2024-07-31 10:59

TOKYO, July 31 (Reuters) - Japanese authorities spent 5.53 trillion yen ($36.8 billion)intervening in the foreign exchange market this month to pull the yen off 38-year lows, official data showed on Wednesday. The Ministry of Finance figures confirmed the suspicions of traders and analysts following sharp yen spikes over July 11 and 12 that money market estimates had suggested was worth 5.71 trillion yen. Over the two days from July 11, the yen shot from as low as 161.76 per dollar to as high as 157.30. Wednesday's data only provides a total for the period spanning June 27-July 29. A day-by-day breakdown will be available in quarterly data due in about three months' time. The finance ministry's latest foray differed from other recent rounds of intervention - including the record 9.79 trillion yen intervention spanning the end of April and start of May - because officials bought yen as the dollar was already tumbling following a surprisingly weak U.S. consumer inflation print. Even so, analysts pointed to factors other than Tokyo's dollar selling for keeping the yen surging over the course of this month. The dollar took another leg lower after Republican presidential candidate Donald Trump said he wanted a weaker currency. That was quickly followed by a host of high-profile Japanese politicians, including the prime minister, urging near-term Bank of Japan interest rate hikes to curb yen weakness. The BOJ's decision to raise interest rates earlier Wednesday and subsequent hawkish news conference by Governor Kazuo Ueda send the dollar spiralling down to the cusp of 150 yen. It was at 150.37 yen as of 1039 GMT. "I'm not saying intervention didn't have an impact. It did. But if Trump and the others hadn't come out and said what they did, we'd probably have gone back to around 160," said Shoki Omori, chief Japan desk strategist at Mizuho Securities. Despite rising expectations for further BOJ policy normalization, Omori says he expects the yen to weaken again over the course of August. "A mere 25 basis point rate hike does not necessarily diminish the attractiveness of carry trades," he said, referring to a practice where market players borrow yen at Japan's near-zero interest rates and invest it in higher yielding assets overseas, including the United States. Japanese authorities have made a practice of refraining from confirming intervention, while consistently warning that they stand ready to act at any time to counter one-sided, speculative currency moves. Tokyo still has plenty of firepower to act again, with foreign reserves standing at a whopping $1.23 trillion as of the end of June, and a weak yen remains unpopular with the public and could figure prominently in ruling party leadership elections in September. However, further intervention would take place under new leadership, with Masato Kanda's stint as Japan's top currency diplomat ending on Tuesday. Financial regulation expert Atsushi Mimura took over as vice finance minister for international affairs, saying in an interview that intervention remains on the table. ($1 = 150.4200 yen) Sign up here. https://www.reuters.com/markets/currencies/japan-spent-368-billion-july-intervention-official-data-shows-2024-07-31/

2024-07-31 10:22

MUMBAI, July 31 (Reuters) - The Indian rupee dipped to its weakest level on record on Wednesday, extending the gradual decline seen over recent trading sessions on outflows from local equities, volatility in the yuan and persistent dollar bids from local importers. The rupee closed at 83.72 against the U.S. dollar, nearly unchanged from its close of 83.7275 in the previous session. The currency hit an all-time low of 83.7450 earlier in the session, slipping past its previous lifetime low of 83.74. It hit lifetime lows in six of the last eight trading sessions and was down about 0.4% in July, its worst month-on-month performance since March. Despite the weakness, interventions from the Reserve Bank of India (RBI) have ensured that volatility remained subdued. Intermittent dollar sales from state-run banks, likely on behalf of the RBI, helped limit the currency's losses on Wednesday as well, traders said. The dollar index was down 0.2% at 104.2 while Asian currencies rose, with the Japanese yen gaining by more than 1% after the Bank of Japan raised interest rates and unveiled a plan to taper its huge bond-buying programme. The rally in the yen also helped lift the offshore Chinese yuan, one of the rupee's closely tracked peers, by 0.3% to 7.21. Investors now await the Federal Reserve's policy decision due later on Wednesday. The U.S. central bank is widely expected to keep rates unchanged and investors will pay attention to remarks from Chair Jerome Powell for cues on the future path of benchmark interest rates. "Powell will reiterate a cautious tone on inflation this time, but he has often been the voice of a more dovish faction of the FOMC and the press conference could generate some USD-negative headlines," ING Bank said in a note. Sign up here. https://www.reuters.com/markets/currencies/rupee-ends-flat-after-slipping-record-low-logs-worst-monthly-decline-four-2024-07-31/

2024-07-31 10:20

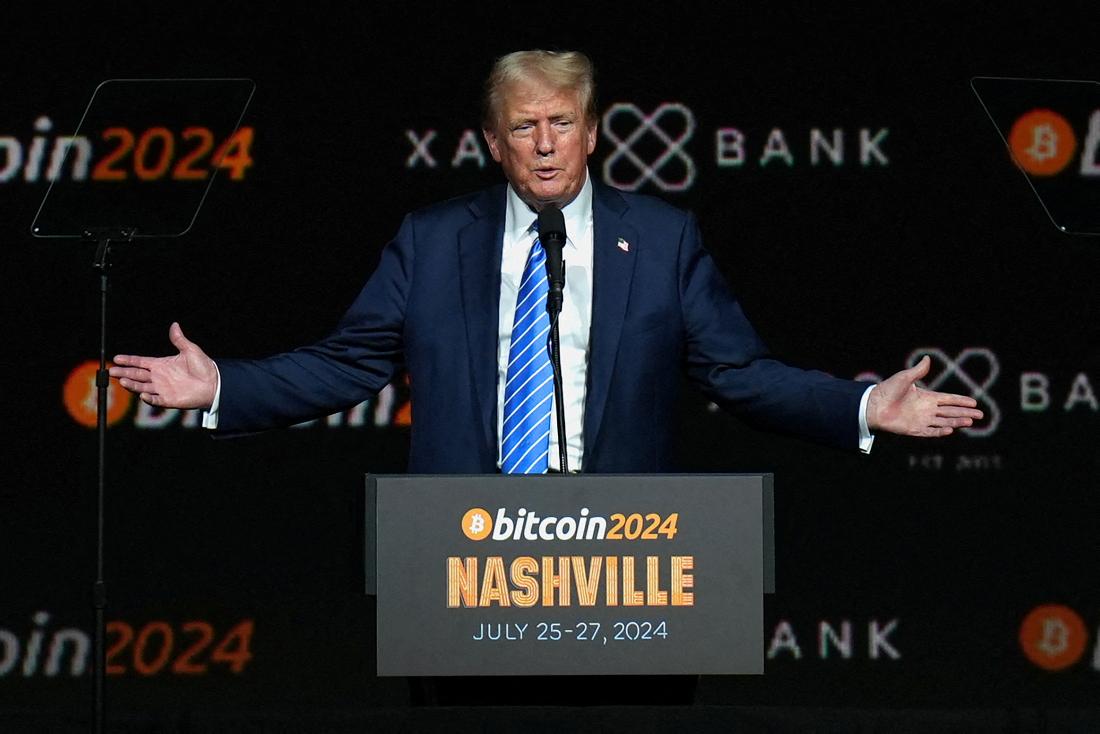

July 31 (Reuters) - When former U.S. president Donald Trump promised a bitcoin conference on Saturday that if reelected he would fire Securities and Exchange Commission Chair Gary Gensler, a crypto skeptic, the crowd roared with delight. "Wow, I didn't know he was that unpopular," the Republican presidential nominee shouted over the cheers. Trump, who once derided cryptocurrencies as a "scam," is courting the industry and winning big checks from donors hoping he will swiftly end Gensler's crypto crackdown. Under Gensler, a Democrat appointed by President Biden, the SEC has brought dozens of crypto enforcement actions, including against major exchanges Coinbase COIN., Binance and Kraken, and levied hundreds of millions of dollars in fines. A Trump victory could change that virtually overnight. He could appoint a crypto-friendly chair to advance the industry's wishlist, which includes spiking guidance that it says has limited Americans' crypto custody options; a safe harbor for new tokens; and pulling enforcement actions. "The most important thing we want out of a new administration is the nomination of individuals to key positions ... that have an appreciation and an understanding of crypto," said Kristin Smith, CEO of the Blockchain Association, an industry group. Gensler's spokesperson declined to comment. Citing a Supreme Court ruling, Gensler says most crypto tokens behave like securities and should be strictly regulated in the same way, a position lower courts have mostly backed. Crypto firms argue tokens are commodities and want new laws clarifying their status, although that could take years if Congress remains divided. While Gensler's term ends in 2026, Trump could replace him with another commissioner as acting chair. The likely candidate is Hester Peirce, a crypto advocate and the longer-serving of the SEC's two Republican commissioners. The industry is pushing crypto enthusiasts Brian Brooks and Chris Giancarlo, who served in Trump's first administration, for the permanent job, executives said. An acting chair could immediately rescind 2022 SEC guidance requiring public companies to account for crypto assets held on behalf of others as liabilities due to their riskiness. Banks struggle with this policy because strict capital rules require them to hold cash against liabilities. Cryptocurrencies, with a market capitalization of around $2.5 trillion according to CoinGecko, would become more popular if consumers could store them with trusted lenders, executives say. "I believe that'll be rescinded Day One of the Trump administration," said Cody Carbone, chief policy officer at the Chamber of Digital Commerce, a digital asset group. The industry is also pushing for a safe harbor from SEC registration rules for issuing and trading crypto tokens, an idea Peirce floated in 2020. "We need to look for a workable way to ensure both that token offerings can occur outside of the legal shadows and that token purchasers have access to the information they need," Peirce told Reuters by email. Smith said such a framework would be "incredibly positive." Giancarlo, who earned the nickname "Crypto Dad" when he was Commodity Futures Trading Commission chair, declined to comment on whether he would be interested in becoming SEC chair under a second Trump administration. Until Congress acts, regulators have discretion to craft an interim regulatory regime that better serves the public and investors, he said. He also backed a crypto safe harbor. "It would be an excellent place to start a new era of engaging with this innovation," Giancarlo said. Brooks did not respond to a request for comment. Brian Hughes, senior advisor to Trump's campaign, said in a statement the former president is prepared to remove "obstacles and unnecessary burdens" for crypto. POLITICAL DEADLOCK? A new chair's power would depend, though, on the political weighting of the five-member commission which votes on rules, enforcement and other major issues. It is dominated 3-2 by Gensler and two other Democrats also critical of crypto. While the president can replace an SEC chair with another commissioner, Gensler could still see out his term as commissioner. Even if he left, the four remaining members would be evenly divided initially, constraining a new chair. Peirce said, for example, that she expected any safe harbor plan and major proposed changes to enforcement litigation, to go to a commission vote, suggesting approval might have to wait until Republicans take the majority. Giancarlo said he would like a pause in enforcement actions where there is no investor harm, manipulation or fraud. "I think the right approach would be to pause it ... while the agency immediately turns to rule-writing in coordination with Congress and then give innovators time to comply," Giancarlo added. Sign up here. https://www.reuters.com/technology/crypto-players-ready-wishlist-potential-second-trump-administration-2024-07-31/

2024-07-31 07:46

DUBAI, July 31 (Reuters) - A drone strike targeted an eastern Sudanese army base during a visit by army chief General Abdel Fattah al-Burhan, eyewitnesses told Reuters on Wednesday, casting doubt over recent efforts to bring an end to a 15-month civil war. A statement by the army said the attack took place at a graduation ceremony at the Gibeit army base, about 100 km (62 miles) from the army's de facto capital Port Sudan in Sudan's Red Sea state, and that five people were killed. An adviser to the leader of the Rapid Support Forces (RSF), the army's rival in the war, denied that the paramilitary force was responsible for the strike. Witnesses said Burhan was at the base during the strike. Officials from the government, which is aligned with the army, said he was taken safely to Port Sudan afterwards. "We heard sounds of explosions all of a sudden and everyone ran scared," said one eyewitness, noting that many families of graduating officers were present. A video shared on social media and verified by Reuters showed soldiers marching in a graduation ceremony before a whirring sound is heard followed by the sound of an explosion. Another video shows a cloud of dust and scores of people running. Footage shared by the military that it says was filmed in Gibeit after the graduation ceremony shows Burhan being mobbed by cheering civilians, chanting "one army, one people." The drone attack is the latest in a string of such attacks on army locations in recent months, and the closest to Port Sudan. Over the past two days, drone strikes have hit Kosti, Rabak, and Kenana in Sudan's southern White Nile state, as well as al-Damer, to the north of the capital, according to locals. The RSF has not commented on those strikes. War broke out between the RSF and the regular army in April 2023 over plans to integrate the two forces under a political transition towards elections. The two forces had shared power uneasily after staging a coup in 2021, derailing a previous transition that followed the overthrow of former leader Omar al-Bashir in 2019. The conflict has created the world's largest humanitarian crisis, pushed half the population into a hunger crisis and driven more than 10 million out of their homes. PLANS FOR PEACE TALKS The latest strike came after the army-aligned foreign ministry conditionally accepted a U.S. invitation to talks in Switzerland in August. The RSF responded to the ministry's statement on Tuesday saying it would only negotiate with the army and not Islamists who dominate the civil service. On Wednesday an RSF official blamed the drone strike on Islamist elements. "The RSF has nothing to do with the drones that targeted Gibeit today...they are the result of internal disagreements, between Islamists," legal adviser Mohamed al-Mukhtar told Reuters. In recent weeks, the RSF has renewed its efforts to capture more territory, and has staged incursions into the southeastern state of Sennar, displacing more than 165,000 people, as well as White Nile and al-Gedaref states. Last year, it swiftly took control of the capital Khartoum, followed by most of the Darfur region and El Gezira state, though it has continued to shell the city of al-Fashir, one of 14 sites in Sudan where experts warn of famine. Previous efforts to mediate the conflict have failed to secure a lasting ceasefire, and many Sudanese consider the talks in Switzerland as the best opportunity to negotiate an end to the war. The talks are co-sponsored by Saudi Arabia and are to include Egypt and the United Arab Emirates, which the army and others have said is supporting the RSF, in particular with weaponry such as drones. The UAE denies the accusation. Sign up here. https://www.reuters.com/world/africa/drone-strike-targets-eastern-sudanese-base-during-visit-by-army-chief-witnesses-2024-07-31/

2024-07-31 07:42

July 31 (Reuters) - Belgian chemicals group Solvay (SOLB.BR) , opens new tab said on Wednesday it aims to supply 30% of the European market's needs for permanent magnets with rare earth materials from its facility in La Rochelle, France. The group confirmed that regular production should start in early 2025 in La Rochelle, the only facility in Europe able to process light and heavy rare earth materials at an industrial level. Permanent magnets are essential components to power electric vehicles, wind turbines and electronics. Solvay's announcement follows the EU's Critical Raw Materials Act came into force in May, aiming to secure the bloc's self sufficiency. Sign up here. https://www.reuters.com/markets/commodities/solvay-aims-produce-30-eus-needs-critical-components-evs-wind-turbines-2024-07-31/

2024-07-31 07:33

SYDNEY, July 31 (Reuters) - Australian airline Regional Express Holdings (REX.AX) , opens new tab will cut hundreds of job after it entered voluntary administration, the second small airline to do so this year, in a move that will further concentrate the country's aviation market. Traditionally focused on servicing Australia's vast regional areas with small planes, Rex in 2021 began larger jet flights in the lucrative "golden triangle" between Sydney, Brisbane and Melbourne, which is dominated by Qantas Airways (QAN.AX) , opens new tab and Virgin Australia. However the airline failed to meaningfully dent their control of the overall market, which was over 90% in March, according to the competition regulator. On Tuesday, Rex called in administrators Ernst & Young. The administrators will shutter the subsidiary which operates Rex's Boeing 737 flights between major cities and make 360 workers redundant, according to the Transport Workers Union (TWU). A further 250 jobs will be cut elsewhere, it said. Regional flights on its fleet of Saab 340 aircraft will continue. Rex investor and private equity group PAG Asia Capital has provided bridging finance to help keep regional flights running, according to a source not authorised to speak with media. PAG, which has one board seat, helped bankroll Rex's expansion into major cities in 2021 with a A$150 million convertible bond. PAG declined to comment. Transport Minister Catherine King said the government had provided Rex some support to keep its regional flights in the air but stopped short of guaranteeing a rescue package. "I think it is fair to say that we would be reluctant to just throw money at the problem," she said. "What we would want to do is ensure that there is a long term solution to the security of regional aviation." AVIATION REFORM The collapse, which comes only three months after budget airline Bonza closed down, is likely to put a spotlight on the barriers smaller airlines face breaking into the vast, sparsely populated market dominated by Qantas and Virgin. In March 62% of domestic passengers were carried by Qantas and subsidiary Jetstar, 31% by Virgin Australia, 5% by Rex and 2% by Bonza, according to the Australian Competition and Consumer Commission (ACCC). The regulator has previously said Bonza and Rex presented opportunities for a more competitive domestic industry. Adrian Schofield, an analyst at CAPA Centre for Aviation, said both Bonza and Rex's jet operations were too small to be really competitive. "They weren't able to grow their fleets quickly enough to generate efficiencies of scale required to produce the kind of revenues and profit needed for their parent companies to continue to support them," Schofield said. The ACCC has called on the government to reform how airlines are allocated flight slots, especially on busy state capital journeys, where critics have argued that Qantas and Virgin's control of profitable routes keeps out new entrants. The company which administers flight slots is majority owned by the two airlines, which reject the accusation. The regulator said in May that Rex needed a larger fleet and more slots at Sydney airport to grow to the point where it could meaningfully compete with Qantas and Virgin. In February the government announced reforms to slot management at Sydney airport, including greater reporting requirements. A government review into the aviation sector is due later this year. AVIATION DEMAND While slot availability at Sydney airport was an issue, Rex's failure also comes down to a general slowdown in aviation as leisure travellers cut back, according to Morningstar analyst Angus Hewitt. Aviation saw high demand and fares as aviation bounced back from the pandemic, but airlines globally are seeing a weaker-than-expected quarter due to costs and falling revenue per passenger because of pressure on ticket prices. Virgin, which had flight slots at Sydney, had not reported an underlying profit since 2012 when it filed for bankruptcy in 2020, Hewitt added. Sign up here. https://www.reuters.com/business/aerospace-defense/australia-airline-rex-cuts-jobs-cancels-flights-after-calling-administrators-2024-07-31/