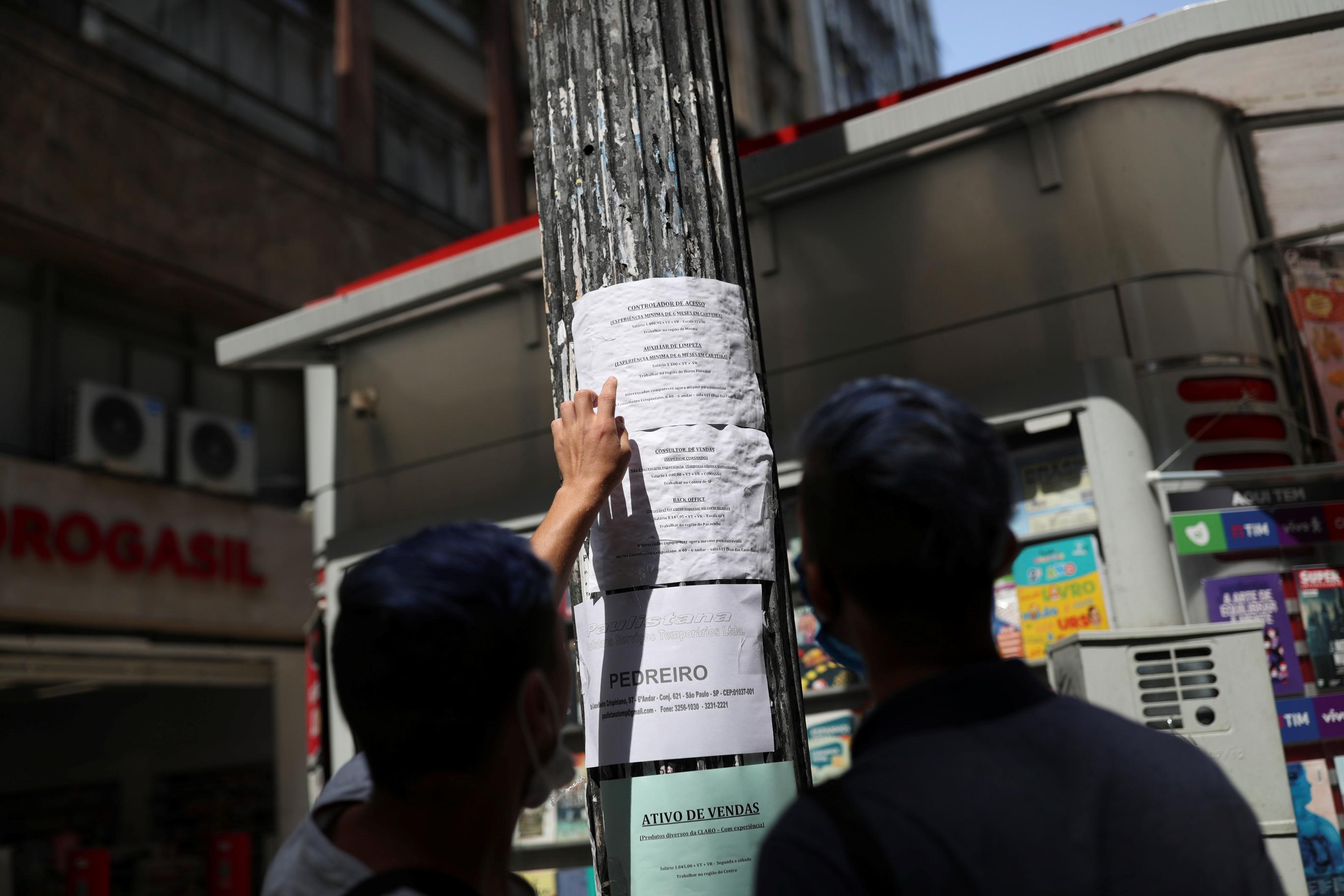

SAO PAULO, July 31 (Reuters) - Brazil's jobless rate remained at its lowest level in a decade in the three months through June, data from statistics agency IBGE showed on Wednesday, as the number of employed people in Latin America's largest economy hit an all-time high. The unemployment rate in Brazil stood at 6.9% in the April-June period, IBGE said, in line with market expectations and down from 7.9% in the previous quarter, marking the lowest for the period since 2014. Brazil's jobless rate has been hovering around historically low levels for the past year despite elevated interest rates, an indicator cheered by the government even though some worry it could trigger inflationary pressures. "Great news, but no surprises," President Luiz Inacio Lula da Silva said on X after the latest figures were released. "Our work continues to yield results, creating more jobs for Brazilians." Policymakers at the central bank, however, have cautioned that the strength of the labor market could fuel services inflation at higher levels, reducing the chances of interest rate cuts. The bank last month suspended an easing cycle that had gradually brought down its benchmark Selic rate to 10.50% from a six-year high of 13.75%, citing unmoored inflation expectations. It is widely expected to stand pat again later on Wednesday. "The Selic rate is still restrictive enough for the current inflation levels, but new pressures ahead could mean that monetary policy should stay restrictive for longer," said lender Inter's chief economist Rafaela Vitoria. According to IBGE, the number of jobless people in Brazil was 7.5 million in the April-June period, down 12.5% quarter-on-quarter, while employed citizens totaled 101.8 million - the highest ever for the data series started in 2012. Average real wages were up 1.8% in the quarter to 3,214 reais ($572), the statistics agency said. Earlier this week, government data had showed that Brazil's economy created more formal jobs than expected in June. "With the significant decline in unemployment throughout the first half, we now have a downward bias for our jobless rate projection at the end of the year," Itau economists said. "Today's data confirm that the job market remains tight." ($1 = 5.6218 reais) Sign up here. https://www.reuters.com/markets/brazils-jobless-rate-drops-69-quarter-through-june-2024-07-31/

2024-07-31 13:20

ORLANDO, Florida, July 31 (Reuters) - Japanese and Chinese monetary policy is diverging, meaning other Asian currencies may now also be at a crossroads. Do currencies, such as the South Korean won, Indian rupee and Indonesian rupiah take their cue from a firming yen being supported by expectations of policy tightening from the Bank of Japan, or from a depreciating yuan being weighed down by the People's Bank of China's need to ease policy to stimulate a struggling economy? Until recently, the yen and yuan had been joined at the hip, with both under heavy selling pressure as a relentless 'higher for longer' Fed outlook caused the U.S. dollar to rally. But that relationship and U.S. rate expectations have both shifted. Between late April and mid-July, the simple 30-day rolling correlation between the yen and yuan steadily strengthened to its most positive level in 10 months. But it has subsequently reversed. This is largely because the PBOC surprised markets last week by cutting key interest rates. And this week the yuan, which is tightly controlled by the central bank, was fixed at the weakest level against the dollar this year. Meanwhile, Chinese bond yields are at record lows, and pressure on the exchange rate is firmly to the downside. The yen, meanwhile, has jumped some 8% from its recent 38-year low against the dollar. The BOJ followed up March's historic rate hike - the first in 17 years - with a larger-than-expected increase on Wednesday and signaled its commitment to end its decades-long use of ultra-loose policy. Of course, around $100 billion of yen-buying intervention from Tokyo in the last few months has put a floor under the currency, and the BOJ's approach to raising rates is hardly gung-ho. So the yen is not a sure-fire bet to strengthen aggressively from here. But the policy divergence with China is clear, and it's muddying the waters for other Asian currencies. From China's mini-devaluation in 2015 to the beginning of the Federal Reserve's recent rate-hiking cycle, every Asian currency was more sensitive to dollar/yuan than dollar/yen, especially the won, rupiah, Malaysian ringgit and Taiwanese dollar. Even India's rupee, the Asian currency least influenced by the yuan, was still three times more sensitive to moves in China's currency than Japan's. However, once the Fed started tightening policy in 2022, Asian currencies began to be led mostly by the extraordinary rise in dollar/yen. According to analysts at Goldman Sachs, longer-term correlations show that the yen's influence on Asian currencies surged dramatically when U.S. rates started rising. But that correlation has faded since the Fed stopped hiking a year ago. "As such, the broad USD and USD/CNY matters more for Asian FX than USD/JPY," they wrote in a recent report. So if the yuan stays weak, Asian currencies could remain on the soft side even as a Fed easing cycle weighs on the dollar. That's probably not bad news - given China's economic struggles and the likely slowdown in U.S. growth, Asian capitals may welcome weaker exchange rates more than they fear the inflationary consequences. Beijing likely won't be too upset if the yuan and yen diverge. Since the onset of the pandemic in March 2020, Japan's currency has depreciated around 30% against the yuan. Or to put it another way, on a simplistic exchange rate basis, Japanese goods became 30% cheaper over that time compared with equivalent Chinese goods on the international market. Meanwhile, China is also facing the specter of an intensifying trade dispute with the U.S. The trade war between the two countries during Donald Trump's presidency was followed by protectionist policies of President Joe Biden's administration, and the dark cloud of much heavier U.S. tariffs after November's election is looming. This has all had the expected impact: U.S. imports from China as a share of its total imports fell by 8% over the 2017-2023 period, according to Oxford Economics. However, the share of U.S. imports from Europe, Mexico, Vietnam, Taiwan and South Korea rose. Meanwhile, these countries - especially Vietnam - all saw imports from China rise as a share of their total imports over the same period. Beijing will want to ensure that any deterioration in bilateral U.S.-China trade continues to be made up for elsewhere. A weaker yuan, relative to its main regional rival the yen, might help. (The opinions expressed here are those of the author, a columnist for Reuters.) Sign up here. https://www.reuters.com/markets/currencies/asian-fx-crossroads-yen-yuan-diverge-mcgeever-2024-07-31/