2024-07-26 07:14

Gold down over 1% so far this week Gold premiums in India jumped to their highest in a decade Silver, platinum set for third straight weekly fall US PCE data due at 1230 GMT LONDON, July 26 (Reuters) - Gold prices regained some ground on Friday after falling sharply in the previous session, ahead of key U.S. inflation data that could offer more cues on when interest rate cuts will start. Spot gold rose 0.3% to $2,370.5 per ounce by 1110 GMT, but was down 1% so far this week. Prices had hit their lowest since July 9 on Thursday after stronger-than-expected U.S. economic growth data. "That's a bearish factor for gold prices, which tend to fare worse during times of economic strength when other assets perform more positively," said Frank Watson, market analyst at Kinesis Money. Gold prices are down 4.5% since they hit a record high of $2,483.60 on July 17 on growing optimism of a rate cut from the Federal Reserve in September. The U.S. personal consumption expenditure data for June - the Fed's favoured measure of inflation - is due at 1230 GMT. With non-yielding bullion still up 15% so far this year, there are signs high prices and seasonal factors have muted demand in top consumer China. The country's net gold imports via Hong Kong slumped 18% in June from May, when they had been at their lowest in 10 months. Swiss June gold exports to China fell to the lowest level since May 2022. However, physical demand in India, another major gold consumer, received a boost from this week's reduction of the state gold import tax to the lowest in 11 years. Gold premiums in India jumped to their highest level in a decade this week. On the technical front, spot gold price is squeezed between its 21-day and 50-day moving averages at $2,388 and $2,359, respectively. Spot silver fell 0.9% to $27.73 per ounce under pressure from worsening industrial demand prospects after July's decline in manufacturing activity in Japan and some other countries. Platinum was down 0.1% at $932.13 and palladium lost 0.4% to $903.02. Sign up here. https://www.reuters.com/markets/commodities/gold-firms-ahead-us-inflation-data-set-weekly-loss-2024-07-26/

2024-07-26 07:03

LONDON, July 26 (Reuters) - With medals made of iron salvaged from Eiffel Tower refurbishments and stadium seating of recycled plastic, Paris 2024 aims to be the greenest olympics yet. The case for action is clear as scientists , opens new tab have said intense heat linked to man-made carbon emissions is a growing risk to competitors at the world's largest sporting event and beyond. Paris 2024 has pledged to reduce its carbon emissions by half compared to the average emitted during the London and Rio Summer Games. Here are some of Paris 2024's efforts towards meeting that goal. CONSTRUCTION For many people, Olympic stadiums such as Rio's Olympic Aquatic Centre that have failed to find a purpose after the Games symbolise extravagance. Paris 2024 has sought to minimise new construction. Almost all venues use existing or temporary sites, often relying on the city's landmarks as backdrops. Organisers say the replacement of concrete with low carbon building materials, including sustainably-sourced wood, will reduce the Olympic Village's emissions by 30% compared to what the organisers referred to as conventional projects without giving details. Permanent infrastructure accounted for 73% of the estimated 467,000 metric tons of carbon emissions generated by the Olympic Games between 2018 and 2023. In addition, 11,000 seats at the only two purpose-built arenas for Paris 2024 are made out of recycled plastic. TRANSPORT Along with construction, transport is expected to be one of the biggest sources of emissions during the Games. Organisers have said they will use low-carbon vehicles to ferry around athletes and official visitors and that all venues are accessible by bike, foot or public transport. However, Paris is not tackling the emissions generated by spectators travelling to the Games - such emissions made up almost a third (28%) of the 3.3 million metric tons of carbon emitted by the London 2012 Games. RENEWABLE POWER Paris 2024 has said its venues will use renewable energy sources via the grid, rather than the diesel-powered generators often used at sporting venues. Some 5,000 metres squared of solar panels have been installed on the roof of the Aquatics Centre and Olympic Village, and a 400 metre squared floating solar farm set up on the River Seine. Meanwhile, the Olympic Village has a cooling system that draws water from underground rather than air conditioning. State-owned utility EDF told Reuters it would provide guarantees of origin to link the energy used by the Games to six wind and two solar production sites in France. CARBON OFFSETS To make up for the some of the emissions that are not being avoided, notably spectator air travel, Paris 2024 has purchased 1.3 million carbon credits. Each credit represents one ton of emissions reduced or removed elsewhere - from projects protecting biodiversity-rich forests in Kenya and Guatemala and improving access to clean cooking in Kenya, Nigeria and the Democratic Republic of Congo. Organisers are also spending 600,000 euros ($651,720.00) on four forestry projects in France to sequester 14,500 tons of greenhouse gases. Although carbon credits can channel money to climate-friendly projects, often in the Global South, some credit-generating projects have been scrutinised over false claims about the benefits they deliver. Paris 2024 had positioned itself as the first climate-positive Games in reference to plans to remove, reduce or offset more emissions than it generates. It has since dropped such claims, pledging instead to reduce its climate impact and support climate projects. ($1 = 0.9206 euros) Sign up here. https://www.reuters.com/sports/olympics/olympics-can-paris-2024-be-greenest-games-yet-2024-07-26/

2024-07-26 06:50

FRANKFURT, July 26 (Reuters) - BASF (BASFn.DE) , opens new tab eked out a 0.6% gain in adjusted second-quarter earnings as slightly higher sales volumes made up for lower chemical prices but confirmed full-year goals of faster growth as it banks on regaining pricing power. In a statement on Friday, the group said second-quarter earnings before interest, taxes, depreciation and amortisation (EBITDA), adjusted for one-offs, rose to 1.96 billion euros ($2.13 billion), slightly below the average analyst estimate of 2.05 billion in a consensus posted on the company's website. The chemicals giant said it saw volume growth in specialty products for industrial customers, basic chemicals as well as ingredients for food and household products, but its agriculture unit, which competes with Bayer (BAYGn.DE) , opens new tab, saw a worse-than-expected slump in profit. BASF confirmed its forecast for 2024 EBITDA before special items to reach between 8 billion euros and 8.6 billion euros, up from 7.7 billion reported in 2023. "Our forecast assumes a certain improvement in pricing power in the second half of the year," said new BASF CEO Markus Kamieth, who took the helm in April. The group, which has been investing heavily in making battery chemicals, also said it was putting on hold plans to build a large battery recycling site in Spain because of much slower adoption of electric vehicles (EV) outside of China. CEO Kamieth said he saw the shift towards EVs continuing in the longer term, but BASF would only add capacities if established battery cell makers committed to purchasing chemicals. BASF and its partner Eramet (ERMT.PA) , opens new tab of France last month cancelled a $2.6 billion joint investment in a refining complex in Indonesia to make nickel and cobalt for batteries. ($1 = 0.9211 euros) Sign up here. https://www.reuters.com/business/basfs-q2-adjusted-profit-up-06-higher-sales-volumes-2024-07-26/

2024-07-26 06:34

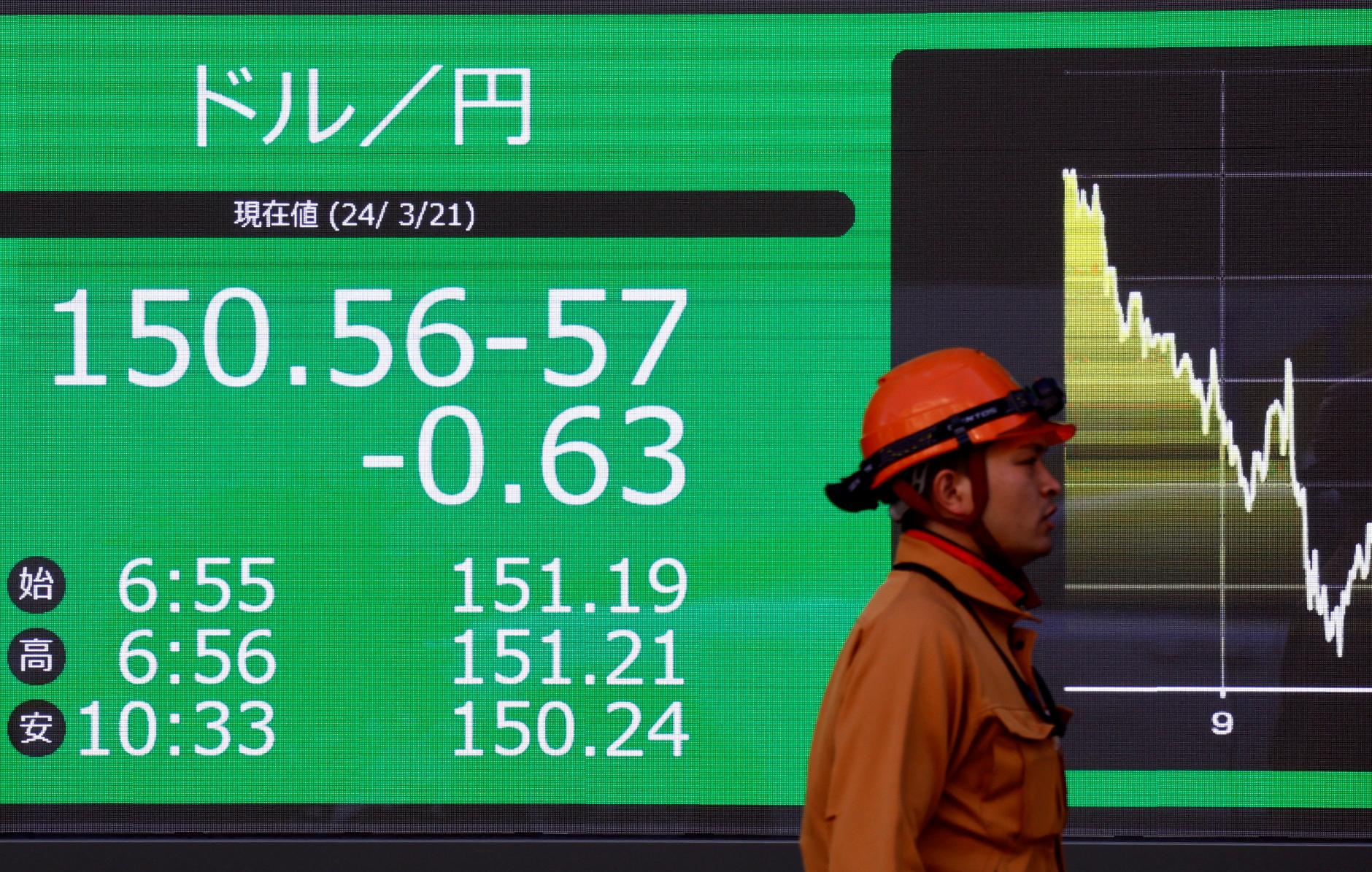

TOKYO, July 26 (Reuters) - The Bank of Japan (BOJ) is expected to unveil details of a quantitative tightening (QT) plan at its monetary policy meeting next week, aimed at reducing its holdings of government bonds. Given the size of its balance sheet and large presence in the market, it's a massive undertaking with various factors for policymakers and investors to consider. Here's what you need to know: WHAT DO MARKETS EXPECT? The BOJ will release plans on how it will reduce its huge purchases of Japanese government bonds (JGB) over one to two years, another step towards loosening its grip on the market and normalising monetary policy. While a wide range of views has surfaced, the broad consensus centres on the BOJ gradually reducing its monthly purchases of JGBs to 3 trillion yen ($19.52 billion) from its current pace of 6 trillion yen. WHAT'S THE BOJ'S AIM? Analysts say the eventual goal will be to cut its bond purchases and reduce its massive balance sheet to a level where short-term interest rates start to rise. The plans unveiled this month will be the first step in a long QT process. It also wants a steeper yield curve that enables banks to make a decent margin from lending. In slowly leaving the market, the BOJ wants to allow enough time for investors to absorb the bonds it will no longer purchase. It also wants to avoid a spike in yields. Takeshi Yamaguchi, chief Japan economist at Morgan Stanley MUFG Securities, says if the central bank reduces its monthly bond buying to 3 trillion yen, the benchmark 10-year yield would only rise between 10 to 20 basis points. HOW BIG IS THE BOJ'S BALANCE SHEET? The BOJ's balance sheet has ballooned over the past decade as it aggressively bought JGBs to defend its now defunct yield curve control (YCC) policy, which kept 10-year yields capped around 0%. Its total assets as of June stood at 754 trillion yen ($4.90 trillion), five times the U.S. Federal Reserve's in ratio-to-GDP terms. The central bank's JGB holdings make up the largest portion, coming in at a whopping 585 trillion yen ($3.80 trillion). Although down from its peak ownership rate of 54%, it's still just over half the entire JGB market. HOW DOES THAT IMPACT MARKET FUNCTIONING? Market functioning was hit as the BOJ expanded its ownership in the JGB market. The BOJ's most recent survey on bond market function stood at -24 in May, up from -29 in February and improving to levels unseen since February 2022 after the central bank ended YCC in March, but still deeply negative. HOW LONG WILL IT TAKE TO TRIM THE BALANCE SHEET? Shrinking the BOJ's balance sheet won't be quick or easy. While no one knows how much stock the BOJ will ultimately keep on hand, Japan's central bank held 175 trillion yen in total assets and 98 trillion yen in JGBs in April 2013 when it began monetary easing. Economists at Capital Economics estimate it would take the BOJ about nine years to reduce JGB holdings to 100 trillion yen if it were to stop buying bonds altogether. Analysts don't expect the BOJ to actively sell bonds. WHAT MATURITIES MIGHT THE BOJ FOCUS ON? Defending YCC policy meant the BOJ's buying has been most concentrated in 10-year bonds or shorter, making supply-demand conditions tight, so market participants and analysts speculate that's where it could reduce purchases the most. But the preferred shape of the curve depends on types of investors. For example, mega banks want a sharper curve as they borrow short-term and lend long-term. ($1=153.72 yen) Sign up here. https://www.reuters.com/markets/asia/what-bojs-reduced-bond-buying-will-mean-markets-2024-07-26/

2024-07-26 06:23

TAIPEI, July 26 (Reuters) - Taiwan's coast guard tried on Friday to rescue dozens of sailors stranded off the southern coast after Typhoon Gaemi sank a freighter and grounded eight others in the Taiwan Strait. The powerful typhoon swept through Taiwan on Thursday with gusts of up to 227 kph (141 mph) before barrelling west across the Taiwan Strait towards China where it is expected to dump more torrential rain. One crew member was found dead, while four were rescued and four others were missing after a Tanzania-flagged cargo ship sank off Taiwan's southern Kaohsiung port, the island's coast guard officials told Reuters. Seventy-nine crew members still awaited rescue on eight other freighters that were stranded, the coast guard said. Nine people were rescued earlier today from a Togo-flagged freighter stranded on a beach. "Braving waves five-meters high...our ships made it to as close as one nautical mile but still failed to get closer," Taiwan's Ocean Affairs Council Minister Kuan Bi-ling, whose department runs the coast guard, said in a post on Facebook. She said the number of freighters stranded by Typhoon Gaemi near Taiwan was unprecedented for a typhoon, adding authorities will continue the rescue efforts. In Taiwan, the storm dumped over 1,800 mm (70.8 inches) rain in southern mountains since Tuesday and bringing flash flooding to several cities and towns that has largely receded. The typhoon injured more than 500 people and killed five, most of them hit by fallen objects, and rescuers took more than 300 people out of floodwater in inflatable boats. Businesses and schools in most parts of southern Taiwan were shut for a third day. Sign up here. https://www.reuters.com/world/asia-pacific/taiwan-attempts-rescue-dozens-sailors-stranded-by-typhoon-gaemi-2024-07-26/

2024-07-26 06:15

NEW YORK, July 26 (Reuters) - A gauge of global stocks climbed for the first time in four sessions on Friday as equities steadied after a sharp selloff and U.S. economic data showed an improving inflation landscape, sending Treasury yields lower. The Commerce Department said the personal consumption expenditures (PCE) price index, the Federal Reserve's preferred inflation gauge, edged 0.1% higher last month after being unchanged in May, matching estimates of economists polled by Reuters. In the 12 months through June, the PCE price index climbed 2.5%, also in line with expectations, after rising 2.6% in May. The data likely sets the stage for the Fed to begin cutting rates in September, as the market widely expects. "The more recent trend is building upon the market's confidence that we are on a trajectory that would get us to 2% over the long run," said Vail Hartman, interest rate strategist at BMO Capital Markets in New York. "This is just another month of good inflation data from the Fed's preferred measure of inflation." The Fed is scheduled to hold its next policy meeting at the end of July. Markets see a less than 5% chance for a rate cut of at least 25 basis points (bps) at that meeting, but are fully pricing in a September cut, according to CME's FedWatch Tool , opens new tab. On Wall Street, U.S. stocks closed with strong gains, as small cap (.RUT) , opens new tab stocks were once again among the best performers in a market that continued its recent rotation into undervalued names. However, megacap names also showed signs of stabilizing and the Nasdaq gained about 1% after three straight days of declines that sent the index down nearly 5%. The Dow Jones Industrial Average (.DJI) , opens new tab rose 654.27 points, or 1.64%, to 40,589.34, the S&P 500 (.SPX) , opens new tab gained 59.88 points, or 1.11%, to 5,459.10 and the Nasdaq Composite (.IXIC) , opens new tab gained 176.16 points, or 1.03%, to 17,357.88. Despite the gains, the S&P 500 was down 0.83% for the week. The Russell 2000, however, secured a third straight week of gains in which it has surged 11.51%, its strongest three-week performance since August 2022. European shares closed higher, buoyed in part by corporate earnings after two consecutive sessions of declines, but still on track for a weekly decline. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab rose 6.69 points, or 0.84%, to 803.47 but was on pace for its second straight weekly fall. The STOXX 600 (.STOXX) , opens new tab index closed up 0.83% but finished down 0.27% on the week. Europe's broad FTSEurofirst 300 index (.FTEU3) , opens new tab ended 17.10 points, or 0.85%, higher. U.S. Treasury yields were lower after the inflation data. The yield on benchmark U.S. 10-year notes fell 6.2 basis points to 4.194% its second straight daily fall, but was slightly higher on the week. The 2-year note yield, which typically moves in step with interest rate expectations, fell 5.6 basis points to 4.3873% for its fourth weekly decline in the past five. The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, slipped 0.03% at 104.30, with the euro up 0.1% at $1.0855. The greenback also weakened 0.1% at 153.78 against the yen after the inflation PCE data and was on track for its biggest weekly percentage drop against the Japanese currency since early May. The yen has strengthened on expectations a cut from the Fed is on the horizon while the Bank of Japan is expected to begin tightening policy by raising rates and reducing its bond purchases in the coming months. In addition, suspected BOJ intervention earlier this month also supported the currency. Sterling strengthened 0.16% at $1.2871. The Bank of England will also hold a policy meeting next week, although uncertainty surrounds what action the central bank may take with regard to rates. U.S. crude oil settled down 1.43% to $77.16 a barrel and Brent fell 1.51% on the day to end at $81.13 per barrel on declining Chinese demand concerns and hopes of a Gaza ceasefire agreement. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-07-26/