2024-07-18 06:35

NEW YORK, July 18 (Reuters) - Oil prices steadied on Thursday as investors wrestled with mixed signals about crude demand, with concerns about an economic slowdown in the U.S. contending with rising expectations the Federal Reserve would soon cut interest rates. Brent futures settled at $85.11 a barrel, rising 3 cents, while U.S. West Texas Intermediate (WTI) crude fell 3 cents to settle at $82.82 a barrel. Both benchmarks were up in the previous trading session. The number of Americans filing new applications for unemployment benefits rose more than expected last week, while initial claims for state unemployment benefits increased by 20,000 to a seasonally adjusted 243,000 for the week ended July 1. The data strengthened the case for the Fed to speed up rate- cutting plans, which could spur more spending on oil. "I believe that healthy expectations of a Fed rate cut in the not-so-distant future will limit downside," Tamas Varga of oil broker PVM told Reuters. Fed officials said on Wednesday the U.S. central bank is closer to cutting rates given inflation's improved trajectory and a labor market in better balance, possibly setting the stage for a reduction in borrowing costs in September. U.S. economic activity expanded at a slight to modest pace from late May through early July, with firms expecting slower growth ahead, according to a report released by the Fed on Wednesday. The rising jobless claims, however, also signalled an economic easing that could cut into crude demand, and kept oil prices from moving higher, said John Kilduff, a partner at Again Capital in New York. "The reality on the ground is that we've got a slowing economy that could potentially soften crude oil demand," Kilduff said. Despite government data on Wednesday that showed U.S. crude inventories fell by 4.9 million barrels last week, more than forecast by analysts in a Reuters poll, weak U.S. gasoline demand kept oil prices from moving higher, Kilduff said. Economic growth in China, which is the biggest importer of crude oil, also weighed on prices. Chinese leaders signalled on Thursday that Beijing would stay the course with economic policy, though few concrete details were disclosed. Together, those events helped to check investor hopes of a push to boost consumption in the world's second-largest economy. The European Central Bank kept interest rates unchanged as expected and gave no hints about its next move, arguing that domestic price pressures remain high and inflation will be above its target well into next year. A mini OPEC+ ministerial meeting scheduled for early August, meanwhile, is unlikely to recommend changing the group's oil output policy, which includes a plan to start unwinding one layer of crude output cuts from October, three sources told Reuters. One of the three OPEC+ sources, all of whom declined to be identified by name, said the meeting would serve as a "pulse check" for the health of the market. Sign up here. https://www.reuters.com/business/energy/oil-prices-rise-bigger-than-expected-drop-us-crude-stocks-2024-07-18/

2024-07-18 06:28

KYIV, July 18 (Reuters) - Ukrainian ferry company Ukrferry has postponed the resumption of its ferry service with Georgia, which was halted after Russia's invasion of Ukraine in 2022, according to the company's timetable. The company said last month it planned to resume services departing from the Black Sea port of Chornomorsk from July 9. The voyage was scheduled to arrive in Georgia on July 12. The current timetable shows that the service now is planned for July 24. The company gave no explanation for the delay. The ferry service was halted after the start of the Russian invasion of Ukraine in 2022. Its resumption would allow Kyiv to gain direct access to its markets in the Caucasus and Central Asia. Apart from passengers, the ferries transport a wide variety of goods, including trucks, cars, railcars and deck cargo on pallets. The route map published by the company showed that the ferry will widely bypass the Russian-occupied Ukrainian Crimea peninsula. Ukraine opened a corridor towards the western Black Sea last year after Ukrainian forces managed to drive Russian military ships away from there by attacking them with sea drones. The corridor has allowed Ukraine to increase its grain and metals exports. Sign up here. https://www.reuters.com/world/europe/ukraine-postpones-resumption-ferry-services-with-georgia-company-says-2024-07-18/

2024-07-18 06:03

United expects improved pricing power in mid-August as U.S. carriers reduce capacity Rival Delta also forecast lower-than-expected Q3 profit Summer travel boom leads to overcapacity, undermining airlines' pricing power CHICAGO, July 17 (Reuters) - United Airlines (UAL.O) , opens new tab on Wednesday forecast a lower-than-expected profit in the current quarter and announced plans to cut capacity, providing further evidence that U.S. carriers are struggling to lift their earnings despite record travel demand. Last week, rival Delta Air Lines' (DAL.N) , opens new tab quarterly profit outlook also came in shy of Wall Street estimates. Meanwhile, American Airlines (AAL.O) , opens new tab and Southwest Airlines (LUV.N) , opens new tab have cut their revenue forecasts for the June quarter. Carriers are enjoying a summer travel boom, with more than 3 million people passing through U.S. airport security checkpoints in a single day on July 7. However, they have increased seats in the domestic market in excess of demand, dampening airfares at the price-sensitive end of the market. That is a worry for an industry that is facing higher labor and other operating costs and has been relying on higher airfares to protect profits. In response, industry capacity growth is estimated to moderate from high-single to low-single digits in the second half of the year, which analysts say should underpin ticket prices. United expects an adjusted profit in the range of $2.75 to $3.25 per share in the quarter ending September 30. Analysts had previously expected the company to report a quarterly profit of $3.44 a share, according to LSEG data. United said mid-August would mark a shift in the industry's capacity as U.S. carriers are estimated to reduce their seats by 3 percentage points from a year ago. The airline will also reduce its planned domestic capacity in the fourth quarter by 3 percentage points to bolster pricing power, it said. "Looking forward, we see multiple airlines have begun to cancel loss-making capacity," said CEO Scott Kirby. "We expect leading unit revenue performance among our largest peers in the second half of the third quarter." Delta also has forecast a significant improvement in its pricing power from August onward. United will discuss the quarterly results on a call with analysts and investors on Thursday morning. TD Cowen analysts said the company's commentary reflected confidence that "the long awaited domestic capacity rationalization is imminent." Major airlines have scheduled about 6% more seats in the domestic market this month than a year earlier, data from consultancy Cirium shows, leading to pressure on airlines to lower prices. Airfares in the U.S. fell by an average of 5.6% from a year ago in the June quarter, data from the Labor Department shows. United reaffirmed its 2024 profit estimate of $9 to $11 a share. Its adjusted earnings in the June quarter came in at $4.14 a share, compared with analysts' expectations of $3.93. Sign up here. https://www.reuters.com/business/aerospace-defense/united-airlines-q3-profit-outlook-falls-short-wall-street-estimates-2024-07-17/

2024-07-18 05:59

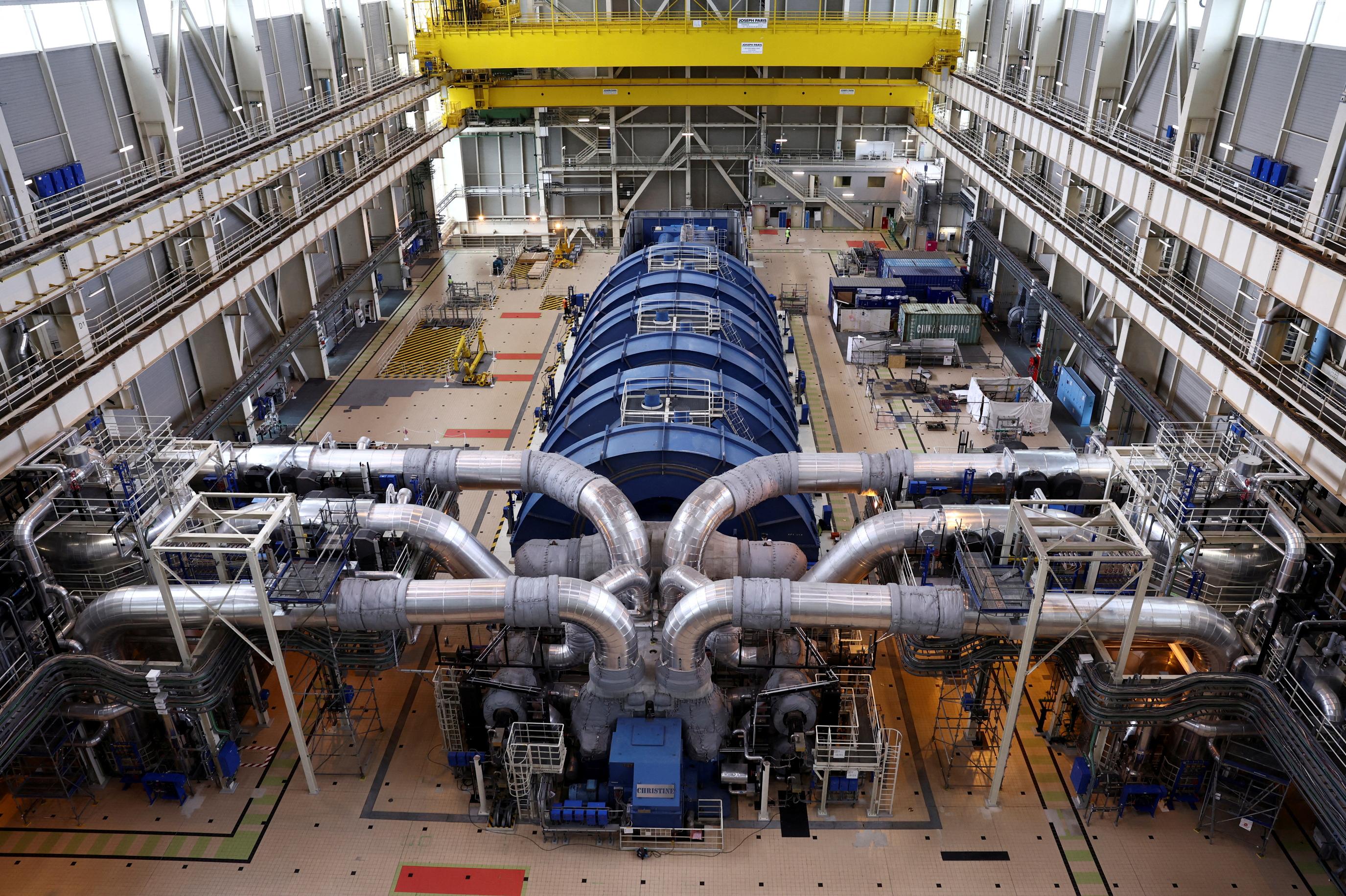

PARIS, July 17 (Reuters) - French state power giant EDF lost a bid to build at least two new nuclear reactors in the Czech Republic on Wednesday, a major blow to Europe's only nuclear power plant builder at a critical time for the company. The project, won instead by Korea's KHNP, would have been the first contract for EDF since Hinkley Point in Great Britain in 2016, and a vote of confidence after being dogged by delays and soaring costs on projects at home and abroad. But its recent track record and a gamble on new, untested technology has cost it a significant new project and likely others in the future too. "We were counting on this project to give credibility to our offer on a European scale," said a source at EDF, declining to be identified because of the sensitivity of the issue. "But unfortunately the reality of the costs outweighed any political rhetoric, and the message sent to the rest of Europe was not the one we had hoped for." EDF said in a statement it was ready to relaunch discussions with the Czech government should the preferred bidder process be modified in coming weeks. A NUCLEAR AIRBUS? EDF has been counting on a revival in European interest in nuclear power for a potential pipeline of new projects as the region looks to boost its energy independence following the Ukraine war and lower carbon emissions. The French company had proposed involving Czech suppliers in the new reactors, building up a European supply chain for future projects, dubbed a "nuclear Airbus" by French President Emmanuel Macron during a visit to Prague in March. But EDF's dismal track record weighs heavily. Its Flamanville project has been delayed by more than a decade, with costs soaring from a planned 3 billion euros to 13.2 billion euros by the end of 2022. Similarly, Hinkley Point C is now set to start up in 2029, years after the 2017 target. Neither EDF nor KHNP have commented on the costs in their bids. Another source at EDF described the rival bid as "cheap". KHNP also beat EDF in a 2009 bid to build four reactors in the United Arab Emirates. "The Koreans had a lot going for them, particularly in terms of the price and the proof of concept, with Abu Dhabi going well and running," said Nicolas Goldberg, associate director at Colombus Consulting, based in Paris. EDF proposed a new reactor model that has not yet been tested, a "real gamble", he said. Czech Prime Minister Petr Fiala said the Korean offer was better in almost all assessed criteria. UNCERTAIN FUTURE The Czech projects, ahead of six new reactors planned by President Macron at home, would have helped EDF raise its efficiency and lower its costs. They would also have positioned the company in the heart of Eastern Europe, a region with power-hungry heavy industry that needs to decarbonise and is turning to nuclear power. But they presented the recently nationalised firm with a challenge that some in the company felt it was not ready for, given current industrial capacity issues, said the second EDF source. "It was too soon," the person said. France's finance ministry declined to comment. There are now serious questions about EDF's role abroad, said Goldberg. The company lost out in 2022 when Poland chose Westinghouse over EDF for a plant on the Baltic Sea. "Will we really be able to export? There's still a big question mark over that," said Goldberg. Sign up here. https://www.reuters.com/business/energy/frances-edf-faces-fresh-setback-after-losing-czech-nuclear-bid-2024-07-17/

2024-07-18 05:49

MELBOURNE, July 18 (Reuters) - Fortescue's (FMG.AX) , opens new tab shares slipped on Thursday following news of sweeping job cuts across its metals and energy divisions and a slowdown in the development of its green hydrogen business. The world's fourth-biggest iron ore miner embarked on a major expansion in late 2020 to turn itself into a green energy giant, based on a view that hydrogen from renewable power sources would become a major source of green energy. But with power prices in Australia remaining high and strong demand yet to take shape, Fortescue will cut about 700 jobs, or 4.5% of its global workforce. It was unlikely to meet a production target of 15 million tonnes of green hydrogen by 2030, a spokesperson told Reuters on Thursday. "We are very committed to green hydrogen, but we probably are not going to get there," she said. "That really comes down to the price of power and policy settings here in Australia." However, Fortescue remains committed to its green hydrogen projects overseas, in Norway, Brazil and Arizona, she said. Fortescue shares fell 1.6%, while peers BHP (BHP.AX) , opens new tab and Rio Tinto (RIO.AX) , opens new tab fell less than half a per cent. "I don't think the market ever believed that target was achievable, but there were worries they would overspend," said Barrenjoey analyst Glyn Lawcock. Fortescue has guided a cumulative spend of $6.2 billion to meet its decarbonisation targets by the end of the decade, but has only spent around $300 million per year so far, which suggests it must step up its spending, he said. It will also have to spend more on sustaining capital and on its Iron Bridge magnetite project, analysts said. As such, reduced headcount may relieve investors' concerns about capital and operating expenditure in the next financial year, Lawcock added. Fortescue has aggressive decarbonisation targets of zero direct and indirect emissions by 2030 and achieving carbon neutrality including the emissions of its customers by 2040. The company has diversified away from its main business of iron ore as new supply from Guinea's Simandou and other regions from next year is expected to drag on iron ore prices. Macquarie expects iron ore prices to fall to an average of $103 next year and $85 in 2026 from $120 this year. Fortescue will report its quarterly production on July 25 and its full-year results on Aug. 28. Sign up here. https://www.reuters.com/markets/commodities/fortescue-job-cuts-come-ahead-expected-spending-ramp-up-decarbonisation-2024-07-18/

2024-07-18 05:44

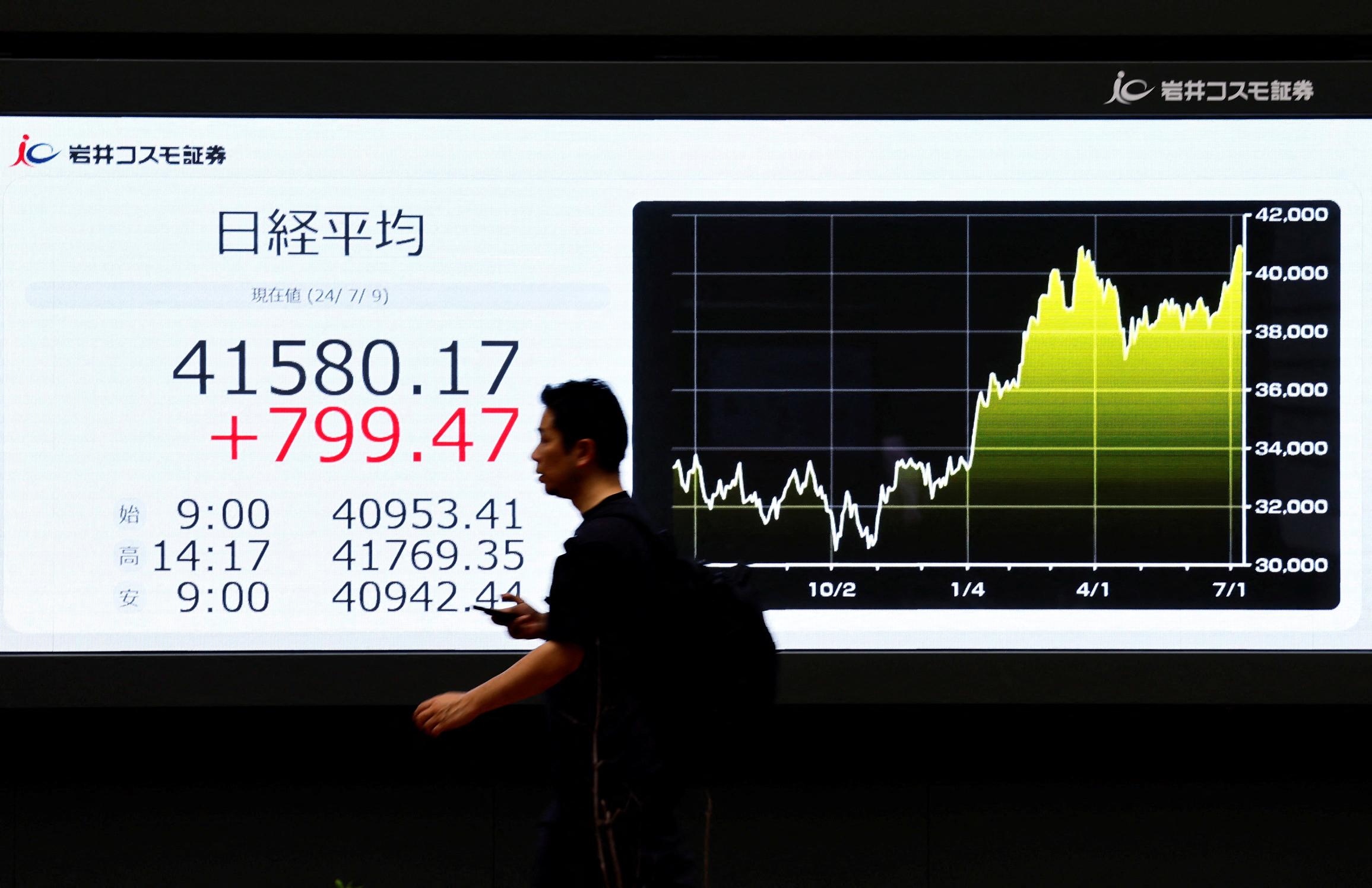

Stocks fall, led by Dow Euro eases after ECB says Sept. rate move "wide open" Dollar gains after U.S. manufacturing, jobs data NEW YORK, July 18 (Reuters) - World stock indexes fell on Thursday as a selling mood around high-priced technology stocks crept into the rest of the market, while the dollar index gained after strong U.S. economic data. Japan's yen sagged after scaling a six-week high, while the euro eased after ECB President Christine Lagarde held off any interest rate change but said a decision at the ECB's next meeting in September was "wide open". The Dow Jones Industrial Average (.DJI) , opens new tab closed down 533.06 points, or 1.29%, at 40,665.02, halting a series of consecutive closing highs. The S&P 500 (.SPX) , opens new tab lost 43.68 points, or 0.78%, to 5,544.59. All of the major S&P 500 indexes ended lower, except for energy (.SPNY) , opens new tab, which was up 0.3%. The Nasdaq Composite (.IXIC) , opens new tab lost 125.70 points, or 0.70%, to 17,871.22, giving back early gains. It had initially recovered from Wednesday's session, its worst since December 2022 . Europe's STOXX 600 (.STOXX) , opens new tab index fell 0.16%. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab fell 6.64 points, or 0.81%, to 816.95. The STOXX 600 (.STOXX) , opens new tab index fell 0.16%. "The technology sell-off seems to be spreading to the rest of the market," said Gene Goldman, chief investment officer at Cetera Investment Management in California. Goldman and others said investors had already factored in good news, including expectations the Federal Reserve would cut interest rates in September and that a recession would likely be avoided. Anticipation of further comments from Republican presidential candidate Donald Trump later on Thursday at the Republican National Convention could add to nervousness, Goldman said. "He may suggest more tariffs, which is a concern for technology companies," Goldman said. DATA BOOSTS DOLLAR In the foreign exchange market, the dollar index advanced after strong U.S. manufacturing data and jobless data that did little to suggest a significant slowing in the labor market. The dollar index , gained 0.5% at 104.19, after hovering close to its weakest level in four months. The euro was down 0.37% at $1.0896, easing from a four-month high on Wednesday. Initial claims for U.S. state unemployment benefits increased 20,000 to a seasonally adjusted 243,000 for the week ended July 13, the Labor Department said on Thursday. Economists polled by Reuters had forecast 230,000 claims for the latest week, although the data was not considered to be a notable shift in the labor market due to seasonal factors. A closely watched part of the Treasury yield curve steepened as the uptick in unemployment claims added to the view that the Fed is likely to begin cutting interest rates in September. Interest rate sensitive two-year yields were last up 3.4 basis points on the day at 4.463% and benchmark 10-year yields rose 4.4 basis points to 4.19%. The yield curve between two-year and 10-year notes steepened one basis point on the day to minus 27 basis points. Investors now view the Fed cutting interest rates as a sure bet. "The market thinks it's more likely there will be the first Fed rate cut in September if inflation continues to go in the right direction," said JoAnne Bianco, investment strategist at BondBloxx, which is based in Larkspur, California. The yen came off its highs after daily data showed little fresh evidence of intervention from authorities. It weakened 0.75% against the greenback at 157.36 per dollar. The yen has dropped sharply against the dollar this year as the wide interest rate difference between the U.S. and Japan weigh, creating a lucrative trading opportunity, in which traders borrow the yen at low rates to invest in dollar-priced assets for a higher return, known as carry trade. Rate cut expectations kept gold near record levels during the session, although it eased later to $2,441.61 an ounce. Oil rose throughout the day before steadying. Brent crude futures settled higher, up 3 cents at $85.11 a barrel, but U.S. crude slipped 3 cents to $82.82 per barrel. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-07-18/