2024-07-31 07:29

LONDON, July 30 (Reuters) - U.S. electricity generators consumed a record amount of gas in the first four months of the year as prices slumped to the lowest level in real terms for more than half a century. Ultra-low prices encouraged more power production from some of the least-efficient single-cycle gas and steam turbines at the expense of coal. But record combustion by generators made little impact on swollen gas inventories amid continued growth in gas production and sluggish exports. Chartbook: U.S. gas-fired electricity generation , opens new tab Generators produced a record 1,334 billion kilowatt-hours (kWh) between January and April, according to the latest data from the U.S. Energy Information Administration. Generation was up by 47 billion kWh (4%) compared with the same period a year earlier and by about the same compared with the prior 10-year average. Two-thirds of the extra output came from gas-fired units (30 billion kWh) with most of the rest from solar farms (13 billion kWh). As a result, generators boosted their gas consumption by 213 billion cubic feet (6%) compared with a year earlier to a record 3,941 bcf. BLOATED STOCKS Despite record power burn, gas stocks remained abnormally high, with inventories 671 bcf (+36% or +1.46 standard deviations) above the prior 10-year seasonal average at the end of April. The surplus had swelled from 261 bcf (+14% or +0.58 standard deviations) a year previously thanks to a mild winter in 2023/24. By April, the actual cost of gas received by electricity generators had slumped to an average of just $2.05 per million British thermal units. After adjusting for inflation, power generators' gas acquisition costs had fallen to the lowest level on record in data going back to 1973. MAXIMISING RUNS Exceptionally cheap fuel encouraged gas-fired generators to run their units for more hours, including the least-efficient, most fuel-hungry plants that normally operate mostly during the summer and winter peak periods. Single-cycle gas turbines and gas-fuelled steam generators are much less efficient than combined-cycle units and usually operate only in peak periods of electricity demand. With fuel so cheap, however, gas turbines operated with a record seasonal capacity factor of more than 14% in April 2024 up from 12% in April 2023 and 10% in April 2022. Gas-fired steam turbines generated more than 15% of their maximum theoretical output, up from 13% in 2023 and 10% in 2022, and the highest for more than a decade. PERSISTENT SURPLUS Record gas-fired generation has helped prevent surplus inventories swelling even further but has not yet reduced bloated stocks to more normal levels. Recurrent problems with the operation of the Freeport LNG export terminal have also delayed the normalisation of stocks. Gas generation spiked to an all-time record early in July 2024, owing to high temperatures across much of the Lower 48 states, slow wind speeds, and the impact of low gas prices themselves. Even so, inventories were still the second-highest on record for the time of year on July 19 and 479 bcf (+17% or +1.35 standard deviations) above the prior ten-year seasonal average. After bouncing a little in May and June, futures prices have slumped in July towards the trough earlier this year, returning near to multi-decade lows in real terms. Such extraordinarily low prices are sending the strongest possible signal to gas producers on the need to cut drilling and output even further after an initial round of cuts announced in February. They are also sending a signal to generators to offer their units to the grid as much as possible, with gas generation records likely to be smashed this summer. Prices will remain lower for longer until the inventories start to converge with the long-term seasonal average, most likely by the end of winter 2024/25. Related columns: - U.S. oil output growth slows, gas production begins to fall (July 2, 2024) - U.S. gas surplus will be eliminated before end of winter 2024/25 (May 8, 2024) - Northern Hemisphere's record winter warmth slashes gas consumption(March 20, 2024) John Kemp is a Reuters market analyst. The views expressed are his own. Follow his commentary on X https://twitter.com/JKempEnergy , opens new tab Sign up here. https://www.reuters.com/business/energy/us-power-producers-binge-ultra-cheap-gas-kemp-2024-07-30/

2024-07-31 07:14

PARIS, July 31 (Reuters) - French bank Societe Generale (SOGN.PA) , opens new tab said on Wednesday it had agreed to buy a 75% stake in Reed Management, an alternative asset management company dealing in the energy sector. The takeover will also see SocGen invest 250 million euros ($270.45 million) in the Reed Management business. Reed Management said it aims to be a leading global investor in the energy transition sector, and it will target direct equity investments in companies specialising in areas such as cutting carbon emissions. "This acquisition is a new step in the execution of the group strategic roadmap, as part of our ambition to bolster our ESG (environmental, social and governance) leadership," said SocGen CEO Slawomir Krupa. ($1 = 0.9244 euros) Sign up here. https://www.reuters.com/markets/deals/frances-socgen-buy-75-stake-energy-focused-investment-firm-reed-management-2024-07-31/

2024-07-31 07:03

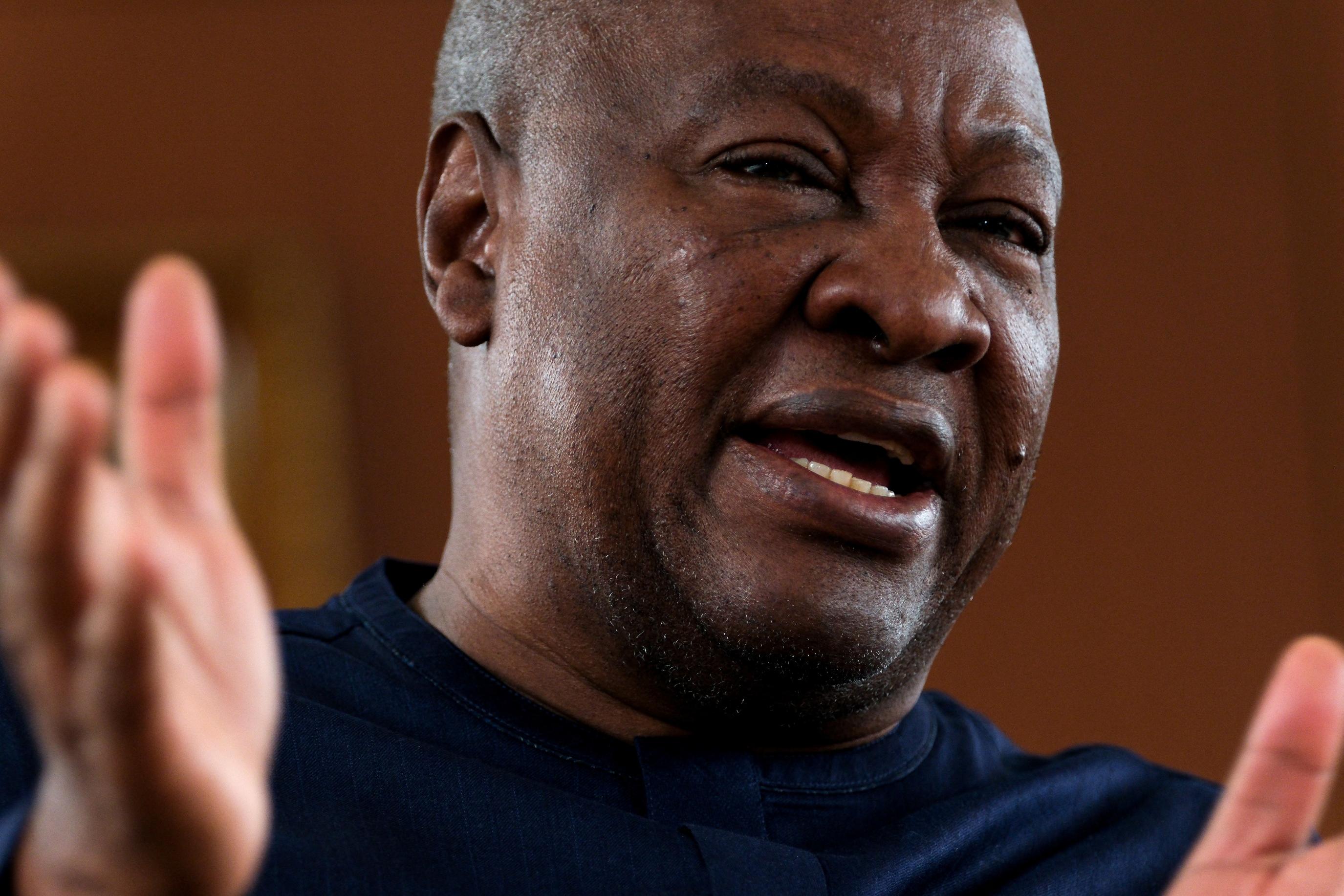

President Akufo-Addo to step down after December election Ex-president Mahama will be main opposition candidate Wants more money from IMF in addition to agreed $3 bln Would seek larger stakes in future oil, mining projects ACCRA, July 31 (Reuters) - Former Ghanaian president John Dramani Mahama will try to renegotiate terms of an International Monetary Fund bailout and boost local ownership of future oil and mining projects if he wins a new term in office in December, he told Reuters. Mahama, who was in office from 2012-16, will be the main challenger to the ruling party's candidate, Vice President Mahamadu Bawumia, with a good chance to win given a severe economic crisis that has made the government unpopular. "I've been in an IMF programme before, when I was president, and I know that the IMF is not averse to sitting and talking and renegotiating issues," Mahama, 65, said in an interview. Ghana defaulted on most of its $30 billion external debt in 2022 after the effects of years of overstretched borrowing were exacerbated by the COVID-19 pandemic, knock-on impacts of the war in Ukraine, and higher global interest rates. The oil, gold and cocoa producer secured a $3 billion IMF bailout in May 2023, and in June this year reached separate deals with bilateral and commercial creditors to restructure its debts and freeze repayments until 2025. The IMF has already disbursed $1.56 billion with another $360 million due by December. But Mahama said he would seek additional IMF funds to help Ghana resume the debt repayments. He also said he would amend a public finance management law to introduce a compulsory debt-to-GDP ceiling of 60-70% to prevent excessive borrowing. Further, Mahama said he would respect existing production contracts with oil and mining companies and not seek to raise taxes, but rather aim for higher royalties from future projects. "I think we are at the upper range of taxes on profit ... But I do think that in some cases the level at which we locked in the royalties is low." He held out the prospect of higher government stakes in future projects via the Minerals Income and Investment Fund, a sovereign wealth facility. NORTHERN DUEL While vice president in 2012, Mahama, of the National Democratic Congress (NDC), became president when John Evans Atta-Mills died in office. Mahama won his own mandate in a presidential election a few months later. He lost elections in 2016 and 2020 to Nana Akufo-Addo of the New Patriotic Party (NPP), who must step down after this year's Dec. 7 vote as he will have served the maximum two terms. As president, Mahama invested heavily in infrastructure but drew criticism over power shortages, macroeconomic instability and allegations of political corruption, though he was not personally tainted. Critics of the NPP say those trends have continued or worsened under Akufo-Addo's administration. Mahama and Bawumia are both from northern Ghana, where the NDC was dominant for many years but the NPP has been making inroads. "We the youth are hopeless, we don't have jobs. How to eat, pay bills and feed our families is very hard," Abdul-Wakil Neindow, 30, who lost his construction job in 2017 and has yet to find work, said at Mahama's campaign launch at the weekend. Ghana is one of Africa's most stable democracies, with a history of peaceful transfers of power. No party has ever won more than two consecutive terms in government. However, the last election was marred by opposition accusations that the government used the advantages of office to unfairly influence the outcome, which it denied. Mahama urged supporters at his campaign launch to stay awake for 48 hours after voting to guard against any vote-rigging. ($1 = 15.4500 Ghanaian cedi) Sign up here. https://www.reuters.com/world/africa/ghanas-mahama-would-renegotiate-imf-deal-if-he-regains-presidency-2024-07-31/

2024-07-31 06:59

NEW DELHI, July 31 (Reuters) - India has no plans to reimpose foreign investor limits on new issuances of 5-year, 7-year and 10-year bonds, a government source aware of the development said on Wednesday, after curbs were imposed on bonds with longer tenors. On Monday, the Reserve Bank of India said that in consultation with the government it had decided that foreign portfolio investors (FPIs) would no longer have access to new Indian government bonds with 14-year and 30-year tenors under the fully accessible route (FAR). Foreign investors see India's decision to return to curbs on purchases of some government securities as a flip-flop in policy that may force them to revise investment strategies, global fund managers said on Tuesday. "One objective of excluding 14-year and 30-year securities is to focus FPI demand in securities up to 10 years and thereby improve liquidity in this segment," the source said on condition of anonymity as the discussions are not public. "In future, securities of 5-year, 7-year, and 10-year are planned to be kept under the FAR," the source added. India could choose to reimpose foreign investment limits on some government securities, if the inclusion of local bonds in JPMorgan's (JPM.N) , opens new tab emerging market debt index leads to a deluge of inflows, India's Economic Affairs Secretary Ajay Seth told Reuters in an interview last week. The decision on exclusions from the FAR category is not based on any consideration of volatility, as 5-year and 10-year securities have attracted the most attention of foreign investors, the source said. "The market has adequate liquidity to absorb any volatility arising from inflows," the person added. Foreign funds can continue to invest in all securities, including the 14-year and 30-year bonds, through the secondary market, as against a limit of 6.0% of outstanding stock accessible to foreigners the actual usage is quite low, the source said. "There is adequate space in this category." Sign up here. https://www.reuters.com/markets/rates-bonds/india-wont-reimpose-foreign-investment-limits-5-yr-7-yr-10-yr-bonds-government-2024-07-31/

2024-07-31 06:58

CHOORALMALA, India, July 31 (Reuters) - Nearly 1,000 people have been rescued after landslides in the hills of Wayanad district in India's Kerala state, authorities said on Wednesday, with at least 151 people dead and many still missing. Heavy rain in one of India's most attractive tourist destinations collapsed hillsides early on Tuesday sending torrents of mud, water and tumbling boulders through tea and cardamom estates and small settlements. It was the worst disaster in the state since deadly floods in 2018. At least 151 people died and 187 were still missing, the state chief minister's spokesman, P.M. Manoj, told Reuters by phone. The Indian Army said it rescued 1,000 people and has begun the process to construct an alternate bridge after the main bridge linking the worst affected area of Mundakkai to the nearest town of Chooralmala was destroyed. Near the site where the bridge was washed away, a land excavator was slowing removing trees and boulders from a mound of debris. Rescue workers in raincoats were making their way carefully through slush and rocks, under steady rain. "We are quite sure there are multiple bodies here," said Hamsa T A, a fire and rescue worker, pointing to the debris. "There were many houses here, people living inside have been missing." The landslides were mostly on the upper slopes of hills which then cascaded to the valley below, M R Ajith Kumar, a top state police officer, told Reuters. "Focus right now is to search the entire uphill area for stranded people and recover as many bodies (as possible)," he said. Nearly 350 of the 400 registered houses in the affected region have been damaged, Asianet TV reported, citing district officials. After a day of extremely heavy rainfall that hampered rescue operations, the weather department expects some respite on Wednesday, although the area is likely to receive rain through the day. Sign up here. https://www.reuters.com/world/india/death-toll-india-landslides-rises-151-search-missing-2024-07-31/

2024-07-31 06:50

July 31 (Reuters) - Belgian chemicals group Solvay (SOLB.BR) , opens new tab reported a stronger-than-expected core profit for the second quarter on Wednesday, as higher volumes and further improvements in fixed costs offset pressure from negative net pricing. Earnings before interest, taxes, depreciation, and amortization (EBITDA) came in at 272 million euros ($294.43 million), compared with the 261 million euros expected by analysts in a company-provided consensus. "Our focus on deploying our cost-saving initiatives was key, and the 46 million euros of structural cost savings achieved so far are a testimony of the hard work of our teams," said group CEO Philippe Kehren in a press release. Solvay has been cutting costs due to soft demand and a volatile macro and geopolitical environment. It aims to save 300 million euros by 2028. Chemical companies have been under pressure for more than a year, forced to reduce inventories on lower demand from industrial clients as energy prices soared. Earnings were robust with improvement to full-year free cash flow guidance despite higher investments in the second half of the year, said analyst Sebastian Bray from Berenberg. "It is nice to see businesses outside soda ash outperforming expectations," Bray added. Solvay tightened its forecast for 2024 underlying EBITDA to a 10-15% range from earlier expectation of a 10-20% drop. It upgraded its free cash flow forecast to more than 300 million euros, from a previous goal of above 260 million euros. The company reported net sales of 1,194 million euros for the second quarter, while analysts had expected 1,203 million euros. Solvay's volumes improved in most of its markets, both in basic and performance chemicals. However, this positive trend was offset by the impact of lower net pricing, which dragged core profit from basic chemicals 25.6% lower. Sign up here. https://www.reuters.com/markets/commodities/solvay-core-profit-rises-more-than-expected-higher-volumes-cost-improvement-2024-07-31/