2024-07-18 21:48

July 19 (Reuters) - A look at the day ahead in Asian markets. The global tech selloff spread across equity markets more broadly on Thursday, setting the tone for a choppy session in Asia on Friday as investors try and get to the end of a volatile week without incurring any more pain. Japanese inflation will be the main local focus. These figures will go a long way to determining what the Bank of Japan does at its July 30-31 policy meeting - keep interest rates on hold, or hike another 10 basis points? The MSCI World, Asia ex-Japan, and emerging market indices are on course for their biggest weekly losses in eight weeks, while Japan's benchmark Nikkei 225 index is set for its biggest weekly fall since April. Tech has been bruised more severely, with a report that the United States is considering tighter curbs on exports of advanced chip technology to China weighing heavily on the sector. Netflix on Thursday reported a stronger-than-expected rise in subscribers in the second quarter but cautioned that third-quarter gains would be lower than the same period in 2023. Its shares fell in after-hours trading. This comes a day after Taiwan's TSMC, the world's largest contract chipmaker, raised its full-year revenue forecast on surging artificial intelligence related demand for chips. Its shares still lost over 2% for a second straight day. In China, investors are likely to be deeply underwhelmed by the outcome of the Communist Party's Central Committee meeting, known as a plenum, which they were watching for signs of much-needed stimulus to revive the struggling economy. Chinese leaders reiterated their wide-ranging economic policy goals - modernizing industry, expanding domestic demand and curbing debt and property sector risks. But detail on how this will be implemented was very thin on the ground. The focus switches to Japanese inflation. Economists polled by Reuters reckon core inflation picked up in June to a 2.7% annual rate from 2.5% in May. That would mean inflation has been above the central bank's 2% target for 27 months in a row. Officials are worried that inflation is being powered by external factors rather than the domestic demand policymakers are trying to encourage. But strong wage hikes have yet to be felt. Nearly 90% of Japanese households - the most in 16 years - expect prices to rise a year from now, according to surveys published last week. More economists now reckon the BOJ will raise rates later this month by 10 basis points to 0.20%. This would follow its landmark move in March, when it raised rates for the first time in 17 years. Japanese money markets are split fairly evenly between a hike or hold. Friday's data could tip the balance one way or the other. Here are key developments that could provide more direction to markets on Friday: - Japan CPI inflation (June) - Malaysia GDP (Q2) - Philippine central bank governor Eli Remolona speaks Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-07-18/

2024-07-18 21:32

LONDON, July 19 (Reuters) - Ukrainian President Volodymyr Zelenskiy addressed British government ministers on Friday, a rare appearance by a foreign leader at a cabinet meeting that new Prime Minister Keir Starmer hopes will underline London's support for Kyiv. A day after hosting a forum of European leaders at Blenheim Palace, Starmer pressed on with his bid to raise Britain's role in international affairs by inviting Zelenskiy to address his cabinet of top ministers. The last foreign leader to do so was U.S. President Bill Clinton in 1997, Starmer's office said. Welcomed to the meeting by a standing ovation and applause from British ministers, Zelenskiy renewed his call for Western allies to allow long-range strikes on Russia, saying Britain should try to convince its partners to remove the limits on their use. "Right now we are missing the main answer to this question and that is our long-range capability," Zelenskiy said at the beginning of the meeting in Downing Street. "Please convince the other partners to remove the limits." NATO members have taken different approaches to how Ukraine can use weapons they donate. Some have made clear Kyiv can use them to strike targets inside Russia while the United States has taken a narrower approach, allowing its weapons to be used only just inside Russia's border against targets supporting Russian military operations in Ukraine. Starmer, who met Zelenskiy separately for 35 minutes before a wider bilateral with officials, told Zelenskiy that Britain would speed up delivery of aid to Ukraine. His defence minister said earlier this month that the deliveries promised by the former Conservative government would be delivered within 100 days. "Ukraine is, and always will be, at the heart of this government's agenda and so it is only fitting that President Zelenskiy will make a historic address to my cabinet," Starmer had said in a statement before the meeting. Britain has been a vocal supporter of Ukraine since Russia's full-scale invasion in 2022 and Starmer swiftly reaffirmed London's commitment to Kyiv after winning a landslide election earlier this month, telling Zelenskiy at NATO that despite the change of government, there would be "no change of approach". He said on Thursday that Britain would pursue a new plan to try to disrupt Russia's attempts to evade shipping sanctions. On Thursday, Britain announced sanctions on 11 vessels used to transport Russian oil. He also unveiled the Defence Export Support Treaty, to be signed by defence ministers, that will enable Ukraine to draw on 3.5 billion pounds ($4.5 billion) of export finance, to bolster both countries' defence industrial bases and boost production. ($1 = 0.7708 pounds) Sign up here. https://www.reuters.com/world/europe/show-support-uks-starmer-invites-ukraines-zelenskiy-attend-cabinet-2024-07-18/

2024-07-18 20:48

July 18 (Reuters) - Trinidad and Tobago's High Court reaffirmed on Thursday a decision recognizing U.S. oil producer ConocoPhillips' (COP.N) , opens new tab arbitration claim against Venezuela, which could freeze the Caribbean country's payments to its neighbor for joint natural gas projects. In late May, the court's original decision opened the door for ConocoPhillips to enforce in that country a $1.33 billion claim against Venezuela for past expropriations by seizing any compensation from joint energy projects. Venezuela and its state-owned company PDVSA did not respond to the court by a deadline to present their arguments, Judge Frank Seepersad said in his decision seen by Reuters. Earlier this month, Venezuela's embassy in Port of Spain, Trinidad' capital, acknowledged receipt of the court order, the document showed. "The order gives to the claimant a green light to be able to enforce the judgment in Trinidad if they can establish there are assets held by the defendants or there is money which is owed to the defendant by entities in Trinidad and Tobago," Judge Seepersad said in May when he made his original decision. PDVSA paid Conoco about $700 million through a settlement agreement, but ceased payments in late 2019. Conoco has since attempted similar moves in Caribbean countries seeking to enforce arbitration rulings against Venezuela and PDVSA. In a U.S. federal court, the oil producer is among companies at the top of a list of creditors pursuing proceeds from an auction of shares in one of PDVSA's subsidiaries, PDV Holding, whose only asset is Houston-based refiner Citgo. Venezuela and Trinidad, along with energy companies NGC, Shell (SHEL.L) , opens new tab and BP (BP.L) , opens new tab are looking to develop major offshore gas fields shared by the countries and on the Venezuelan side of the maritime border. NGC said it has not been served with any documents related to the ConocoPhillips claims and continues to work with its partners and stakeholders to progress the Dragon gas Project. NGC and Shell have a 30-year license to develop the 4.5-trillion-cubic-feet Dragon gas field in Venezuela and export the gas to Trinidad to be turned into LNG and petrochemicals with payments to be made to Venezuela and PDVSA. ConocoPhillips specifically identified Dragon as one reason it wanted the Trinidad court to recognize the judgment. As part of those projects' negotiations, parties in Trinidad were expected to pay PDVSA and Venezuela bonds to have access to the gas reserves, Conoco has told the court. Shell and ConocoPhillips declined to comment. PDVSA did not immediately respond to requests for comment. Sign up here. https://www.reuters.com/business/energy/trinidads-court-reaffirms-recognition-conocophillips-claim-against-venezuela-2024-07-18/

2024-07-18 20:47

SAO PAULO, July 18 (Reuters) - Authorities are taking measures to contain an outbreak of Newcastle disease on a poultry farm in Brazil's southernmost state of Rio Grande do Sul, Agriculture Minister Carlos Favaro told a press conference on Thursday. Favaro estimated around 7,000 birds perished on the small property where the outbreak was detected, representing 50% of the flock there. Newcastle is a viral disease that affects domestic and wild birds, causing respiratory problems, among other symptoms, and can lead to death. Its notification is mandatory as per guidelines from the World Organization for Animal Health. The last confirmed cases of Newcastle disease in Brazil occurred in 2006 in subsistence birds in the states of Amazonas, Mato Grosso and Rio Grande do Sul, the agriculture ministry said. Praising the country's sanitary protocols as one of the best in the world, Favaro said the area where the case was detected has been isolated and there are no other outbreaks in the vicinity. Brazil is the world's largest chicken exporter, responding to almost 40% of global supplies. Countries which buy poultry products from Brazil have been informed of the issue, as detection of Newcastle disease could trigger trade bans, Favaro said. The most rigorous buyers are China and members of the European Union, he noted. It is unclear if any importer effectively banned products from Brazil or the region where the outbreak occurred. The ministry of agriculture did not reply to emails seeking clarification. The government had confirmed late on Wednesday that a sample tested positive for the viral disease, saying it came from a commercial poultry farm in the municipality of Anta Gorda. According to an industry source, the circumstances of the mass deaths are still under investigation as cold weather may have contributed to the perishing of the animals. "The official protocols to mitigate (risks) have been put in place and the surrounding area continues to be monitored," ABPA, a meat lobby, said in a statement. Sign up here. https://www.reuters.com/world/americas/brazil-meat-lobby-says-sample-tested-positive-newcastle-disease-2024-07-18/

2024-07-18 20:38

TSX ends down 0.5% at 22,726.76 Posts second straight day of declines Materials sector falls 2%; copper hits 3-month low Tech and consumer discretionary lose ground July 18 (Reuters) - Canada's main stock index extended its pullback from a record high on Thursday, pressured by declines for technology and metal mining shares, as investors took stock of recent gains for the market. The S&P/TSX composite index (.GSPTSE) , opens new tab ended down 124.41 points, or 0.5%, at 22,726.76, its second straight day of losses after it posted an all-time high on Tuesday. "I don't think there is any specific catalyst," said Barry Schwartz, chief investment officer at Baskin Wealth Management. "We've had a hell of a run up and this is just the pause that refreshes." U.S. stocks were also lower as investors continued to rotate away from high-priced megacap growth stocks and second-quarter earnings season gathered steam. "The elements are still in place for multi-year strong returns on markets. Inflation has been tamed, interest rates I'm certain are going to be cut globally in the next few months or so ... it's just we got pretty spicy in terms of valuations for a lot of companies," Schwartz said. Data on Tuesday showed that Canada's annual inflation rate slowed to 2.7% in June from 2.9% in May, leading to increased bets the Bank of Canada would cut interest rates for a second time at a policy decision next week. The materials group, which includes metal miners and fertilizer companies, lost 2% as the prices of gold and copper fell, with the latter tumbling to a three-month low. Technology was down 1.1% and consumer discretionary ended 1.4% lower. Not all stocks lost ground. Shares of Tenaz Energy Corp (TNZ.TO) , opens new tab jumped 56.4% after the company agreed to acquire all shares of NAM Offshore B.V., which operates the Groningen gas field in the Netherlands. Sign up here. https://www.reuters.com/markets/tsx-futures-flat-dip-crude-prices-offset-metal-gains-2024-07-18/

2024-07-18 20:14

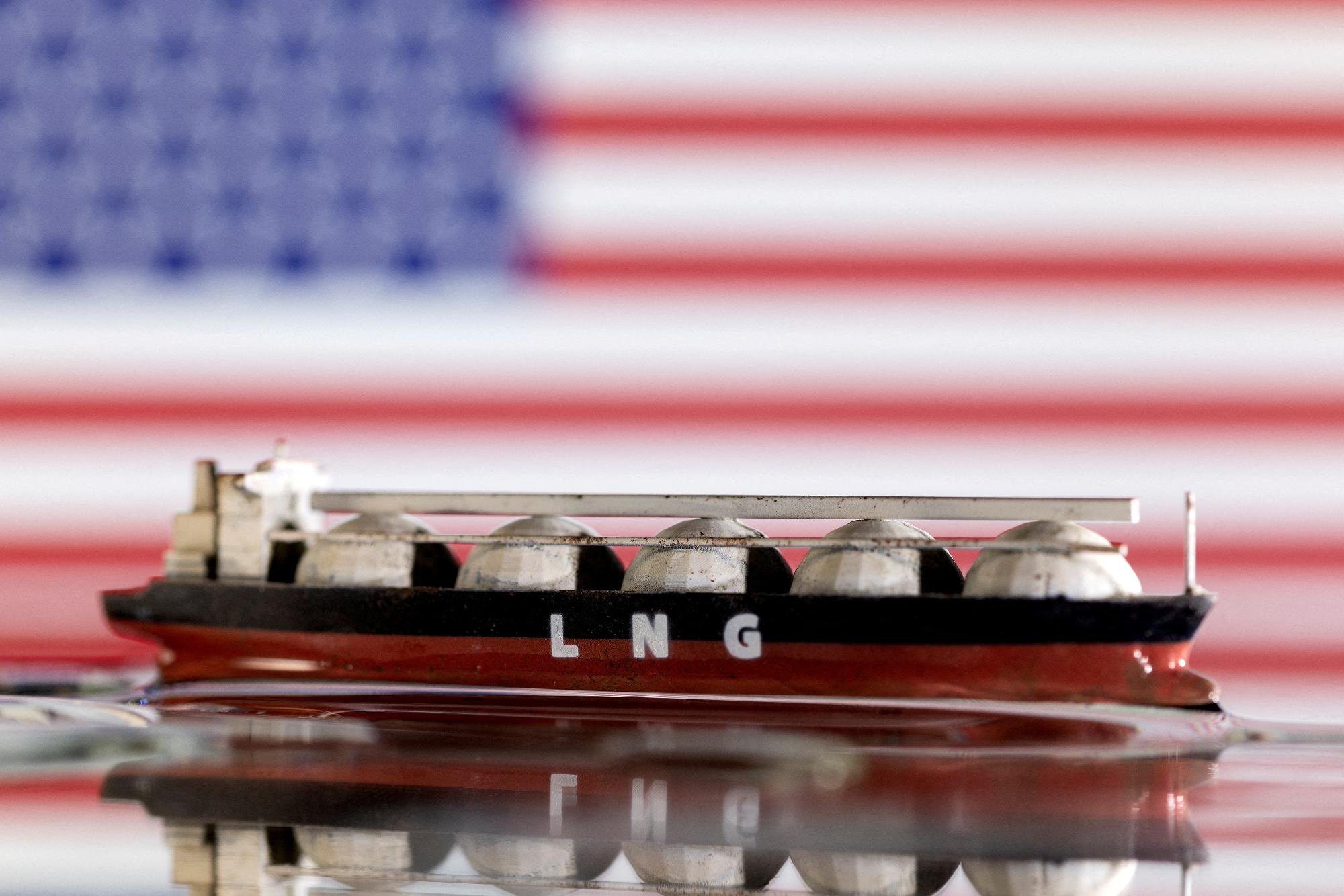

HOUSTON, July 18 (Reuters) - The number of liquefied natural gas (LNG) tankers waiting to load at Freeport LNG in Texas has increased since the U.S. second largest exporter of the supercooled gas halted processing ahead of Hurricane Beryl's landfall last week, according to shipping data on Thursday. Beryl made landfall on July 8 near Matagorda, on the Texas coast, lashing the state with 80-mph (130-kph) winds that caused infrastructure damages and left more than 2 million customers without electricity for days. Ports and energy companies in many coastal cities, including Freeport, suffered wind damage and slow restoration of power. Freeport LNG, which shut its three liquefaction trains on July 7 and reported wind damage after, has had a slow operational restart since. The LNG exporter said on Monday it planned to restart one processing train this week and the remaining two trains shortly after, but production would be reduced while it continued repairs. U.S. gas futures had dropped about 7% on Monday to a 10-week low after it became clear to the market that Freeport LNG would likely continue to operate at less than full capacity for several more days. On Thursday, feedgas to the facility was rising with it expected to use 500 million cubic feet, up from 400 mmcf on Wednesday, according to LSEG data. The gas utilization increase is seen as an indicator of LNG production starting in the first train, which can use up to 700 mmcf per day. However, vessel loading has not resumed. A total of six empty LNG tankers were anchored near the port, compared with a couple ships before the storm, with some of them accumulating more than 10 days of wait. Last loaded vessels before Beryl's landfall departed Freeport on July 5, according to LSEG. As of Thursday, Freeport LNG had not distributed any instruction to bring tankers into its berths, even though there were some vessels in schedule, a source familiar with the company's operations said. The Port of Freeport last week reopened the navigation channel, but draft restrictions for vessels remain, the Brazos Pilots Association said. Long waits for vessels that have back-to-back contracts tend to lead to cargo cancellations. Freeport LNG has canceled at least 10 cargoes for loading through August, Bloomberg reported, citing traders familiar with the matter. Freeport LNG said on Thursday it would not comment on its commercial activity, including cargoes. Gas flows to the seven big U.S. LNG export plants has fallen to 11.6 billion cubic feet per day (bcfd) so far in July due mostly to the Freeport outage, down from 12.8 bcfd in June and a monthly record high of 14.7 bcfd in December 2023. Sign up here. https://www.reuters.com/business/energy/texas-tanker-bottleneck-grows-slow-freeport-lng-restart-after-beryl-2024-07-18/