2024-07-29 06:43

July 29 (Reuters) - British meat producer Cranswick (CWK.L) , opens new tab reported a higher first-quarter revenue on Monday, driven by strong demand for its premium ranges and pet products. Cranswick, which produces fresh pork, bacon, gourmet sausages, poultry items and continental foods, said export sales volumes were strongly ahead in the quarter. British food producers have been benefiting from a revival in consumer spending and easing costs, after a long spell of staggering demand and supply-chain constraints amid inflationary pressures. Cranswick also said its quarterly revenue was 6.7% ahead of the year-earlier period, while maintaining its outlook for the current financial year. Sign up here. https://www.reuters.com/business/retail-consumer/uk-meat-producer-cranswicks-q1-revenue-rises-strong-demand-2024-07-29/

2024-07-29 06:29

Central bank removes restrictions on FX trading Birr currency falls 30% against dollar Floatation of currency key to securing IMF support ADDIS ABABA, July 29 (Reuters) - Ethiopia's central bank floated the birr currency on Monday, a move it hopes will secure International Monetary Fund (IMF) support and enable progress on a long-delayed debt restructuring. The birr's value against the U.S. dollar slumped by 30% to 74.73 per dollar, the country's biggest lender, Commercial Bank of Ethiopia said. The currency had been trading at 57.48 birr to the dollar on Friday. The Horn of Africa nation, which has been struggling with soaring inflation and chronic foreign currency shortages, became the third economy on the continent in as many years to default on its government debt last December. It has been in talks with the IMF to establish a new lending programme after the last programme, agreed in 2019, was abandoned due to conflict in the northern region of Tigray. Negotiations resumed after a November 2022 peace deal. The central bank said in a statement on the float that "banks are henceforth allowed to buy and sell foreign currencies from/to their clients and among themselves at freely negotiated rates" and that it would only make "limited interventions" in the FX markets going forward. The reforms were initially announced by Prime Minister Abiy Ahmed late on Sunday. Central bank governor Mamo Mihretu said in an online video that, as part of the reforms, Ethiopia would get $10.7 billion in external financing from the IMF, the World Bank, and other creditors. "The IMF and World Bank are both providing exceptional and front-loaded funding support that will be among their highest such allocations in the African continent," he said. Importers, who had been relying on the black market to secure dollars, expressed relief at the central bank's move. "Now I don't need to go to black market to buy or sell dollars. It is now a market-based foreign exchange regime, so (we) will buy or sell based on the legal channels," said a businessman in the capital Addis Ababa, who did not want to be named. The IMF did not immediately respond to a request for comment. The fund's executive board was scheduled to meet on Monday to discuss a new programme for Ethiopia, Bloomberg news agency reported. Reuters could not confirm the meeting. Ethiopia's main $1 billion dollar government bond edged higher to reach 75.42 cents on the dollar by 1400 GMT, its highest level since early 2022. The United States welcomed the shift. "Market-based FX is a difficult, but necessary step for Ethiopia to address macroeconomic distortions," the U.S embassy in Addis Ababa posted on social media platform X. Ethiopia, Africa's second-most populous country, requested a debt restructuring under the Group of 20's Common Framework process in early 2021, but the war in Tigray slowed progress. The government previously announced other reforms that analysts say are linked to the IMF talks, including adopting an interest rate-based monetary policy earlier this month. Some said the longer-term impact of the devaluation was less clear. "The consequences of exchange rate regime change will take some time to be reflected on the economy," Abdulmenan Mohammed, an Ethiopian economic analyst based in Britain, told Reuters. He said it could result in an increased cost of living "which will mainly affect the urban poor, the jobless, the pensioners, the low-paid employees." Sign up here. https://www.reuters.com/markets/currencies/ethiopia-shifts-market-based-foreign-exchange-system-2024-07-29/

2024-07-29 06:14

Ola is biggest e-scooter maker in India IPO to draw bids from Fidelity, Nomura, Norges Bank IPO values Ola 25% below last private fundraising MUMBAI, July 29 (Reuters) - Indian e-scooter maker Ola Electric said on Monday it aimed to raise $734 million in the country's biggest IPO this year, a deal set to lure major foreign investors and highlight growing confidence in India's financial markets. A stock market boom has already led more than 150 Indian companies to raise nearly $5 billion through public listings in the country between January and July, nearly double the figure for the same period last year, LSEG data shows. The first IPO by an Indian electric vehicle maker will let investors bet on a clean energy push by Prime Minister Narendra Modi's government, as well as firms from Tata Motors (TAMO.NS) , opens new tab and TVS Motor (TVSM.NS) , opens new tab to Hyundai Motor (005380.KS) , opens new tab. "Our mission is to really make India a global EV hub," Ola's chairman Bhavish Aggarwal told reporters at a press conference in Mumbai, where he posed for photographs sitting on his e-scooters that start retailing at $900. SoftBank-backed Ola Electric has become the biggest player in a country where adoption of clean vehicles is still low, but rising rapidly. It had 46% of the e-scooter market as of June 30 despite slashing sales goals last year. "Tesla is for the West and Ola for the rest," has become a catchphrase linked to Aggarwal, who is betting big on cleaner vehicles. Aggarwal had plans to start selling an electric car in 2024, but Reuters reported they have been suspended to let the company focus on e-scooters and EV battery cells. It also plans a foray into electric bikes. Aggarwal said Ola had a good product line up in place for e-motorbikes. Ola's aggressive push into e-scooters has already disrupted the market forcing a pivot by incumbents such as TVS, Hero MotoCorp (HROM.NS) , opens new tab and Bajaj Auto (BAJA.NS) , opens new tab. Its entry into the motorcycle segment, which makes up two-thirds of total two-wheelers sold in the country, will intensify competition. ATTRACTIVE VALUATION A term sheet for the IPO, which will run from Aug. 1 to Aug. 6, puts a value of $4 billion on the company, which sold its first scooter in 2021. That valuation is about 25% lower than Ola's last funding round in September, led by Singapore's investment firm Temasek (TEM.UL) which valued the EV maker at $5.4 billion. The lower figure stems from a correction in the valuation of global tech companies as well as Ola's desire to attract participants to the stock offering, said sources who spoke on condition of anonymity. The IPO is set to draw bids from Fidelity, Nomura and Norges Bank at the $4 billion valuation, as well as several Indian mutual funds, sources who asked not to be identified told Reuters. In the IPO, Ola will issue new shares to raise $657 million while existing investors offload their stake of about $77 million to IPO investors, the term sheet showed. The loss-making company unveiled the price band of 72 rupees to 76 rupees ($0.86-$0.91) in an advertisement in the Financial Express newspaper, with a discount of 7 rupees a share for some eligible employees. Aggarwal and investors such as SoftBank and Matrix Partners will sell part of their stakes in the IPO. Monday's newspaper ad showed 10% of the IPO will be reserved for retail investors, with proceeds going to fund capital expenditure and research and development efforts. Sign up here. https://www.reuters.com/markets/deals/indias-ola-electric-prices-ipo-72-76-rupees-per-share-2024-07-28/

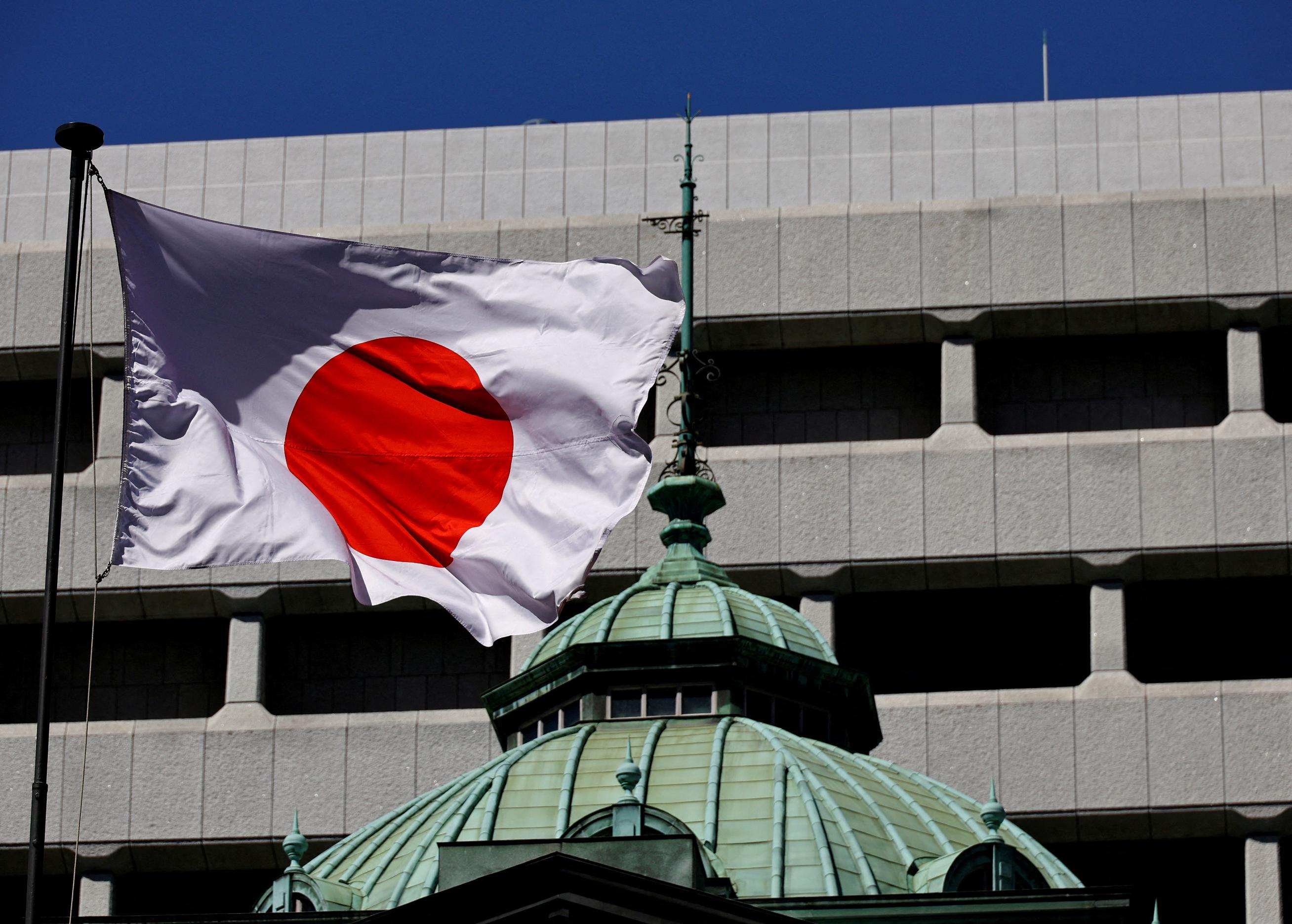

2024-07-29 06:09

TOKYO, July 29 (Reuters) - Japan's government and central bank must guide policy by taking into careful consideration recent yen weakness that is hurting consumption, the government's top economic council said on Monday. Achieving a recovery in consumption, which shrank for four straight quarters, is key to the government's near-term economic policy, the council said in a statement that laid out guidelines for crafting next year's state budget. "We cannot overlook the impact a weak yen and rising prices are having on households' purchasing power," the council said. "It's important for the government and Bank of Japan to guide policy with a close eye on recent yen declines," the council said in the statement presented at its meeting on Monday. The statement underscores concerns policymakers share on the economic fallout from the weak yen, which has hit consumption by pushing up the cost of fuel and food imports. The weak yen is also likely to be a key topic of debate at the Bank of Japan's two-day policy meeting ending on Wednesday, when its board will lay out a detailed plan to taper its huge bond buying and debate whether to raise interest rates. The yen briefly hit a 38-year low of 161.96 to the dollar earlier in July, down 14% from the start of this year, triggering yen-buying intervention by Japanese authorities. It has recouped some of the losses to hover at 154.09 on Monday. The government, for its part, will seek to raise the minimum wage and take steps to cushion the blow from rising prices, such as payouts to low-income households and temporary subsidies to curb utility bills, the council said. Consumption has been a soft spot in Japan's fragile recovery with its weakness blamed for the economy's contraction in the first quarter. In its monthly economic report for July, the government described a pick-up in consumption as stalling. The assessment is bleaker than that of the BOJ, which has described consumption as "resilient." Sign up here. https://www.reuters.com/markets/asia/japans-top-council-urges-govt-boj-guide-policy-with-eye-weak-yen-2024-07-29/

2024-07-29 05:54

NEW YORK/LONDON/TOKYO, July 29 (Reuters) - The dollar held steady on Monday as traders braced for an avalanche of market events featuring midweek policy decisions by the Federal Reserve, Bank of Japan and Bank of England, and what could be a pivotal U.S. employment report for the Fed on Friday. The yen was little changed following the Japanese currency's strongest weekly rally since late April on the back of shifting interest rate expectations and a stock market sell-off. The dollar index , which measures the currency against the euro, yen and four other major currencies, rose 0.18% to 104.56. The euro slipped 0.33% to $1.0821 . Dollar/yen was last up 0.13% at 153.995 , reversing an earlier decline of as much as 0.49% to 153.04. Markets have been focused on the surge in the yen over the last week, with rising speculation of a BOJ interest rate hike this week helping buoy the currency, along with the specter of BOJ intervention after several rounds of official yen buying in recent weeks. Win Thin, Brown Brothers Harriman's global head of market strategy, said in a client note that the yen will likely struggle to gain further upside momentum, with the BOJ likely to deliver a dovish hike at its meeting on Wednesday. The U.S. Federal Open Market Committee (FOMC) is widely expected to leave rates unchanged this week, but to cut them by a quarter point at the following meeting in September. While the FOMC does not meet in August, Fed chair Jerome Powell could use the Jackson Hole gathering of central bankers in late August to prepare the market for a rate cut. By then more data on inflation and Friday's July employment report will be available for policy makers to weigh conditions for a September cut. While U.S. Japan yield differentials are thus expected to narrow, it does not look like the near-term carry trade advantage of borrowing/shorting yen to fund investments outside of Japan will erode significantly in the coming two months. "The market doesn't have much conviction right now. It doesn't have much conviction, because everybody is reading from same song book, what would be called a 'dovish hold' by the Fed," said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York. MARKET MOVES Data released on Friday showed investors have sharply cut back on their bets against the yen , which was trading at a 38-year low at the start of the month. "Sentiment remains fragile," said Shinichiro Kadota, a currency and rates strategist at Barclays in Tokyo. Ultimately, "U.S. equities are still the key," Kadota added, referencing the demand for safe-haven currencies like the yen seen during last week's stock market rout. "Market moves have been led by U.S. equities, and we need to see if things stabilize there." Wall Street was steady on Monday, coming off a volatile week marked by a deep two-day shakeout on worries about megacap earnings. The U.S. earnings calendar this week is populated with heavyweights including Amazon.com (AMZN.O) , opens new tab, Apple (AAPL.O) , opens new tab, Meta Platforms (META.O) , opens new tab and Microsoft (MSFT.O) , opens new tab. Currency traders also face a Bank of England meeting on Thursday, where the odds of a first rate cut are seen as a coin toss. British bond yields fell on Monday, weighing on the pound. There was little reaction in sterling after Britain's new finance minister, Rachel Reeves, announced spending cuts worth 13.5 billion pounds ($17.3 billion) over the next two years to help plug what she said was a 22 billion-pound overspend caused by the previous government. The pound wrapped up 0.01% easier at $1.28645. "There are lot of big things happening this week and this is still market-positioning ahead of those events," said Chandler. Elsewhere, the Australian dollar was 0.02% firmer at $0.6548, attempting to recover from Friday's low of $0.65105, a level not seen since the start of May. Leading cryptocurrency bitcoin was 1.22% lower at $67,390, shaking off positive comments from Republican presidential candidate Donald Trump, who told a bitcoin conference on Saturday that the U.S. must dominate the sector or China would. Sign up here. https://www.reuters.com/markets/currencies/yen-eases-nikkei-jumps-central-bank-meetings-loom-2024-07-29/

2024-07-29 05:54

FRANKFURT/GDANSK, July 29 (Reuters) - European companies focused on clean energy are abandoning expansion plans, bracing for lower sales or see funding of U.S projects in doubt because of fears over what a potential election victory for Donald Trump could mean for their sector. Trump has dismissed President Joe Biden's policies to fight climate change as a "green new scam" and is expected to try to undo much of his administration's work, including the Inflation Reduction Act (IRA) that offers tax breaks and subsidies to U.S. and foreign companies investing in sustainable energy. The law passed in 2022 has acted as a powerful incentive for European companies from the sector to expand or establish their U.S. presence, but a spectre of a second Trump presidency is giving them a pause. "With a Donald Trump who A) is very opportunistic, B) is also very polemic and C) is also fairly unpredictable, you have to ask yourself whether it makes sense to make such a bet," Peter Roessner, chief executive of Luxembourg-based hydrogen firm H2Apex (H2A.DE) , opens new tab, told Reuters. Under the IRA, the company could have built a hydrogen tank production plant in the United States for around a third of the $15 million in costs. In February, however, Roessner decided to cancel the plan over concerns that Trump could be reelected even though the company already had held initial talks with potential customers. Market bets that Trump would win back the White House in November have intensified this month after he was shot at during an election rally and days later secured the Republican Party nomination. Recent polls show a narrowing gap between Trump and Kamala Harris, the likely Democratic candidate with similar views on climate to Biden's. Yet Roessner's comments reflect anxiety among Europe's clean tech firms over what a Trump presidency could mean and how they are trying to prepare for such a scenario. Wood Mackenzie energy data and analytics company reckons it would put a projected $1 trillion in low-carbon energy investments at risk by 2050. Consultancy Roland Berger said that while a full repeal of the IRA was improbable, a Trump administration could still jeopardise incentives for electric vehicles, EV charging, solar power and energy efficiency. German solar firm SMA Solar (S92G.DE) , opens new tab issued a profit warning last month, citing a possible government change in the United States, the world's second-largest solar market after China, as one of the risk factors. The world's largest maker of solar inverters initially aimed , opens new tab to choose a location for a planned factory in the United States by the end of June, but is yet to find one, saying it is still evaluating possible sites in a number of states. 'BOARDROOM HEADACHES' While SMA is not abandoning its expansion plans for now, the company told Reuters on July 4 that it "is observing that the unclear outcome of the presidential elections in the USA is currently leading to a certain reluctance to invest in renewable energies locally." That hesitation is reflected in the performance of clean tech shares, with the RENIXX (.RENIXX) , opens new tab index, which tracks the world's 30 biggest renewable firms, underperforming global stocks (.MIWD00000PUS) , opens new tab since the assassination attempt. Orsted (ORSTED.CO) , opens new tab, the world's largest offshore wind farm developer, has been hit particularly hard after Trump said in May he would target the sector on his first day in office if he got reelected. Orsted declined to comment. Some renewable energy companies appear undeterred by the uncertainty. German wind turbine maker Nordex (NDXG.DE) , opens new tab, for example, last month said it would resume production at a mothballed plant in Iowa, saying the U.S. would remain an important and sufficiently big market in the future "regardless of political developments". Several others, however, report delays as prospective partners expected to co-fund projects hold off with their commitments. Hydrogen firm Thyssenkrupp Nucera (NCH2.DE) , opens new tab has spoken of delays to final investment decisions concerning U.S. projects, a factor that drove an outlook cut at its alkaline water electrolysis unit earlier this year. The company said while it continued to focus on the U.S., it was vital how the IRA programme would look like after the election. It said strategic investors with a long-term focus on the cleantech sector were likely to resume projects earlier in the face of continuing uncertainty than those who are more opportunistic. Norwegian rival Nel (NEL.OL) , opens new tab said it was yet to make an final investment decision for a planned production facility in Michigan, which was contingent on the demand for its products in the U.S. market. The uncertainly over the U.S. election outcome and its impact is starting to affect industries beyond the clean tech sector. For example, German machinery firm Trumpf reported earlier this month a 12% drop in U.S. sales for its 2023/24 fiscal year, blaming "geopolitical uncertainties" that made industrial customers cautious. This growing complexity companies have to navigate globally can create "analysis paralysis" when it comes to investment decisions, said Marcus Berret, global managing director at Roland Berger. "Boardroom headaches have increased considerably as a result." ($1 = 0.9220 euros) Sign up here. https://www.reuters.com/sustainability/boards-policy-regulation/trump-effect-clean-tech-sector-deepens-angst-europes-boardrooms-2024-07-29/