2024-07-24 06:13

SINGAPORE, July 24 (Reuters) - Canada's The Metals Company (TMC.O) , opens new tab plans to apply for a licence to extract minerals from the ocean floor before the end of this year, its chief executive told Reuters, as nations gather in Jamaica to thrash out new rules to minimise environmental risks. The United Nations' International Seabed Authority (ISA) is currently meeting in Kingston, Jamaica to negotiate a draft "mining code" that will regulate the collection of "polymetallic nodules" and other deep sea deposits. Negotiators have been racing to ensure that formal rules are in place before mining activities begin. Those rules are now expected to be completed next year. "The guidance we told the market is that we would lodge (our application) after the July (ISA) session," said Gerard Barron, TMC's chief executive. "We see no reason to change that. From our perspective, what we're looking for out of the current session is continual movement towards finalising the regulations." The 36-member ISA council is meeting until July 26. TMC's bid to become the first company to gain approval to develop deep sea minerals has been controversial. Environmental groups are calling for all activities to be banned, warning that industrial operations on the ocean floor could cause irreversible biodiversity loss. But TMC says extracting nodules from the ocean floor is far less damaging than terrestrial mining, and will boost supplies of elements like nickel and cobalt that are considered vital for the global energy transition. TMC, sponsored by the Pacific state of Nauru, invoked the so-called "two-year rule" in 2021, a provision of the U.N. Convention on the Law of the Sea (UNCLOS) that allows mining applications to be submitted within two years, whether the mining code has been finalised or not. "There has been tremendous progress in the time since we lodged that two-year notice, and it does provide us with legal cover that we can lodge that application at any time," said Barron. Once it has been submitted, the application will undergo a review expected to take one year. "We said we would like the regulations to be there by the time we start, but it is not a requirement," he said, adding that draft regulations already ensure mining is done responsibly. As many as 27 countries have backed calls for a pause in deep sea mining activities, and this month, Hawaii became the fourth U.S. Pacific state to ban mining in its territorial waters. "What we see are a number of states signing on to the notion that we don't want to see any exploitation before the regulations are in place," said Barron. "Our response to that is, same here, so let's get on and get them completed." Sign up here. https://www.reuters.com/markets/commodities/canadas-tmc-apply-deep-sea-mining-licence-this-year-chief-exec-says-2024-07-24/

2024-07-24 06:04

LONDON, July 24 (Reuters) - Corporate planners must have a headache as the U.S. political pendulum swings at its fastest rate since World War Two and the related policy churn may act as a drag on future investment. It's easy to get blasé about increasingly polarised U.S. politics, and history may be a poor guide to many unprecedented developments unfolding. But switching economic policy tack every four years surely takes some toll for those needing to think a decade or more hence. And this period is indeed highly unusual. Whoever wins in November, Vice President Kamala Harris' likely nomination as Democrat candidate after Joe Biden stepped aside last weekend means the White House , opens new tab will change hands for the third election in a row for the first time in more than a century. A win for former President Donald Trump would see the presidency switch parties at a third consecutive vote for the first time since the late 19th century. There were, of course, seven separate presidents between 1960 and 1984 - though that was due to the assassination of John F. Kennedy and resignation of Richard Nixon rather than election outcomes per se. The party of the president changed only four times in that period. A win for Trump this year, however, would see the fifth elected change of party in the White House over a similar time frame since 2000. Congressional calculus is another matter, critical as it is to the policy effectiveness of any administration. But there have now been five two-year periods since 2000 when the White House, Senate and House have all been controlled by the same party, compared to just three over the prior 30 years. And it's those "trifecta" periods that are most impactful. Perhaps the rapid ebbs and flows are just the new normal that everyone has to accept. But if you're a company trying to gain visibility on taxation, trade, immigration and jobs, energy or financial regulation, your horizon must be shortened given the gulf between prospective presidents and parties and the speed at which they're revolving power. EDGY YEAREND And that's before you even begin to calculate who might win this year's contest - after two weeks in which Democrats have switched candidates from Biden to Harris and Trump narrowly escaped assassination. While Trump still seems to have an edge opinion polls in some key marginal states and remains a clear favorite in betting markets, the situation seems fluid. Bookmakers' ascribed probability on his win already narrowed from as high as 70% early last week before Biden stood aside to less than 60% now. The latest nationwide Reuters/Ipsos poll conducted this week also surprised and showed Harris opening up a marginal 2 percentage point lead over Trump - 44% to 42%. That uncertainty is high is an understatement, even if financial volatility gauges remain peculiarly low and most markets are still buoyant. Noses to the windscreen, financial markets had started to bet tentatively on so-called Trump trades earlier this month. Some of those trades - steepening the Treasury yield curve on fiscal concerns or buying oil stocks and selling renewable energy ones, switching to small caps from globally-exposed megacaps or buying bitcoin, and even selling Chinese shares or Mexico's peso - have all gone a bit flat again. There's three and half more months of this to go. Yet for companies at the coalface of the economy trying to plan years into the future or trade overseas, unanswered questions about tax, tariff levels and possible retaliation, the size of the workforce due to differing immigration policies and even long-term borrowing costs must be difficult. UNCERTAINTY INDEX Beyond financial markets, one measure of the power churn often cited is the Economic Policy Uncertainty index, which is compiled mostly from media stories on such issues. Not unlike financial markets, that index was relatively subdued through the spring of this year. But it has tripled since June to its highest since last October. While absolute levels are still below the pandemic shock or even the regional banking wobble early last year, the direction of travel is clear. And despite decent economic and earnings growth more broadly, business sentiment captured by the ISM surveys of manufacturing and services firms pointed to a rare twin contraction of activity for both sectors last month. To be sure, NFIB's small business survey showed some uptick last month and small cap stocks seemed to get a burst of optimism on Trump's chances. But the overall sentiment gauge from the survey remains well below long-term averages. None of these gauges necessarily presages a freeze of corporate activity, but they remain subdued in contrast to the seeming nonchalance on financial markets and still buoyant top-line growth levels. Water off a duck's back? Some investors think corporate America is now somewhat inured to the political upheavals beyond some temporary second-guessing. "For all the consternation around election winners and losers, historically the election effect is fairly short lived with the earnings cycle ultimately shaping market performance in the wake of the election," said Garrett Melson, portfolio strategist at Natixis IM. "Corporates have proven time and again their dynamism and ability to adapt, suggesting investors should have confidence in markets' ability to shake off any short term impacts of election developments," Melson said, adding the economy still looked strong and the independent Federal Reserve was set to ease rates. That may well be true - but if the political pendulum keeps swinging at this rate they need every ounce of that "dynamism". The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/markets/us/us-political-churn-muddies-corporate-horizon-mike-dolan-2024-07-24/

2024-07-24 05:43

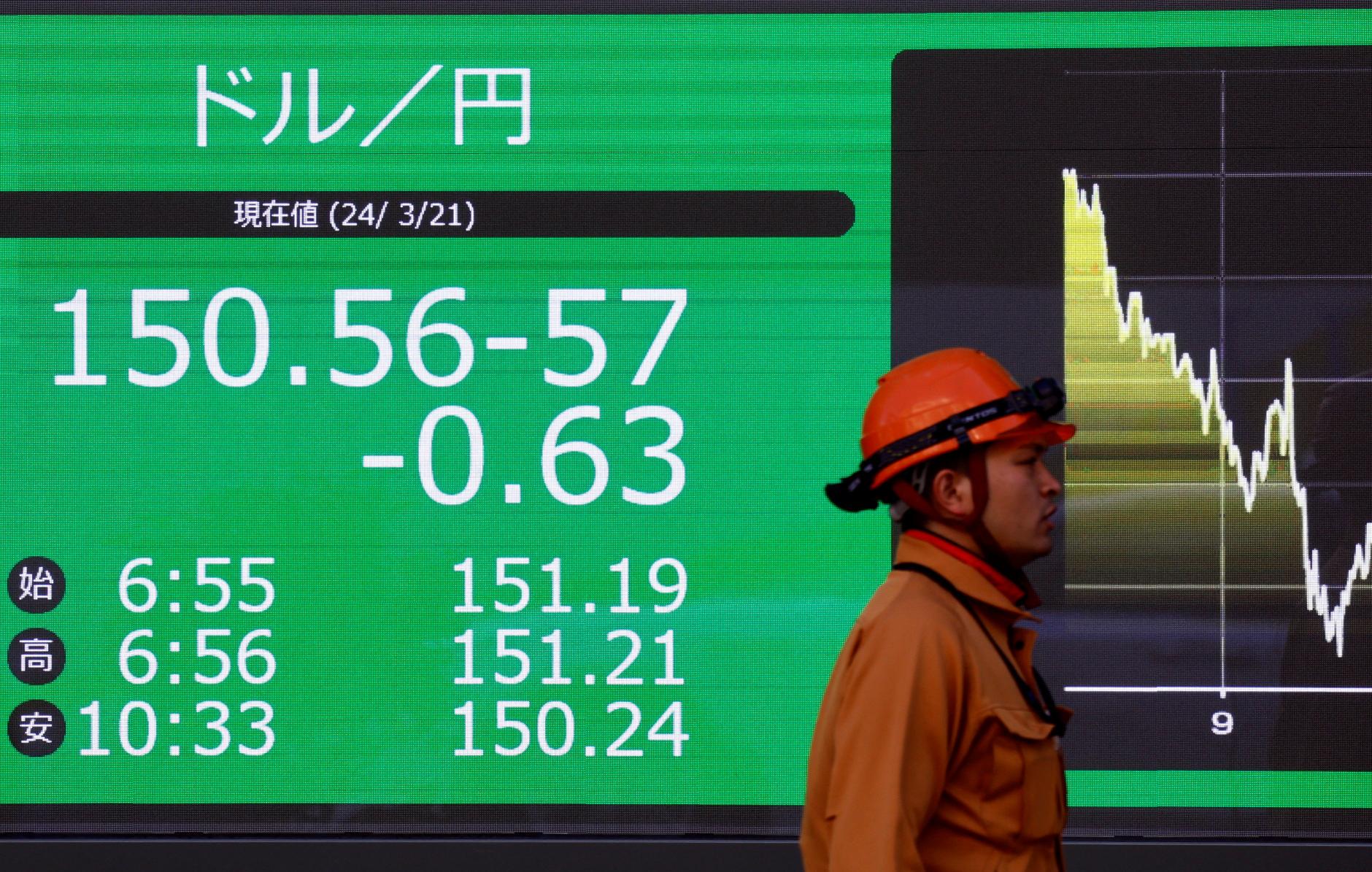

Wall Street stocks dip Benchmark 10-year yields edge higher Europe's STOXX close down 0.61% Gold pare gains, dollar index weakens Oil prices settle higher LONDON/NEW YORK, July 24 (Reuters) - Stocks sagged worldwide on Wednesday as earnings from Tesla and European luxury brands disappointed, while oil prices edged higher after trading near-six week lows due to concerns over weak global demand. The U.S. dollar edged lower, with traders watching out for an inflation reading on Friday and a Federal Reserve meeting next week, while the yen climbed to a seven-week high ahead of a central bank meeting next week. "I think the big story is clearly the earnings front and you've kind of seen reports all over the map, with Tesla probably the disappointing one," said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions in Boston. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab lost 1.7%, while Japan's Nikkei (.N225) , opens new tab fell 1%. On Wall Street, all three main indexes finished lower, led by losses in technology, consumer discretionary and communication services stocks. Tesla's (TSLA.O) , opens new tab shares slumped 12.3% after it reported its lowest profit margin in five years amid waning demand for electric vehicles. Other so-called "Magnificent Seven" stocks including, Nvidia (NVDA.O) , opens new tab, Alphabet (GOOGL.O) , opens new tab, Amazon (AMZN.O) , opens new tab and Microsoft (MSFT.O) , opens new tab, closed down between 2.8% and 6.8%. The Dow Jones Industrial Average (.DJI) , opens new tab fell 1.25% to 39,853.87, the S&P 500 (.SPX) , opens new tab lost 2.31% to 5,427.13 and the Nasdaq Composite (.IXIC) , opens new tab lost 3.64% to 17,342.41. The pan-European STOXX 600 index (.STOXX) , opens new tab fell 0.61% to 512.30 points. The world's biggest luxury group LVMH (LVMH.PA) , opens new tab had reported slower sales growth as Chinese shoppers rein in their spending. "It's the curse of high expectations, that's what the market was coming into earnings season with, especially for the tech companies that have been the darlings of the market", said James St. Aubin, chief investment officer at Sierra Mutual Funds in Santa Monica, California. RATE CUT EXPECTATIONS Subdued stock trading globally was symptomatic of markets looking for direction, with traders digesting a range of themes including the U.S. election, expectations of rate cuts and weak corporate earnings reports. Oil prices settled higher thanks to falling U.S. crude inventories and growing supply risks from wildfires in Canada, but still sat near month-and-a-half lows amid lacklustre demand. Brent crude futures closed 0.9% higher at $81.71 a barrel. U.S. West Texas Intermediate crude rose 0.8% to $77.59 per barrel. U.S. GDP data on Thursday and personal consumption expenditure data - the Fed's favoured measure of inflation - on Friday could help investors calibrate their expectations of when interest rates might be cut. Markets are pricing in 62 basis points of easing this year, with a cut in September priced in at 95%, the CME FedWatch tool showed. The benchmark U.S. 10-year Treasury yield was lower for a second straight session. The yield rose 4.9 basis points to 4.288%. "The rotation is in full force. Magnificent 7 earnings growth are decelerating, while un-magnificent 493 growth are accelerating," said Thomas Hayes, chairman at Great Hill Capital in New York, in a statement. "Fed cut will add fuel to this new trend for cyclicals, small caps and dividend stocks picking up the mantle," he said. Gold prices slipped after paring early gains. Spot gold lost 0.45% to $2,398.45 an ounce, while U.S. gold futures settled 0.3% higher at $2,415.70. The Japanese yen strengthened 1.06% against the greenback at 153.97 per dollar. In cryptocurrencies, bitcoin gained 0.01% at $65,848.00. Ethereum declined 3.18% at $3,372.50. ($1 = 155.3600 yen) Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-07-24/

2024-07-24 04:38

A look at the day ahead in European and global markets from Ankur Banerjee A sales miss by luxury giant LVMH due to Chinese shoppers keeping a lid on spending and disappointing results from major U.S. tech firms Tesla and Alphabet will likely keep investors skittish ahead of a slew of European earnings. A busy Wednesday sees European banks take the spotlight, with the focus on whether gains from higher interest rates have run out of steam and if recent political drama is weighing on sentiment. The euro zone's two largest lenders by market value, Spain's Santander and France's BNP Paribas (BNPP.PA) , opens new tab, are due to report for the April to June period, alongside Germany's Deutsche Bank (DBKGn.DE) , opens new tab and Italy's UniCredit (CRDI.MI) , opens new tab. Luxury stocks in Europe will likely take a beating after LVMH (LVMH.PA) , opens new tab, owner of labels Louis Vuitton, Tiffany & Co and Hennessy, flagged a 14% decline in sales in Asia, excluding Japan, in the second quarter, after a 6% drop in first quarter. A gauge of the top 10 European luxury stocks (.STXLUXP) , opens new tab is already down 2.6% in July, set for a fifth straight month in the red after a profit warning from smaller label Burberry (BRBY.L) , opens new tab last week. The technology sub-index in Europe (.SX8P) , opens new tab, which has been volatile in the past few weeks due to worries of rising trade tensions over chips, will likely be under pressure after EV maker Tesla (TSLA.O) , opens new tab reported its smallest profit margin in more than five years. Beyond earnings, attention will also be on PMI data in Europe that will allow investors to gauge the health of the economy and ascertain whether the European Central Bank will cut interest rates in September. Currency traders are eyeing rapid gains by the yen , which is up 3.7% against the U.S. dollar this month and at more than six week high in the wake of suspected intervention by Tokyo and speculators unwinding short positions on the frail currency. The Bank of Japan is due to meet next week as is the U.S. Federal Reserve and while both may hold rates, a lot is at stake if they strongly hint at diverging rate outlooks - the BOJ hinting at hikes vs the Fed hinting at cuts. Key developments that could influence markets on Wednesday: Economic events: July PMI data from France, Germany, Britain and euro zone Earnings: Reckitt Benckiser (RKT.L) , opens new tab, Santander, BNP Paribas, Deutsche Bank and UniCredit Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-07-24/

2024-07-24 03:08

MUMBAI, July 24 (Reuters) - The Indian rupee is expected to decline further on Wednesday due to a rise in the dollar index and a possible slowdown in equity flows. Non-deliverable forwards indicate the rupee will open at 83.70-83.71 to the U.S. dollar, compared with 83.6875 in the previous session. The rupee dipped to an all-time low of 83.7150 on Tuesday, amid choppy price action in local equities, prompting the Reserve Bank of India to intervene. "It will be more of the same today, with the RBI stepping in to make sure that the move higher (on dollar/rupee) is at an unhurried pace," a currency trader at a bank said. "The overall direction (for dollar/rupee) was on the higher side before the budget and now all the more so." The government raised the tax rate on profit from equity investments and on equity derivatives trades, which led to a volatile session in the stock market. Since June, the rupee had been helped by foreigners lapping up equities. Following the budget, these inflows "are in a bit of a doubt", the trader said. Foreign investors withdrew more than $350 million from Indian shares on Tuesday. They had invested nearly $5 billion this month before Tuesday. Meanwhile, the dollar index inched higher in Asia, adding to Tuesday's advance. The dollar gauge rose despite a rally in the Japanese yen amid a possibility that the Bank of Japan may hike interest rates next week. The U.S. preliminary July PMI data will be out later in the day, providing cues on how manufacturing and services activity is holding up. The June-quarter GDP data follows on Thursday and is likely to confirm that the economy "is on track for a soft-landing", ANZ Bank said in a note. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.77; onshore one-month forward premium at 7 paisa ** Dollar index up at 104.49 ** Brent crude futures up 0.4% at $81.3 per barrel ** Ten-year U.S. note yield at 4.26% ** As per NSDL data, foreign investors bought a net $997.6mln worth of Indian shares on July 22 ** NSDL data shows foreign investors bought a net $4.4mln worth of Indian bonds on July 22 Sign up here. https://www.reuters.com/markets/currencies/rupees-downward-bias-likely-persist-cenbank-expected-help-out-2024-07-24/

2024-07-24 00:52

LONDON, July 24 (Reuters) - Oil prices edged higher on Wednesday but were still close to their lowest level in six weeks with few signs of the fuel consumption surge usually seen at this stage of the northern hemisphere summer. Still, prices snapped three straight sessions of decline on falling U.S. crude inventories and growing supply risks from wildfires. Brent crude futures for September rose 71 cents, or 0.9%, to $81.72 a barrel by 1117 GMT. U.S. West Texas Intermediate crude for September increased 75 cents, or 1%, to $77.71 per barrel. The likely reason for the wider sell-off has been the "diminishing hopes of demand resurrection," with "an admission from refiners that the summer leap in consumption is simply not taking place", said Tamas Varga of oil broker PVM. U.S. oil refiners are expected to report sharply lower second quarter earnings versus a year ago after a listless summer driving season weakened refining margins, energy analysts said. Oil prices fell to a six-week low on Tuesday, with Brent closing at its lowest level since June 9 on ceasefire talks between Israel and Hamas in a plan outlined by U.S. President Joe Biden in May and mediated by Egypt and Qatar. Prices also suffered due to continued concern that the economic slowdown in China, the world's biggest crude importer, would weaken global oil demand. Meanwhile, crude oil deliveries to India, the world's third-biggest oil importer and consumer, slipped in June to their lowest since February, government data showed. WTI lost 7% over the previous three sessions, while Brent was down nearly 5%. Buoying prices, U.S. crude oil, gasoline and distillate inventories fell for the fourth straight week in the previous week, according to market sources citing the American Petroleum Institute (API), reflecting steady demand in the world's largest consumer of oil. That would be the first time crude stocks in the United States fell for four weeks in a row since September 2023. Official government oil inventory data is due for release later on Wednesday. Wildfires in Canada forced some producers to curtail production and threatened a large amount of supply, ING analysts said. "Market is nearing oversold territory and we still believe that the fundamentals support prices moving higher from current levels over the remainder of the third quarter on the back of a deficit environment," ING analysts said in a note. Sign up here. https://www.reuters.com/business/energy/oil-prices-rise-us-crude-fuel-inventories-seen-shrinking-2024-07-24/