2024-07-19 10:08

A look at the day ahead in U.S. and global markets from Mike Dolan Volatility is resurfacing as a turbulent week for world markets and politics was met on Friday with a global tech outage that's compounded a recoil in mega-cap shares, already hit by fears of new chipmaker curbs and underwhelming earnings guidance. Major U.S. airlines ordered ground stops on Friday citing communications issues, while other carriers, media companies, banks and telecoms firms around the world also reported that system outages were disrupting their operations. The Australian government said the problem there appears to be linked to an issue at global cybersecurity firm Crowdstrike (CRWD.O) , opens new tab, whose stock fell more than 10% out of hours. The hiatus added to tech sector nerves, where the first sweep of earnings updates in the current reporting season failed to jump the increasingly high market bar. Streaming giant Netflix (NFLX.O) , opens new tab registered a beat late Thursday as it added more than 8 million subscribers - exceeding the 5 million expected. But its stock fell overnight on cautious guidance and after said its advertising business would not become a primary driver of revenue growth until at least 2026. There was a similar reaction for Taiwan's chipmaking bellwether TSMC (2330.TW) , opens new tab, whose Taipei-listed shares ended 3.5% lower on Friday despite its strong earnings and guidance - dragged down by Sino-U.S. trade concerns and the U.S. market swoon. Wall Street futures stayed in the red ahead of Friday's open, with the VIX volatility gauge (.VIX) , opens new tab hitting its highest level since April. Thursday's drop in the Nasdaq (.IXIC) , opens new tab meant it was the worst two-day performance for the index since last October and even the small cap (.RUT) , opens new tab, which had benefited in the early week rotation away from Big Tech, fell back more than 1%. Big tech wobbles aside, the backdrop of the increasingly uncertain U.S. election race jangled nerves. While Republican challenger Donald Trump - now clear favorite in betting markets for a return to the White House - took the stage overnight at his party's convention, pressure on President Joe Biden to step aside reached a crescendo and press reports suggest he may announce a withdrawal over the weekend. Perhaps hedging bets on who may replace Biden, bookmakers reduced the chances of a Trump win to about 60% from more than 70% on Monday after last weekend's assassination attempt on the former President. Interest rate markets were edgier too, with 10-year U.S. Treasury yields pushing higher despite news of a sharp jump in weekly jobless claims on Thursday. While futures are still baking in the first Federal Reserve interest rate cut for September, the dollar (.DXY) , opens new tab bounced back from its week's lows. The euro retreated following Thursday's expected decision from the European Central Bank to leave its policy rates unchanged - with markets now expecting a second cut of the year in September but having doubts about the trajectory after that. Sterling fell back to $1.29 after a poor UK retail sales reading for June. Japan's yen and China's yuan both slipped too, with the former knocked back by sub-forecast Japanese inflation readings that cast some doubt on Bank of Japan tightening. Japan's government also cut this year's growth forecast on Friday as consumption took a hit from rising import costs due to a weak yen. Mexico's peso nursed sharp losses from the prior session. China's mainland stocks (.CSI300) , opens new tab held the line again, however, and ended the week higher with a seven-session winning streak after the four-day government leadership gathering concluded on Thursday. Hong Kong shares (.HSI) , opens new tab, however, were closer to the global mood and lost 2% on Friday. Due to its lack of detail, Chinese officials acknowledged on Friday that the sweeping list of economic goals re-emphasised at the end of the key Communist Party meeting contained "many complex contradictions", pointing to a bumpy road ahead for policy. More concrete measures may emerge next week. Back on Wall Street, an anxious end to the week beckons with the patchy trading day due to various tech problems with the global outage and with a thin diary of events and a close eye on the weekend's politics. Key developments that should provide more direction to U.S. markets later on Friday: * US corporate earnings: American Express, Fifth Third, Regions Financial, Huntington Bancshares, Travelers, Halliburton, Schlumberger * Canada June producer prices, May retail sales * New York Federal Reserve President John Williams and Atlanta Fed President Raphael Bostic speaks Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-07-19/

2024-07-19 10:07

NEW YORK, July 19 (Reuters) - As earnings season goes into full swing, bullish investors hope solid corporate results will stem a tumble in technology shares that has cooled this year’s U.S. stock rally. The S&P 500’s technology sector (.SPLRCT) , opens new tab has dropped nearly 6% in just over a week, shedding about $900 billion in market value as growing expectations of interest rate cuts and a second Donald Trump presidency draw money away from this year’s winners and into sectors that have languished in 2024. The S&P 500 (.SPX) , opens new tab has fared somewhat better, losing 1.6% in just over a week, with declines in tech partly offset by sharp gains in areas such as financials, industrials and small caps. The benchmark index is up more than 16% so far this year. Second-quarter earnings could help tech reclaim the spotlight. Tesla (TSLA.O) , opens new tab and Google-parent Alphabet (GOOGL.O) , opens new tab both report on Tuesday, kicking off results from the "Magnificent Seven" megacap group of stocks that have propelled markets since early 2023. Microsoft (MSFT.O) , opens new tab and Apple (AAPL.O) , opens new tab are set to report the following week. Big tech stocks "have been leading the charge, and it's for a good reason," said Scott Wren, senior global market strategist at the Wells Fargo Investment Institute. "They're making money, they're growing earnings, they're owning their niche." Strong results from the market’s leaders could assuage some of the worries that have recently dogged megacaps, including concerns over stretched valuations and an advance highlighted by eye-watering gains in stocks such as Nvidia (NVDA.O) , opens new tab, which is up 145% this year despite a recent dip. On the other hand, signs that profits are flagging or artificial intelligence-related spending is less than anticipated would test the narrative of tech dominance that has boosted stocks this year. That could turn quickly into a problem for broader markets: Alphabet, Tesla, Amazon.com (AMZN.O) , opens new tab, Microsoft, Meta Platforms (META.O) , opens new tab, Apple and Nvidia have accounted for around 60% of the S&P 500’s gain this year. Corporate results for the market’s leaders are expected to meet a high bar. The tech sector is projected to increase year-over-year earnings by 17%, and earnings for the communication services sector (.SPLRCL) , opens new tab -- which includes Alphabet and Facebook parent Meta -- is seen rising about 22%. Such gains would outpace the 11% estimated rise for the S&P 500 overall, according to LSEG IBES. Anthony Saglimbene, chief market strategist at Ameriprise Financial, believes many investors were caught off guard by an inflation report earlier this month that all-but-cemented expectations of a September rate cut by the Fed, sparking a rotation into areas of the market that have struggled under tighter monetary policy. The move out of tech accelerated this week, after a failed assassination attempt on Trump over the weekend appeared to boost his standing in the presidential race. In addition, semiconductor shares were hit hard after a report earlier this week said the United States was mulling tighter curbs on exports of advanced semiconductor technology to China. The Philadelphia SE semiconductor index (.SOX) , opens new tab has tumbled about 8% since last week. "What we're advising investors to do is use some of the pullbacks in these areas as an opportunity to allocate on a longer-term basis," said Saglimbene, who believes the upcoming earnings reports could ease the selling pressure on Big Tech. To be sure, the widening of gains to other parts of the market has heartened some investors over the durability over the rally in stocks this year. During the recent rotation, the number of stocks gaining compared to those declining over five days reached its highest rate since November, according to Ned Davis Research. Historically, when gainers outnumber decliners by at least 2.5 times, as has been the case in this recent five-day period, the S&P 500 has rallied an average of 4.5% over the next three months, according to NDR. "The risk is that mega-caps pull the popular averages lower, but history suggests that strong breadth improvements have been bullish for stocks moving forward," Ned Davis strategists said in a report on Wednesday. Sign up here. https://www.reuters.com/markets/us/wall-st-week-ahead-investors-count-earning-calm-900-billion-us-tech-rout-2024-07-19/

2024-07-19 07:56

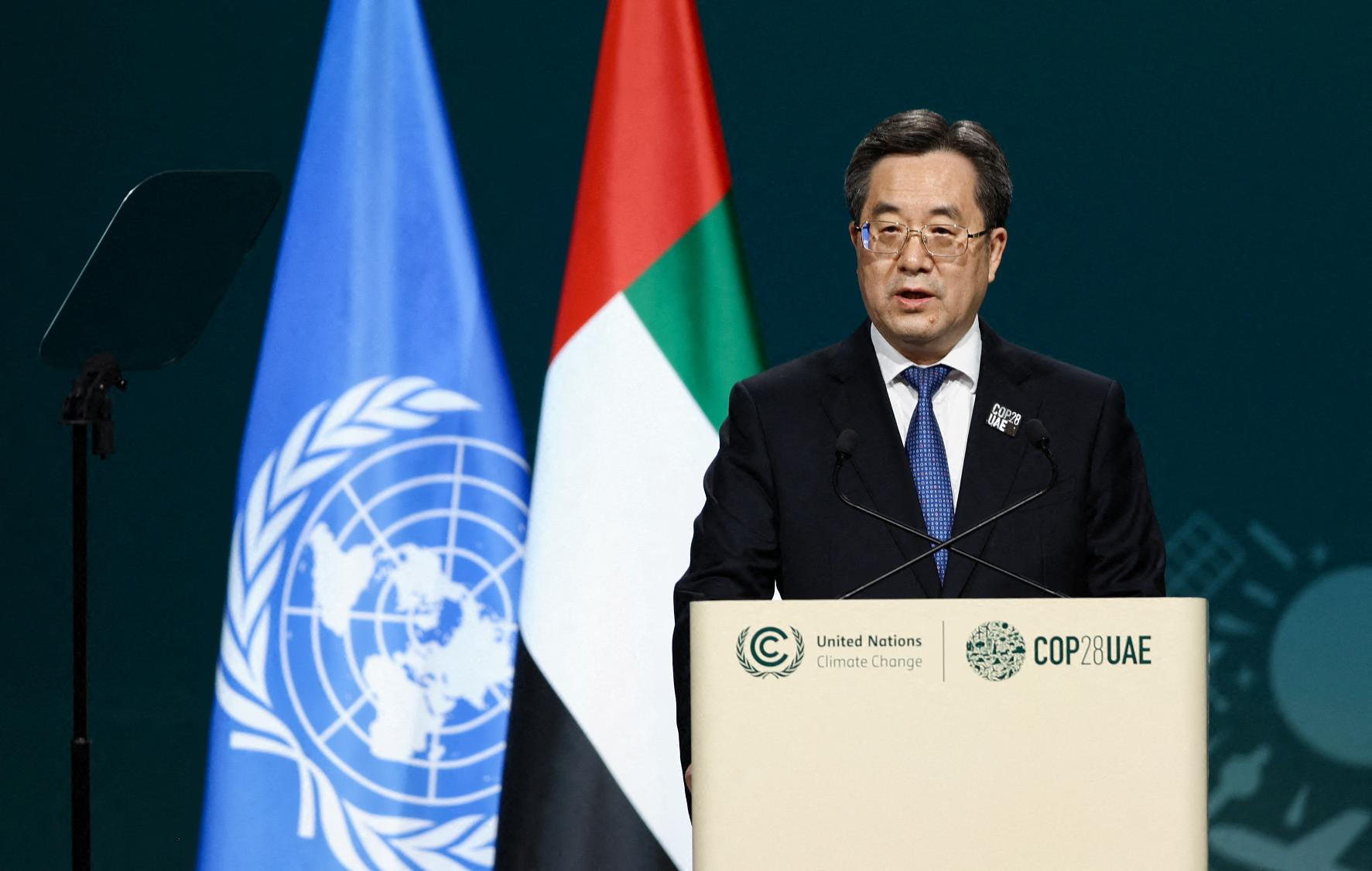

BEIJING, July 19 (Reuters) - China's Vice Premier Ding Xuexiang will attend the 21st China-Russia Energy Cooperation Committee meeting and the sixth China-Russia Energy Business Forum on July 21-23, the foreign ministry said on Friday. The Vice Premier will also attend the 11th meeting of the China-Russia Investment Cooperation Committee during his visit, the ministry said in a statement. Sign up here. https://www.reuters.com/world/china/chinas-vice-premier-attend-china-russia-energy-cooperation-committee-meeting-2024-07-19/

2024-07-19 07:55

FTSE 100, FTSE 250 off 0.6% Miners, personal goods stocks leading declines UK retail sales fall 1.2% in June vs estimates 0.4% July 19 (Reuters) - London stocks tumbled on Friday as investors assessed a fall in domestic retail sales in June, while a downtick in commodity prices further dampened sentiment. The blue-chip FTSE 100 index (.FTSE) , opens new tab was down 0.6%, set to end the week lower. The mid-cap FTSE 250 (.FTMC) , opens new tab was off 0.6% by 0730 GMT. Precious metal miners (.FTNMX551030) , opens new tab weighed heavily on the index, with a 2.5% decline. Fresnillo (FRES.L) , opens new tab slipped 5.4% to the bottom of the FTSE 100, in sync with spot gold prices that declined more than 1%. Industrial metal miners (.FTNMX551020) , opens new tab were down 1.9% after copper prices hit an over three-month low in the absence of Chinese stimulus measures. Aerospace and defence stocks (.FTNMX502010) , opens new tab were the only outliers with a 0.2% gain amid the broader declines after senior executives from British defence firms, including BAE (BAES.L) , opens new tab and Babcock (BAB.L) , opens new tab, met Ukrainian President Volodymyr Zelenskiy to discuss the need to boost military support for the country in its conflict with Russia. Investors parsed through domestic retail sales data that showed a 1.2% drop in June against an estimated 0.4% fall, bringing bets of an August cut to 43%, up from roughly 39% on Thursday. 0#BOEWATCH The numbers follow recent data that indicated slowing wage growth in Britain and inflation at the Bank of England's 2% target. Personal goods (.FTNMX402040) , opens new tab and retail (.FTNMX404010) , opens new tab stocks fell 2.8% and 0.6%, respectively. Next week, the focus will shift to corporate earnings in the United States and the UK. U.S. inflation numbers will be in the limelight as the last crucial dataset ahead of the Federal Reserve's next rate cut decision. In London, Hargreaves Lansdown (HRGV.L) , opens new tab slipped 1% despite a strong growth in new customers and a rise in net new business in the fourth quarter. LSEG Group's (LSEG.L) , opens new tab shares also trended marginally lower after its Workspace news and data platform suffered an outage on Friday that affected user access worldwide. Sign up here. https://www.reuters.com/world/uk/londons-ftse-100-slips-resources-shares-weigh-retail-sales-drop-june-2024-07-19/

2024-07-19 07:34

LONDON, July 19 (Reuters) - Britain's Sky News, one of the country's major television news channels, was off air on Friday. "Sky News have not been able to broadcast live TV this morning, currently telling viewers that we apologise for the interruption," the broadcaster's executive chairman David Rhodes said on X. A global tech outage was affecting operations across different countries including at Spanish airports, a Turkish airline and Australian media and banks. Sign up here. https://www.reuters.com/world/uk/uks-sky-news-unable-broadcast-live-chairman-says-2024-07-19/

2024-07-19 07:02

July 19 (Reuters) - Top U.S. carriers including Delta Air (DAL.N) , opens new tab and United Airlines (AAL.O) , opens new tab are restoring some operations on Friday after a technical issue related to an IT vendor forced multiple carriers to ground flights. However, delays and cancellations were expected to persist throughout the day, as airlines try to fully recover from the impact of the outage that upended their flying schedules and affected thousands of passengers. More than 2,200 flights were canceled across the U.S., with nearly 7,000 delayed, as of 1:23 pm ET on Friday, according to data tracker FlightAware. Delta and United said they were resuming some flights but expected additional delays and cancellations. The airlines also issued travel waivers for impacted passengers. The issue affected many separate systems, such as those used for calculating aircraft weight, checking in customers and phone systems in their call centers, United said in a statement. Peer American Airlines (AAL.O) , opens new tab, which had earlier issued a ground stop notice, said it had safely re-established operations. Budget carrier Southwest Airlines (LUV.N) , opens new tab said it was not impacted by the outage. Outages at Microsoft (MSFT.O) , opens new tab and cybersecurity firm CrowdStrike (CRWD.O) , opens new tab hit banking, healthcare and a number of other sectors globally on Friday. While American, Delta and United did not name the vendor, smaller carrier Frontier Airlines (ULCC.O) , opens new tab said a "major Microsoft technical outage" hit its operations temporarily. The issue stemmed from a defect found in a CrowdStrike content update for Microsoft Windows hosts, the cybersecurity firm's CEO George Kurtz said on Friday. The U.S. Federal Aviation Administration said in an emailed statement it was closely monitoring the technical issue impacting IT systems at U.S. airlines and that several airlines had requested its assistance with ground stops. Parcel delivery firm FedEx (FDX.N) , opens new tab said it faced substantial disruptions throughout its networks, while peer United Parcel Service (UPS.N) , opens new tab also warned of potential delivery delays. Microsoft said its outage started at about 6 pm ET on Thursday, with a subset of its customers experiencing issues with multiple Azure services in the Central U.S. region. Azure is a cloud computing platform that provides services for building, deploying, and managing applications and services. Sign up here. https://www.reuters.com/technology/frontier-says-operations-impacted-by-microsoft-outage-2024-07-19/