2024-07-29 04:55

LAUNCESTON, Australia, July 29 (Reuters) - (The opinions expressed here are those of the author, a columnist for Reuters.) Asia continues to draw liquefied natural gas (LNG) from Europe with imports in July rising to the most in six months, even as spot prices stayed near seven-month highs. The top-importing region is on track for arrivals of 24.85 million metric tons of the super-chilled fuel, up from 22.60 million in June and the highest since January's 26.19 million, according to data compiled by commodity analysts Kpler. In contrast, Europe's imports are tracking at 6.56 million tons for July, the lowest since September 2021 and down from 7.21 million in June. Europe's LNG imports have declined every month since December, when they were 11.75 million tons, or almost double the level expected for July. Much of the reason for the shift in global LNG flows can be attributed to Asia's higher price, with spot cargoes for delivery to North Asia being assessed at $12.00 per million British thermal units (mmBtu) in the week to July 26. This was down from the previous week's $12.20 per mmBtu, but still close to the $12.60 for the week to June 21, which was the highest price since mid-December. The benchmark Dutch contract ended at 32.60 euros per megawatt hour on July 26, which is equivalent to $10.30 per mmBtu, or a discount of 14.2% to the Asian spot price. The Asian spot price is currently close to the sweet spot of being high enough to draw cargoes to the region, but not quite at levels to start crimping demand in price-sensitive buyers such as China and India. China, the world's biggest LNG buyer, is on track for imports of 6.41 million tons in July, up from 5.80 million in June and the highest since April, according to Kpler. India, Asia's fourth-biggest LNG importer, is forecast to see arrivals of 2.61 million tons in July, up from 2.60 million in June and the most since October 2020. In some ways the ongoing strength in India's LNG imports are surprising, as the South Asian country tends to cut back in the face of higher prices. The spot price has been rallying since its 2024 low of $8.30 per mmBtu in early March, and has been above $10 since mid-April, a level that has in the past seen India, and even China, cut back on spot purchases as LNG becomes uncompetitive in their domestic markets. It's likely that India's strong economic growth is keeping LNG demand robust, especially since the fuel is generally used in industrial processes rather than for electricity generation. Similarly, China's appetite for LNG is being boosted by its use as a transport fuel, with research from consultants Wood Mackenzie showing sales of LNG-powered heavy vehicles rose from below 10% of the market to as much as 30% by the end of 2023. JAPAN PEAKING? Japan, the world's second-biggest LNG buyer, also saw solid imports in July, with Kpler tracking 5.62 million tons, up from 4.75 million in June and the highest since March. However, Japan's imports may ease in coming months as the summer demand peak passes and inventories remain elevated, with stocks held by major utilities rising to 2.35 million tons by July 21, which is 21% higher than a year earlier, and 7% above the five-year average of 2.19 million. The strength in Asia's demand can be readily seen in the import data from the United States and Qatar, the world's top and third biggest LNG shippers, and also swing suppliers to both Europe and Asia. Asia's imports from the United Stares are expected at 3.41 million tons in July, second only to the record high of 3.75 million from February 2021 and up from 2.71 million in June. In contrast, Europe's imports from the United States are forecast at 2.25 million tons, down from 2.85 million in June and the lowest since November 2021. Asia's imports from Qatar are forecast at 6.09 million tons, up from 5.23 million in June and the highest since January. Europe's imports from Qatar are estimated at 740,000 tons in July, down from June's 1.05 million and the weakest since September. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/markets/commodities/asias-lng-imports-shift-higher-europes-fades-russell-2024-07-29/

2024-07-29 04:54

BEIJING, July 29 (Reuters) - China's state planner on Monday said it had issued 500 million yuan ($69 million) from the central budget to support the recovery of five provinces following a typhoon and torrential rains. The investment will "support the emergency recovery of Hunan, Henan, Sichuan and Shaanxi (provinces) after heavy rainfall and flooding and the typhoon disaster in Fujian (province)," the National Development and Reform Commission said in a statement, with a focus on restoring damaged flood control infrastructure, schools, hospitals, and other public service facilities. ($1 = 7.2558 Chinese yuan renminbi) Sign up here. https://www.reuters.com/world/china/chinas-state-planner-allocates-flood-relief-funding-five-provinces-2024-07-29/

2024-07-29 04:39

July 29 (Reuters) - A look at the day ahead in European and global markets from Wayne Cole. Asian equities have started the week with a solid bounce - well, all but China where lower interest rates seem to have only reinforced investors' concerns about its economy. Wall Street and European stock futures are also higher, perhaps anticipating at least dovish guidance from the Federal Reserve and the Bank of England, if not an actual rate cut from the latter. In the Middle East, fears mounted of a widening conflict following a rocket strike in the Israeli-occupied Golan Heights, which Israel and the United States blamed on Lebanese armed group Hezbollah. Oil prices inched up after the news, while some flights at Beirut airport have been cancelled or delayed due to insurance risks. Stock futures are fully priced for a quarter-point easing by the Fed in September and even imply a 12% chance of 50 basis points. There is 70 basis points of easing priced in by Christmas and rates are seen at 3.6% by the end of 2025, which is where markets think the new neutral is. Investors are divided on whether the Bank of England will ease at its meeting on Thursday, with futures showing a 52% probability of a cut to 5%. The Bank of Japan holds its meeting on Wednesday and markets imply a 66% chance it will hike rates by 10 basis points to 0.2%, with some chance it could move by 15 basis points. Also due this week are the U.S. jobs report for July, closely watched surveys on U.S. and global manufacturing, and Eurozone gross domestic product and inflation data. The U.S. Treasury will outline later on Monday how much in bonds it plans to sell for the quarter, while China's politburo meeting could reveal more stimulus following surprise rate cuts last week. For Wall Street, around 40% of the S&P500 by market worth report this week, including tech darlings Microsoft (MSFT.O) , opens new tab, Apple (AAPL.O) , opens new tab, Amazon.com (AMZN.O) , opens new tab and Facebook parent Meta Platforms (META.O) , opens new tab. Expectations are lofty, so any hint of disappointment will test the mega-caps' sky-high valuations. Options imply Microsoft's shares could rise or fall almost 5% after its results late on Tuesday. And just a note on U.S. politics: PredictIT now shows Trump at 53 cents and Harris at 50 cents. A couple of weeks ago, Trump was at 64 cents and Harris at 27 cents. Key developments that could influence markets on Monday: - UK consumer credit figures for June - Dallas Fed manufacturing activity - US Treasury announces quarterly borrowing estimates - Company earnings include McDonald's and Loews Sign up here. https://www.reuters.com/markets/global-markets-view-europe-2024-07-29/

2024-07-29 00:47

Global shares, Wall St gain Fed, BOE and BOJ all meet this week Earnings include Microsoft, Amazon and Meta NEW YORK/SYDNEY, July 29 (Reuters) - Global stocks advanced and longer-dated U.S. yields slipped on Monday, at the start of a week jammed with earnings and a trio of central bank meetings that could see the United States and Britain open the door to interest rate cuts. U.S. jobs data for July, closely watched surveys on U.S. and global manufacturing, and euro zone gross domestic product and inflation data are all due later this week. The markets were jittery ahead of Big Tech earnings and concern over the Federal Reserve's next moves. Big Tech stocks were up, but off the day's highs. S&P 500 companies representing about 40% of index's market value will report this week, including tech darlings Microsoft (MSFT.O) , opens new tab, Apple (AAPL.O) , opens new tab, Amazon.com (AMZN.O) , opens new tab and Facebook-parent Meta Platforms (META.O) , opens new tab. "The market is fearful that if the Big Tech names disappoint, it could drag on the entire market. The markets were up handily and then we saw them pull back," said Quincy Krosby, chief global strategist for LPL Financial in Charlotte, North Carolina. The U.S. Treasury will outline its bond sale plans for the quarter, while China's politburo meeting could produce more stimulus following surprise rate cuts last week. After a benign June inflation report, markets are wagering that the Federal Reserve will lay the groundwork for a September rate cut at the close of its two-day policy meeting on Wednesday. Futures are fully priced for a quarter-point easing and even imply a 12% chance of 50 basis points in cuts, and have 68 basis points of easing priced in by December . "The FOMC is set to hold steady but is likely to revise its statement to hint that a cut at the following meeting in September has become more likely," wrote analysts at Goldman Sachs in a note. "We now see the risks to the Fed path as tilted slightly to the downside of our baseline of quarterly rate cuts, though not quite as much as market pricing implies." The Bank of Japan also meets on Wednesday, and markets imply a 70% chance it will hike rates by 10 basis points to 0.2%, with some chance it could move by 15 basis points . Investors are less sure whether the Bank of England will ease at its meeting on Thursday, with futures showing a 51% probability of a cut . EARNINGS TEST MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab rose 1.03 points, or 0.13%, to 804.51. European shares eased as investors remained risk averse. The pan-European STOXX 600 index (.STOXX) , opens new tab closed 0.2% lower, with autos (.SXAP) , opens new tab the biggest decliner among major sectors. The Nasdaq and the S&P 500 rose on Monday, buoyed by megacap stocks, while the Dow Jones (.DJI) , opens new tab ended down. The S&P 500 (.SPX) , opens new tab gained 4.44 points, or 0.08%, to 5,463.54 and the Nasdaq Composite (.IXIC) , opens new tab gained 12.32 points, or 0.07%, to 17,370.20. The Dow Jones Industrial Average (.DJI) , opens new tab fell 49.41 points, or 0.12%, to 40,539.93. With expectations for earnings high, any hint of disappointment will test the mega-caps' sky-high valuations. "With some sizeable moves implied by the options market for the individual names on the day of reporting, movement at a stock level could resonate across other plays within their sector and potentially promote volatility," said Chris Weston, head of research at broker Pepperstone. "Company earnings don't come much bigger than Microsoft, where the options market implies a move (higher or lower) of 4.7% - the after-market session on Tuesday could get lively." In currency markets, the dollar index , which measures the greenback against a basket of currencies including the yen and the euro, gained 0.18% at 104.56 The euro retreated 0.33% at $1.0821. The Japanese yen traded at 153.99 . The yield on benchmark U.S. 10-year notes fell 3 basis points to 4.171%, a more than one-week trough. In commodities markets, gold slipped as the dollar advanced. Spot prices lost 0.08% to $2,383.64 an ounce, and U.S. gold futures settled 0.1% lower at $2,377.80. Oil prices fell in volatile trading. Israeli officials said they wanted to avoid an all-out war in the Middle East following a rocket strike in the Israeli-occupied Golan Heights, which Israel and the United States attributed to Lebanese armed group Hezbollah. Brent crude oil futures settled down 1.7% at $79.78 a barrel. U.S. crude ended 1.8% lower at $75.81 a barrel. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-07-29/

2024-07-29 00:31

NEW YORK, July 29 (Reuters) - Oil fell by nearly 2% on Monday after Israeli officials said they wanted to avoid dragging the Middle East into an all-out war while responding to a deadly rocket strike in the Israeli-occupied Golan Heights over the weekend. Brent crude oil futures settled at $79.78 a barrel, falling $1.35, 1.7%. U.S. crude futures ended $1.35, or 1.8%, lower at $75.81 a barrel. Two Israeli officials told Reuters on Monday that Israel wanted to hurt the Iranian-backed Lebanese group Hezbollah, which the country blames for the Saturday attack that killed 12 children and teenagers, without sparking a broader conflict. "It seems like the market has come around to the idea that - even as horrific as these episodes are - they are not likely to cause a region-wide conflict," said John Kilduff, partner at Again Capital in New York. On Sunday, Israel's security cabinet authorized Prime Minister Benjamin Netanyahu's government to decide on the "manner and timing" of a response to the attack at a sports field. Israel vowed retaliation in Lebanon against Iran-backed Hezbollah, which denied responsibility for the attack. Israeli jets hit targets in southern Lebanon on Sunday. The tensions sparked investor concerns about the potential impact on crude output from the world's largest oil-producing region, but so far output has not been affected. "Despite renewed geopolitical tensions in the Middle East, the lack of any supply disruptions limits any positive price reaction," said UBS analyst Giovanni Staunovo. Brent and U.S. crude lost 1.8% and 3.7% respectively last week on sagging Chinese demand and hopes of a Gaza ceasefire agreement. "The economic problems in China are also sucking the juice out of the oil market," said Bob Yawger, director of energy futures at Mizuho in New York. Data released this month showed that China's total fuel oil imports dropped 11% in the first half of 2024, raising concerns about the wider demand outlook in the world's biggest crude importer. Prices also fell at the end of last week on news that the huge Dangote oil refinery in Nigeria is reselling cargoes of U.S. and Nigerian crude after technical problems at the plant. Meanwhile, markets are keeping a watch on oil producer Venezuela after the country's electoral authority said that President Nicolas Maduro had won a third term with 51% of the vote despite multiple exit polls pointing to an opposition win. The U.S. had previously said it would "calibrate" its sanctions policy towards Venezuela depending on how the election unfolds in the OPEC nation. Sign up here. https://www.reuters.com/business/energy/oil-prices-rise-fears-wider-middle-east-conflict-after-rocket-strike-golan-2024-07-29/

2024-07-29 00:12

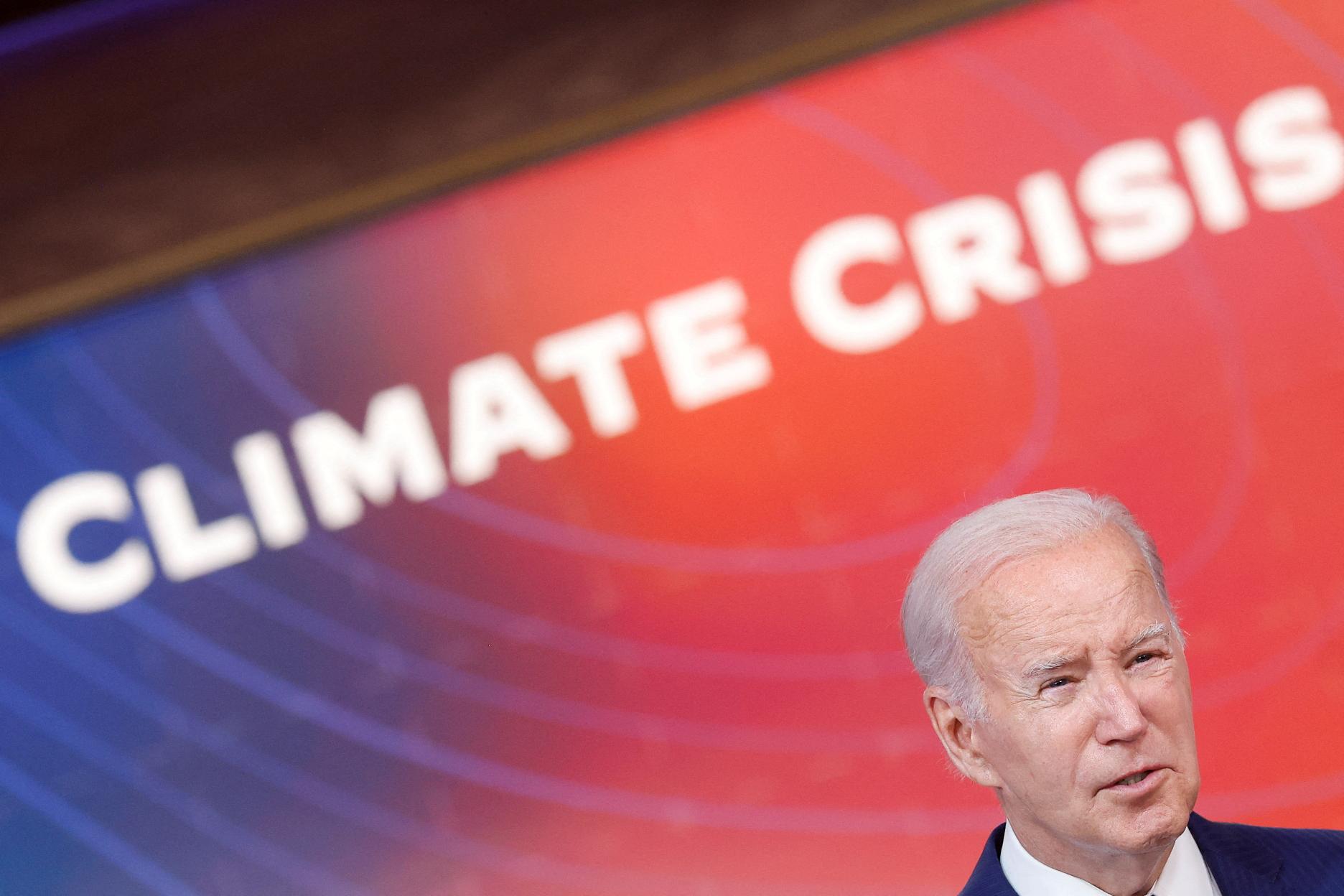

WASHINGTON, July 23 (Reuters) - (This July 23 story has been corrected to fix the spelling of 'Dreyfus' in paragraph 9) The Biden administration on Tuesday announced it would seek to curb U.S. emissions of powerful industrial greenhouse gases such as nitrous oxide as it enters a new phase in the national strategy to fight climate change under the Paris agreement. The focus on industrial gases follows U.S. measures to reduce methane emissions, which yielded an international campaign to get other countries to make big cuts as well as domestic reductions. Like methane, nitrous oxide is a shorter-lived but potent source of global warming, so the U.S. hopes targeting it will yield rapid and inexpensive gains in the fight against climate change. "Most of the discussion of climate change focuses on carbon dioxide, but super pollutants like methane and nitrous oxide cause half of the climate change we're experiencing today," said John Podesta, Senior Adviser to the President for International Climate Policy. The White House kicked off the effort with an event on Tuesday and announcements by industrial companies, including Ascend Performance Materials, that are taking voluntary actions to cut nitrous oxide emissions, officials said. Nitrous oxide emissions come from a variety of sources including the production of some fertilizers and synthetic materials such as nylon. A State Department official told Reuters that it can cost as little as $10 per metric ton to reduce nitrous oxide emissions through projects implemented through the voluntary carbon offset market. Last year, the U.S. and China agreed to include a commitment to reduce all non-carbon greenhouse gases in their new national climate plans under the Paris climate agreement, which are due to be submitted to the United Nations next year. Gabrielle Dreyfus, chief scientist for the Institute for Governance & Sustainable Development, said she hoped the two biggest industrial emitters would cooperate on nitrous oxide. “When the U.S. and China work together, big things can happen," she said. Podesta told another event hosted by IGSD, the Asia Society and think tank Climate Advisers that he will travel to China to meet with counterparts "later this year". Tuesday's event also included a commitment of $300 million from philanthropies for the Global Methane Hub, which supports projects to cut methane emissions around the world. Sign up here. https://www.reuters.com/sustainability/climate-energy/us-targets-nitrous-oxide-new-phase-climate-fight-2024-07-23/