2024-07-22 10:02

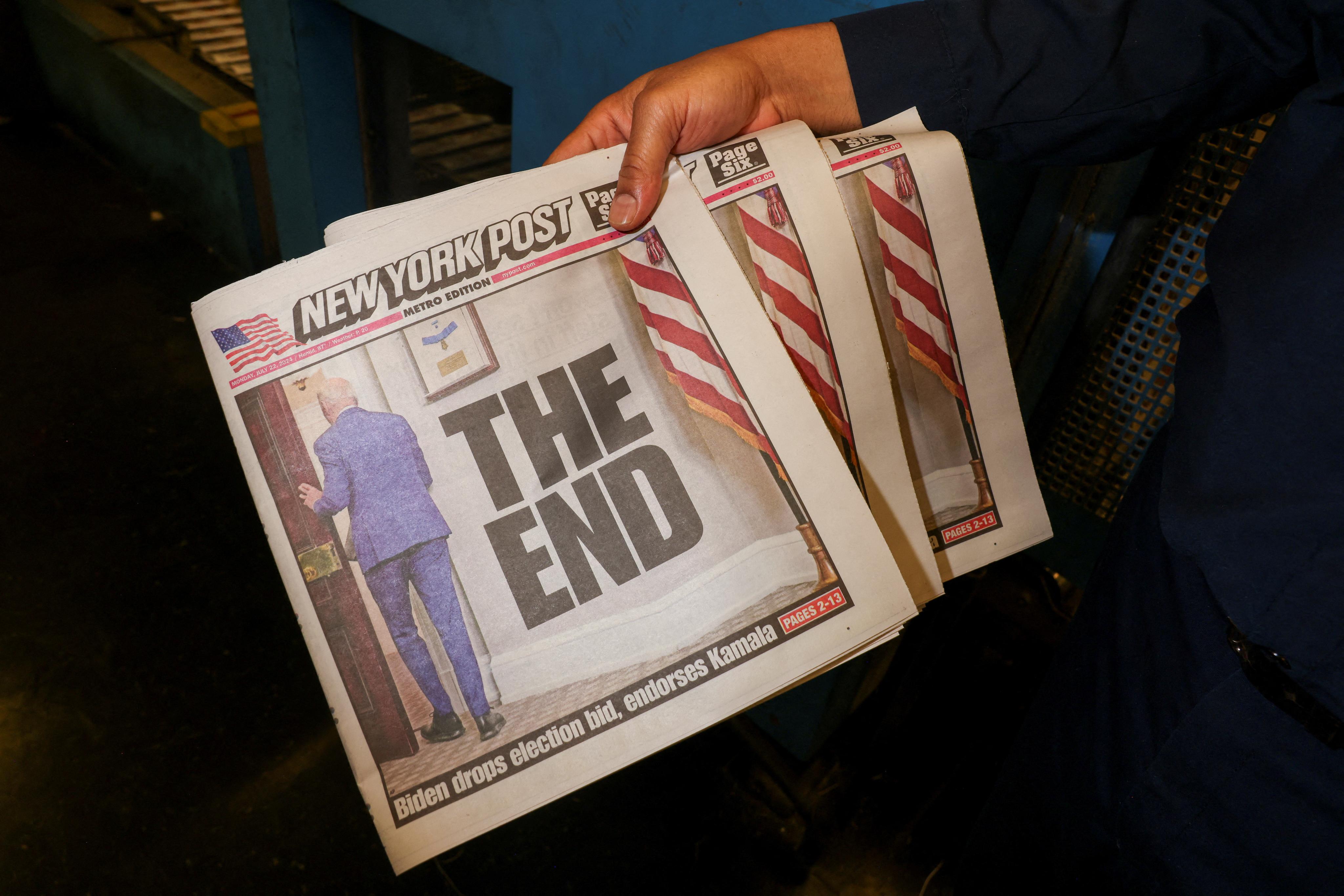

A look at the day ahead in U.S. and global markets from Mike Dolan U.S. President Joe Biden's weekend withdrawal from the White House race can hardly be seen as a big surprise, but it adds some doubts to market bets that Republican challenger Donald Trump is a shoo-in in November's election. After a turbulent few days for Wall Street stocks that saw their biggest weekly loss since April, and as big tech megacaps hiccupped into the start of the second-quarter reporting season, volatility had already resurfaced to some degree. Tightening odds on the next president may just keep that on the boil as some of so-called "Trump trades" were pared back marginally on Monday - long-term Treasury yields and the dollar (.DXY) , opens new tab ebbed a bit, Mexico's peso firmed, stock futures were a touch higher and the VIX volatility gauge (.VIX) , opens new tab held at last week's 3-month high. An unexpected interest rate cut from the People's Bank of China on Monday added the main international backdrop as the new week got underway and pushed the yuan to its weakest in more than two weeks. And a nervy tech sector, its head spinning after last week's sudden investor rotation to small caps and the global computing outage on Friday, now sizes up the next wave of earnings updates - with Google-parent Alphabet (GOOGL.O) , opens new tab and Tesla (TSLA.O) , opens new tab due to report on Tuesday. But Biden's exit and the focus on who replaces him as Democrat nominee will dominate the week's talking points at least. His endorsement of Vice President Kamala Harris puts her in pole position ahead of next month's Democratic party convention and that's where betting markets will lean. To the extent that betting markets set the tone for investors minded to trade on the outcome this far ahead of the election, there's been some distortion in recent weeks. What will ultimately be a binary choice was split several ways due to Biden's difficulties and skewed the odds somewhat. Now his exit puts Harris firmly in the frame, the picture is becoming more balanced. Even though Trump remains clear favorite, his 70%-plus probability this time last week following the failed attempt on his life has been pared back to 60% - even if much of that had happened by Friday. PredictIt betting site puts Harris on about 40% - even though she has not yet got the formal nomination and hasn't campaigned for the role yet. If she does get the nod, there will also be much attention on her choice of running mate. One possible market twist is that futures markets' near certainty that the Federal Reserve will deliver its first interest rate cut in September just before the election may wobble a bit if it's a tighter election race than assumed over the past couple of weeks. Even though the Fed insists it pays no heed to the electoral calendar or political process in deciding monetary policy, some felt the optics of a pre-election rate cut were less awkward in the light of Trump's seemingly unassailable odds of winning. That calculation might just change at the margin now. Otherwise, markets have another busy calendar ahead this week. Aside from the big earnings releases, the release of the Fed-favored PCE inflation gauge for June on Friday will be a focus. Also, flash business surveys for July are due from around the world and there's another heavy schedule of Treasury sales. In Europe, bank earnings are a feature of the week. Wednesday sees Germany's Deutsche Bank (DBKGn.DE) , opens new tab, Britain's Lloyds (LLOY.L) , opens new tab, BNP Paribas (BNPP.PA) , opens new tab in France, Spain's Santander (SAN.MC) , opens new tab and Italy's UniCredit (CRDI.MI) , opens new tab all report. Back on Wall Street, Nvidia (NVDA.O) , opens new tab rose 1.3% after Reuters reported the AI chip leader is working on a version of its new flagship AI chips for the China market that would be compatible with current U.S. export controls. Key developments that should provide more direction to U.S. markets later on Monday: * Chicago Federal Reserve's June economic activity index * US corporate earnings: Verizon, Truist Financial, WR Berkley, Nucor, NXP Semiconductors, IQVIA, Cadence Design, Alexandria Real Estate * G20 Finance Ministers and Central Bank Governors meet in Rio de Janeiro ahead of G20 Brazil Summit (To July 23) * New York Federal Reserve President John Williams and Atlanta Fed President Raphael Bostic speak * US Treasury auctions 3-, 6-month bills Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-pix-2024-07-22/

2024-07-22 07:48

LISBON, July 22 (Reuters) - Portugal plans to raise the contribution of renewables in electricity consumption to 93% by 2030, as part of its decarbonisation push, according to an updated draft of its energy and climate plan seen by Reuters on Monday. However, the draft proposal plans to lower the 2030 target for the installed capacity of electrolyzers to make green hydrogen by 45%. Portugal is only just now taking the first steps to install electrolyzers and has almost no production of green hydrogen. Portugal's new centre-right government will release the draft later on Monday for in public consultation until Sept 5, when it will be sent to parliament. European nations are increasingly betting on renewable energies, especially after gas prices hit record highs in 2022 after the Russian invasion of Ukraine. Renewable utilities supplied 61% of Portugal's electricity consumption in 2023, already one of the highest ratios in Europe. A year ago, the former socialist government set the target for 2030 at 85%. Environment and Energy Minister Maria da Graca Carvalho said the updated plan aims to combat climate change and guarantee energy security and also "attract investment and generate competitiveness". She said two weeks ago her government wanted to increase the weight of renewables to 51% of the country's final energy needs by 2030 from a current target of 47%. The revised draft maintains Portugal's commitment to reduce greenhouse gas emissions by 55% from 2005 levels by 2030, a target set by the former socialist government a year ago, and the goal of achieving carbon neutrality by 2045. The overall installed renewable energy capacity will rise to 42.9 gigawatts (GW) by 2030 or twice as much as the capacity in operation in 2023, with 12.4 GW of wind power, including 2 GW of offshore wind, by 2030. The country had 5.9 GW of onshore wind capacity in 2023 and a small, 25-megawatt floating wind project off its Atlantic coast. The draft proposal seeks to raise the installed solar capacity to 20.8 GW by 2030, up from 4 GW last year. However, it lowered the target for electrolyzers to make green hydrogen to a capacity of 3 GW by 2030, down from the 5.5 GW set in June 2023. These would absorb 8.6 GW of renewable electricity. Still, the draft added Portugal has "very favorable conditions for installation of a green hydrogen industry" as its main advantage is renewable electricity production low cost. Sign up here. https://www.reuters.com/business/energy/portugal-plans-raise-share-renewables-electricity-consumption-93-by-2030-2024-07-22/

2024-07-22 07:40

Drone caused fire at Tuapse refinery, blaze later put out Tuapse is Russia's biggest refinery on Black Sea Russia says it downed 75 drones in all overnight No casualties in any of the strikes, officials say MOSCOW, July 22 (Reuters) - Russia's Tuapse oil refinery, its biggest on the Black Sea, was damaged in a major Ukrainian drone attack overnight which sparked a fire, Russian officials said on Monday, though the extent of the damage was not immediately clear. Debris from the drone, which was shot down, caused a fire at the refinery, which is owned by oil major Rosneft (ROSN.MM) , opens new tab, the officials said. The fire has since been contained, the regional administration said on the Telegram messaging app. Russia's SHOT and Mash Telegram news channels reported that a series of blasts were heard near the refinery early on Monday. There were no casualties, officials said. Reuters was unable to immediately verify whether the refinery was operational or to establish the extent of the damage it had sustained. Ukraine has been systematically targeting Russian energy infrastructure in an attempt to disrupt Russia's economy and its ability to fund what the Kremlin calls its special military operation in Ukraine. Ukrainian officials say the attacks have been carried out in retaliation for Russian strikes on Ukraine's energy system. Russia says the drone attacks by Ukraine amount to acts of terrorism. Overall, Russia's defence ministry said its air defence systems had destroyed a total of 75 drones launched overnight by Ukraine, including eight near Tuapse. The Tuapse plant, which has processing capacity of 240,000 barrels per day (bpd) of oil, has been a target of several Ukrainian air attacks since the start of the war that Russia launched against Ukraine in 2022, including on May 17. The Tuapse refinery produces naphtha, fuel oil, vacuum gasoil and high-sulphur diesel, supplying fuel mainly to Turkey, China, Malaysia and Singapore. In 2023 the plant processed 9.322 million metric tons of crude oil, producing 3.306 million tons of gasoil and 3.123 million tons of fuel oil. DRONE ATTACKS Of the 75 drones launched overnight, Russia's ministry said 47 drones had been downed over the Rostov region in southwestern Russia, 17 over the waters of the Black and Azov seas, eight over the Krasnodar region, where Tuapse is located, and single drones over the Belgorod, Voronezh and Smolensk regions . Russian officials rarely disclose the full extent of damage inflicted by Ukrainian attacks. Vasily Golubev, governor of the Rostov region, said on Telegram that no one was injured as a result of the attack there and that no serious damage had been detected. Reuters could not independently verify the Russian reports. There was no immediate comment from Ukraine. Sign up here. https://www.reuters.com/world/europe/russia-says-downs-75-ukraine-launched-drones-some-near-tuapse-oil-refinery-2024-07-22/

2024-07-22 07:06

JAKARTA, July 22 (Reuters) - Indonesia launched on Monday an online system to track movements of nickel and tin from mines to domestic processing facilities to improve accountability and government revenue, authorities said. The system, known as SIMBARA, was first implemented in 2022 to track coal, with a plan to widen its use to other minerals. Indonesia is the world's biggest exporter of coal. It is the top global producer of nickel, and one of the largest producers of tin. Speaking at the launch, Finance Minister Sri Mulyani Indrawati said the system had improved governance in the coal sector, including by forcing companies to pay liabilities to the state, and she hoped to replicate this with nickel and tin. For coal, the system monitors compliance on documentation of mining quotas, known as RKAB, all the way to export papers, flows of funds, logistics, the people involved, as well as the goods, Sri Mulyani said. A senior government official told Reuters last week that for tin and nickel, the system will first track transportations, including inter-island shipments, from mines to domestic processing facilities and will be linked with RKAB. "With this system, we can work tidily, consistently, firm, authoritative and without burdening companies," Sri Mulyani said. Improvement in compliance is expected to increase tin and nickel miners' royalty payments by between 5 trillion to 10 trillion rupiah ($308 million - $616 million) in a year, Coordinating Minister of Maritime and Investment Affairs, Luhut Pandjaitan, said at the same event. Nickel miners group APNI hoped SIMBARA will help prevent illegal mining and avoid oversupply such as what happened in recent years, secretary general Meidy Katrin Lengkey said. Through SIMBARA, authorities would be alerted if a smelter produces more nickel metal than they should be able to based on the amount of the ore they bought, she said, and the smelter would be required to explain where the extra ore came from. "We hope, after this implementation, there will truly be a control and monitoring of all the process from upstream to downstream," she said. The government plans to further widen the system to track gold, copper, bauxite, manganese and other resources, Mining Minister Arifin Tasrif said. Later on, the government will also link SIMBARA to compliance in manpower and environmental rules, Luhut said, adding sales by miners can be blocked by the system if they are found breaking the rules. ($1 = 16,220.0000 rupiah) Sign up here. https://www.reuters.com/markets/commodities/indonesia-launches-nickel-tin-online-tracking-system-2024-07-22/

2024-07-22 07:05

MUMBAI, July 22 (Reuters) - The Indian rupee weakened to an all-time low on Monday, pressured by a decline in most of its Asian peers and sustained dollar demand from local corporates and oil companies. The rupee hit a record low of 83.67 against the U.S. dollar, slipping past its previous lifetime low of 83.6650 hit in June. The currency was last trading at 83.6575 as of 12:30 p.m. IST. The dollar index was slightly higher at 104.3, while most Asian currencies weakened, with the offshore Chinese yuan, a closely tracked peer of the rupee, down 0.1% at 7.29. The rupee has remained under pressure over the last few trading sessions despite strong inflows into the local debt and equity markets. Despite the decline to a record low on Monday, traders expect the Reserve Bank of India to continue intervening to support the rupee and not allow sharp declines in the currency. Sign up here. https://www.reuters.com/markets/currencies/indian-rupee-slips-record-low-amid-weaker-yuan-broad-based-dollar-outflows-2024-07-22/

2024-07-22 06:56

NEW DELHI, July 22 (Reuters) - India's government has taken a more cautious stance than private economists on the outlook for growth this fiscal year, predicting the world's fifth-largest economy will expand between 6.5% and 7%. The projection from the finance ministry's economic division is lower than the 8.2% robust growth seen in the year ended March and a weaker range than estimates of 6.8% to 7.2% from economists. The central bank is also more upbeat, forecasting growth of 7.2%. "Global growth and trade volume are difficult to come by," Chief Economic Adviser V. Anantha Nageswaran told reporters after the release of the annual report citing geopolitical risks, growing protectionism and concerns about supply chains. The Indian economy was on a strong wicket and stable footing, and the real GDP was up by nearly one fifth from pre-pandemic levels, he said, citing a rebound in private investments and higher state spending on infrastructure. However, after good growth in the last three years, fears of cheaper imports from countries with excess capacity could limit the formation of private capital, he said. The 476-page report was tabled in parliament by Finance Minister Nirmala Sitharaman on Monday ahead of presenting the federal budget on Tuesday. Prime Minister Narendra Modi, whose party fell short of a majority in the general election, is widely expected to boost tax collection and use a record $25 billion dividend from the central bank to ramp up budget spending to address concerns over uneven economic growth. The report said inflationary pressures had moderated in most economies in line with a decline in commodity prices and an easing of supply chain pressures. It cited the International Monetary Fund's global growth forecast of 3.2% for 2024. But any escalation of geopolitical conflicts could revive inflationary pressures and could influence the Reserve Bank of India's (RBI) monetary policy stance, it said. RBI's monetary policy committee last month kept the repo rate (INREPO=ECI) , opens new tab on hold at 6.50%, noting monetary conditions could remain tight for some time while it looked at further curbing inflationary pressures. Annual retail inflation marginally rose to 5.08% in June, from 4.75% in the previous month due to high food prices. Food inflation hit 9.36% in June. The report also said that India's inflation targeting framework should consider targeting inflation excluding food, as higher food prices tend to be supply-induced than demand-induced. Although food prices were high, headline inflation was largely under control, the report added. MEDIUM-TERM GROWTH The Indian economy is capable of growing at a rate of 7%-plus on a sustained basis in the medium term if structural reforms are implemented, it also said. He identified boosting private investment, strengthening small businesses and agriculture, along with bridging the gap between education and employment as areas that need policy focus. To boost exports, Nageswaran said the government could either integrate into China's supply chain or promote foreign direct investment (FDI) from China. The report added that the implementation of revamped labour legislation needs to be expedited to create a more conducive environment for job creation. "The Indian economy needs to generate an average of nearly 7.85 million jobs annually until 2030 in the non-farm sector to cater to the rising workforce," the report said. Nearly one in two of India's youth joining the workforce were not fit to join the industry due to a lack of required skills, he said warning about the impact of artificial intelligence on jobs. MARKET RISKS Referring to the increasing participation of retail investors in derivative trading, the report urged regulators to raise investors' awareness. It also cautioned about the rise in the market capitalisation of listed Indian companies, with the market capitalisation-to-GDP ratio rising to 124% - higher than other emerging market economies like China and Brazil. "It is essential to strike a note of caution. If equity market claims on the real economy are excessively high, it is a harbinger of market instability rather than market resilience." Sign up here. https://www.reuters.com/world/india/indias-economy-likely-grow-65-7-yy-202425-government-sources-say-2024-07-22/