2024-07-30 11:23

ROME, July 30 (Reuters) - Italy's economic growth slowed to 0.2% in the second quarter from the previous three months in line with forecasts, driven by domestic demand, preliminary data showed on Tuesday. The figure came in after an unrevised 0.3% increase in January-March. On a year-on-year basis, second quarter gross domestic product in the euro zone's third largest economy was up 0.9%, national statistics bureau ISTAT said, also in line with a Reuters survey. "From the demand side, there is a positive contribution by the domestic component (gross of change in inventories) and a negative one by the net export component", ISTAT said. It gave no numerical breakdown of components with its preliminary estimate, but said services had supported the growth whereas both industry and agriculture had made a negative impact. "We think that part of this weakness could be reversed, and that gradual GDP acceleration is likely in 3Q24, mainly thanks to strengthening of demand," said Loredana Federico, chief Italian economist at UniCredit. The statistics bureau signalled that the quarterly increase was the fourth consecutive one, with "acquired variation growth" at the end of the second quarter at 0.7%. That means that if quarterly GDP growth were flat for the rest of 2024, full year growth would still come in at 0.7%. Italy's government forecast in April that the economy would expand 1% this year, broadly in line with last year's 0.9% growth rate. Italian think tank Prometeia said it maintained a "cautious optimism", even though data were confirming "the critical elements of this economic phase". According to data published on Tuesday, GDP in the euro zone rose by 0.3% quarter-on-quarter in January-March. Year-on-year Italian growth in the first quarter was slightly lowered to 0.6% from a previously reported 0.7%. ISTAT will release final Q2 GDP data on September 2. Sign up here. https://www.reuters.com/markets/europe/italy-q2-gdp-rises-02-line-with-forecasts-istat-2024-07-30/

2024-07-30 10:48

MOSCOW, July 30 (Reuters) - Russian lawmakers passed a bill on Tuesday that will allow businesses to use crypto currencies in international trade, as part of efforts to skirt Western sanctions imposed after Russia's invasion of Ukraine. The law is expected to go into force in September, and Russian central bank Governor Elvira Nabiullina, one of the backers of the new law, said the first transactions in cryptocurrencies will take place before the end of the year. Russia has faced significant delays in international payments with major trading partners such as China, India and the United Arab Emirates after banks in those countries, under pressure from Western regulators, became more cautious. "We are taking a historic decision in the financial sphere," the head of the Duma lower house of parliament, Anatoly Aksakov, told lawmakers. Under the new law, the central bank will create a new "experimental" infrastructure for cryptocurrency payments. Details of the infrastructure have yet to be announced. The law is part of a package that also includes regulations on the mining of cryptocurrencies and the circulation of other digital assets. The new law will not lift an existing ban on cryptocurrency payments inside Russia. The central bank said that delays in payments have become a major challenge for the Russian economy, leading to an 8% decline in Russian imports in the second quarter of 2024. Despite Russia's efforts to switch to the currencies of its trade partners and develop an alternative payment system within the BRICS group of emerging economies, many payments are still conducted in dollars and euros and go through the international SWIFT system. This exposes banks in countries trading with Russia to the risk of secondary sanctions, forcing them to tighten their compliance procedures. "The risks of secondary sanctions have grown. They make payments for imports difficult, and that concerns a wide range of goods," Nabiullina said, stressing that payment delays have led to longer supply chains and rising costs. Sign up here. https://www.reuters.com/technology/russia-launch-international-payments-crypto-before-end-2024-2024-07-30/

2024-07-30 10:30

Deal with IMF will put debt overhaul back on track State minister sees rework completed within six months Ethiopia secured IMF deal after floating currency ADDIS ABABA, July 30 (Reuters) - Ethiopia's new $3.4 billion financing deal with the International Monetary Fund paves the way for completion of its long-delayed debt restructuring in the next three to six months, a senior finance ministry official said on Tuesday. The announcement of the four-year, $3.4 billion programme on Monday came hours after Ethiopia had undertaken one of the IMF's key recommendations and floated its currency, the birr. "Debt restructuring should be finalised before the next IMF programme review," State Minister of Finance Eyob Tekalign told Reuters, adding that would typically be between three and six months. The IMF deal is expected to be followed by further financing of up to $7.3 billion from the World Bank and other creditors, Ethiopian officials have said. The World Bank's board was scheduled to meet later on Tuesday to approve its portion of the extra funds, Eyob said. News of the IMF deal lifted the $1 billion government bond at the centre of the restructuring plan to its highest level since October 2021 on Tuesday. A more than 2 cents jump left it trading at almost 78 cents on the dollar - or just over a 20% discount of its original face value. In the foreign exchange market, leading commercial banks quoted the Ethiopian birr at 74.74 against the dollar. That was unchanged from where it had settled after Monday's float announcement prompted it to drop 30% against the dollar. Ethiopia's development partners have welcomed the move to a market-based foreign exchange rate, but some analysts have said it could drive up inflation and the cost of living, especially for the poorest. Ethiopia also faces other challenges including the impact of climate change and the need to reconstruct its northern Tigray region, which was ravaged by a two-year civil war that ended in late 2022. Sign up here. https://www.reuters.com/world/africa/ethiopias-imf-deal-paves-way-debt-restructuring-official-says-2024-07-30/

2024-07-30 10:22

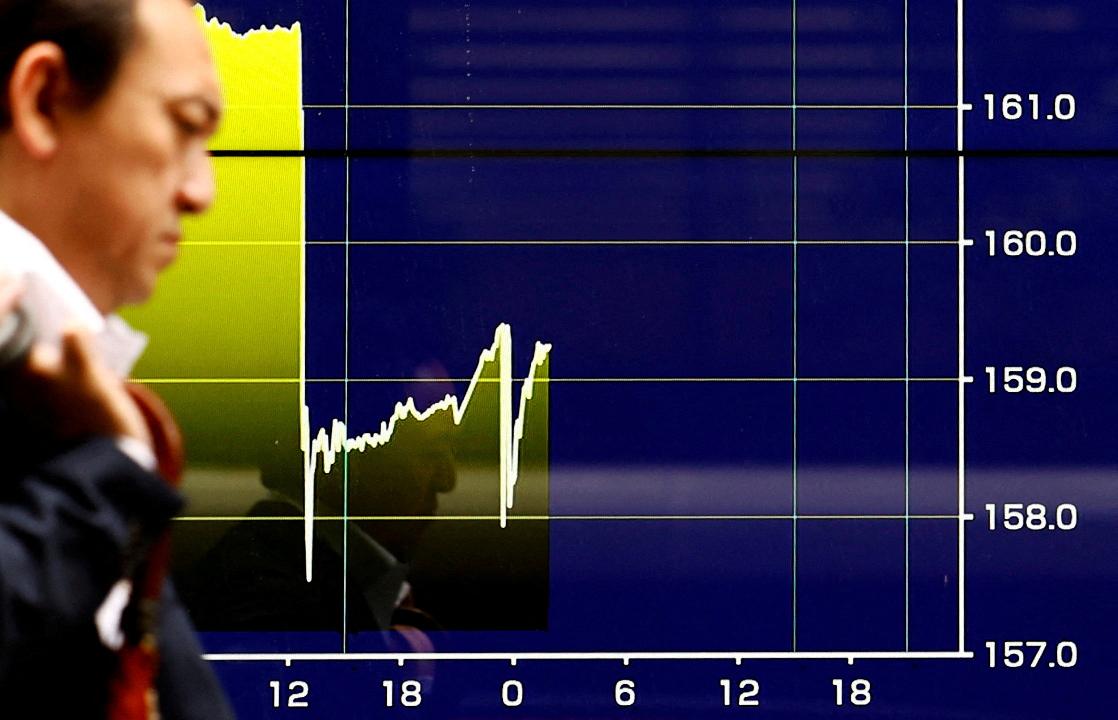

HONG KONG, July 30 (Reuters) - Global hedge funds made a massive retreat from their bearish bets on the Japanese yen during the currency's strong rise against the U.S. dollar over the last two weeks, a UBS note to clients seen by Reuters on Tuesday said. Hedge funds covered nearly all the short yen positions built up over the last year, as the yen rallied by roughly 5% against the U.S. dollar since July 10, UBS said in a note on Monday, citing its internal forex flow data without disclosing the numbers. A nearly $40 billion suspected intervention by Japanese authorities has driven the yen to roughly 153 per dollar from around 162 per dollar in mid-July. "I think the Bank of Japan's goal is to convince investors not to bet against them and to push the market to deleverage the carry trade," Zhiwei Zhang, president at hedge fund Pinpoint Asset Management, said. The reversal in the yen's trend also disrupted popular carry trades whereby an investor borrows in a currency with low interest rates and invests in a higher-yielding currency. The yen was the most popular funding currency as Japan has the lowest interest rate among the G10 currencies. Analysts said investors must seek alternatives now the yen has become too volatile. Japan's central bank started a two-day policy meeting that will conclude on Wednesday. Market traders have shown caution this week as they await upcoming interest rate decisions and details of its plan to gradually retreat from its huge purchases of government bonds. Not everyone is convinced by the BOJ's intervention, however, and views on the yen's future direction are growing divergent. In contrast to the hedge funds' pull-back, the real money community, or traditional long-only asset managers, used "the recent yen rally as an opportunity to keep selling the currency," UBS said in the same note. Sign up here. https://www.reuters.com/markets/hedge-flow-hedge-funds-make-massive-retreat-short-yen-positions-ubs-says-2024-07-30/

2024-07-30 10:10

A look at the day ahead in U.S. and global markets from Mike Dolan To the extent that worries about pricey tech stocks and rising AI capex spending were partly behind last week's market shakeout, Microsoft's quarterly update should prove a key moment later on Tuesday, just as the Federal Reserve's latest policy meeting gets under way. Markets run the gauntlet of three major central bank decisions this week, the July U.S. employment report on Friday and four U.S. megacap earnings reports. With U.S. election uncertainty as the backdrop, trepidation ahead of the week's events understandably held most major macro prices in check. U.S. stock futures , were marginally higher ahead of Tuesday's bell, while Treasury yields and the dollar (.DXY) , opens new tab nudged up too. Caution ahead of the Fed's policy decision on Wednesday - which is preceded by a possible tightening jolt from the Bank of Japan earlier that day - may muffle the initial reaction to Microsoft's (MSFT.O) , opens new tab report. But a key question for investors will be whether growth in Microsoft's Azure cloud-computing business has picked up enough to justify the billions of dollars being spent on artificial intelligence infrastructure. Its stock was down a touch, out of hours on Tuesday. Meta (META.O) , opens new tab follows with its earnings release on Wednesday and Apple (AAPL.O) , opens new tab and Amazon (AMZN.O) , opens new tab report the day after. For the next 36 hours or so, however, it will be hard to disentangle the issues surrounding the so-called Magnificent Seven megacaps from the Fed meeting - where signals on a first interest rate cut as soon as September are expected. With disinflation resuming, Fed attention is shifting to the other side of its twin mandate and what appears to be a significant cooling of the labor market. Friday's national payrolls report for July comes too late to influence Fed thinking this week. But policymakers will today get a glimpse of just how much the jobs market was loosening last month with the latest JOLTS job openings numbers. Treasury markets remained calm - helped by Fed easing hopes, a cut in government borrowing estimates for the coming quarter and falling crude oil prices . The U.S. Treasury said on Monday it expects to borrow $740 billion in the third quarter, $106 billion lower than the April estimate and mainly due to lower redemptions in the Federal Reserve System Open Market Account and a higher cash balance at the beginning of the quarter. The government will offer more details on the refunding schedule on Wednesday morning. Even though the election fogs the windscreen before then, analysts are already crunching the Treasury numbers to see what it may mean for the debt ceiling, which is due to be reinstated on Jan. 2 unless Congress suspends it again. As it stands, the estimated cash balance for December makes it likely government could last until July or August before running out of cash. With OPEC+ oil ministers due to meet again on Thursday and political tensions in OPEC member Venezuela rising after a disputed weekend election result there, crude oil prices ebbed to their lowest in six weeks and clocked their deepest year-on-year loss since Feb. 1 - almost 5%. Elsewhere, the yen weakened into the BOJ meeting and sterling was steady ahead of the Bank of England's likely tight decision on a first UK rate cut on Thursday. The euro rose on mixed bag of economic numbers. Even though Germany recorded an unexpected contraction of its economy in the second quarter, and some German states exceeded inflation expectations for July, the euro zone economy as a whole actually beat forecasts as GDP in the bloc climbed 0.3% in Q2. And it was a heavy earnings diary in Europe too. Standard Chartered (STAN.L) , opens new tab jumped almost 6% after the UK-based bank announced a $1.5 billion share buyback, its biggest ever, and lifted its income outlook for 2024. UK asset manager St James's Place (SJP.L) , opens new tab soared more than 20% after outlining a six-year plan to slash costs and revamp its services, putting its stock on course for their biggest one-day rise since 2008. Key developments that should provide more direction to U.S. markets later on Tuesday: * US June JOLTS job openings report, July consumer confidence, Dallas Fed July service sector survey, May house prices * Federal Reserve's Federal Open Market Committee starts two-day policy meeting, decision Wednesday; Bank of Japan also holds Monetary Policy Meeting, decision Wednesday * US corporate earnings: Microsoft, Advanced Micro Devices, Pfizer, Merck, Corning, Proctor & Gamble, Starbucks, Caesars Entertainment, Arista Networks, Archer-Daniels-Midland, Sysco, Stryker, Skyworks Solutions, S&P Global, Stanley Black & Decker, American Tower, Illinois Took Works, Mondelez, Essex Property, First Solar, FirstEnergy, Howmet, Xylem, Incyte, Zebra, Match, Live Nation, Ecolab, Gartner etc Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-07-30/

2024-07-30 10:04

LONDON, July 30 (Reuters) - The Bank of England has established a new cost benefit analysis panel to provide advice when new rules are proposed for firms and financial market infrastructures. Laurel Powers-Freeling, who chairs Uber UK and a number of other businesses, has been appointed chair of the panel, the BoE said on Tuesday. Sign up here. https://www.reuters.com/markets/europe/bank-england-sets-up-cost-benefit-analysis-panel-2024-07-30/