2024-07-30 07:20

July 30 (Reuters) - BP (BP.L) , opens new tab said on Tuesday it has given the go-ahead for the sixth operated hub, Kaskida, in the U.S. Gulf of Mexico, with oil production slated to start in 2029. The new hub features a new floating production platform with the capacity to produce 80,000 barrels of crude oil per day from six wells in the first phase, BP said. The London-listed company discovered the Kaskida field in 2006 and last year revived plans to develop it. The company said it plans to leverage its existing platform and subsea equipment designs that can be replicated in future projects to drive cost efficiencies across Kaskida's construction, commissioning and operations. BP's U.S. Gulf of Mexico output averaged 300,000 barrels of oil and gas per day (bpd) in 2023 and last year the company said it was targeting 400,000 bpd by 2030. The British energy major is also considering a 2025 financial greenlight decision for its Tiber offshore oil project in the U.S. Gulf of Mexico. Kaskida, Tiber, and nearby discoveries combined have an estimated 10 billion barrels of discovered resources in place. Separately, BP on Tuesday reported a second-quarter profit of $2.76 billion, beating expectations, and increased its dividend. Sign up here. https://www.reuters.com/markets/commodities/bp-green-lights-sixth-production-hub-gulf-mexico-2024-07-30/

2024-07-30 07:04

Fed likely to hold rates steady on Wednesday U.S. nonfarm payrolls data due on Friday India's duty cut to revive gold demand, WGC says July 30 (Reuters) - Gold prices held firm on Tuesday as investors braced for Federal Reserve's policy meeting and U.S. data that could offer more cues on the rate-cut timeline. Spot gold was up 0.2% at $2,388.65 per ounce, as of 0635 GMT. U.S. gold futures rose 0.3% at $2,385.30. The Fed is expected to hold rates steady at the end of its two-day meeting on Wednesday, but open the door to policy easing as early as September by acknowledging inflation has edged nearer to its 2% target. Investors will also keep a tab on a series of employment data scheduled to be released this week, with the main focus on the nonfarm payrolls report due on Friday. "The tone of the Fed meet and Friday's jobs report could pull the rug out from underneath the U.S. dollar if investors start to price in more rate cuts between now and year-end," said Tim Waterer, KCM Trade's chief market analyst. "Any moves lower in the dollar would likely provide a boon to gold, which could again see levels north of $2,400." Lower interest rates reduce the opportunity cost of holding the non-yielding bullion. India's gold demand in the June quarter fell 5% from a year earlier, but consumption in the second half of 2024 should improve due to a correction in local price following a steep reduction in import taxes, the World Gold Council said. Among other metals, spot silver gained 0.1% to $27.89 per ounce. If silver prices stay above $25 for the rest of the year, it is unlikely that Indian imports will meaningfully pick up aside from surges on dips as seen in the past, analysts at Heraeus said in a note. "This could result in a contraction in Indian jewellery and silverware fabrication demand for a second year in a row," analysts added. Platinum rose 0.3% to $951.25 and palladium dipped 0.6% to $898.08. Sign up here. https://www.reuters.com/markets/commodities/gold-little-changed-with-spotlight-fed-meeting-2024-07-30/

2024-07-30 06:59

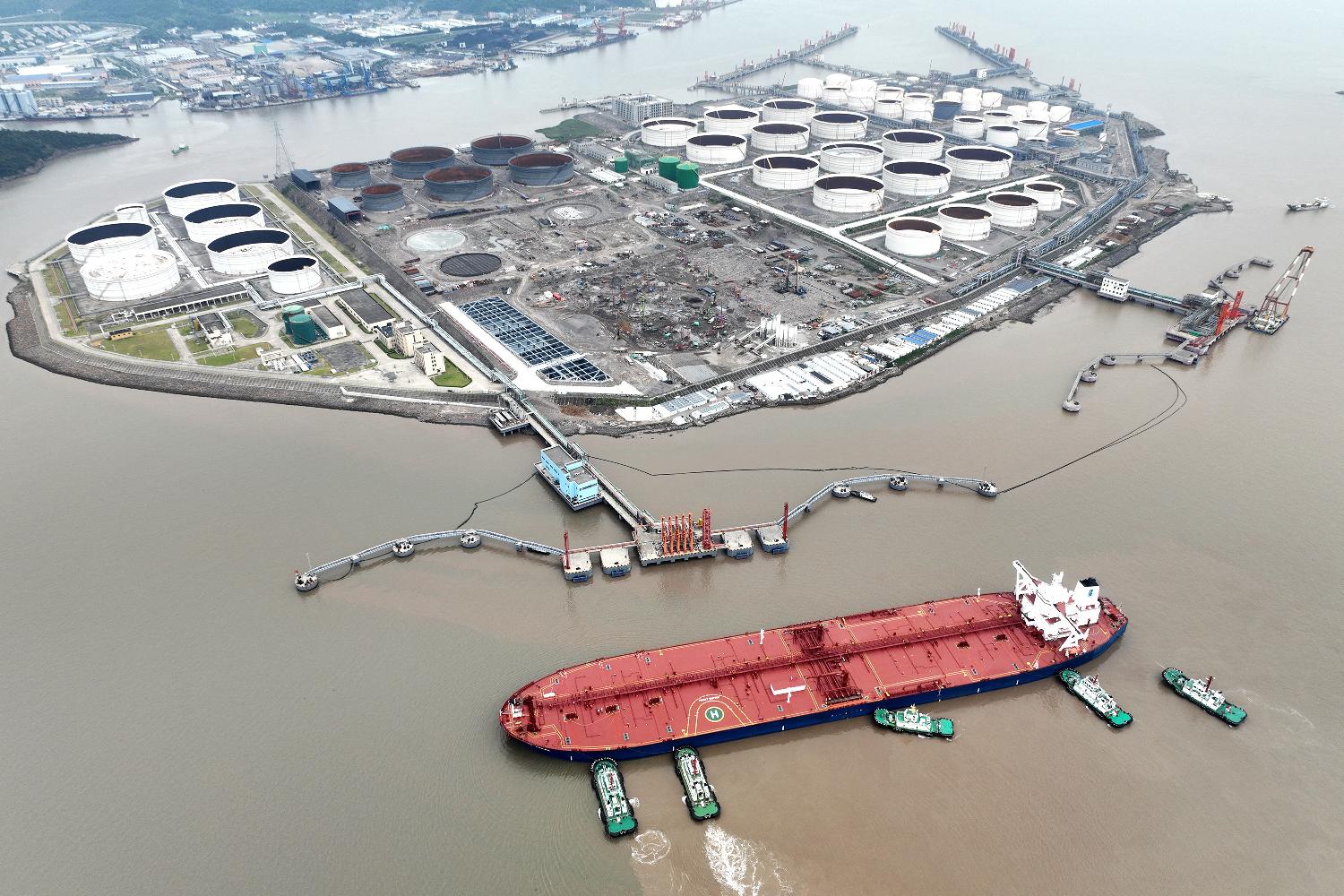

KUALA LUMPUR, July 30 (Reuters) - Two large oil tankers that collided and caught fire near Singapore earlier this month are afloat and anchored in Malaysian waters, with an investigation into the incident ongoing, Malaysia's marine department said on Tuesday. The Singapore-flagged Hafnia Nile and the Sao Tome- and Principe-flagged Ceres I collided and caught fire about 55 km (35 miles) northeast of the Singaporean island of Pedra Branca early on July 19. The Hafnia Nile, a Panamax tanker, was carrying about 300,000 barrels of naphtha destined for Japan, according to ship-tracking data from Kpler and LSEG. Naphtha is a raw material for making petrochemicals. "The Hafnia Nile is hazardous as it is still carrying its naphtha cargo," Mohamad Halim Ahmed, Director General of Malaysia's Marine Department, told a press conference, adding the tanker was severely burnt and its superstructure was compromised but its cargo intact. "Our priority is to ensure it remains afloat and can be moved safely." Mohamad Halim said preliminary investigations found that the Ceres I was anchored before the collision due to technical issues. The Hafnia Nile's attempts to avoid the Ceres I failed, resulting in the collision, he said. Malaysia's coast guard initially said the Ceres I, a very large crude carrier (VLCC) supertanker, had fled the location of the incident and was believed to have turned off its tracking system. However, Mohamad Halim said the Ceres I drifted away from the location of the collision as its anchor was damaged, before it was located and detained by Malaysia's coast guard. He said there was no oil spill detected at the location of the collision, only an oil sheen believed to be from damage to the Hafnia Nile's bunker tank. Mohamad Halim said his department was in contact with Singaporean authorities and the owner of the Ceres I to move both vessels to a safe location. Once both vessels were moved out of open waters to a port, the Malaysian government would then decide on the next steps of the investigation, he said. Sign up here. https://www.reuters.com/world/asia-pacific/malaysia-says-tankers-july-19-collision-anchored-its-waters-2024-07-30/

2024-07-30 06:54

China's leaders vow to boost policy support for economy U.S. crude stockpiles expected to fall in latest report OPEC+ panel meets on Thursday, no policy tweaks expected NEW YORK, July 30 (Reuters) - Oil prices slid about 1% to settle at a seven-week low on Tuesday as investors worried that demand from China could be weakening while OPEC+ seems likely to stick to plans to increase supplies. Market participants have been talking for days about a possible ceasefire deal in Gaza that could reduce the geopolitical risk premium for crude prices. Brent futures delivery fell $1.15, or 1.4%, to settle at $78.63. U.S. West Texas Intermediate (WTI) crude fell $1.08, or 1.4%, to $74.73. That was the lowest close for both benchmarks since June 5 and kept both in technically oversold territory for a second day. U.S. futures for diesel and gasoline also closed at their lowest since early June. Manufacturing activity in China, the world's largest crude importer, likely shrank for a third month in July, according to a Reuters poll. Chinese leaders have vowed to step up support for the economy, but investors expect such measures will be limited since the Third Plenum policy meeting largely reiterated existing goals. In Lebanon, an Israeli air strike targeted a senior Hezbollah commander in Beirut's southern suburbs in what the Israeli military called retaliation for a cross-border rocket attack over the weekend that killed 12 children and teenagers. Some analysts have said Israel's measured response could signal a deal was close on Gaza. A ceasefire deal with Hamas has "the potential to (remove) $4 to $7 (a barrel) of risk premium out of the market," Bob Yawger, director of energy futures at Mizuho, said in a note. On Thursday, top ministers from OPEC+, the Organization of the Petroleum Exporting Countries (OPEC) and allies like Russia, will meet to review the market, including a plan to start unwinding some output cuts from October. No changes are currently expected. U.S. INVENTORY DATA DUE Weekly U.S. oil storage data is due from the American Petroleum Institute (API) trade group later on Tuesday and the U.S. Energy Information Administration (EIA) on Wednesday. Analysts projected U.S. energy firms pulled about 1.1 million barrels of crude out of storage during the week ended July 26. , If correct, that would be the first time U.S. crude stocks declined for five weeks in a row since January 2022. U.S. job openings fell modestly in June and data for the prior month was revised higher, suggesting the labor market continued to cool, which analysts say makes it more likely the Federal Reserve will reduce interest rates. The Fed is expected hold its benchmark overnight interest rate steady at its July 30-31 meeting and signal that rate cuts may begin as soon as the central bank's September meeting. The Fed hiked rates aggressively in 2022 and 2023 to tame a surge in inflation. Lower rates can boost economic growth and demand for oil. The U.S. is considering fresh sanctions on OPEC member Venezuela following disputed results in the South American country's presidential election. President Nicolas Maduro's victory in the latest Venezuelan election "is a headwind for global supply, as this could result in tighter U.S. sanctions," ANZ analysts said in a note, estimating such a scenario could cut Venezuela's exports by 100,000-120,000 barrels per day. Sign up here. https://www.reuters.com/markets/commodities/oil-prices-slip-china-demand-concerns-waning-middle-east-worries-2024-07-30/

2024-07-30 06:47

LONDON, July 30 (Reuters) - Glencore (GLEN.L) , opens new tab on Tuesday left its 2024 production guidance unchanged for most metals and lifted coal to reflect the acquisition of Teck's steelmaking coal unit, saying it will announce whether it will separate its coal assets at its half-year financial results next week. The miner and trader this month completed a deal to buy the majority of Teck's coal business. "We are now in the process of consulting with shareholders to assess their views regarding the potential demerger of our coal and carbon steel materials business," CEO Gary Nagle said in a release. "We expect to be able to announce the outcome of such engagement and the decision of the Board ...next week." Glencore is already a top producer of thermal coal, the most polluting fossil fuel, with an expected output of between 98 million and 106 million tons this year. Its 2024 steelmaking coal production should increase to 19-21 million tons post-acquisition, from 7-9 million. Reuters in March reported that a growing group of Glencore investors were keen for it to keep mining coal instead of spinning out the soon-to-be enlarged unit, with one eye on its financial outlook and another on the environmental benefits of keeping coal in-house. While a demerger could lead to a share price bump, critics say that spun-off assets are often shifted into private ownership and run for longer with less rigorous investor oversight, potentially leading to a worse climate outcome. Glencore said it will responsibly run down its thermal coal assets. "A coal demerger is highly unlikely, and ...the acquisition of EVR from Teck will prove to be a significant positive for Glencore as this is the world's highest quality met coal business by a fairly wide margin," said Chris LaFemina, analyst at Jefferies. Glencore reported lower numbers for its first half copper, nickel, zinc, coal and cobalt production, compared to the same year-ago period. It left its overall 2024 guidance for copper, a metal key for energy transition applications, unchanged at between 950,000 and 1.01 million tons, having produced 462,600 tons in the six months to June. Sign up here. https://www.reuters.com/markets/commodities/glencore-announce-decision-coal-portfolio-demerger-interim-results-2024-07-30/

2024-07-30 06:39

MELBOURNE, July 30 (Reuters) - An Australian shareholder advocacy group said it would no longer engage with Rio Tinto (RIO.AX) , opens new tab after the miner lobbied the Australian government to remove a reference to climate change impacts in impending environmental legislation. Rio Tinto, Hancock Prospecting, and several other Western Australian industry parties sent a letter to Australia's Prime Minister Anthony Albanese expressing concerns about the government's 'nature positive' environmental reforms. The letter, which became public after a Freedom of Information (FoI) request by Greenpeace, contained an appeal to remove climate change requirements such as carbon emissions as a trigger for assessment. The names of other companies were redacted. The Australasian Centre for Corporate Responsibility (ACCR), which owns a small stake in Rio, said the appeal was inconsistent with the miner's own public commitments for enhanced climate advocacy and transparency, adding that the miner's actions were a "breach of trust", as it was not informed of this position. "ACCR is now stepping away from an agreement to support climate and decarbonisation related engagement with Rio Tinto. We will not participate in engagements that could rightly be perceived as greenwashing," it said in a statement. Engagement with Rio Tinto would only be possible again once the company clearly and formally updated its advocacy position on the environmental reforms, ACCR added. Rio Tinto said in a statement that it supported strong environmental protection and that it looked forward to engaging with the Australian government to ensure the new rules were practical and workable. "We believe reform should drive both stronger environmental and heritage protections and more efficient approvals processes," it said in a statement. Sign up here. https://www.reuters.com/sustainability/boards-policy-regulation/rio-tinto-iced-out-by-investor-advocate-accr-over-climate-stance-2024-07-30/