2024-07-29 17:46

LONDON, July 29 (Reuters) - Britain's Office for Budget Responsibility will initiate a review into how a March budget held by the last government was prepared after the new finance minister said it would have led to a 22 billion pound ($28.27 billion) overspend. Rachel Reeves announced spending cuts worth 13.5 billion pounds over the next two years, saying the scale of the overspend was unsustainable. OBR Chair Richard Hughes said that he had been made aware of the scale of the overspend last week, and would review the preparation of departmental spending plans, known as Departmental Expenditure Limits (DEL), as a result. "If a significant fraction of these pressures is ultimately accommodated through higher DEL spending in 2024-25, this would constitute one of the largest year ahead overspends against DEL forecasts outside of the pandemic years," Hughes said in a letter to a parliamentary committee. "Given the seriousness of this issue, I have initiated a review into the preparation of the DEL forecast in the March 2024 (fiscal outlook)." ($1 = 0.7781 pounds) Sign up here. https://www.reuters.com/world/uk/uks-obr-review-last-budget-preparations-after-new-government-identifies-2024-07-29/

2024-07-29 15:13

LONDON, July 29 (Reuters) - Britain's new finance minister Rachel Reeves said on Monday she had scrapped the previous government's plan to sell shares in Natwest Group (NWG.L) , opens new tab to the general public as it would be too costly for the taxpayer. Reeves said the government still intends to fully exit its shareholding by 2025-26, but that a retail share offer would mean having to offer the public discounts worth hundreds of millions of pounds. "It would therefore not represent value for money, and it will not go ahead," Reeves said. NatWest said this month that the government's stake in it fell below 20%, moving the bank closer to full private ownership after its state bailout in the 2008 financial crisis. The previous Conservative government had mooted a share sale to the public as a means of expediting the process before it lost in the July general election to the left-leaning Labour party. NatWest last week raised its performance targets for 2024 despite reporting a fall in first half profit, thanks to its upbeat assessment of the economy and customer activity. Sign up here. https://www.reuters.com/world/uk/uks-reeves-scraps-plan-natwest-public-share-sale-too-costly-2024-07-29/

2024-07-29 15:01

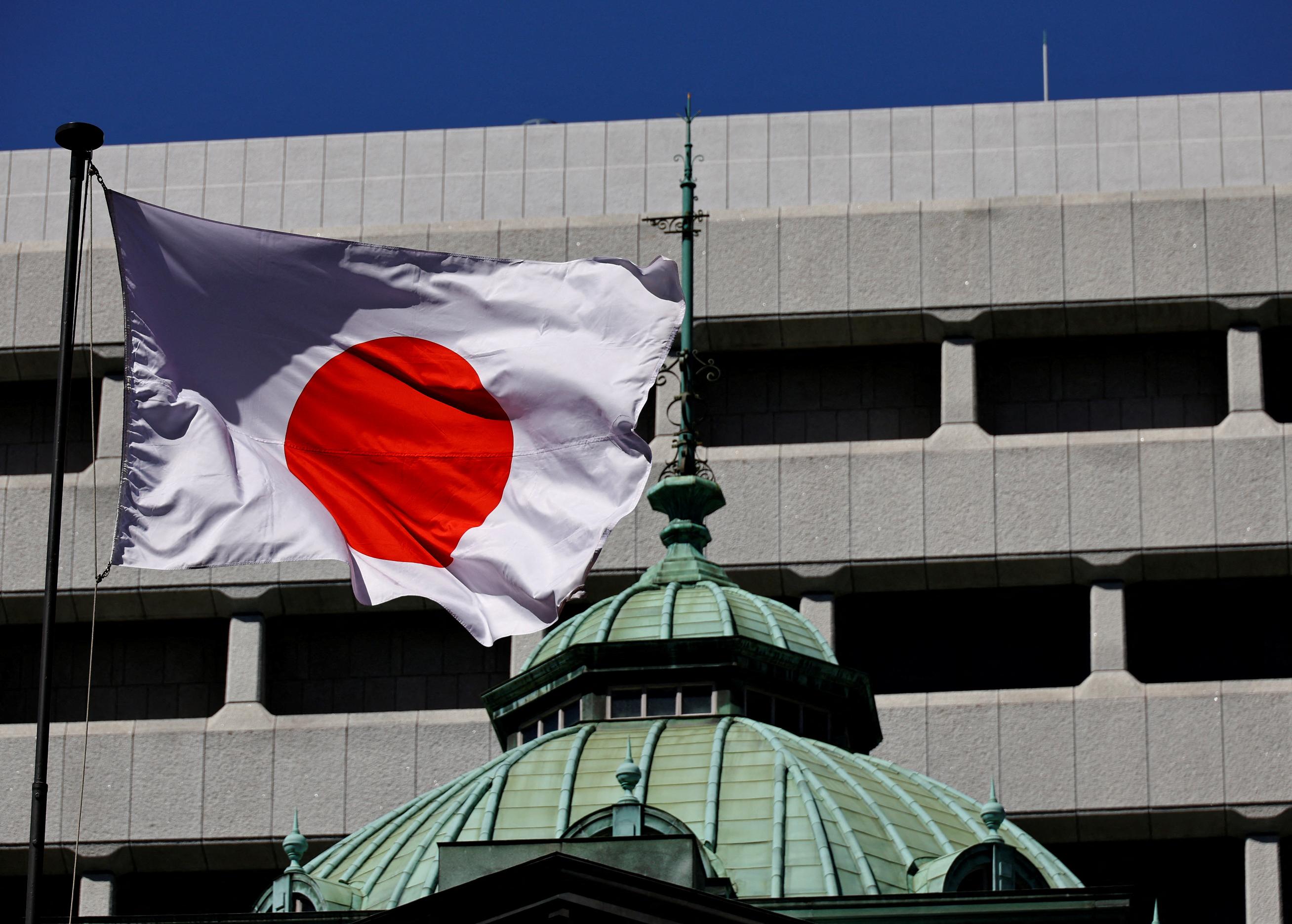

LONDON/SINGAPORE, July 29 (Reuters) - A perfect storm of political, policy and technical risks has upended one of the year's most popular currency trades, sending the Japanese yen soaring from 38-year lows with ripples spreading as far as Switzerland, Australia and Mexico. Nearly $40 billion in suspected intervention by Japanese authorities ignited the yen's rally but the move has taken on a life of its own, upending the carry trades which exploit differences in interest rates and often utilise the currency. The yen has surged from around 162 per dollar in mid July to roughly 153 per dollar , its biggest two week gain of the year, even if it remains this 2024's worst performing G10 currency. "The yen is a classic example of where positioning and top-down factors are aligning," said Hugh Gimber, global market strategist at JPMorgan Asset Management. Analysts point to expectations that the yawning gap between U.S. and Japanese interest rates could soon narrow, as well as concerns that a Donald Trump victory in November's U.S. presidential election could unleash new currency wars. Speculators have cut their bearish bets against the yen by the most in a month since March 2020. At $8.61 billion, the net short position is 40% below April's near-seven year high, according to data from the U.S. markets regulator . "Because this unwinding of short yen positioning is correlated with the so-called carry trade it can affect other carry positions as well," said Athanasios Vamvakidis, global head of G10 FX strategy at Bank of America. STEAMROLLER Carry trades have proved hugely popular this year and last, fuelled by a combination of low volatility and big differences between central bank interest rates. Traders borrowed in yen or Swiss francs at rock-bottom rates and invested in assets with higher returns such as Mexican government bonds or even U.S. tech stocks, with analysts saying last week's equity-market rout may have got an extra kick from some carry trades unwinding. Benchmark 10-year borrowing costs are around 1% in Japan and 0.5% in Switzerland versus more than 4% in Australia - popular with developed-market carry traders - or near 10% in Mexico. The recent pick up in volatility has added pressure to carry trades that did well in the more benign markets of the first half of 2024, said Nathan Swami, head of currency trading at Citi in Singapore "Carry trades involving funding in yen appear to be increasingly vulnerable to VaR shocks, similar to what we saw last week," he said. A VaR shock is essentially a jump in the maximum loss an investment can sustain over a period of time. The resulting shifts are felt far and wide. The Swiss franc and China's offshore yuan, other popular carry trade funding currencies, also appreciated last week, with the yuan seeing its biggest weekly gain against the dollar since April, and the franc hitting its strongest since March. , . "It's all about carry trades. You can see from the daily moves in say the Swiss franc, when the news isn't to do with the franc but the yen," said Jamie Niven, senior fixed income portfolio manager at Candriam. Niven said he began reducing a short position in China's yuan last week, as its sudden appreciation made him wary of carry-trade currencies. Meanwhile, the Australian dollar has fallen 3.6% against the U.S. dollar in two weeks, and nearly 6% on the yen, its most in a fortnight since the pandemic volatility of March 2020. Latin American currencies like the Mexican peso are also softer. "It's not a pure carry environment for the moment," said Andreas Koenig, head of global FX at Amundi, Europe's largest asset manager, noting that the recent daily moves in currencies like the peso can easily wipe out any gains from carry. The surprise outcome of the Mexican election in June also jolted carry trades, while the U.S. vote and uncertainty about the trajectory of central bank policy are likely to drive further currency volatility, deterring investors from carry trades for now. "When uncertainty goes up and we're coming closer to big events, like U.S. elections, I would say I would wait until these are out," said Koenig. "Afterwards," Koenig added, "I'm pretty sure a lot of opportunities can open up, especially let's say on the Mexican side." Sign up here. https://www.reuters.com/markets/currencies/surging-yen-upends-popular-global-fx-carry-trades-2024-07-29/

2024-07-29 12:40

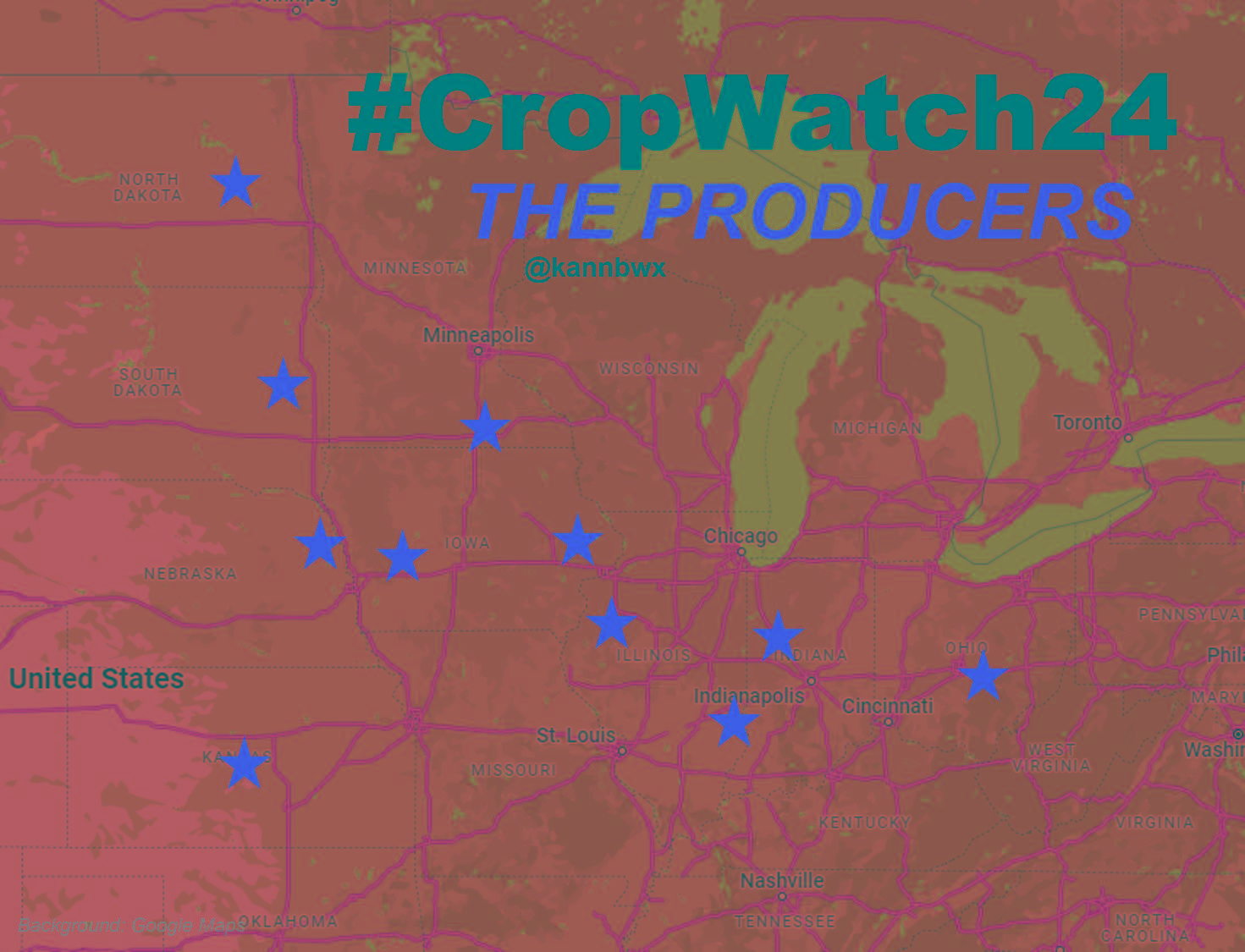

PARIS, July 30 (Reuters) - Last week was the driest yet of the growing season for U.S. Crop Watch corn and soybeans, though yield expectations largely held as most areas enjoyed comfortable temperatures. However, heat is expected to prevail this week, especially in western areas, though many spots in the main Corn Belt will have rain chances this week. That could be associated with strong and potentially damaging storms. Western Crop Watch locations have been dry for about three weeks now, so any moisture captured over the next several days could preserve yield potential heading into early August, which could turn dry again according to Sunday’s short-term outlook from U.S. forecasters. Crop Watch producers continue to be more pleased with soybean prospects versus those for corn, and some of the eastern Belt beans could notch record yields if rains materialize in the next couple of weeks. Most of the Crop Watch corn has come through pollination, though the producers are cautious about predicting large yields because of unfavorable weather earlier in the season and uncertainty around grain filling given a warm August forecast. Crop Watch producers are rating crop conditions and yield potential on 1-to-5 scales. The condition scores are a primarily visual assessment similar to the U.S. government’s where 1 is very poor, 3 is average and 5 is excellent. Yield potential is meant to capture both visible and non-visible elements. On this scale, 3 is around farm average yield, 4 is solidly above average and 5 is among the best crops ever. The 11-field, average corn yield dropped to 3.27 from 3.34 last week mainly on a cut in western Illinois, where storm damage from a couple weeks ago is still being assessed. Corn conditions jumped to 3.5 from 3.45, led by increases in North Dakota and southeastern Illinois. Average soybean yield slipped to 3.59 from 3.61 in the prior week as trims in North Dakota and western Illinois offset an increase in Nebraska. But soybeans are still looking visually healthy as improvements in Iowa helped bean conditions climb to 3.89 from 3.84 last week, marking the best soy conditions since mid-June. No score reductions were made in Kansas this week, but the producer is certain those are coming next week after several more days of dry and scorching weather. The beans there are expected to suffer more than the corn. The following are the states and counties of the 2024 Crop Watch corn and soybean fields: Kingsbury, South Dakota; Freeborn, Minnesota; Burt, Nebraska; Rice, Kansas; Audubon, Iowa; Cedar, Iowa; Warren, Illinois; Crawford, Illinois; Tippecanoe, Indiana; Fairfield, Ohio. The North Dakota soybeans are in Griggs County and the corn is in Stutsman County. Karen Braun is a market analyst for Reuters. Views expressed above are her own. Sign up here. https://www.reuters.com/markets/commodities/crop-watch-rain-needed-fend-off-heat-driven-yield-losses-2024-07-29/

2024-07-29 12:03

MADRID, July 29 (Reuters) - The Spanish government has authorised the construction of almost 300 renewable power projects with a total capacity of more than 28 gigawatts, which will help the country meet its ambitious green energy goals, it said on Monday. The projects, which will represent a combined investment worth over 17 billion euros ($18.4 billion), comprise mainly photovoltaic power plants, as well as 43 wind farms and one hydropower plant, the Energy Ministry said in a statement. Leveraging on its sunny plains, windy hillsides and fast-flowing rivers, Spain intends to raise the share of renewable-generated electricity to 81% of the total by 2030, up from about 50% now. ($1 = 0.9230 euros) Sign up here. https://www.reuters.com/business/energy/spain-greenlights-almost-300-renewable-power-projects-with-18-bln-investment-2024-07-29/

2024-07-29 12:01

MOSCOW, July 29 (Reuters) - The governor of Russia's west-central Chelyabinsk region ordered preventative evacuations in a small city on Monday after heavy rains caused a dam to burst last week, the TASS state news agency reported. Aleksei Teksler was quoted by TASS as saying that evacuations were underway in the city of Miass, which has roughly 160,000 residents. "There is a risk that the water will reach residential houses. It is still rising, so a decision has been made to start preventive evacuation of residents in order to ensure their safety. At the moment this work is underway," Teksler told Rossiya-24 state television, TASS reported. Strong rains last week burst a 100-metre section of a dam and prompted officials on Friday to evacuate several villages in the southern Ural mountains. Sign up here. https://www.reuters.com/world/europe/russian-governor-orders-evacuations-over-threat-flooding-urals-region-2024-07-29/